Q4 2025 Earnings

2 Forward-looking statements and non-GAAP financial measures This presentation contains forward-looking statements relating to our plans and expectations including, without limitation, statements regarding the future performance and operations of our business, expectations regarding stabilization in demand, and expected growth from our digital investments, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this presentation and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions, which can be negatively impacted by factors such as rising interest rates, inflation, changes in government policies, political instability, epidemics and global trade uncertainty, (2) factors relating to any unsolicited offer (“Offer”) to purchase the shares of the Company, actions taken by the Company or its shareholders in respect to such an Offer, and the effects of such an Offer, or the completion or failure to complete an Offer, on the Company’s business, or other developments involving such an Offer; (3) actions of activist investors including costs and expenses incurred to address activism- related matters and the distraction of management from business operations in responding to those actions, including any proposals or a proxy context for the election of directors at our annual meeting of shareholders; (4) our ability to maintain profit margins, (5) our ability to attract and retain clients, (6) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, (7) our ability to successfully execute on business strategies and further digitalize our business model, (8) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (9) new laws, regulations, and government incentives that could affect our operations or financial results, (10) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit, (11) our ability to successfully integrate acquired businesses, and (12) the timing and amount of common stock repurchases, if any, which will be determined at management’s discretion and depend upon several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities. Other information regarding factors that could affect our results is included in our Securities and Exchange Commission (SEC) filings, including the Company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated. In addition, we use several non-GAAP financial measures when presenting our financial results in this presentation. Please refer to the reconciliations between our U.S. GAAP and non-GAAP financial measures in the appendix to this presentation and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

