UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2010

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-14543

TrueBlue, Inc.

(Exact name of Registrant as specified in its charter)

| Washington | 91-1287341 | |

| (State of Incorporation) | (IRS Employer ID) | |

| 1015 A Street, Tacoma, Washington | 98402 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (253) 383-9101

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock without par value | The New York Stock Exchange |

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value (based on the NYSE quoted closing price) of the common stock held by non-affiliates of the registrant as of the last business day of the second fiscal quarter, June 25, 2010, was approximately $0.523 billion.

As of January 28, 2011, there were 44,105,588 shares of the registrant’s common stock outstanding.

Page -1

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report is incorporated by reference from the registrant’s definitive proxy statement, relating to the Annual Meeting of Shareholders scheduled to be held May 11, 2011, which definitive proxy statement will be filed not later than 120 days after the end of the fiscal year to which this report relates.

COMMENT ON FORWARD LOOKING STATEMENTS

This Form 10-K contains forward-looking statements. These statements relate to our expectations for future events and future financial performance. Generally, the words “anticipate,” “believe,” “expect,” “intend,” “plan,” and similar expressions identify forward-looking statements. Forward-looking statements involve risks and uncertainties, and future events and circumstances could differ significantly from those anticipated in the forward-looking statements. These statements are only predictions. Actual events or results may differ materially. Factors which could affect our financial results are described in Item 1A of this Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of the forward-looking statements. We undertake no duty to update any of the forward-looking statements after the date of this report to conform such statements to actual results or to changes in our expectations.

Page -2

2010 Annual Report on Form 10-K

Table of Contents

| Page | ||||

| PART I | ||||

| Item 1. |

4 | |||

| Item 1A. |

9 | |||

| Item 1B. |

11 | |||

| Item 2. |

11 | |||

| Item 3. |

11 | |||

| Item 4. |

11 | |||

| PART II | ||||

| Item 5. |

12 | |||

| Item 6. |

14 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 | ||

| Item 7A. |

29 | |||

| Item 8. |

30 | |||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

54 | ||

| Item 9A. |

54 | |||

| Item 9B. |

56 | |||

| PART III | ||||

| Item 10. |

56 | |||

| Item 11. |

56 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

56 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

56 | ||

| Item 14. |

56 | |||

| PART IV | ||||

| Item 15. |

57 | |||

Page -3

TrueBlue, Inc.

Form 10-K

PART I

| Item 1. | BUSINESS |

TrueBlue, Inc. (“TrueBlue,” “we,” “us,” “our”) provides temporary blue-collar staffing services through the following brands: Labor Ready for general labor, Spartan Staffing for light industrial services, CLP Resources for skilled trades, PlaneTechs for aviation and diesel mechanics and technicians, and Centerline for dedicated and temporary drivers. We are a leader in blue-collar staffing services and through our brands we provide a wide range of specialized blue-collar staffing services to our customers.

We began operations in 1989 under the name Labor Ready, Inc. providing on-demand, general labor staffing services. In 2004 we began acquiring additional brands to expand our service offerings to customers in the blue-collar staffing market. Effective December 18, 2007, Labor Ready, Inc. changed its name to TrueBlue, Inc. The name change reflects our vision to be the leading provider of blue-collar staffing with multiple brands serving the temporary staffing industry. We are headquartered in Tacoma, Washington.

TrueBlue operations are one reportable segment. Our operations are all in the blue-collar staffing market of the temporary staffing industry and focus on supplying customers with temporary workers. All our brands have the following similar characteristics:

| — | They provide blue-collar temporary labor services; |

| — | They serve customers who have a need for temporary staff to perform tasks which do not require a permanent employee; |

| — | They each build a temporary work force through recruiting, screening and hiring. Temporary workers are dispatched to customers where they work under the supervision of our customers; |

| — | They each drive profitability by managing the bill rates to our customers and the pay rates to our workers. The difference between the bill rate and pay rate is a key metric used to drive the business in all our brands. Profitable growth requires increased volume or bill rates which grow faster than pay rates. Profitable growth is also driven by leveraging our cost structure across all brands; and |

| — | The long-term performance expectations of all our brands are similar as are the underlying financial and economic metrics used to manage those brands. |

Our international operations are not significant to our total operations for segment reporting purposes.

Our fiscal year ends on the last Friday of December. Fiscal 2010 includes 53 weeks ended December 31, 2010. Fiscal 2009 and 2008 each included 52 weeks ended December 25, 2009 and December 26, 2008, respectively. In fiscal years consisting of 53 weeks, the final quarter will consist of 14 weeks while in 52-week years all quarters will consist of 13 weeks.

Temporary Staffing Industry

The temporary staffing industry evolved out of the need for a flexible workforce to minimize the cost and effort of hiring and administering permanent employees in order to rapidly respond to changes in business conditions and to temporarily replace absent employees. Competitive pressures have forced businesses to focus on reducing costs, including converting fixed or permanent labor costs to variable or flexible costs. The temporary staffing industry includes a number of markets focusing on business needs that vary widely in duration of assignment and level of technical specialization. We operate within the blue-collar staffing market of the temporary staffing industry.

Temporary staffing companies act as intermediaries in matching available temporary workers to employer assignments. Staffing companies compete both to recruit and retain a supply of temporary workers and to attract and retain customers to employ these workers. Temporary workers are recruited through a wide variety of means, including personal referrals, online resources, internal databases, advertisements, job fairs and various other methods. An important aspect in the selection of temporary workers for an assignment is the ability to identify the skills, knowledge, abilities, and personal characteristics of a temporary worker and match their competencies or capabilities to an employer’s requirements. Methods used to sell temporary staffing services to customers vary depending on the customer’s need for temporary staffing services, the local labor supply, the length of assignment and the number of workers required. We are a business-to-business sales provider. Our sales process takes place at the customer’s location. Success is often based on the experience and skill of the sales person and the strength of relationship with the customer. Retention of customers, exclusive of economic conditions, is dependent on the strength of our relationship with the customer, the skill, quality and tenure of temporary workers and customer service skills.

Page -4

The temporary staffing industry is large and highly fragmented with many competing companies. No single company has a dominant share of the temporary staffing industry. Customer demand for temporary staffing services is dependent on the overall strength of the labor market and trends toward greater workforce flexibility. The staffing industry is highly volatile based on overall economic conditions. Historically, in periods of economic growth, the number of companies providing temporary staffing services has increased significantly due to low barriers to entry and during recessionary periods the number of companies has decreased significantly through consolidation, bankruptcies, or other events.

During the recent recession and current post-recessionary environment, the temporary staffing industry is experiencing increased volatility in comparison with past economic cycles. This is largely due to the severity of the recession which resulted in a dramatic drop in the use of temporary staffing as companies aggressively reduced the size of their workforce. However, in the post-recessionary environment, the temporary staffing industry has experienced increased demand in relation to total job growth as customers have placed a greater priority on maintaining a more flexible workforce.

Long-term Strategies

Our objective is to profitably grow our share of the blue-collar staffing market. We plan to achieve this objective by:

| — | Growing revenue through our existing geographic footprint; |

| — | Expanding into new geographic areas; |

| — | Making strategic acquisitions; and, |

| — | Leveraging centralized support services. |

Growing revenue through our existing geographic footprint

Our primary objective is to increase revenues generated by our existing network of branch offices. Our network of branch offices focuses on meeting customer needs with market leading sales and service. This strategy produces strong incremental operating profit as we leverage the revenue and associated gross profit over our existing cost structure.

