UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 26, 2008

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-14543

TrueBlue, Inc.

(Exact name of Registrant as specified in its charter)

Washington |

91-1287341 (IRS Employer Identification No.) |

|

1015 A Street, Tacoma, Washington |

98402 |

Registrant's telephone number, including area code: (253) 383-9101

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class Common Stock without par value |

Name of each exchange on which registered The New York Stock Exchange |

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. Large accelerated filer ý Accelerated filer o Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company o

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value (based on the NYSE quoted closing price) of the common stock held by non-affiliates of the registrant as of the last business day of the second fiscal quarter, June 27, 2008, was approximately $0.575 billion.

As of February 10, 2009, there were 43,285,656 shares of the registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report is incorporated by reference from the registrant's definitive proxy statement, relating to the Annual Meeting of Shareholders scheduled to be held May 13, 2009, which definitive proxy statement will be filed not later than 120 days after the end of the fiscal year to which this report relates.

COMMENT ON FORWARD LOOKING STATEMENTS

This Form 10-K contains forward-looking statements. These statements relate to our expectations for future events and future financial performance. Generally, the words "anticipate," "believe," "expect," "intend," "plan" and similar expressions identify forward-looking statements. Forward-looking statements involve risks and uncertainties, and future events and circumstances could differ significantly from those anticipated in the forward-looking statements. These statements are only predictions. Actual events or results may differ materially. Factors which could affect our financial results are described in Item 1A of this Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of the forward-looking statements. We undertake no duty to update any of the forward-looking statements after the date of this report to conform such statements to actual results or to changes in our expectations.

Page -2

TrueBlue, Inc.

2008 Annual Report on Form 10-K

Table of Contents

Page -3

TrueBlue, Inc.

Form 10-K

Description of the Business

TrueBlue, Inc. ("TrueBlue," "we," "us," "our") is an international provider of temporary blue-collar staffing. In 2008, we put approximately 500,000 people to work through the following brands: Labor Ready for general labor, Spartan Staffing for light industrial services, and CLP Resources, PlaneTechs, and TLC for skilled trades. Headquartered in Tacoma, Washington, we serve approximately 250,000 small to mid-sized businesses in the construction, warehousing, hospitality, landscaping, transportation, light manufacturing, retail, wholesale, facilities, sanitation, and aviation industries.

We began operations in 1989 under the name Labor Ready, Inc. providing on-demand, general labor staffing services. Starting in 2004, we began acquiring additional brands to expand our service offerings to customers in the blue-collar staffing market. Effective December 18, 2007, Labor Ready, Inc. changed its name to TrueBlue, Inc. The name change reflects our vision to be the leading provider of blue-collar staffing with multiple brands serving the temporary staffing industry. Our former company name of Labor Ready remains as our primary brand name for on-demand, general labor staffing services.

Temporary Staffing Industry

The temporary staffing industry evolved out of the need to minimize the cost and effort of hiring and administering permanent employees in response to temporary changes in business conditions. The demand for temporary employees has been driven primarily by the need to satisfy peak production and service requirements and to temporarily replace full-time employees absent due to illness, vacation or abrupt termination. Competitive pressures have forced businesses to focus on reducing costs, including converting fixed or permanent labor costs to variable or flexible costs. During an economic downturn, businesses generally reduce their use of temporary staffing as they experience lower levels of demand from consumers.

The temporary staffing industry includes a number of markets focusing on business needs that vary widely in duration of assignment and level of technical specialization. We operate within the industrial staffing, or blue-collar staffing market of the temporary staffing industry. This market is fragmented among a large number of providers and presents opportunities for larger, well-capitalized companies to compete effectively. Our primary competitive advantages include:

The blue collar staffing market is experiencing significant decreases in demand as a result of the current recession which has negatively impacted our performance. We believe the markets we serve will continue to remain under pressure until the overall economy stabilizes and begins to grow again.

Long-term Strategy

Our long-term business strategies for profitable growth remain unchanged. We plan to expand our market share in the blue-collar staffing markets we serve; be the industry customer service leader; and operate multiple blue-collar staffing brands. We believe we are the gateway to individual growth for our temporary workers and the gateway for our customers seeking to reduce their costs, convert their costs to variable costs, and ultimately grow their businesses.

Page -4

We plan to grow our market share in the industrial staffing market by executing on the following objectives:

Our primary objective is to increase existing branch revenue. Same branch revenue generally drives increasing operating margins due to the fixed costs in our business. We believe the key to increasing same branch revenue is largely tied to our strategy of becoming the service leader in the blue-collar staffing market. During the economic slow down and subsequent recession, same branch revenue has declined. We remain committed to service leadership and growing our market share during the recession.

Our second objective is to open new branches that can reach or exceed performance standards and close branches that are under-performing. However, during recessionary times, we will reduce branch openings and increase the number of branch closings. Primary factors influencing which branches to close included financial performance, ability to consolidate with another branch, tenure and quality of branch management, market potential of branch location, and long-term potential of the location. During 2008, we opened 4 new branches, closed 73 branches, and sold the remaining 29 branches in the United Kingdom for a total reduction of 102 branches. During 2009, we plan to be disciplined in our approach to new branch openings and closures and adjust as needed to further worsening in the economy. Upon return to favorable economic conditions we plan to focus our new branch openings in the Spartan Staffing, CLP Resources, and TLC brands in order to build a national presence. We continually analyze individual branch results, and may close further branches in 2009 that do not meet specific performance standards.

Our third objective is to expand into new markets by making strategic acquisitions in the blue-collar staffing market that can produce strong returns on investment. Our focus is on the light industrial and skilled trades staffing services. During the first half of 2008, we purchased Personnel Management, Inc. ("PMI") and TLC Services Group, Inc. ("TLC"). We purchased all of the stock of PMI, a light industrial staffing company, adding 44 branches to our light industrial network. The acquisition of PMI expanded our reach into key, adjacent markets where Spartan Staffing operates with long-standing relationships with clients and experienced, tenured branch employees. PMI was integrated with the Spartan Staffing brand effective December 27, 2008. We also purchased substantially all of the assets of TLC. Founded in 1975, TLC is a skilled truck-driver staffing provider with operations in Arizona, California, Idaho, Nevada, New Jersey, Oregon, Pennsylvania, Texas, Utah and Washington. During the current recession, management has no plans to make any further acquisitions.

We plan to be the service leader by executing on the following objectives:

We are building a sales culture with a commitment to capturing and cultivating customer loyalty. We build a relationship of trust with our customers, obtaining a firm understanding of their needs, finding solutions, and ensuring our service delivery meets or exceeds expectations. Our ability to provide the right temporary employee, at the right time, and for the right duration is important to meeting our customers' needs. We remain committed to maintaining a safe work environment through our safety and risk management programs to keep our temporary employees safe and better serve our customers.

Our customers value the relationship with our branch personnel. We focus on attracting and retaining high quality branch personnel. We invest in a variety of training programs including programs covering the following topics: company values, sales techniques, customer service and account management, and management of branch operations. We offer competitive compensation and benefits.

We plan to operate with multiple blue-collar brands.

We plan to achieve a dominant market position in each of our blue-collar brands. We have achieved a dominant position with our general labor brand Labor Ready. That blueprint for success is being applied to Spartan Staffing, CLP Resources, PlaneTechs, and TLC. We believe these brands can be expanded into a national presence with dominant market positions. We will continue to invest in building effective and efficient support services. Those support services are leveraged across brands to provide cost efficient support services to our operations.