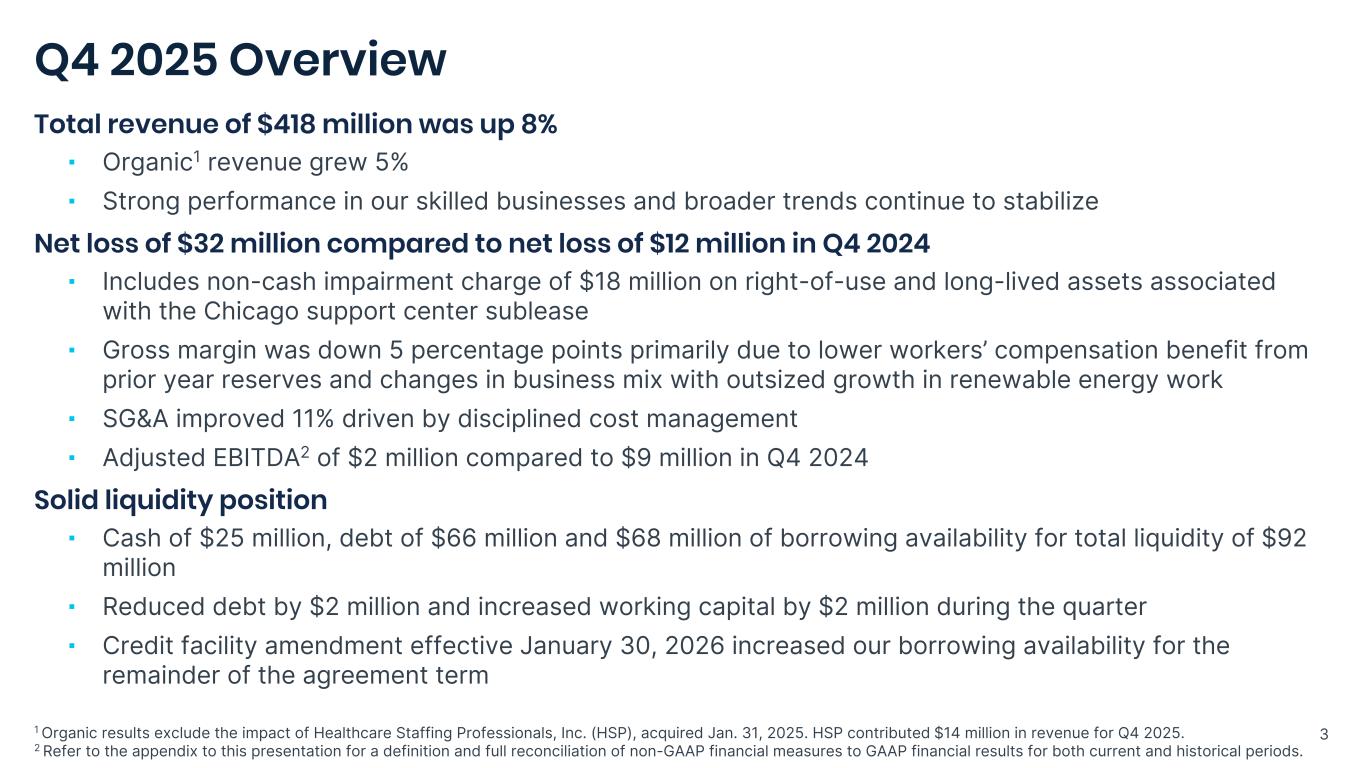

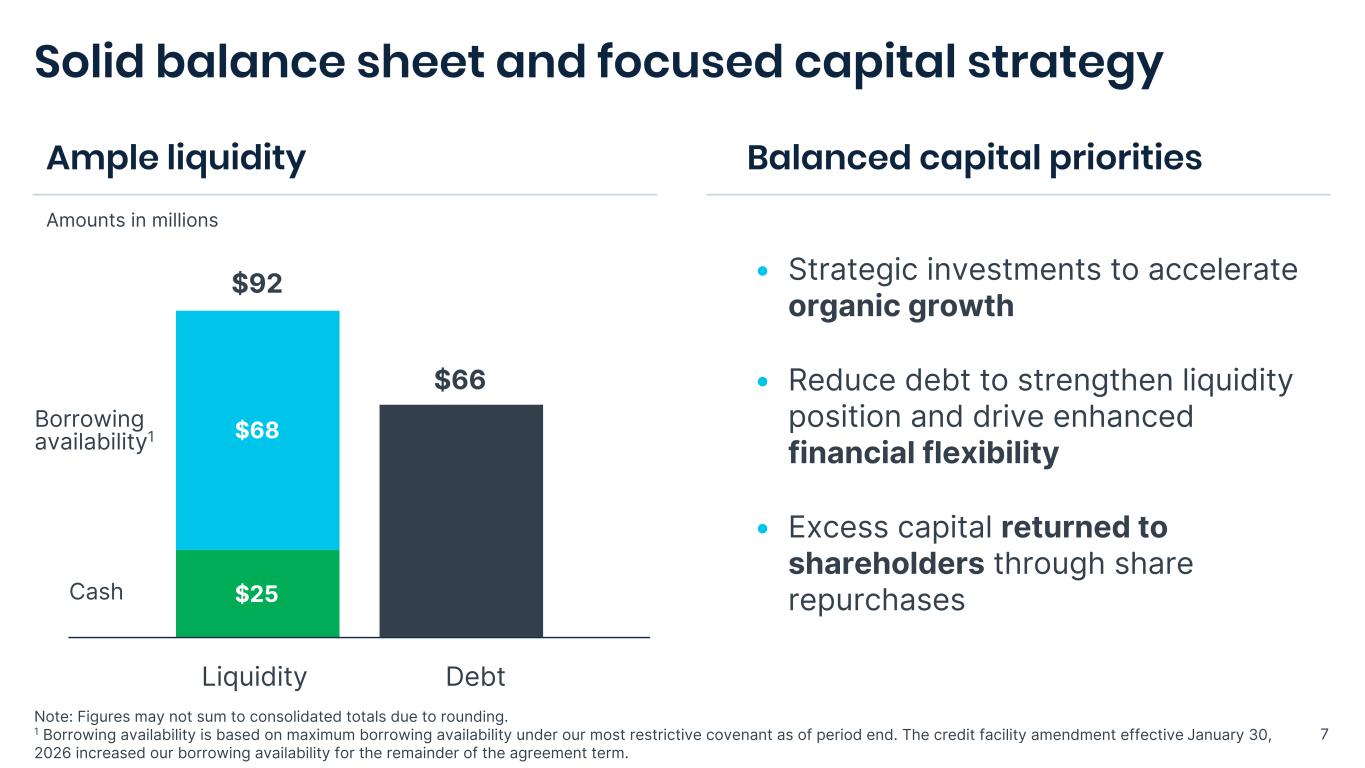

3 Q4 2025 Overview Total revenue of $418 million was up 8% ▪ Organic1 revenue grew 5% ▪ Strong performance in our skilled businesses and broader trends continue to stabilize Net loss of $32 million compared to net loss of $12 million in Q4 2024 ▪ Includes non-cash impairment charge of $18 million on right-of-use and long-lived assets associated with the Chicago support center sublease ▪ Gross margin was down 5 percentage points primarily due to lower workers’ compensation benefit from prior year reserves and changes in business mix with outsized growth in renewable energy work ▪ SG&A improved 11% driven by disciplined cost management ▪ Adjusted EBITDA2 of $2 million compared to $9 million in Q4 2024 Solid liquidity position ▪ Cash of $25 million, debt of $66 million and $68 million of borrowing availability for total liquidity of $92 million ▪ Reduced debt by $2 million and increased working capital by $2 million during the quarter ▪ Credit facility amendment effective January 30, 2026 increased our borrowing availability for the remainder of the agreement term 1 Organic results exclude the impact of Healthcare Staffing Professionals, Inc. (HSP), acquired Jan. 31, 2025. HSP contributed $14 million in revenue for Q4 2025. 2 Refer to the appendix to this presentation for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results for both current and historical periods.

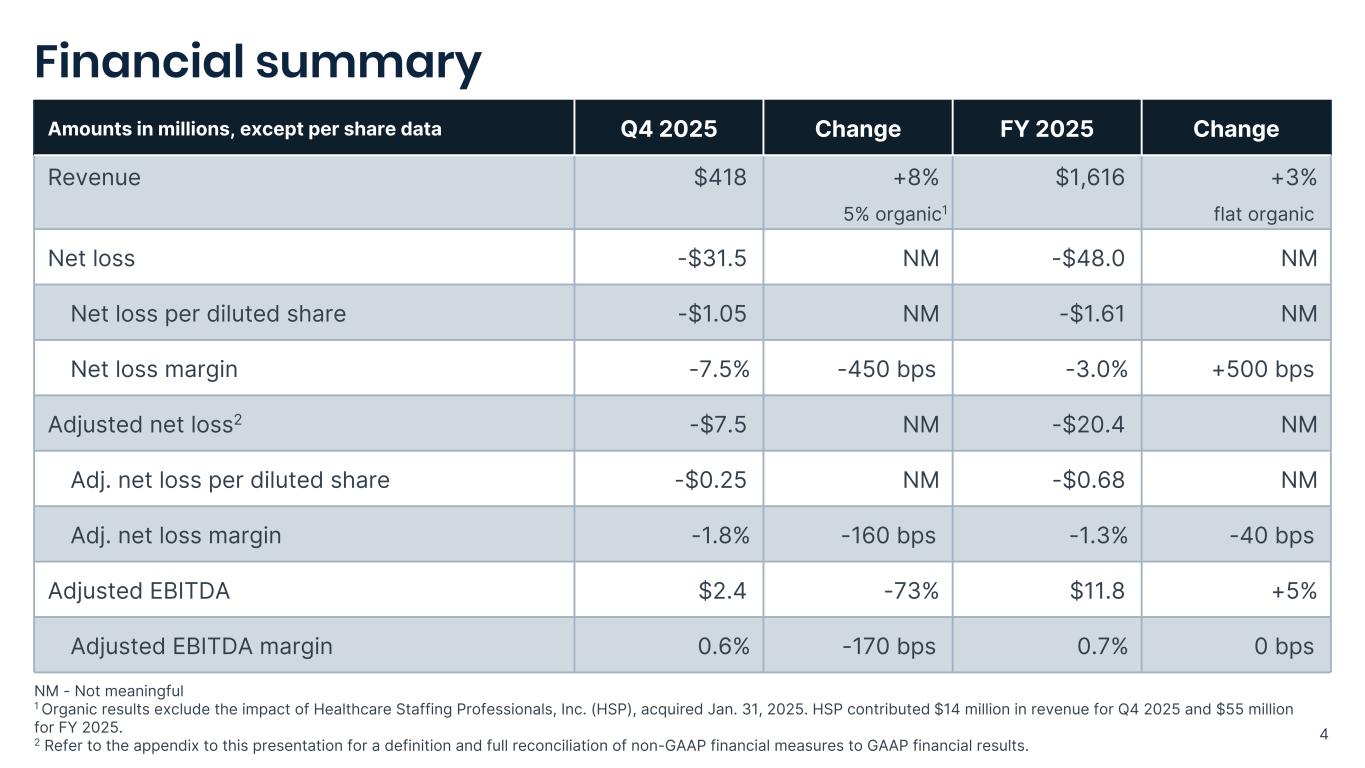

4 Financial summary Amounts in millions, except per share data Q4 2025 Change FY 2025 Change Revenue $418 +8 % $1,616 +3 % 5% organic1 flat organic Net loss -$31.5 NM -$48.0 NM Net loss per diluted share -$1.05 NM -$1.61 NM Net loss margin -7.5 % -450 bps -3.0 % +500 bps Adjusted net loss2 -$7.5 NM -$20.4 NM Adj. net loss per diluted share -$0.25 NM -$0.68 NM Adj. net loss margin -1.8 % -160 bps -1.3 % -40 bps Adjusted EBITDA $2.4 -73 % $11.8 +5 % Adjusted EBITDA margin 0.6 % -170 bps 0.7 % 0 bps NM - Not meaningful 1 Organic results exclude the impact of Healthcare Staffing Professionals, Inc. (HSP), acquired Jan. 31, 2025. HSP contributed $14 million in revenue for Q4 2025 and $55 million for FY 2025. 2 Refer to the appendix to this presentation for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