Our separate brands each have in-depth industry knowledge and expertise in providing temporary staffing services to customers in their respective blue-collar markets and customer groups within those markets. We have developed proprietary systems and programs to attract and retain temporary workers with skills required by the various blue-collar markets and to match those workers to the needs of our customers. We are committed to being the blue-collar market leaders in customer sales and service. We have built a strong sales-culture backed by sales professionals with a proven track record of selling blue-collar staffing services and a process to expand these relationships into larger revenue streams. We continue to invest in developing our sales programs to identify customer needs and expand our customers’ use of our temporary staffing to solve their unique challenges. We have also increased our focus on improving our customer service capabilities, and we believe further investment could make a considerable difference in our ability to strengthen and retain customer relationships.

Expanding into new geographic areas

We have achieved a leading market position with our Labor Ready brand which specializes in providing on-demand, general labor through a national network of branch offices. We plan to expand all brands into a national presence with dominant market positions. Centerline will leverage our network of branch offices for its expansion in providing temporary and dedicated drivers to the transportation and distribution industries. Spartan Staffing plans to expand with their customers in adjacent markets and into on-site locations where customers have significant requirements for temporary skilled labor in the manufacturing and logistics industries. PlaneTechs has multiple expansion opportunities within aviation and other transportation industries to supply mechanics using our current centralized model which does not require additional office locations.

While we do not believe the construction industry will return to its pre-recessionary market size in the near term, we do believe growth will return to this industry. We believe that we are well positioned to serve this market. We retained the expertise and customer relationships to service various types of construction and expanded our service offerings to include remote industrial construction projects, industrial plant repair and maintenance projects and emerging renewable energy projects such as solar and wind farms. As we see meaningful signs of sustainable growth in this market, we will evaluate investments to expand our geographic presence through our CLP brand.

Page -5

Making strategic acquisitions

We continually evaluate acquisition candidates for fit with our strategy, culture, and the ability to produce strong returns on investment. Our focus is on acquisitions that can accelerate the building of a national presence for all our brands or that provide new opportunities to serve the blue-collar staffing market. Historically, our acquisitions were focused on establishing a platform for specialized staffing services to the blue-collar market. Our future acquisitions will be focused on businesses that are complementary to our current brands which typically produce more synergies enhancing our return on investment. We plan to integrate these acquisitions with our existing brands.

Leverage centralized support services and programs

We are highly centralized for all back office and shared support programs and activities. Branch operations are dependent on corporate headquarters for most administrative functions. We are committed to leveraging technology and third-party services, and increasing the efficiency of our centralized back office support services as we grow. Our focus on technology and back office support service reduces the administrative work of our branch office employees to focus on sales and service and increases the overall efficiency and profitability of our business. We also remain focused on our risk management programs. Our risk management practices have increased the safety of the work environment for our temporary workers, improved service to our customers, and reduced workers’ compensation expense.

Operations

We provide temporary blue-collar staffing services through the following specialized brands:

| — | Labor Ready specializes in providing on-demand, general labor to various industries through a nationwide network of local community branch offices. Temporary assignments are generally project-based and filled on short notice for unplanned “just-in-time” jobs, tough to fill jobs, and recurring short term jobs. At the end of fiscal 2010, Labor Ready operated 606 branches in all 50 states and Canada. |

| — | Spartan Staffing specializes in providing skilled labor for the manufacturing and logistics industries. Temporary workers’ skills are matched to jobs for a customized workforce solution which enables our customers to obtain immediate value by placing a productive and skilled employee on the job site. Spartan Staffing was acquired in 2004. In April 2008, we purchased Personnel Management, Inc. which was integrated with Spartan Staffing effective in fiscal 2009. At the end of fiscal 2010, Spartan Staffing operated 50 branches in 11 states. |

| — | CLP Resources (“CLP”) specializes in providing skilled trades people for commercial, industrial and residential construction and building and plant maintenance industries. Temporary workers’ skills are matched to jobs which enable our customers to obtain immediate value by placing a highly productive and skilled employee on the job site. Job assignments are project-based and the skilled temporary worker is often needed for a substantial amount of the construction and maintenance project until completion. CLP was acquired in 2005. In April 2007, we acquired Skilled Services Corporation which expanded our geographic reach for skilled trades services. Skilled Services Corporation was integrated with CLP effective in fiscal 2008. At the end of fiscal 2010, CLP operated 49 branches in 21 states. |

| — | PlaneTechs specializes in providing skilled mechanics and technicians to the aviation maintenance, repair and overhaul, aerospace manufacturing and assembly industries, and other transportation industries. In-depth screening verifies aviation certification and specialized skills of the mechanics and technicians. In December 2007, we purchased substantially all of the assets of PlaneTechs, LLC. PlaneTechs operates nationally out of one recruiting center, as well as on-site locations at customers with significant temporary workforce requirements. Centralized recruiting and dispatch provides efficient and cost-effective solutions for customers across the country and in foreign locations. |

| — | Centerline Drivers (“Centerline”) specializes in providing temporary and dedicated drivers to the transportation and distribution industries. In February 2008, we purchased substantially all of the assets of TLC Services Group, Inc. Effective January 4, 2010, we changed the name of this brand to Centerline Drivers. At the end of fiscal 2010, Centerline operated 15 branches in 9 states. |

Management of our temporary staffing operations is coordinated from our headquarters in Tacoma, Washington where we provide support and centralized services to our brands and their respective branch offices. As of December 31, 2010, we conducted our staffing services operations through 721 branch offices in all 50 states, Puerto Rico and Canada. Branch managers are responsible for most activities of their offices, including sales, recruitment, servicing the customers’ needs, accident prevention, and compliance with the laws and regulations.

Page -6

The following table summarizes the number of TrueBlue branch offices open at the end of each of the last three fiscal years:

| 2010 | 2009 | 2008 | ||||||||||

| Beginning branches |

754 | 850 | 894 | |||||||||

| Branches acquired (1) |

-- | -- | 54 | |||||||||

| New branches |

2 | 9 | 4 | |||||||||

| Branches consolidated/closed (2) |

(35) | (105) | (102) | |||||||||

| Ending locations |

721 | 754 | 850 |

| (1) | In February 2008, we purchased substantially all of the assets of Centerline (formerly TLC) which included 10 operating branches. In April 2008, we acquired all the stock of Personnel Management Inc. which included 44 operating branches. |

| (2) | The majority of our closed branches are consolidated with another branch to retain customer relationships. |

Customers

Our customer mix consists primarily of small and medium-size businesses serviced by one or more branch offices. We also serve larger national customers. These large national customers frequently enter into non-exclusive arrangements with several companies, with the ultimate choice among them being left to the local managers. Customer relationships with small and medium-size businesses rely less upon longer-term contracts, and the competitors for this business are primarily locally-owned businesses. Our full range of blue-collar temporary staffing services and multiple brands enables us to cross-market to customers in order to leverage our relationships and expand our services provided.

During 2010, we served approximately 175,000 customers. Our ten largest customers accounted for 18.6% of total revenue in 2010, 21.3% for 2009 and 10.7% for 2008. Sales to The Boeing Company and affiliates (“Boeing”) accounted for 9.4% of total revenue for 2010, 13.4% for 2009, and 5.1% for 2008. While we predominately serve the small to mid-sized customer, we experienced proportionately more growth from large customers during 2010. However, we expect future growth to include small to mid-sized customers as the economy continues to recover.