Brand Operations

Labor Ready – On-Demand, General Labor Services. Labor Ready provides general labor on an on-demand basis. Our customers' needs are generally project based and only last a few days. Of primary importance to our customers is our ability to supply the general laborers needed each day on time and often with same day notice. Our service is especially important to customers that value a commitment to compliance with applicable laws and regulations. In 1994, we

Page -5

expanded our Labor Ready brand for on-demand labor into Canada. At the end of 2008, the Labor Ready brand had in aggregate 697 branches in all 50 states, Puerto Rico, and Canada.

Spartan Staffing – Light Industrial Temporary Services. Spartan Staffing provides workers to the light industrial market which includes, among others, manufacturing, logistics, and warehousing. Spartan Staffing enables our customers to have access to a wide variety of workers. Spartan Staffing was acquired in 2004 with 10 branches and we continued to open new branches through 2007. In April 2008, we added 44 branches to our light industrial temporary services with the purchase of PMI. At the end of fiscal 2008, Spartan Staffing operated 64 branches.

CLP Resources ("CLP") – Skilled Construction Trade Services. CLP provides skilled trades people primarily to the commercial construction market. Customers value CLP's ability to supply high-quality skilled trades people. This enables our customers to obtain immediate value by placing a highly productive and skilled employee on the job site. The staffing assignments are project based but typically last several weeks since the tradesperson is often needed for a substantial amount of the construction process. CLP was acquired in 2005 with 50 branches and we continued to open new branches through 2007. In April 2007, we acquired 17 branches through the purchase of Skilled Services Corporation ("SSC"). SSC was integrated with CLP effective in fiscal 2008. At the end of fiscal 2008, CLP operated 77 branches.

PlaneTechs – Skilled Aviation Services. PlaneTechs provides skilled staffing to the aviation maintenance, repair and overhaul, and aerospace manufacturing and assembly industries, through a full range of specialty technicians. PlaneTechs delivers an innovative approach to the flexible workforce requirements of the aviation industry. In December 2007, we purchased substantially all of the assets of PlaneTechs, LLC. PlaneTechs operates out of one branch facility in Oak Brook, IL.

Transportation Logistics Company ("TLC") – Professional Truck Drivers. TLC specializes in providing professional truck drivers and logistics personnel to the transportation and distribution industries and provides a new element of specialization to our skilled trades services. In February 2008, we purchased substantially all of the assets of TLC Services Group, Inc. TLC has operations in 10 states.

Page -6

The following table reconciles the number of TrueBlue branches open at the end of each of the last five fiscal years :

| |

TrueBlue Branches | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

General Labor |

Light Industrial |

Skilled Trades (1) |

Total Branches |

||||||||||

| |

||||||||||||||

2003 Ending Branches |

779 | – | – | 779 | ||||||||||

Branches acquired (2) |

17 | 10 | – | 27 | ||||||||||

Branches opened |

33 | – | – | 33 | ||||||||||

Branches closed |

(24 | ) | – | – | (24 | ) | ||||||||

2004 Ending Branches |

805 | 10 | – | 815 | ||||||||||

Branches acquired (2) |

– | – | 50 | 50 | ||||||||||

Branches opened |

30 | 8 | 3 | 41 | ||||||||||

Branches closed |

(19 | ) | – | – | (19 | ) | ||||||||

2005 Ending Branches |

816 | 18 | 53 | 887 | ||||||||||

Branches acquired |

– | – | – | – | ||||||||||

Branches opened |

24 | 10 | 16 | 50 | ||||||||||

Branches closed |

(24 | ) | – | (1 | ) | (25 | ) | |||||||

2006 Ending Branches |

816 | 28 | 68 | 912 | ||||||||||

Branches acquired (2) |

– | – | 18 | 18 | ||||||||||

Branches opened |

5 | 7 | 10 | 22 | ||||||||||

Branches closed |

(47 | ) | (3 | ) | (8 | ) | (58 | ) | ||||||

2007 Ending Branches |

774 | 32 | 88 | 894 | ||||||||||

Branches acquired (2) |

– | 44 | 10 | 54 | ||||||||||

Branches opened |

– | – | 4 | 4 | ||||||||||

Branches closed (3) |

(77 | ) | (12 | ) | (13 | ) | (102 | ) | ||||||

2008 Ending Branches |

697 | 64 | 89 | 850 | ||||||||||

Information about Business Segments

TrueBlue operations are one reportable segment. Our operations are all in the blue-collar staffing market of the temporary labor industry and focus on supplying customers with temporary employees. All our brands have the following similar characteristics:

Page -7

We expect similar operating margins for our brands based on historical experience. The long-term performance expectations of all our brands are similar as are the underlying financial and economic metrics used to manage those brands.

Our international operations are not significant to our total operations for segment reporting purposes. In 2008 we sold the remaining Labor Ready branches in the United Kingdom. Total revenues from operations in the United Kingdom in 2008 were less than 2% of consolidated revenues.

Operations

Branch operations are organized into geographic areas. Each area is under the supervision of a manager who oversees branch performance. Within an area, multi-unit managers supervise branch operations and meet regularly with branch managers to discuss new customers, customer satisfaction, temporary workforce recruitment and retention, and operating performance. Similar meetings are conducted at the corporate level with regional management.

Branches are generally open five days a week, with extended hours as required to meet customer needs. Branch locations are generally staffed with a branch manager and two or more additional employees that focus on customer sales and service, temporary worker recruiting, screening and placement. Branches follow standardized and detailed operating procedures.

We believe that one of the most critical factors determining the success of a branch is selecting, hiring and retaining an effective branch manager. Each branch manager has the responsibility for recruiting and retaining a quality temporary workforce and capturing and cultivating customer loyalty. Each branch manager manages the operations of the branch which include the recruiting, dispatch and payment of temporary employees, meeting the needs of our customers with a guarantee of customer satisfaction, selling our services to new customers, as well as cost control through accident prevention, and compliance with the laws and regulations. We commit substantial resources to the training, development, and operational support of our branch managers.

Our Labor Ready, CLP, and Spartan Staffing brands own proprietary front-end software systems to process all required credit, work order, billing, collection and temporary worker payroll, together with other information and reporting systems necessary for the management of hundreds of thousands of temporary employees and operations in multiple locations. Corporate, brand management and branch staff can run a variety of reports on-demand, such as receivables aging, margin reports and customer activity reports. Regional, area, and district managers are able to monitor their territories from remote locations.

Our Customers

The majority of our customers require temporary employees for peak production and service requirements and to temporarily replace absent full time employees. We currently derive our revenue from a large number of customers and we are not dependent on any individual customer for more than 3% of our annual revenue. During 2008, we served approximately 250,000 customers. Our ten largest customers accounted for approximately 10.7% of total revenue in 2008, up from 4% for 2007 and 2006.

Our Temporary Employees

During 2008, we put approximately 500,000 people to work. We recruit temporary employees daily so that we can be responsive to the planned as well as unplanned needs of the customers we serve. Our customers know we can respond quickly to their labor needs. Under our "satisfaction guaranteed" policy, if the customer notifies us within an established time frame, temporary employees unsatisfactory to our customer are promptly replaced and the customer is not charged for their time. We attract our pool of temporary employees through advertising and word of mouth. We believe our focus

Page -8

on locating branches in areas convenient for our temporary employees is particularly important in attracting temporary employees. We consider our relations with temporary employees to be good.

Seasonality

Our business experiences seasonal fluctuation. Construction and landscaping businesses and, to a lesser degree, other customer businesses typically increase activity in spring, summer and early fall months and decrease activity in late fall and winter months. Inclement weather can slow construction and landscaping activities in such periods. As a result, we generally experience an increase in temporary labor demand in the spring, summer and early fall months, and lower demand in the late fall and winter months.

