Q4 2022 Earnings

www.TrueBlue.c om 2 Forward-looking statements and non-GAAP financial measures This document contains forward-looking statements relating to our plans and expectations including, without limitation, statements regarding the future performance and operations of our business, and expected growth from our digital investments, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this release and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions which can be negatively impacted by factors such as rising interest rates, inflation, political instability, epidemics and global trade uncertainty, (2) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (3) our ability to attract and retain clients, (4) our ability to maintain profit margins, (5) our ability to successfully execute on business strategies to further digitalize our business model, (6) the timing and amount of common stock repurchases, if any, which will be determined at management’s discretion and depend upon several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities, (7) new laws, regulations, and government incentives that could affect our operations or financial results, (8) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, and (9) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. In addition, we use several non-GAAP financial measures when presenting our financial results in this document. Please refer to the reconciliations between our GAAP and non-GAAP financial measures in the appendix to this presentation and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated.

www.TrueBlue.c om 3 Overview 1 Refer to the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. Q4 2022 FY 2022 Strong execution despite macroeconomic conditions ▪ Total revenue -10% • Steady underlying monthly revenue trends at PeopleReady and PeopleManagement despite year-over-year decline • PeopleScout demand softened ▪ Net income was $7 million v. $20 million in Q4 2021 • Net income margin -190 bps • Gross margin -30 bps due to lower, high- margin volumes offset by favorable bill / pay spread inflation and lower workers' compensation costs • SG&A down in dollars but up as a percent of revenue due to operational deleveraging ▪ Adjusted EBITDA1 was $21 million v. $36 million in Q4 2021 • Adjusted EBITDA margin -200 bps Revenue growth and gross margin drive bottom-line results ▪ Total revenue +4% • Strong revenue growth across all three segments in the first half of the year • Demand tapered in the second half of the year ▪ Net income of $62 million was flat v. 2021 • Net income margin was unchanged • Gross margin +90 bps due to favorable bill / pay spread inflation and lower workers' compensation costs ▪ Adjusted EBITDA was $117 million v. $104 million in 2021 • Adjusted EBITDA margin +40 bps

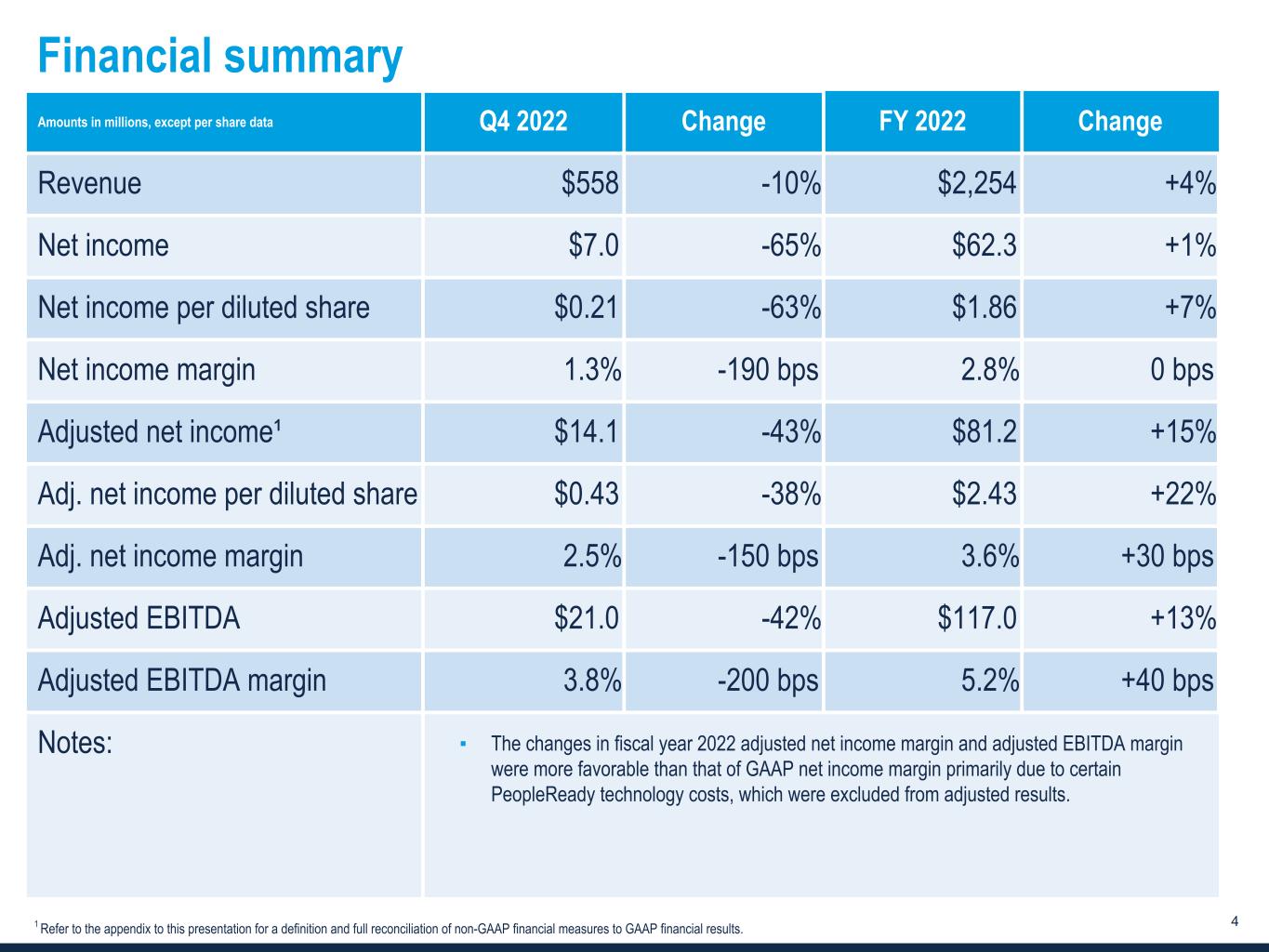

www.TrueBlue.c om 4 Financial summary 1 Refer to the appendix to this presentation for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. Amounts in millions, except per share data Q4 2022 Change FY 2022 Change Revenue $558 -10 % $2,254 +4 % Net income $7.0 -65 % $62.3 +1 % Net income per diluted share $0.21 -63 % $1.86 +7 % Net income margin 1.3 % -190 bps 2.8 % 0 bps Adjusted net income¹ $14.1 -43 % $81.2 +15 % Adj. net income per diluted share $0.43 -38 % $2.43 +22 % Adj. net income margin 2.5 % -150 bps 3.6 % +30 bps Adjusted EBITDA $21.0 -42 % $117.0 +13 % Adjusted EBITDA margin 3.8 % -200 bps 5.2 % +40 bps Notes: ▪ The changes in fiscal year 2022 adjusted net income margin and adjusted EBITDA margin were more favorable than that of GAAP net income margin primarily due to certain PeopleReady technology costs, which were excluded from adjusted results.

