Exhibit 99.1

Exhibit 99.1

2010 Q1 Investor Presentation

Safe Harbor Statement

Cautionary Note About Forward-Looking Statements:

Certain statements made by us in this presentation that are not historical facts or that relate to future plans, events or performances are forward-looking statements within the meaning of the federal securities laws. Our actual results may differ materially from those expressed in any forward-looking statements made by us. Forward-looking statements involve a number of risks and uncertainties including, but not limited to, the risks described in the Company’s most recent 10-K and 10-Q filings. All forward-looking statements are qualified by those risk factors.

Use of estimates and forecasts:

Any references made to Q-1 2010 and fiscal year 2010 are based on management guidance issued Feb. 3, 2010 and are included for illustrative purposes, and are not deemed an update or reaffirmation of Feb. 3, 2010 guidance.

Company and Industry Overview

Investment Highlights

Leader in blue-collar staffing

Poised to benefit from economic recovery Attractive long-term industry growth prospects Strong operating leverage New growth platforms and diversification

TrueBlue™ | 2010 Q1 Investor Presentation

4

The Leading Provider of Blue-Collar Staffing

$1 Billion in Revenue across Five Blue-Collar Brands

Logistics & Aviation

Specialty General Labor Skilled Trades CDL Drivers

Manufacturing Mechanics

Branch

Locations 627 52 59 1 15

2009

Revenue $630 Million $80 Million $100 Million $180 Million $30 Million

Market Size / $3 Billion $6 Billion $1 Billion $500 Million $700 Million

(10% Market Share) (34% Market Share)

Share1 (20% Market Share) (1% Market Share) (4% Market Share)

Geography Southeast & Southeast & U.S. West Coast, GA &

U.S. & Canada

Served Midwest West (centralized dispatch) FL

1 U.S. market size and share estimated by TrueBlue based on Staffing Industry Analysts 2009 forecast of total blue-collar temporary staffing.

TrueBlue™ | 2010 Q1 Investor Presentation 5

Blue-Collar Specialties

General Labor

Postions filled on-demand Numerous workers available Convenient community branches

Logistics & Manufacturing

Specialized skills for manufacturing & logistics Longer term assignments and temp to perm On-site management of employees

Skilled Trades

Skilled tradespeople for a variety of end markets Rigorous assessment of skill and trades experience Long-term, multiple project opportunities

Aviation Mechanics

Mechanics and technicians for aviation In-depth screening for aviation certification Centralized recruiting and assignment nationwide

CDL Drivers

Temporary staffing or driver management services Comprehensive application and hiring process 24/7 central dispatch

TrueBlue™ | 2010 Q1 Investor Presentation 6

Why Multiple Brands

Access to a much larger staffing market than traditional general labor services Expertise in selected industries and skill sets which creates a significant competitive advantage vs. general staffing firms Unique recruiting model to attract the best employees for specific industry services Focus on occupations expected to experience long-term shortages (truck drivers, skilled trades people, forklift drivers, skilled mechanics, etc.)

