UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant o | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

LABOR READY, INC. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

LABOR READY, INC. |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

||||

![]()

Tacoma,

Washington

April 16, 2004

Dear Shareholders:

It is a pleasure to invite you to your Company's 2004 Annual Meeting of Shareholders, to be held at the Sheraton Hotel, 1320 Broadway, Tacoma, WA, on Wednesday, June 2, 2004, at 10:00 a.m. (Pacific Daylight Time).

The matters to be acted upon are described in the accompanying Notice of Annual Meeting and Proxy Statement.

I look forward to seeing our shareholders at the meeting. We will report on Labor Ready's operations and respond to questions you may have.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend, it is important that your shares be represented. Please sign, date and mail the enclosed proxy card as soon as possible in the enclosed postage prepaid envelope in order to ensure that your vote is counted. If you attend the meeting you will, of course, have the right to vote your shares in person.

| Very truly yours, | ||

/s/ ROBERT J. SULLIVAN Robert J. Sullivan Chairman of the Board |

LABOR READY, INC.

1015 A Street

Tacoma, Washington 98402

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Wednesday, June 2, 2004

To the Shareholders:

The annual meeting of the Shareholders of Labor Ready, Inc., a Washington corporation, will be held at the Sheraton Hotel, 1320 Broadway, Tacoma, WA, on Wednesday, June 2, 2004, at 10:00 a.m. (Pacific Daylight Time) for the following purposes:

Only shareholders of record at the close of business on April 8, 2004 will be entitled to notice of, and to vote at, the annual meeting and any adjournments thereof.

| By Order of the Board of Directors | ||

/s/ TIMOTHY J. ADAMS |

||

| Timothy J. Adams Secretary Tacoma, Washington April 16, 2004 |

YOUR VOTE IS IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE URGED TO DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT AS PROMPTLY AS POSSIBLE IN THE ENCLOSED STAMPED AND ADDRESSED ENVELOPE IN ORDER THAT THE PRESENCE OF A QUORUM MAY BE ASSURED. THE GIVING OF SUCH PROXY DOES NOT AFFECT YOUR RIGHT TO REVOKE IT LATER OR VOTE YOUR SHARES IN PERSON IN THE EVENT THAT YOU SHOULD ATTEND THE MEETING.

LABOR READY, INC.

1015 A Street

Tacoma, Washington 98402

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

Wednesday, June 2, 2004

The Board of Directors of Labor Ready, Inc., a Washington corporation, is soliciting your proxy to vote your shares at the 2004 Annual Meeting of Shareholders of the Company to be held at 10:00 a.m. (Pacific Daylight Time) on Wednesday, June 2, 2004, at the Sheraton Hotel, 1320 Broadway, Tacoma, WA, and at any adjournment thereof. This proxy statement contains the required information under the rules of the Securities and Exchange Commission and is designed to assist you in voting your shares.

Revocation of Proxies. If you execute a proxy, you will retain the right to revoke it at any time before it is voted. You may revoke or change your proxy before it is voted by: (i) sending a written revocation to the Corporate Secretary of the Company at P.O. Box 2910, Tacoma, WA 98401; (ii) submitting a proxy with a later date; (iii) delivering a written request in person to return the executed proxy; or (iv) attending and voting at the annual meeting. Your right to revoke your proxy is not limited by or subject to compliance with a specified formal procedure, but you should give written notice to the Secretary of the Company at or before the annual meeting so that the number of shares represented by proxy can be recomputed.

Voting of Proxies. If you properly execute and return the enclosed proxy card, the individuals named on the proxy card (your proxies) will vote your shares in the manner you indicate. We urge you to specify your choices by marking the appropriate box on the enclosed proxy card; if you sign and return the proxy card without indicating your instructions, your shares will be voted FOR PROPOSAL 1 (THE ELECTION OF DIRECTORS NOMINATED BY THE BOARD OF DIRECTORS) AND FOR PROPOSAL 2 (RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS), and with respect to any other business that may come before the meeting, as recommended by the Board of Directors. You may vote for, against, or abstain from voting on, any matter that may properly come before the meeting.

Quorum. A quorum is necessary to hold a valid meeting. If shareholders entitled to cast at least a majority of all the votes entitled to be cast at the annual meeting are present in person or by proxy, a quorum will exist. Shares represented by proxies containing an abstention as to any matter will be treated as shares that are present and entitled to vote for purposes of determining a quorum. Similarly, shares held by brokers or nominees for the accounts of others as to which voting instructions have not been given for that matter and for which the broker does not have discretionary voting authority for that matter ("Broker Non-Votes") will be treated as shares that are present and entitled to vote for purposes of determining a quorum.

Effect of Abstentions and Broker Non-Votes. Nominees for election as directors who receive the greatest number of votes cast will be elected directors. The proposal to ratify the appointment of PricewaterhouseCoopers LLP as the Company's independent auditors will be approved if the number of votes cast in favor of the matter exceeds the number of votes cast against it. Abstentions and Broker Non-Votes will have no practical effect in the election of directors and in the vote to ratify the appointment of PricewaterhouseCoopers because abstentions and Broker Non-Votes do not represent votes cast by shareholders.

Record Date. Shareholders of record at the close of business on April 8, 2004 are entitled to vote at the annual meeting. On April 8, 2004, the Company had 41,331,831 shares of common stock outstanding. Each share of common stock entitles the holder thereof to one vote.

Discretionary Authority. If any nominee for director is unable to serve or for good cause will not serve, or if any matters not specified in this proxy statement come before the meeting, eligible shares will be voted as specified by the named proxies pursuant to discretionary authority granted in the proxy. At the time this proxy statement was printed, we were not aware of any other matters to be voted on.

Solicitation of Proxies. Proxies may be solicited by officers, directors and regular supervisory and executive employees of the Company, none of whom will receive any additional compensation for their services.

Mailing and Forwarding of Proxy Materials. On or about April 16, 2004, we mailed this proxy statement and the enclosed proxy card to shareholders. We will arrange with brokerage firms and other custodians, nominees and fiduciaries to forward proxy solicitation material to certain beneficial owners of the common stock and will reimburse such brokerage firms, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses that they incur as a result of forwarding the proxy materials.

Executive Offices. The principal executive office of the Company is located at 1015 A Street, Tacoma, WA 98402. The mailing address of the principal executive office is P.O. Box 2910, Tacoma, WA 98401. The telephone number for the Company is (253) 383-9101.

2

PROPOSAL 1. ELECTION OF DIRECTORS

The Company's directors are elected each year at the annual meeting of shareholders to serve until their successors are elected and qualified, or until they resign or are removed or are otherwise disqualified to serve. The Company's Board of Directors currently consists of seven directors. The Board of Directors has nominated the following persons for election as directors, all of whom are currently directors. The Board of Directors recommends a vote for each of the nominees. Proxies cannot be voted for a greater number of persons than the number of nominees named. The nominees are as follows:

Robert J. Sullivan, 73, has served as Chairman of the Board of the Company since July 2000 and as a director since November 1994. Mr. Sullivan's career included 12 years at American Express Company and related companies, where he served as a financial officer and division general manager. He served three years as chief financial officer of Cablevision, Inc., and was general manager of the Long Island cable television system. He also spent 10 years as a financial consultant to small businesses, including Labor Ready from 1993 to 1994.