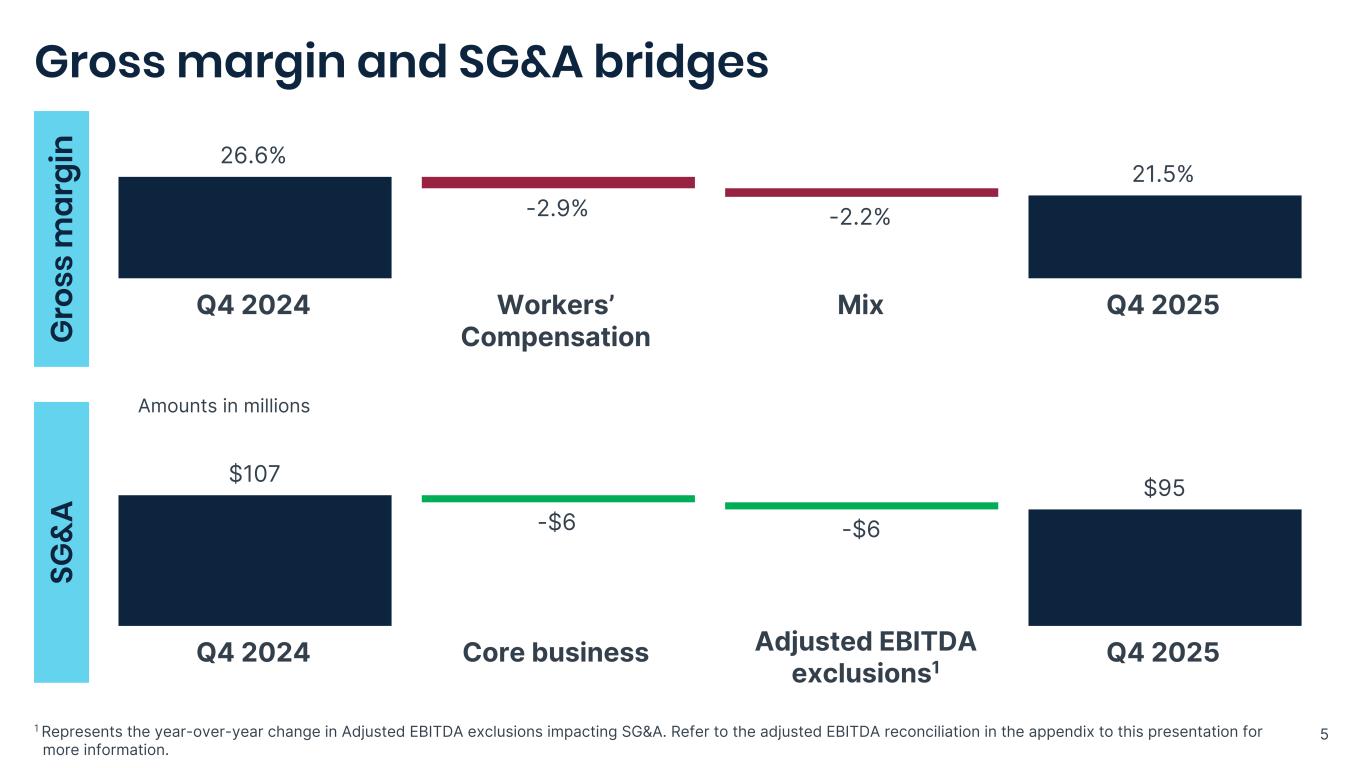

5 Gross margin and SG&A bridges G ro ss m ar gi n 26.6% -2.9% -2.2% 21.5% Q4 2024 Workers’ Compensation Mix Q4 2025 SG &A $107 -$6 -$6 $95 Q4 2024 Core business Q4 2025 Amounts in millions 1 Represents the year-over-year change in Adjusted EBITDA exclusions impacting SG&A. Refer to the adjusted EBITDA reconciliation in the appendix to this presentation for more information. Adjusted EBITDA exclusions1