Competition

The blue-collar staffing market is highly competitive with limited barriers to entry. We compete with several multi-national full-service companies, specialized temporary staffing companies, as well as local companies. The majority of temporary staffing companies serving the blue-collar staffing market have local operations with fewer than five branches. In most geographic areas, no single company has a dominant share of the market. One or more of these competitors may decide at any time to enter or expand their existing activities in the blue-collar staffing market and provide new and increased competition to us. While entry to the market has limited barriers, lack of working capital frequently limits the growth of smaller competitors.

We believe that the primary competitive factors in obtaining and retaining customers are:

Competitive forces have historically limited our ability to raise our prices to immediately and fully offset increased costs of doing business, including increased labor costs, costs for workers' compensation and state unemployment insurance. As a result of these forces, we have in the past faced pressure on our operating margins. See Item 1A below of this Form 10-K– Risk Factors.

Government Regulations

We are in the business of employing people and placing them in the workplaces of other businesses. As a result, we are subject to a number of federal, state and local laws and regulations regulating our industry. Some of the most important areas of regulation include the following:

Patents and Trademarks

Our business is not presently dependent on any patents, licenses, franchises or concessions. "TrueBlue," "Labor Ready," "Spartan Staffing," "CLP Resources," "PlaneTechs," and certain other service marks are registered with the U.S. Patent and Trademark Office.

Page -9

Fiscal Year End

Our fiscal year is based on a 52/53-week year ending on the last Friday in December. In fiscal years consisting of 53 weeks the final quarter will consist of 14 weeks while in 52-week years all quarters will consist of 13 weeks. Our next fiscal year with 53 weeks will be fiscal 2010.

Financial Information about Geographic Areas

The following table depicts our revenue derived from within the United States and that derived from international operations for the past three years (in thousands). International operations include Canada and the United Kingdom.

| |

2008 | 2007 | 2006 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

United States (including Puerto Rico) |

$ | 1,308,013 | 94.5% | $ | 1,288,456 | 93.0% | $ | 1,263,642 | 93.7% | ||||||||||

International Operations |

76,256 | 5.5% | 97,200 | 7.0% | 85,476 | 6.3% | |||||||||||||

Total revenue from services |

$ | 1,384,269 | 100% | $ | 1,385,656 | 100% | $ | 1,349,118 | 100% | ||||||||||

The following table depicts our net property and equipment located in the United States and the net property and equipment located in international operations for the past three years (in thousands).

| |

2008 | 2007 | 2006 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

United States (including Puerto Rico) |

$ | 61,225 | 99.5% | $ | 43,644 | 97.2% | $ | 29,982 | 93.8% | ||||||||||

International Operations |

317 | 0.5% | 1,265 | 2.8% | 1,967 | 6.2% | |||||||||||||

Total property and equipment, net |

$ | 61,542 | 100% | $ | 44,909 | 100% | $ | 31,949 | 100% | ||||||||||

The international operations are dependent on shared information and communications equipment housed and maintained in the United States.

Number of Employees

As of February 10, 2009, we employed approximately 2,900 full time and part time employees in addition to our temporary employees.

Available Information

Our Internet website address is www.trueblueinc.com. We make available at this address, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Information available on our website is not incorporated by reference in and is not deemed a part of this Form 10-K.

Investing in our securities involves a high degree of risk. The following risk factors, issues and uncertainties should be considered in evaluating our future prospects. In particular, keep these risk factors in mind when you read "forward-looking" statements elsewhere in this report. Forward-looking statements relate to our expectations for future events and time periods. Generally, the words "anticipate," "believe," "expect," "intend," "plan" and similar expressions identify forward-looking statements. Forward–looking statements involve risks and uncertainties, and future events and circumstances could differ significantly from those anticipated in the forward–looking statements. Any of the following risks could harm our business, operating results or financial condition and could result in a complete loss of your investment. Additional risks and uncertainties that are not yet identified or that we currently think are immaterial may also harm our business and financial condition in the future.

The current recession has negatively affected our customers and our business, and could continue to negatively affect our customers and materially adversely affect our results of operations and liquidity.

The current recession is having a significant negative impact on businesses around the world. The full impact of this recession on our customers, especially our customers engaged in construction, cannot be predicted and may be quite severe. These and other economic factors, such as consumer demand, unemployment, inflation levels and the availability

Page -10

of credit could have a material adverse effect on demand for our services and on our financial condition and operating results. We sell our services to a large number of small and medium sized businesses and these businesses have been and are more likely to be impacted by unfavorable general economic and market conditions than larger and better capitalized companies. If our customers cannot access credit to support increased demand for their product or if demand for their products declines, they will have less need for our services.

We may be negatively affected by the financial crisis in the U.S. and global capital and credit markets.

We must maintain liquidity to fund our working capital and to fund our premium and collateral obligations to our insurance providers. Without sufficient liquidity, we could be forced to limit our operations or we may not be able to pursue new business opportunities. The principal sources of our liquidity are cash generated from operating activities, available cash and cash equivalents, and borrowings under our credit facility. The capital and credit markets have been experiencing extreme volatility and disruption during the past year. These market conditions could affect our ability to borrow under our credit facility, or adversely affect our banking partners. We can make no assurances that our banking partners will not experience a significant adverse event that could impact their abilities to fulfill their obligations to us. Even if the credit markets improve, the availability of financing will depend on a variety of factors, such as economic and market conditions, the availability of credit and our credit ratings, as well as the possibility that lenders could develop a negative perception of us or the markets that we serve. We may not be able to successfully obtain any necessary additional financing on favorable terms, or at all.

Competition for customers in the staffing markets we serve is intense, and if we are not able to effectively compete, our financial results could be harmed and the price of our securities could decline.

The temporary services industry is highly competitive, with limited barriers to entry. Several very large and mid-sized full-service and specialized temporary labor companies, as well as small local operations, compete with us in the staffing industry. Competition in the markets we serve is intense and these competitive forces limit our ability to raise prices to our customers. For example, competitive forces have historically limited our ability to raise our prices to immediately and fully offset increased costs of doing business, including increased labor costs, costs for workers' compensation and state unemployment insurance. As a result of these forces, we have in the past faced pressure on our operating margins. Pressure on our margins remains intense, and we cannot assure you that it will not continue. If we are not able to effectively compete in the staffing markets we serve, our operating margins and other financial results will be harmed and the price of our securities could decline.

A significant portion of our insurance coverage, including workers' compensation, is provided by AIGCI. If AIGCI, or its insurance subsidiaries, were to experience further financial problems, it could harm our business, financial condition or results of operations.

Our workers' compensation insurance policies are with various insurance subsidiaries of AIGCI. AIGCI holds the majority of the restricted cash collateralizing our self-insured workers' compensation policies. We also rely on AIGCI to provide state-mandated statutory workers' compensation coverage, employers' liability coverage, auto coverage, and general liability coverage. While we have not experienced a loss of collateral with any of the prior insurance companies that have entered liquidation, if AIGCI were to experience further financial problems, our restricted cash deposits, letters of credit, and/or our workers' compensation or other coverage at AIGCI could be at risk. The loss of the cash deposits and letters of credit would have a material negative impact on our balance sheet and could require us to seek additional sources of capital to pay our accrued workers' compensation claims. These additional sources of financing may not be available on commercially reasonable terms, or at all. The loss of our workers' compensation coverage would prevent us from doing business in the majority of our markets.