TrueBlue™ | 2010 Q1 Investor Presentation

7

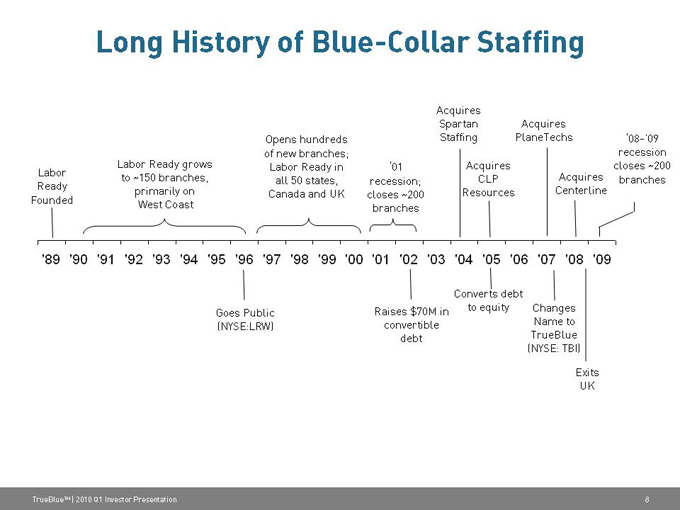

Long History of Blue-Collar Staffing

Acquires

Spartan Acquires

Opens hundreds Staffing PlaneTechs ‘08-’09

of new branches; recession

Labor Ready grows Labor Ready in ‘01 Acquires closes ~200

Labor to ~150 branches, all 50 states, recession; CLP Acquires branches

Ready primarily on Canada and UK closes ~200 Resources Centerline

Founded West Coast branches

‘89 ‘90 ‘91 ‘92 ‘93 ‘94 ‘95 ‘96 ‘97 ‘98 ‘99 ‘00 ‘01 ‘02 ‘03 ‘04 ‘05 ‘06 ‘07 ‘08 ‘09

Converts debt

Goes Public Raises $70M in to equity Changes

(NYSE:LRW) convertible Name to

debt TrueBlue

(NYSE: TBI)

