Q1 2022 Earnings April 2022

www.TrueBlue.c om 2 Forward-looking statements and non-GAAP financial measures This document contains forward-looking statements relating to our plans and expectations including, without limitation, statements regarding the future performance and operations of our business, and expected growth from our digital investments, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this release and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions, (2) the continued impact of COVID-19 and related economic impact and governmental response, (3) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (4) our ability to attract and retain clients, (5) our ability to maintain profit margins, (6) our ability to successfully execute on business strategies to further digitalize our business model, (7) the timing and amount of common stock repurchases, if any, which will be determined at management’s discretion and depend upon several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities, (8) new laws, regulations, and government incentives that could affect our operations or financial results, (9) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, and (10) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. In addition, we use several non-GAAP financial measures when presenting our financial results in this document. Please refer to the reconciliations between our GAAP and non-GAAP financial measures in the appendix to this presentation and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated.

www.TrueBlue.c om 3 Q1 2022 Overview Total revenue +20% - fourth consecutive quarter of double-digit growth ▪ Revenue growth across all three segments ▪ Rising bill rates, improving worker supply and higher same client revenue Net income was $11 million v. $7 million in Q1 2021 ▪ Net income margin +40 bps ▪ Gross margin was +130 bps primarily from favorable bill / pay spreads Adjusted EBITDA1 was $23 million v. $13 million in Q1 2021 ▪ Adjusted EBITDA margin +120 bps Meaningful return of capital to shareholders ▪ $36 million in share repurchases 1 Refer to the appendix to this presentation for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

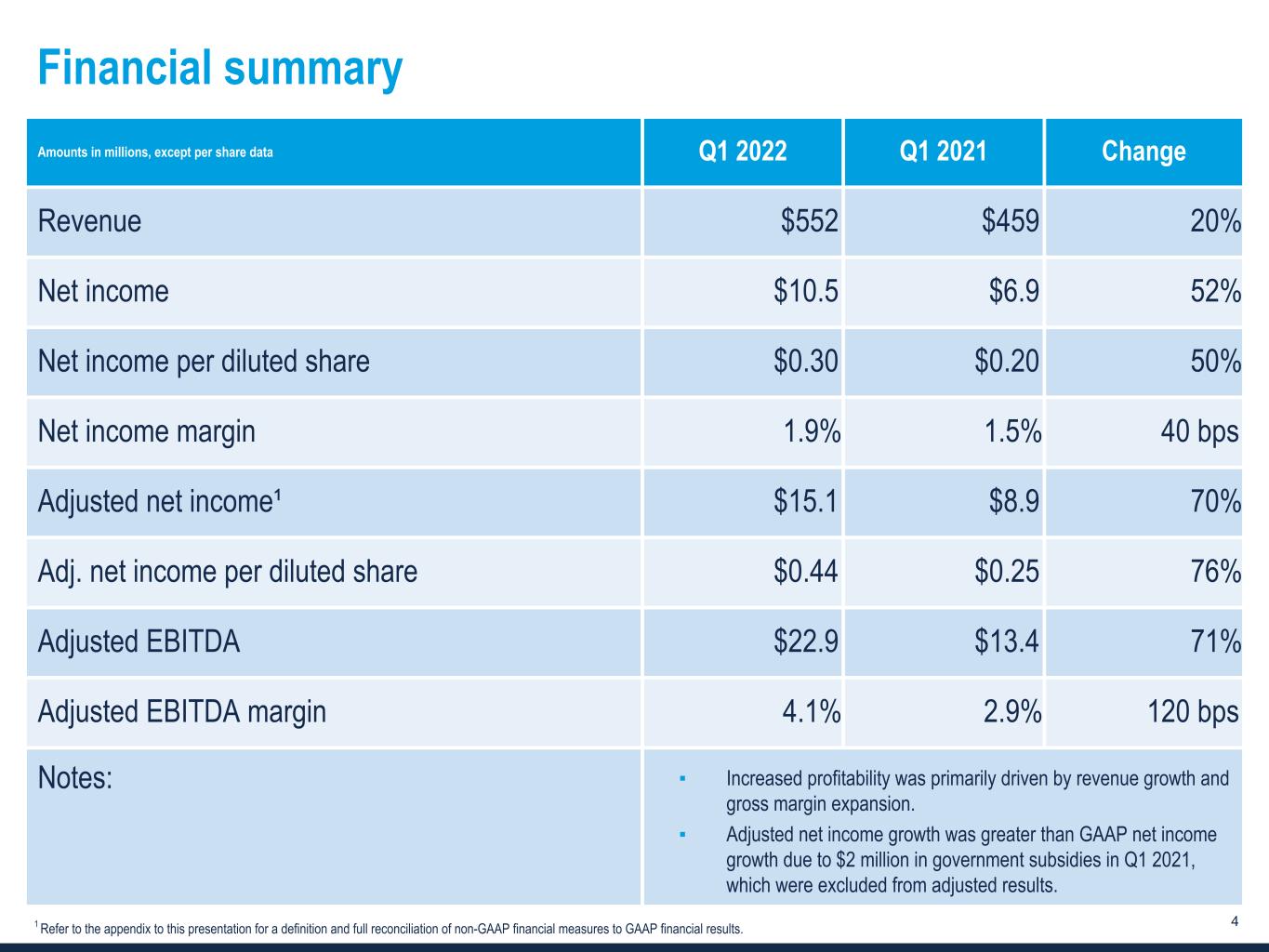

www.TrueBlue.c om 4 Financial summary 1 Refer to the appendix to this presentation for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. Amounts in millions, except per share data Q1 2022 Q1 2021 Change Revenue $552 $459 20 % Net income $10.5 $6.9 52 % Net income per diluted share $0.30 $0.20 50 % Net income margin 1.9 % 1.5 % 40 bps Adjusted net income¹ $15.1 $8.9 70 % Adj. net income per diluted share $0.44 $0.25 76 % Adjusted EBITDA $22.9 $13.4 71 % Adjusted EBITDA margin 4.1 % 2.9 % 120 bps Notes: ▪ Increased profitability was primarily driven by revenue growth and gross margin expansion. ▪ Adjusted net income growth was greater than GAAP net income growth due to $2 million in government subsidies in Q1 2021, which were excluded from adjusted results.