If we are not able to obtain or maintain insurance on commercially reasonable terms, our financial condition or results of operations could suffer.

We maintain various types of insurance coverage to help offset the costs associated with certain risks to which we are exposed. We have previously experienced, and could again experience, changes in the insurance markets that result in significantly increased insurance costs and higher deductibles. For example, we are required to pay workers' compensation benefits for our temporary and permanent employees. Under our workers' compensation insurance program, we maintain "per occurrence" insurance, which covers claims for a particular event above a $2.0 million deductible, and we do not maintain an aggregate stop-loss limit other than on a per-occurrence basis. While we have secured coverage with AIG Commercial Insurance ("AIGCI") for occurrences during the period from July 2008 to July 2009, our insurance policies must be renewed annually, and we cannot guarantee that we will be able to successfully renew such policies for any period after July 2009. In the event we are not able to obtain workers' compensation insurance, or any of our other insurance coverages, on commercially reasonable terms, our ability to operate our business would be significantly impacted and our

Page -11

financial condition and results of operations could suffer. If our financial results deteriorate, our insurance carrier may accelerate our premium payments or require all premium to be paid in one initial payment. Such a change in our insurance payment terms could impact our available cash, and our financial condition or operations could suffer.

The terms under which we post the collateral necessary to support our workers' compensation obligations may change which could reduce the capital we have available to support our operations.

We are required to maintain commitments such as cash and cash-backed instruments, irrevocable letters of credit, and/or surety bonds to secure repayment to our insurance companies (or in some instances, the state) of the deductible portion of all open workers' compensation claims. We pledge cash or other assets in order to secure these commitments and there are a number of factors that cause the size of our collateral commitments to grow over time. As our business grows so does our workers' compensation reserve and the collateral needed to support it. We sometimes face difficulties in recovering our collateral from insurers, particularly when those insurers are in financial distress, and we cannot guarantee that our collateral for past claims will be released in a timely manner as we pay down claims. As a result, we expect that the amount of collateral required to secure our commitments to our insurance carriers could continue to increase. Alternatively, if our financial results deteriorate, our insurance carriers may require additional collateral, or we may see a shortening of the amount of time that the insurance carriers allow us to deposit collateral. Such a change in our collateral payment terms could impact our available cash, and our financial condition or operations could suffer. Deteriorating financial results could also cause our surety carriers to require more cash to collateralize surety bonds that they have issued. Our currently available sources of capital for these commitments are limited, and have been further limited by the current global liquidity shortage, and we could be required to seek additional sources of capital in the future. These additional sources of financing may not be available on commercially reasonable terms, or at all. Even if such sources of financing are available, they could result in a dilution of value to our existing shareholders.

Our reserves for workers' compensation claims, other liabilities, and our allowance for doubtful accounts may be inadequate, and we may incur additional charges if the actual amounts exceed the estimated amounts.

We maintain reserves for workers' compensation claims, including the excess claims portion above our deductible, using actuarial estimates of the future cost of claims and related expenses. These estimates are impacted by items that have been reported but not settled and items that have been incurred but not reported. This reserve, which reflects potential liabilities to be paid in future periods based on estimated payment patterns, is discounted to its estimated net present value using discount rates based on average returns of "risk-free" U.S. Treasury instruments with maturities comparable to the weighted average lives of our workers' compensation claims. We evaluate the reserve regularly throughout the year and make adjustments accordingly. If the actual costs of such claims and related expenses exceed the amounts estimated, or if the discount rates represent an inflated estimate of our return on capital over time, actual losses for these claims may exceed reserves and/or additional reserves may be required. We have also established reserves for contingent legal and regulatory liabilities, based on management's estimates and judgments of the scope and likelihood of these liabilities. While we believe our judgments and estimates are adequate, if the actual outcome of these matters is less favorable than expected, an adjustment would be charged to expense in the period in which the outcome occurs or the period in which our estimate changes. We also establish an allowance for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments. If the financial condition of our customers were to deteriorate, resulting in an impairment of their ability to make payments, we may be required to incur additional charges.

Some insurance companies with which we have previously done business are in financial distress, and one has been relieved of its insurance obligations to us. If our insurers do not fulfill their obligations, we could experience significant losses.

Prior to our current policies with AIG Commercial Insurance ("AIGCI"), we purchased annual insurance policies in connection with our workers' compensation obligations from three primary carriers. Prior to 2001, Legion Insurance Company (Legion) and Reliance Insurance Company (Reliance) provided coverage to us. Legion and Reliance are in liquidation and have failed to pay a number of covered claims that exceed our deductible limits. We have presented these excess claims to the guarantee funds of the states in which the claims originated. Certain of these excess claims have been rejected by the state guarantee funds due to statutory eligibility limitations. As a result, we have concluded it is likely that we will be unable to obtain reimbursement for at least a portion of these excess claims. To the extent we experience additional claims that exceed our deductible limits and our insurers do not satisfy their coverage obligations, we may be forced to satisfy some or all of those claims directly; this in turn could harm our financial condition or results of operations.

Our workers' compensation reserves include not only estimated expenses for claims within our self-insured layer but also estimated expenses related to claims in excess of the deductible limits. We record a receivable for the insurance coverage on excess claims. We have also recorded a valuation allowance against the insurance receivables from Legion and Reliance

Page -12

to reflect our best estimates of amounts we may not realize as a result of the liquidations of those insurers. The outcome of those liquidations is inherently uncertain and we may realize significantly less than currently estimated, in which case an adjustment would be charged to expense in the period in which the outcome occurs or the period in which our estimate changes.

Kemper Insurance Company (Kemper) provided coverage for occurrences commencing in 2001 through June 30, 2003. In December 2004, we executed a novation agreement pursuant to which we relinquished insurance coverage and assumed all further liability for all claims originating in the Kemper policy years. These claims are reserved for in the consolidated financial statements. Although we believe our judgements and estimates are adequate, we cannot assure you that claims originating in the Kemper policy years will not experience unexpected adverse developments.

Our operations expose us to the risk of litigation which could lead to significant potential liability and costs that could harm our business, financial condition or results of operations.

We are in the business of employing people and placing them in the workplaces of other businesses. As a result, we are subject to a large number of federal and state laws and regulations relating to employment. This creates a risk of potential claims that we have violated laws related to discrimination and harassment, health and safety, wage and hour laws, criminal activity, personal injury and other claims. We are also subject to other types of claims in the ordinary course of our business. Some or all of these claims may give rise to litigation, which could be time-consuming for our management team, costly and harmful to our business.

In addition, we are exposed to the risk of class action litigation. The costs of defense and the risk of loss in connection with class action suits are greater than in single-party litigation claims. Due to the costs of defending against such litigation, the size of judgments that may be awarded against us, and the loss of significant management time devoted to such litigation, we cannot assure you that such litigation will not disrupt our business or impact our financial results.

A significant portion of our revenue is derived from operations in a limited number of markets. Unfavorable economic conditions in these markets have harmed and could continue to harm our operations.

A significant portion of our revenue is derived from our operations in a limited number of states. Total revenue generated from operations in California, Texas and Florida, accounted for 33% of our overall revenue in 2008, 36% of our overall revenue in 2007 and 38% of our overall revenue in 2006.

International operations will burden our resources and may fail to generate a substantial increase in revenue.

Our international branch operations expose us to certain risks. These risks include risks already discussed in connection with our domestic branch operations and also include risks related to fluctuations in the value of foreign currencies, the additional expense and risks inherent in operations in geographically and culturally diverse locations, being subject to complex foreign tax laws and regulations. If we are not able to effectively manage those risks, our financial results could be harmed. As of December 26, 2008, we had 39 branches outside the United States.