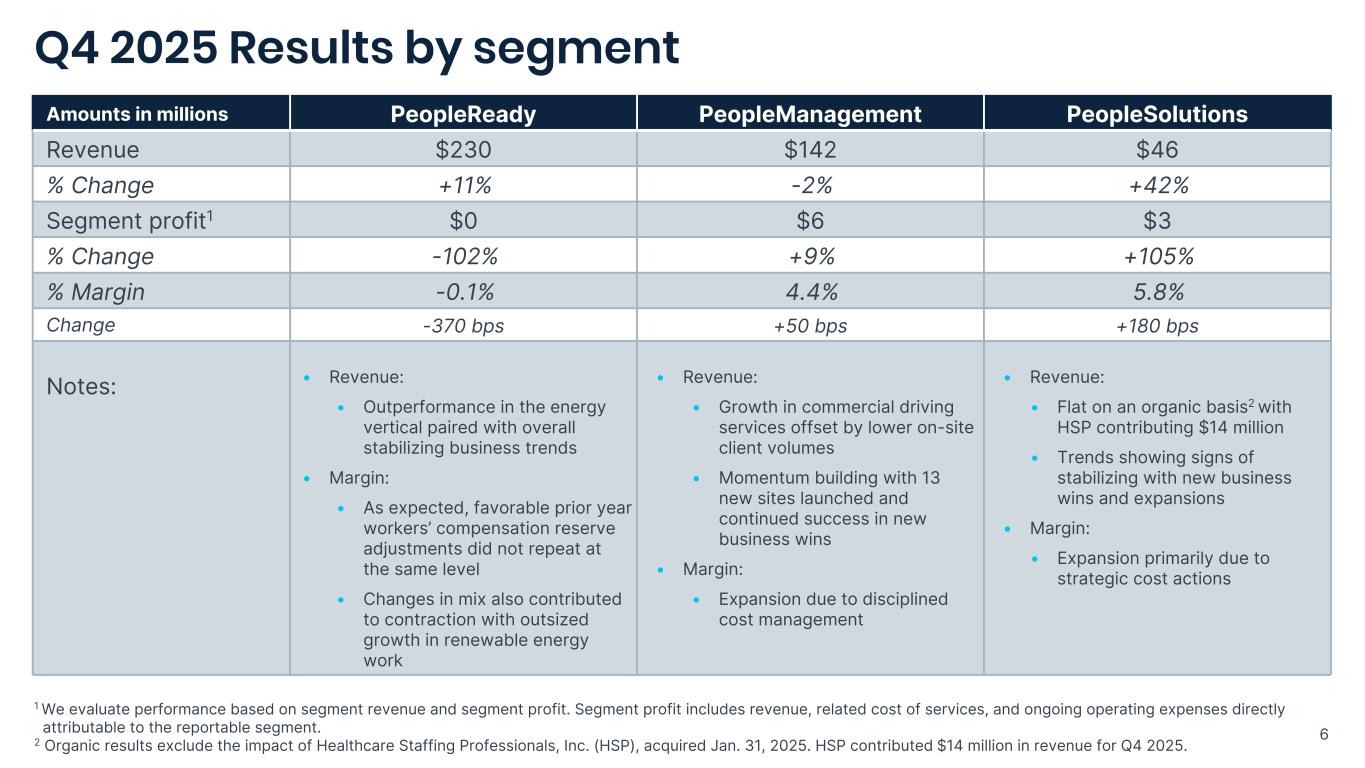

6 Q4 2025 Results by segment Amounts in millions PeopleReady PeopleManagement PeopleSolutions Revenue $230 $142 $46 % Change +11% -2% +42% Segment profit1 $0 $6 $3 % Change -102% +9% +105% % Margin -0.1% 4.4% 5.8% Change -370 bps +50 bps +180 bps Notes: • Revenue: • Outperformance in the energy vertical paired with overall stabilizing business trends • Margin: • As expected, favorable prior year workers’ compensation reserve adjustments did not repeat at the same level • Changes in mix also contributed to contraction with outsized growth in renewable energy work • Revenue: • Growth in commercial driving services offset by lower on-site client volumes • Momentum building with 13 new sites launched and continued success in new business wins • Margin: • Expansion due to disciplined cost management • Revenue: • Flat on an organic basis2 with HSP contributing $14 million • Trends showing signs of stabilizing with new business wins and expansions • Margin: • Expansion primarily due to strategic cost actions 1 We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. 2 Organic results exclude the impact of Healthcare Staffing Professionals, Inc. (HSP), acquired Jan. 31, 2025. HSP contributed $14 million in revenue for Q4 2025.

7 Solid balance sheet and focused capital strategy Amounts in millions $93 $66 $25 $68 Liquidity Debt Borrowing availability1 Cash Ample liquidity Balanced capital priorities • Strategic investments to accelerate organic growth • Reduce debt to strengthen liquidity position and drive enhanced financial flexibility • Excess capital returned to shareholders through share repurchases Note: Figures may not sum to consolidated totals due to rounding. 1 Borrowing availability is based on maximum borrowing availability under our most restrictive covenant as of period end. The credit facility amendment effective January 30, 2026 increased our borrowing availability for the remainder of the agreement term. 2