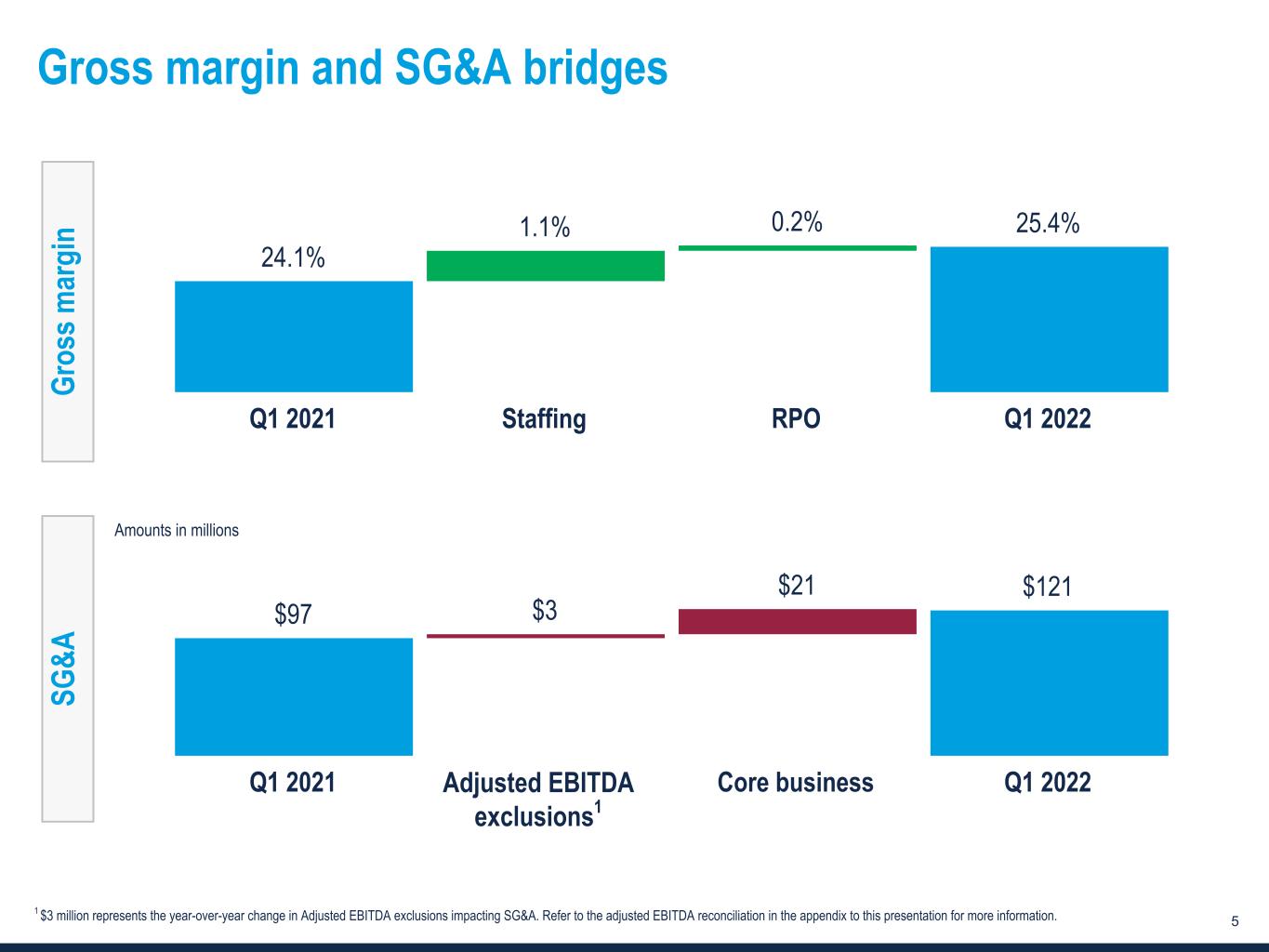

www.TrueBlue.c om 5 Gross margin and SG&A bridges Amounts in millions Gr os s m ar gi n SG &A $97 $3 $21 $121 Q1 2021 Core business Q1 2022 24.1% 1.1% 0.2% 25.4% Q1 2021 Staffing RPO Q1 2022 Adjusted EBITDA exclusions1 1 $3 million represents the year-over-year change in Adjusted EBITDA exclusions impacting SG&A. Refer to the adjusted EBITDA reconciliation in the appendix to this presentation for more information.

