UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

| Filed by the Registrant ☒ | ||||

| Filed by a Party other than the Registrant ☐ | ||||

| Check the appropriate box: | ||||

| ☐ | Preliminary Proxy Statement | ☐ | Soliciting Material Under Rule 14a-12 | |

| ☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| TrueBlue, Inc. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | |||||

| ☒ | No fee required. | ||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||||

| 1 | Title of each class of securities to which transaction applies: | ||||

| 2 | Aggregate number of securities to which transaction applies: | ||||

| 3 | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||

| 4 | Proposed maximum aggregate value of transaction: | ||||

| 5 | Total fee paid: | ||||

| ☐ | Fee paid previously with preliminary materials: | ||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||||

| 1 | Amount previously paid: | ||||

| 2 | Form, Schedule or Registration Statement No.: | ||||

| 3 | Filing Party: | ||||

| 4 | Date Filed: | ||||

Letter to Shareholders

Tacoma,

Washington

April 2, 2020

Dear Shareholders:

On behalf of the board of directors and management of TrueBlue, Inc. (“TrueBlue”), it is a pleasure to invite you to TrueBlue’s 2020 Annual Meeting of Shareholders, to be held at TrueBlue’s corporate headquarters located at 1015 A Street, Tacoma, Washington 98402, on Wednesday, May 13, 2020, at 10:00 a.m., Pacific Daylight Time.

As in prior years, TrueBlue has elected to deliver our proxy materials to the majority of our shareholders over the internet. This delivery process allows us to provide shareholders with the information they need, while at the same time conserving resources and lowering the cost of delivery. On or about April 2, 2020, we mailed to our shareholders a Notice of Internet Availability of Proxy Materials (the “Proxy Notice”) containing instructions on how to access our 2020 proxy statement and 2019 Annual Report to Shareholders for the fiscal year ended December 29, 2019 (the “2019 Annual Report”). The Proxy Notice also provides instructions on how to vote online, by telephone, or by requesting and returning a proxy card, and includes instructions on how to receive a paper copy of the proxy materials by mail.

The matters to be acted upon are described in this Notice of Annual Meeting of Shareholders and Proxy Statement.

I look forward to seeing you at the Annual Meeting of Shareholders. We will report on TrueBlue’s operations and respond to questions you may have.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED. PLEASE VOTE ONLINE, BY TELEPHONE, OR BY MAIL AS SOON AS POSSIBLE IN ORDER TO ENSURE THAT YOUR VOTE IS COUNTED. IF YOU ARE A SHAREHOLDER OF RECORD AND ATTEND THE ANNUAL MEETING OF SHAREHOLDERS, YOU WILL HAVE THE RIGHT TO VOTE YOUR SHARES IN PERSON.

Very truly yours,

/s/ Steven C. Cooper

Steven C. Cooper

Board Chair

| TrueBlue, Inc. 2020 Proxy Statement P. 1 |

Notice of Annual Meeting of Shareholders

Trueblue, Inc.

1015 A Street

Tacoma, Washington 98402

Notice of Annual Meeting of Shareholders: Wednesday, May 13, 2020

The 2020 Annual Meeting of Shareholders of TrueBlue, Inc. (the “Meeting”), will be held at our corporate headquarters at 1015 A Street, Tacoma, Washington 98402, on Wednesday, May 13, 2020, at 10:00 a.m., Pacific Daylight Time, for the following purposes:

| 1. | To elect the directors named in this proxy statement to serve until the next annual meeting of shareholders or until their respective successors are elected and qualified; |

| 2. | To conduct an advisory vote on our executive compensation; and |

| 3. | To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 27, 2020. |

Important notice regarding the availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 13, 2020: Our proxy statement is attached. Financial and other information concerning TrueBlue is contained in our 2019 Annual Report. The proxy statement and our 2019 Annual Report are available on our website at www.TrueBlue.com. Additionally, you may access our proxy materials and vote your shares at www.proxyvote.com.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE URGED TO VOTE ONLINE, BY TELEPHONE, OR BY MAIL, AS PROMPTLY AS POSSIBLE, IN ORDER THAT THE PRESENCE OF A QUORUM MAY BE ASSURED. THE GIVING OF A PROXY DOES NOT AFFECT YOUR RIGHT TO REVOKE IT LATER OR, IF YOU ARE A SHAREHOLDER OF RECORD, VOTE YOUR SHARES IN PERSON IF YOU ATTEND THE MEETING.

Only shareholders of record at the close of business on March 16, 2020, will be entitled to notice of, and to vote at, the Meeting and any adjournments thereof. Brokers cannot vote for Proposals 1 or 2 without shareholders’ instructions on how to vote.

By Order of the Board of Directors,

/s/ James E. Defebaugh

James E. Defebaugh

Secretary

Tacoma, Washington

April 2, 2020

| TrueBlue, Inc. 2020 Proxy Statement P. 2 |

Proxy Statement Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

| Annual Meeting of Shareholders | Vote Right Away | |||

Date and Time May 13, 2020 at 10:00 a.m., Pacific Daylight Time Location TrueBlue Building Record Date March 16, 2020 Voting Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals. |

Even if you plan to attend our 2020 Annual Meeting of Shareholders, please read this proxy statement with care and vote right away using any of the methods below. In all cases, have your proxy card or voting instructions form in hand and follow the instructions. | |||

|

Vote online: visit www.proxyvote.com | |||

|

Vote using your mobile device: scan this QR Code to vote with your mobile device | |||

|

Vote by telephone: dial toll-free 1-800-690-6903 | |||

|

Vote by requesting and mailing your proxy card: cast your ballot, sign your proxy card, and send by U.S. mail | |||

Voting Matters

| Agenda Item | Board

Vote Recommendation |

Page

Reference for | |

|

1 |

Elect the directors named in the proxy statement |

FOR |

14 |

|

2 |

Advisory vote on our executive compensation |

FOR |

31 |

|

3 |

Ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 27, 2020. |

FOR |

63 |

| TrueBlue, Inc. 2020 Proxy Statement P. 3 |

Proxy Statement Summary

2019 Business Summary

| Revenue | $2.4 billion |

|

Return of Capital |

$39 million of common stock repurchases in 2019 |

| $110 million of capital returned to shareholders via share repurchases since 2017 | |

|

Progress on Digital Strategy |

Approximately four million shifts filled in 2019, or a job filled every nine seconds through our JobStackTM mobile application |

| 21,300 clients using JobStackTM at the end of 2019 | |

| PeopleScout’s AffinixTM is helping clients improve time to fill, candidate flow, and candidate satisfaction |

Governance Best Practices

| Leadership | Separation of chair, lead independent director, and CEO roles since 2008 |

|

Independence |

6 of 7 non-executive directors are independent |

| All members of the governance, audit, and compensation committees are independent | |

|

Elections |

All directors are elected annually |

| Directors must be elected by the majority of votes cast | |

|

Evaluations |

All directors complete annual evaluations of the Board |

| The members of the audit, compensation, and innovation and technology committees complete annual self-evaluations of these committees | |

|

Alignment with Shareholder Interests |

All directors have stock ownership guidelines |

| All directors receive annual equity grants | |

| Attendance | All directors attended at least 75% of the meetings of the Board and their respective committees |

|

Stock Ownership |

Meaningful stock ownership guidelines are in place for directors and executive officers |

| Anti-Hedging policy in place that prohibits hedging against the Company stock by directors and all employees, including executive officers |

| TrueBlue, Inc. 2020 Proxy Statement P. 4 |

Proxy Statement Summary

Corporate Governance Materials

The following corporate governance materials are available and can be viewed and downloaded from the Governance Documents and Committee Composition subsection of the Corporate Citizenship section of the Company’s Investor Relations website at investor.trueblue.com.

