Investor Roadshow Presentation April 2022

Forward-looking statements and non-GAAP financial measures This document contains forward-looking statements relating to our plans and expectations including, without limitation, statements regarding the future performance and operations of our business, expected growth from our digital investments, and the expected amount and timing of any share repurchases, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this release and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions, (2) the continued impact of COVID-19 and related economic impact and governmental response, (3) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (4) our ability to attract and retain clients, (5) our ability to maintain profit margins, (6) our ability to successfully execute on business strategies to further digitalize our business model, (7) the timing and amount of common stock repurchases, if any, which will be determined at management’s discretion and depend upon several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities, (8) new laws, regulations, and government incentives that could affect our operations or financial results, (9) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, and (10) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. In addition, we use several non-GAAP financial measures when presenting our financial results in this document. Please refer to the reconciliations between our GAAP and non-GAAP financial measures in the appendix to this presentation and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated.

Investment highlights Return of Capital Market leader in U.S. blue collar staffing and global RPO with increasingly diverse service offerings Attractive growth potential from secular, cyclical and post-Covid recovery factors Strong balance sheet and cash flow to support stock buybacks Sound growth strategies applying industry leading digital technology to increase market share Experienced Leadership Team Deep human capital expertise with proven success at driving growth and delivering value to stakeholders

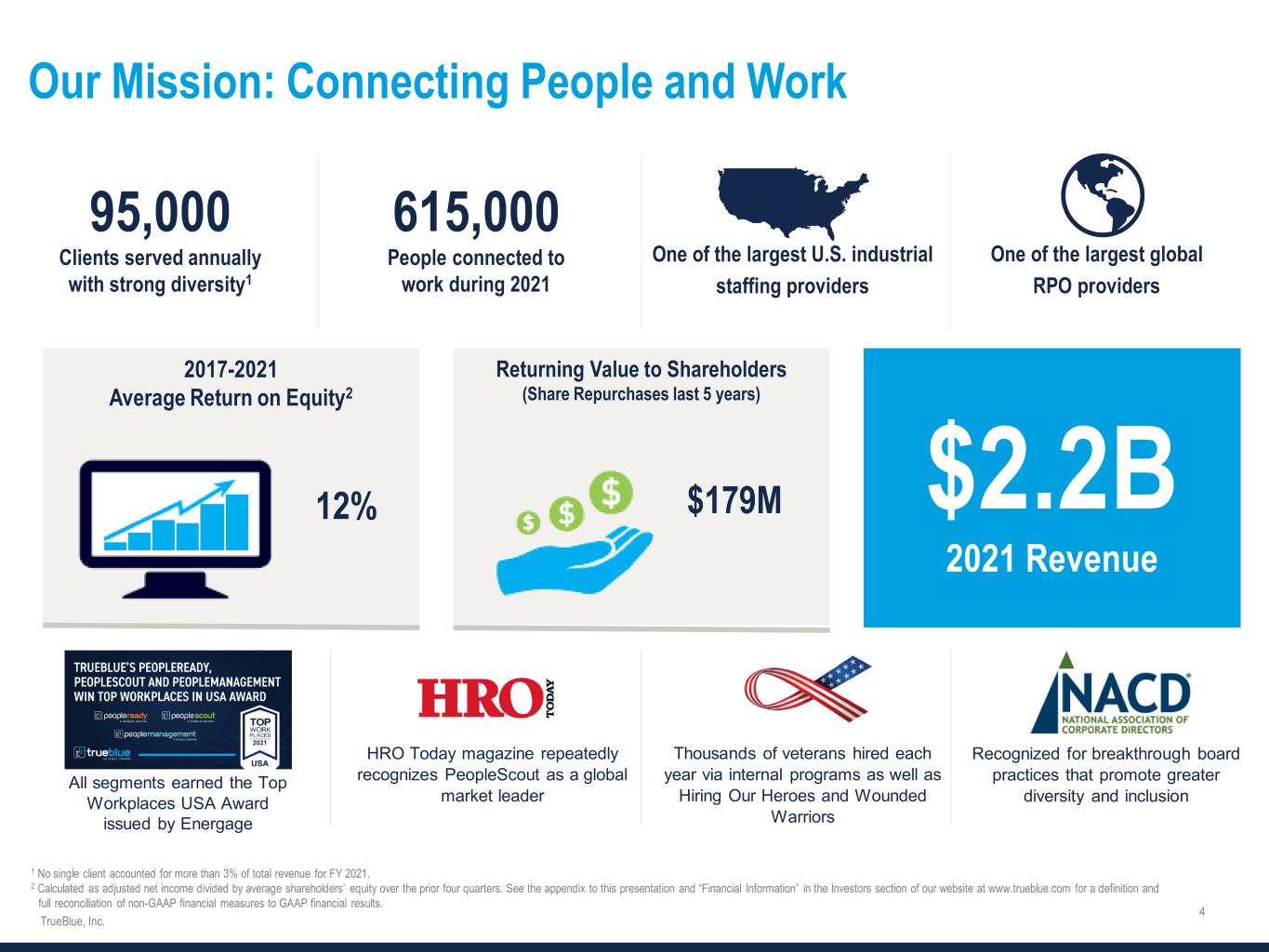

Our Mission: Connecting People and Work 95,000 Clients served annually with strong diversity1 615,000 People connected to work during 2021 One of the largest U.S. industrial staffing providers One of the largest global RPO providers Returning Value to Shareholders (Share Repurchases last 5 years) 2017-2021 Average Return on Equity2 $2.2B 2021 Revenue 12% $179M HRO Today magazine repeatedly recognizes PeopleScout as a global market leader Thousands of veterans hired each year via internal programs as well as Hiring Our Heroes and Wounded Warriors Recognized for breakthrough board practices that promote greater diversity and inclusion 1 No single client accounted for more than 3% of total revenue for FY 2021. 2 Calculated as adjusted net income divided by average shareholders’ equity over the prior four quarters. See the appendix to this presentation and “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. All segments earned the Top Workplaces USA Award issued by Energage