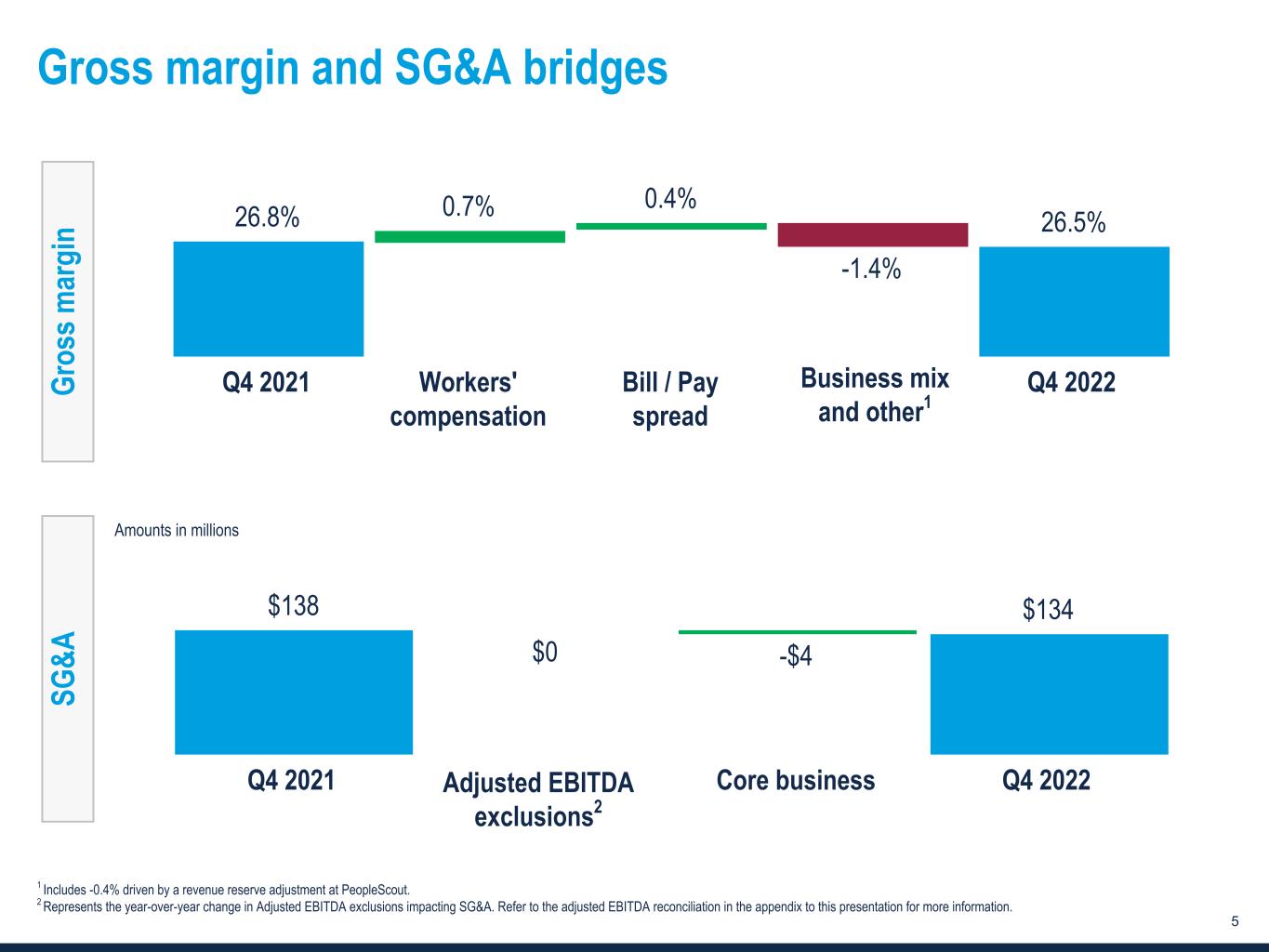

www.TrueBlue.c om 5 Gross margin and SG&A bridges Amounts in millions Gr os s m ar gi n SG &A $138 $0 -$4 $134 Q4 2021 Core business Q4 2022 26.8% 0.7% 0.4% -1.4% 26.5% Q4 2021 Workers' compensation Bill / Pay spread Q4 2022 Adjusted EBITDA exclusions2 1 Includes -0.4% driven by a revenue reserve adjustment at PeopleScout. 2 Represents the year-over-year change in Adjusted EBITDA exclusions impacting SG&A. Refer to the adjusted EBITDA reconciliation in the appendix to this presentation for more information. Business mix and other1