| · | The Company’s Amended and Restated Articles of Incorporation |

| · | The Company’s Amended and Restated Bylaws |

| · | The Company’s Corporate Governance Guidelines |

| · | The Audit Committee Charter |

| · | The Compensation Committee Charter |

| · | The Nominating and Governance Committee Charter |

| · | The Innovation and Technology Committee Charter |

| · | The Company’s Anti-Bribery and Corruption Policy |

| · | The Company’s Insider Trading Policy |

| · | The Code of Conduct and Business Ethics |

Board Composition

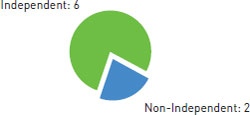

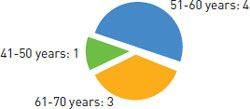

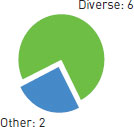

Independence 75% Independent |

Tenure Average Tenure: 6.3 Years | |

|

| |

Age Average Age: 60 Years |

Racial and Gender Diversity 75% Female or Racially Diverse | |

|

|

| TrueBlue, Inc. 2020 Proxy Statement P. 5 |

Proxy Statement Summary

Director Skills and Experience

Our directors bring a wide range of experiences, skills, qualifications, and abilities to our Board. The most relevant of these skills and qualifications are summarized below:

SKILL |

NUMBER OF DIRECTORS |

TOTAL OF 8 | |

|

HUMAN RESOURCES, COMPENSATION, AND HUMAN CAPITAL INDUSTRY Experience is vital in helping TrueBlue better understand, sustain, and grow its core business operations |

8

| |

|

AUDIT, ACCOUNTING, AND FINANCE Experience provides valuable insight to ensure transparency and accuracy for TrueBlue’s financial reporting and internal controls |

8

| |

|

PUBLIC COMPANY BOARD AND INVESTOR RELATIONS Experience provides TrueBlue management with valuable advice in meeting its obligations as a publicly traded entity as well as its interactions with the investment community |

8

| |

|

MERGERS AND ACQUISITIONS Experience is integral to allow TrueBlue to meet its growth strategies and global expansion goals through strategic acquisitions |

7

| |

|

SALES AND MARKETING Experience provides key guidance to TrueBlue’s business expansion and organic growth goals |

8

| |

|

GLOBAL Experience gives key insight and leadership to TrueBlue’s global expansion strategy |

8

| |

|

RISK MANAGEMENT Experience is critical to provide advice to TrueBlue on the importance and execution of effective enterprise risk management |

7

| |

|

TECHNOLOGY Experience in technology including digital solutions, innovation, and cyber security provides TrueBlue with key leadership as TrueBlue seeks to innovate and expand its technical footprint |

8

|

| TrueBlue, Inc. 2020 Proxy Statement P. 6 |

Proxy Statement Summary

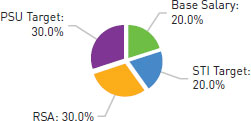

Compensation Governance Highlights

| Shareholder Approval | 97% of shareholders approved our executive compensation program in 2019 |

|

Compensation Committee |

Compensation Committee, comprised entirely of independent directors, oversees and regularly reviews named executive officer compensation |

| Compensation Consultant | Mercer (US), Inc. is the Compensation Committee’s independent, third party consultant |

| Risk | Compensation programs do not encourage excessive or unnecessary risk-taking |

Compensation Best Practices

| What We Do | What We Do Not Do | |||

| ü | Pay for performance by delivering a significant portion of compensation through performance and equity-based compensation | ü | No excessive or guaranteed pay targets. All potential payouts are capped and tied to measurable targets | |

| ü | Request annual shareholder advisory say-on-pay vote | ü | No re-pricing of options or equity grants | |

| ü | Target executive compensation near the median of relevant peers | ü | No pension benefits | |

| ü | Maintain meaningful stock ownership guidelines for all named executive officers | ü | No gross-up of excise taxes upon change-in-control | |

| ü | Engage an independent compensation consultant | ü | No hedging or short sales of Company stock | |

| ü | Retain double trigger change-in-control agreements | ü | No reward for excessive risk-taking | |

| ü | Conduct an annual risk analysis of compensation programs | ü | No excessive executive perquisites | |

| ü | Maintain a clawback policy | ü | No cash buyouts of underwater options | |

| ü | Require minimum vesting period for equity grants |

| TrueBlue, Inc. 2020 Proxy Statement P. 7 |

Table of Contents

| TrueBlue, Inc. 2020 Proxy Statement P. 8 |

Table of Contents

| TrueBlue, Inc. 2020 Proxy Statement P. 9 |

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of TrueBlue, Inc. (“TrueBlue,” “Company,” “we,” “us,” or “our”) to be voted on at our 2020 Annual Meeting of Shareholders (the “Meeting”) to be held at 10:00 a.m., Pacific Daylight Time, on Wednesday, May 13, 2020, at the corporate headquarters of TrueBlue at 1015 A Street, Tacoma, Washington 98402, and at any adjournment thereof. This proxy statement contains the required information under the rules of the U.S. Securities and Exchange Commission (“SEC”) and is designed to assist you in voting your shares.

Background What is the purpose of the Meeting? At the Meeting, shareholders as of the record date will vote on the items of business outlined in the Notice of Annual Meeting of Shareholders (“Meeting Notice”). In addition, management will report on our business and respond to questions from shareholders.

When is the record date? The Board has established March 16, 2020, as the record date for the Meeting (“Record Date”).

Why did I receive a Notice of Internet Availability of Proxy Materials or why did I receive this proxy statement and a proxy card? You received a Notice of Internet Availability of Proxy Materials (“Proxy Notice”) or this proxy statement and a proxy card because you owned shares of TrueBlue common stock (“Common Stock”) as of the Record Date and are entitled to vote on the items of business at the Meeting. This proxy statement describes the items of business that will be voted on at the Meeting and provides information on these items so that you can make an informed decision.

Who may vote? In order to vote at the Meeting, you must be a TrueBlue shareholder as of the Record Date. If, on the close of business on the Record Date, your shares were registered directly in your name with our transfer agent, then you are a shareholder of record. As a shareholder of record, you may vote in person at the Meeting or by proxy.

If, on the close of business on the Record Date, your shares were held in an account at a brokerage firm, bank, or other agent (“Agent”) and not in your name, then you are the beneficial owner of shares held in “street name” and these proxy materials are being made available or being forwarded to you by your Agent. The Agent holding your account is considered to be the shareholder of record for purposes of voting at the Meeting. As a beneficial owner, you have the right to direct your |

Agent on how to vote the shares in your account. You are also invited to attend the Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the Meeting unless you request and obtain a valid legal proxy issued in your name from your Agent.

How many shares of Common Stock are outstanding? As of the Record Date, there were 36,127,685 shares of Common Stock outstanding. There are no other classes of capital stock outstanding.

Voting Procedure How do I vote? If you are a shareholder of record (your shares are owned in your name and not in “street name”), you may vote:

· online at www.proxyvote.com;

· by using your mobile device to scan the Quick Response (“QR”) Code provided in the proxy statement summary;

· by telephone toll-free (within the U.S. or Canada) at 1-800-690-6903;

· by requesting, signing, and returning a proxy card; or

· by attending the Meeting and voting in person.

If you wish to vote online or by telephone, you must do so before 11:59 p.m., Eastern Daylight Time, on Tuesday, May 12, 2020. After that time, online or telephone voting will not be permitted, and a shareholder wishing to vote, or revoke an earlier proxy, must submit a signed proxy card or vote in person. Shareholders can vote in person during the Meeting. Shareholders of record will be on a list held by the inspector of election. “Street name” shareholders, also known as beneficial holders, must obtain a proxy from the institution that holds their shares and present it to the inspector of election with their ballot. Shareholders voting online will need to follow the instructions at www.proxyvote.com. Voting in person or online by a shareholder will revoke and replace any previous votes submitted by proxy.

In accordance with the SEC rules, we are providing all shareholders with their proxy materials online unless a shareholder has affirmatively elected to receive paper materials. You may elect to receive paper copies of proxy materials, at no cost to you, by following the instructions contained in the Proxy Notice.