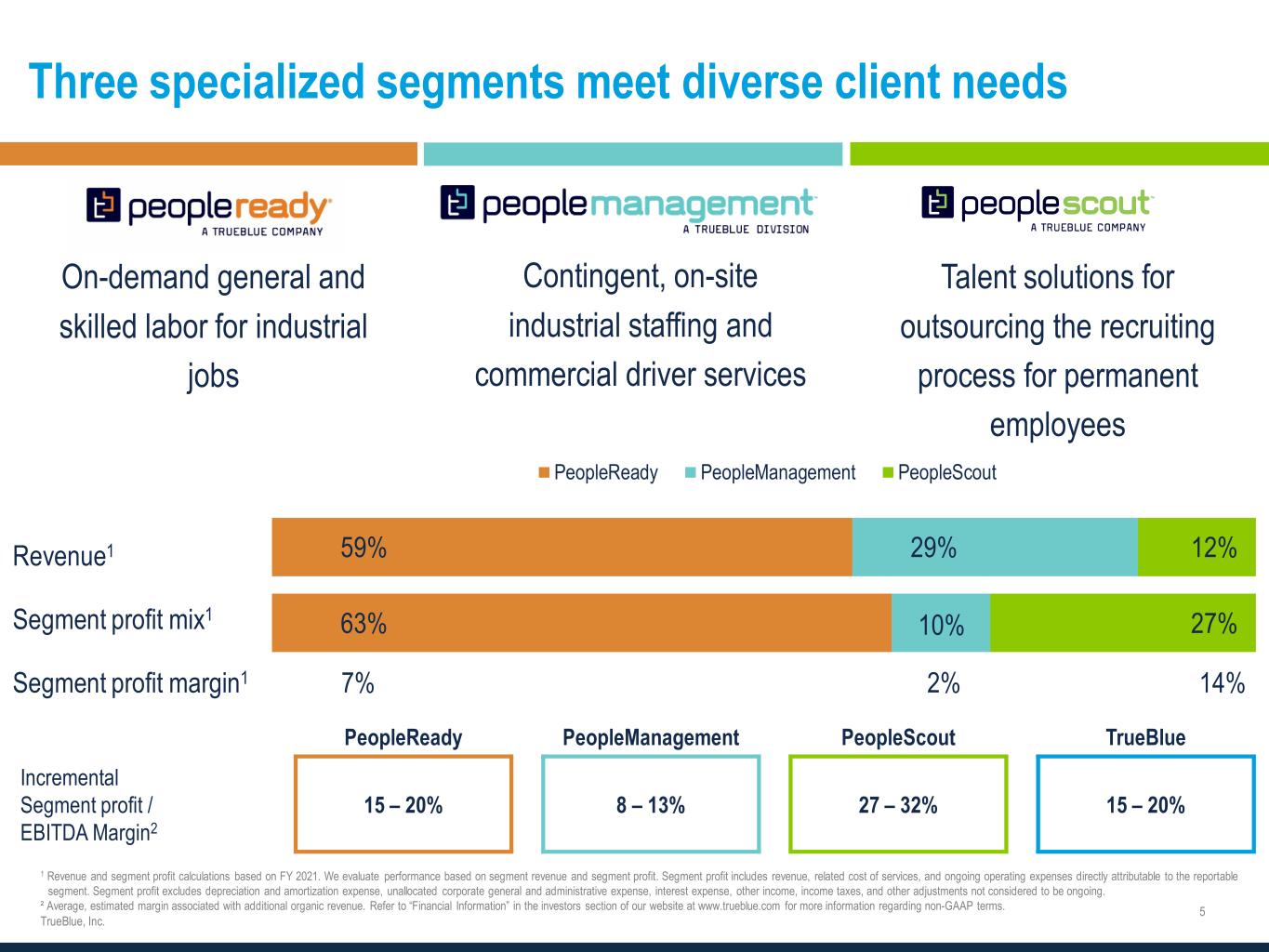

Revenue1 Segment profit mix1 Segment profit margin1 7% 2% 14% Three specialized segments meet diverse client needs On-demand general and skilled labor for industrial jobs Contingent, on-site industrial staffing and commercial driver services Talent solutions for outsourcing the recruiting process for permanent employees 1 Revenue and segment profit calculations based on FY 2021. We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit excludes depreciation and amortization expense, unallocated corporate general and administrative expense, interest expense, other income, income taxes, and other adjustments not considered to be ongoing. ² Average, estimated margin associated with additional organic revenue. Refer to “Financial Information” in the investors section of our website at www.trueblue.com for more information regarding non-GAAP terms. PeopleReady PeopleManagement PeopleScout TrueBlue Incremental Segment profit / EBITDA Margin2 15 – 20% 8 – 13% 27 – 32% 15 – 20% 59% 63% 29% 10% 12% 27% PeopleReady PeopleManagement PeopleScout

Solving workforce challenges Workforce Complexity Many factors, including globalization, the “gig” economy and diversity are changing the world of work requiring a disciplined approach to hiring. Artificial Intelligence Companies are seeking ways to become nimbler and more efficient Deploying AI to source human capital will be a requirement to compete. Remote Recruiting The worker supply chain is becoming increasingly decentralized. TrueBlue’s digital strategy connects people anywhere at any time. Workforce solutions are in high demand as businesses increasingly turn to human capital experts to solve talent challenges. A robust value proposition with specialized, digital solutions for staffing, workforce management and recruitment process outsourcing.

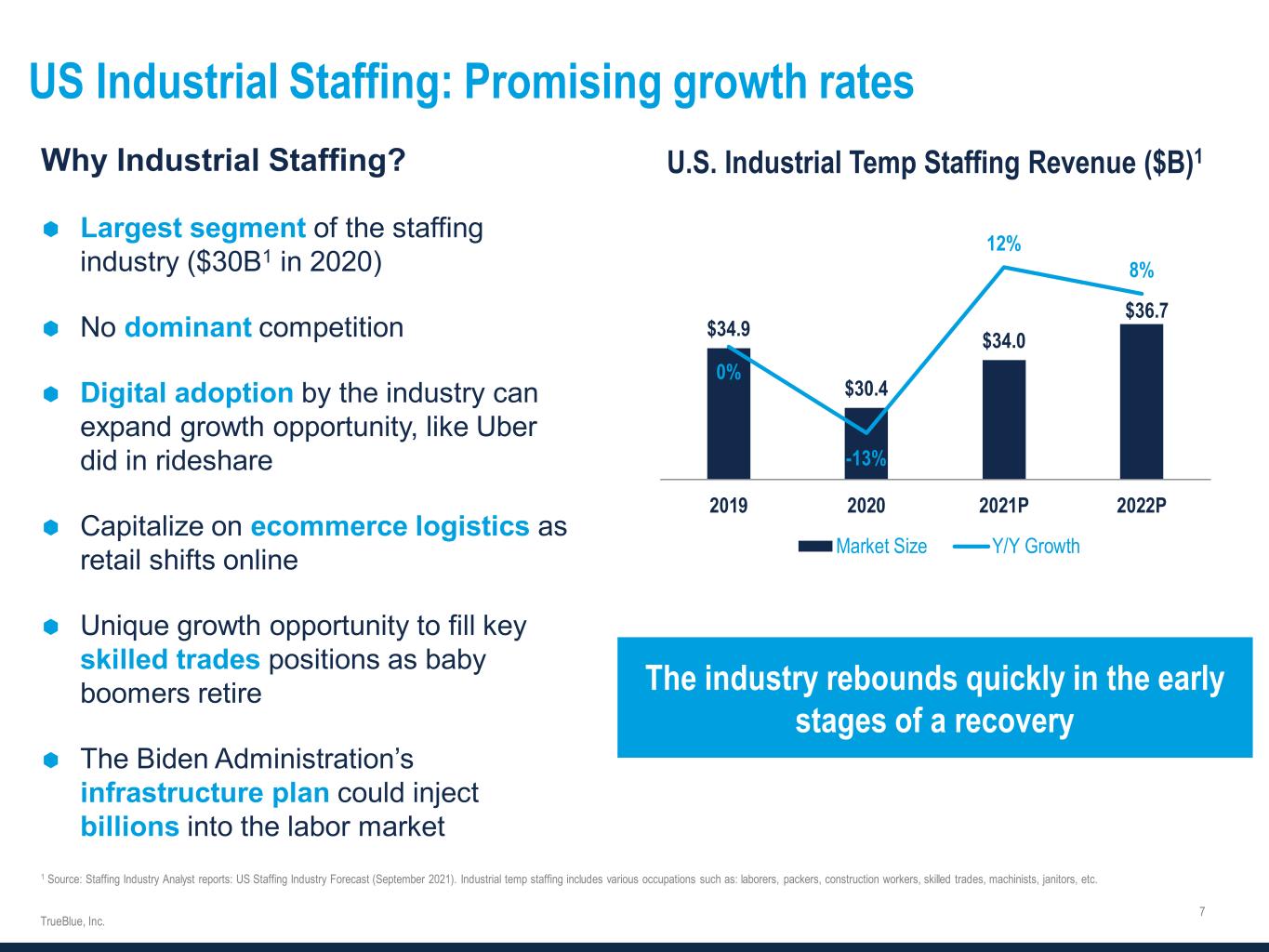

US Industrial Staffing: Promising growth rates Why Industrial Staffing? Largest segment of the staffing industry ($30B1 in 2020) No dominant competition Digital adoption by the industry can expand growth opportunity, like Uber did in rideshare Capitalize on ecommerce logistics as retail shifts online Unique growth opportunity to fill key skilled trades positions as baby boomers retire The Biden Administration’s infrastructure plan could inject billions into the labor market 1 Source: Staffing Industry Analyst reports: US Staffing Industry Forecast (September 2021). Industrial temp staffing includes various occupations such as: laborers, packers, construction workers, skilled trades, machinists, janitors, etc. U.S. Industrial Temp Staffing Revenue ($B)1 The industry rebounds quickly in the early stages of a recovery $34.9 $30.4 $34.0 $36.7 0% -13% 12% 8% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25 27 29 31 33 35 37 39 41 43 45 2019 2020 2021P 2022P Market Size Y/Y Growth