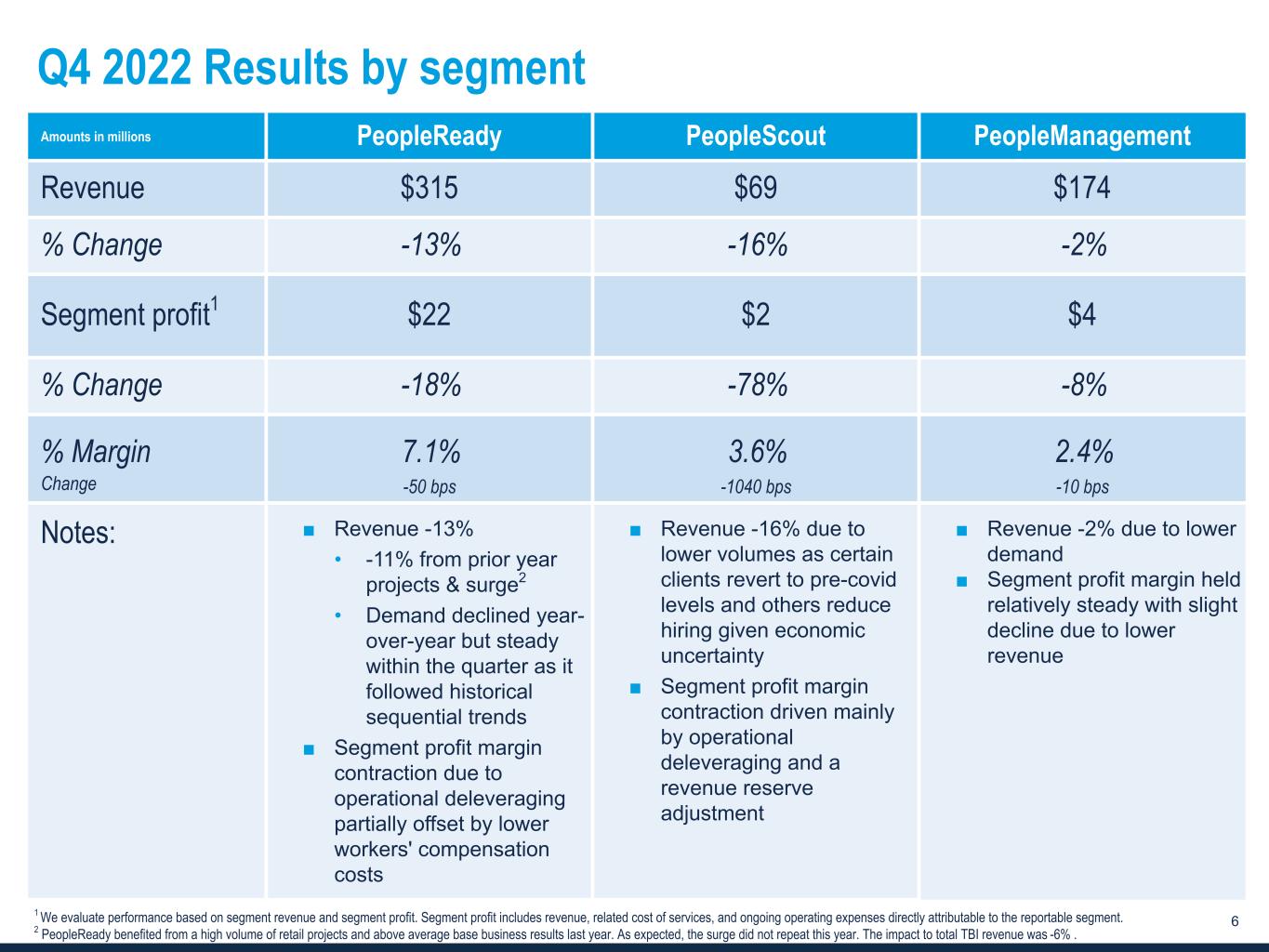

www.TrueBlue.c om 6 Q4 2022 Results by segment Amounts in millions PeopleReady PeopleScout PeopleManagement Revenue $315 $69 $174 % Change -13% -16% -2% Segment profit1 $22 $2 $4 % Change -18% -78% -8% % Margin 7.1% 3.6% 2.4% Change -50 bps -1040 bps -10 bps Notes: ■ Revenue -13% • -11% from prior year projects & surge2 • Demand declined year- over-year but steady within the quarter as it followed historical sequential trends ■ Segment profit margin contraction due to operational deleveraging partially offset by lower workers' compensation costs ■ Revenue -16% due to lower volumes as certain clients revert to pre-covid levels and others reduce hiring given economic uncertainty ■ Segment profit margin contraction driven mainly by operational deleveraging and a revenue reserve adjustment ■ Revenue -2% due to lower demand ■ Segment profit margin held relatively steady with slight decline due to lower revenue 1 We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. 2 PeopleReady benefited from a high volume of retail projects and above average base business results last year. As expected, the surge did not repeat this year. The impact to total TBI revenue was -6% .

www.TrueBlue.c om 7 Strategic highlights and priorities Advance technology and enhance the experience for those we serve to grow market share ▪ Augment sales team to enable specialization and gain market share in high growth sectors ▪ Seek opportunities to grow domestically and globally through acquisition and / or new product offerings ▪ Advance technology platform with a focus on improving client delivery and recruiting efficiency ▪ Digitalize our business model to gain market share from smaller, less capitalized competitors and reduce expenses ▪ Advance JobStackTM capabilities to better accommodate our associates and increase worker supply ▪ Enhance training and expand geographic and vertical coverage to drive sales and improve the client and associate experience ▪ Leverage sales resource investments to expand into under-penetrated geographic markets ▪ Increase adoption of onsite workflow product offering to expand margin profile ▪ Invest in client and associate care in addition to retention programs

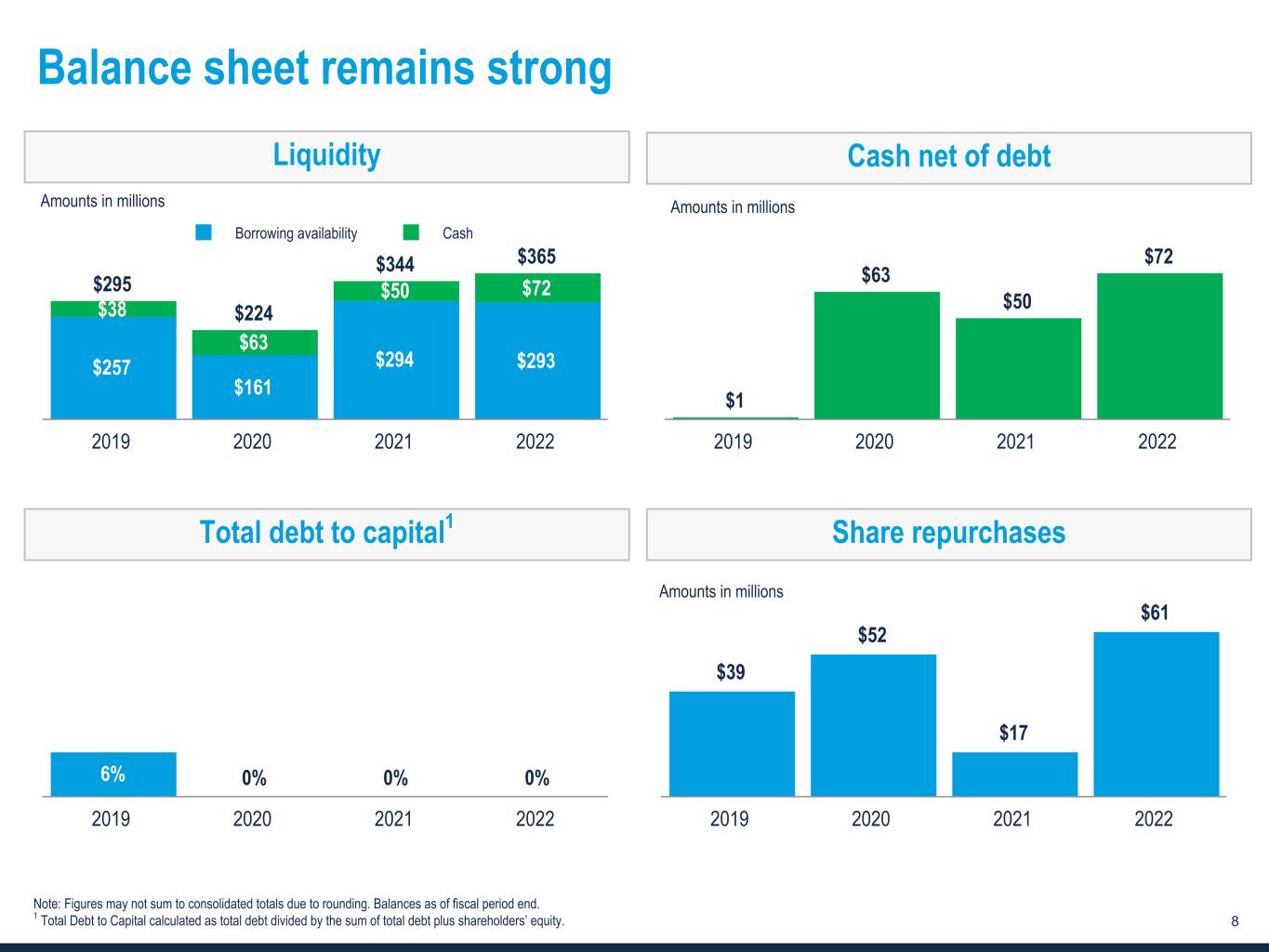

www.TrueBlue.c om 8 $1 $63 $50 $72 2019 2020 2021 2022 6% 0% 0% 0% 2019 2020 2021 2022 $295 $224 $344 $365 $257 $161 $294 $293 $38 $63 $50 $72 Borrowing availability Cash 2019 2020 2021 2022 Balance sheet remains strong Amounts in millions Note: Figures may not sum to consolidated totals due to rounding. Balances as of fiscal period end. 1 Total Debt to Capital calculated as total debt divided by the sum of total debt plus shareholders’ equity. Liquidity Amounts in millions Share repurchasesTotal debt to capital1 Cash net of debt $39 $52 $17 $61 2019 2020 2021 2022 Amounts in millions