How are my voting instructions carried out and how does the Board recommend I vote? When you vote via proxy, by properly executing and returning a proxy card, or by voting online or by telephone, you appoint the individuals named on the proxy card (the “Proxy”) as your |

| TrueBlue, Inc. 2020 Proxy Statement P. 10 |

General Information

representatives at the Meeting. The Proxy will vote your shares at the Meeting, or at any adjournment of the Meeting, as you have instructed them on the proxy card. We urge you to specify your choices by marking the appropriate boxes on the proxy card, or carefully following the instructions for voting online or by telephone.

The Board recommends that you vote:

1. FOR the election of the director nominees named in this proxy statement (Proposal 1);

2. FOR the advisory approval of our executive compensation (Proposal 2); and

3. FOR the ratification of the selection of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 27, 2020 (Proposal 3).

With proxy voting, your shares will be voted regardless of whether you attend the Meeting. Even if you plan to attend the Meeting, it is advisable to vote your shares via Proxy in advance of the Meeting in case your plans change.

If any nominee for director is unable to serve, or for good cause will not serve, or if an item that is not described in the Meeting Notice properly comes up for vote at the Meeting, or at any postponement or adjournment of the Meeting, your Proxy will vote the shares as recommended by the Board pursuant to the discretionary authority granted in the proxy card. At the time this proxy statement was printed, we were not aware of any other matters to be voted on.

How many votes do I have? You have one vote for each share you own, and you can vote those shares for each director nominee and for each other item of business to be addressed at the Meeting.

How many shares must be present to hold a valid Meeting? For us to hold a valid Meeting, we must have a quorum, which means that a majority of the outstanding shares of Common Stock that are entitled to cast a vote are present in person, or by Proxy, at the Meeting. Proxy cards received but marked as abstentions and Broker Non-Votes (discussed below) will be treated as shares that are present and entitled to vote for purposes of determining a quorum. Your shares will be counted as present at the Meeting if you:

· vote online or by telephone;

· properly submit a proxy card by mail (even if you do not provide voting instructions); or

· attend the Meeting and vote in person. |

How many votes are required to approve an item of business? As described in more detail under “Proposal 1. Election of Directors,” the Company has adopted majority voting procedures for the election of directors in uncontested elections. As this is an uncontested election, each of the nominees for directors will be elected by the vote of the majority of the votes cast. A “majority of votes cast” means that the number of votes cast “For” a nominee’s election exceeds the number of votes cast “Against” that nominee. There is no cumulative voting for the election of the Company’s directors. Abstentions and Broker Non-Votes are not considered “votes cast.” Likewise, a share otherwise present at the Meeting as to which a shareholder gives no authority or direction to vote is also not considered a “vote cast.”

The proposal to approve, by advisory vote, our executive compensation will be approved under Washington law if the number of votes cast “For” the proposal exceeds the number of votes cast “Against” the proposal. Abstentions and Broker Non-Votes are not considered “votes cast.” Likewise, a share otherwise present at the Meeting as to which a shareholder gives no authority or direction to vote is also not considered a “vote cast.”

The proposal to ratify the appointment of Deloitte as the Company’s independent registered public accounting firm will be approved under Washington law if the number of votes cast “For” the proposal exceeds the number of votes cast “Against” the proposal. Abstentions and Broker Non-Votes are not considered “votes cast.” Likewise, a share otherwise present at the Meeting as to which a shareholder gives no authority or direction to vote is also not considered a “vote cast.”

What if my shares are held by a brokerage firm? If you are a beneficial owner whose shares are held on record by a broker, you should instruct the broker how to vote your shares. The rules of the New York Stock Exchange (“NYSE”) allow brokerage firms to vote their clients’ shares on routine matters if the clients do not provide voting instructions at least ten (10) days prior to the annual shareholder meeting. The ratification of the appointment of Deloitte as our independent registered public accounting firm is considered a routine matter under NYSE rules. However, all the other proposals in this proxy statement are not considered routine matters under NYSE rules. The NYSE rules do not allow brokerage firms to vote their clients’ shares on non-routine matters in the absence of affirmative voting instructions. Accordingly, it is particularly important that the beneficial owners instruct their brokers how they wish to vote their shares.

If your shares are represented at the Meeting but you do not provide voting instructions (a “Broker Non-Vote”), your shares will be counted for purposes of establishing a quorum to conduct business at the Meeting but will not be counted in determining the number of shares voted for or against the non-routine matter. |

| TrueBlue, Inc. 2020 Proxy Statement P. 11 |

General Information

What if I change my mind after I submit my proxy? You may revoke your proxy at any time before your shares are voted by:

· submitting a later dated proxy prior to the Meeting (by mail, online, or telephone to be received before 11:59 p.m. Eastern Daylight Time, on May 12, 2020);

· delivering a written request to return the executed proxy;

· voting in person at the Meeting; or

· providing written notice of revocation to the Secretary of the Company at 1015 A Street, Tacoma, Washington 98402.

Where can I find the voting results of the Meeting? We will announce preliminary voting results at the Meeting. We plan to publish the final voting results in a Current Report on Form 8-K (“Form 8-K”) filed with the SEC within four (4) business days of the Meeting. If final voting results are not available within the four (4) business day time frame, we plan to file a Form 8-K disclosing preliminary voting results within the required four (4) business days, to be followed as soon as practicable by an amendment to the Form 8-K containing final voting results.

How can multiple shareholders sharing the same address request the receipt of only one set of proxy materials and other investor communications? If you opt to continue to receive paper copies of our proxy materials, you may elect to receive future proxy materials, as well as other investor communications, in a single package per address. This practice, known as “householding,” is designed to reduce our paper use, printing, and postage costs. To make the election, please indicate on your proxy card under “Householding Election” your consent to receive such communications in a single package per address. Once we receive your consent, we will send a single package per household until you revoke your consent by notifying our Investor Relations Department at 1015 A Street, Tacoma, |

Washington 98402 or by phone at (253) 680-8214. We will start sending you individual copies of proxy materials and other investor communications within thirty (30) days of your revocation. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of our 2019 Form 10-K, this proxy statement, proxy card, or the Proxy Notice to a stockholder at a shared address to which a single copy of the documents was delivered.

Can I receive the proxy materials electronically? Yes. Shareholders who have not affirmatively opted to receive paper proxy materials through the mail will receive a Proxy Notice and may access our proxy materials online. On or about April 2, 2020, we mailed to our shareholders a Proxy Notice directing shareholders to the website where they can access our 2020 proxy statement, 2019 Annual Report, and instructions on how to vote online or by phone. If you received the Proxy Notice and would like to receive a paper copy of the proxy materials, please follow the instructions printed on the Proxy Notice to request that a paper copy be mailed to you.

We will arrange with brokerage firms, custodians, nominees, and fiduciaries to forward proxy materials to certain beneficial owners of Common Stock. We will reimburse such brokerage firms, custodians, nominees, and fiduciaries for reasonable out-of-pocket expenses that they incur as a result of forwarding the proxy materials.

Who may solicit proxies? Proxies may be solicited by our officers, directors, and regular supervisory and executive employees, none of whom will receive any additional compensation for their services.