Joseph P. Sambataro, Jr., 53, has served as Chief Executive Officer and President of the Company since September 2001 and as a director since January 2000. Mr. Sambataro joined the Company in August 1997 and served as Chief Financial Officer, Treasurer and Assistant Secretary until January 2001 and as Executive Vice President until March 2001. Prior to joining the Company, he served as the Managing Partner of the Seattle office of BDO Seidman, LLP, an accounting and consulting firm, from 1990 to 1997. From 1985 to 1990, Mr. Sambataro was co-founder and CEO of an onsite toxic waste bioremediation company and co-founder and VP Finance of a natural products biotechnology company. From 1972 to 1985, Mr. Sambataro was with KPMG Peat Marwick and partner in charge of audit in the Seattle office from 1983 to 1985.

Mark R. Beatty, 49, has served as a director of the Company since June 2001. Since 2000, Mr. Beatty has served as General Counsel to Cascade Investments, LLC, the private investment vehicle of Microsoft Chairman William H. Gates III. From 1990 to 2000, Mr. Beatty was a partner in the Seattle law firm of Preston Gates & Ellis LLP, where his practice focused on corporate and securities law.

Gates McKibbin, 57, has served as a director of the Company since March 2001. Since 1996, Ms. McKibbin has been self-employed as a consultant developing comprehensive strategy and leadership programs for large, nationally respected organizations. Prior to 1996 she was Vice President of Change Management for Bank of America, and has held numerous other executive positions.

Thomas E. McChesney, 57, has served as a director of the Company since July 1995. Mr. McChesney has been the Director of Investment Banking with Blackwell Donaldson and Company since 1998. He is also a director of Nations Express, Inc., and Stonestreet One, Inc.

Carl W. Schafer, 68, has served as a director of the Company since September 1999. Mr. Schafer is currently President of The Atlantic Foundation, a charitable foundation. Mr. Schafer has also been Financial Vice President and Treasurer of Princeton University, Chairman of the Investment Advisory Committee for the Howard Hughes Medical Institute, and a principal of Rockefeller & Co., Inc. He serves on various boards including Frontier Oil Corporation, which is traded on the New York Stock Exchange, and the UBS, Guardian, Harding Loevner and European Investors groups of mutual funds.

William W. Steele, 68, has served as a director of the Company since August 2001. Mr. Steele is currently a director and Chairman of the Executive Committee of ABM Industries, a large facilities services contractor traded on the New York Stock Exchange. In the course of his 43-year career with ABM Industries, Mr. Steele was appointed its President in 1991 and its Chief Executive Officer in 1994, and served in those capacities until his retirement in October of 2000.

3

PROPOSAL 2. RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP to serve as the independent auditors of the Company for the fiscal year ending December 31, 2004. Services provided to the Company and its subsidiaries by PricewaterhouseCoopers in fiscal 2003 and 2002 are described under "Fees Paid to Independent Auditors for Fiscal 2003 and 2002" below. Representatives of PricewaterhouseCoopers will be present at the annual meeting to make a statement if they desire to do so and respond to appropriate questions by shareholders. The affirmative vote of a majority of the shares represented at the meeting is required for the ratification of the Board's selection of PricewaterhouseCoopers as the Company's independent auditors for the fiscal year ending December 31, 2004. The Board of Directors recommends a vote "FOR" the ratification of the selection of PricewaterhouseCoopers as independent auditors of the Company. In the event shareholders do not ratify the appointment, the Audit Committee will reconsider the appointment. The Audit Committee reserves the right to change its independent auditors without seeking shareholder approval if it determines that such change is in the best interests of the Company.

Fees Paid to Independent Auditors for Fiscal 2003 and 2002

PricewaterhouseCoopers provided audit and other services in the following categories and was paid the following amounts:

| |

2003 |

2002 |

||||

|---|---|---|---|---|---|---|

| Audit fees:(1) | $ | 321,152 | $ | 398,978 | ||

| Audit-related fees:(2) | $ | 17,170 | $ | -0- | ||

| Tax fees:(3) | $ | 16,625 | $ | 8,000 | ||

| All other fees:(4) | $ | 3,165 | $ | -0- | ||

The services described above were approved by the Audit Committee pursuant to the policy described below; the Audit Committee did not rely on any of the exceptions to pre-approval under Rule 2-01(c)(7)(i)(C) under Regulation S-X.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee pre-approves all audit and non-audit services provided by the independent auditors prior to the engagement of the independent auditors with respect to such services. The Company's independent auditors may be engaged to provide non-audit services only after the Audit Committee has first considered the proposed engagement and has determined in each instance that the proposed services are not prohibited by applicable regulations and the auditors' independence will not be materially impaired as a result of having provided such services. In making this determination, the Audit Committee shall take into consideration whether a reasonable investor, knowing all relevant facts and circumstances, would conclude that the auditors' exercise of objective and impartial judgment on

4

all issues encompassed within the auditors' engagement would be materially impaired. The Audit Committee may delegate its approval authority to pre-approve services provided by the independent auditors to one or more of the members of the Audit Committee, provided that any such approvals are presented to the Audit Committee at its next scheduled meeting.

Change in Independent Auditors

On May 3, 2002, the Company dismissed Arthur Andersen, LLP as its independent auditors and appointed PricewaterhouseCoopers as the Company's independent auditors. The decision not to renew the engagement of Arthur Andersen and to select PricewaterhouseCoopers was approved by the Company's Board of Directors upon the recommendation of the Audit Committee.

The audit reports of Arthur Andersen on the Company's financial statement for the two years ended December 31, 2001 and 2000 did not contain an adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the two fiscal years of the Company ended December 31, 2001, and the subsequent interim period through May 3, 2002, there were no disagreements between Arthur Andersen and the Company on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Arthur Andersen, would have caused it to make reference to the subject matter of the disagreements in connection with its report, and there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

The Company provided Arthur Andersen with a copy of the foregoing disclosures. A copy of Arthur Andersen's letter dated May 6, 2002, stating its agreement with such statements, is attached as Exhibit 16.1 to our Current Report on Form 8-K dated May 3, 2002 filed with the Securities and Exchange Commission.

During the Company's two fiscal years ended December 31, 2001, and the subsequent interim period through May 3, 2002, the Company did not consult with PricewaterhouseCoopers regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

GOVERNANCE OF THE COMPANY

Meetings and Committees of the Board

Board of Directors. The Board of Directors consists of a majority of "independent directors" as such term is defined in the NYSE corporate governance rules. The Board of Directors has determined that Messrs. McChesney, Schafer, Sullivan, Steele* and Beatty and Ms. McKibbin are independent directors. The Board of Directors met five times during fiscal year 2003. The non-management directors regularly meet in executive session, at which the Chairman of the Board presides. Each director is expected to attend the Company's Annual Meeting of Shareholders. Last year all directors attended the Company's 2003 Annual Meeting of Shareholders.

Compensation Committee. The Board of Directors has appointed the Compensation Committee to review and recommend executive compensation and to serve as the administrative committee for the Company's stock option and stock purchase plans. The Compensation Committee, which currently consists of Mr. McChesney, who chairs the committee, Ms. McKibbin and Mr. Beatty, met seven times during fiscal year 2003. The Board of Directors has adopted a charter governing the duties and responsibilities of the Compensation Committee. A copy of the Compensation Committee charter is

5

included in this proxy statement as Appendix A and is available on the Company's website at www.laborready.com. The report of the Compensation Committee is included in this proxy statement.

Audit Committee. The Board of Directors has appointed the Audit Committee to consider the adequacy of our internal controls and the integrity of our financial reporting. The Audit Committee is also responsible for appointing, approving the fee arrangements of, and monitoring the independence, qualifications and performance of the Company's independent public accountants. The Audit Committee, which currently consists of Mr. Schafer, who chairs the committee, and Messrs. Sullivan and Steele, met four times during fiscal year 2003. The Board of Directors has affirmatively determined that: (a) each member of the Audit Committee is "independent" within the meanings of Rule 10A-3 of the Securities and Exchange Act of 1934, as amended, and the corporate governance rules of the NYSE; (b) no member of the committee has a material relationship with the Company; (c) each member of the committee is "financially literate" under the listing standards of the NYSE; and (d) Messrs. Schafer and Sullivan are "audit committee financial experts" as such term is defined in Item 401 of Regulation S-K.