RPO: Historically, a double-digit growth industry Why RPO? “Immature” market with no one dominant player Industry produced double-digit annual revenue growth historically and swift recovery from recent recession is expected Industry poised for growth as companies seek new solutions to increasing labor challenges Traditionally “sticky” business model with high client retention and engagement 1 Source: Everest Group State of the Market Report 2021 (September 2021) RPO Revenue Growth1 $4.6 $4.0 $4.6 $5.3 18% -13% 15% 15% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% 2 3 4 5 6 7 8 2019 2020 2021P 2022P Market Size Y/Y Growth

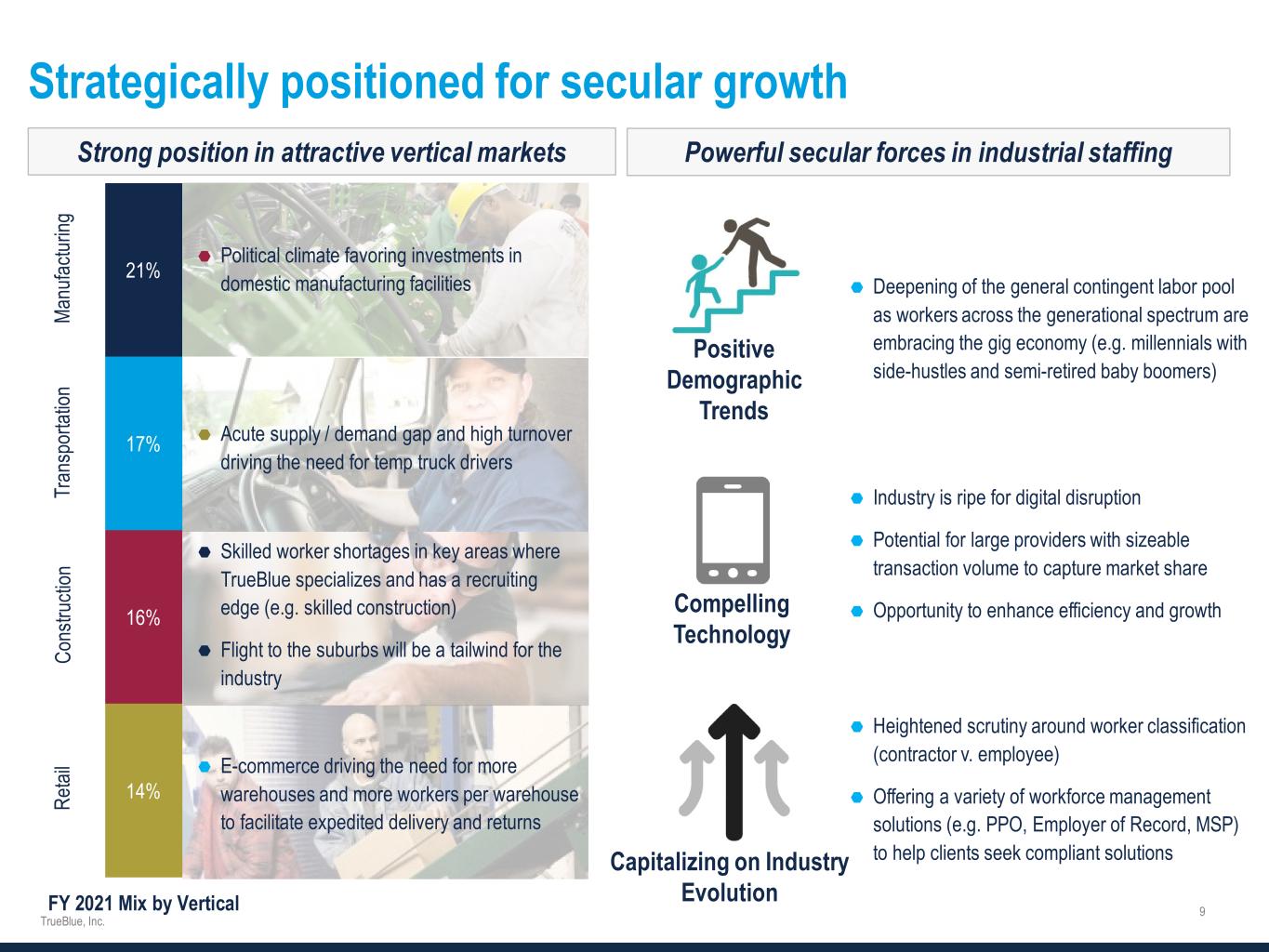

Strategically positioned for secular growth Strong position in attractive vertical markets Powerful secular forces in industrial staffing Deepening of the general contingent labor pool as workers across the generational spectrum are embracing the gig economy (e.g. millennials with side-hustles and semi-retired baby boomers) Positive Demographic Trends Industry is ripe for digital disruption Potential for large providers with sizeable transaction volume to capture market share Opportunity to enhance efficiency and growthCompelling Technology Heightened scrutiny around worker classification (contractor v. employee) Offering a variety of workforce management solutions (e.g. PPO, Employer of Record, MSP) to help clients seek compliant solutionsCapitalizing on Industry Evolution 14% 16% 17% 21% FY 2021 Mix by Vertical Co ns tru cti on Skilled worker shortages in key areas where TrueBlue specializes and has a recruiting edge (e.g. skilled construction) Flight to the suburbs will be a tailwind for the industry Ma nu fac tur ing Political climate favoring investments in domestic manufacturing facilities Tr an sp or tat ion Acute supply / demand gap and high turnover driving the need for temp truck drivers E-commerce driving the need for more warehouses and more workers per warehouse to facilitate expedited delivery and returns Re tai l

Leverage technology and industry leading position to grow share and enhance efficiency Strategy highlights Digitalize our business model to gain market share from smaller and less capitalized competitors and reduce expenses Drive higher client usage of JobStackTM, our industry-leading technology, to accelerate revenue growth Improve client and candidate experience using centralized services combined with digital onboarding platforms Continue momentum on new customer wins through strong execution of sales initiatives Leverage recent sales resource investments to expand into under- penetrated geographic markets Invest in client and associate care in addition to retention programs Focus sales and marketing efforts to capitalize on industry trend towards outsourcing Leverage our strong brand; independently ranked as a market leader Expand technology offering to improve client delivery and recruiting efficiency

Leadership with deep industry experience A. Patrick Beharelle President and CEO 25+ years of industry experience 10 years of CEO experience TrueBlue CEO since 2018 Derrek Gafford EVP and CFO 20 years of industry experience 18 years of CFO experience TrueBlue CFO since 2006 Taryn Owen President and COO PeopleReady & PeopleScout 20+ years of industry experience 9 years as business leader PeopleReady President since 2019 7 years as PeopleScout President Carl Schweihs President and COO PeopleManagement 9 years of industry experience PeopleManagement President since 2019