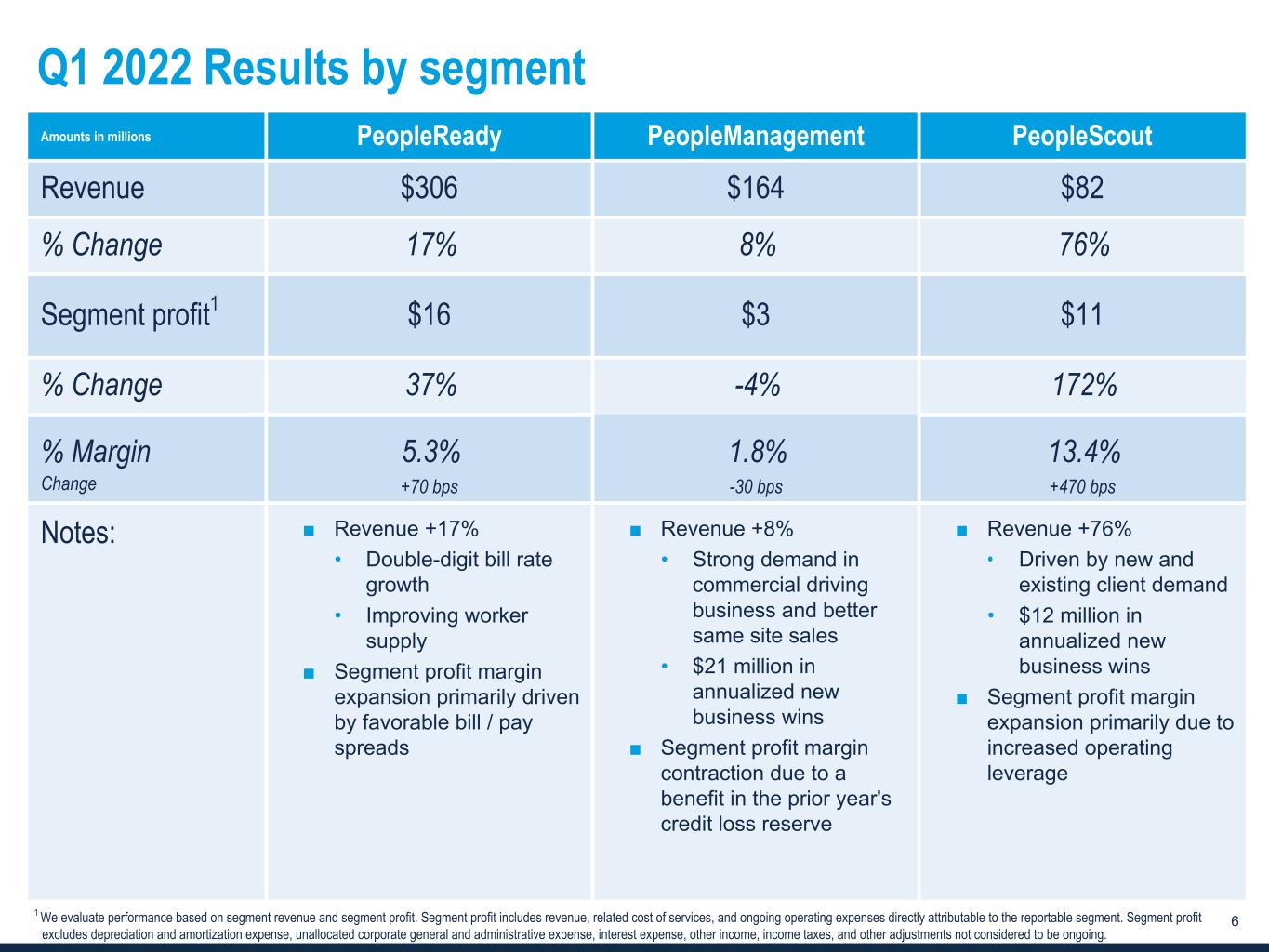

www.TrueBlue.c om 6 Q1 2022 Results by segment Amounts in millions PeopleReady PeopleManagement PeopleScout Revenue $306 $164 $82 % Change 17% 8% 76% Segment profit1 $16 $3 $11 % Change 37% -4% 172% % Margin 5.3% 1.8% 13.4% Change +70 bps -30 bps +470 bps Notes: ■ Revenue +17% • Double-digit bill rate growth • Improving worker supply ■ Segment profit margin expansion primarily driven by favorable bill / pay spreads ■ Revenue +8% • Strong demand in commercial driving business and better same site sales • $21 million in annualized new business wins ■ Segment profit margin contraction due to a benefit in the prior year's credit loss reserve ■ Revenue +76% • Driven by new and existing client demand • $12 million in annualized new business wins ■ Segment profit margin expansion primarily due to increased operating leverage 1 We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit excludes depreciation and amortization expense, unallocated corporate general and administrative expense, interest expense, other income, income taxes, and other adjustments not considered to be ongoing.

www.TrueBlue.c om 7 Strategy highlights Leverage technology and industry leading position to grow market share and enhance efficiency ▪ Focus sales and marketing efforts to capitalize on industry trend towards outsourcing ▪ Leverage our strong brand; independently ranked as a market leader ▪ Expand technology offering to improve client delivery and recruiting efficiency ▪ Digitalize our business model to gain market share from smaller and less capitalized competitors and reduce expenses ▪ Drive higher client usage of JobStackTM, our industry-leading technology, to accelerate revenue growth ▪ Improve client and candidate experience using centralized services combined with digital onboarding platforms ▪ Continue momentum on new customer wins through strong execution of sales initiatives ▪ Leverage recent sales resource investments to expand into under- penetrated geographic markets ▪ Invest in client and associate care in addition to retention programs

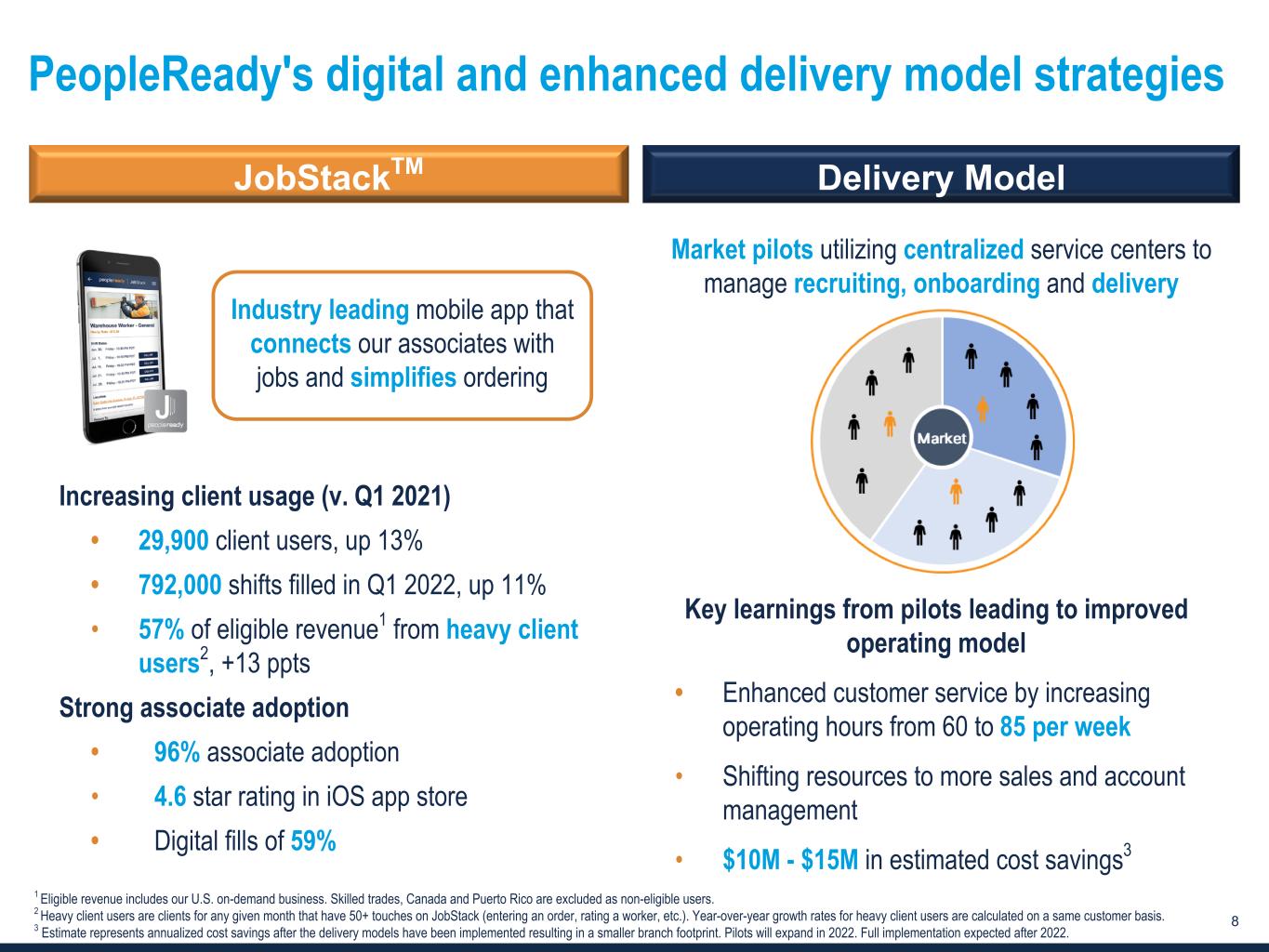

www.TrueBlue.c om 8 PeopleReady's digital and enhanced delivery model strategies Industry leading mobile app that connects our associates with jobs and simplifies ordering Market pilots utilizing centralized service centers to manage recruiting, onboarding and delivery Increasing client usage (v. Q1 2021) • 29,900 client users, up 13% • 792,000 shifts filled in Q1 2022, up 11% • 57% of eligible revenue1 from heavy client users2, +13 ppts Strong associate adoption • 96% associate adoption • 4.6 star rating in iOS app store • Digital fills of 59% Key learnings from pilots leading to improved operating model • Enhanced customer service by increasing operating hours from 60 to 85 per week • Shifting resources to more sales and account management • $10M - $15M in estimated cost savings3 JobStackTM Delivery Model 1 Eligible revenue includes our U.S. on-demand business. Skilled trades, Canada and Puerto Rico are excluded as non-eligible users. 2 Heavy client users are clients for any given month that have 50+ touches on JobStack (entering an order, rating a worker, etc.). Year-over-year growth rates for heavy client users are calculated on a same customer basis. 3 Estimate represents annualized cost savings after the delivery models have been implemented resulting in a smaller branch footprint. Pilots will expand in 2022. Full implementation expected after 2022.