8 Outlook

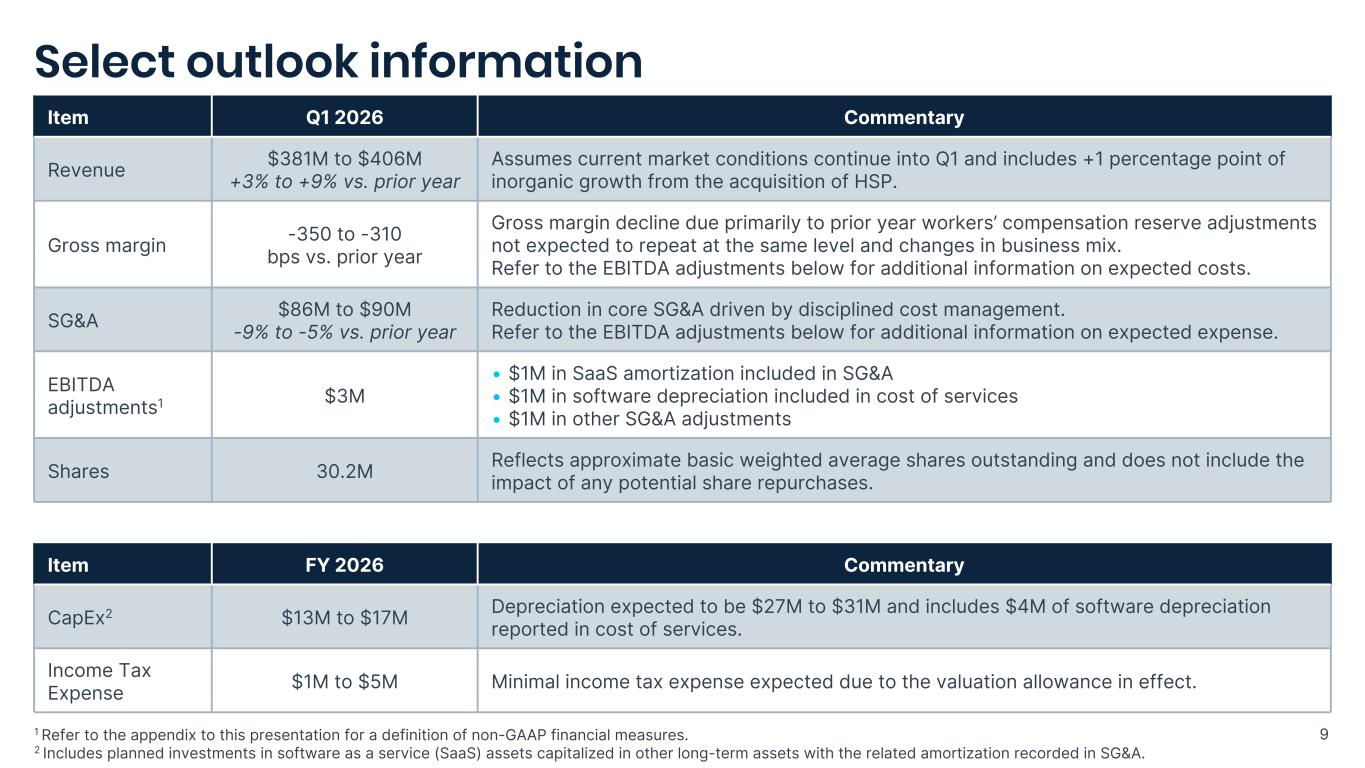

9 Select outlook information Item Q1 2026 Commentary Revenue $381M to $406M +3% to +9% vs. prior year Assumes current market conditions continue into Q1 and includes +1 percentage point of inorganic growth from the acquisition of HSP. Gross margin -350 to -310 bps vs. prior year Gross margin decline due primarily to prior year workers’ compensation reserve adjustments not expected to repeat at the same level and changes in business mix. Refer to the EBITDA adjustments below for additional information on expected costs. SG&A $86M to $90M -9% to -5% vs. prior year Reduction in core SG&A driven by disciplined cost management. Refer to the EBITDA adjustments below for additional information on expected expense. EBITDA adjustments1 $3M • $1M in SaaS amortization included in SG&A • $1M in software depreciation included in cost of services • $1M in other SG&A adjustments Shares 30.2M Reflects approximate basic weighted average shares outstanding and does not include the impact of any potential share repurchases. Item FY 2026 Commentary CapEx2 $13M to $17M Depreciation expected to be $27M to $31M and includes $4M of software depreciation reported in cost of services. Income Tax Expense $1M to $5M Minimal income tax expense expected due to the valuation allowance in effect. 1 Refer to the appendix to this presentation for a definition of non-GAAP financial measures. 2 Includes planned investments in software as a service (SaaS) assets capitalized in other long-term assets with the related amortization recorded in SG&A.