Outlook

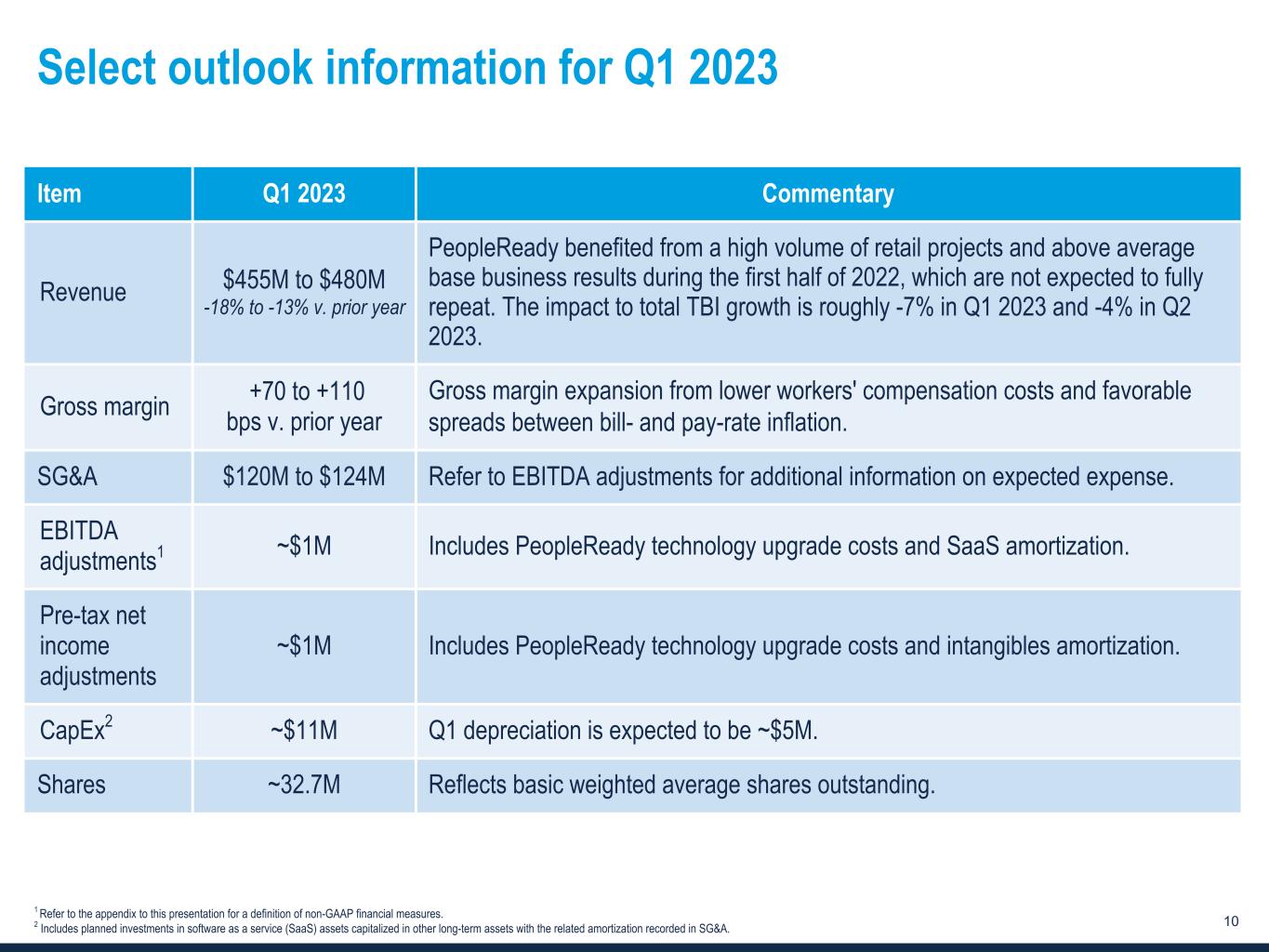

www.TrueBlue.c om 10 Select outlook information for Q1 2023 Item Q1 2023 Commentary Revenue $455M to $480M -18% to -13% v. prior year PeopleReady benefited from a high volume of retail projects and above average base business results during the first half of 2022, which are not expected to fully repeat. The impact to total TBI growth is roughly -7% in Q1 2023 and -4% in Q2 2023. Gross margin +70 to +110 bps v. prior year Gross margin expansion from lower workers' compensation costs and favorable spreads between bill- and pay-rate inflation. SG&A $120M to $124M Refer to EBITDA adjustments for additional information on expected expense. EBITDA adjustments1 ~$1M Includes PeopleReady technology upgrade costs and SaaS amortization. Pre-tax net income adjustments ~$1M Includes PeopleReady technology upgrade costs and intangibles amortization. CapEx2 ~$11M Q1 depreciation is expected to be ~$5M. Shares ~32.7M Reflects basic weighted average shares outstanding. 1 Refer to the appendix to this presentation for a definition of non-GAAP financial measures. 2 Includes planned investments in software as a service (SaaS) assets capitalized in other long-term assets with the related amortization recorded in SG&A.