Employees

As of December 31, 2010 we employed approximately 2,600 full-time and part-time employees. In addition, we placed approximately 300,000 temporary workers on assignments with our customers during 2010. We recruit temporary workers daily so that we can be responsive to the planned as well as unplanned needs of the customers we serve. We attract our pool of temporary workers through personal referrals, online resources, extensive internal databases, advertising, job fairs, and various other methods. We identify the skills, knowledge, abilities, and personal characteristics of a temporary worker and match their competencies or capabilities to a customer’s requirements. This enables our customers to obtain immediate value by placing a highly productive and skilled employee on the job site. We use a variety of proprietary programs for identifying and assessing the skill level of our temporary workers when selecting a particular individual for a specific assignment. We believe that our assessments systems enable us to offer a higher quality of service by increasing productivity, decreasing turnover and reducing absenteeism.

We provide a bridge to permanent, full-time employment for thousands of temporary workers each year. Temporary workers come to us to fill a short-term financial need or as a flexible source of income while also working elsewhere or pursuing education. Many stay because of the flexibility that we offer. In many cases, we enable individuals to pay their rent, buy groceries, and remain self-sufficient. Temporary workers may be assigned to different jobs and job sites, and their assignments could last for as little as a single day or extend for several weeks or months.

We are considered the legal employer of our temporary workers and laws regulating the employment relationship are applicable to our operations. We consider our relations with our employees and temporary workers to be good.

Competition

We compete in the temporary staffing industry by offering a full range of blue-collar staffing services. Our industry is large and fragmented, comprised of thousands of companies employing millions of people and generating billions of dollars in annual revenues.

We experience competition in attracting customers as well as qualified employment candidates. The staffing business is highly competitive with limited barriers to entry, with a number of firms offering services similar to those provided by us on a national, regional or local basis. We compete with several multi-national full-service and specialized temporary staffing companies, as well as a multitude of local companies. In most geographic areas, no single company has a dominant share of the market. The majority of temporary staffing companies serving the blue-collar staffing market are locally-owned business. In many areas the local companies are the strongest competitors, largely due to their longevity in the market and the strength of their customer relationships.

Page -7

The most significant competitive factors in the staffing business are price, ability to promptly fill customer orders, success in meeting customers’ quality expectations of temporary workers, and appropriately addressing customer service issues. We believe we derive a competitive advantage from our service history and commitment to the blue-collar temporary employment market and our specialized approach in serving the industries of our customers. Also, our national presence and proprietary systems and programs including worker safety, risk management, and legal and regulatory compliance are key differentiators from many of our competitors.

Competitive forces have historically limited our ability to raise our prices to immediately and fully offset increased costs of doing business; some of which include increased temporary worker wages, costs for workers’ compensation and state unemployment insurance. As a result of these forces, we have in the past faced pressure on our operating margins.

Seasonality

Our business experiences seasonal fluctuations. Our quarterly operating results are affected by the seasonality of our customers’ businesses. Demand for our staffing services is higher during the second and third quarters of the year with demand peaking in the third quarter and lower during the first and fourth quarters, in part due to limitations to outside work during the winter months. Our working capital requirements are primarily driven by temporary worker payroll and customer accounts receivable. Since receipts from customers generally lag payroll to temporary workers, working capital requirements increase substantially in periods of growth.

Financial Information about Geographic Areas

The following table depicts our revenue derived from within the United States and that derived from international operations for the past three fiscal years (in millions). Our international operations include Canada in 2010 and 2009 and Canada and the United Kingdom for 2008. We sold the remaining operations in the United Kingdom in 2008.

| 2010 | 2009 | 2008 | ||||||||||||||||||||||

| United States (including Puerto Rico) |

$1,105.5 | 96.2% | $984.5 | 96.7% | $1,308.0 | 94.5% | ||||||||||||||||||

| International operations |

$43.9 | 3.8% | $33.9 | 3.3% | $76.3 | 5.5% | ||||||||||||||||||

| Total revenue from services |

$1,149.4 | 100.0% | $1,018.4 | 100.0% | $1,384.3 | 100.0% | ||||||||||||||||||

The international operations are dependent on shared information and communications equipment housed and maintained in the United States. Net property and equipment located in international operations was less than 1% of total property and equipment in each of the last three fiscal years.

Available Information

Our Annual Report on Form 10-K, along with all other reports and amendments filed with or furnished to the Securities and Exchange Commission (“SEC”) are publicly available, free of charge, on our website at www.trueblueinc.com or at www.sec.gov as soon as reasonably practicable after such reports are filed with or furnished to the SEC. Our Corporate Governance Guidelines, Code of Business Conduct and Ethics, and Board committee charters are also posted to our website. The information on our website is not part of this or any other report we file with, or furnish to, the SEC.

Page -8

| Item 1A. | RISK FACTORS |

Investing in our securities involves risk. The following risk factors and all other information set forth in this Annual Report on Form 10-K should be considered in evaluating our future prospects. In particular, keep these risk factors in mind when you read “forward-looking” statements elsewhere in this report. Forward-looking statements relate to our expectations for future events and time periods. Generally, the words “anticipate,” “believe,” “expect,” “intend,” “plan” and similar expressions identify forward-looking statements. Forward–looking statements involve risks and uncertainties, and future events and circumstances could differ significantly from those anticipated in the forward–looking statements. If any of the events described below occurs, our business, financial condition, results of operations, liquidity or access to the capital markets could be materially and adversely affected.

Our business is significantly affected by fluctuations in general economic conditions.

The demand for our blue-collar staffing services is highly dependent upon the state of the economy and upon staffing needs of our customers. Any variation in the economic condition or unemployment levels of the United States and Canada, or in the economic condition of any region or specific industry in which we have a significant presence may severely reduce the demand for our services and thereby significantly decrease our revenues and profits.

Our business is subject to extensive government regulation and a failure to comply with regulations could materially harm our business.

Our business is subject to extensive regulation. The cost to comply and any inability to comply with government regulation could materially harm our business. Increased government regulation of the workplace or of the employer-employee relationship, or judicial or administrative proceedings related to such regulation, could materially harm our business.

The Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (collectively, the “Health Care Reform Laws”) includes various health-related provisions to take effect through 2014, including requiring most individuals to have health insurance and establishing new regulations on health plans. Although the Health Care Reform Laws do not mandate that employers offer health insurance, beginning in 2014 penalties will be assessed on large employers who do not offer health insurance that meets certain affordability or benefit requirements. Unless modified by regulations or subsequent legislation, providing such additional health insurance benefits to our temporary workers, or the payment of penalties if such coverage is not provided, would increase our costs. If we are unable to raise the rates we charge our customers to cover these costs, such increases in costs could materially harm our business.

We may incur employment related and other claims that could materially harm our business.

We employ individuals on a temporary basis and place them in our customers’ workplaces. We have limited control over our customers’ workplace environments. As the employer of record of our temporary workers we incur a risk of liability for various workplace events, including claims for personal injury, wage and hour requirements, discrimination or harassment, and other actions or inactions of our temporary workers. In addition, some or all of these claims may give rise to litigation including class action litigation. Although we currently believe resolving all of these matters, individually or in the aggregate, will not have a material adverse impact on our financial statements, the litigation and other claims are subject to inherent uncertainties and our view of these matters may change in the future. A material adverse impact on our financial statements also could occur for the period in which the effect of an unfavorable final outcome becomes probable and can be reasonably estimated.

We cannot be certain that our insurance will be sufficient in amount or scope to cover all claims that may be asserted against us. Should the ultimate judgments or settlements exceed our insurance coverage, they could have a material effect on our business. We cannot be certain we will be able to obtain appropriate types or levels of insurance in the future, that adequate replacement policies will be available on acceptable terms, if at all, or that the companies from which we have obtained insurance will be able to pay claims we make under such policies.

We are dependent on workers’ compensation insurance coverage at commercially reasonable terms.

