Introduction and Summary of Proposed Amendment and Restatement

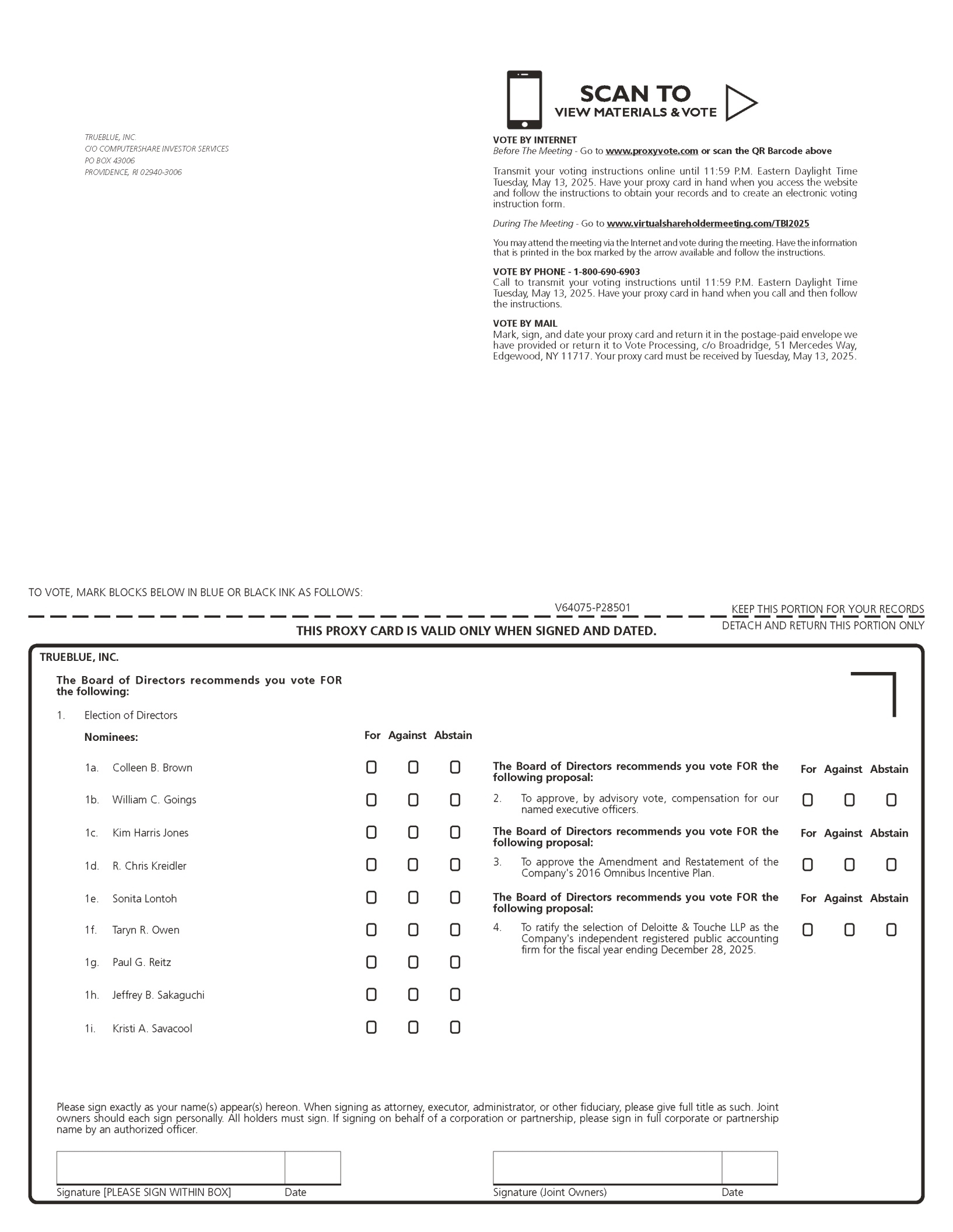

The Company currently maintains the TrueBlue, Inc. 2016 Omnibus Incentive Plan (the “2016 Plan”), which our shareholders originally approved on May 11, 2016 and later approved amendments and restatements on May 9, 2018, May 11, 2023 and May 15, 2024. Under the 2016 Plan, the Company has reserved a number of shares of the Company’s common stock (“Common Stock”) for issuance in the form of stock options, shares of restricted Common Stock (including other stock-based awards for non-employee directors under the director compensation program), restricted stock units (“RSUs”), performance share units (“PSUs”) and stock appreciation rights (“SARs”) and cash awards to employees, officers, consultants, and advisors of the Company and its subsidiaries and to non-employee directors of the Company. The purpose of the 2016 Plan is to (i) attract and retain talented employees, officers, directors, and consultants; and (ii) promote the growth and success of our business by aligning the long-term interests of employees, officers, directors, and consultants with those of our shareholders by providing an opportunity to acquire an interest in our business, rewards for exceptional performance, and long-term incentives for future contributions to our success.

In order to provide a sufficient pool of equity for the Company to continue to attract and retain talent, the Board has adopted, subject to shareholder approval, an amendment and restatement of the 2016 Plan (the “Amended 2016 Plan”) primarily to:

(i)

| increase the number of authorized shares of Common Stock available for awards by 1,475,000; |

(ii)

| require that all equity-based awards be subject to minimum vesting of one year from the date of grant, subject to certain exceptions described below. |

Increase in Shares Available for Awards

The aggregate number of shares of Common Stock authorized to be awarded under the 2016 Plan after the amendment and restatement on May 15, 2024, is (i) 1,542,944 shares carried over from, and previously registered for offer or sale under, the Company’s Amended and Restated 2005 Long-Term Equity Incentive Plan (the “2005 Plan”); plus (ii) 1,800,000 shares approved at the 2018 Annual Meeting of Shareholders; plus (iii) shares underlying any outstanding award granted under the 2005 Plan that, following the original adoption of the 2016 Plan, expired, or were terminated, surrendered, or forfeited for any reason without issuance of such shares (the “Rollover Shares”); plus (iv) 695,000 shares approved at the 2023 Annual Meeting of Shareholders; plus (v) 840,000 shares approved at the 2024 Annual Meeting of Shareholders. As of March 14, 2025, 289,910 shares of Common Stock remained available for issuance under the 2016 Plan. Pursuant to the proposed Amended 2016 Plan, there would be added an additional 1,475,000 shares of Common Stock, such that the total number of shares available to be awarded after the Amended 2016 Plan is approved will be 1,764,910. The maximum aggregate number of shares of Common Stock authorized to be awarded over the life of the Amended 2016 Plan is 10,719,695, including an aggregate total of 4,366,751 Rollover Shares that as of March 14, 2025, have become or may still become available for awards under the 2016 Plan.

Under the 2016 Plan, as of March 14, 2025, there were 2,801,721 shares subject to granted and outstanding awards, consisting of: 13,444 restricted shares; 1,804,568 RSUs; and 983,709 PSUs (at the target payout level). As of March 14, 2025, the closing price of a share of Common Stock on the New York Stock Exchange was $5.83.