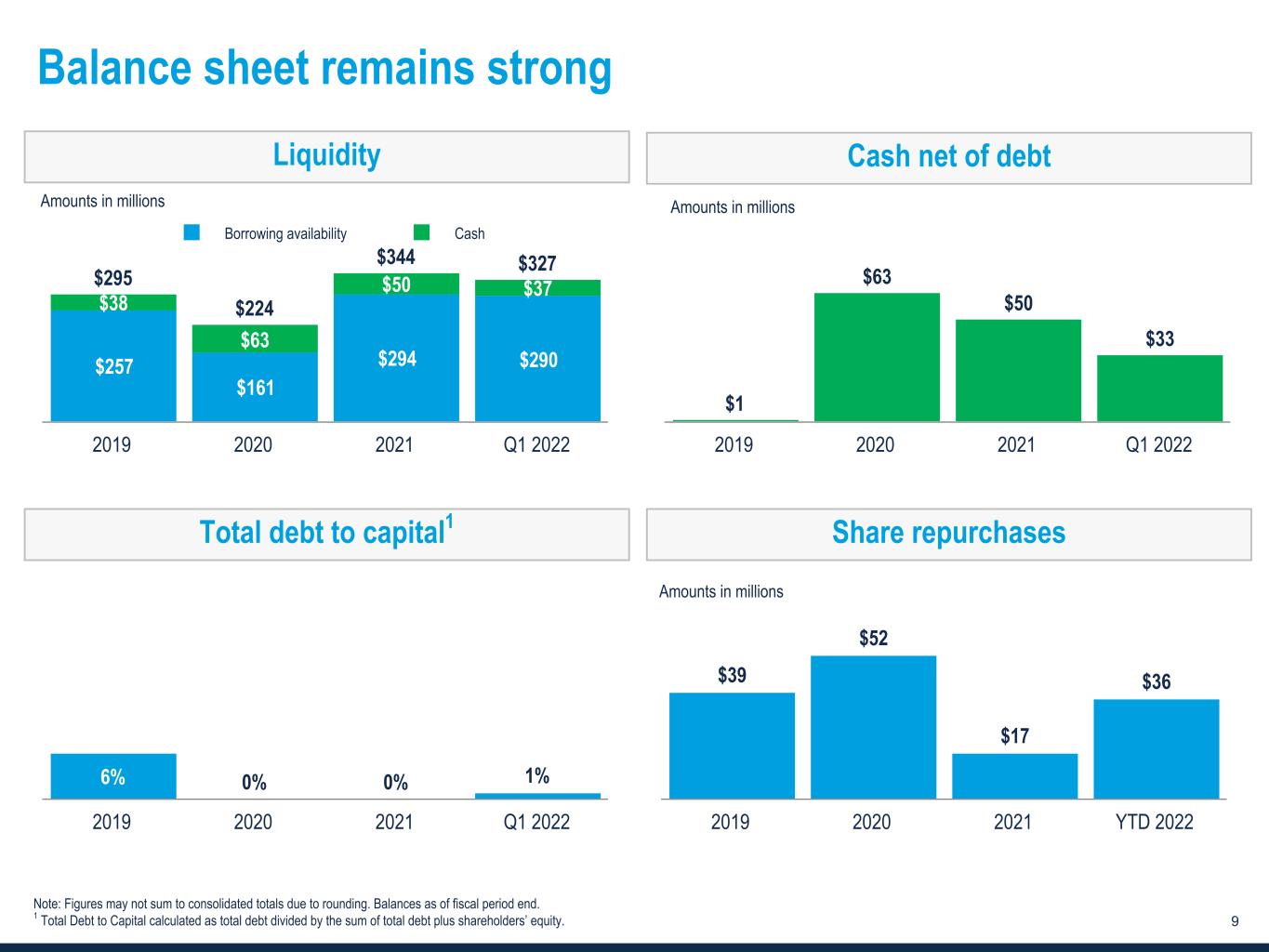

www.TrueBlue.c om 9 $1 $63 $50 $33 2019 2020 2021 Q1 2022 6% 0% 0% 1% 2019 2020 2021 Q1 2022 $295 $224 $344 $327 $257 $161 $294 $290 $38 $63 $50 $37 Borrowing availability Cash 2019 2020 2021 Q1 2022 Balance sheet remains strong Amounts in millions Note: Figures may not sum to consolidated totals due to rounding. Balances as of fiscal period end. 1 Total Debt to Capital calculated as total debt divided by the sum of total debt plus shareholders’ equity. Liquidity Amounts in millions Share repurchasesTotal debt to capital1 Cash net of debt $39 $52 $17 $36 2019 2020 2021 YTD 2022 Amounts in millions