We provide workers’ compensation insurance for our temporary workers. Our workers’ compensation insurance policies are renewed annually. The majority of our insurance policies are with Chartis, a subsidiary of American International Group, Inc. Chartis requires us to collateralize a significant portion of our workers’ compensation obligation. We cannot be certain we will be able to obtain appropriate types or levels of insurance in the future or that adequate replacement policies will be available on acceptable terms, if at all. As our business grows or our financial results deteriorate, the amount of collateral required will likely increase and the timing of providing collateral could be accelerated. Resources to meet these requirements may not be available. The loss of our workers’ compensation insurance coverage would prevent us from doing business in the majority of our markets.

Page -9

Further, we cannot be certain that Chartis will be able to pay claims we make under such policies or release the collateral controlled by them for payment of claims. The loss of the collateral could require us to seek additional sources of capital to pay our workers’ compensation claims. These additional sources of capital may not be available on commercially reasonable terms, or at all.

Our liquidity may be materially adversely affected by constraints in the capital markets.

We must have sufficient sources of liquidity to fund our working capital requirements, workers’ compensation collateral requirements, service our outstanding indebtedness and finance investment opportunities. Without sufficient liquidity, we could be forced to curtail our operations or we may not be able to pursue promising business opportunities. The principal sources of our liquidity are funds generated from operating activities, available cash and cash equivalents, and borrowings under credit facilities.

Our failure to comply with the restrictive covenants under our revolving credit facility could result in an event of default, which, if not cured or waived, could result in our being required to repay these borrowings before their due date. If we are forced to refinance these borrowings on less favorable terms, or are unable to refinance at all, our results of operations and financial condition could be adversely affected by increased costs and rates.

Acquisitions and new business ventures may have an adverse effect on our business.

We expect to continue making acquisitions or entering into new business ventures as part of our long-term business strategy. These acquisitions involve significant challenges and risks including that the acquisition does not advance our business strategy, that we do not realize a satisfactory return on our investment, that we experience difficulty in integrating their operations, or diversion of management’s attention from our other business. These events could cause harm to our operating results or financial condition.

We operate in a highly competitive business and may be unable to retain customers or market share.

The staffing services business is highly competitive and the barriers to entry are low. There are new competitors entering the market which may increase pricing pressures. In addition, long-term contracts form only a small portion of our revenue. Therefore, there can be no assurance that we will be able to retain customers or market share in the future. Nor can there be any assurance that we will, in light of competitive pressures, be able to remain profitable or, if profitable, maintain our current profit margins.

Our management information systems are vulnerable to damage and interruption.

The efficient operation of our business is dependent on our management information systems. We rely heavily on proprietary management information systems to manage our order entry, order fulfillment, pricing and collections, as well as temporary worker recruitment, dispatch and payment. The failure of our management information systems to perform as we anticipate could disrupt our business and could result in decreased revenue and increased overhead costs, causing our business and results of operations to suffer materially. Our primary computer systems and operations are vulnerable to damage or interruption from power outages, computer and telecommunications failures, computer viruses, security breaches, catastrophic events and errors in usage by our employees. In addition, we are nearing the completion of a project to replace a key proprietary management information system and have experienced, and may continue to experience, problems with functionality and associated delays in implementation. Failure of our management information systems to perform may require significant additional capital and management resources to resolve, causing material harm to our business.

Our results of operations could materially deteriorate if we fail to attract, develop and retain qualified employees.

Our performance is dependent on attracting and retaining qualified employees who are able to meet the needs of our customers. We believe our competitive advantage is providing unique solutions for each individual customer, which requires us to have highly trained and engaged employees. Our success depends upon our ability to attract, develop and retain a sufficient number of qualified employees, including management, sales, service and administrative personnel. The turnover rate in the staffing industry is high, and qualified individuals of the requisite caliber and number needed to fill these positions may be in short supply. Our inability to recruit a sufficient number of qualified individuals may delay or affect the speed of our planned growth. Delayed expansion, significant increases in employee turnover rates or significant increases in labor costs could have a material adverse effect on our business, financial condition and results of operations.

We may be unable to attract and retain sufficient qualified temporary workers.

We compete with other temporary staffing companies to meet our customer needs and we must continually attract reliable temporary workers to fill positions. We have in the past experienced worker shortages and we may experience such shortages in the future. Further, if there is a shortage of temporary workers the cost to employ these individuals could increase. If we are unable to pass those costs through to our customers, it could materially and adversely affect our business.

Page -10

We may have additional tax liabilities that exceed our estimates.

We are subject to federal taxes and a multitude of state and local taxes in the United States and taxes in foreign jurisdictions. In the ordinary course of our business, there are transactions and calculations where the ultimate tax determination is uncertain. We are regularly subject to audit by tax authorities. Although we believe our tax estimates are reasonable, the final determination of tax audits and any related litigation could be materially different from our historical tax provisions and accruals. The results of an audit or litigation could materially harm our business.

Accidental disclosure of our employees’ or customers’ information could materially harm our business.

Failure to protect the integrity and security of our employees’ and customers’ information, including proprietary information, could expose us to litigation and materially damage our relationship with our employees and customers.

Failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting.

Failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting. If our management is unable to certify the effectiveness of its internal controls or if its independent registered public accounting firm cannot render an opinion on the effectiveness of its internal control over financial reporting, or if material weaknesses in our internal controls are identified, we could be subject to regulatory scrutiny and a loss of public confidence. In addition, if we do not maintain adequate financial and management personnel, processes and controls, we may not be able to accurately report our financial performance on a timely basis, which could cause our stock price to fall.

Outsourcing certain aspects of our business could result in disruption and increased costs.

We have outsourced certain aspects of our business to third party vendors that subject us to risks, including disruptions in our business and increased costs. For example, we have engaged third parties to host and manage certain aspects of our data center information and technology infrastructure and to provide certain back office support activities. Accordingly, we are subject to the risks associated with the vendor’s ability to provide these services to meet our needs. If the cost of these services is more than expected, or if the vendor or we are unable to adequately protect our data and information is lost, or our ability to deliver our services is interrupted, then our business and results of operations may be negatively impacted.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

We lease the building space at all of our branch offices except for two that we own in Florida. Under the majority of these leases, both parties have the right to terminate the lease on 90 days notice. We own an office building in Tacoma, Washington, which serves as our headquarters. Management believes all of our facilities are currently suitable for their intended use.

| Item 3. | LEGAL PROCEEDINGS |

See discussion of Legal contingencies and developments in Note 13 to the consolidated financial statements included in Part II, Item 8 of this Annual Report on Form 10-K.

| Item 4. | (REMOVED AND RESERVED) |

Page -11

PART II

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is listed on the New York Stock Exchange under the ticker symbol TBI. The table below sets forth the high and low sales prices for our common stock as reported by the New York Stock Exchange during the last two fiscal years:

| High |

Low |

|||||||

| December 31, 2010: |

||||||||

| Fourth Quarter |

$ | 19.48 | $ | 12.96 | ||||

| Third Quarter |

14.01 | 9.97 | ||||||

| Second Quarter |

17.23 | 11.20 | ||||||

| First Quarter |

17.22 | 13.03 | ||||||

| December 25, 2009: |

||||||||

| Fourth Quarter |

$ | 15.49 | $ | 11.69 | ||||

| Third Quarter |

15.29 | 7.55 | ||||||

| Second Quarter |

10.29 | 7.60 | ||||||

| First Quarter |

10.47 | 5.95 | ||||||

Holders of the Corporation’s Capital Stock

We had approximately 929 shareholders of record as of January 28, 2011.