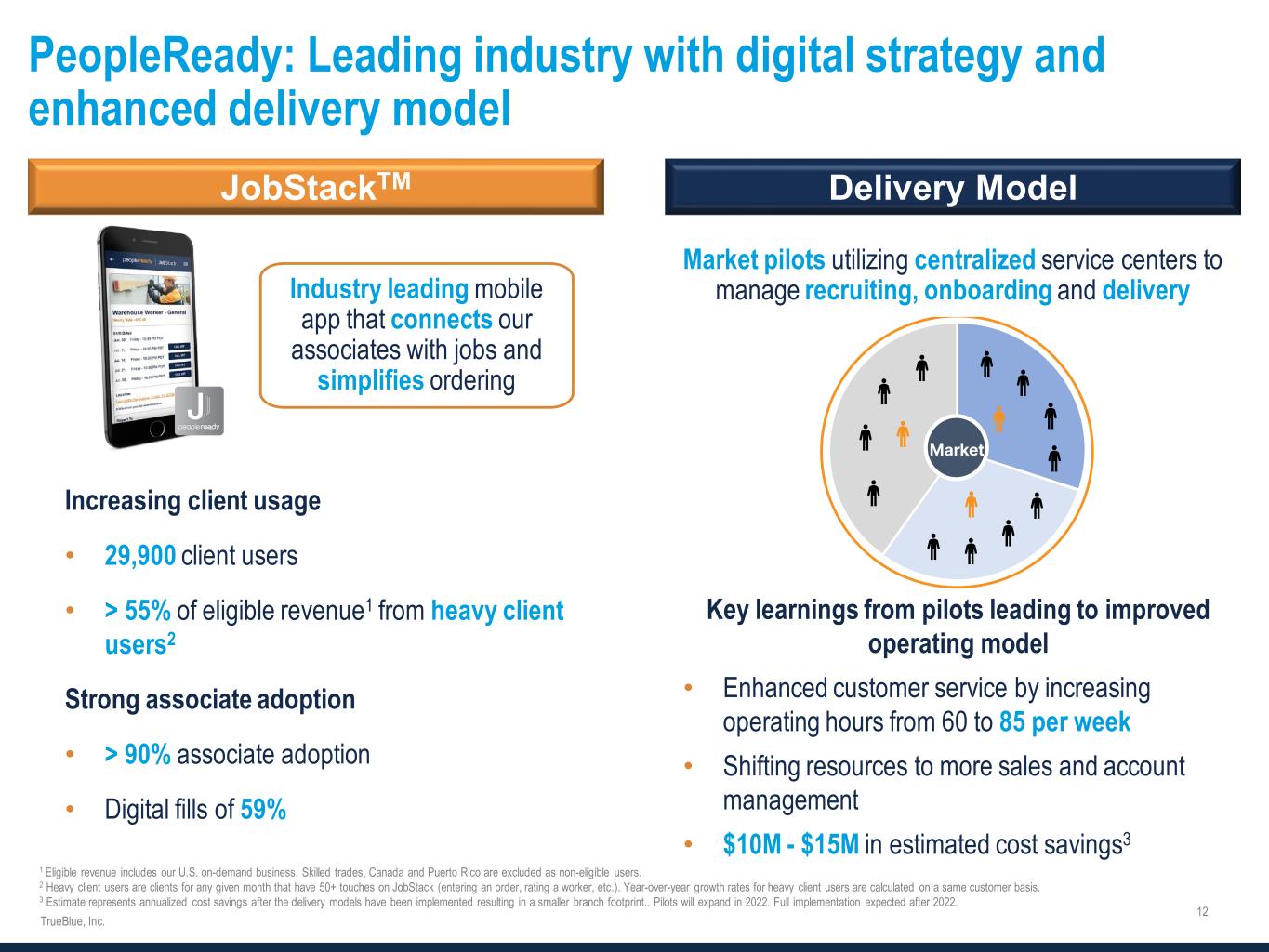

PeopleReady: Leading industry with digital strategy and enhanced delivery model JobStackTM Delivery Model Industry leading mobile app that connects our associates with jobs and simplifies ordering Increasing client usage • 29,900 client users • > 55% of eligible revenue1 from heavy client users2 Strong associate adoption • > 90% associate adoption • Digital fills of 59% Market Market pilots utilizing centralized service centers to manage recruiting, onboarding and delivery Key learnings from pilots leading to improved operating model • Enhanced customer service by increasing operating hours from 60 to 85 per week • Shifting resources to more sales and account management • $10M - $15M in estimated cost savings3 1 Eligible revenue includes our U.S. on-demand business. Skilled trades, Canada and Puerto Rico are excluded as non-eligible users. 2 Heavy client users are clients for any given month that have 50+ touches on JobStack (entering an order, rating a worker, etc.). Year-over-year growth rates for heavy client users are calculated on a same customer basis. 3 Estimate represents annualized cost savings after the delivery models have been implemented resulting in a smaller branch footprint.. Pilots will expand in 2022. Full implementation expected after 2022.

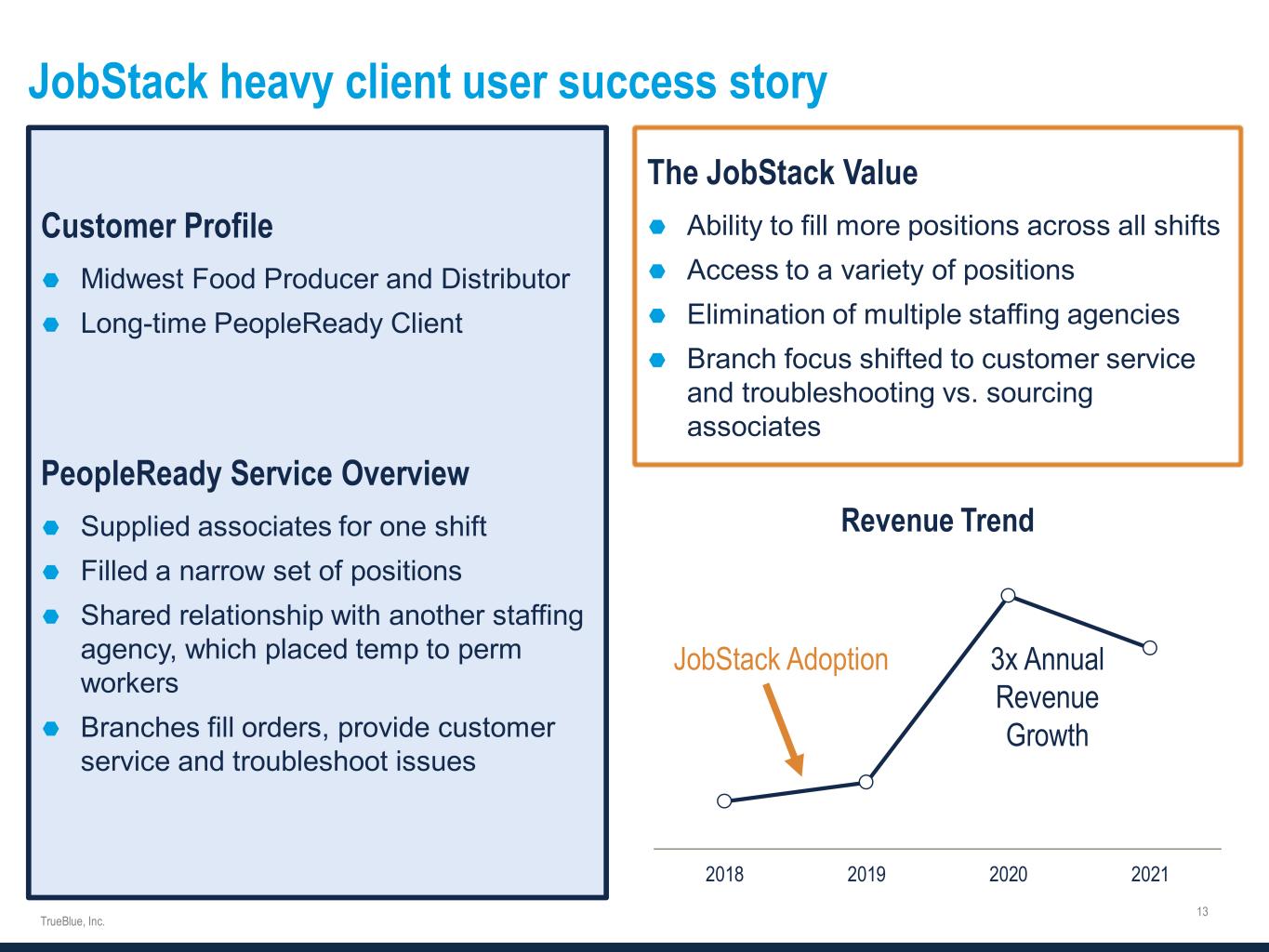

2018 2019 2020 2021 Revenue Trend JobStack heavy client user success story Customer Profile Midwest Food Producer and Distributor Long-time PeopleReady Client PeopleReady Service Overview Supplied associates for one shift Filled a narrow set of positions Shared relationship with another staffing agency, which placed temp to perm workers Branches fill orders, provide customer service and troubleshoot issues The JobStack Value Ability to fill more positions across all shifts Access to a variety of positions Elimination of multiple staffing agencies Branch focus shifted to customer service and troubleshooting vs. sourcing associates JobStack Adoption 3x Annual Revenue Growth