We are continually subject to the risk of new regulation, which could harm our business.

Each year a number of bills are introduced to Federal, State, and local governments, any one of which, if enacted, could impose conditions which could harm our business. This proposed legislation has included provisions such as a requirement that temporary employees receive equal pay and benefits as permanent employees, requirements regarding employee health care, and a requirement that our customers provide workers' compensation insurance for our temporary employees. We actively oppose proposed legislation adverse to our business and inform policy makers of the social and economic benefits of our business. However, we cannot guarantee that any of this legislation will not be enacted, in which event demand for our service may suffer.

The cost of compliance with government laws and regulations is significant and could harm our operating results.

We incur significant costs to comply with complex federal, state, and local laws and regulations relating to employment, including occupational safety and health provisions, wage and hour requirements (including minimum wages), workers' compensation unemployment insurance, and immigration. In addition, from time to time we are subject to audit by various state and governmental authorities to determine our compliance with a variety of these laws and regulations. We have in the past been found, and may in the future be found, to have violated such laws or regulations. We may, from time to time, incur fines and other losses or negative publicity with respect to any such violation. If we incur additional costs to comply with these laws and regulations or as a result of fines or other losses and we are not able to increase the rates we charge our customers to fully cover any such increase, our margins and operating results may be harmed.

Page -13

Our business depends extensively on recruiting and retaining qualified branch managers. If we are not able to attract a sufficient number of qualified branch managers, our future growth and financial performance may suffer.

We rely heavily on the performance and productivity of our branch managers, who manage the operation of the branches, including recruitment and assignment of temporary employees, marketing and providing quality customer service. We have historically experienced a high degree of turnover among our branch managers. As a result, we must continue to recruit a sufficient number of managers to staff new branches and to replace managers lost through attrition or termination. Our future growth and financial performance depend on our ability to hire, train and retain qualified managers from a limited pool of qualified candidates.

Our credit facility requires that we meet certain levels of financial performance. In the event we fail either to meet these requirements or have them waived, we may be subject to penalties and we could be forced to seek additional financing.

We have a credit agreement with certain unaffiliated financial institutions (the "Revolving Credit Facility") that expires in April 2011. The Revolving Credit Facility requires that we comply with certain financial covenants. Among other things, these covenants require us to maintain certain leverage and coverage ratios. Deterioration of our financial results would make it harder for us to comply with these financial covenants. In the past we have negotiated amendments to these covenants to ensure our continued compliance with their restrictions. We cannot be assured that our lenders would consent to such amendments on commercially reasonable terms in the future if we once again required such relief. In the event that we do not comply with the covenants and the lenders do not waive such non-compliance, then we will be in default of the Revolving Credit Facility, which could subject us to penalty rates of interest and accelerate the maturity of the outstanding balances. Accordingly, in the event of a default under the Revolving Credit Facility, we could be required to seek additional sources of capital to satisfy our liquidity needs. These additional sources of financing may not be available on commercially reasonable terms, or at all.

A significant portion of our liquidity relies on a limited number of banking partners. If these banks fail we could face a shortage of liquidity, which could harm our business operations.

In the current economic recession, we cannot assure you that the lenders under the Revolving Credit Facility will remain able to support their commitments to us in the future. If these lenders fail we may not be able to secure alternative financing on commercially reasonable terms, or at all.

We have significant working capital requirements.

We require significant working capital in order to operate our business. We may experience periods of negative cash flow from operations and investment activities, especially during seasonal peaks in revenue experienced in the second and third quarter of the year. We invest significant cash into the opening and operations of new branches until they begin to generate revenue sufficient to cover their operating costs. We also pay our temporary employees before customers pay us for the services provided. As a result, we must maintain cash reserves to pay our temporary employees prior to receiving payment from our customers. Our collateral requirements may increase in future periods, which would decrease amounts available for working capital purposes. If our available cash balances and borrowing base under our existing credit facility do not grow commensurate with the growth in our working capital requirements, or if our banking partners experience cash shortages or are unwilling to provide us with necessary cash, we could be required to explore alternative sources of financing to satisfy our liquidity needs.

Our management information and computer processing systems are critical to the operations of our business and any failure, interruption in service, or security failure could harm our ability to effectively operate our business.

The efficient operation of our business is dependent on our management information systems. We rely heavily on our management information systems to manage our order entry, order fulfillment, pricing, and point-of-sale processes. The failure of our management information systems to perform as we anticipate could disrupt our business and could result in decreased revenue, increased overhead costs and could require that we commit significant additional capital and management resources to resolve the issue, causing our business and results of operations to suffer materially. Failure to protect the integrity and security of our customers' and employees' information could expose us to litigation and materially damage our standing with our customers.

The loss of any of our key personnel could harm our business.

Our future financial performance will depend to a significant extent on our ability to motivate and retain key management personnel. Competition for qualified management personnel is intense and in the event we experience turnover in our key management positions, we cannot assure you that we will be able to recruit suitable replacements or assimilate new key management personnel into our organization to achieve our operating objectives. Even if we are successful, turnover in key management positions could temporarily harm our financial performance and results of operations until new

Page -14

management becomes familiar with our business. Furthermore, we do not maintain key person life insurance on any of our executive officers.

Our business would suffer if we could not attract enough temporary employees or skilled trade workers.

We compete with other temporary personnel companies to meet our customer needs and we must continually attract reliable temporary employees to fill positions. We have in the past experienced short-term worker shortages and we may continue to experience such shortages in the future. In addition, our CLP, PlaneTechs and TLC brands rely on their ability to attract skilled trade workers. If we are unable to find temporary employees or skilled trade workers to fulfill the needs of our customers over a long period of time, we could lose customers and our business could suffer.

Labor unions have attempted to harm our business.

Various labor unions and activist groups have attempted to disrupt our business. For example, these groups have backed legislation designed to adversely impact our business, coordinated legal actions directed at our activities and engaged in a public relations campaign to discredit members of our management team and influence our customers. We cannot assure you that these activities will not harm our business or the price of our securities.

Failure in our pursuit or execution of new business ventures, strategic alliances and acquisitions could have a material adverse impact on our business.

Our long-term growth strategy includes expansion via new business ventures and acquisitions. While we employ several different valuation methodologies to assess a potential growth opportunity, we can give no assurance that new business ventures and strategic acquisitions will positively affect our financial performance. Acquisitions may result in the diversion of our capital and our management's attention from other business issues and opportunities. Unsuccessful acquisition efforts may result in significant additional expenses that would not otherwise be incurred. We may not be able to assimilate or integrate successfully companies that we acquire, including their personnel, financial systems, distribution, operations and general operating procedures. If we fail to assimilate or integrate acquired companies successfully, our business could suffer materially. In addition, we may not realize the revenues and cost savings that we expect to achieve or that would justify the acquisition investment, and we may incur costs in excess of what we anticipate. We may also encounter challenges in achieving appropriate internal control over financial reporting in connection with the integration of an acquired company. In addition, the integration of any acquired company, and its financial results, into ours may have a material adverse effect on our operating results.

We are highly dependent on the cash flows and net earnings we generate during our second and third fiscal quarters.

A majority of our cash flow from operating activities is generated during the 2nd and 3rd quarters which include the summer months. Unexpected events or developments such as natural disasters, manmade disasters and adverse economic conditions in our second and third quarter could have a material adverse effect on our operating cash flows.