Outlook

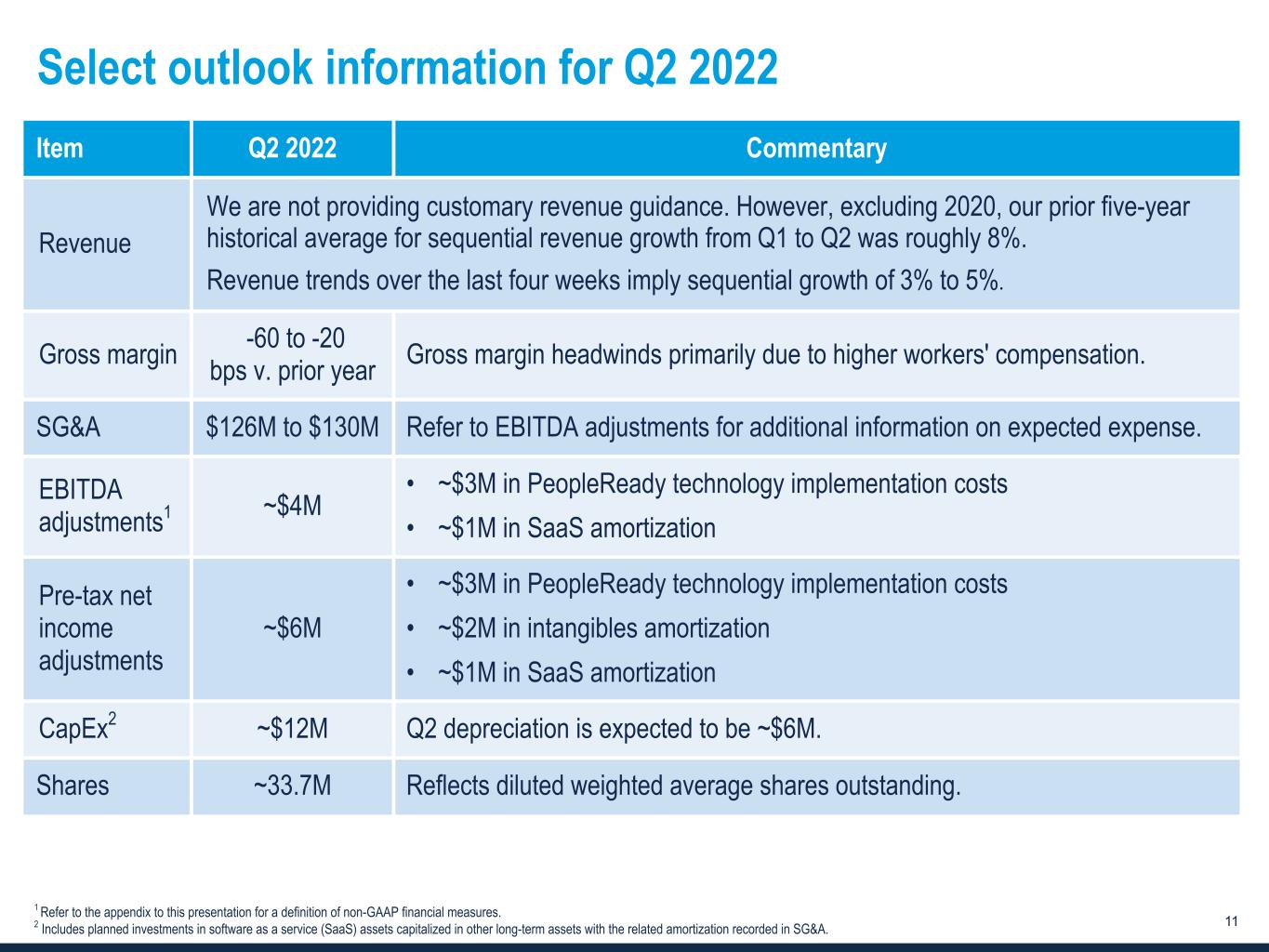

www.TrueBlue.c om 11 Select outlook information for Q2 2022 Item Q2 2022 Commentary Revenue We are not providing customary revenue guidance. However, excluding 2020, our prior five-year historical average for sequential revenue growth from Q1 to Q2 was roughly 8%. Revenue trends over the last four weeks imply sequential growth of 3% to 5%. Gross margin -60 to -20 bps v. prior year Gross margin headwinds primarily due to higher workers' compensation. SG&A $126M to $130M Refer to EBITDA adjustments for additional information on expected expense. EBITDA adjustments1 ~$4M • ~$3M in PeopleReady technology implementation costs • ~$1M in SaaS amortization Pre-tax net income adjustments ~$6M • ~$3M in PeopleReady technology implementation costs • ~$2M in intangibles amortization • ~$1M in SaaS amortization CapEx2 ~$12M Q2 depreciation is expected to be ~$6M. Shares ~33.7M Reflects diluted weighted average shares outstanding. 1 Refer to the appendix to this presentation for a definition of non-GAAP financial measures. 2 Includes planned investments in software as a service (SaaS) assets capitalized in other long-term assets with the related amortization recorded in SG&A.

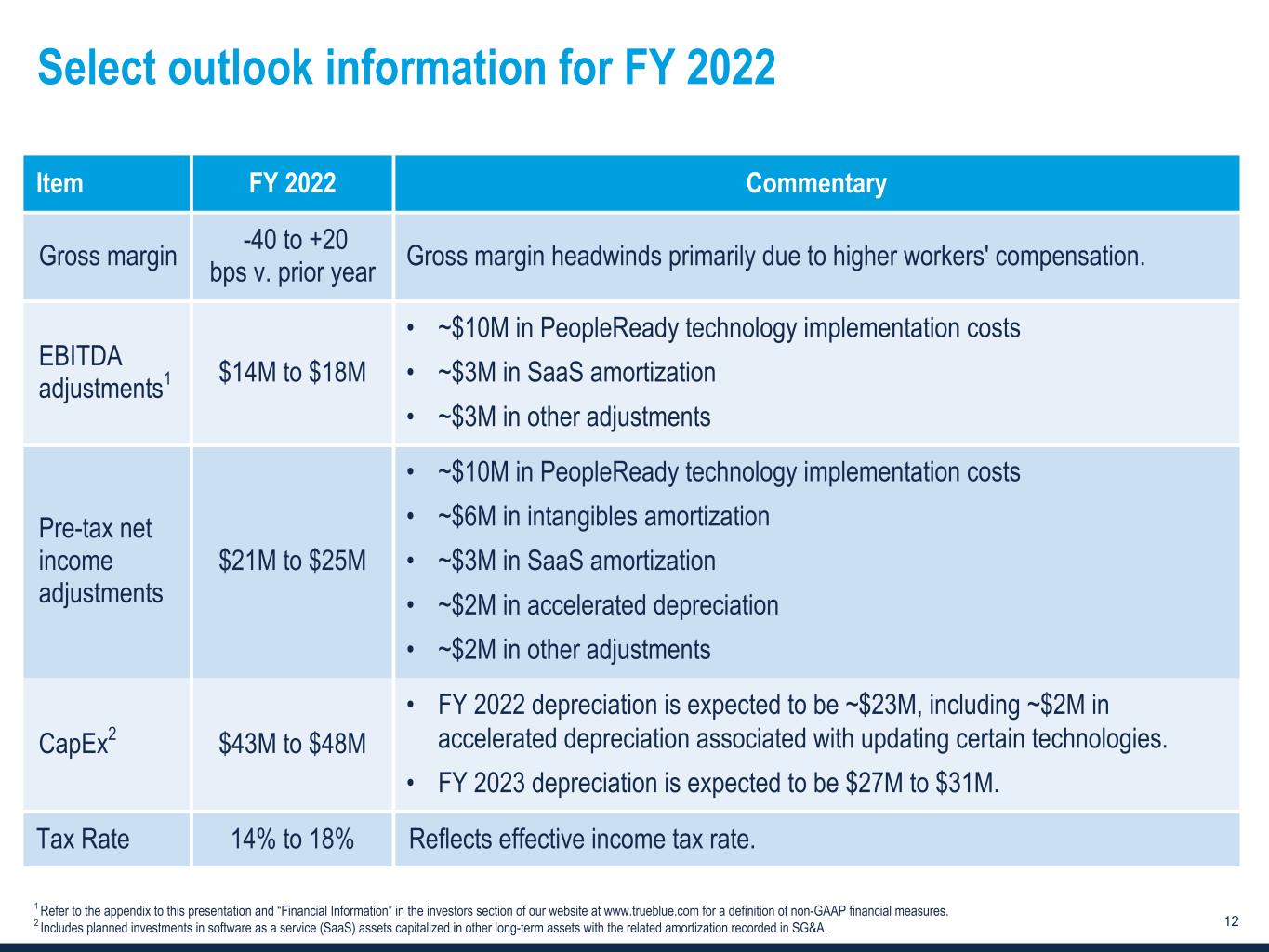

www.TrueBlue.c om 12 Select outlook information for FY 2022 1 Refer to the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition of non-GAAP financial measures. 2 Includes planned investments in software as a service (SaaS) assets capitalized in other long-term assets with the related amortization recorded in SG&A. Item FY 2022 Commentary Gross margin -40 to +20 bps v. prior year Gross margin headwinds primarily due to higher workers' compensation. EBITDA adjustments1 $14M to $18M • ~$10M in PeopleReady technology implementation costs • ~$3M in SaaS amortization • ~$3M in other adjustments Pre-tax net income adjustments $21M to $25M • ~$10M in PeopleReady technology implementation costs • ~$6M in intangibles amortization • ~$3M in SaaS amortization • ~$2M in accelerated depreciation • ~$2M in other adjustments CapEx2 $43M to $48M • FY 2022 depreciation is expected to be ~$23M, including ~$2M in accelerated depreciation associated with updating certain technologies. • FY 2023 depreciation is expected to be $27M to $31M. Tax Rate 14% to 18% Reflects effective income tax rate.