PeopleManagement: Expanding market share PeopleManagement proved more resilient during the pandemic due to the outsourced nature of our client relationships and is well-positioned for growth The team is deploying a variety of tactics and strategies to expand market share o Creating an offering focused on short-term quick ramp requirements (e.g., projects, site start-ups) o Launched effort focused on smaller, local markets o Hiring additional salespeople and condensing their geographic footprint o Expanding into new sites at National Account clients o Cross-selling with other TrueBlue brands Approximately 80% of Onsite revenue is in the East and Midwest – Significant opportunity to the West Onsite growth opportunities

PeopleScout: Industry leader with historically high margins Strong Brand Recognition o #1 by HRO Today’s Total Workforce Solution Baker’s Dozen o 5th largest global RPO provider1 Affinix Technology: A Differentiated Experience o Connects clients and candidates using AI, machine learnings and predictive analytics ideal in today’s remote recruiting landscape o Flexible platform with plans to monetize services our clients can use directly Strong Growth & Profitability Prospects o Demonstrated track record servicing large employers with dynamic needs in industries (hospitality, travel) positioned for a rebound o Segment profit margins expected to increase as scale returns o Expanding sales and client delivery teams to accelerate new business o Global focus as growing number of deals are multi-region and multi-country $181 $252 $160 $263 2016 2019 2020 2021 Revenue 19% 15% 3% 14% 2016 2019 2020 2021 Segment Profit Margin 1 Source: Transformative RPO for the New Era of Work - HR Technology and Services, December 2021 [Nelson Hall]

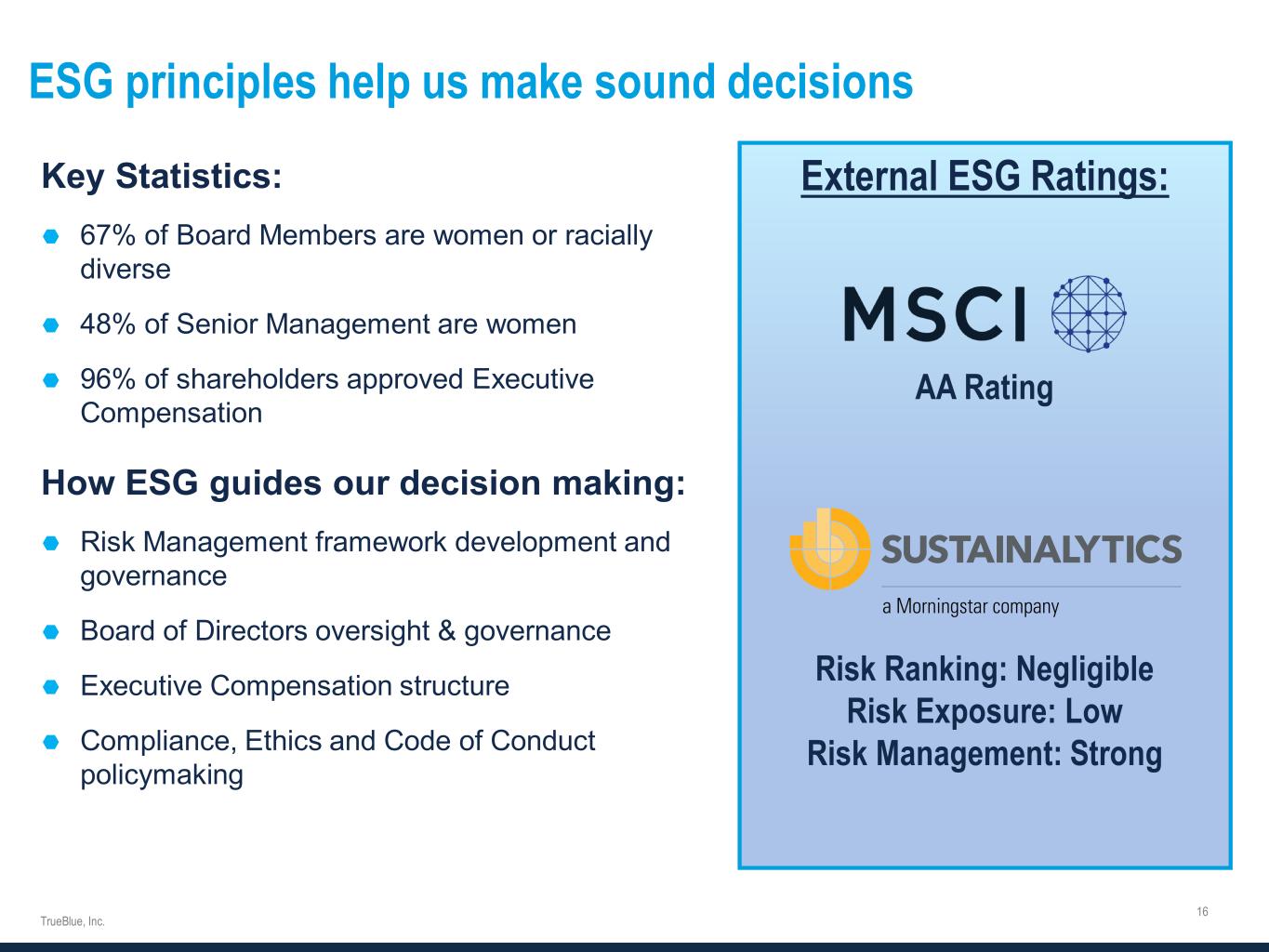

ESG principles help us make sound decisions External ESG Ratings: AA Rating Risk Ranking: Negligible Risk Exposure: Low Risk Management: Strong Key Statistics: 67% of Board Members are women or racially diverse 48% of Senior Management are women 96% of shareholders approved Executive Compensation How ESG guides our decision making: Risk Management framework development and governance Board of Directors oversight & governance Executive Compensation structure Compliance, Ethics and Code of Conduct policymaking