The foregoing should not be construed as an exhaustive list of all factors that could cause actual results to differ materially from those expressed in forward-looking statements made by us or on our behalf.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

We lease the building space at virtually all of our branches. Under the majority of these leases, both parties to the agreement have the right to terminate the lease on 90 days notice and upon payment of an early termination penalty equivalent to three months rent. A small percentage of leases provide for a minimum lease term in excess of one year. We own an office building in Tacoma, Washington, which serves as our headquarters. We also own two branches in Florida. Management believes all of our facilities are currently suitable for their intended use.

From time to time we are subject to compliance audits by federal, state and local authorities relating to a variety of regulations including wage and hour laws, taxes, workers' compensation, immigration and safety. From time to time we are also subject to legal proceedings in the ordinary course of our operations. A summary of our most significant pending litigation and regulatory proceedings is set forth below. It is not possible at this time for us to determine fully the effect of all legal proceedings on our consolidated financial position, results of operations or liquidity; however, to the extent

Page -15

possible, where legal liabilities can be reasonably estimated and are considered probable, we have recorded a liability. To the extent that an insurance company is contractually obligated to reimburse us for a liability, we record a receivable for the amount of the probable reimbursement. We have established reserves for our contingent legal and regulatory liabilities in the amount of $4.3 million at December 26, 2008 and $4.8 million at December 28, 2007. We believe that none of the currently pending legal proceedings, individually or in the aggregate, will have a material adverse impact on our financial position, results of operations or cash flows beyond amounts that have been accrued in the financial statements, although we can make no assurances in this regard.

On January 12, 2005, the New Jersey Division of Taxation (the "Division") filed a Notice of Assessment Related to Final Audit Determination asserting that we owe $7.0 million for delinquent sales taxes, penalties and interest for the period October 1, 2000 through September 30, 2004. The amount of the assessment is based on the Division's assertion that 100% of our revenue from New Jersey operations is subject to sales tax. We disputed the Division's position that we provide taxable services under New Jersey law and filed an administrative protest. The administrative protest was handled internally by the Division and did not involve any outside or independent governmental bodies. On September 19, 2006, the Division issued a final determination on our administrative protest increasing the amount that we allegedly owe for delinquent sales taxes, penalties and interest to $8.1 million. Interest continues to accrue on this amount. We have sought independent review of this determination by filing a complaint with the Tax Court of New Jersey on December 15, 2006. On September 17, 2008, the Court heard our motion for summary judgment, as well as a cross-motion for summary judgment by the Division, and ordered the parties to conduct additional discovery.

On July 16, 2003, Alecia Recio, Elizabeth Esquivel, Debbie Owen and Barry Selbts, each a current or former employee of ours, jointly filed an action in United States District Court for the Central District of California, alleging failure to pay overtime under state and federal law and seeking unspecified damages and certification of a class of similarly situated employees (this matter now includes the claims of Scott Romer and Shawna Clark previously pursued in a separate action). On September 23, 2003, the court dismissed the case for improper venue. On October 1, 2003, Recio re-filed her case in California State Court, Los Angeles County, seeking similar relief on behalf of our employees employed in the State of California. The case went to mediation on September 27, 2007 and on October 12, 2007. Subsequently, the parties entered into a settlement which resolved all claims. The settlement received final approval from the court on September 22, 2008. All amounts related to the settlement are accounted for in our established reserves for our contingent legal and regulatory liabilities.

On August 2, 2002, a New York State Department of Labor audit of a single Labor Ready branch located in New York resulted in an administrative finding that the CDM fees collected at that branch violated New York labor laws. We appealed this administrative finding to the New York Board of Industrial Appeals, which overruled the Department of Labor and issued a unanimous finding that CDM fees did not violate New York wage payment laws. On October 24, 2005, the New York Appellate Division reversed the decision of the Board of Industrial Appeals. We appealed this decision and on November 16, 2006, the Court of Appeals affirmed the decision of the Appellate Division. Thereafter, we promptly shut down the CDMs in the State of New York. Recently, the New York Attorney General ("NYAG") has threatened to file a lawsuit against us seeking restitution for fees collected at all of our New York branches for a six-year period. The total claimed restitution is $1.6 million. In addition to this amount, the NYAG is also seeking interest and penalties.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter ended December 26, 2008.

Page -16

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is listed on the New York Stock Exchange under the ticker symbol TBI. The table below sets forth the high and low sales prices for our common stock as reported by the New York Stock Exchange during the periods indicated:

Quarter Ended

|

High | Low | ||||||

|---|---|---|---|---|---|---|---|---|

March 30, 2007 |

$ | 19.78 | $ | 17.00 | ||||

June 29, 2007 |

$ | 24.56 | $ | 17.62 | ||||

September 28, 2007 |

$ | 28.63 | $ | 18.35 | ||||

December 28, 2007 |

$ | 21.58 | $ | 14.22 | ||||

March 28, 2008 |

$ | 15.00 | $ | 11.01 | ||||

June 27, 2008 |

$ | 14.65 | $ | 12.00 | ||||

September 26, 2008 |

$ | 17.50 | $ | 12.39 | ||||

December 26, 2008 |

$ | 16.23 | $ | 5.57 | ||||

Holders of the Corporation's Capital Stock

We had approximately 907 shareholders of record as of February 10, 2009.

Dividends

No cash dividends have been declared on our common stock to date nor have any decisions been made to pay a dividend in the future. Payment of dividends is evaluated on a periodic basis and if a dividend were paid, it would be subject to the covenants of our lending facility, which may have the effect of restricting our ability to pay dividends.

Issuer Purchases of Equity Securities

Under our authorized share purchase program, we purchased and retired 1.2 million shares of our common stock for a total of $16.0 million during 2008 and 7.6 million shares of our common stock for a total of $150.3 million during 2007.

The table below includes purchases of our common stock pursuant to publicly announced plans or programs and those not made pursuant to publicly announced plans or programs during the thirteen weeks ended December 26, 2008.

| |

|

|

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Period |

Total number of shares purchased (1) |

Weighted average price paid per share (2) |

Total number of shares purchased as part of publicly announced plans or programs |

Maximum number of shares (or approximate dollar value) that may yet be purchased under plans or programs at period end (3) |

|||||||||

9/27/08 through 10/24/08 |

1,972 | $ | 11.97 | – | $ | 21.5 million | |||||||

10/25/08 through 11/21/08 |

1,248 | $ | 8.21 | – | $ | 21.5 million | |||||||

11/22/08 through 12/26/08 |

8,621 | $ | 7.70 | – | $ | 21.5 million | |||||||

Total |

11,841 | $ | 8.15 | 0 | $ | 21.5 million | |||||||

Page -17

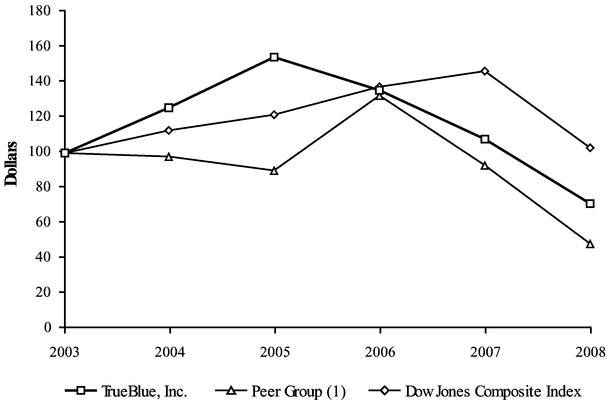

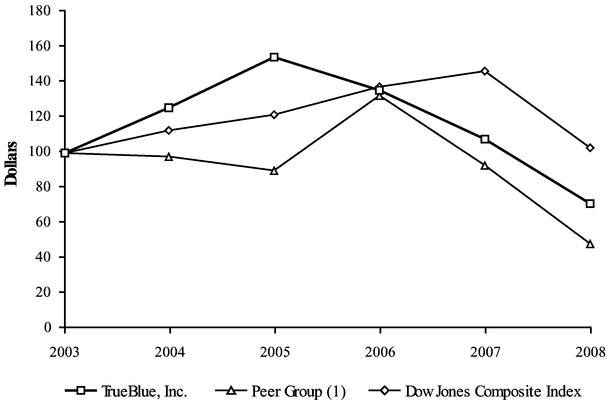

TrueBlue Stock Comparative Performance Graph

The following graph depicts our stock price performance from December 31, 2003, through December 26, 2008, relative to the performance of the Dow Jones Composite and a peer group of companies in the temporary labor industry. All indices shown in the graph have been reset to a base of 100 as of December 31, 2003, and assume an investment of $100 on that date and the reinvestment of dividends, if any, paid since that date.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN

Among TrueBlue, Inc., the Dow Jones Composite Index

and Selected peer group*

TOTAL RETURN TO SHAREHOLDERS

(assumes $100 Investment on 12/31/03)

Total Return Analysis

|

2003 | 2004 | 2005 | 2006 | 2007 | 2008 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

TrueBlue, Inc. |

$ | 100 | $ | 126 | $ | 155 | $ | 136 | $ | 108 | $ | 71 | ||||||||

Peer Group (1) |

$ | 100 | $ | 98 | $ | 90 | $ | 133 | $ | 93 | $ | 48 | ||||||||

Dow Jones Composite Index |

$ | 100 | $ | 113 | $ | 122 | $ | 138 | $ | 147 | $ | 103 | ||||||||

Page -18

Item 6. SELECTED FINANCIAL DATA

The following selected consolidated financial information has been derived from our audited Consolidated Financial Statements. The data should be read in conjunction with our Consolidated Financial Statements and the notes thereto, and Management's Discussion and Analysis of Financial Condition and Results of Operations included elsewhere herein.

Summary Consolidated Financial And Operating Data

(in thousands, except per share data and number of branches)

| |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 (2) | 2007 (2) | 2006 | 2005 (2) | 2004 (2) | ||||||||||||

Statement of Income Data: |

|||||||||||||||||

Revenue from services |

$ | 1,384,269 | $ | 1,385,656 | $ | 1,349,118 | $ | 1,236,070 | $ | 1,044,236 | |||||||

Cost of services |

971,757 | 943,563 | 915,773 | 844,448 | 727,059 | ||||||||||||

Gross profit |

412,512 | 442,093 | 433,345 | 391,622 | 317,177 | ||||||||||||

Selling, general and administrative expenses |

332,113 | 336,220 | 318,681 | 286,460 | 244,606 | ||||||||||||

Goodwill and intangible asset impairment |

61,000 | – | – | – | – | ||||||||||||

Depreciation and amortization |

16,774 | 12,223 | 10,364 | 9,603 | 10,127 | ||||||||||||

Interest and other income (expense), net |

5,530 | 10,953 | 11,873 | 4,636 | (2,599 | ) | |||||||||||

Income before tax expenses |

8,155 | 104,603 | 116,173 | 100,195 | 59,845 | ||||||||||||

Income tax expense |

12,314 | 38,405 | 39,701 | 38,174 | 23,532 | ||||||||||||

Net income (loss) |

$ | (4,159 | ) | $ | 66,198 | $ | 76,472 | $ | 62,021 | $ | 36,313 | ||||||

Net income (loss) per diluted share: |

|||||||||||||||||

Diluted |

$ | (0.10 | ) | $ | 1.44 | $ | 1.45 | $ | 1.18 | $ | 0.75 | ||||||

Weighted average diluted shares outstanding (1): |

|||||||||||||||||

Diluted |

43,073 | 45,960 | 52,853 | 53,793 | 52,289 | ||||||||||||

Operating Data (unaudited): |

|||||||||||||||||

Revenue from branches open 12 or more months |

$ | 1,240,843 | $ | 1,314,919 | $ | 1,325,902 | $ | 1,136,617 | $ | 980,672 | |||||||

Revenue from branches open less than 12 months or acquired during the year |

94,753 | 48,201 | 22,236 | 96,530 | 59,717 | ||||||||||||

Revenue from branches closed during the year |

48,673 | 22,536 | 980 | 2,923 | 3,847 | ||||||||||||

Total |

$ | 1,384,269 | $ | 1,385,656 | $ | 1,349,118 | $ | 1,236,070 | $ | 1,044,236 | |||||||

Branches open at period end |

850 |

894 |

912 |

887 |

815 |

||||||||||||

| |

At Year End, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 (2) | 2007 (2) | 2006 | 2005 (2) | 2004 (2) | |||||||||||

Balance Sheet Data: |

||||||||||||||||

Working capital |

$ | 147,496 | $ | 114,970 | $ | 238,373 | $ | 218,649 | $ | 184,550 | ||||||

Total assets |

519,675 | 545,249 | 592,306 | 572,076 | 444,107 | |||||||||||

Long-term liabilities |

154,238 | 146,884 | 138,403 | 123,464 | 165,205 | |||||||||||

Total liabilities |

$ | 249,546 | $ | 261,422 | $ | 239,788 | $ | 223,478 | $ | 241,713 | ||||||

Page -19

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with, and is qualified in its entirety by, the Consolidated Financial Statements and Notes thereto included elsewhere in this Annual Report on Form 10-K. This item contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those indicated in such forward-looking statements. Factors that may cause such a difference include, but are not limited to, those discussed in "Item 1A, Risk Factors."

Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A") is designed to provide the reader of our financial statements with a narrative from the perspective of management on our financial condition, results of operations, liquidity and certain other factors that may affect future results. Our MD&A is presented in six sections:

EXECUTIVE SUMMARY

TrueBlue, Inc. ("TrueBlue," "we," "us," "our") is an international provider of temporary blue-collar staffing. In 2008, we put approximately 500,000 people to work through the following brands: Labor Ready for general labor, Spartan Staffing for light industrial services, and CLP Resources, PlaneTechs, and TLC for skilled trades. Headquartered in Tacoma, Washington, we serve approximately 250,000 small to mid-sized businesses in the construction, warehousing, hospitality, landscaping, transportation, light manufacturing, retail, wholesale, facilities, sanitation, and aviation industries.

Revenue for 2008 was $1.4 billion, a decrease of 0.1% over the prior year. The decline for the year consisted of 15.6% growth from acquisitions completed within the last 12 months offset by a 15.7% decrease in organic revenue. Growth from acquisitions included several acquisitions. In 2007 we purchased Skilled Services Corporation, a skilled construction trades staffing provider and PlaneTechs, LLC, a skilled staffing provider for aviation maintenance and aero space manufacturing. In 2008 we purchased TLC Services Group, Inc., a professional truck driver staffing provider and Personnel Management, Inc., a light industrial staffing company. The decline in demand for our services accelerated in the fourth quarter. Revenue for the quarter ended December 26, 2008 was $302 million, a decrease of 14.7% compared to the fourth quarter of 2007. The 14.7% revenue decline for the quarter consisted of 12.8% growth from acquisitions completed within the last 12 months offset by a 27.5% decrease in organic revenue.