The Board of Directors has adopted a charter governing the duties and responsibilities of the Audit Committee. A copy of the Audit Committee charter is included in this proxy statement as Appendix B and is available on the Company's website at www.laborready.com. The report of the Audit Committee is included in this proxy statement.

Corporate Governance and Nominating Committee. The Board of Directors has appointed the Corporate Governance and Nominating Committee, which is responsible for (i) nominating directors consistent with criteria approved by the Board, (ii) establishing guidelines on the composition and function of Board committees, (iii) developing and recommending to the Board of Directors corporate governance principles applicable to the Company and (iv) overseeing the evaluation of the Board and management. The Corporate Governance and Nominating Committee, which currently consists of Mr. Steele, who chairs the committee, Messrs. Beatty, Schafer, Sullivan and McChesney and Ms. McKibbin, met four times during 2003. Each of the members of the Corporate Governance and Nominating Committee is independent within the meaning of the NYSE corporate governance rules. The Corporate Governance and Nomination Committee operates under a written charter adopted by the Board of Directors, which is attached to this proxy statement as Appendix C and is available on the Company's website at www.laborready.com.

Executive Committee. The Board of Directors has appointed an Executive Committee, to which is delegated the authority to act on behalf of the Board of Directors as necessary when the Board is not in session and it would be impractical to call a meeting of the Board. The Executive Committee, which currently consists of Mr. Sullivan, who chairs the committee, and Messrs. McChesney, Steele and Sambataro, met eight times during fiscal year 2003.

Consideration of Director Nominees. The Corporate Governance and Nominating Committee will consider director candidates recommended by shareholders. Candidates recommended by shareholders are evaluated on the same basis as are candidates recommended by the Corporate Governance and Nominating Committee. Any shareholder wishing to nominate a candidate should provide the following information in a letter addressed to the Chairman of the Corporate Governance and Nominating Committee in care of the Company's General Counsel no later than 120 days prior to the corresponding date on which the Company's annual proxy statement was mailed in connection with the most recent annual meeting: (i) the name and address of the shareholder recommending the person to be nominated, (ii) a representation that the shareholder is a holder of record of stock of Labor Ready, including the number of shares held and the period of holding, (iii) a description of all arrangements or understandings between the shareholder and the recommended nominee, (iv) information as to any plans or proposals of the type required to be disclosed in Schedule 13D (i.e., plans involving acquisitions of Labor Ready's securities and/or plans involving a potential merger or change of control

6

transaction) and any proposals that the nominee proposes to bring to the Board of Directors if so elected, (v) any other information regarding the recommended nominee as would be required to be included in a proxy statement filed pursuant to Regulation 14A promulgated by the Securities Exchange Commission pursuant to the Securities Exchange Act of 1934 and (vi) the consent of the recommended nominee to serve as a director of Labor Ready if so elected. Additional information may be requested to assist the Corporate Governance and Nominating Committee in determining the eligibility of a proposed candidate to serve as a director. This may include requiring that a prospective nominee complete a director and officer questionnaire and provide any follow-up information requested. In addition, the notice must meet all other requirements contained in Labor Ready's Bylaws, if any.

Board Membership Criteria. Our Corporate Governance Guidelines adopted by our Board of Directors, a copy of which is included as Appendix D to this proxy statement and is available at the Company's website at www.laborready.com, include the criteria our Board believes are important in the selection of director nominees. While the Board has not established any minimum qualifications for nominees, the Board does consider the composition of the Board as a whole, the requisite characteristics (including independence, diversity, experience in industry, finance, administration and operations) of each candidate, and the skills and expertise of its current members taking into account the overall operating efficiency of the Board and its committees.

Committee Membership. The Board appoints committee chairs and members on an annual basis with consideration given to the qualifications and preferences of individual directors. In its deliberations, the Corporate Governance and Nominating Committee is aware that (i) each member of the Audit Committee must be financially literate, as such qualification is interpreted by the Board in its business judgment, (ii) each member of the Corporate Governance and Nominating Committee, the Audit Committee and the Compensation Committee must be independent within the meaning of the NYSE corporate governance rules, (iii) each member of the Audit Committee must meet the independence standards set forth in Rule 10A-3 of the Securities and Exchange Act of 1934, as amended, and (iv) at least one member of the Audit Committee must be a person who satisfies the definition of an "audit committee financial expert" as set out in Item 401 of Regulation S-K.

Process for Identifying and Evaluating Nominees. The Corporate Governance and Nominating Committee may employ a variety of methods for identifying and evaluating nominees for director. The Corporate Governance and Nominating Committee regularly assesses the size of the Board, the need for particular expertise on the Board, the upcoming election cycle of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated or arise, the Corporate Governance and Nominating Committee considers various potential candidates for director which may come to the Corporate Governance and Nominating Committee's attention through current Board members, professional search firms, shareholders or other persons. These candidates will be evaluated at regular or special meetings of the Corporate Governance and Nominating Committee, and may be considered at any time during the year.

The Corporate Governance and Nominating Committee will consider candidates recommended by shareholders when the nominations are properly submitted, under the criteria summarized above in "Consideration of Director Nominees." Included in this discussion is a description of the deadlines and procedures for shareholder submissions of director nominees. Following verification of the shareholder status of persons proposing candidates, the Corporate Governance and Nominating Committee will make an initial analysis of the qualifications of any candidate recommended by shareholders or others pursuant to the criteria summarized above to determine whether the candidate is qualified for service on the Board, before deciding to undertake a complete evaluation of the candidate. If a shareholder or professional search firm in connection with the nomination of a director candidate provides any materials, such materials will be forwarded to the Corporate Governance and Nominating Committee

7

as part of its review. If the Corporate Governance and Nominating Committee determines that additional consideration is warranted, it may request the third-party search firm to gather additional information about the prospective nominee's background and experience and to report its findings to the Corporate Governance and Nominating Committee. Other than the verification of compliance with procedures and shareholder status, and the initial analysis performed by the Corporate Governance and Nominating Committee, the Corporate Governance and Nominating Committee will treat a potential candidate nominated by a shareholder like any other potential candidate during the review process. In connection with this evaluation, the Corporate Governance and Nominating Committee will determine whether to interview the prospective nominee, and if warranted, one or more members of the Corporate Governance and Nominating Committee, and others as appropriate, will interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Corporate Governance and Nominating Committee will make a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board will determine the nominees after considering the recommendation and report of the Corporate Governance and Nominating Committee.