Exits

UK

TrueBlue™ | 2010 Q1 Investor Presentation

8

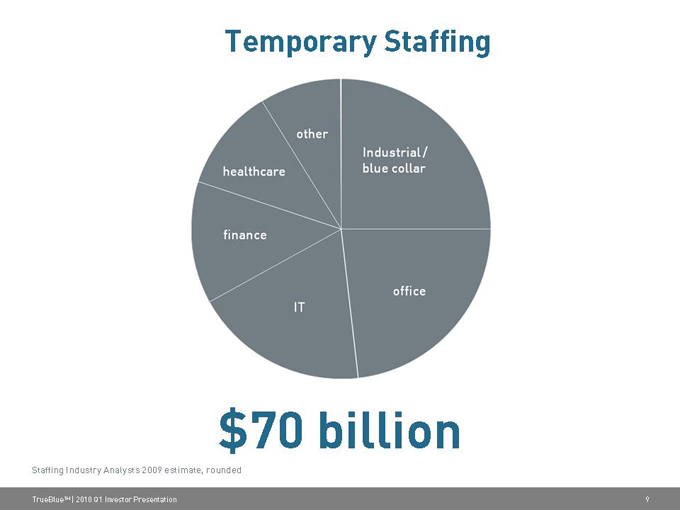

Temporary Staffing

$70 billion

Staffing Industry Analysts 2009 estimate, rounded

other

Industrial/blue collar

office

IT

finance

healthcare

TrueBlue™ | 2010 Q1 Investor Presentation 9

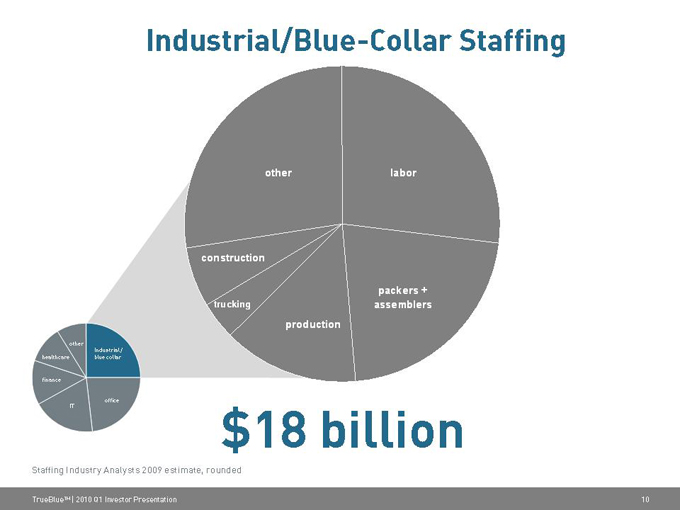

Industrial/Blue-Collar Staffing

other labor

construction

packers + trucking assemblers production

other

Industrial / healthcare blue collar

finance

IT office $18 billion

Staffing Industry Analysts 2009 estimate, rounded

TrueBlue™ | 2010 Q1 Investor Presentation 10

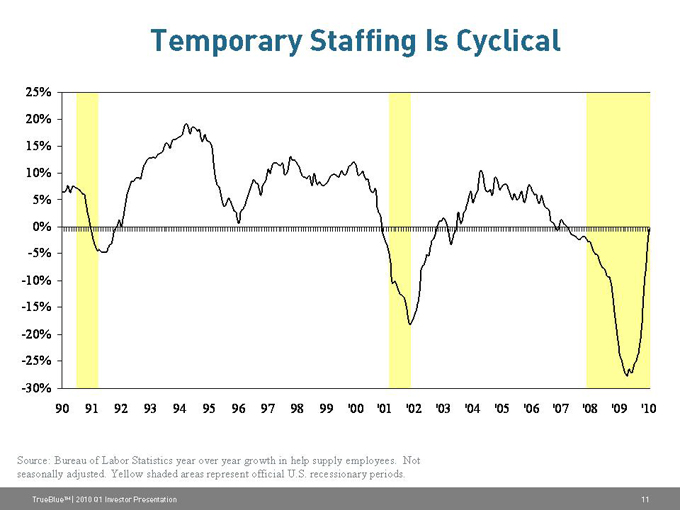

Temporary Staffing Is Cyclical

25% 20% 15% 10% 5% 0% -5% -10% -15% -20% -25% -30%

90 91 92 93 94 95 96 97 98 99 ‘00 ‘01 ‘02 ‘03 ‘04 ‘05 ‘06 ‘07 ‘08 ‘09 ‘10

Source: Bureau of Labor Statistics year over year growth in help supply employees. Not seasonally adjusted. Yellow shaded areas represent official U.S. recessionary periods.

TrueBlue™ | 2010 Q1 Investor Presentation

11

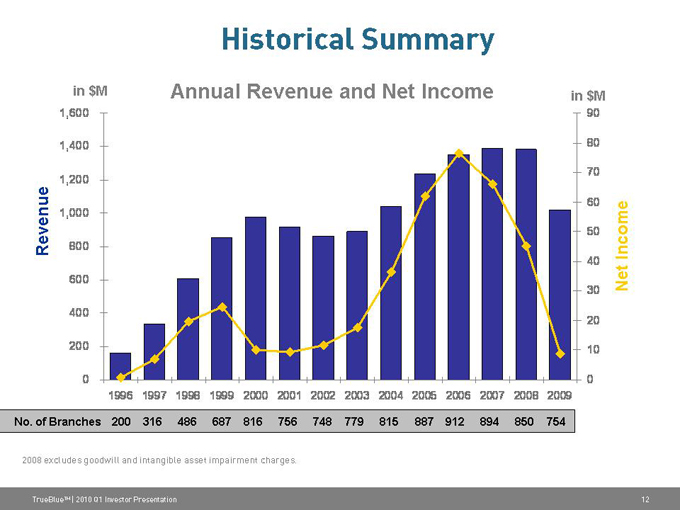

Historical Summary

in $M Annual Revenue and Net Income in $M

1,600 90

1,400 80 70 1,200 1,000 60 50

Revenue 800 Income

40 600 30 Net 400 20

200 10

0 0 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

No. of Branches 200 316 486 687 816 756 748 779 815 887 912 894 850 754

2008 excludes goodwill and intangible asset impairment charges.

TrueBlue™ | 2010 Q1 Investor Presentation

12

Recent & Potential Staffing Industry Trends

Temporary help penetration rate improved to 1.5%* in January 2010 versus 1.3%* in October 2009.

Layoffs and economic uncertainty may create an increase in the temporary help penetration rate peak of 2%* in the last cycle. Recent revenue trends for most industrial staffing companies have outperformed trends in other lines of staffing.

Purchasing Managers’ Index improved to 58 in January 2010 – this marked 6 consecutive months above 50 and the highest rating since October 2005.