Dividends

No cash dividends have been declared on our common stock to date nor have any decisions been made to pay a dividend in the future. Payment of dividends is evaluated on a periodic basis and if a dividend were paid, it would be subject to the covenants of our lending facility, which may have the effect of restricting our ability to pay dividends.

Issuer Purchases of Equity Securities

We did not purchase any shares of our common stock under our authorized share purchase program during 2010 and 2009. Pursuant to our share purchase program, we purchased and retired 1.2 million shares of our common stock for a total of $16.0 million during 2008. Any future common stock repurchases are subject to the covenants of our lending facility, which may have the effect of restricting our ability to repurchase common stock.

The table below includes purchases of our common stock pursuant to publicly announced plans or programs and those not made pursuant to publicly announced plans or programs during the fourteen weeks ended December 31, 2010.

| Period | Total number of |

Weighted average price paid per share (2) |

Total number of shares purchased as |

Maximum number of

shares (or approximate dollar value) that may yet be purchased under plans or programs at period end (3) | ||||||||||||

| 9/25/10 through 10/22/10 |

854 | $13.84 | -- | $21.5 million | ||||||||||||

| 10/23/10 through 11/26/10 |

1,424 | $16.40 | -- | $21.5 million | ||||||||||||

| 11/27/10 through 12/31/10 |

3,550 | $18.36 | -- | $21.5 million | ||||||||||||

|

Total |

5,828 | $17.22 | 0 | |||||||||||||

Page -12

| (1) | During the fourteen weeks ended December 31, 2010, we purchased 5,828 shares in order to satisfy employee tax withholding obligations upon the vesting of restricted stock. These shares were not acquired pursuant to any publicly announced purchase plan or program. |

| (2) | Weighted average price paid per share does not include any adjustments for commissions. |

| (3) | Our Board of Directors authorized a $100 million share purchase program in April 2007 that does not have an expiration date. An additional $21.5 million may be purchased by us pursuant to this program. We did not purchase any shares of our common stock pursuant to this program during the fifty-three weeks ended December 31, 2010. |

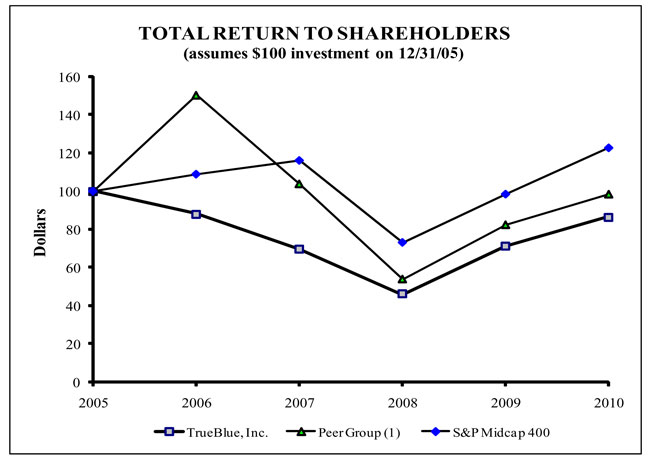

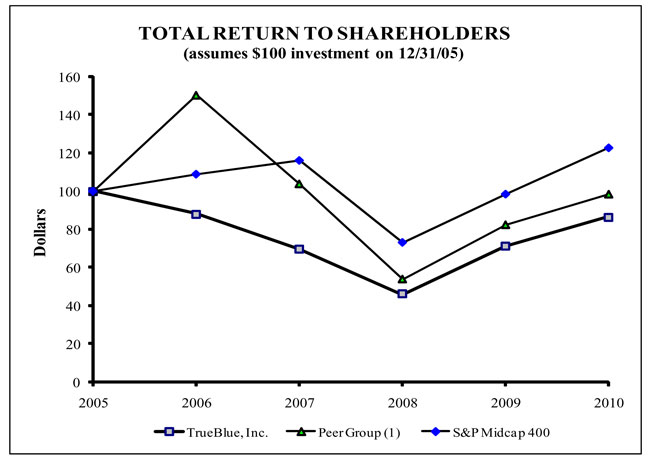

TrueBlue Stock Comparative Performance Graph

The following graph depicts our stock price performance from December 31, 2005 through December 31, 2010, relative to the performance of the S&P Midcap 400 Index, and a peer group of companies in the temporary staffing industry. All indices shown in the graph have been reset to a base of 100 as of December 31, 2005, and assume an investment of $100 on that date and the reinvestment of dividends, if any, paid since that date.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN

Among TrueBlue, Inc., the S&P Midcap 400 Index

and Selected Peer Group

| Total Return Analysis |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

||||||||

| TrueBlue, Inc. |

$100 | $88 | $70 | $46 | $71 | $86 | ||||||||

| Peer Group (1) |

$100 | $150 | $104 | $54 | $82 | $98 | ||||||||

| S&P Midcap 400 Index |

$100 | $109 | $116 | $73 | $98 | $123 |

| (1) | The peer group includes Kelly Services, Inc., Manpower, Inc., Volt Information Sciences, Inc., Spherion Corp. and Adecco SA. |

Page -13

| Item 6. | SELECTED FINANCIAL DATA |

The following selected consolidated financial information has been derived from our audited Consolidated Financial Statements. The data should be read in conjunction with item 1A “Risk Factors”, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and the notes included in Item 8 of this Annual Report on Form 10-K.

Summary Consolidated Financial and Operating Data

As of and for the Fiscal Year Ended (1)

(in millions, except per share data and number of branches)

| 2010 (53 Weeks) |

2009 (52 Weeks) |

2008 (52 Weeks) |

2007 (52 Weeks) |

2006 (52 Weeks) |

||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||

| Revenue from services |

$ | 1,149.4 | $ | 1,018.4 | $ | 1,384.3 | $ | 1,385.7 | $ | 1,349.1 | ||||||||||

| Cost of services |

845.9 | 727.4 | 971.8 | 943.6 | 915.8 | |||||||||||||||

| Gross profit |

303.5 | 291.0 | 412.5 | 442.1 | 433.3 | |||||||||||||||

| Selling, general and administrative expenses |

258.8 | 262.2 | 332.1 | 336.2 | 318.7 | |||||||||||||||

| Goodwill and intangible asset impairment |

-- | -- | 61.0 | -- | -- | |||||||||||||||

| Depreciation and amortization |

16.5 | 17.0 | 16.8 | 12.2 | 10.3 | |||||||||||||||

| Interest and other income, net |

0.9 | 2.3 | 5.5 | 10.9 | 11.9 | |||||||||||||||

| Income before tax expenses |

29.1 | 14.1 | 8.1 | 104.6 | 116.2 | |||||||||||||||

| Income tax expense |

9.3 | 5.3 | 12.3 | 38.4 | 39.7 | |||||||||||||||

| Net income (loss) |

$ | 19.8 | $ | 8.8 | $ | (4.2) | $ | 66.2 | $ | 76.5 | ||||||||||

| Net income (loss) per diluted share |

$ | 0.46 | $ | 0.20 | $ | (0.10) | $ | 1.44 | $ | 1.45 | ||||||||||

| Weighted average diluted shares outstanding |

43.5 | 43.0 | 42.9 | 46.0 | 52.9 | |||||||||||||||

| At Fiscal Year End, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Working capital |

$ | 207.6 | $ | 163.2 | $ | 147.5 | $ | 115.0 | $ | 238.4 | ||||||||||

| Total assets |

546.5 | 518.1 | 519.7 | 545.2 | 592.3 | |||||||||||||||

| Long-term liabilities |

147.8 | 147.9 | 154.2 | 146.9 | 138.4 | |||||||||||||||

| Total liabilities |

$ | 233.8 | $ | 232.7 | $ | 249.5 | $ | 261.4 | $ | 239.8 | ||||||||||

| Branches open at period end |

721 | 754 | 850 | 894 | 912 | |||||||||||||||

| (1) | Our fiscal year ends on the last Friday in December. The 2010 fiscal year ended on December 31, 2010, included 53 weeks, with the 53rd week |

The operating results reported above include the results of acquisitions subsequent to their respective purchase dates:

| — | In April 2007, we acquired 100% of the common stock of Skilled Services Corporation and in December 2007, we acquired substantially all of the assets of PlaneTechs, LLC; |

| — | In February 2008, we acquired substantially all of the assets of TLC Services Group, Inc. and in April 2008, we acquired 100% of the common stock of Personnel Management, Inc. |

No cash dividends have been declared on our common stock to date nor have any decisions been made to pay a dividend in the future.