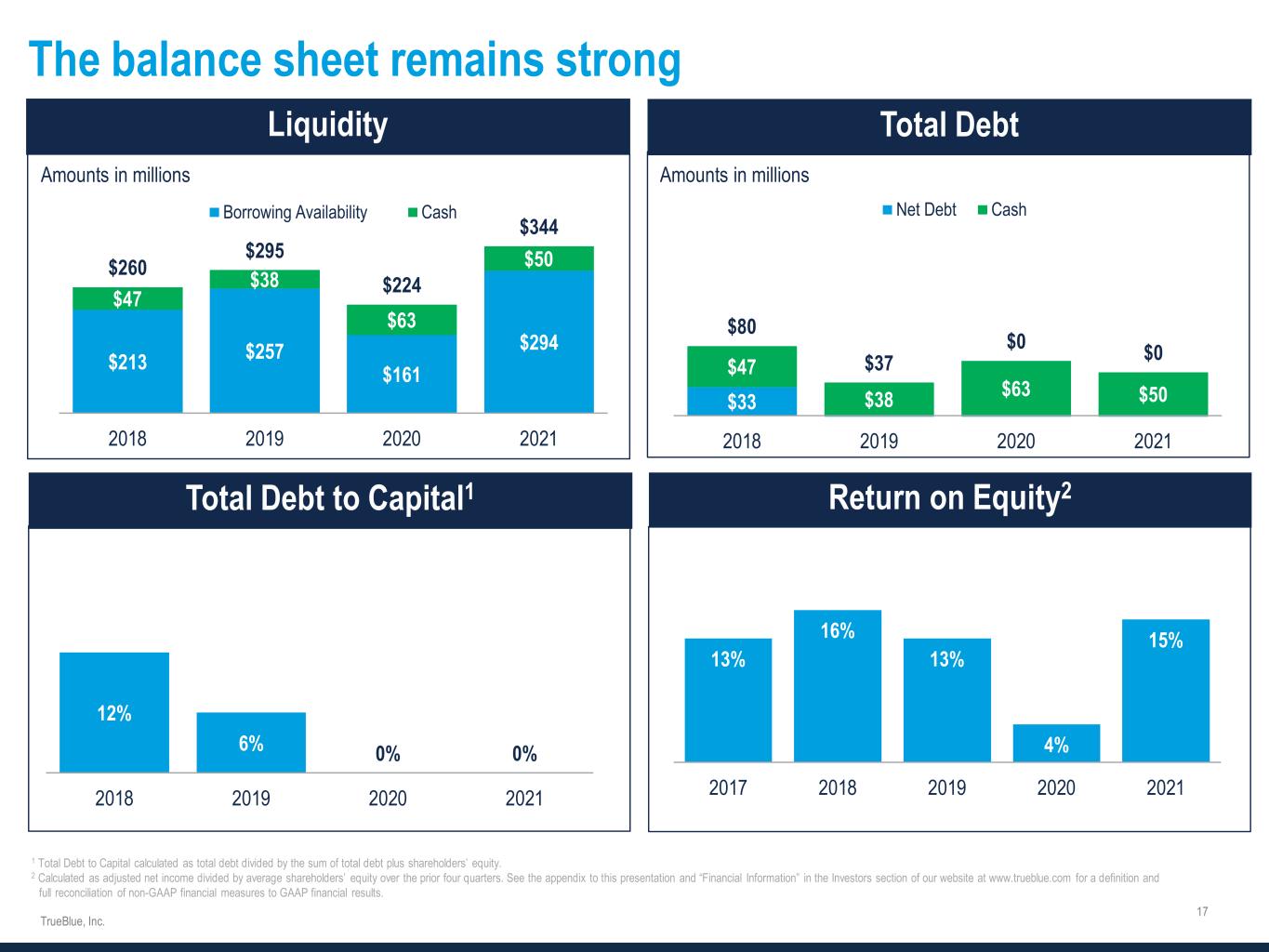

$33 $47 $38 $63 $50 $80 $37 $0 $0 2018 2019 2020 2021 Net Debt Cash $213 $257 $161 $294 $47 $38 $63 $50$260 $295 $224 $344 2018 2019 2020 2021 Borrowing Availability Cash The balance sheet remains strong 1 Total Debt to Capital calculated as total debt divided by the sum of total debt plus shareholders’ equity. 2 Calculated as adjusted net income divided by average shareholders’ equity over the prior four quarters. See the appendix to this presentation and “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. 2 Amounts in millions Amounts in millions 13% 16% 13% 4% 15% 2017 2018 2019 2020 2021 12% 6% 0% 0% 2018 2019 2020 2021

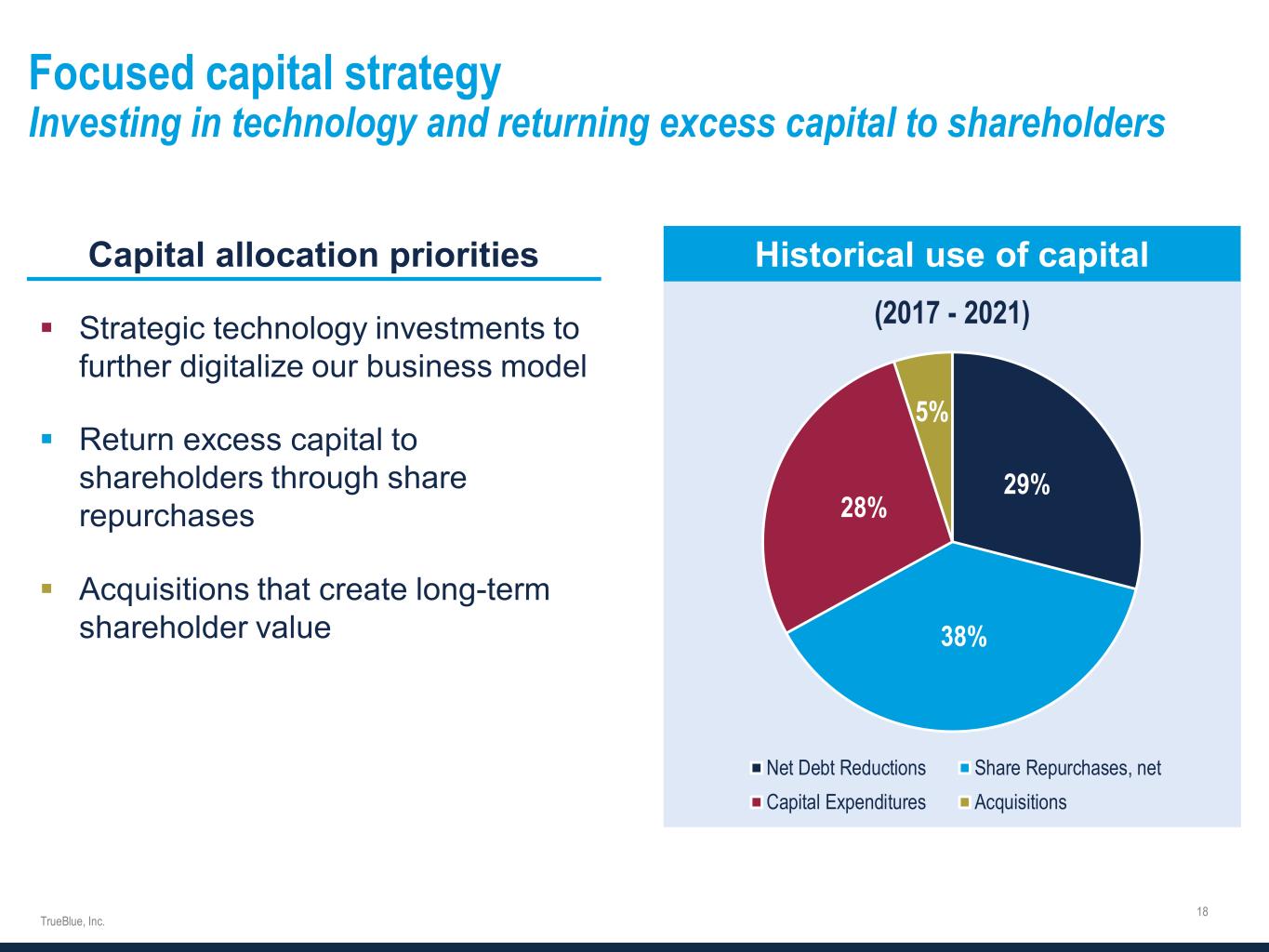

Focused capital strategy Investing in technology and returning excess capital to shareholders 29% 38% 28% 5% (2017 - 2021) Net Debt Reductions Share Repurchases, net Capital Expenditures Acquisitions Historical use of capitalCapital allocation priorities Strategic technology investments to further digitalize our business model Return excess capital to shareholders through share repurchases Acquisitions that create long-term shareholder value