Weakened balance sheets may eliminate competitors or spur consolidation presenting market share gains for surviving firms.

* Source: BLS

TrueBlue™ | 2010 Q1 Investor Presentation

13

Strategies for Growth

Operating Leverage of Existing Branch Network Same-branch revenue growth Cost controls Geographic Expansion Strategic Acquisitions

TrueBlue™ | 2010 Q1 Investor Presentation

14

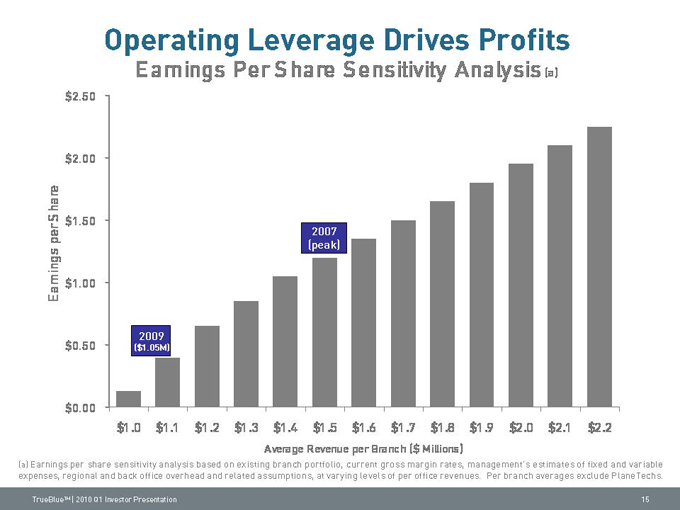

Operating Leverage Drives Profits

Earnings Per Share Sensitivity Analysis (a)

$2.50

$2.00

Share $1.50 per 2007 (peak)

Earnings $1.00

2009

$0.50 ($1.05M)

$0.00 $1.0 $1.1 $1.2 $1.3 $1.4 $1.5 $1.6 $1.7 $1.8 $1.9 $2.0 $2.1 $2.2 Average Revenue per Branch ($ Millions)

(a) Earnings per share sensitivity analysis based on existing branch portfolio, current gross margin rates, management’s estimates of fixed and variable expenses, regional and back office overhead and related assumptions, at varying levels of per office revenues. Per branch averages exclude PlaneTechs.

TrueBlue™ | 2010 Q1 Investor Presentation

15

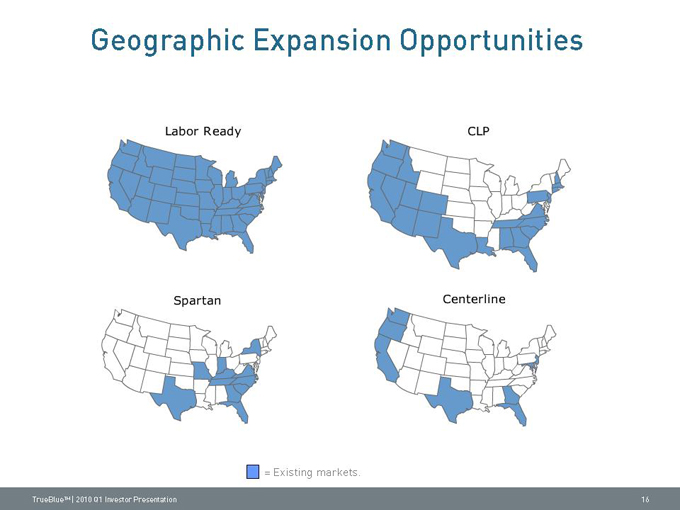

Geographic Expansion Opportunities

= Existing markets.