Page -14

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with, and is qualified in its entirety by, the Consolidated Financial Statements and Notes thereto included in Item 8 in this Annual Report on Form 10-K. This item contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those indicated in such forward-looking statements. Factors that may cause such a difference include, but are not limited to, those discussed in “Item 1A, Risk Factors.”

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is designed to provide the reader of our financial statements with a narrative from the perspective of management on our financial condition, results of operations, liquidity and certain other factors that may affect future results. Our MD&A is presented in six sections:

| — | Overview |

| — | Results of Operations |

| — | Liquidity and Capital Resources |

| — | Contractual Obligations and Commitments |

| — | Summary of Critical Accounting Estimates |

| — | New Accounting Standards |

OVERVIEW

TrueBlue, Inc. (“TrueBlue,” “we,” “us,” “our”) is a leading provider of temporary blue-collar staffing. The temporary staffing industry includes a number of markets focusing on business needs that vary widely in duration of assignment and level of technical specialization. We operate within the blue-collar staffing market of the temporary staffing industry. In 2010, we connected approximately 300,000 people to work through the following blue-collar staffing brands: Labor Ready for general labor, Spartan Staffing for light industrial services, CLP Resources for skilled trades, PlaneTechs for aviation and diesel mechanics and technicians, and Centerline for dedicated and temporary drivers.

Headquartered in Tacoma, Washington, we serve approximately 175,000 businesses primarily in the services, construction, transportation, manufacturing, retail, and wholesale industries. As of December 31, 2010, we conducted our staffing services operations through 721 branch offices in all 50 states, Puerto Rico and Canada.

Fiscal 2010 is a 53-week year ending on the last Friday in December. The final quarter of fiscal 2010 consists of 14 weeks. References to 2009 and 2008 relate to the 52-week fiscal years ended December 25, 2009 and December 26, 2008, respectively.

Revenue grew to $1.15 billion for 2010, a 12.9% increase compared to the prior year. Excluding the 53rd week of 2010, revenue grew by 11.5% compared to 2009. The strong growth during 2010 was primarily driven by the economic recovery across most major geographies and significant industries we serve. Revenues associated with Boeing, our largest customer declined in 2010 as expected. Excluding the revenue associated with Boeing projects and the 53rd week of 2010, revenue increased 15.9% compared to 2009.

Net income grew by 126% to $19.8 million or $0.46 per diluted share for fiscal 2010 as compared to $8.8 million or $0.20 per diluted share for fiscal 2009. We used our operating leverage to significantly improve our operating results. The improved operating leverage resulted from utilization of the excess capacity in our branch network and cost reduction actions taken in 2009 to support the revenue growth without an increase in expenses. During the recession we reduced our branch network and consolidated branch management, field management, and substantially all support services while preserving capacity to expand as the economy recovered. The additional week of revenue during 2010 was insignificant to our net income.

Customer demand for blue-collar staffing services is dependent on the overall strength of the labor market and trends towards greater workforce flexibility within the blue-collar markets in which we operate. Improving economic growth typically results in increasing demand for labor, resulting in greater demand for our staffing services. During periods of increasing demand, we are able to improve our profitability by leveraging additional revenue and the associated gross profit across our fixed cost structure. Future growth trends will be dependent on whether the underlying economy continues to improve, trends in customer preference towards a more flexible workforce continue, and we are able to effectively serve customer needs. Given the uncertain nature of economic trends, it is not possible to predict when we will return to pre-recession levels of revenue and profitability. However, we do expect demand for our services to continue to grow during 2011.

Page -15

We are in a strong financial position to fund working capital needs for planned 2011 growth and expansion opportunities. We have cash and cash equivalents of $163 million at December 31, 2010, a 31% increase over the prior year. As of December 31, 2010, the maximum $80 million was available under the Revolving Credit Facility and $11 million of letters of credit have been issued against the facility, leaving an unused portion of $69 million.

RESULTS OF OPERATIONS

The following table presents the Consolidated Statements of Operations as a percent of revenue (except per share amounts):

| 2010 | 2009 | 2008 | ||||||||||

| Revenue from services |

100.0% | 100.0% | 100.0% | |||||||||

| Cost of services |

73.6% | 71.4% | 70.2% | |||||||||

| Gross profit |

26.4% | 28.6% | 29.8% | |||||||||

| Selling, general and administrative expenses |

22.5% | 25.7% | 24.0% | |||||||||

| Goodwill and intangible asset impairment |

-- | -- | 4.4% | |||||||||

| Depreciation and amortization |

1.4% | 1.7% | 1.2% | |||||||||

| Income from operations |

2.5% | 1.2% | 0.2% | |||||||||

| Interest and other income, net |

0.1% | 0.2% | 0.4% | |||||||||

| Income before tax expenses |

2.6% | 1.4% | 0.6% | |||||||||

| Income tax expense |

0.8% | 0.5% | 0.9% | |||||||||

| Net income (loss) |

1.8% | 0.9% | (0.3%) | |||||||||

| Net income (loss) per diluted share |

$ | 0.46 | $ | 0.20 | $ | (0.10) | ||||||

| Revenue from services | ||||||||||||

| Revenue from services for each of the past three years is as follows (in millions): |

||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Revenue from services |

$ | 1,149.4 | $ | 1,018.4 | $ | 1,384.3 | ||||||

Revenue for 2010 increased 12.9% compared to 2009. Fiscal 2010 is a 53-week year. Excluding the 53rd week of 2010, revenue grew by 11.5% compared to 2009. The strong growth was primarily driven by the economic recovery across most geographies and significant industries we serve. Further, our customers continue to increase their use of a flexible workforce to meet the demands of the recovering economy.

Revenue for 2009 decreased 26.4% compared to 2008. This decline was largely related to lower usage of our services as customers reduced their workforces in response to the economic recession. We began in 2008 to scale our cost structure to meet the declining demand for our services. Those efforts continued throughout 2009 and helped to ensure our continued profitability and put us in a strong position to face the challenges of the recession and increase profitability as the economy improved.