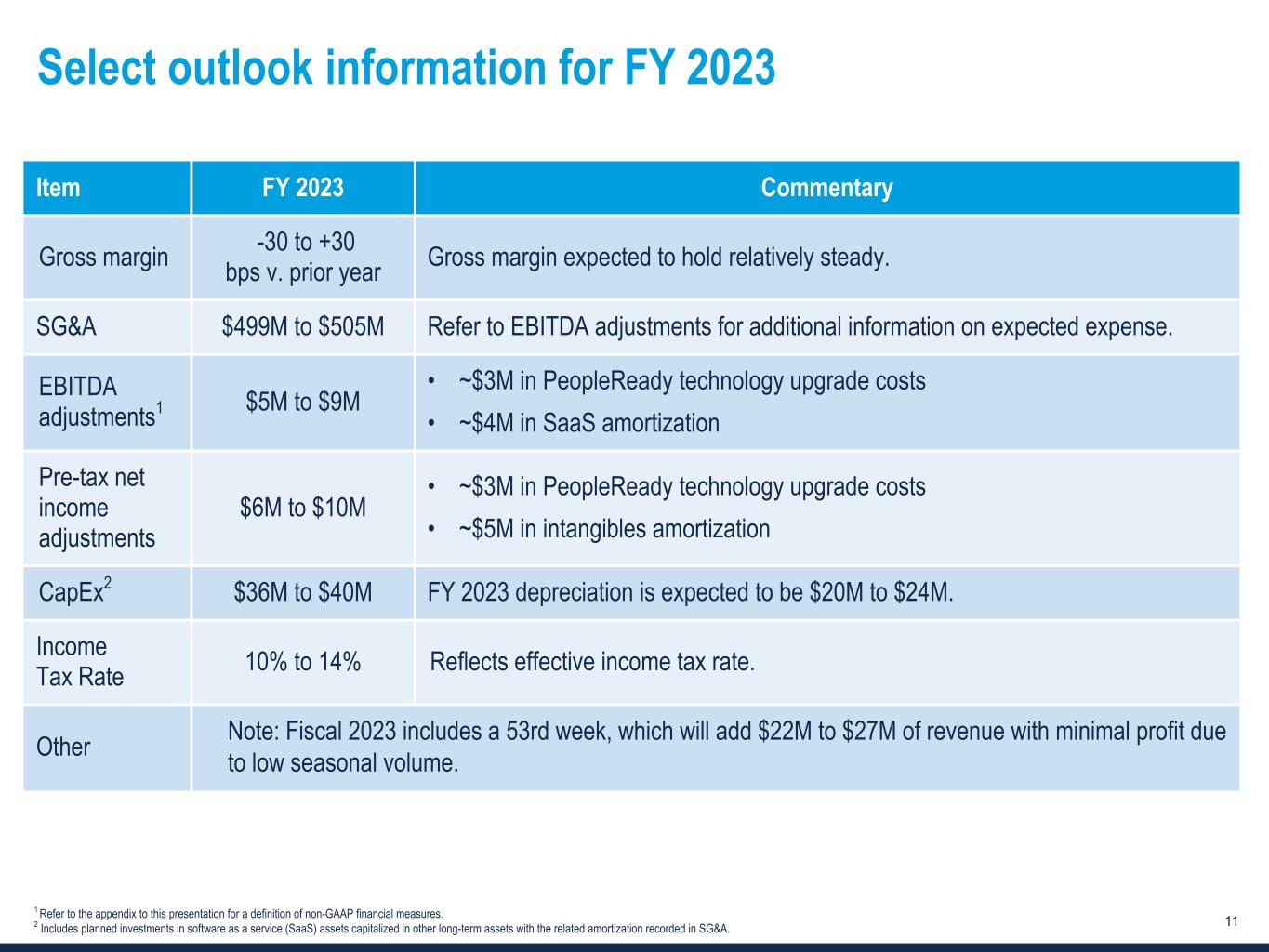

www.TrueBlue.c om 11 Select outlook information for FY 2023 1 Refer to the appendix to this presentation for a definition of non-GAAP financial measures. 2 Includes planned investments in software as a service (SaaS) assets capitalized in other long-term assets with the related amortization recorded in SG&A. Item FY 2023 Commentary Gross margin -30 to +30 bps v. prior year Gross margin expected to hold relatively steady. SG&A $499M to $505M Refer to EBITDA adjustments for additional information on expected expense. EBITDA adjustments1 $5M to $9M • ~$3M in PeopleReady technology upgrade costs • ~$4M in SaaS amortization Pre-tax net income adjustments $6M to $10M • ~$3M in PeopleReady technology upgrade costs • ~$5M in intangibles amortization CapEx2 $36M to $40M FY 2023 depreciation is expected to be $20M to $24M. Income Tax Rate 10% to 14% Reflects effective income tax rate. Other Note: Fiscal 2023 includes a 53rd week, which will add $22M to $27M of revenue with minimal profit due to low seasonal volume.

Appendix

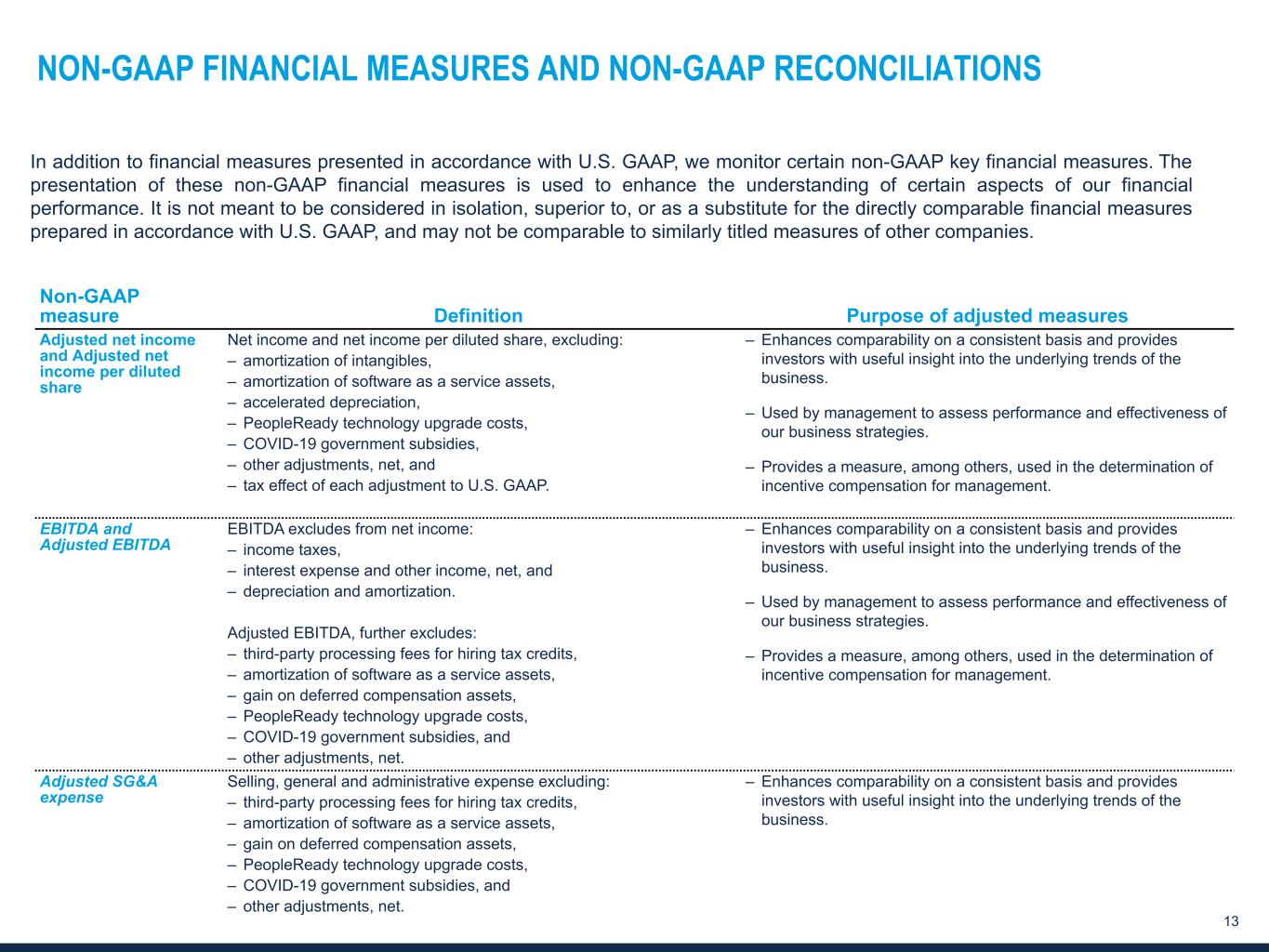

www.TrueBlue.c om 13 NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP measure Definition Purpose of adjusted measures Adjusted net income and Adjusted net income per diluted share Net income and net income per diluted share, excluding: – amortization of intangibles, – amortization of software as a service assets, – accelerated depreciation, – PeopleReady technology upgrade costs, – COVID-19 government subsidies, – other adjustments, net, and – tax effect of each adjustment to U.S. GAAP. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. – Used by management to assess performance and effectiveness of our business strategies. – Provides a measure, among others, used in the determination of incentive compensation for management. EBITDA and Adjusted EBITDA EBITDA excludes from net income: – income taxes, – interest expense and other income, net, and – depreciation and amortization. Adjusted EBITDA, further excludes: – third-party processing fees for hiring tax credits, – amortization of software as a service assets, – gain on deferred compensation assets, – PeopleReady technology upgrade costs, – COVID-19 government subsidies, and – other adjustments, net. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. – Used by management to assess performance and effectiveness of our business strategies. – Provides a measure, among others, used in the determination of incentive compensation for management. Adjusted SG&A expense Selling, general and administrative expense excluding: – third-party processing fees for hiring tax credits, – amortization of software as a service assets, – gain on deferred compensation assets, – PeopleReady technology upgrade costs, – COVID-19 government subsidies, and – other adjustments, net. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business.