Who will count the votes? Broadridge Investor Services will count the votes and will serve as the independent inspector of election. |

| TrueBlue, Inc. 2020 Proxy Statement P. 12 |

General Information

Proposals by Shareholders How can a shareholder submit a proposal to be voted on at the 2021 annual meeting of shareholders? If a shareholder wishes to submit a proposal for consideration at the 2021 annual meeting of shareholders (“2021 Meeting”), the shareholder must submit the proposal in writing to our principal executive offices located at 1015 A Street, Tacoma, Washington 98402, Attn: Corporate Secretary, no earlier than the close of business on the 120th day and no later than the 90th day prior to the first anniversary of the date of the Meeting (for the 2021 Meeting, proposals must be submitted between January 13, 2021, and February 12, 2021). In the event that the number of directors to be elected at a meeting is increased and we do not make a public announcement naming all of the nominees for director or specifying the size of the increased Board at least 100 days prior to the first anniversary of the preceding year’s annual meeting, a proposal will be considered timely, only with respect to nominees for any new positions created by such increase, if delivered to the Corporate Secretary no later than the tenth day following the day on which the public announcement of the increase is first made. Any such proposal must comply with the requirements set forth in our Amended and Restated Bylaws (the “Bylaws”). Copies of the Bylaws are available to shareholders upon request to the Company’s Corporate Secretary.

If a shareholder wishes to have a proposal considered for inclusion in our 2021 proxy statement pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, the proposal must comply with the requirements set forth in our Bylaws and in Rule 14a-8 and be received by the Company at our principal executive offices located at 1015 A Street, Tacoma, Washington 98402, Attn: Corporate Secretary, by no later than 120 calendar days before the first anniversary of the date on which the Company is releasing this proxy statement to shareholders in connection with the Meeting (for the 2021 Meeting, proposals must be submitted by December 3, 2020).

A proposal for action to be presented by any shareholder at an annual meeting will be out of order and will not be acted upon unless it has been submitted in compliance with the requirements set forth in our Bylaws and is, under law, an appropriate subject for shareholder action.

Shareholder nominations of candidates for election to the Board are subject to the requirements described under “Nominations for Directors - Nominations by Shareholders” in the Corporate Governance section of this proxy statement. |

Additional Information Where can I find additional information about TrueBlue? Our reports on Forms 10-K, 10-Q, 8-K, and other publicly available information should be consulted for other important information about TrueBlue. You can also find additional information about us on our website at www.TrueBlue.com. The mailing address of the principal executive office of the Company is 1015 A Street, Tacoma, Washington 98402. The telephone number for the Company is (253) 383-9101. |

| TrueBlue, Inc. 2020 Proxy Statement P. 13 |

Election of Directors

The Nominees The board of directors (the “Board”) has nominated the following persons for election as directors. The Board recommends a vote “FOR” each of the nominees. Proxies cannot be voted for a greater number of persons than the number of nominees named. The biographies of each of the nominees below contain information regarding the nominees’ service on the Board, business experience, director positions held currently or at any time during the last five (5) years, and information regarding involvement in certain legal or administrative proceedings, if applicable. Each biographic summary is followed by a brief summary of certain experiences, qualifications, attributes, or skills that led the Corporate Governance and Nominating Committee (the “Governance Committee”) and the Board to determine that each nominee should serve as a director for the Company. The summaries do not include all of the experiences, qualifications, attributes, or skills of the nominees. General information regarding the nomination process is included in the Corporate Governance Section under “Nominations for Directors.”

A. Patrick Beharelle

A. Patrick Beharelle, 50, has served as a Director and the Company’s Chief Executive Officer since September 2018, after serving as President and Chief Operating Officer of the Company since May 2015. Mr. Beharelle served as Executive Vice President and Chief Operating Officer of the workforce management group, which included PeopleScout, Staff Management | SMX, Centerline, PlaneTechs, and the Australian-based RPO provider, PeopleScout Pty, from June 2014 to May 2015. Prior to its acquisition by TrueBlue in June 2014, Mr. Beharelle served as the Chief Executive Officer of Staffing Solutions Holdings, Inc. (“Seaton”). Mr. Beharelle has participated in advisory meetings at the White House focused on reducing long-term unemployment. Prior to joining Seaton, Mr. Beharelle held senior level positions at Spherion and Accenture. Mr. Beharelle currently serves as a Director for the non-profit Skills For Chicagoland’s Future and the Chicagoland Chamber of Commerce.

Mr. Beharelle has extensive experience in strategic planning, operations, finance, and accounting. Mr. Beharelle is the only management member of the Board, thus his participation on the Board fulfills a critical communication and leadership role. |

Colleen B. Brown, 61, has served as a Director of the Company since June 2014. Ms. Brown serves as a Director of the privately held Port Blakely, the venture capital firm SpringRock Ventures, the publicly traded Spark Networks SE, and the publicly traded Big 5 Sporting Goods Corporation. She is the Founding Principal of Marca Global, an internet technology company and currently serves as a Director of a nonprofit, Delta Dental of Washington. Ms. Brown is a member of NACD, WCD, IWF, and C200. Previously, Ms. Brown served as Director, President, and Chief Executive Officer of Fisher Communications, a public multimedia company. Ms. Brown has served as Chairman of the board of directors of American Apparel, as a Director of Career Builder, and as a Director of Classified Ventures. Her community activities have included the Washington Roundtable, a nonprofit public policy organization representing major private sector employers throughout Washington State, and United Way of King County. Ms. Brown is a Henry Crown Fellow and a member of the Aspen Global Leadership Network at the Aspen Institute.

Ms. Brown brings extensive executive experience in strategic planning, operations, finance, and technology. Her leadership as a public company Chief Executive Officer, as well as a senior officer in two large media companies, is a valuable resource to the Company. As an NACD fellow, Ms. Brown is a champion of best practices in corporate governance.

Steven C. Cooper

Steven C. Cooper, 57, has served as a Director of the Company since 2006 and as Board Chair since January 2019. Mr. Cooper served as Board Executive Chair from September 2018 to December 2018, as the Company’s Chief Executive Officer from 2006 to 2018, as President between 2005 and 2015, and as Executive Vice President and Chief Financial Officer between 2001 and 2005. He currently serves as a Director and member of the audit committee of the Boise Cascade Company. Mr. Cooper previously served as a board member of the Washington Roundtable, a nonprofit public policy organization representing major private sector employers throughout Washington State, and as a member of the American Cancer Society CEOs Against Cancer. He also served as the Chair of the United Way of Pierce County’s fundraising committee between 2014 and 2015.

Mr. Cooper’s long and successful tenure as Chief Executive Officer and Chief Financial Officer for the Company during a period of tremendous growth, combined with his effective leadership and coaching skills, financial and accounting expertise, and unique ability to develop consensus, are among the contributions he makes to the Board and the primary reasons why he serves as our Board Chair. |

| TrueBlue, Inc. 2020 Proxy Statement P. 14 |

PROPOSAL 1.

Election of Directors

|

William C. Goings, 62, has served as a Director of the Company since April 2016. Mr. Goings was Executive Vice President of TD Bank Group and President of TD Insurance from 2010 to 2012. Mr. Goings also held the positions of Senior Vice President and Chief Operating Officer at TD Insurance between 2009 and 2010. Prior to joining TD Bank Group, Mr. Goings was in a variety of operating roles with Genworth Financial from 2004 to 2009 and GE Capital from 1996 to 2004. Mr. Goings currently serves as a member of the Board of Trustees for Penn Mutual Insurance Company. Mr. Goings’s earlier career was spent working for global companies in corporate banking, strategic planning, and business development.

Mr. Goings brings to the Board extensive expertise having served as a senior officer of a large multi-national corporation as well as an executive level, operations focused, strategic planning, and problem-solving ability.

Kim Harris Jones, 60, has served as a Director of the Company since May 2016. Ms. Harris Jones most recently served as Senior Vice President and Corporate Controller of Mondelez International from 2012 until 2014. She previously served as the Senior Vice President and Corporate Controller at Kraft Foods, Inc. from 2009 until 2012. Prior to her time at Kraft, Ms. Harris Jones served in a number of positions at Chrysler LLC, most notably as Senior Vice President and Corporate Controller from 2008 to 2009. Ms. Harris Jones currently serves as a Director of United Rentals Inc., Fossil Group, Inc., and the Ethiopian North American Health Professionals Association. She also serves on the finance committee of the Consortium for Graduate Study in Management and is a member of the Executive Leadership Council.

