2011 Q1

Investor Presentation

Exhibit 99.1 |

2011 Q1

Investor Presentation

Exhibit 99.1 |

Cautionary

Note About Forward-Looking Statements: Certain statements made by us in this

presentation that are not historical facts or that relate to future plans, events

or performances are forward-looking statements that reflect management’s

current outlook for future periods, including

statements regarding future financial performance.

These forward-looking statements are based upon our current expectations, and our

actual results may differ materially from those described or contemplated in the

forward–looking statements. Factors that may cause our actual results to

differ materially from those contained in the forward-looking statements,

include without limitation the following: 1) national and global

economic conditions, including the impact of changes in national

and global credit markets and

other changes on our customers; 2) our ability to continue to attract and retain

customers and maintain profit margins in the face of new and existing competition;

3) new laws and regulations that could have a materially adverse effect on our

operations and financial results; 4) significant labor disturbances which could

disrupt industries we serve; 5) increased costs and collateral requirements in

connection with our insurance obligations, including workers’ compensation

insurance; 6) the adequacy of our financial reserves; 7) our continuing ability to

comply with financial covenants in our lines of credit and other financing

agreements; 8) our ability to attract and retain competent employees in key

positions or to find temporary employees to fulfill the needs of our customers; 9)

our ability to successfully complete and integrate acquisitions that we may make

from time to time; and 10) other risks described in our filings with the

Securities and Exchange Commission, including our most recent Form 10-K and

Form 10-Q filings. Use of estimates and forecasts:

Any references made to Q-1 2011 or fiscal year 2011 are based on management guidance

issued Feb. 09, 2011, and are included for informational purposes only.

Any reference to future financial

estimates or targets are included for informational purposes only and subject to factors

discussed in our 10-K and 10-Q filings. |

Company and

Industry Overview |

4

Investment Highlights

Specialized approach in serving the market

Attractive industry growth prospects

Unique industry-

related upside

Strong operating leverage

Multiple opportunities to increase market share

Solid balance sheet

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

|

We’re the people making a positive difference.

Every day, we use our specialized brands to find

new opportunities to better serve customers and

workers at all skill levels.

Our vision:

Be

the

Leading

Provider

of

Blue-Collar

Staffing

TrueBlue™

(NYSE:TBI)

2011

Q1

Investor

Presentation |

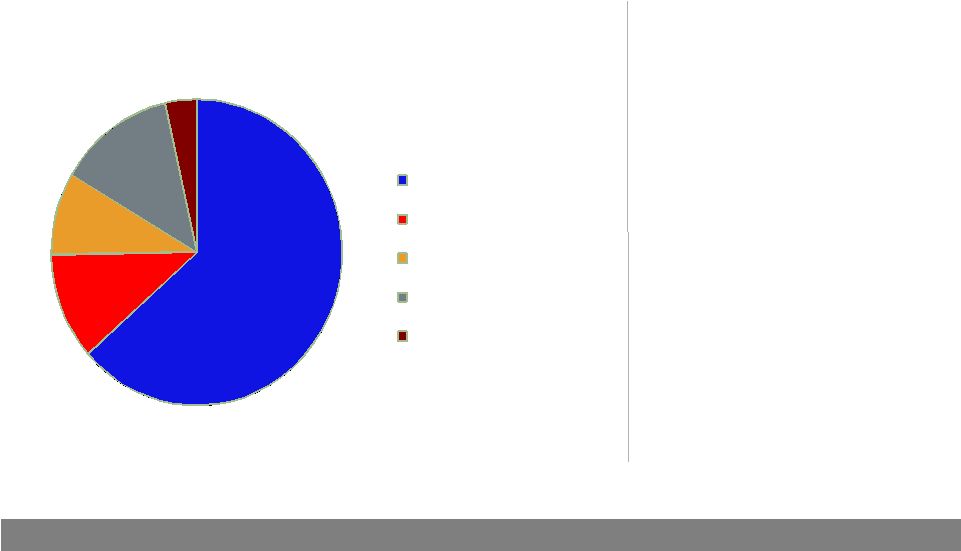

6

The

Leading

Provider

of

Blue-Collar

Staffing

Market

size/share

($)

2

Labor Ready

$4 billion (20%)

Spartan Staffing

$7 billion (1%)

CLP

$1 billion (10%)

PlaneTechs

$500 million (35%)

Centerline

$800 million (5%)

TrueBlue™

(NYSE:TBI) 2010 Q4 Investor Presentation

1

2010 revenue rounded to the nearest $5 million.