Page -16

The change in revenue for each of the past three years includes the following components:

| 2010 | 2009 | 2008 | ||||

| Major Revenue Trends: |

||||||

| Organic revenue growth / (decline) |

12.9% | (27.8%) | (15.7%) | |||

| Acquisitions within last 12 months |

-- | 1.4% | 15.6% | |||

| Total revenue growth / (decline) |

12.9% | (26.4%) | (0.1%) | |||

| Organic Revenue Trends (1): |

||||||

| Same branch (2) |

13.9% | (21.5%) | (13.4%) | |||

| New branches (3) |

0.9% | 0.2% | 0.8% | |||

| Consolidated / closed branches (4) |

(3.1%) | (7.7%) | (3.0%) | |||

| Additional week (5) |

1.4% | -- | -- | |||

| (1) | Percentages for Organic Revenue Trends do not sum to total organic revenue growth / (decline) as same branch growth is determined off a revenue base of branches open for 12 or more months, whereas total Organic revenue growth is measured off a total revenue base. |

| (2) | Same branch revenue is defined as those branches opened 12 months or more. |

| (3) | New branches are defined as those branches opened less than 12 months. |

| (4) | Represents the impact on revenue trends from closed branches assuming no customer retention. The majority of our closed branches are consolidated with another branch to retain customer relationships. The impact of retained customers is captured in same branch revenue. |

| (5) | Represents revenue growth as a result of an additional week in the year ended December 31, 2010 in comparison with the same period in the prior years. |

Our quarterly same branch revenue trends in comparison with the same period in prior years are as follows:

| Same Branch | ||||||

| Growth / (Decline) | ||||||

| 2010 |

2009 |

2008 | ||||

| First Quarter |

11.5% | (32.8%) | (1.6%) | |||

| Second Quarter |

17.1% | (27.4%) | (10.5%) | |||

| Third Quarter |

11.1% | (18.8%) | (14.7%) | |||

| Fourth Quarter (1) |

15.9% | (6.2%) | (24.5%) | |||

| October |

16.8% | (15.1%) | (19.8%) | |||

| November |

14.6% | (6.6%) | (24.6%) | |||

| December (1) |

17.0% | 5.1% | (29.0%) | |||

| (1) | Excluded impact of 53rd week in order to compare to prior years on a same-week basis. |

The improvement of our year-over-year quarterly same branch revenue trends for 2010 was due primarily to the economic recovery which was partially offset by the anticipated decline in work associated with Boeing projects. Excluding the impact of the revenue associated with Boeing and the extra week in the fourth quarter of 2010, same branch revenue growth would have been 2.9% for the first quarter, 23.1% for the second quarter, 22.6% for the third quarter, and 25.4% for the fourth quarter of 2010.

Gross profit

Gross profit for each of the past three fiscal years is as follows (in millions):

| 2010 | 2009 | 2008 | ||||||||||

| Gross profit |

$ | 303.5 | $ | 291.0 | $ | 412.5 | ||||||

| Gross profit as a % of revenue |

26.4% | 28.6% | 29.8% | |||||||||

Gross profit as a percentage of revenue for fiscal 2010 declined as compared to fiscal 2009. The decline is primarily due to revenue mix, increased costs associated with our temporary workers, and higher workers’ compensation expense.

The impact on gross profit from revenue mix is related to two primary factors. First, brands with a lower gross margin as a percent of revenue which specialize in manufacturing and industrial activities have become a larger portion of our business during the recession and the subsequent recovery. Second, our mix of blue-collar staffing business has shifted to service more national and large industrial customers which remained stronger than small to medium sized business during the recession and early stages of the recovery. These national and large industrial customers have put increased pricing pressure on our gross margins.

Page -17

The increased cost of our temporary workers results primarily from increased state unemployment taxes and certain other payroll taxes. The unemployment tax increases have in part been passed through to our customers. However, in most cases, the pass through did not include our standard markup. Increased cost of our temporary workers was partially offset by the incentives from the Hiring Incentives to Restore Employment (HIRE) Act which was enacted in March of 2010. The HIRE Act provided incentives for hiring and retaining workers by exempting the employer share of the social security tax on wages paid to qualified individuals beginning on March 18, 2010 and expired on December 31, 2010. We recognized $1.9 million of HIRE Act incentives net of other non-recurring payroll tax expense in 2010.

Workers’ compensation expense was 3.8% of revenue for 2010 versus 3.1% of revenue for 2009. The actual settlement cost of workers’ compensation claims continues to be less than previously estimated due primarily to the success of our risk management programs. The success of these programs has resulted in reducing prior estimated claim settlement costs. However, those reductions were less in 2010 as compared to 2009 resulting in increased workers’ compensation expense as a percent of revenue.

The decline in gross profit as a percentage of revenue for 2009 as compared to 2008 is primarily due to pricing pressures, increased statutory minimum wages, and revenue mix. The pricing pressure was due largely to increased price competition as a result of the recession. Our customers requested bill rate decreases and new customers also requested lower bill rates in comparison with historical bill rates. Statutory minimum wages paid to our temporary workers increased in 43 states as well as in Canada during 2009. While we increased the bill rates to our customers for pay increases, we did not fully pass through the amount of our standard markup due to our customers’ heightened level of price sensitivity related to slower economic conditions. Workers’ compensation expense as a percentage of revenue for 2009 was approximately 3.1% compared to 4.1% for 2008, which helped offset the negative impact from minimum wage increases and the drop in construction-related revenue which generally produced a higher gross margin in comparison with the blended, overall gross margin of the company. The improvement in workers’ compensation expense was due primarily to the continued success of our accident prevention and risk management programs that have been implemented over several years.

Selling, general and administrative expenses

Selling, general and administrative (“SG&A”) expenses for each of the past three fiscal years are as follows (in millions):

| 2010 | 2009 | 2008 | ||||||||||

| Selling, general and administrative expenses |

$ | 258.7 | $ | 262.2 | $ | 332.1 | ||||||

| Percentage of revenue |

22.5% | 25.7% | 24.0% | |||||||||

The decline in SG&A as a percentage of revenue for 2010 was the result of increased revenues without a corresponding increase to SG&A. During periods of increasing demand, we are able to improve our profitability and operating leverage as our current cost base can support some increases in business without a similar increase in SG&A. The decrease in SG&A during 2010 was also due to a combination of cost reduction actions in 2009 and aggressive cost containment in 2010. We remain focused on leveraging our existing network of branches and support services which will produce a strong incremental operating margin as we continue to leverage our fixed cost structure. SG&A expenses declined by 1.3% and 21.0% for 2010 and 2009, respectively, in comparison with the prior year.

The decrease in 2009 as compared to 2008 is largely the result of the aggressive cost management actions taken across the organization in 2009 in response to the recession, which included the consolidation of branches, branch management, field management, and substantially all back office support activities, as well as the reduction of various program expenses.

Goodwill and Intangible Asset Impairment

In the fourth quarter of 2008, we experienced a significant decline in our stock price. As a result of this decline, our market capitalization fell significantly below the recorded value of our consolidated net assets. The reduced market capitalization reflected, in part, the economic climate at the time, as well as expected continued weakness in pricing and demand for our temporary staffing services. As a result of our 2008 assessment, we concluded that the carrying amounts of goodwill and indefinite-lived intangible assets for the CLP, Spartan Staffing, and Centerline reporting units exceeded their implied fair values and we recorded non-cash impairment losses totaling $61.0 million, which was reflected in our Consolidated Statements of Operations for the fiscal year ended December 26, 2008. Our assessment of goodwill and indefinite-lived intangible assets impairment indicated that as of December 26, 2008, the fair value of each of the Labor Ready and PlaneTechs reporting units exceeded its carrying value and therefore goodwill was not impaired.

Page -18

Depreciation and amortization

Depreciation and amortization for each of the past three fiscal years are as follows (in millions):

| 2010 | 2009 | 2008 | ||||||||||

| Depreciation and amortization |

$ | 16.5 | $ | 17.0 | $ | 16.8 | ||||||

| Percentage of revenue |

1.4% | 1.7% | 1.2% | |||||||||

Depreciation and amortization decreased for fiscal 2010 as compared to 2009 by $0.5 million from reduced capital spending and a decrease in amortization of intangible assets which have become fully amortized. Depreciation increased for fiscal 2009 as compared to 2008 by $4.1 million resulting primarily from investments in technology to improve branch and branch support efficiencies. The increase was largely offset by $3.8 million of decreased amortization of intangible assets as a result of their impairment in fiscal 2008.