Ms. Harris Jones has extensive management, financial, and business experience at large complex corporations undergoing significant corporate growth and change. |

Jeffrey B. Sakaguchi, 58, has served as a Director of the Company since December 2010 and as Chair of the Governance Committee and Lead Independent Director since January 2017. Mr. Sakaguchi serves as a Director of Eccentex, Inc., a privately held early-stage software company, and as a Director of ThinkIQ, Inc., a privately held early-stage software company. Mr. Sakaguchi previously served as a director of Neah Power Systems, Inc. until 2017 and ACT Holdings, Inc. until April 2019, and as a member of the Board of Advisors of Habla.AI until October 2019. Mr. Sakaguchi was formerly President and Chief Operating Officer of Evolution Robotics Retail, Inc., a senior partner with Accenture, and a senior manager with McKinsey & Company. He is a member and former Chairman of the board of directors for the Los Angeles Region of the American Red Cross, a non-profit humanitarian organization, serving on the Governance, Philanthropy, and Biomedical committees. He is also the appointed Chairman of the National Philanthropic Board of the American Red Cross.

Mr. Sakaguchi’s experience in several leadership roles helps the Company improve performance and build market share. His background and expertise in emerging technology, start-ups, and strategy provides valuable guidance to the Company’s strategic, innovative, and technological efforts. His experience provides a valuable resource to the Company. |

| TrueBlue, Inc. 2020 Proxy Statement P. 15 |

PROPOSAL 1.

Election of Directors

|

Kristi A. Savacool, 60, has served as a Director of the Company since July 2018. Previously, Ms. Savacool served as Chief Executive Officer of Aon Hewitt, the global human resources solutions business of Aon plc., from 2012 until her retirement in January 2018. She was responsible for setting Aon Hewitt’s strategy, financial performance, sponsoring relationships with its largest clients, including a large proportion of the Fortune 100 companies, and overseeing operations. She played a key role in the sale of Aon Hewitt’s RPO business to the Company in 2016. Prior to her time at Aon Hewitt, Ms. Savacool had a lengthy and distinguished career at The Boeing Company, where she held several senior executive management positions spanning technology, operations, and shared services, including experience in commercial and federal business sectors. Ms. Savacool has served on several boards and executive organizations over her career. She currently serves as a Director of Ascension and as a Director of Springbuck, Inc. Until recently, Ms. Savacool served as a Trustee for DePaul University, on the board of the Midtown Educational Foundation, Chicago, IL, and the Board of Court Appointed Special Advocates of Lake County, Illinois. She was also an executive member of the Center for Corporate Innovation Fortune 1000 health care CEO roundtable.

Ms. Savacool has extensive financial, management, and business experience in the human resource and outsourcing industry. Her invaluable experience as a public company business unit Chief Executive Officer in the human resource and outsourcing industry provides valuable guidance to the Company.

Bonnie W. Soodik, 69, has served as a Director of the Company since March 2010. Ms. Soodik’s career spanned 30 years with The Boeing Company, where she had most recently served as Senior Vice President, Office of Internal Governance, and as a member of the Boeing Executive Council. Ms. Soodik also served in various vice president roles within Boeing and McDonnell Douglas Corporation, where she began her career in 1977.

Ms. Soodik has experience from a broad number of functions at Boeing, from operations to human resources, and has overseen governance, compliance, and regulatory affairs. Her experience with such a large organization provides a valuable resource to the Company. |

Majority Voting The Company’s directors are elected each year at the annual meeting of shareholders to serve until the next annual meeting when their successors are elected and qualified, or until they resign, are removed, or are otherwise disqualified to serve. The Company’s Board currently consists of eight (8) directors.

A nominee for director in an uncontested election who does not receive a majority vote but who was a director at the time of the election shall not be elected, but shall continue to serve as a holdover director until the earliest of: (i) ninety (90) days after the date on which an inspector determines the voting results as to that director pursuant to Section 23B.07.280 of the Washington Business Corporation Act; (ii) the date on which the Board appoints an individual to fill the office held by such director, which appointment shall constitute the filling of a vacancy by the Board; or (iii) the date of the director’s resignation. Any vacancy resulting from the non-election of a director under these circumstances may be filled by the Board as provided in Article II, Section 2.11 of the Company’s bylaws. The Governance Committee will promptly consider whether to fill the position of a nominee failing to receive a majority vote and make a recommendation to the Board to fill the position. The Board will act on the Governance Committee’s recommendation and, within ninety (90) days after the certification of the shareholder vote, will publicly disclose its decision. Except as provided in the next sentence, a director who fails to receive a majority vote for election will not participate in the Governance Committee’s recommendation or the Board’s decision about filling his or her office. If no director receives a majority vote in an uncontested election, then the incumbent directors: (i) will nominate a slate of nominee directors and hold a special meeting for the purpose of electing those nominees as soon as practicable; and (ii) may in the interim fill one or more director positions with the same director(s) who will continue in office until their successors are elected.

THE CORPORATE GOVERNANCE AND NOMINATING COMMITTEE AND THE BOARD OF DIRECTORS RECOMMEND A VOTE “FOR” THE ELECTION OF EACH NOMINEE NAMED ABOVE. |

| TrueBlue, Inc. 2020 Proxy Statement P. 16 |

The board of directors (the “Board”) has divided its leadership among three directors:

| · | A. Patrick Beharelle serves as Chief Executive Officer (the “CEO”); |

| · | Steven C. Cooper serves as Chair of the Board (the “Board Chair”); and |

| · | Jeffrey B. Sakaguchi serves as lead independent director and Chair of the Corporate Governance and Nominating Committee (the “Governance Committee”). |

The Board has appointed different individuals to fulfill the roles of the Board Chair and the CEO for over ten (10) years. The Board believes that it is in the best interest of the shareholders and an efficient allocation of the time and responsibilities for Company leadership to separate these roles. The key duties and responsibilities of the Board Chair, lead independent director, and Chair of the Governance Committee are set forth in the tables below.

| Position | Key Duties and Responsibilities |

| Board Chair | · Plans the Board meeting calendar. · Proposes the agenda for meetings of the Board and Shareholders, with input from the CEO and other directors. · Presides at meetings of the Board and the shareholders except: · for executive sessions of independent directors where the Board has determined that the Board Chair is not independent; and · where the Board Chair has a conflict or elects to delegate such responsibility to another director. · Maintains effective communications between the Board and the CEO. · Participates on an ex officio and non-voting basis in all committees of the Board, subject to each committee’s right to exclude such participation during executive sessions and for other good governance purposes. |

| Lead Independent Director |

· Presides at meetings of the Board and the shareholders in the absence of the Board Chair. · Maintains effective communications and otherwise serves as a liaison between the independent directors, the Board Chair, and the CEO. · Reviews and approves agendas for, and the scheduling of, Board and shareholder meetings, including ensuring that independent directors have proper input into Board meetings. |

| Chair of Governance Committee |

· Presides at meetings of the Board and the shareholders in the absence of the Board Chair and the lead independent director. · Leads the Governance Committee in discharging such responsibilities as may be established in its charter including without limitation: · the annual evaluation processes for the CEO, the Board, and Board committees; · the identification, review, and proposal of nominees (including the nomination of existing directors) to the Board; · changes in the composition of the Board’s committees; and · the CEO succession planning process. · Identifies, communicates, and reviews existing and new governance requirements, proposals, and trends. · Undertakes such other matters as may be delegated to the Chair of the Governance Committee by the Board Chair or lead independent director. |

| TrueBlue, Inc. 2020 Proxy Statement P. 17 |

Corporate Governance

|

The Board affirmatively determines the independence of each director and nominee for election as a director in accordance with criteria set forth in the Company’s Corporate Governance Guidelines (the “Guidelines”), which include all elements of independence set forth in the New York Stock Exchange (“NYSE”) listing standards and related Securities and Exchange Commission (“SEC”) Rules and Regulations. At a regularly scheduled portion of each Board meeting or as part of the Governance Committee meetings, the independent directors meet in executive session without management or any non-independent directors present. Independent directors have no material relationship with the Company, except as directors and shareholders of the Company.

