Q4 2021 Earnings February 2022

www.TrueBlue.c om 2 Forward-looking statements This document contains forward-looking statements relating to our plans and expectations including, without limitation, statements regarding the future performance and operations of our business, expected growth from our digital investments, and the expected amount and timing of any share repurchases, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this release and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions, (2) the continued impact of COVID-19 and related economic impact and governmental response, (3) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (4) our ability to attract and retain clients, (5) our ability to maintain profit margins, (6) our ability to successfully execute on business strategies to further digitalize our business model, (7) the timing and amount of common stock repurchases, if any, which will be determined at management’s discretion and depend upon several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities, (8) new laws, regulations, and government incentives that could affect our operations or financial results, (9) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, and (10) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. In addition, we use several non-GAAP financial measures when presenting our financial results in this document. Please refer to the reconciliations between our GAAP and non-GAAP financial measures in the appendix to this presentation and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated.

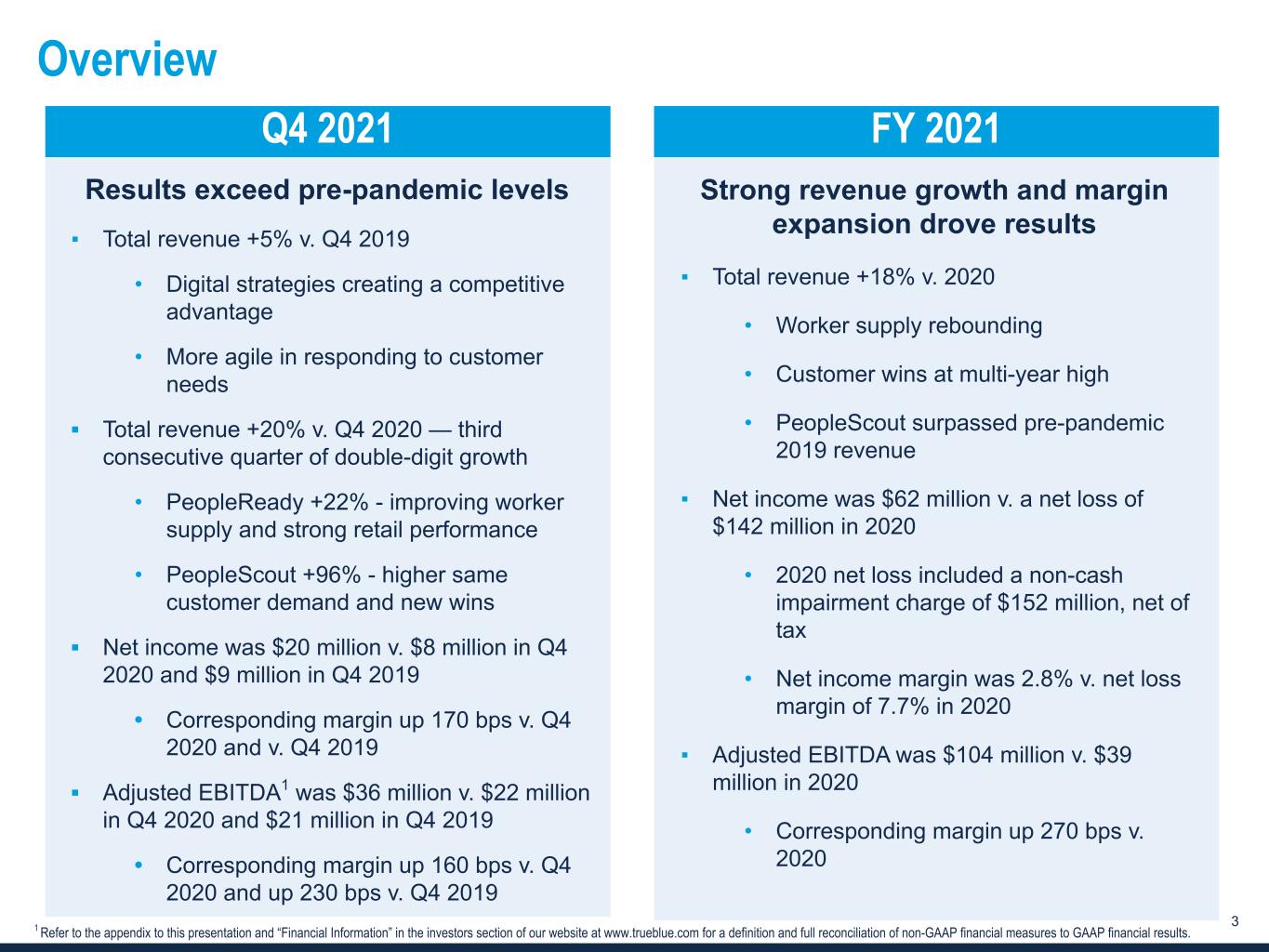

www.TrueBlue.c om 3 Overview 1 Refer to the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. Q4 2021 FY 2021 Results exceed pre-pandemic levels ▪ Total revenue +5% v. Q4 2019 • Digital strategies creating a competitive advantage • More agile in responding to customer needs ▪ Total revenue +20% v. Q4 2020 — third consecutive quarter of double-digit growth • PeopleReady +22% - improving worker supply and strong retail performance • PeopleScout +96% - higher same customer demand and new wins ▪ Net income was $20 million v. $8 million in Q4 2020 and $9 million in Q4 2019 • Corresponding margin up 170 bps v. Q4 2020 and v. Q4 2019 ▪ Adjusted EBITDA1 was $36 million v. $22 million in Q4 2020 and $21 million in Q4 2019 • Corresponding margin up 160 bps v. Q4 2020 and up 230 bps v. Q4 2019 Strong revenue growth and margin expansion drove results ▪ Total revenue +18% v. 2020 • Worker supply rebounding • Customer wins at multi-year high • PeopleScout surpassed pre-pandemic 2019 revenue ▪ Net income was $62 million v. a net loss of $142 million in 2020 • 2020 net loss included a non-cash impairment charge of $152 million, net of tax • Net income margin was 2.8% v. net loss margin of 7.7% in 2020 ▪ Adjusted EBITDA was $104 million v. $39 million in 2020 • Corresponding margin up 270 bps v. 2020