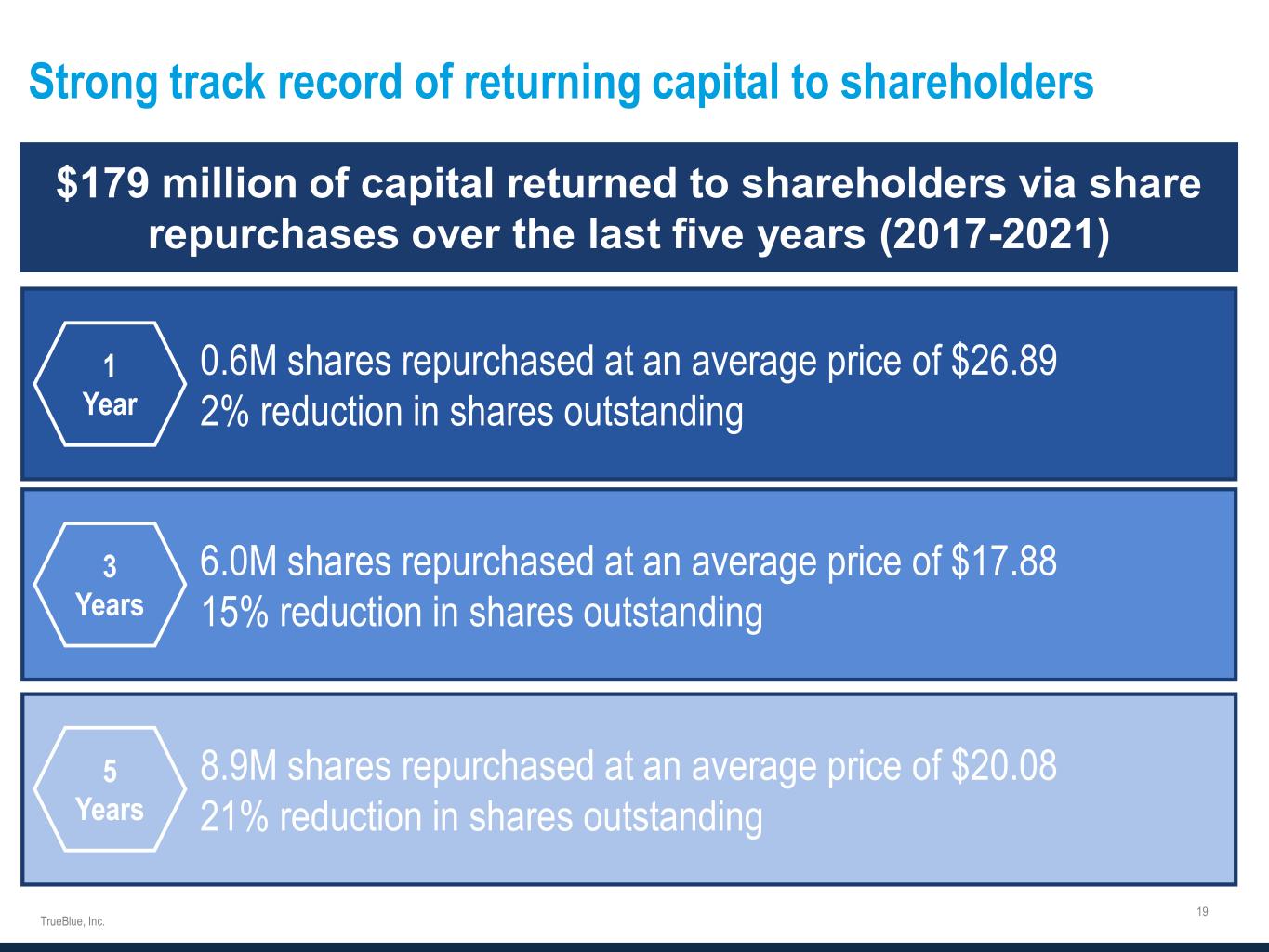

Strong track record of returning capital to shareholders $179 million of capital returned to shareholders via share repurchases over the last five years (2017-2021) 0.6M shares repurchased at an average price of $26.89 2% reduction in shares outstanding 1 Year 6.0M shares repurchased at an average price of $17.88 15% reduction in shares outstanding 8.9M shares repurchased at an average price of $20.08 21% reduction in shares outstanding 3 Years 5 Years