Shareholder Communications. Any shareholder or interested party who wishes to communicate with our board of directors or any specific directors, including non-management directors, may write to:

Board

of Directors

c/o General Counsel

P.O. Box 2910

Tacoma, WA 98401

The mailing envelope must contain a clear notation indicating that the enclosed letter is a "Shareholder-Board Communication" or "Shareholder-Director Communication." All such letters must identify the author as a shareholder and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The General Counsel will make copies of all such letters and circulate them to the appropriate director or directors. If the Company develops any other procedures, they will be posted on the Company's corporate website. Procedures addressing the reporting of other concerns by shareholders, employees or other third parties are set forth in our Code of Business Conduct and Ethics, which is posted on our corporate website at www.laborready.com. Our Code of Business Conduct and Ethics is applicable to all employees of the Company, including our principal executive officer, principal financial officer and the principle accounting officer.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of common stock of the Company as of January 2, 2004 for (i) each person known to the Company to own beneficially 5% or more of our common stock as of January 2, 2004, (ii) each director of the Company, (iii) each individual required to be identified as a named executive officer of the Company pursuant to Item 402 of Regulation S-K, and (iv) all officers and directors of the Company as a group. Except as

8

otherwise noted, the named beneficial owner has sole voting and investment power. As of January 2, 2004, the Company had no other classes of outstanding equity securities.

| Name of Beneficial Owner |

Title of Class |

Amount and Nature of Beneficial Ownership (Number of Shares)(1) |

Percent of Class |

||||

|---|---|---|---|---|---|---|---|

| Joseph P. Sambataro, Jr.(2) | Common Stock | 357,018 | * | ||||

| Steven C. Cooper(3) | Common Stock | 279,114 | * | ||||

| Timothy J. Adams(4) | Common Stock | 133,017 | * | ||||

| John P. Hopkins(5) | Common Stock | 63,043 | * | ||||

| Gary W. North(6) | Common Stock | 85,647 | * | ||||

| Robert J. Sullivan(7) | Common Stock | 17,701 | * | ||||

| Mark R. Beatty(8) | Common Stock | 18,550 | * | ||||

| Thomas E. McChesney(9) | Common Stock | 68,432 | * | ||||

| Gates McKibbin(10) | Common Stock | 14,447 | * | ||||

| Carl W. Schafer(11) | Common Stock | 31,000 | * | ||||

| William W. Steele(12) | Common Stock | 12,000 | * | ||||

| FMR Corp.(13) Edward C. Johnson 3rd Abigail P. Johnson |

Common Stock | 5,962,198 | 14.51 | % | |||

| Systematic Financial Management, L.P.(14) | Common Stock | 2,073,400 | 5.04 | % | |||

| Columbia Wanger Asset Management, L.P.(15) | Common Stock | 2,300,000 | 5.60 | % | |||

| Highbridge International LLC(16) | Common Stock | 2,595,412 | 6.31 | % | |||

| Barclays Global Investors, NA.(17) | Common Stock | 3,037,247 | 7.39 | % | |||

| All officers and directors as a group (11 individuals) | Common Stock | 1,078,969 | 2.63 | % |

9

EXECUTIVE OFFICERS

The names, ages and positions of the non-director executive officers of the Company are listed below along with their business experience during the past five years. No family relationships exist among any of the directors or executive officers of the Company.

10

Steven C. Cooper, 41, has served as Chief Financial Officer and Executive Vice President since January 2001. Prior to that time, Mr. Cooper served as our Vice President of Finance and Corporate Controller after joining the Company in April 1999. Prior to joining Labor Ready, Mr. Cooper's most recent position was with Arthur Andersen as a Senior Consulting Manager from 1998 to 1999. From 1993 to 1998, Mr. Cooper held a Director position in the Finance Department of Albertson's. Previous to that, he was a Senior Manager with Deloitte & Touche.

Timothy J. Adams, 43, has served as Executive Vice President, General Counsel and Secretary since June 2001. Mr. Adams joined the Company as Director of Legal Services in October 1999. From 1996 to 1999 he was General Counsel of Saxton Incorporated, a publicly-traded real estate development company in Las Vegas, Nevada. Prior to that, he spent nine years in private practice in Nevada.

Gary W. North, 45, has served as a Regional Vice President for Operations since November 1999, after joining the Company as an Area Director of Operations in August of 1999. From 1996 to 1999, Mr. North was the Chief Operating Officer for SkillMaster Staffing Services. From 1993 to 1996, Mr. North served as an Area Manager for Personnel Management, Inc. Previous to that, he served as President of Metropolitan Media, a diverse media holding company.

John P. Hopkins, 37, has served as a Regional Vice President for Operations since April 2003. Mr. Hopkins joined the Company in October 1997 as a Branch Manager and has served as a District Manager, Area Director and Senior Area Director. Prior to joining Labor Ready, Mr. Hopkins' most recent position was with Morris Kirschman and Co. as a Store and Sales Manager during 1997. Prior to that, Mr. Hopkins had 12 years of experience in operations, management and sales with Home Depot and 84 Lumber Co.

11

EXECUTIVE COMPENSATION

The following table sets forth the compensation earned in each of the last three years by each of our named executive officers.

SUMMARY COMPENSATION TABLE(1)

| |

|

Annual Compensation |

Long-Term Compensation |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Position |

Year |

Salary ($) |

Bonus ($) |

Matching 401(k) Contributions ($) |

Securities Underlying Options/ SARs (#) |

All Other Compensation |

||||||

| Joseph P. Sambataro, Jr. Director, Chief Executive Officer and President |

2003 2002 2001 |

500,000 500,000 207,843 |

250,000 50,000 — |

3,000 2,750 2,625 |

— 120,000 412,000 |

— — — |

||||||

Steven C. Cooper Executive Vice President & Chief Financial Officer |

2003 2002 2001 |

280,000 265,000 235,770 |

135,000 25,000 — |

3,000 2,750 1,625 |

— 45,000 262,000 |

— — — |

||||||

Timothy J. Adams Executive Vice President, General Counsel & Secretary |

2003 2002 2001 |

220,000 219,990 186,155 |

83,000 25,000 — |

— — — |

— 42,500 254,642 |

— — — |

||||||

John P. Hopkins Regional Vice President |

2003 2002 2001 |

225,000 200,000 180,770 |

77,000 — — |

3,000 2,750 762 |

— 15,000 73,120 |

— — — |

||||||

Gary W. North Regional Vice President |

2003 2002 2001 |

225,000 200,000 200,000 |

77,000 — — |

3,000 2,750 2,640 |

— 15,000 65,000 |

— — — |

||||||

Equity Compensation Plans

We maintain several plans pursuant to which incentive and non-qualified stock options have been granted in the past and may be granted in the future. One of our plans also provides for the granting of restricted stock and stock appreciation rights ("SARs"), although no restricted stock or SARs had been granted as of January 2, 2004. Participation in these plans is generally limited to our full-time employees and our directors. The option exercise price of all options granted under our plans has been 100% of the fair market value on the date of grant. The majority of these options vest evenly over a four-year period from the date of grant and expire if not exercised within five years after the date of grant. We also have an employee stock purchase plan (ESPP) under which employees may purchase our shares at a discount to their market value, as more fully described below.

12

The following table summarizes information, as of January 2, 2004, relating to equity compensation plans of the Company pursuant to which grants of options, restricted stock, SARs or other rights to acquire shares may be granted from time to time.

Equity Compensation Plan Information (in thousands, except exercise price):

| Plan Category |

(a) Number of securities to be issued upon exercise of outstanding options |

(b) Weighted-average exercise price of outstanding options |

(c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

||||

|---|---|---|---|---|---|---|---|

| Equity compensation plans not approved by security holders(1) | 3,479 | $ | 6.20 | 358 | |||

Equity compensation plans approved by security holders(2) |

1,050 |

$ |

10.33 |

755 |

|||

| 4,529 | $ | 7.16 | 1,113 | ||||

Employee stock purchase plans approved by security holders(3) |

— |

— |

740 |

||||

| 4,529 | $ | 7.16 | 1,853 | ||||

Labor Ready, Inc. 2000 Stock Option Plan. This is a broadly based plan, which provides for the issuance of non-qualified stock options to directors, officers, and employees of the Company. The Board or a committee of the Board administers the plan. The exercise price for options issued under the plan must not be less than 100% of the fair market value of the Company's common stock on the grant date. As of the end of 2003, there were 259 shares available for future issuance under this plan.