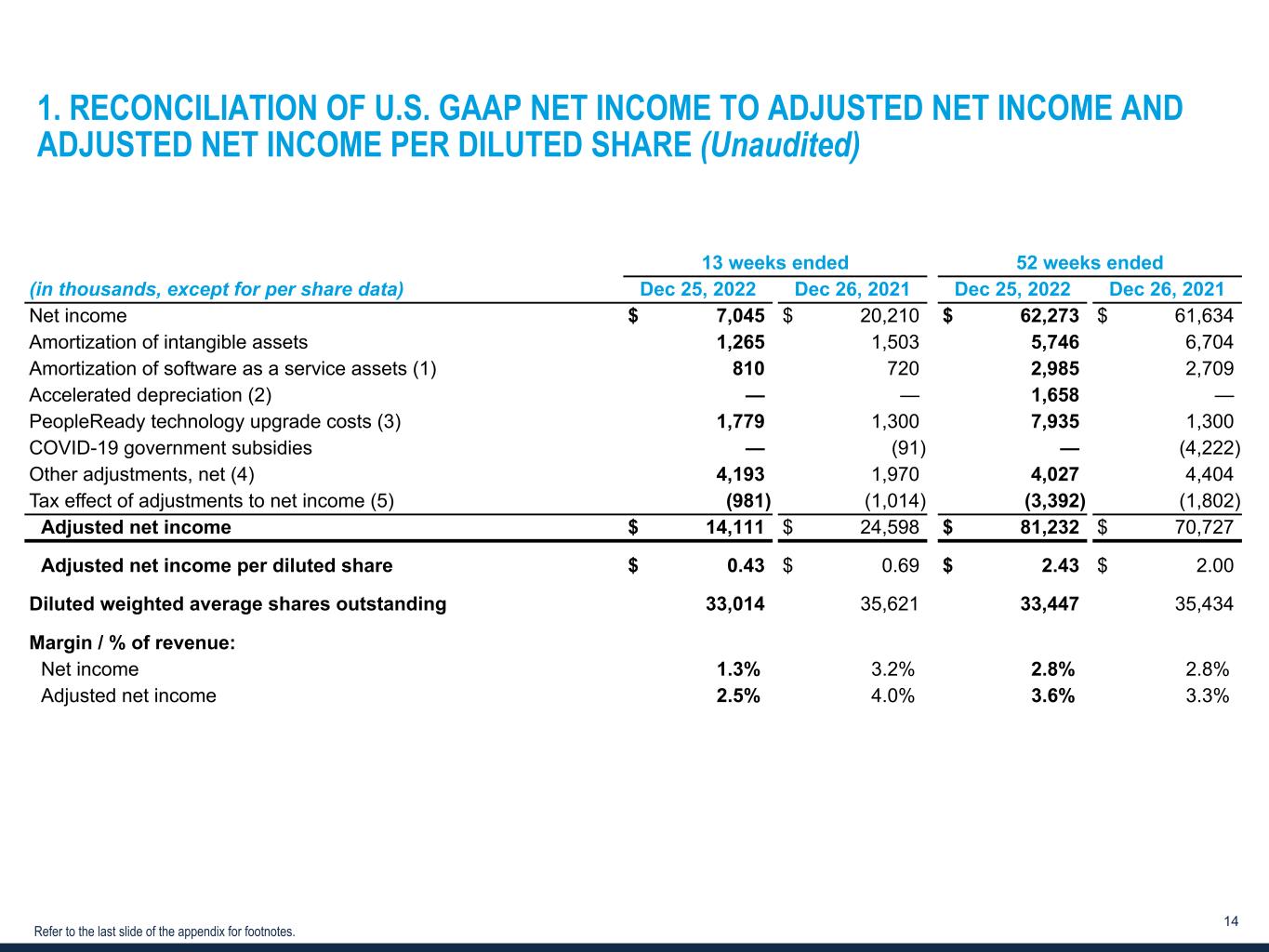

www.TrueBlue.c om 14 1. RECONCILIATION OF U.S. GAAP NET INCOME TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME PER DILUTED SHARE (Unaudited) Refer to the last slide of the appendix for footnotes. 13 weeks ended 52 weeks ended (in thousands, except for per share data) Dec 25, 2022 Dec 26, 2021 Dec 25, 2022 Dec 26, 2021 Net income $ 7,045 $ 20,210 $ 62,273 $ 61,634 Amortization of intangible assets 1,265 1,503 5,746 6,704 Amortization of software as a service assets (1) 810 720 2,985 2,709 Accelerated depreciation (2) — — 1,658 — PeopleReady technology upgrade costs (3) 1,779 1,300 7,935 1,300 COVID-19 government subsidies — (91) — (4,222) Other adjustments, net (4) 4,193 1,970 4,027 4,404 Tax effect of adjustments to net income (5) (981) (1,014) (3,392) (1,802) Adjusted net income $ 14,111 $ 24,598 $ 81,232 $ 70,727 Adjusted net income per diluted share $ 0.43 $ 0.69 $ 2.43 $ 2.00 Diluted weighted average shares outstanding 33,014 35,621 33,447 35,434 Margin / % of revenue: Net income 1.3 % 3.2 % 2.8 % 2.8 % Adjusted net income 2.5 % 4.0 % 3.6 % 3.3 %