2

Staffing

Industry

Analysts

2010

forecast,

TrueBlue

estimates.

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor

Presentation

Revenues in millions ($)

1

Labor Ready: $730

Spartan Staffing: $130

CLP: $100

PlaneTechs: $150

Centerline: $40 |

“Award of

Excellence”

“Hot Growth

Company”

“National Universal

Agreement to Mediate”

“Forbes Most

Trustworthy

Companies “

“VIP program to

promote employee

fairness and

safety”

“Platinum 400”

“Best practices by

DHS/ICE Partner”

Recognized

as

a

Credible

Industry

Leader

TrueBlue™

(NYSE:TBI)

2011

Q1

Investor

Presentation

7 |

8

Sales by Industry

Construction

37%

22%

Manufacturing

17%

20%

Transportation

9%

12%

Wholesale

Trade

10%

9%

Retail

8%

7%

Services

&

Other

19%

16%

Aviation

0%

14%

2006

2010 TrueBlue™

(NYSE:TBI) 2011 Q1 Investor

Presentation |

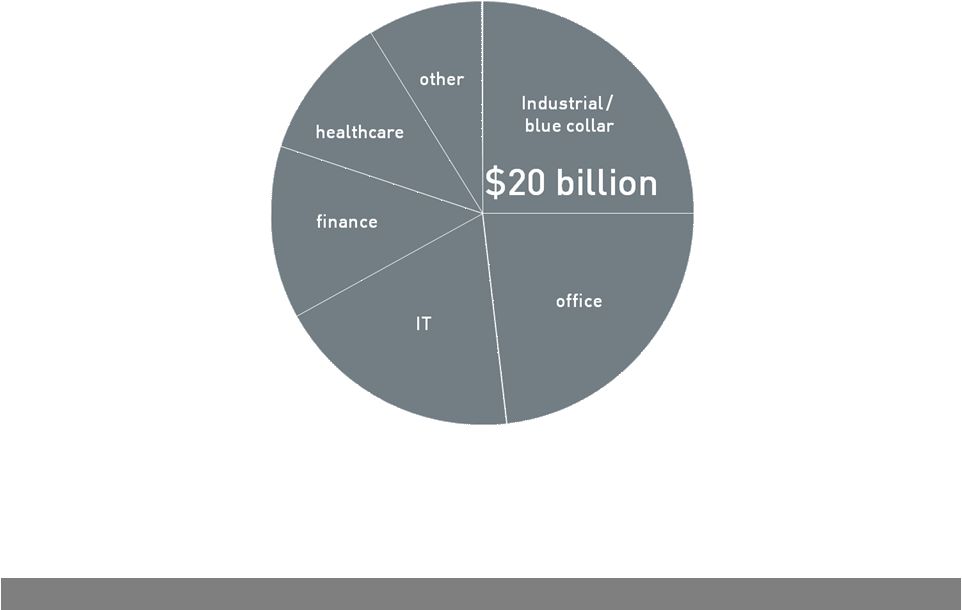

9

Temporary

Staffing

$75 billion

Staffing Industry Analysts 2010 forecast, rounded

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor

Presentation |

2010 Market

10

$20B

2015 Market Forecast

$30B

Blue-collar

Staffing

–

Strong

Future

Growth

Source:

Staffing

Industry

Analysts,

Moody’s

economic

forecasts,

TrueBlue

estimates

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor

Presentation |

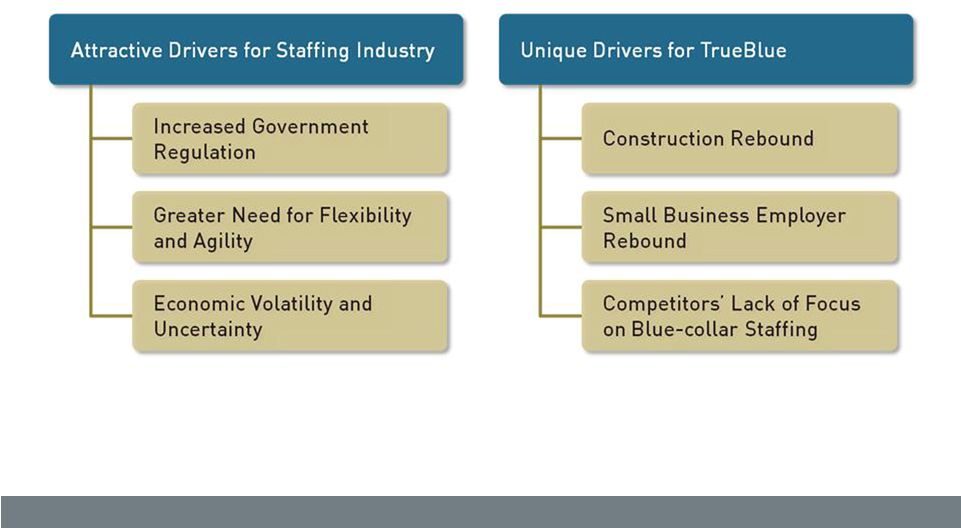

Industry Growth Drivers

11

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

|

12

Strategic Priorities

Focus

Why

How

Organic

Growth –

Existing

Geographies

+++

Operating

Leverage

Brand Specialization

Brand Leadership

Intra-brand Industry Specialization

Service

Excellence

Geographic

Expansion

+

Increase

Market

Share

On-site Locations

Multi-Brand Locations

Acquisitions

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation |

13

Operating Leverage of Organic Growth

Organic growth from existing geographies = 15% -

18% incremental

operating margins

*

Example calculation of incremental operating margins:

Incremental Revenue

100

$

Gross Profit Generated

26

$

Operating Expense

Associated with Incremental Revenue

(8) -

(11)

$

Incremental Operating Income

18

$15 -

*

Reflects

an

approximation

of

the

incremental

operating

margin

that

management

believes

can

be

achieved

in

2011,

in

general,

with

favorable

revenue

growth

and

current

gross

margin,

revenue

mix

and

geographic

footprint.