The U.S. economy is in a recession and as a result we have experienced a significant decrease in demand for blue collar staffing which has negatively impacted our performance. We believe the markets we serve will continue to remain under pressure until the overall economy stabilizes and begins to grow again. In response to the recession we have increased the number of branch closings. Primary factors influencing which branches to close included financial performance, ability to consolidate with another branch, tenure and quality of branch management, market potential of branch location, and long-term potential of the location. During 2008, we closed 73 branches and sold the remaining 29 branches in the United Kingdom. We will continue our focus on aggressive cost management and maintaining a strong balance sheet.

Gross profit as a percentage of revenue decreased during 2008. Gross profit as a percentage of revenue was 29.8% in 2008 compared to 31.9% of revenue during 2007. The impact of acquisitions, pricing pressures resulting from the current economic slowdown, and increased wages paid to our temporary workers due to statutory minimum wage increases are the primary causes for the decline in gross profit as a percentage of revenue. The gross profit as a percentage of revenue of acquired companies has been less than that of our core business creating a decrease in the overall blended gross profit as a percentage of revenue. While we have increased the bill rates to our customers for these pay increases, we have not fully passed through the amount of our standard markup due to an increased level of price sensitivity with our customers associated with slower economic conditions. Pricing pressure on gross profit as a percentage of revenue was partially offset by the improvement in workers' compensation expense which is primarily due to continued improvements in accident prevention and risk management.

Page -20

Selling, General and Administrative ("SG&A") expenses decreased to 24.0% of revenue for 2008 compared to 24.3% of revenue during 2007. The decrease in SG&A expense as a percentage of revenue was largely attributed to the impact of acquisitions and cost control measures offset by a decline in organic revenue. SG&A expense as a percentage of revenue for acquired companies was lower than that of our core business creating a decrease in the overall blended gross margin. A variety of cost control measures were also implemented in 2008 to decrease SG&A expense. However, the impact of a lower organic revenue base to spread our fixed costs across largely offset the impact from acquisitions and cost control measures. Cost management will remain a focus during this recession.

Net loss for 2008 was $4.2 million, or $0.10 per diluted share, compared to net income of $66.2 million or $1.44 per diluted share for 2007. Results for 2008 include a goodwill and intangible asset impairment charge of $61 million ($49.3 million after tax) or $1.15 per diluted share related to the company's acquisitions over the past five years. Excluding this impairment charge, net income would have been $45.2 million or $1.05 per diluted share. The charge is largely a result of the adverse impact on expected future cash flows related to the current state of the economy. The charge does not impact the company's current cash, liquidity, or banking covenants.

We expect to continue to face a very difficult economic environment throughout fiscal 2009, both in the U.S. and internationally. As the global financial crisis has broadened and intensified, other sectors of the global economy have been adversely impacted and a severe global recession of uncertain length now appears likely. During an economic downturn, businesses generally reduce their use of temporary staffing as they experience a lower level of demand from consumers. As a result, we expect to face a challenging fiscal 2009 because of these economic conditions. Accordingly, we expect to report negative comparable branch sales for fiscal 2009. We plan to be disciplined in our approach to new branch openings and closures and adjust as needed in response to further worsening in the economy.

RESULTS OF OPERATIONS

The following table presents selected consolidated financial data for each of the past three years (in thousands, except per share amounts):

| |

2008 | 2007 | 2006 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Revenue from services |

$ | 1,384,269 | $ | 1,385,656 | $ | 1,349,118 | ||||

Total revenue growth (decline) % |

(0.1%) | 2.7% | 9.1% | |||||||

Gross profit as a % of revenue |

29.8% | 31.9% | 32.1% | |||||||

SG&A as a % of revenue |

24.0% | 24.3% | 23.6% | |||||||

Income from operations |

$ | 2,625 | $ | 93,650 | $ | 104,300 | ||||

Income from operations as % of revenue |

0.2% | 6.8% | 7.7% | |||||||

Goodwill and intangible asset impairment |

$ |

61,000 |

– |

– |

||||||

Depreciation and amortization |

$ | 16,774 | $ | 12,223 | $ | 10,364 | ||||

Interest and other income, net |

$ | 5,530 | $ | 10,953 | $ | 11,873 | ||||

Effective income tax rate |

151.0% | 36.7% | 34.2% | |||||||

Net income (loss) |

$ | (4,159) | $ | 66,198 | $ | 76,472 | ||||

Net income (loss) as a % of revenue |

(0.3%) | 4.8% | 5.7% | |||||||

Net income (loss) per diluted share |

$ | (0.10) | $ | 1.44 | $ | 1.45 | ||||

Revenue from services. Revenue for 2008 was $1.4 billion, a decrease of 0.1% over the prior year. The revenue decline for the year consisted of 15.6% growth from acquisitions completed within the last 12 months offset by a 15.7% decrease in organic revenue. Growth from acquisitions included several acquisitions. In 2007 we purchased Skilled Services Corporation, a skilled construction trades staffing provider and PlaneTechs, LLC, a skilled staffing provider for aviation maintenance and aero space manufacturing. In 2008 we purchased TLC Services Group, Inc, a professional truck driver staffing provider and Personnel Management, Inc., a light industrial staffing company. The slowdown in demand for our services accelerated during the fourth quarter. Revenue for the quarter ended December 26, 2008 of $302 million decreased 14.7% compared to the fourth quarter of 2007. The 14.7% revenue decline for the quarter consisted of 12.8% growth from acquisitions completed within the last 12 months offset by a 27.5% decrease in organic revenue. We will continue our focus on aggressive cost management and maintaining a strong balance sheet. In response to the recession we have increased the number of branch closings. Primary factors influencing which branches to close included financial performance, ability to consolidate with another branch, tenure and quality of branch management, market potential of branch location, and long-term potential of the location. During 2008, we closed 73 branches. In December 2008, we sold the remaining 29 branches in the United Kingdom for a total reduction of 102 branches for 2008.

Page -21

The change in revenue for 2008 compared to 2007 and 2006, respectively, is made up of the following five components:

| |

2008 | 2007 | 2006 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Same branch (1) |

(13.4 | %) | (0.2 | %) | 4.0 | % | |||||

New branches (2) |

0.8 | % | 1.3 | % | 1.5 | % | |||||

Closed branches |

(3.0 | %) | (1.7 | %) | (0.8 | %) | |||||

Currency and other |

(0.1 | %) | 0.6 | % | 0.1 | % | |||||

Total organic revenue growth (decline) |

(15.7 | %) | 0.0 | % | 4.8 | % | |||||

Acquisitions within last 12 months |

15.6 | % | 2.7 | % | 4.3 | % | |||||

Total sales growth (decline) |

(0.1 | %) | 2.7 | % | 9.1 | % | |||||

Revenue from our international operations for 2008 was approximately 5.5% of our total revenue compared to 7.0% and 6.3%, respectively, for 2007 and 2006.

Gross profit. Gross profit as a percentage of revenue was 29.8% for 2008 compared to 31.9% for 2007. Workers' compensation costs as a percentage of revenue for 2008 were approximately 4.1% compared to 4.7% for 2007. The improvement in workers' compensation expense is due primarily due to the continued success of our accident prevention and risk management programs that have been implemented over several years. The decrease in workers' compensation costs was partially offset by an increase in wages paid to temporary workers. There were 48 state minimum wage increases during 2008 as well as minimum wage increases in our international operations. While we have increased the bill rates to our customers for these pay increases, we have not yet fully passed through our standard markup due to an increased level of price sensitivity with our customers associated with slower economic conditions. As a result, our average pay rate increased 3.2% while our average bill rate increased 2.3%.