TrueBlue™ | 2010 Q1 Investor Presentation

Labor Ready

CLP

Spartan

Centerline

16

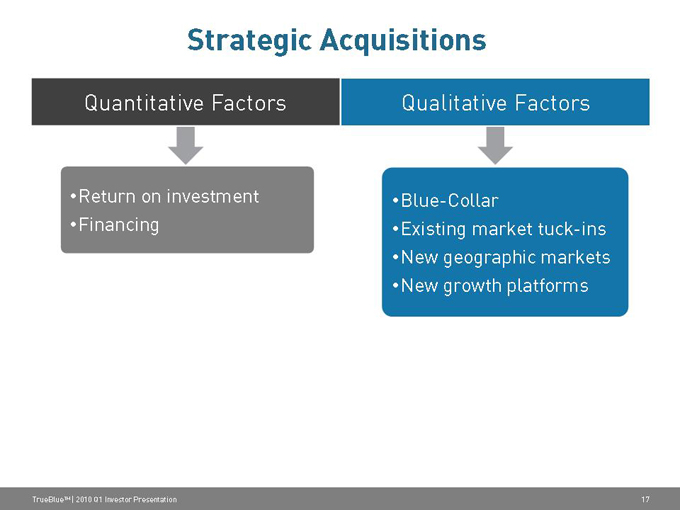

Strategic Acquisitions

Quantitative Factors Qualitative Factors

Return on investment Blue-Collar

Financing Existing market tuck-ins New geographic markets New growth platforms

TrueBlue™ | 2010 Q1 Investor Presentation

17

Financial Review

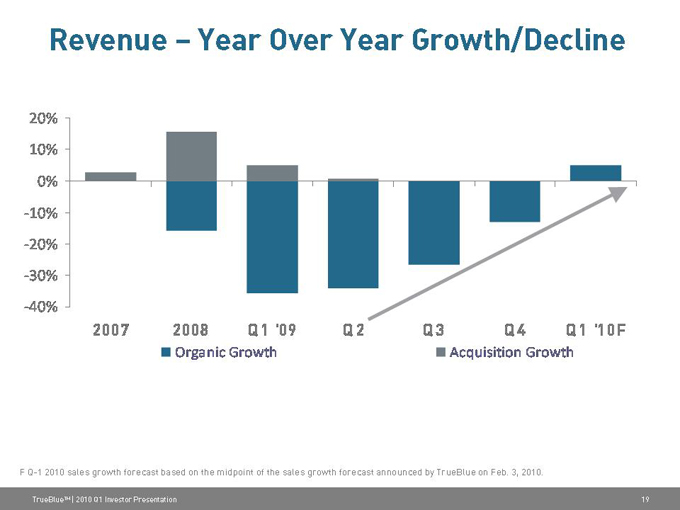

Revenue – Year Over Year Growth/Decline

20% 10% 0% -10% -20% -30% -40%

2007 2008 Q1 ‘09 Q2 Q3 Q4 Q1 ‘10F

Organic Growth Acquisition Growth

F Q-1 2010 sales growth forecast based on the midpoint of the sales growth forecast announced by TrueBlue on Feb. 3, 2010.