Interest and other income, net

Net interest income has declined over the past three years due to a continued decline in investment yields on our restricted and unrestricted cash.

Income taxes

Our effective income tax rate was 32.0% in 2010, as compared to 37.8% in 2009 and 151.0% in 2008. Excluding the impairment of goodwill and intangible assets in 2008, our effective income tax rate in 2008 would have been 34.7%. The principal difference between the statutory federal income tax rate of 35.0% and our 2010 effective income tax rate results from state and foreign income taxes, federal tax credits, and certain non-deductible expenses. Our 2010 effective tax rate of 32.0% was lower than our 2009 rate of 37.8% primarily due to the tax benefit related to the favorable development of a federal income tax matter. Our 2008 effective tax rate of 34.7% excluding the effect of the impairment charge was lower than our 2009 rate primarily due to the favorable resolution of certain state income tax matters during 2008.

Results of Operations Future Outlook

The following highlights represent our expectations in regard to operating trends for fiscal year 2011. These expectations are subject to revision as our business changes with the overall economy:

| — | Due to our industry’s sensitivity to economic factors, the inherent difficulty in forecasting the direction and strength of the economy, and the short term nature of staffing assignments, our visibility for future demand is limited. As a result, we monitor a number of economic indicators as well as certain trends to estimate future revenue trends. Based on these anticipated trends, we expect continued revenue growth in 2011 as the economy continues to recover. However, our revenue growth percentage will diminish due to more challenging prior period revenue comparisons versus the prior period comparables for 2010. Our expected revenue growth will be partially offset by reduced revenue associated with our largest customer as they complete certain multi-year projects. Revenue associated with Boeing projects in 2010 was $113 million and our expectation for the first quarter of 2011 is $20 million which is our best estimate for expected revenue in future quarters. |

| — | Fiscal 2011 will be a 52-week year as compared to fiscal 2010 which was a 53-week year. The extra week in 2010 added approximately $14 million to 2010 revenue which will negatively impact our growth rate comparisons for 2011 versus 2010. |

| — | Our top priority is increasing revenue through our existing branch network and improving gross margin. This will continue to produce strong incremental operating margins as we leverage our fixed cost structure across additional organic revenue. We will continue to invest in our sales and customer service programs which we believe will enhance our ability to capitalize on further growth and customer retention. While we do incur additional SG&A costs to support additional organic revenue, we will continue to diligently manage our cost structure to meet our goal of producing a strong incremental operating margin on additional organic revenue. |

| — | As the economy grows, we will continue to evaluate opportunities to expand our market presence. All of our multi-location brands have opportunities to expand through new physical locations or by sharing existing locations. Where possible we plan to expand the presence of our brands by sharing existing locations to achieve cost synergies. We plan to build on our success with centralized recruitment and dispatch of our temporary workers to locations without physical branches and expand our geographic reach. We will also evaluate strategic acquisitions in the blue-collar staffing market that can produce strong returns on investment. Our focus is on acquisitions that can accelerate the building of a national presence for a particular brand or that provide an opportunity to serve a new, but sizable portion of the blue-collar staffing market. |

Page -19

| — | Federal and state unemployment taxes will increase again in 2011. Our best estimate of the impact, assuming no action on our part, is an increase that would negatively impact gross margin by 0.6% of revenue. We have put in place programs to pass these costs through to our customers. Until the economy fully recovers and state unemployment funds have been replenished and related federal loans repaid by certain states, we expect continued increases to our unemployment taxes and our customers could be resistant to price increases to cover these costs. |

| — | We have certain non-recurring benefits to our gross margin in 2010. The benefits from the HIRE Act for hiring and retaining workers who qualify for certain payroll tax exemptions expired in 2010. The benefit of this non-recurring program net of other non-recurring payroll tax expense was $1.9 million or nearly 20 basis points of gross margin in 2010. Likewise, our workers’ compensation expense as a percentage of revenue has been running at approximately 4% during the second half of 2010, which we believe is a reasonable expectation for 2011. During the first half of 2010, our workers’ compensation expense was less than 4% of revenue which contributed to our workers’ compensation expense for fiscal year 2010 of approximately 3.8%, or 0.2% of revenue less than our current run rate. |

Starting in 2011, we will report our organic revenue trends without reference to revenue by branch, which is consistent with our industry. Given our objective of leveraging our existing branch network, increasing our focus on centralized activities, sharing branch offices, and a variety of other factors, we believe reporting revenue as a function of branch count is no longer meaningful.

LIQUIDITY AND CAPITAL RESOURCES

Our principal source of liquidity is operating cash flows. Our net income and, consequently, our cash provided from operations are impacted by sales volume, seasonal sales patterns and profit margins. Over the past three fiscal years, net cash provided by operations was approximately $168 million.

Cash flows from operating activities

Our cash flows provided by operating activities for each of the past three fiscal years were as follows (in millions):

| 2010 | 2009 | 2008 | ||||||||||

| Net income (loss) |

$ | 19.8 | $ | 8.8 | $ | (4.2) | ||||||

| Goodwill and intangible asset impairment |

-- | -- | 61.0 | |||||||||

| Depreciation and amortization |

16.5 | 17.0 | 16.8 | |||||||||

| Provision for doubtful accounts |

8.2 | 14.5 | 13.2 | |||||||||

| Stock-based compensation |

7.2 | 7.1 | 7.7 | |||||||||

| Deferred income taxes |

5.3 | 2.8 | 3.0 | |||||||||

| Other operating activities |

(0.2) | 1.1 | (0.3) | |||||||||

| Changes in operating assets and liabilities, exclusive of businesses acquired: |

||||||||||||

| Accounts receivable |

(11.6) | (14.8) | 32.8 | |||||||||

| Income taxes |

(3.3) | 13.4 | (25.2) | |||||||||

| Workers’ compensation |

(2.2) | (14.1) | 1.7 | |||||||||

| Accounts payable and accrued expenses |

3.4 | (2.6) | (14.1) | |||||||||

| Other |

(1.1) | 0.4 | - | |||||||||

| Net cash provided by operating activities |

$ | 42.0 | $ | 33.6 | $ | 92.4 | ||||||

| — | Net income for 2010 was $19.8 million as compared to $8.8 million for 2009 due to the recovering economy. Net income was lower in 2009 and 2008 due to the recession. Results for 2008 include a goodwill and intangible asset impairment charge of $61.0 million related to the company’s acquisitions since 2004. Excluding this impairment charge, net income would have been $45.2 million. The charge is largely a result of the adverse impact on expected future cash flows related to the global recession. The charge did not impact the company’s cash, liquidity, or compliance with banking covenants. |

| — | Accounts receivable increased in 2010 primarily due to revenue growth which was partially offset by improved collections and a decrease in our days sales outstanding. The provision for doubtful accounts declined in 2010 and reflects the improving economy and ability of our customers to pay. Accounts receivable increased in 2009 due to recession and customers extending their payment cycle. The provision for doubtful accounts for 2009 increased as a result of the recession and inability of some customers to pay. |

Page -20

| — | The change in income taxes during 2009 is primarily due to tax refunds claimed in 2008 and received in 2009. |

| — | Generally, our workers’ compensation reserve for estimated claims increases as temporary labor services increase and decreases as temporary labor services decline. During 2010, our workers’ compensation reserve increased as we increased temporary labor services offset by the timing of payments. During 2009, the estimated claims decreased as we decreased temporary labor services due to the recession. |