10 Appendix

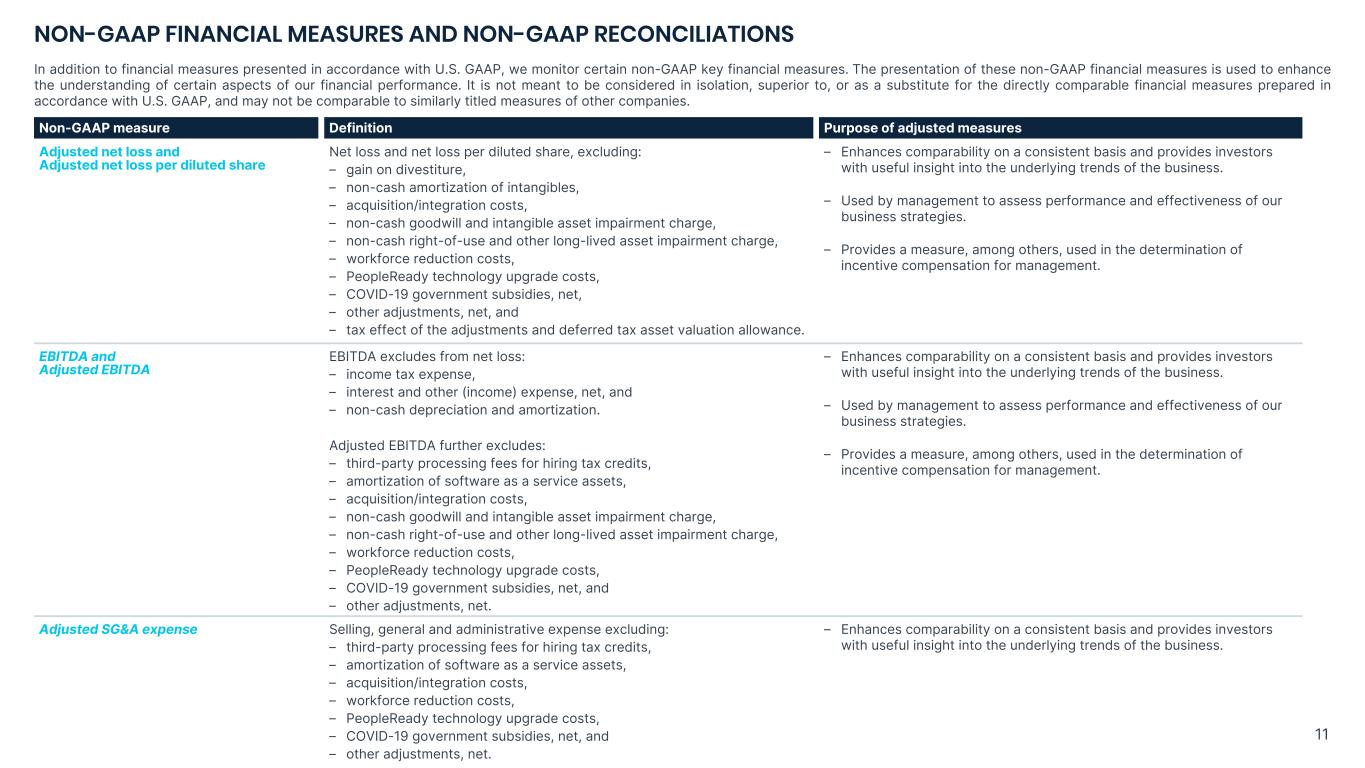

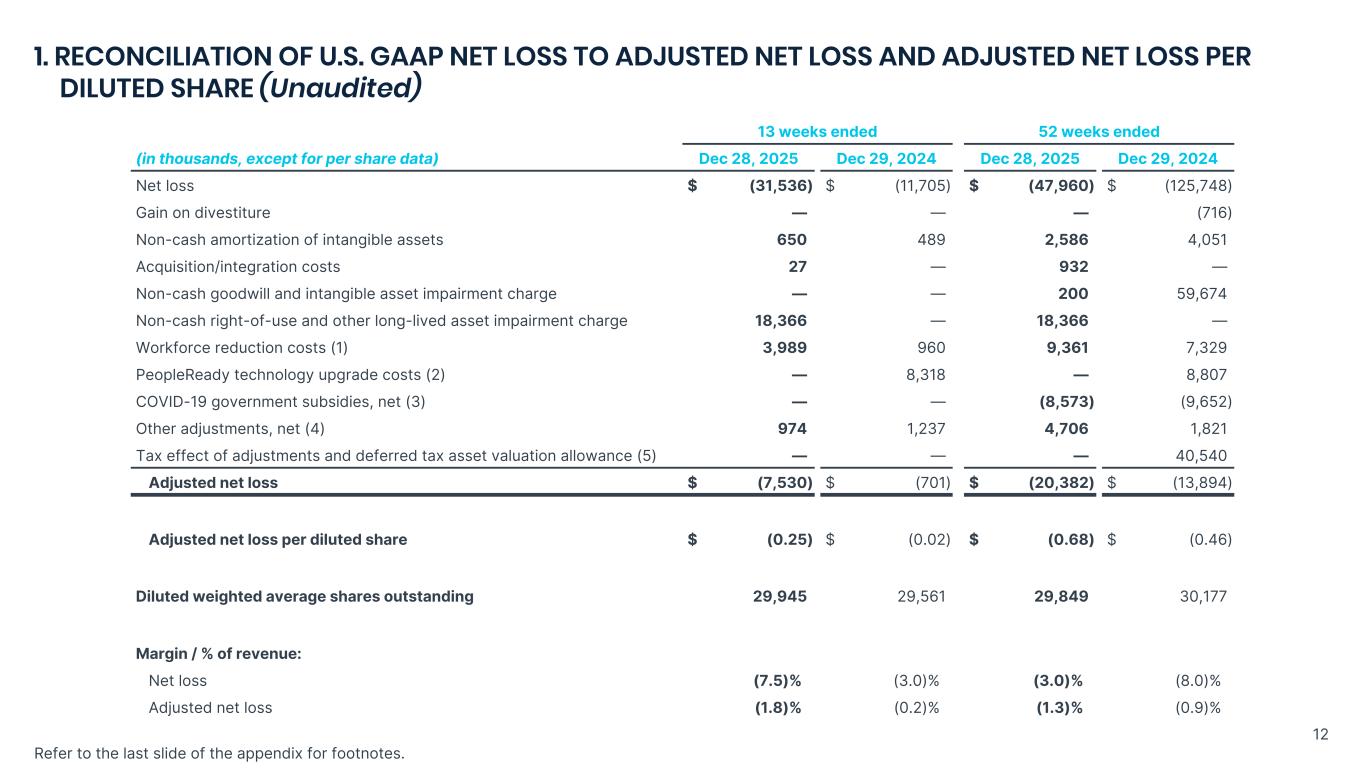

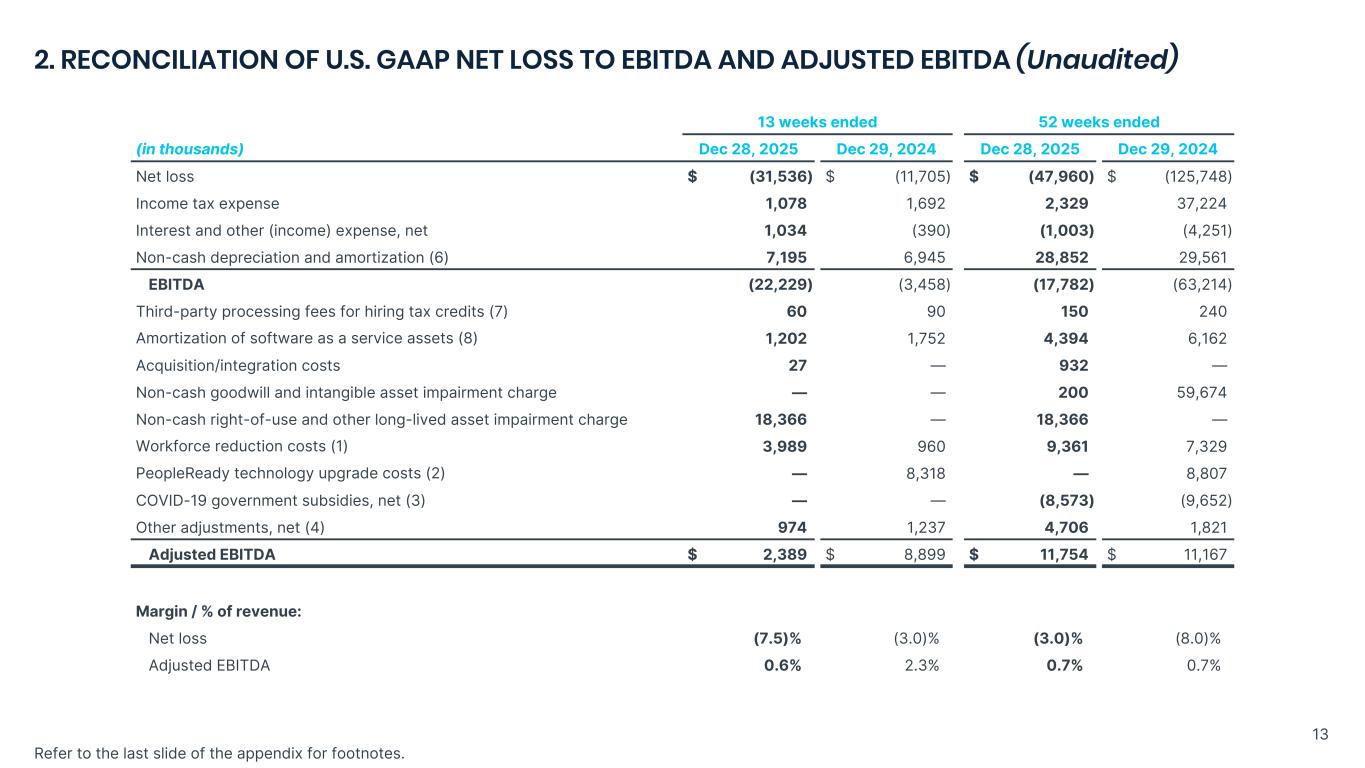

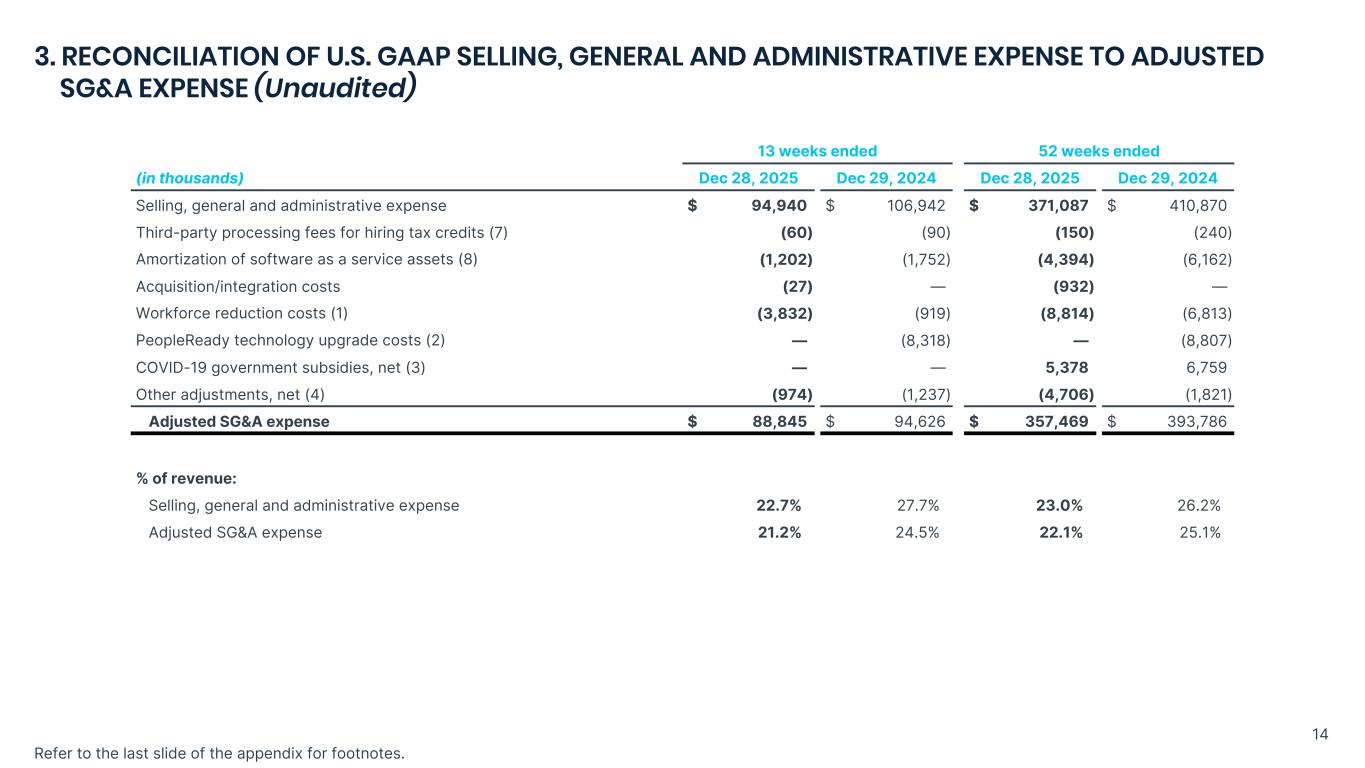

11 NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP measure Definition Purpose of adjusted measures Adjusted net loss and Adjusted net loss per diluted share Net loss and net loss per diluted share, excluding: – gain on divestiture, – non-cash amortization of intangibles, – acquisition/integration costs, – non-cash goodwill and intangible asset impairment charge, – non-cash right-of-use and other long-lived asset impairment charge, – workforce reduction costs, – PeopleReady technology upgrade costs, – COVID-19 government subsidies, net, – other adjustments, net, and – tax effect of the adjustments and deferred tax asset valuation allowance. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. – Used by management to assess performance and effectiveness of our business strategies. – Provides a measure, among others, used in the determination of incentive compensation for management. EBITDA and Adjusted EBITDA EBITDA excludes from net loss: – income tax expense, – interest and other (income) expense, net, and – non-cash depreciation and amortization. Adjusted EBITDA further excludes: – third-party processing fees for hiring tax credits, – amortization of software as a service assets, – acquisition/integration costs, – non-cash goodwill and intangible asset impairment charge, – non-cash right-of-use and other long-lived asset impairment charge, – workforce reduction costs, – PeopleReady technology upgrade costs, – COVID-19 government subsidies, net, and – other adjustments, net. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. – Used by management to assess performance and effectiveness of our business strategies. – Provides a measure, among others, used in the determination of incentive compensation for management. Adjusted SG&A expense Selling, general and administrative expense excluding: – third-party processing fees for hiring tax credits, – amortization of software as a service assets, – acquisition/integration costs, – workforce reduction costs, – PeopleReady technology upgrade costs, – COVID-19 government subsidies, net, and – other adjustments, net. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business.