Labor Ready, Inc. 2002 U.K. Stock Option Plan. This is a "sub-plan" of the 2000 Stock Option Plan discussed above, which provides for the issuance of non-qualified stock options to officers and employees of the Company's UK subsidiary. The plan is administered by the Board or a committee of the Board. The exercise price for options issued under the plan must not be less than 100% of the fair market value of the Company's common stock on the grant date. The plan limits the amount of options that may be granted to any grantee under the plan, by providing that the aggregate fair market value of common stock underlying all such options held by a grantee (measured as of the grant dates) cannot exceed £30,000. As of the end of 2003, there were 99 shares available for future issuance under this plan.

1996 Labor Ready Employee Stock Option and Incentive Plan. This plan applies to directors, officers, and employees of the Company and permits the granting of non-qualified and incentive stock options, stock appreciation rights and other stock based awards. The Board or a committee of the Board administers this plan. As of the end of 2003, there were 755 shares available for future issuance under this plan.

1996 Labor Ready Employee Stock Purchase Plan. This plan provides an opportunity for regular employees who have met certain service qualifications to purchase shares of our common stock through payroll deductions of up to 10% of eligible after-tax compensation. These deductions are

13

used to purchase shares of our common stock at 85% of the fair market value of our common stock as of either the first day or last day of each month, whichever is less. As of the end of 2003, there were 740 shares available for future issuance under this plan.

Option Grants During 2003 Fiscal Year

There were no options granted to the named executive officers during fiscal 2003.

Option Exercises During 2003 and Year End Option Values

The following table provides information related to options exercised by the named executive officers during 2003 and the number and value of options held at year end. The Company does not have any outstanding SARs.

AGGREGATE OPTION/SAR EXERCISES IN 2003 AND YEAR END OPTION/SAR VALUE

| |

|

Number of Securities Underlying Unexercised Options/SARs at January 2, 2004 |

Value of Unexercised In-the-Money Options/SARs at January 2, 2004(1) |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Number of Shares Acquired on Exercise |

Value Realized |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

|||||||||

| Joseph P. Sambataro, Jr. Director, Chief Executive Officer and President |

100,000 | $ | 945,000 | 275,000 | 199,000 | $ | 2,415,050 | $ | 1,804,550 | ||||||

| Steven C. Cooper Executive Vice President & Chief Financial Officer |

10,000 | $ | 92,760 | 182,857 | 173,285 | $ | 1,033,476 | $ | 1,656,822 | ||||||

| Timothy J. Adams Executive Vice President, General Counsel & Secretary |

55,000 | $ | 406,183 | 133,769 | 164,468 | $ | 1,057,523 | $ | 1,519,343 | ||||||

| John P. Hopkins Regional Vice President |

— | — | 52,034 | 55,035 | $ | 291,765 | $ | 435,332 | |||||||

| Gary W. North Regional Vice President |

— | — | 67,250 | 54,250 | $ | 444,250 | $ | 425,308 | |||||||

Compensation of Directors

Annual Retainers. The Chairman of the Board of Directors, if not an employee of the Company, receives an annual retainer of $60,000. The Audit Committee chair receives an annual retainer of $35,000. All other non-employee directors receive an annual retainer of $30,000.

Meeting Fees. Each non-employee director receives $1,000 for attending each regular or special Board of Directors meeting. In addition, the Audit Committee chair receives $1,500 for attending each Audit Committee meeting, and all other Audit Committee members receive $1,125 per committee meeting. The Compensation Committee chair receives $1,000 for attending each Compensation

14

Committee meeting, and all other Compensation Committee members receive $750 per committee meeting. The Nominating and Corporate Governance Committee chair receives $1,000 for attending each committee meeting, and all other members receive $750 per meeting. Each Executive Committee member receives $750 per committee meeting.

Option Grants. Each non-employee director receives an annual grant of nonqualified options on the first business day of each January, exercisable at the fair market value of the Company's common stock. Under the current terms of this annual grant, the Chairman of the Board of Directors receives options for 10,000 shares, each committee chair receives options for 7,500 shares, and all other outside directors receive options for 5,000 shares. In addition, the Board of Directors may grant nonqualified options to a non-employee director upon his or her initial election or appointment to the Board of Directors.

Compensation Committee Report on Executive Compensation

The Company's executive compensation is determined by a Compensation Committee comprised of three independent members of the Board of Directors. Members of the Compensation Committee currently include Mr. McChesney, who chairs the committee, and Ms. McKibbin and Mr. Beatty.

Executive Officer Compensation Policies for 2003

Compensation for executive officers in 2003 consisted of base salary and incentive compensation. In 2002 the Compensation Committee adopted a Compensation Philosophy, attached as Appendix E to this proxy statement, which formed the general basis for making compensation decisions in 2003. The Chief Executive Officer ("CEO") and two other executive officers have employment contracts entered into in 2001, which set minimum base compensation. The CEO and one executive officer received the minimum base compensation in 2003. Base compensation for executive officers other than the CEO in 2003 was based on recommendations by the CEO, which were reviewed and concurred in by the Compensation Committee.

The Compensation Committee in conjunction with the Corporate Governance Committee, which consists of all of the independent directors, adopted an incentive plan at the beginning of 2003 establishing net after-tax, pre-bonus earnings targets and corresponding executive bonus levels. The plan established individual incentive bonuses for each executive ranging from 25% to 45% of their base compensation, at threshold, target, and maximum levels which provided possible bonuses ranging from 0 to 125% of the individual target. All bonuses were further subject to individual multipliers of .8 to 1.2, maximum payouts of 50% of base compensation for each executive and a requirement that at least 25% of each bonus be paid in stock. The actual multiplier was based on individual executive performance evaluations and recommendations by the CEO, which were reviewed and approved by the Compensation Committee.

Chief Executive Officer's 2003 Compensation

The CEO's base compensation is set by an employment contract entered into in October 2001. The CEO has received adjustment to base compensation since that time. Under the incentive plan described above, the CEO was entitled to a maximum bonus of 50% of base compensation if net after-tax, pre-bonus earnings for the Company increased 40% or more. The CEO's bonus was subject to a multiple of .8 to 1.2 based on his individual performance as determined by the Compensation Committee and approved by all independent directors. Based on a 51% increase in net after-tax earnings in 2003, the CEO earned the maximum bonus of $250,000. The determination of the CEO's bonus was reviewed and approved by Compensation Committee and the Board of Directors in executive session without participation by the CEO.

15

In January 2004, an independent evaluation was conducted by a member of the Compensation Committee to generally evaluate the CEO's performance. In February 2004 the Board of Directors met in Executive Session to review the resulting report. The CEO and the Board of Directors collaborated in the setting of goals for 2004 based on strategic and organizational priorities.

Executive Compensation Policies for 2004

In December 2003 the Compensation Committee engaged outside compensation consultants from a national firm to advise the Committee on structuring short-term and long-term incentive plans for senior executives. The consultants did extensive research and analysis and met with the Committee numerous times over a period of months. In February 2004, the Board of Directors met in Executive Session to discuss the Committee's preliminary findings. Based on the Board's feedback and further research, the Committee prepared final recommendations for short-term and long-term executive incentive plans that were approved by all of the independent members of the Board of Directors in March 2004.

The short-term incentive plan framework adopted in 2003 was revised for 2004 to reflect updated performance targets based on the increase in net profit after tax. Individual target bonuses will continue to range from 25% to 45% of base compensation, but were adjusted for certain positions. Bonuses will continue to be subject to thresholds, targets and maximums similar to 2003. The maximum payout is 50% of base salary for each executive. As was previously established, at least 25% of the payment must be made in stock, and the Board of Directors may apply a multiplier of .8 to 1.2 to each executive's bonus to reflect variations in individual performance.