Appendix

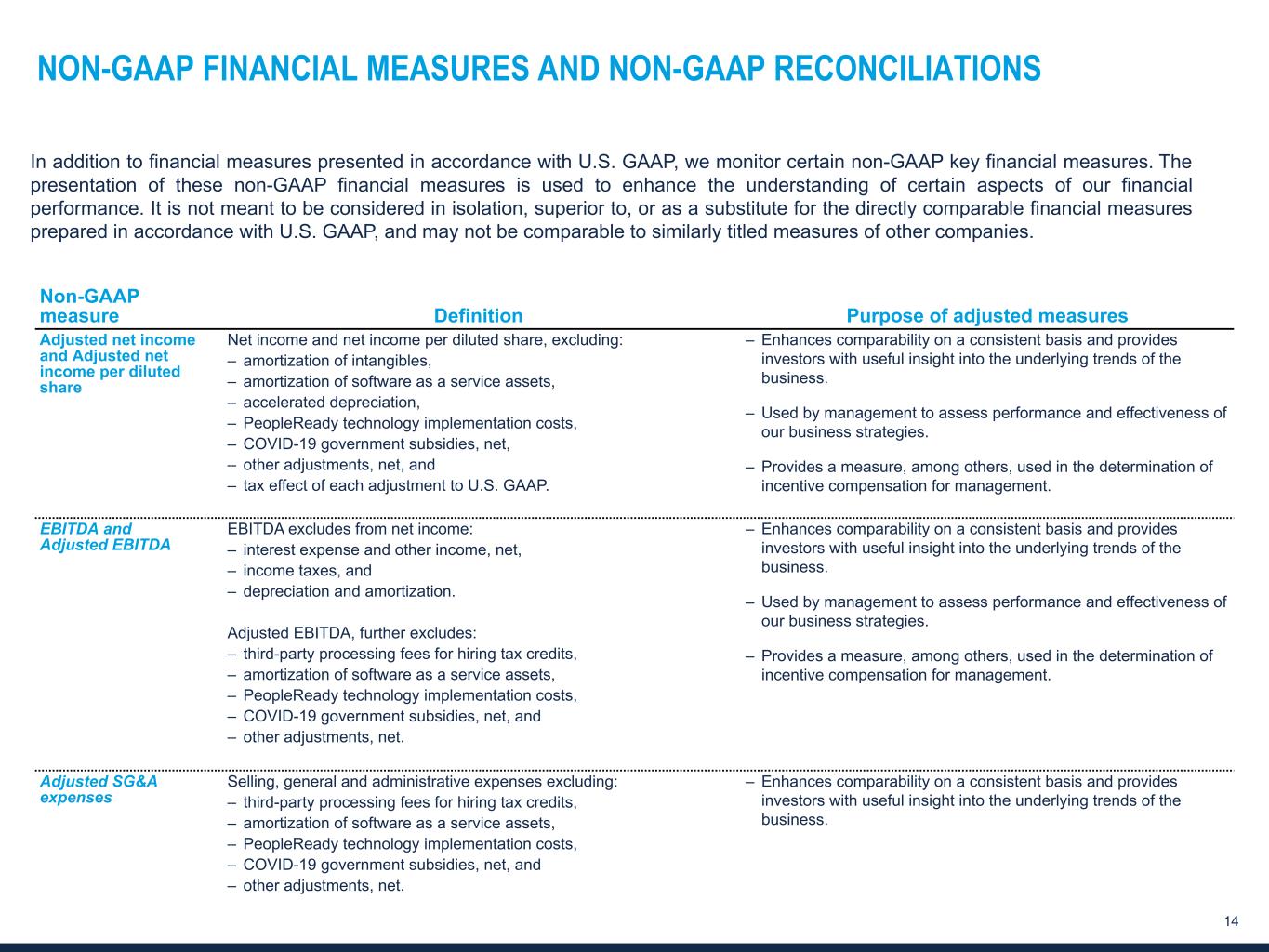

www.TrueBlue.c om 14 NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP measure Definition Purpose of adjusted measures Adjusted net income and Adjusted net income per diluted share Net income and net income per diluted share, excluding: – amortization of intangibles, – amortization of software as a service assets, – accelerated depreciation, – PeopleReady technology implementation costs, – COVID-19 government subsidies, net, – other adjustments, net, and – tax effect of each adjustment to U.S. GAAP. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. – Used by management to assess performance and effectiveness of our business strategies. – Provides a measure, among others, used in the determination of incentive compensation for management. EBITDA and Adjusted EBITDA EBITDA excludes from net income: – interest expense and other income, net, – income taxes, and – depreciation and amortization. Adjusted EBITDA, further excludes: – third-party processing fees for hiring tax credits, – amortization of software as a service assets, – PeopleReady technology implementation costs, – COVID-19 government subsidies, net, and – other adjustments, net. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. – Used by management to assess performance and effectiveness of our business strategies. – Provides a measure, among others, used in the determination of incentive compensation for management. Adjusted SG&A expenses Selling, general and administrative expenses excluding: – third-party processing fees for hiring tax credits, – amortization of software as a service assets, – PeopleReady technology implementation costs, – COVID-19 government subsidies, net, and – other adjustments, net. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business.