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

|

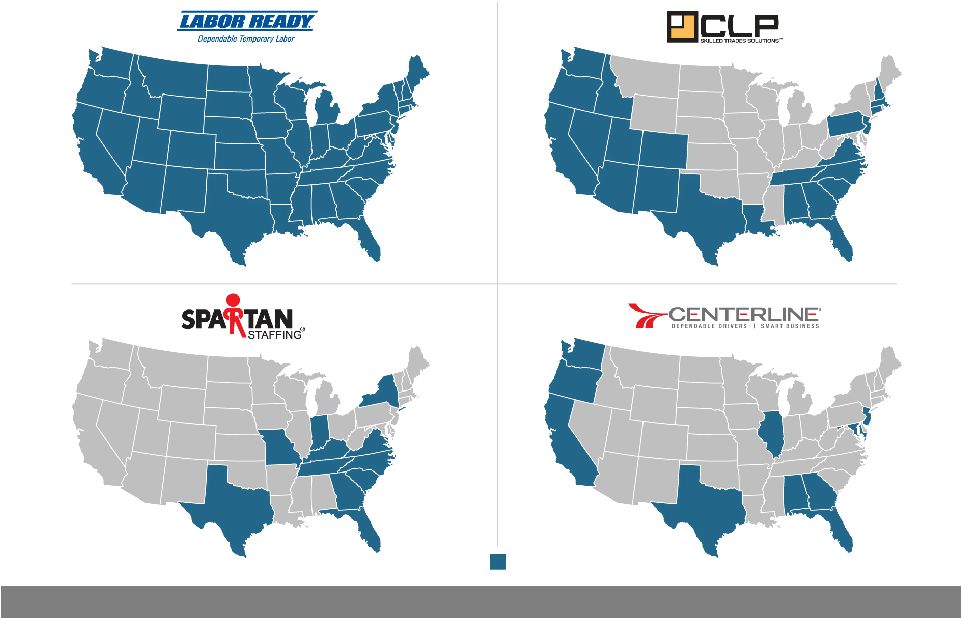

Geographic Expansion Opportunities

14

Existing markets

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

|

15

Strategic Acquisitions

Qualitative Factors

Quantitative Factors

•

Blue-collar

•

Existing Market Tuck-ins

•

New Geographic Markets

•

Cultural Alignment

•

Return on Investment

•

Financing

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

|

Financial

Review |

17

Financial Targets

Revenue

Growth

Market

>

EBITDA

%

7%

>

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

*See disclosure and reconciliation of EBITDA on slide 25. |

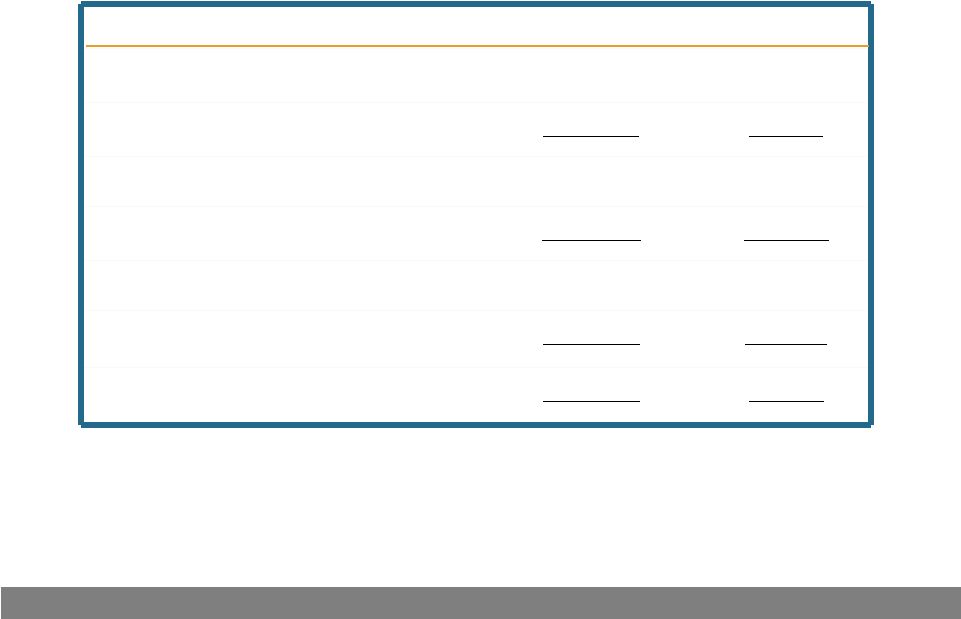

18

Financial Summary

** 2010 included a 53

rd

week which contributed 1% to revenue growth.

2010**

2009

Growth %

Revenue

$1,149

$1,018

13%

Gross profit

$ 303

$ 291

4%

% of Revenue

26.4%

28.6%

SG&A expense

$ 259

$ 262

-1%

% of Revenue

22.5%

25.8%

EBITDA*

$ 45

$ 29

55%

% of Revenue

3.9%

2.8%

Net income

$ 20

$ 9

122%

% of Revenue

1.7%

0.9%

Earnings per share

$ 0.46

$ 0.20

129%

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

*See disclosure and reconciliation of EBITDA on slide 25.

|

19

Recent Revenue Trends

-5%

0%

5%

10%

15%

20%

25%

30%

Q2 '10

Q3 '10

Q4 '10 *

Q1 '11

Forecast

Revenue Growth

-5%

0%

5%

10%

15%

20%

25%

30%

Q2 '10

Q3 '10

Q4 '10 *

Q1 '11

Forecast

Revenue Growth excluding

Largest Customer

*

Q4

2010

Revenue

Growth

excludes

14

th

week

for

comparative

purposes.

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

|

20

Strong Balance Sheet

Cash and investments

$163

$124

Current ratio

3.4

2.9

Restricted cash

$120

$124

Workers’

comp reserve

$187

$190

Debt

$ 0

$ 1

Shareholders’

equity

$313

$285

Q-4 2010 Q-4 2009

$ in millions.