Based on these standards, at its meeting held on March 12, 2020, the Governance Committee made the following independence determinations for each of our directors.

|

|||

| Tenure | Independent | ||

| Colleen Brown | 6 years | Yes | |

| William Goings | 4 years | Yes | |

| Kim Harris Jones | 4 years | Yes | |

| Jeffrey Sakaguchi | 9 years | Yes | |

| Kristi Savacool | 2 years | Yes | |

| Bonnie Soodik | 10 years | Yes | |

| Patrick Beharelle | 2 years | No(1) | |

| Steven Cooper | 14 years | No(1) | |

(1) Based on the NYSE rules, the Board determined that A. Patrick Beharelle is not independent because he is the CEO of the Company. Mr. Cooper is not independent under the NYSE rules because he served as an employee of the Company until December 30, 2018. |

|||

Enterprise risk management is an integral part of our business processes and the Company has an enterprise risk management (“ERM”) program to integrate risk responsibilities within the current management structure. Specific risks are assigned to the Board’s committees and business area experts. The most significant risks are regularly discussed with the Board as part of its active oversight of risks that could affect the Company. Risks are delegated among the committees based on the expertise of each committee. Each committee and the Board discuss specific risks with management throughout the year, as appropriate. The Board believes the administration of this risk oversight function does not negatively affect the Board’s leadership structure.

The Board exercises an oversight role with respect to the most significant risks facing our Company and maintains responsibility for certain risks, while designating the Audit Committee with the primary responsibility for overseeing the Company ERM process. Management provides the Board with periodic reports on the Company’s risk and ERM program findings. The Audit Committee has responsibility to periodically review the Company’s guidelines, policies, and procedures to assess and manage risk exposure.

The individual committees also consider risk within their areas of responsibility as highlighted below. The committee chairs provide reports of their activities to the Board at each regular Board meeting including apprising the Board of any significant risks within their areas of responsibility and management’s response to those risks.

| TrueBlue, Inc. 2020 Proxy Statement P. 18 |

Corporate Governance

| TrueBlue, Inc. 2020 Proxy Statement P. 19 |

Corporate Governance

| Committees,

Members, and Number of Meetings in 2019 |

Key Areas of Responsibility and Risk Oversight during 2019 |

Full Board

7 Meetings |

Retains responsibility for oversight of major Company initiatives and risks such as: · Strategy; · Competition; · Mergers & Acquisitions; · Major Litigation; · Leadership and oversight of ethical standards; · Government Relations; and · Enterprise Risk Management. |

Corporate

Sakaguchi

(Chair)

4 Meetings |

· Oversees corporate governance matters. · Establish criteria for Board membership, including diversity, experience, skill set, and the ability to act effectively on behalf of shareholders. · Identifies and reviews the candidates for the Board. · Provides a forum for Board independent directors to meet separately from management. · Reviews and recommends to the Board any changes to the Guidelines. · Oversees the Board’s evaluation process. · Conducts the CEO evaluation and succession planning process. · Reviews and determines compensation paid to non-employee directors. · Reviews any conflicts of interest and related party transactions and relationships involving directors and executive officers. · Monitors trends and best practices in corporate governance. · Leads Company’s response on environment, social, and governance issues. |

Audit Committee Robb

(Chair)(1)

8 Meetings |

· Reviews and discusses the Company’s earnings reports and financial statements with management and the independent auditors prior to the release of this information to the public. · Monitors risk relating to the Company’s financial statements, systems, reporting process, and compliance. · Consults with the Company’s independent external auditors and management to ensure the adequacy of internal controls that could significantly affect the Company’s financial statements. · Reviews compliance policies to ensure alignment with legal and regulatory requirements. · Oversees the Company’s Ethics and Compliance Program, including monitoring compliance with the Company’s Code of Conduct and Business Ethics. · Oversees management’s process for identifying risks and setting mitigation strategies. · Reviews and discusses with management the guidelines, policies, and procedures that govern the process by which the Company assesses and manages its exposure to risk. · Monitors the process and management of the Company-wide ERM program. · Evaluates and approves or disapproves in advance all audit and non-audit services proposed to be provided by the independent auditors. |

| TrueBlue, Inc. 2020 Proxy Statement P. 20 |

Corporate Governance

| Committees,

Members, and Number of Meetings in 2019 |

Key Areas of Responsibility and Risk Oversight during 2019 |

Compensation Committee Soodik

(Chair)

4 Meetings |

· Approves compensation, including incentive plan awards, for the CEO and executives. · Administers incentive compensation plans. · Monitors compliance with stock ownership guidelines. · Determines compensation levels for senior leaders. · Prepares required disclosures regarding compensation practices. · Manages executive compensation risk. · Oversees the Company’s human capital management program. · Reviews compensation and benefits policies and practices of the Company. · Establishes incentive plan performance metrics and goals. · Receives and monitors reports regarding the Company’s human capital management risks. |

Innovation

and Brown

(Chair)

4 Meetings |

· Oversees and advises management on significant Company digital policies and trends. · Leads Company technology initiatives and development of intellectual property. · Monitors reports on the Company’s cyber security risks and related incidents. · Examines reports on the protection and privacy of client, employee, candidate, and worker data. · Oversees major business model innovation and technology programs, investments, and architecture decisions. · Monitors emerging technology trends and industry trends, and their potential impact on the Company’s strategy. · Advises on leadership and talent development in the Company’s innovation and technology teams. · Oversees disaster recovery plans for the Company’s ongoing business activities. · Provides guidance on the risks and benefits associated with business model innovation and technology strategies, including financial, acquisition and execution risks. |

| (1) | Mr. Robb resigned from the Board effective March 12, 2020. |

| (2) | Ms. Harris Jones assumed the position of the Audit Committee Chair effective March 12, 2020. |

| TrueBlue, Inc. 2020 Proxy Statement P. 21 |

Corporate Governance

| TrueBlue, Inc. 2020 Proxy Statement P. 22 |

Corporate Governance

| TrueBlue, Inc. 2020 Proxy Statement P. 23 |

Corporate Governance

| TrueBlue, Inc. 2020 Proxy Statement P. 24 |

Corporate Governance

After reviewing all facts and circumstances, the Governance Committee may approve or ratify the Related Person Transaction only if it determines that the transaction is in, or is not inconsistent with, the best interests of the Company.

There were no Related Person Transactions in 2019.

Qualifications of Nominees The Guidelines include the criteria our Board believes are important in the selection of director nominees. While the Board has not established any minimum qualifications for nominees, the Board does consider the composition of the Board as a whole, the requisite characteristics (including independence, diversity, and experience in industry, finance, administration, and operations) of each candidate, and the skills and expertise of its current members while taking into account the overall operating efficiency of the Board and its committees. With respect to diversity, we broadly construe diversity to mean not only diversity of race, gender, and ethnicity, but also diversity of opinions, perspectives, and professional and personal experiences. Nominees are not discriminated against on the basis of race, gender, religion, national origin, sexual orientation, disability, or any other basis proscribed by law. Service on other boards of directors and other commitments by directors will be considered by the Governance Committee and the Board when reviewing director candidates and in connection with the Board’s annual self-assessment process for current members of the Board.

Change in Director’s Principal Business Association Each time a director’s principal occupation or business association changes substantially, the director is required to tender a proposed resignation from the Board to the Chair of the Governance Committee (or, in the case of the Chair of the Governance Committee’s occupation or association changing, to the Board Chair and the lead independent director, if one has been elected). The Governance Committee shall review the director’s continuation on the Board and recommend to the Board whether, in light of all the circumstances, the Board should accept such proposed resignation or request that the director continue to serve.