TrueBlue™ | 2010 Q1 Investor Presentation

19

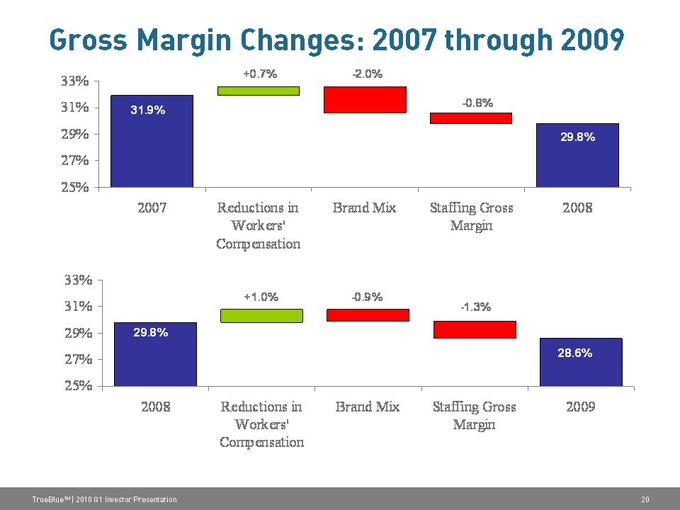

Gross Margin Changes: 2007 through 2009

33% +0.7% -2.0%

31% -0.8% 31.9%

29% 29.8%

27% 25%

2007 Reductions in Brand Mix Staffing Gross 2008 Workers’ Margin Compensation

33%

+1.0% -0.9%

31% -1.3% 29% 29.8%

27% 28.6%

25%

2008 Reductions in Brand Mix Staffing Gross 2009 Workers’ Margin Compensation

TrueBlue™ | 2010 Q1 Investor Presentation

20

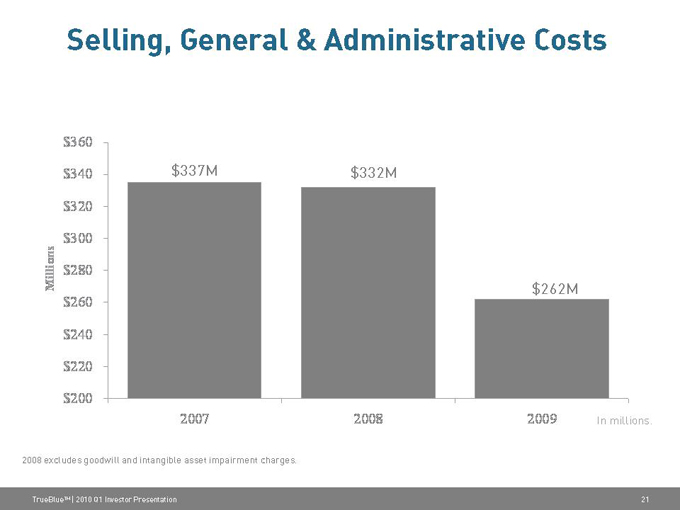

Selling, General & Administrative Costs

$360 $340 $337M $332M $320

$300

Millions $280

$260 $262M $240

$220

$200

2007 2008 2009 In millions.

2008 excludes goodwill and intangible asset impairment charges.

TrueBlue™ | 2010 Q1 Investor Presentation

21

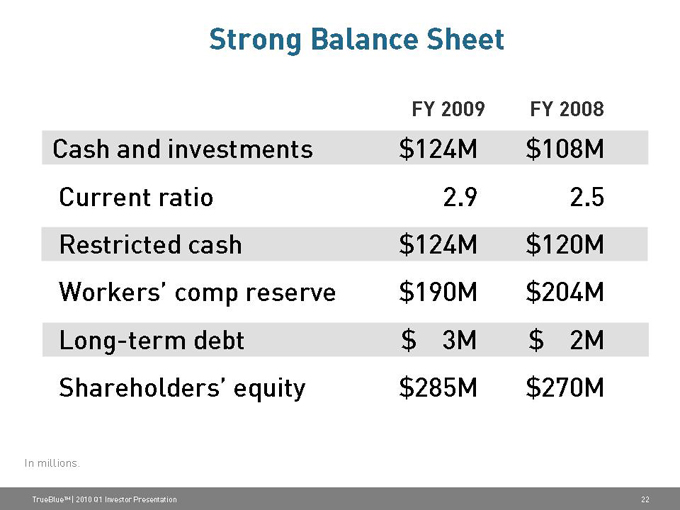

Strong Balance Sheet

FY 2009 FY 2008

Cash and investments $124M $108M

Current ratio 2.9 2.5

Restricted cash $124M $120M

Workers’ comp reserve $190M $204M

Long-term debt $ 3M $ 2M

Shareholders’ equity $285M $270M

In millions.

TrueBlue™ | 2010 Q1 Investor Presentation

22

Investment Highlights

Leader in blue-collar staffing

Poised to benefit from economic recovery Attractive long-term industry growth prospects Strong operating leverage New growth platforms and diversification

TrueBlue™ | 2010 Q1 Investor Presentation

23