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

|

21

Investment Highlights

Specialized approach in serving the market

Attractive industry growth prospects

Unique industry-related upside

Strong operating leverage

Multiple opportunities to increase market share

Solid balance sheet

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

|

Appendix |

23

Blue-Collar Specialties

General Labor

Postions filled on-demand

Numerous workers available

Convenient community branches

Logistics & Manufacturing

Specialized skills for manufacturing & logistics

Longer term assignments and temp to perm

On-site management of employees

Skilled Trades

Skilled tradespeople for a variety of end markets

Rigorous assessment of skill and trades experience

Long-term, multiple project opportunities

Aviation Mechanics

Mechanics and technicians for aviation

In-depth screening for aviation certification

Centralized recruiting and assignment nationwide

CDL Drivers

Temporary staffing or driver management services

Comprehensive application and hiring process

24/7 central dispatch

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

|

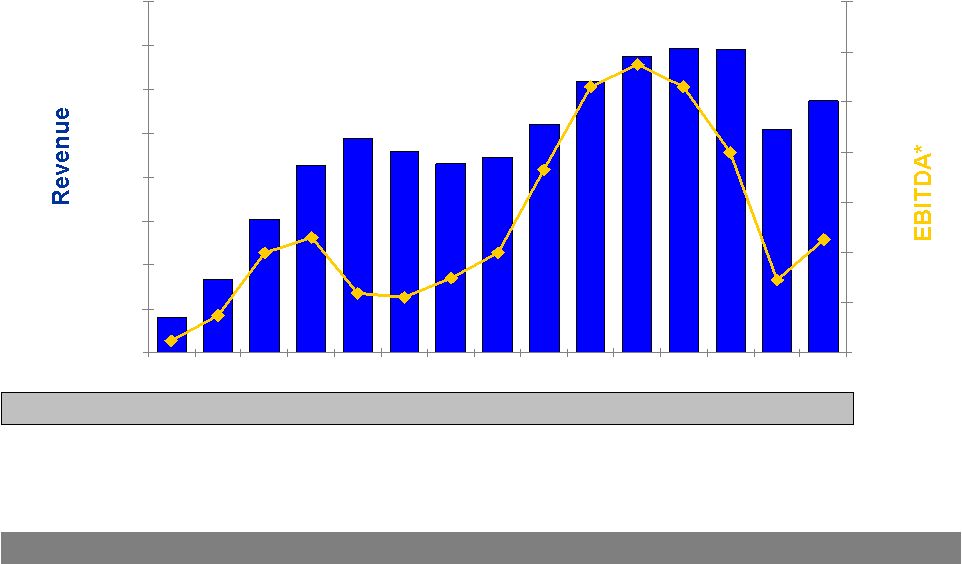

24

0

200

400

600

800

1,000

1,200

1,400

1,600

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

0

20

40

60

80

100

120

140

Historical Summary

Annual Revenue and EBITDA*

in $M

in $M

No. of Branches

200 316 486

687 816 756 748 779 815

887 912 894

850 754 721 2008

excludes

goodwill

and

intangible

asset

impairment

charges.

See

10-K

for

additional

information.

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

*See disclosure and reconciliation of EBITDA on slide 25.

|

25

Reconciliation of EBITDA to Net Income

*EBITDA is non-GAAP financial measure which excludes interest, taxes,

depreciation and amortization from net income. EBITDA is a key measure used

by management in evaluating performance. EBITDA should not be considered a measure of financial performance in

isolation or as an alternative to net income (loss) in the Statement of Operations

in accordance with GAAP, and, as presented, may not be comparable to

similarly titled measures of other companies. 2010**

2009**

Net income

$ 20

$ 9

Income tax expense

9

5

Income before tax expense

29

14

Interest and other income, net

(1)

(2)

Income from operations

28

12

Depreciation & Amortization

16

17

EBITDA*

$ 45

$ 29

TrueBlue™

(NYSE:TBI) 2011 Q1 Investor Presentation

**Some amounts may not sum due to rounding. |