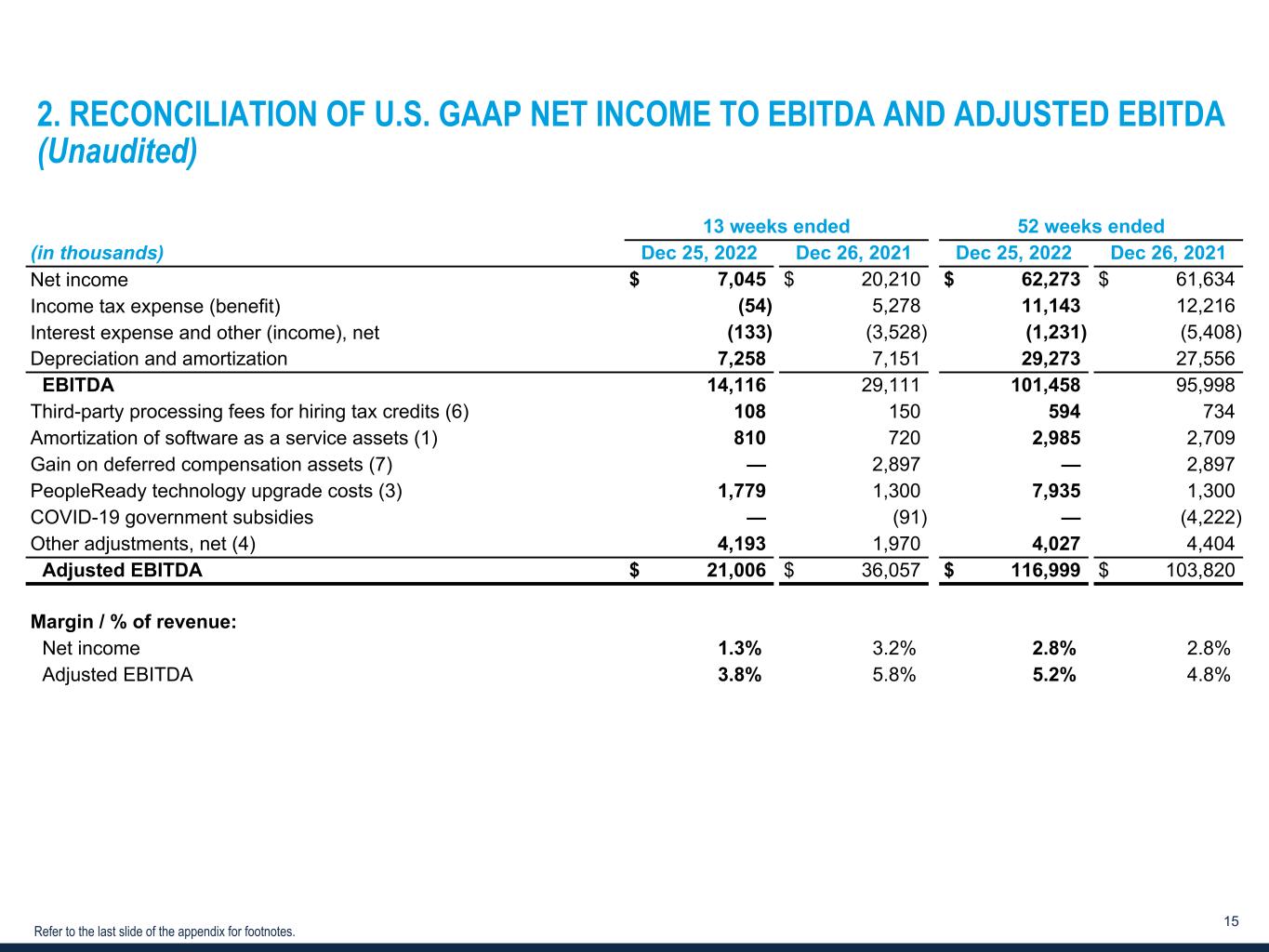

www.TrueBlue.c om 15 Refer to the last slide of the appendix for footnotes. 2. RECONCILIATION OF U.S. GAAP NET INCOME TO EBITDA AND ADJUSTED EBITDA (Unaudited) 13 weeks ended 52 weeks ended (in thousands) Dec 25, 2022 Dec 26, 2021 Dec 25, 2022 Dec 26, 2021 Net income $ 7,045 $ 20,210 $ 62,273 $ 61,634 Income tax expense (benefit) (54) 5,278 11,143 12,216 Interest expense and other (income), net (133) (3,528) (1,231) (5,408) Depreciation and amortization 7,258 7,151 29,273 27,556 EBITDA 14,116 29,111 101,458 95,998 Third-party processing fees for hiring tax credits (6) 108 150 594 734 Amortization of software as a service assets (1) 810 720 2,985 2,709 Gain on deferred compensation assets (7) — 2,897 — 2,897 PeopleReady technology upgrade costs (3) 1,779 1,300 7,935 1,300 COVID-19 government subsidies — (91) — (4,222) Other adjustments, net (4) 4,193 1,970 4,027 4,404 Adjusted EBITDA $ 21,006 $ 36,057 $ 116,999 $ 103,820 Margin / % of revenue: Net income 1.3 % 3.2 % 2.8 % 2.8 % Adjusted EBITDA 3.8 % 5.8 % 5.2 % 4.8 %