12 1. RECONCILIATION OF U.S. GAAP NET LOSS TO ADJUSTED NET LOSS AND ADJUSTED NET LOSS PER DILUTED SHARE (Unaudited) 13 weeks ended 52 weeks ended (in thousands, except for per share data) Dec 28, 2025 Dec 29, 2024 Dec 28, 2025 Dec 29, 2024 Net loss $ (31,536) $ (11,705) $ (47,960) $ (125,748) Gain on divestiture — — — (716) Non-cash amortization of intangible assets 650 489 2,586 4,051 Acquisition/integration costs 27 — 932 — Non-cash goodwill and intangible asset impairment charge — — 200 59,674 Non-cash right-of-use and other long-lived asset impairment charge 18,366 — 18,366 — Workforce reduction costs (1) 3,989 960 9,361 7,329 PeopleReady technology upgrade costs (2) — 8,318 — 8,807 COVID-19 government subsidies, net (3) — — (8,573) (9,652) Other adjustments, net (4) 974 1,237 4,706 1,821 Tax effect of adjustments and deferred tax asset valuation allowance (5) — — — 40,540 Adjusted net loss $ (7,530) $ (701) $ (20,382) $ (13,894) Adjusted net loss per diluted share $ (0.25) $ (0.02) $ (0.68) $ (0.46) Diluted weighted average shares outstanding 29,945 29,561 29,849 30,177 Margin / % of revenue: Net loss (7.5) % (3.0) % (3.0) % (8.0) % Adjusted net loss (1.8) % (0.2) % (1.3) % (0.9) % Refer to the last slide of the appendix for footnotes.

13 2. RECONCILIATION OF U.S. GAAP NET LOSS TO EBITDA AND ADJUSTED EBITDA (Unaudited) Refer to the last slide of the appendix for footnotes. 13 weeks ended 52 weeks ended (in thousands) Dec 28, 2025 Dec 29, 2024 Dec 28, 2025 Dec 29, 2024 Net loss $ (31,536) $ (11,705) $ (47,960) $ (125,748) Income tax expense 1,078 1,692 2,329 37,224 Interest and other (income) expense, net 1,034 (390) (1,003) (4,251) Non-cash depreciation and amortization (6) 7,195 6,945 28,852 29,561 EBITDA (22,229) (3,458) (17,782) (63,214) Third-party processing fees for hiring tax credits (7) 60 90 150 240 Amortization of software as a service assets (8) 1,202 1,752 4,394 6,162 Acquisition/integration costs 27 — 932 — Non-cash goodwill and intangible asset impairment charge — — 200 59,674 Non-cash right-of-use and other long-lived asset impairment charge 18,366 — 18,366 — Workforce reduction costs (1) 3,989 960 9,361 7,329 PeopleReady technology upgrade costs (2) — 8,318 — 8,807 COVID-19 government subsidies, net (3) — — (8,573) (9,652) Other adjustments, net (4) 974 1,237 4,706 1,821 Adjusted EBITDA $ 2,389 $ 8,899 $ 11,754 $ 11,167 Margin / % of revenue: Net loss (7.5) % (3.0) % (3.0) % (8.0) % Adjusted EBITDA 0.6 % 2.3 % 0.7 % 0.7 %