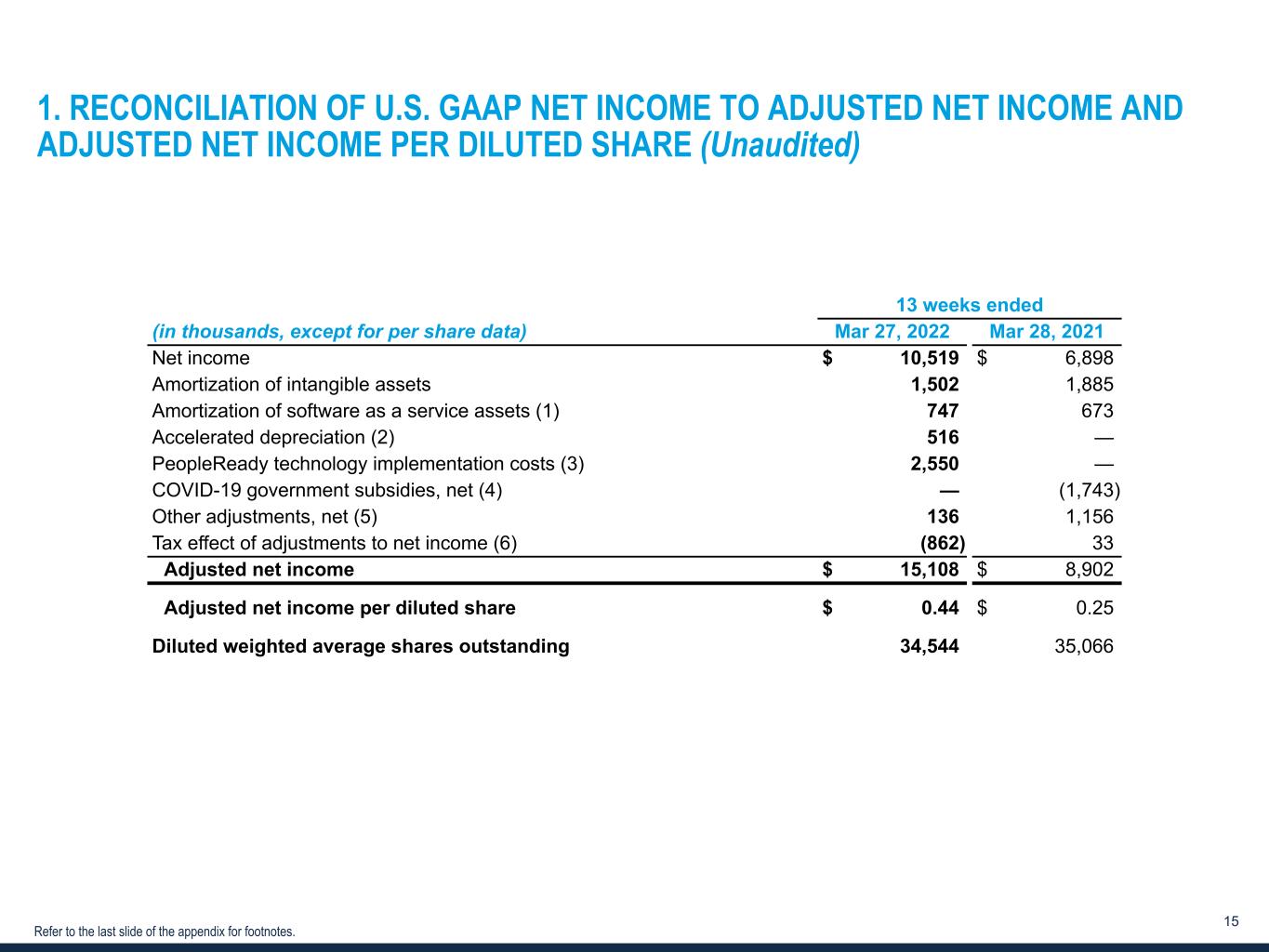

www.TrueBlue.c om 15 1. RECONCILIATION OF U.S. GAAP NET INCOME TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME PER DILUTED SHARE (Unaudited) Refer to the last slide of the appendix for footnotes. 13 weeks ended (in thousands, except for per share data) Mar 27, 2022 Mar 28, 2021 Net income $ 10,519 $ 6,898 Amortization of intangible assets 1,502 1,885 Amortization of software as a service assets (1) 747 673 Accelerated depreciation (2) 516 — PeopleReady technology implementation costs (3) 2,550 — COVID-19 government subsidies, net (4) — (1,743) Other adjustments, net (5) 136 1,156 Tax effect of adjustments to net income (6) (862) 33 Adjusted net income $ 15,108 $ 8,902 Adjusted net income per diluted share $ 0.44 $ 0.25 Diluted weighted average shares outstanding 34,544 35,066