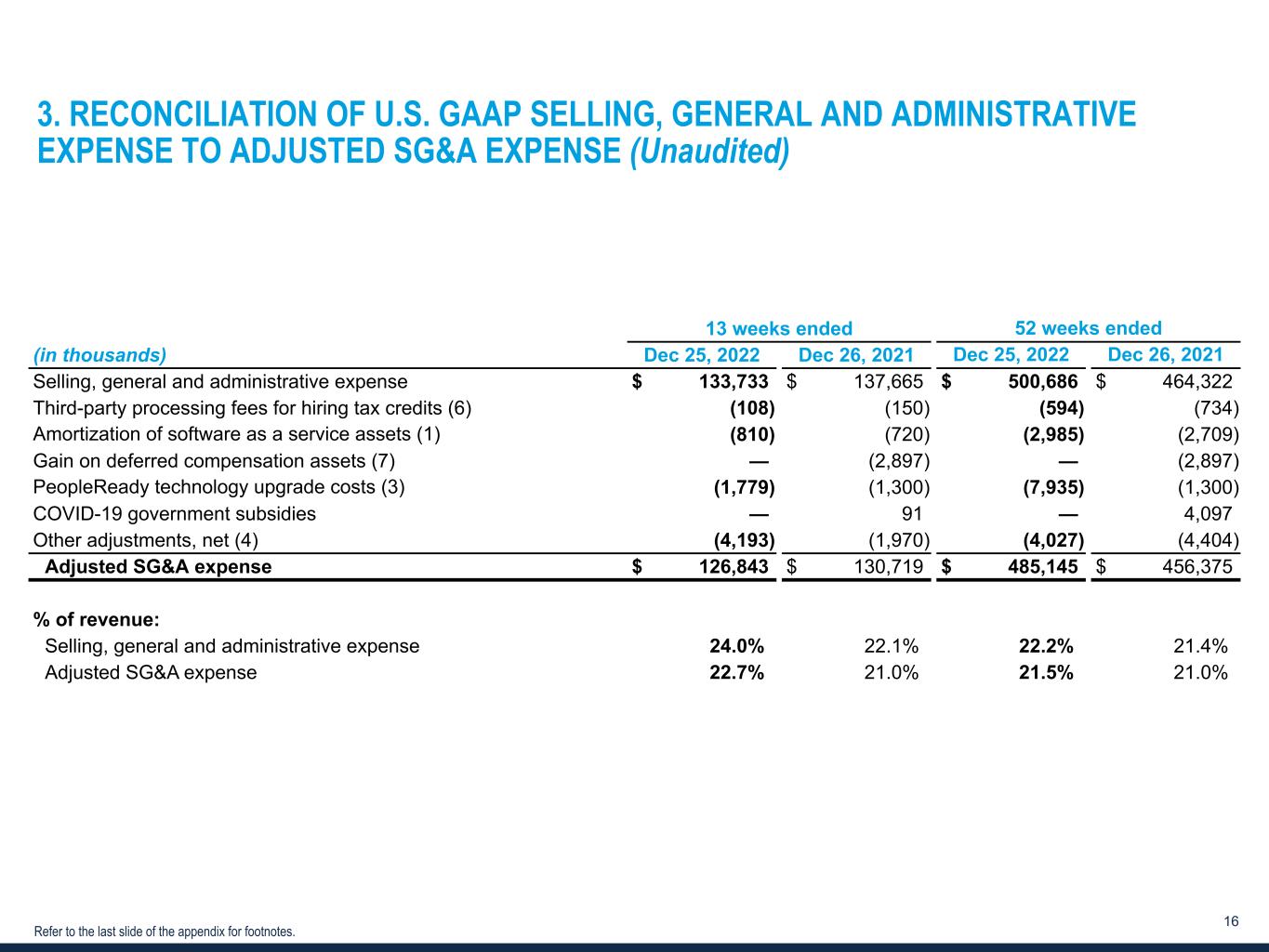

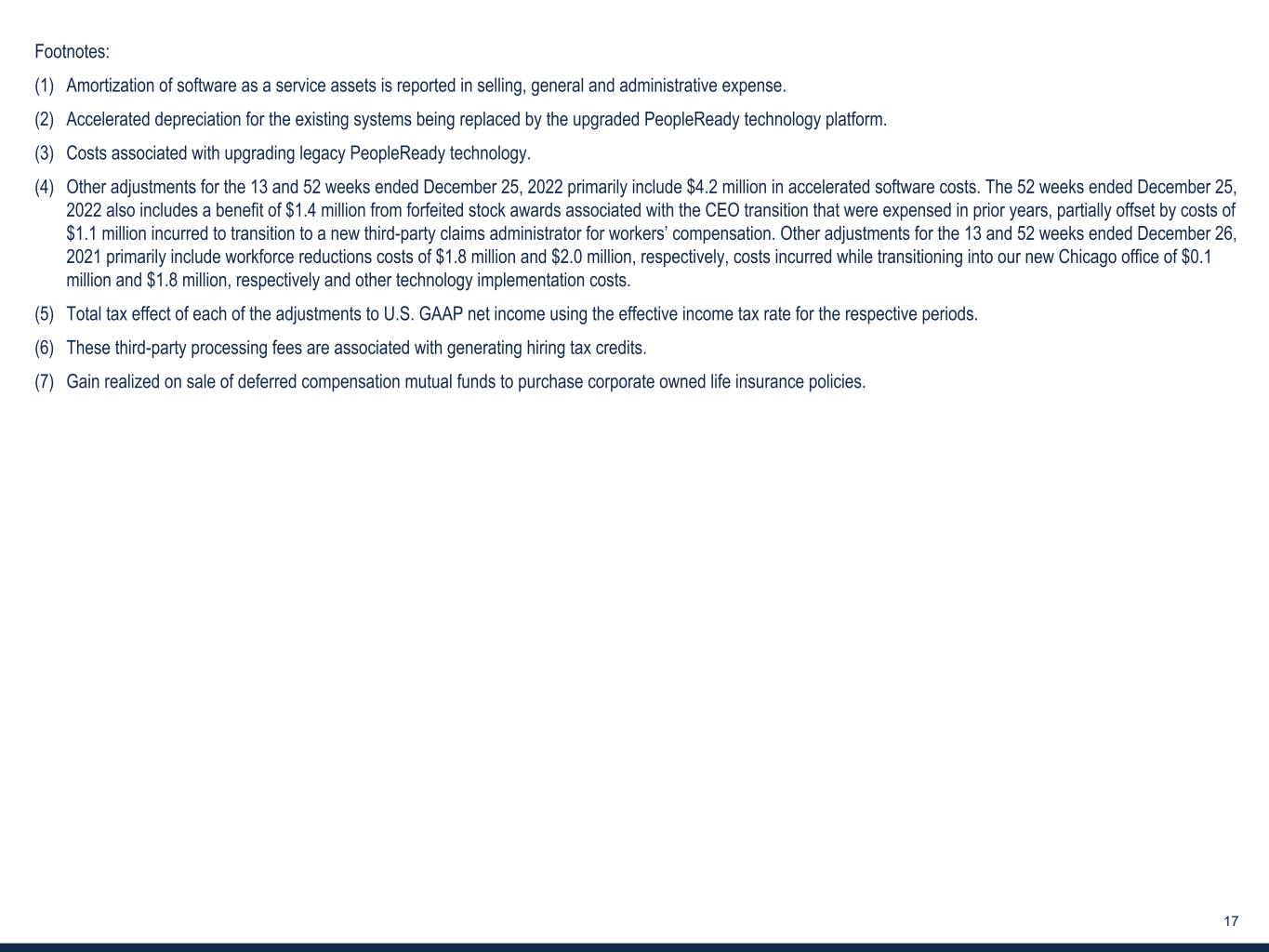

www.TrueBlue.c om 16 Refer to the last slide of the appendix for footnotes. 3. RECONCILIATION OF U.S. GAAP SELLING, GENERAL AND ADMINISTRATIVE EXPENSE TO ADJUSTED SG&A EXPENSE (Unaudited) 13 weeks ended 52 weeks ended (in thousands) Dec 25, 2022 Dec 26, 2021 Dec 25, 2022 Dec 26, 2021 Selling, general and administrative expense $ 133,733 $ 137,665 $ 500,686 $ 464,322 Third-party processing fees for hiring tax credits (6) (108) (150) (594) (734) Amortization of software as a service assets (1) (810) (720) (2,985) (2,709) Gain on deferred compensation assets (7) — (2,897) — (2,897) PeopleReady technology upgrade costs (3) (1,779) (1,300) (7,935) (1,300) COVID-19 government subsidies — 91 — 4,097 Other adjustments, net (4) (4,193) (1,970) (4,027) (4,404) Adjusted SG&A expense $ 126,843 $ 130,719 $ 485,145 $ 456,375 % of revenue: Selling, general and administrative expense 24.0 % 22.1 % 22.2 % 21.4 % Adjusted SG&A expense 22.7 % 21.0 % 21.5 % 21.0 %

www.TrueBlue.c om 17 Footnotes: (1) Amortization of software as a service assets is reported in selling, general and administrative expense. (2) Accelerated depreciation for the existing systems being replaced by the upgraded PeopleReady technology platform. (3) Costs associated with upgrading legacy PeopleReady technology. (4) Other adjustments for the 13 and 52 weeks ended December 25, 2022 primarily include $4.2 million in accelerated software costs. The 52 weeks ended December 25, 2022 also includes a benefit of $1.4 million from forfeited stock awards associated with the CEO transition that were expensed in prior years, partially offset by costs of $1.1 million incurred to transition to a new third-party claims administrator for workers’ compensation. Other adjustments for the 13 and 52 weeks ended December 26, 2021 primarily include workforce reductions costs of $1.8 million and $2.0 million, respectively, costs incurred while transitioning into our new Chicago office of $0.1 million and $1.8 million, respectively and other technology implementation costs. (5) Total tax effect of each of the adjustments to U.S. GAAP net income using the effective income tax rate for the respective periods. (6) These third-party processing fees are associated with generating hiring tax credits. (7) Gain realized on sale of deferred compensation mutual funds to purchase corporate owned life insurance policies.