| |

Filed by the Registrant ☒

|

|

| |

Filed by a Party other than the Registrant ☐

|

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Under Section 240.14a-12

|

| |

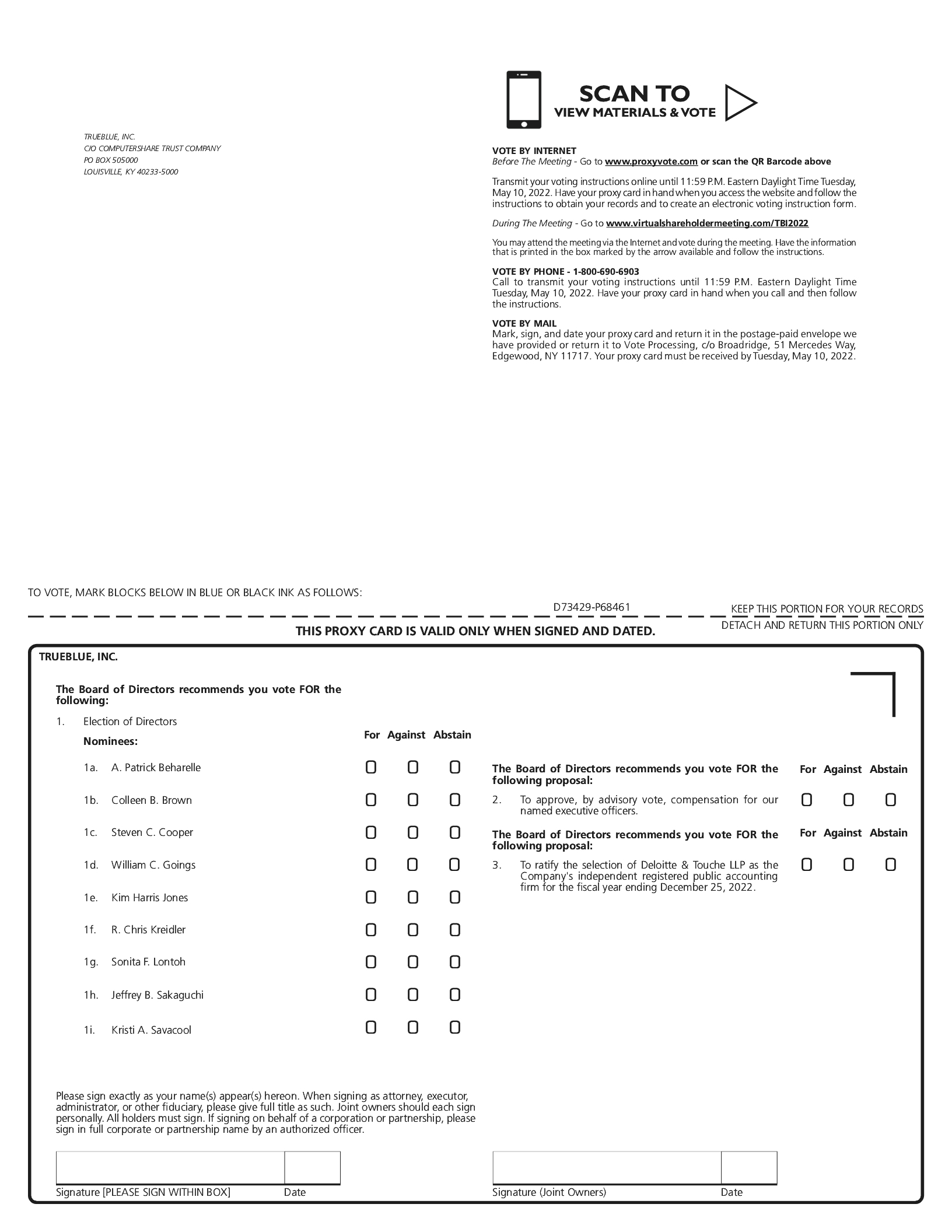

TrueBlue, Inc.

|

|

| |

(Name of Registrant as Specified In Its Charter)

|

|

| |

|

|

| |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

|

| |

☒

|

| |

No fee required.

|

| |||

| |

☐

|

| |

Fee paid previously with preliminary materials:

|

| |||

| |

☐

|

| |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

| |||