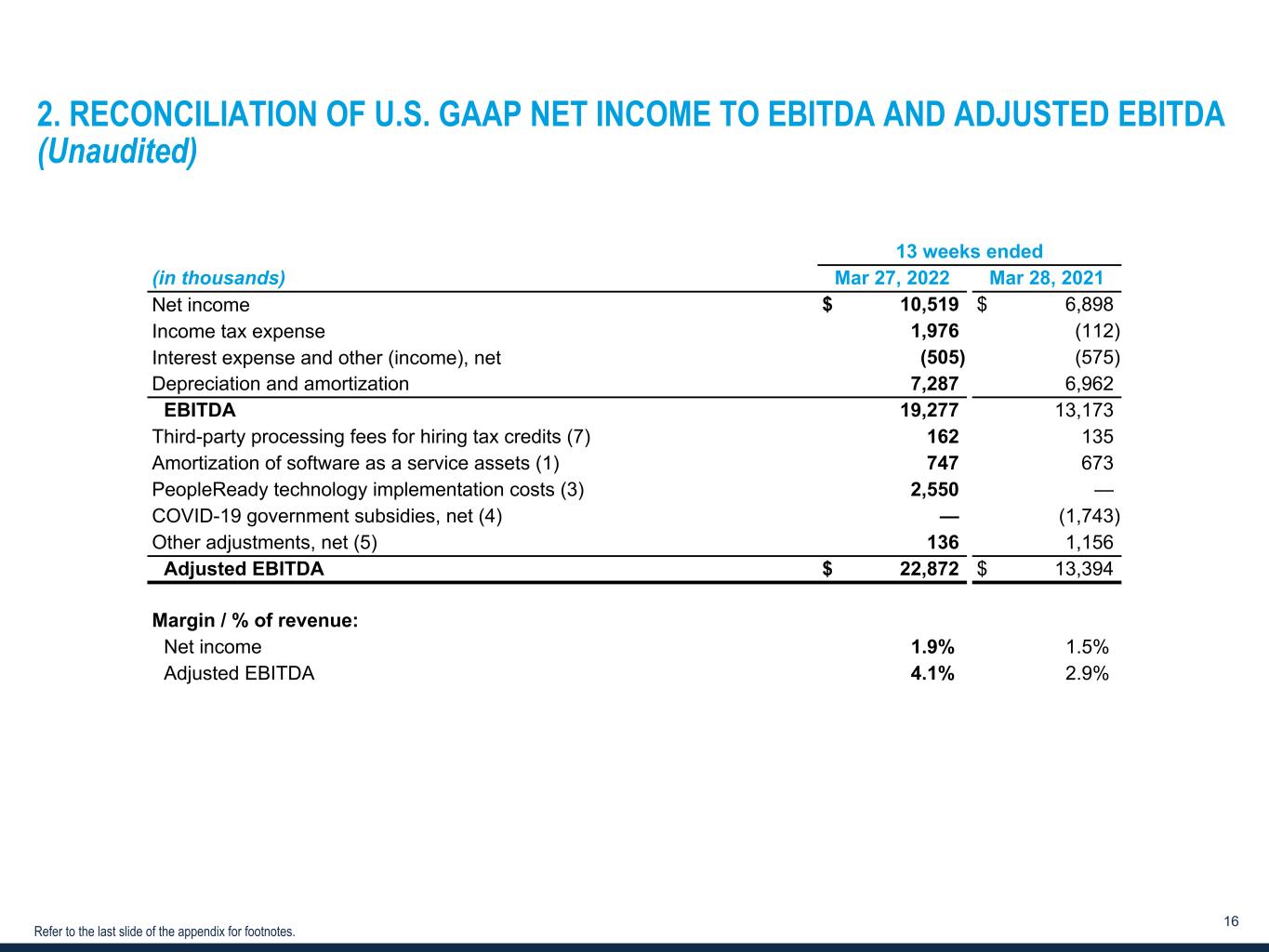

www.TrueBlue.c om 16 Refer to the last slide of the appendix for footnotes. 2. RECONCILIATION OF U.S. GAAP NET INCOME TO EBITDA AND ADJUSTED EBITDA (Unaudited) 13 weeks ended (in thousands) Mar 27, 2022 Mar 28, 2021 Net income $ 10,519 $ 6,898 Income tax expense 1,976 (112) Interest expense and other (income), net (505) (575) Depreciation and amortization 7,287 6,962 EBITDA 19,277 13,173 Third-party processing fees for hiring tax credits (7) 162 135 Amortization of software as a service assets (1) 747 673 PeopleReady technology implementation costs (3) 2,550 — COVID-19 government subsidies, net (4) — (1,743) Other adjustments, net (5) 136 1,156 Adjusted EBITDA $ 22,872 $ 13,394 Margin / % of revenue: Net income 1.9 % 1.5 % Adjusted EBITDA 4.1 % 2.9 %

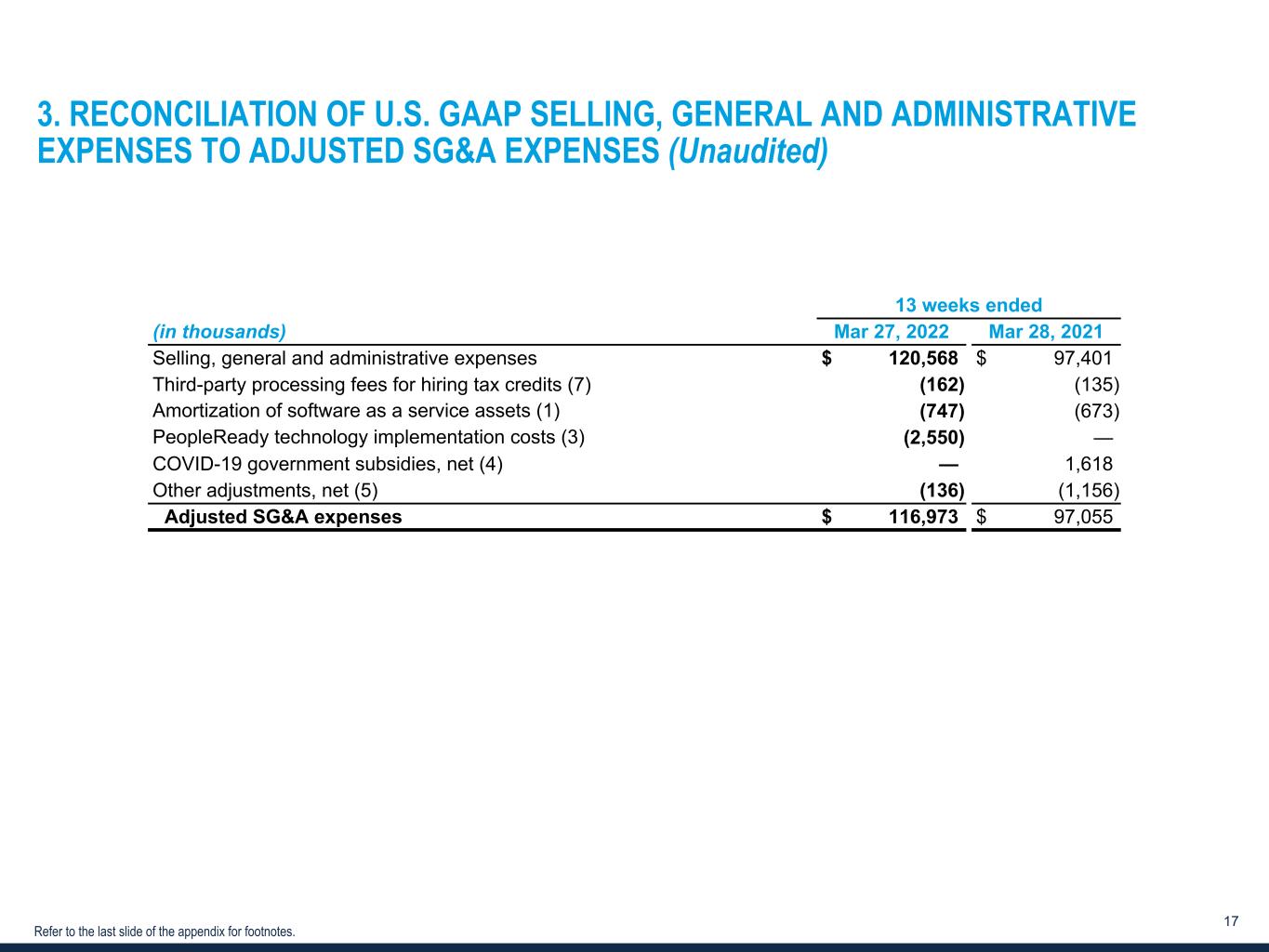

www.TrueBlue.c om 17 Refer to the last slide of the appendix for footnotes. 3. RECONCILIATION OF U.S. GAAP SELLING, GENERAL AND ADMINISTRATIVE EXPENSES TO ADJUSTED SG&A EXPENSES (Unaudited) 13 weeks ended (in thousands) Mar 27, 2022 Mar 28, 2021 Selling, general and administrative expenses $ 120,568 $ 97,401 Third-party processing fees for hiring tax credits (7) (162) (135) Amortization of software as a service assets (1) (747) (673) PeopleReady technology implementation costs (3) (2,550) — COVID-19 government subsidies, net (4) — 1,618 Other adjustments, net (5) (136) (1,156) Adjusted SG&A expenses $ 116,973 $ 97,055

www.TrueBlue.c om 18 Footnotes: (1) Amortization of software as a service assets is reported in selling, general and administrative expense. (2) Accelerated depreciation for the existing systems being replaced by the new PeopleReady technology platform. (3) Implementation costs associated with upgrading legacy PeopleReady technology with a new platform. (4) Net impact of COVID-19 related government subsidies of $1.7 million ($0.1 million in cost of services and $1.6 million in selling, general and administrative expenses). (5) Other adjustments for the 13 weeks ended March 27, 2022 include costs of $0.1 million incurred while transitioning to a new third party administrator for workers’ compensation. Other adjustments for the 13 weeks ended March 28, 2021 primarily include costs of $0.8 million incurred while transitioning into our new Chicago office. (6) Total tax effect of each of the adjustments to U.S. GAAP net income using the effective income tax rate for the respective periods. (7) These third-party processing fees are associated with generating hiring tax credits.