After extensive consideration and due diligence, the Compensation Committee developed a new long-term equity incentive plan. The stock ownership targets for executives established in 2003 were replaced by a retention-based stock ownership plan, which the Compensation Committee believes is reflective of current best practices adopted by other companies and appropriate for the Company. Under this plan executives are required to retain 75% of all shares received through Company options exercises or restricted stock vesting, after shares are sold to pay taxes due and the option exercise price. The annual equity incentive plan calls for a 50/50 mix of restricted stock and stock options based on relative values of the two forms of equity compensation. The use of both stock options and restricted stock along with the new retention requirements aligns executive compensation very closely to the performance of the Company by providing an incentive for the executives to increase the value of company stock above present levels. The use of restricted stock aligns executive and shareholder interests regardless of the increase or decrease in the market value of the Company's stock. The retention period will be four years after vesting, after an initial phase-in. Based on the analysis of market data on executive compensation, annual equity grant levels were set as a multiple of base salary ranging from 1.5 for the CEO to 0.8 for some executives. The Board of Directors continues to encourage executives to achieve and retain significant direct ownership of Company stock. The Compensation Committee believes, since the equity incentive plan provides long-term incentives for executives and the cash incentive plan provides executives short-term incentives, that the plans are not duplicative.

Members of the Compensation Committee

Thomas

E. McChesney, Chair

Mark R. Beatty

Gates McKibbin

Audit Committee Report*

The Audit Committee is comprised of three independent members of the Board of Directors. Members of the Audit Committee currently include Mr. Schafer, who chairs the committee, and

16

Messrs. Sullivan and Steele. The Board of Directors has affirmatively determined that each member of the committee is "financially literate" under the listing standards of the NYSE, and that Mr. Schafer and Mr. Sullivan are "audit committee financial experts" as such term is defined in Item 401 of Regulation S-K.

The Audit Committee met four times in 2003. Over the course of these meetings, the Audit Committee met with the Company's chief executive officer, chief financial officer, other senior members of the finance department, the director of internal audit, the Company's outside counsel and independent auditors. These meetings included private executive sessions between the Audit Committee and the Company's independent auditors and director of internal audit, respectively. During its meetings, the Audit Committee reviewed and discussed, among other things:

The Audit Committee has reviewed and discussed with management and the independent auditors the Company's audited financial statements as of and for the year ended January 2, 2004. This discussion included, among other things:

In addition to the meetings discussed above, the chairman of the Audit Committee reviewed with management and the Company's independent auditors the Company's financial statements for each quarter of 2003 prior to the quarterly release of earnings.

17

The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. The Audit Committee has received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1, Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and has discussed with the independent accountants the independent accountants' independence.

The Audit Committee has considered whether the provision of non-audit services by the Company's principal auditor is compatible with maintaining auditor independence and has concluded that such services are compatible with maintaining independence of the auditors. Based on the reviews and discussions referred to above, the Audit Committee believes that PricewaterhouseCoopers has been objective and impartial in conducting the 2003 audit.

In performing all of the functions described above, the Audit Committee acts in an oversight capacity. In that role, the Audit Committee relies primarily on the work and assurances of our management, which has the primary responsibility for our financial statements and reports, and of the independent auditors who, in their report, express an opinion on the conformity of our annual financial statements to accounting principles generally accepted in the United States.

The Audit Committee has recommended to the Board of Directors that the financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended January 2, 2004 for filing with the Securities and Exchange Commission.

Members of the Audit Committee

Carl W.

Schafer, Chair

Robert J. Sullivan

William W. Steele

Employment Agreements

In October 2001, the Company entered into an employment agreement with Joseph P. Sambataro, Jr., the Company's President and Chief Executive Officer, which provides for initial annual compensation of $500,000, subject to annual increases on the anniversary date of the agreement at the discretion of the Board of Directors. In addition, the employment agreement provides for a bonus, at the discretion of the Compensation Committee, based on Mr. Sambataro's performance and the overall performance of the Company. The agreement provides Mr. Sambataro with options to purchase 400,000 shares of the Company's common stock at its fair market value of $3.05 at date of grant. Under this agreement, 100,000 options vested in October 2001 and an additional 100,000 options vest annually through October 2004. The agreement expires December 31, 2004.

In January 2001, the Company entered into an employment agreement with Steven C. Cooper, the Company's Executive Vice President and Chief Financial Officer, which provides for initial annual compensation of $220,000, subject to annual increases on the anniversary date of the agreement at the discretion of the Board of Directors. In addition, the employment agreement provides for a bonus, as determined by the Compensation Committee, based on Mr. Cooper's performance and the overall performance of the Company. The agreement provides Mr. Cooper with options to purchase 250,000 shares of the Company's common stock at its fair market value of $3.25 at date of grant. Under this agreement, 62,500 options vest annually from January 2002 through January 2005. The agreement expires January 8, 2006.

In May 2001, the Company entered into an employment agreement with Timothy J. Adams, the Company's Executive Vice President and General Counsel, which provides for initial annual compensation of $220,000, subject to annual increases on the anniversary date of the agreement at the

18

discretion of the Board of Directors. In addition, the employment agreement provides for a bonus, at the discretion of the Compensation Committee, based on Mr. Adam's performance and the overall performance of the Company. The agreement provides Mr. Adams with options to purchase 250,000 shares of the Company's common stock at its fair market value of $3.74 at date of grant. Under this agreement, 62,500 options vest annually from May 2002 through May 2005. The agreement expires May 28, 2006.

Certain Relationships and Related Transactions

On June 9, 2003 our then Chief Operating Officer Matthew J. Rodgers left the Company. On October 9, 2003, we entered into a Separation Agreement with Mr. Rodgers pursuant to which we agreed to pay Mr. Rodgers severance payments of $25,000 per month from July 6, 2003 until February 21, 2006 and Mr. Rodgers agreed to waive any claims with respect to his employment with us and to abide by certain covenants against competition.

19

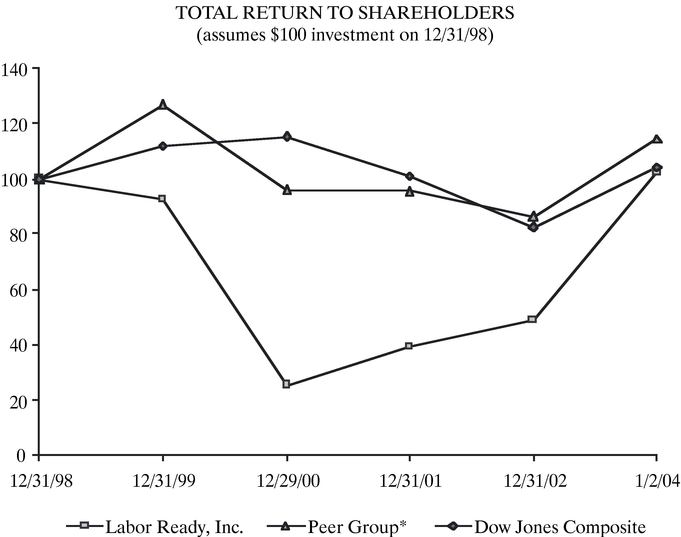

Performance Graph

The following graph depicts the Company's stock price performance from December 31, 1998 through January 2, 2004, relative to the performance of the Dow Jones Composite, and a peer group of companies in the temporary labor industry. All indices shown in the graph have been reset to a base of 100 as of December 31, 1998, and assume an investment of $100 on that date and the reinvestment of dividends, if any, paid since that date. The lines represent calendar year end index levels; if the Company's calendar year ended on a Sunday, the preceding trading day was used.