Nominee Identification and Evaluation The Governance Committee may employ a variety of methods for identifying and evaluating nominees for director. The Governance Committee regularly assesses the size of the Board, the need for particular expertise on the Board, the need for diversity on the Board, and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated or arise, the Governance Committee considers potential candidates for director which may come to the Governance Committee’s attention through current |

Board members, professional search firms, shareholders, or other persons. These candidates will be evaluated at regular or special meetings of the Governance Committee and may be considered at any time during the year.

Under the Guidelines, the Governance Committee is responsible for reviewing with the Board the requisite skills and characteristics of new Board nominees in the context of the current Board composition. This assessment will include experience in industry, finance, administration, operations, marketing, and technology, as well as diversity.

Although the Board does not have a formal policy specifying how diversity of background and personal experience should be applied in identifying or evaluating director nominees, to help ensure that the Board remains aware of and responsive to the needs and interests of our shareholders, employees, customers, and other stakeholders, the Board believes it is important to identify qualified director candidates that would increase the diversity of experience, profession, expertise, skill, background, gender, racial, ethnic, cultural, and of other diversity characteristics (“Diversity Characteristics”) of the Board. Accordingly, the Governance Committee has made an effort when nominating new directors to ensure that the composition of the Board reflects broad Diversity Characteristics.

In recent years, the Governance Committee has directed its third-party search firm to present a slate of possible candidates which includes qualified potential nominees with broad Diversity Characteristics in considering nominees for the Board. The Governance Committee considers the entirety of each candidate’s credentials, in addition to diversity, as they fit with the current composition and skills and experience of the Board. The Company considers the Board to be a valuable strategic asset of the Company. To maintain the integrity of this asset, the membership of the Board has been carefully crafted to ensure that its expertise covers broad Diversity Characteristics, and these Diversity Characteristics will continue to be considered when nominating individuals to serve on the Board.

The Governance Committee will consider candidates recommended by shareholders. The Governance Committee will make an initial analysis of the qualifications of any candidate recommended by shareholders or others pursuant to the criteria summarized in this section to determine whether the candidate is qualified for service on the Board before deciding to undertake a complete evaluation of the candidate. If a shareholder or professional search firm provides any materials in connection with the nomination of a director candidate, such materials will be forwarded to the Governance Committee as part of its review. If the Governance Committee determines that additional consideration is warranted, it may engage a third-party search firm to gather additional information about the prospective nominee’s background and experience and report its findings to the Governance Committee. Other than the verification of compliance with procedures, shareholder |

| TrueBlue, Inc. 2020 Proxy Statement P. 25 |

Corporate Governance

status, and the initial analysis performed by the Governance Committee, the Governance Committee will treat a potential candidate nominated by a shareholder like any other potential candidate during the review process. In connection with this evaluation, the Governance Committee will determine whether to interview the prospective nominee. One or more members of the Governance Committee, and others as appropriate, will interview the prospective nominees in person or by telephone. After completing this evaluation and interview, the Governance Committee will make a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board will determine the nominees after considering the recommendation and report of the Governance Committee.

Nominations by Shareholders The Governance Committee will consider director candidates recommended by shareholders on the same basis as candidates recommended by the Governance Committee. In accordance with the Company’s bylaws, shareholders wishing to nominate a candidate must deliver the name and address of the shareholder as they appear on the Company’s books (or if the shareholder holds shares for the benefit of another person, the name and address of such beneficial owner) in a letter addressed to the Chair of the Governance Committee in care of the Company’s Secretary and mailed to the Company’s principal executive offices at 1015 A Street, Tacoma, WA 98402, not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the first anniversary of the 2020 Annual Meeting of the Shareholders (nominations for the 2021 Annual Meeting of Shareholders must be submitted between January 13, 2021, and February 12, 2021). In addition, the submitting shareholder must provide the following information about said shareholder:

· the class or series and number of shares of the Company which are, directly or indirectly, owned beneficially and/or of record;

· any option, warrant, convertible security, stock appreciation right, or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of shares of the Company or with a value derived, in whole or in part, from the value of any class or series of shares of the Company, whether or not such instrument or right shall be subject to settlement in the underlying class or series of capital stock of the Company or otherwise (a “Derivative Instrument”) that is, directly or indirectly, owned beneficially and any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the Company;

· any proxy, contract, arrangement, understanding, or relationship pursuant to which the shareholder has a right to vote or has been granted a right to vote any shares of any security of the Company; |

· any short interest in any security of the Company;

· any rights to dividends on the shares of the Company owned beneficially by the shareholder that are separated or separable from the underlying shares of the Company;

· any proportionate interest in shares of the Company or Derivative Instruments held, directly or indirectly, by a general or limited partnership, limited liability company, or similar entity in which the shareholder is a general partner or, directly or indirectly, beneficially owns an interest in a general partner, is the manager, managing member or, directly or indirectly, beneficially owns an interest in the manager or managing member of a limited liability company or similar entity;

· any performance-related fee (other than an asset-based fee) that the shareholder is entitled to which is based on any increase or decrease in the value of shares of the Company or any Derivative Instruments; and

· the information called for above for any members of the shareholder’s immediate family sharing the same household.

For each person who the shareholder proposes to nominate for election or re-election to the Board, the shareholder must also provide:

· all information relating to the nominee that would be required to be disclosed in a proxy statement or other filings required in connection with solicitations of proxies for election of directors in a contested election pursuant to Section 14 of the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules and regulations promulgated thereunder (including the nominee’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected);

· a description of all direct and indirect compensation and other material monetary agreements, arrangements, and understandings during the past three (3) years; and

· any other material relationships, between or among the shareholder and its respective affiliates and associates, or others acting in concert therewith, on the one hand, and each proposed nominee, and his or her respective affiliates and associates, or others acting in concert therewith, on the other hand, including, without limitation all information that would be required to be disclosed pursuant to Rule 404 promulgated under Regulation S-K if the shareholder making the nomination or on whose behalf the nomination is made, if any, or any affiliate or associate thereof or person acting in concert therewith, was the “registrant” for purposes of such rule and the nominee was a director or executive officer of such registrant. |

| TrueBlue, Inc. 2020 Proxy Statement P. 26 |

Corporate Governance

| TrueBlue, Inc. 2020 Proxy Statement P. 27 |

|

other non-employee directors received $110,000 as their target equity annual grant value. The Audit Committee Chair received an additional $10,000 grant while all other committee chairs received an additional $7,500 grant. The Company determined the number of shares of each such annual grant of Common Stock based on the average closing price of Common Stock during the sixty (60) trading days prior to and including the second full trading day after the announcement of the Company’s fourth quarter and year-end financial results, which was $23.66 per share. The aggregate equity award values received by each non-employee director in 2019 are set forth in the table below. | |

|

Name |

Equity

Award Value |

| Colleen B. Brown | $117,500 |

| Steven C. Cooper | $145,000 |

| William C. Goings | $110,000 |

| Kim Harris Jones | $110,000 |

| Stephen M. Robb | $120,000 |

| Jeffrey B. Sakaguchi | $152,500 |

| Kristi A. Savacool | $110,000 |

| Bonnie W. Soodik | $117,500 |

Equity Retainer and Deferred Compensation Plan for Non-Employee Directors

Each non-employee director is able to participate in the Equity Retainer and Deferred Compensation Plan for Non-Employee Directors (“Director Equity Plan”). Under this plan, a director may elect to modify the manner in which he or she receives the annual retainer from the Company. Directors are given the option to make an irrevocable election to convert up to 100% of his or her cash retainer to an equity retainer, and then further elect to receive up to 50% of the equity retainer in the form of stock options, rather than Common Stock. In addition, a director may make an irrevocable election to defer all or part of his or her annual restricted share grant to a time after he or she leaves the Board.

| TrueBlue, Inc. 2020 Proxy Statement P. 28 |

Compensation of Directors

Non-Employee Director Compensation

The following table discloses the cash, equity awards, and other compensation earned by each of the Company’s non-employee directors during the last completed fiscal year.

|

Name |

Fees

Earned and |

Stock

Award Grant |

Total |

| Colleen B. Brown | $100,000 | $115,559 | $215,559 |

| Steven C. Cooper | $117,000 | $142,599 | $259,599 |

| William C. Goings(2) | $ 90,500 | $108,182 | $198,682 |

| Kim Harris Jones(3) | $ 92,000 | $108,182 | $200,182 |

| Stephen M. Robb(4)(5) | $ 2,500 | $218,342 | $220,842 |

| Jeffrey B. Sakaguchi | $119,000 | $149,975 | $268,975 |

| Kristi A. Savacool(6) | $ 92,000 | $108,182 | $200,182 |

| Bonnie W. Soodik | $100,000 | $115,559 | $215,559 |

(1) This column represents the grant date fair value of shares awarded to each of the non-employee directors in 2019 in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Accounting for Stock Compensation (Topic 718). The amounts are calculated using the closing price of our stock on the grant date, which was $23.27 for all directors. For additional information, refer to Note 11 to the Consolidated Financial Statements found in Item 8 of Part II of our 2019 Form 10-K (listed under Stock-Based Compensation).