14 3. RECONCILIATION OF U.S. GAAP SELLING, GENERAL AND ADMINISTRATIVE EXPENSE TO ADJUSTED SG&A EXPENSE (Unaudited) Refer to the last slide of the appendix for footnotes. 13 weeks ended 52 weeks ended (in thousands) Dec 28, 2025 Dec 29, 2024 Dec 28, 2025 Dec 29, 2024 Selling, general and administrative expense $ 94,940 $ 106,942 $ 371,087 $ 410,870 Third-party processing fees for hiring tax credits (7) (60) (90) (150) (240) Amortization of software as a service assets (8) (1,202) (1,752) (4,394) (6,162) Acquisition/integration costs (27) — (932) — Workforce reduction costs (1) (3,832) (919) (8,814) (6,813) PeopleReady technology upgrade costs (2) — (8,318) — (8,807) COVID-19 government subsidies, net (3) — — 5,378 6,759 Other adjustments, net (4) (974) (1,237) (4,706) (1,821) Adjusted SG&A expense $ 88,845 $ 94,626 $ 357,469 $ 393,786 % of revenue: Selling, general and administrative expense 22.7 % 27.7 % 23.0 % 26.2 % Adjusted SG&A expense 21.2 % 24.5 % 22.1 % 25.1 %

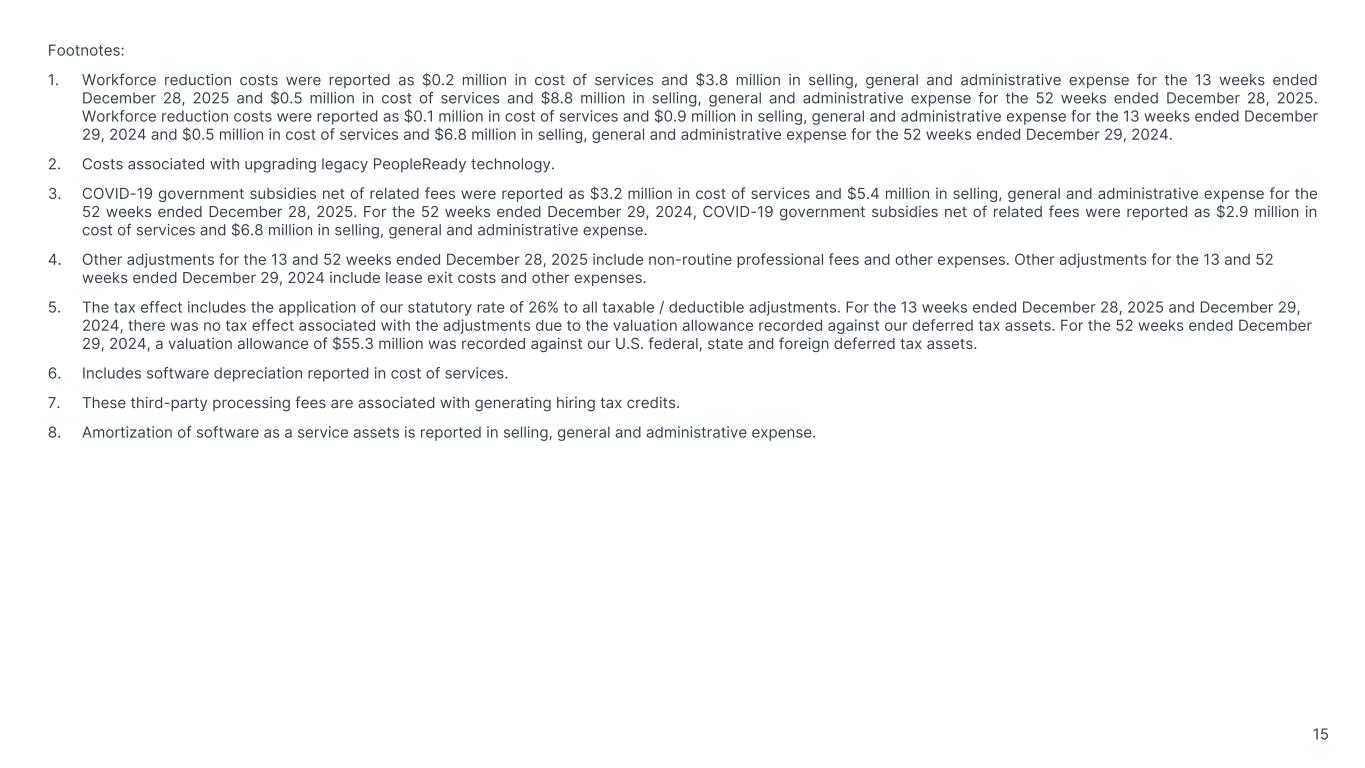

15 Footnotes: 1. Workforce reduction costs were reported as $0.2 million in cost of services and $3.8 million in selling, general and administrative expense for the 13 weeks ended December 28, 2025 and $0.5 million in cost of services and $8.8 million in selling, general and administrative expense for the 52 weeks ended December 28, 2025. Workforce reduction costs were reported as $0.1 million in cost of services and $0.9 million in selling, general and administrative expense for the 13 weeks ended December 29, 2024 and $0.5 million in cost of services and $6.8 million in selling, general and administrative expense for the 52 weeks ended December 29, 2024. 2. Costs associated with upgrading legacy PeopleReady technology. 3. COVID-19 government subsidies net of related fees were reported as $3.2 million in cost of services and $5.4 million in selling, general and administrative expense for the 52 weeks ended December 28, 2025. For the 52 weeks ended December 29, 2024, COVID-19 government subsidies net of related fees were reported as $2.9 million in cost of services and $6.8 million in selling, general and administrative expense. 4. Other adjustments for the 13 and 52 weeks ended December 28, 2025 include non-routine professional fees and other expenses. Other adjustments for the 13 and 52 weeks ended December 29, 2024 include lease exit costs and other expenses. 5. The tax effect includes the application of our statutory rate of 26% to all taxable / deductible adjustments. For the 13 weeks ended December 28, 2025 and December 29, 2024, there was no tax effect associated with the adjustments due to the valuation allowance recorded against our deferred tax assets. For the 52 weeks ended December 29, 2024, a valuation allowance of $55.3 million was recorded against our U.S. federal, state and foreign deferred tax assets. 6. Includes software depreciation reported in cost of services. 7. These third-party processing fees are associated with generating hiring tax credits. 8. Amortization of software as a service assets is reported in selling, general and administrative expense.

TrueBlue, Inc. (NYSE: TBI) is a leading provider of specialized workforce solutions. As The People Company®, we put people first — advancing our mission to connect people and work while delivering smart, scalable solutions that help businesses grow and communities thrive. Since our founding, TrueBlue has connected more than 10 million people with work and served over 3 million clients across a variety of industries. Powered by proprietary, digitally enabled platforms and decades of expertise, our brands — PeopleReady, PeopleScout, Staff Management | SMX, Centerline, SIMOS, and Healthcare Staffing Professionals — provide a full spectrum of flexible staffing, workforce management, and recruitment solutions that bring precision, speed, and scale to the changing world of work.