TOTAL RETURN TO SHAREHOLDERS

(assumes $100 investment on 12/31/98)

20

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934, as amended, requires the Company's officers and directors and certain other persons to timely file certain reports regarding ownership of, and transactions in, the Company's securities with the Securities and Exchange Commission. Copies of the required filings must also be furnished to the Company. Based solely on its review of such forms received by it or representations from certain reporting persons, the Company believes that during 2003 all applicable Section 16(a) filing requirements were met, except as follows: Each of our non-employee directors filed a Form 4 on January 7, 2003 that was one day late. In addition, Director Gates McKibbin filed a Form 4 on August 5, 2003 that was five days late.

The Company anticipates that the 2005 Annual Meeting will be held no later than June 2005. Accordingly, a shareholder proposal to be presented at the Company's 2005 Annual Meeting of Shareholders and included in the Company's proxy statement relating to such meeting must be received by the Company at its executive offices at P.O. Box 2910, Tacoma, WA 98401, no later than December 17, 2004. Please send the proposal to the attention of the Company's Corporate Secretary. A proposal for action to be presented by any shareholder at an annual meeting will be out of order and will not be acted upon unless (a) specifically described in the Company's proxy statement relating to such meeting, (b) such proposal has been submitted in writing to the Secretary at the above address on or before December 17, 2004, and (c) such proposal is, under law, an appropriate subject for shareholder action.

We do not intend to bring any other business before the meeting, and so far as we know, no matters are to be brought before the meeting except as specified in the notice of the meeting. However, as to any other business which may properly come before the meeting, it is intended that proxies, in the form enclosed, will be voted in respect thereof, in accordance with the judgment of the persons voting such proxies.

A copy of the Company's annual report on Form 10-K, as filed with the Securities and Exchange Commission, will be furnished without charge to shareholders upon request to Chief Financial Officer, Labor Ready, Inc., P.O. Box 2910, Tacoma, WA 98401; telephone: (253) 383-9101.

| LABOR READY, INC. By Order of the Board of Directors |

||

Timothy J. Adams Secretary |

||

/s/ TIMOTHY J. ADAMS |

||

Tacoma, Washington April 16, 2004 |

21

APPENDIX A

CHARTER OF THE COMPENSATION COMMITTEE

LABOR READY, INC.

Introduction

The Board of Directors has delegated to the Compensation Committee responsibility for developing and reviewing corporate goals and objectives relevant to compensation of the CEO and other senior executives, evaluating the executives' performance in light of those goals and objectives, and determining the executives' compensation levels accordingly. This Charter is intended to comply with applicable law and New York Stock Exchange listing requirements and to provide the Compensation Committee specific direction in performing its duties. This Charter has been approved by the Company's Board of Directors.

Mission

To further shareholder value by helping to create compensation plans that provide financial incentives to employees for producing results that fairly reward shareholders.

Organization

The Compensation Committee shall be composed of no less than three and no more than five Board members who are independent and otherwise qualified under all applicable regulations, including the corporate governance rules of the New York Stock Exchange, and have no material relationship with the Company, as affirmatively determined by the Board. Additionally, no director may serve on the Committee unless he or she (i) is a "Non-employee Director" for purposes of Rule 16b-3 under the Securities and Exchange Act of 1934 and (ii) satisfies the requirements of an "outside director" for purposes of Section 162(m) of the Internal Revenue Code, including the requirement that he or she not receive remuneration from the Company, either directly or indirectly, in any capacity other than as a director. The members of the Committee, and the Committee chair, shall be elected by the Board annually and shall serve until they are removed by the Board or until their successors shall be duly elected and qualified.

Meetings

The Committee shall meet at least twice annually, or more frequently as circumstances dictate.

Responsibilities

The responsibilities of the Compensation Committee are to:

22

Delegation

The Compensation Committee shall have authority to delegate responsibility to subcommittees, provided that any such subcommittee shall be composed entirely of independent directors and shall have its own published charter.

Resources

In performing the Compensation Committee's responsibilities:

APPROVED AND ADOPTED BY THE COMPENSATION COMMITTEE ON DECEMBER 4, 2003.

APPROVED AND ADOPTED BY THE BOARD OF DIRECTORS ON DECEMBER 5, 2003.

AMENDED BY THE COMPENSATION COMMITTEE AND BY THE BOARD OF DIRECTORS ON MARCH 17, 2004.

23

APPENDIX B

CHARTER OF THE AUDIT COMMITTEE

LABOR READY, INC.

Statement of Policy

The primary functions of the Audit Committee are: (a) to oversee the accounting and financial reporting processes and audits of the financial statements of the Company, including the qualifications, independence and performance of the Company's independent auditors; and (b) to assist the Board of Directors in its oversight and review of the integrity of financial information provided to shareholders and others, the Company's compliance with legal and regulatory requirements, and the adequacy of the Company's system of internal controls and performance of the Company's internal audit function. In performing these functions, the Audit Committee shall provide open means of communication between the directors, the independent auditors and the financial and senior management of the Company.

Composition

The Audit Committee shall be comprised of three or more directors as determined by the Board of Directors, each of whom shall be independent directors under all applicable regulation, including the listing standards of the New York Stock Exchange and the rules of the Securities and Exchange Commission, and have no material relationship with the Company, as affirmatively determined by the Board of Directors. All members of the Audit Committee shall be financially literate and have a working familiarity with basic finance and accounting practices, at least one member shall have accounting or related financial management expertise, and at least one member shall qualify as an "audit committee financial expert" as defined in Item 401 of the Securities and Exchange Commission's Regulation S-K.(1)

A person must have acquired such attributes through any one or more of the following:

24

The members of the Audit Committee shall be elected by the Board of Directors at the annual meeting of the Board of Directors and shall serve until their successors shall be duly elected and qualified. Unless a Chairman is elected by the full Board of Directors, the members of the Audit Committee may designate a Chairman by majority vote of the full Audit Committee membership.

Meetings

The Audit Committee shall meet at least quarterly, or more frequently as circumstances dictate. As part of its job to foster open communication, the Audit Committee should meet at least quarterly with management and the independent auditors in separate executive sessions to discuss any matters that the Audit Committee or each of these groups believe should be discussed privately.

Responsibilities

In carrying out its responsibilities, the Audit Committee will:

25

26

auditing matters. The Audit Committee may review and reassess the adequacy of these procedures periodically and adopt any changes to such procedures that the Audit Committee deems necessary or appropriate.

Relation with the Independent Auditors

The independent auditors shall report directly to the Audit Committee. Accordingly the Audit Committee has the following responsibilities in connection with such relationship:

27

management the timing and process for implementing the rotation of the lead audit partner and any other active audit engagement team partner and consider whether there should be a regular rotation of the audit firm itself. The Audit Committee shall present its conclusions with respect to the independent auditors to the Board of Directors for its information at least annually.

Internal Auditors

At least annually, the Audit Committee shall evaluate the performance and responsibilities of the Company's internal audit function and review the internal audit plan, assessments of the adequacy and effectiveness of internal controls and the sufficiency of the department's resources.

APPROVED AND ADOPTED BY THE AUDIT COMMITTEE ON JUNE 5, 2000.

APPROVED AND ADOPTED BY THE BOARD OF DIRECTORS ON JUNE 6, 2000.

AMENDED BY THE AUDIT COMMITTEE AND THE BOARD OF DIRECTORS ON MARCH 12, 2003.

AMENDED BY THE AUDIT COMMITTEE AND THE BOARD OF DIRECTORS ON MARCH 17, 2004.