(2) Under the Director Equity Plan, Mr. Goings elected to defer 100% of his equity retainer in the form of 4,649 shares of Common Stock. Mr. Goings elected to receive these shares ninety (90) days after his separation from the Board. As of December 29, 2019, Mr. Goings continues to hold 5,172 options.

(3) Under the Director Equity Plan, Ms. Harris Jones elected to defer 100% of her equity retainer in the form of 4,649 shares of Common Stock. Ms. Harris Jones elected to receive these shares ninety (90) days after her separation from the Board.

(4) Prior to the start of the calendar year, Mr. Robb, under the Director Equity Plan, elected to convert 100% of his cash retainer to equity and to defer 100% of his equity retainer and converted cash retainer in the form of 9,383 shares of Common Stock. Mr. Robb elected to receive these shares in full ninety (90) days after the first anniversary of his separation from the Board. Mr. Robb received a prorated amount of $2,500 as cash retainer in the third and fourth quarter as a result of joining the I&T Committee mid-year which was not converted to equity for 2019.

(5) Mr. Robb resigned from the Board effective March 12, 2020.

(6) Under the Director Equity Plan, Ms. Savacool elected to defer 100% of her equity retainer in the form of 4,649 shares of Common Stock. Ms. Savacool elected to receive these shares ninety (90) days after her separation from the Board.

| TrueBlue, Inc. 2020 Proxy Statement P. 29 |

| TrueBlue, Inc. 2020 Proxy Statement P. 30 |

Advisory (Non-Binding) Vote Approving Executive Compensation

Our Board has adopted a policy providing for an annual “say- on-pay” advisory vote. In accordance with this policy and Section 14A of the Securities Exchange Act of 1934, as amended, we are asking shareholders to approve the following advisory (non-binding) resolution at the 2020 Annual Meeting of Shareholders:

RESOLVED, that the shareholders of TrueBlue, Inc. (the “Company”) approve, on an advisory basis, the compensation of the Company’s named executive officers disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table, and the related compensation tables, notes, and narrative in the proxy statement for the Company’s Annual Meeting of Shareholders. |

As an advisory vote, this proposal is not binding upon the Company or the Board. However, the Compensation Committee, which is responsible for designing and administering our executive compensation program, values the feedback received from shareholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for named executive officers.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADVISORY (NON-BINDING) VOTE APPROVING EXECUTIVE COMPENSATION. |

| TrueBlue, Inc. 2020 Proxy Statement P. 31 |

The names, ages, and positions of the executive officers of the Company are listed below, along with their prior business experience. No family relationships exist among any of the directors or executive officers of the Company.

A. Patrick Beharelle, 50, has served as a Director and the Company’s Chief Executive Officer since September 2018, after serving as President and Chief Operating Officer of the Company since May 2015. Mr. Beharelle served as Executive Vice President and Chief Operating Officer of the workforce management group, which included PeopleScout, Staff Management | SMX, Centerline, PlaneTechs, and the Australian-based RPO provider, PeopleScout Pty, from June 2014 to May 2015. Prior to its acquisition by TrueBlue in June 2014, Mr. Beharelle served as the Chief Executive Officer of Staffing Solutions Holdings, Inc. (“Seaton”). Mr. Beharelle has participated in advisory meetings at the White House focused on reducing long-term unemployment. Prior to joining Seaton, Mr. Beharelle held senior level positions at Spherion and Accenture. Mr. Beharelle currently serves as a Director for the non-profit Skills For Chicagoland’s Future and the Chicagoland Chamber of Commerce.

James E. Defebaugh, 65, has served as Executive Vice President, Chief Legal Officer, and Secretary of the Company since March 2019, after serving as Executive Vice President, General Counsel, and Secretary of the Company since 2006. Mr. Defebaugh previously served as Vice President, General Counsel, and Secretary of the Company upon joining the Company in 2005. Prior to joining the Company, Mr. Defebaugh held various positions with Kmart Holding Corporation, including Senior Vice President and Chief Legal Officer from 2004 to 2005, Senior Vice President and Chief Compliance Officer from 2002 to 2004, Vice President and Secretary from 2001 to 2002, and Vice President, Legal in 2001. Mr. Defebaugh currently serves on the Board of Trustees for Annie Wright Schools.

Derrek L. Gafford, 49, has served as the Company’s Executive Vice President and Chief Financial Officer since 2006, after serving as Vice President and Chief Financial Officer since 2005. Mr. Gafford is a Certified Public Accountant (inactive) and first joined the Company in 2002. Mr. Gafford is a Director of Heritage Distilling Co. Prior to joining the Company, Mr. Gafford served as Chief Financial Officer for Metropolitan Market, a grocery retailer, and held various management positions with Deloitte & Touche LLP and Albertsons, Inc. |

Taryn R. Owen, 41, has served as Executive Vice President of the Company and President of PeopleReady since December 2019, after serving as Executive Vice President of the Company and President of PeopleScout, TrueBlue’s recruitment process outsourcing (“RPO”) group, since November 2014. Prior to these roles, she served as Senior Vice President since June 2014 and as President of PeopleScout since August 2013. Prior to that, she was Senior Vice President of Global Operations for PeopleScout since December 2011, after joining PeopleScout in 2010 as Vice President of Client Delivery. Prior to joining PeopleScout, Ms. Owen was an Operations Director at Randstad SourceRight Solutions where she led global RPO engagements. Ms. Owen has more than 20 years of talent acquisition experience. Ms. Owen formerly served as a member of the Board of Advisors of HRO Today and as a member of the Human Capital Industry Advisory Board for Wharton’s Center for Human Resources. She is also a volunteer and avid supporter of Special Olympics.

Carl R. Schweihs, 35, has served as Executive Vice President of the Company and President of PeopleManagement, TrueBlue’s staffing business that is made up of Staff Management | SMX, SIMOS Insourcing Solutions, and Centerline Drivers, since June 2019, after serving as Senior Vice President of the Company for Strategic Accounts since June 2017. Prior to that, he served as Vice President of Finance for the Company since November 2015, after serving as Controller since June 2014. Mr. Schweihs joined the Company following its acquisition of Seaton in 2014. Prior to joining the Company, he served in a variety of financial leadership roles at Seaton and Grant Thornton. |

| TrueBlue, Inc. 2020 Proxy Statement P. 32 |

Compensation Discussion and Analysis

|

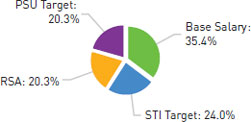

This Compensation Discussion and Analysis section provides a detailed description of our compensation philosophy, programs, practices, and policies used in making compensation decisions with respect to our 2019 Named Executive Officers (“NEOs”). As of December 29, 2019, our NEOs were: |

||

| Executive | Position | |