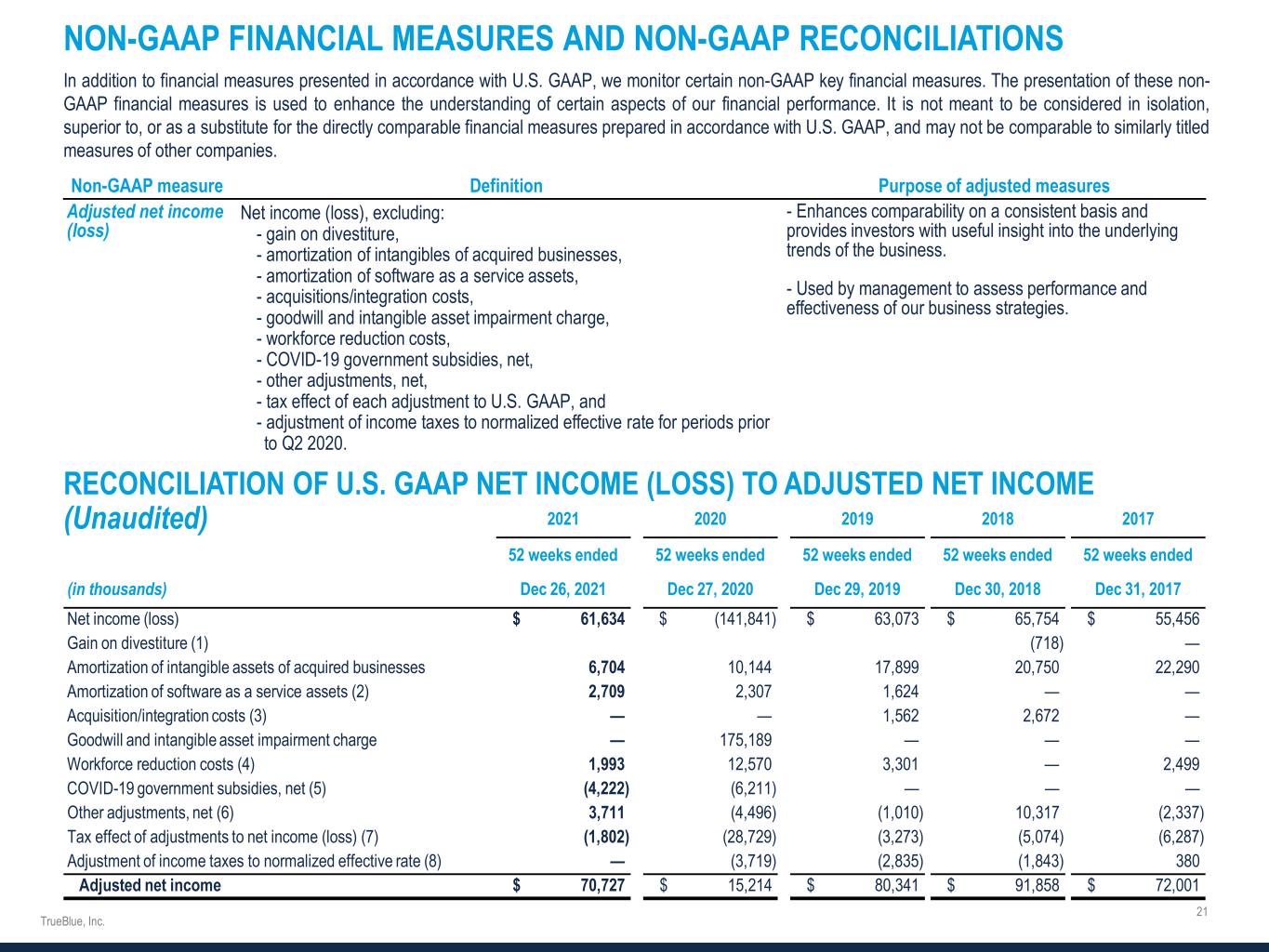

NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non- GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP measure Definition Purpose of adjusted measures Adjusted net income (loss) Net income (loss), excluding: - gain on divestiture, - amortization of intangibles of acquired businesses, - amortization of software as a service assets, - acquisitions/integration costs, - goodwill and intangible asset impairment charge, - workforce reduction costs, - COVID-19 government subsidies, net, - other adjustments, net, - tax effect of each adjustment to U.S. GAAP, and - adjustment of income taxes to normalized effective rate for periods prior to Q2 2020. - Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. - Used by management to assess performance and effectiveness of our business strategies. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO ADJUSTED NET INCOME (Unaudited) 2021 2020 2019 2018 2017 52 weeks ended 52 weeks ended 52 weeks ended 52 weeks ended 52 weeks ended (in thousands) Dec 26, 2021 Dec 27, 2020 Dec 29, 2019 Dec 30, 2018 Dec 31, 2017 Net income (loss) $ 61,634 $ (141,841) $ 63,073 $ 65,754 $ 55,456 Gain on divestiture (1) (718) — Amortization of intangible assets of acquired businesses 6,704 10,144 17,899 20,750 22,290 Amortization of software as a service assets (2) 2,709 2,307 1,624 — — Acquisition/integration costs (3) — — 1,562 2,672 — Goodwill and intangible asset impairment charge — 175,189 — — — Workforce reduction costs (4) 1,993 12,570 3,301 — 2,499 COVID-19 government subsidies, net (5) (4,222) (6,211) — — — Other adjustments, net (6) 3,711 (4,496) (1,010) 10,317 (2,337) Tax effect of adjustments to net income (loss) (7) (1,802) (28,729) (3,273) (5,074) (6,287) Adjustment of income taxes to normalized effective rate (8) — (3,719) (2,835) (1,843) 380 Adjusted net income $ 70,727 $ 15,214 $ 80,341 $ 91,858 $ 72,001

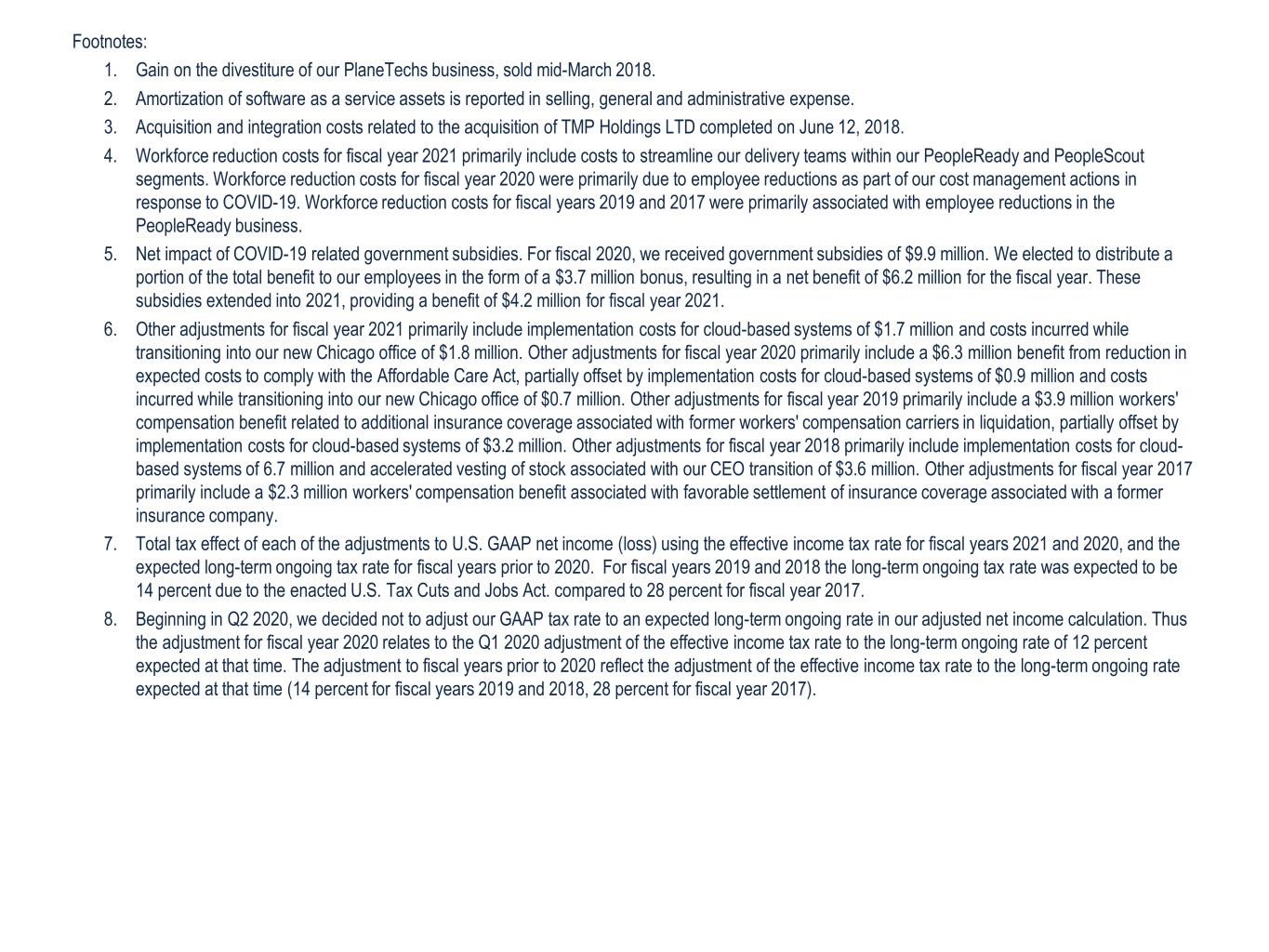

Footnotes: 1. Gain on the divestiture of our PlaneTechs business, sold mid-March 2018. 2. Amortization of software as a service assets is reported in selling, general and administrative expense. 3. Acquisition and integration costs related to the acquisition of TMP Holdings LTD completed on June 12, 2018. 4. Workforce reduction costs for fiscal year 2021 primarily include costs to streamline our delivery teams within our PeopleReady and PeopleScout segments. Workforce reduction costs for fiscal year 2020 were primarily due to employee reductions as part of our cost management actions in response to COVID-19. Workforce reduction costs for fiscal years 2019 and 2017 were primarily associated with employee reductions in the PeopleReady business. 5. Net impact of COVID-19 related government subsidies. For fiscal 2020, we received government subsidies of $9.9 million. We elected to distribute a portion of the total benefit to our employees in the form of a $3.7 million bonus, resulting in a net benefit of $6.2 million for the fiscal year. These subsidies extended into 2021, providing a benefit of $4.2 million for fiscal year 2021. 6. Other adjustments for fiscal year 2021 primarily include implementation costs for cloud-based systems of $1.7 million and costs incurred while transitioning into our new Chicago office of $1.8 million. Other adjustments for fiscal year 2020 primarily include a $6.3 million benefit from reduction in expected costs to comply with the Affordable Care Act, partially offset by implementation costs for cloud-based systems of $0.9 million and costs incurred while transitioning into our new Chicago office of $0.7 million. Other adjustments for fiscal year 2019 primarily include a $3.9 million workers' compensation benefit related to additional insurance coverage associated with former workers' compensation carriers in liquidation, partially offset by implementation costs for cloud-based systems of $3.2 million. Other adjustments for fiscal year 2018 primarily include implementation costs for cloud- based systems of 6.7 million and accelerated vesting of stock associated with our CEO transition of $3.6 million. Other adjustments for fiscal year 2017 primarily include a $2.3 million workers' compensation benefit associated with favorable settlement of insurance coverage associated with a former insurance company. 7. Total tax effect of each of the adjustments to U.S. GAAP net income (loss) using the effective income tax rate for fiscal years 2021 and 2020, and the expected long-term ongoing tax rate for fiscal years prior to 2020. For fiscal years 2019 and 2018 the long-term ongoing tax rate was expected to be 14 percent due to the enacted U.S. Tax Cuts and Jobs Act. compared to 28 percent for fiscal year 2017. 8. Beginning in Q2 2020, we decided not to adjust our GAAP tax rate to an expected long-term ongoing rate in our adjusted net income calculation. Thus the adjustment for fiscal year 2020 relates to the Q1 2020 adjustment of the effective income tax rate to the long-term ongoing rate of 12 percent expected at that time. The adjustment to fiscal years prior to 2020 reflect the adjustment of the effective income tax rate to the long-term ongoing rate expected at that time (14 percent for fiscal years 2019 and 2018, 28 percent for fiscal year 2017).