28

APPENDIX C

CHARTER OF THE CORPORATE GOVERNANCE AND

NOMINATING COMMITTEE

LABOR READY, INC.

Statement of Policy

The primary roles of the Committee are to (a) identify individuals qualified to become directors and make recommendations to the Board of Directors concerning the selection of director nominees to serve on the Board, (b) review the appropriate composition and functions of the Board, (c) oversee the evaluation of the Board and management and (d) develop and recommend to the Board the Company's corporate governance principles.

Composition

The Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent directors under all applicable regulation, including the corporate governance rules of the New York Stock Exchange, and have no material relationship with the Company, as affirmatively determined by the Board.

The members of the Committee, and the Committee Chair, shall be elected by the Board at the annual meeting of the Board and shall serve until their successors are duly elected and qualified. In fulfilling its responsibilities, the Committee shall be entitled to delegate any or all of its responsibilities to subcommittees, provided that any such subcommittee shall be composed entirely of independent directors and shall have its own published charter.

Meetings

The Committee shall meet at least annually, or more frequently as circumstances dictate. The Committee is authorized to adopt its own rules of procedure not inconsistent with this Charter, the Bylaws of the Company, or applicable law. All non-employee directors that are not members of the Committee may attend meetings of the Committee but may not vote. Additionally, the Committee may invite to its meetings any other director or any member of management of the Company and such other persons as it deems appropriate in order to carry out its responsibilities. The Committee may also exclude from its meetings any persons it deems appropriate in order to carry out its responsibilities.

Responsibilities

The Committee shall perform the following functions in carryout out its responsibilities. These functions serve as a guide with the understanding that the Committee may carry out additional functions and adopt additional policies and procedures as may be appropriate from time to time. In discharging its oversight role, the Committee has the power to study or investigate any matter of interest or concern that the Committee deems appropriate and the Committee has the authority to approve the fees payable to and expenses of such counsel or experts and any other terms of retention. If a search firm is to be used to identify director candidates, the Committee has the sole authority to select, retain and terminate the search firm, including the sole authority to approve the search firm's fees and other retention terms. In carrying out its role, the Committee will:

29

Annual Performance Evaluation

The Committee shall perform a review and evaluation, at least annually, of the performance of the Committee and its members. In conducting such performance evaluation the Committee shall review the compliance of the Committee with this charter.

APPROVED AND ADOPTED BY THE CORPORATE GOVERNANCE AND NOMINATING COMMITTEE ON JUNE 12, 2003.

APPROVED AND ADOPTED BY THE BOARD OF DIRECTORS ON JUNE 12, 2003.

AMENDED BY THE CORPORATE GOVERNANCE AND NOMINATING COMMITTEE AND BY THE BOARD OF DIRECTORS ON MARCH 17, 2004.

30

APPENDIX D

CORPORATE GOVERNANCE GUIDELINES

LABOR READY, INC.

The Corporate Governance and Nominating Committee of the Board of Directors (the "Board") of Labor Ready, Inc., a Washington corporation (the "Company"), has developed, and the Board has adopted, the following Corporate Governance Guidelines ("Guidelines") to assist the Board in the exercise of its responsibilities and to serve best the interests of the Company and its shareholders. These Guidelines should be interpreted in the context of all applicable laws and the Company's Articles of Incorporation (as amended and restated), bylaws, and other corporate governance documents, including committee charters. These Guidelines are intended to serve as a flexible framework within which the Board may conduct its business and not as a set of legally binding obligations. These Guidelines are subject to modification from time to time by the Board as it may deem appropriate and in the best interests of the Company or as required by applicable laws, regulations and rules to which the Company may be subject.

A. BOARD COMPOSITION

31

diversity. Director candidates should be able to provide insights and practical wisdom based on their experience and expertise.

The Board has not established minimum qualifications for nominees to the Board. The Corporate Governance and Nominating Committee annually evaluates the performance of the Board, each of the committees and each of the members of the Board. In connection with its annual review it makes an assessment of the skills and expertise of its members and their adherence to these Guidelines and other policies of the Board and the Company. It also reviews the size of the Board and whether it would be beneficial to add additional members and/or any new skills or expertise, taking into account the overall operating efficiency of the Board and its committees. If the Board has a vacancy or the Corporate Governance and Nominating Committee determines that it would be beneficial to add an additional member it is expected that the Corporate Governance and Nominating Committee will take into account the factors identified in the preceding paragraph and all other factors which the Corporate Governance and Nominating Committee in its best judgment deems relevant at such time.

Each Board member is also asked to annually complete a standard director and officer questionnaire which solicits information regarding relationships with the Company and other factors relating to independence, memberships on other company boards and other information required to be disclosed in the Company's proxy statement. Any new candidate for nomination will be required to provide similar information as well as be available for interviews as the Corporate Governance and Nominating Committee may determine to be appropriate.

Directors are expected to rigorously prepare for, attend and participate in Board meetings and meetings of the Board committees on which they serve, to ask direct questions and require straight answers, and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities and duties as directors. Each Board member is expected to ensure that other existing and planned future commitments do not materially interfere with the member's service as a director of the Company. Service on other boards and other commitments by directors will be considered by the Corporate Governance and Nominating Committee and the Board when reviewing Board candidates and in connection with the Board's annual self-assessment process. Each director is also expected to attend the annual meeting of shareholders.

Effective upon the adoption of these Guidelines each executive officer of the Company shall receive approval from the Corporate Governance and Nominating Committee prior to agreeing to be nominated as a director of any for-profit corporation or similar position with a for-profit unincorporated entity.

32

information may be requested as outlined above. Candidates recommended by the Corporate Governance and Nominating Committee are subject to approval by the Board.

B. RESPONSIBILITIES OF THE BOARD OF DIRECTORS

The Board of Directors has delegated to the Chief Executive Officer, working with the other executive officers of the Company, the authority and responsibility for managing the business of the Company in a lawful and ethical manner, consistent with the standards, policies and procedures of the Company, and in accordance with any specific plans, instructions or directions of the Board. The Chief Executive Officer and the other executive officers are required to seek the advice and, in appropriate situations, the approval of the Board with respect to certain major decisions in both the ordinary and extraordinary course of business.

33

employee of the Company in connection with his or her activities on behalf of or relating to the Company. This obligation includes adherence to the Company's policies with respect to conflicts of interest, confidentiality, protection of the Company's assets, ethical conduct in business dealings and respect for and compliance with applicable law. Any waiver of the requirements of the Code of Business Conduct & Ethics with respect to any individual director or officer shall be approved by the Board of Directors and will be disclosed as required by applicable law.

C. BOARD MEETINGS AND MATERIALS

At the beginning of the year, the Board will establish a schedule of agenda topics to be discussed during the year, which shall be subject to change as matters arise during the year. It is expected that the Board will have regularly scheduled presentations from officers in charge of the Company's major business segments and operations, as well as the Chief Financial Officer, Chief Information Officer, Vice President of Human Resources and General Counsel, and in addition will review and, where appropriate, approve the Company's major operational, administrative, financial, marketing and strategic plans and actions.

Officers who report to the Chief Executive Officer shall regularly attend Board meetings in which matters under their supervision and control are under discussion. Furthermore, the Board encourages these officers to bring managers into Board meetings from time-to-time who (a) can provide additional insight into the matters under discussion, or (b) are themselves managers with future potential who should be given exposure to the Board.

34

D. BOARD COMMITTEES

Each committee has a written charter approved by the Board, which sets forth its authority, responsibilities and duties. Each committee will conduct an annual review of its charter, and will work with the Corporate Governance and Nominating Committee and the full Board to make such revisions as are considered appropriate.