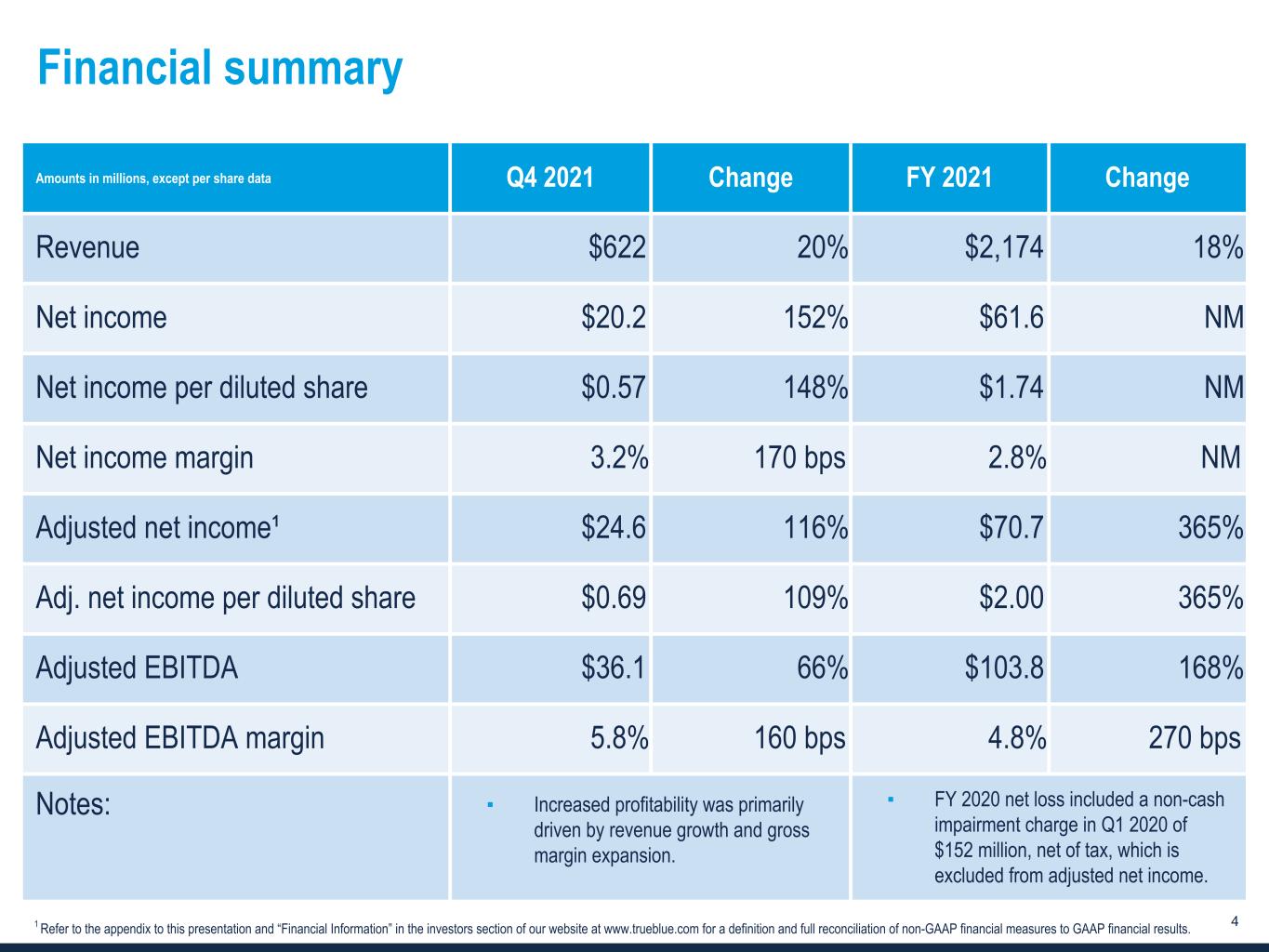

www.TrueBlue.c om 4 Financial summary 1 Refer to the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. Amounts in millions, except per share data Q4 2021 Change FY 2021 Change Revenue $622 20 % $2,174 18 % Net income $20.2 152 % $61.6 NM Net income per diluted share $0.57 148 % $1.74 NM Net income margin 3.2 % 170 bps 2.8 % NM Adjusted net income¹ $24.6 116 % $70.7 365 % Adj. net income per diluted share $0.69 109 % $2.00 365 % Adjusted EBITDA $36.1 66 % $103.8 168 % Adjusted EBITDA margin 5.8 % 160 bps 4.8 % 270 bps Notes: ▪ Increased profitability was primarily driven by revenue growth and gross margin expansion. ▪ FY 2020 net loss included a non-cash impairment charge in Q1 2020 of $152 million, net of tax, which is excluded from adjusted net income.

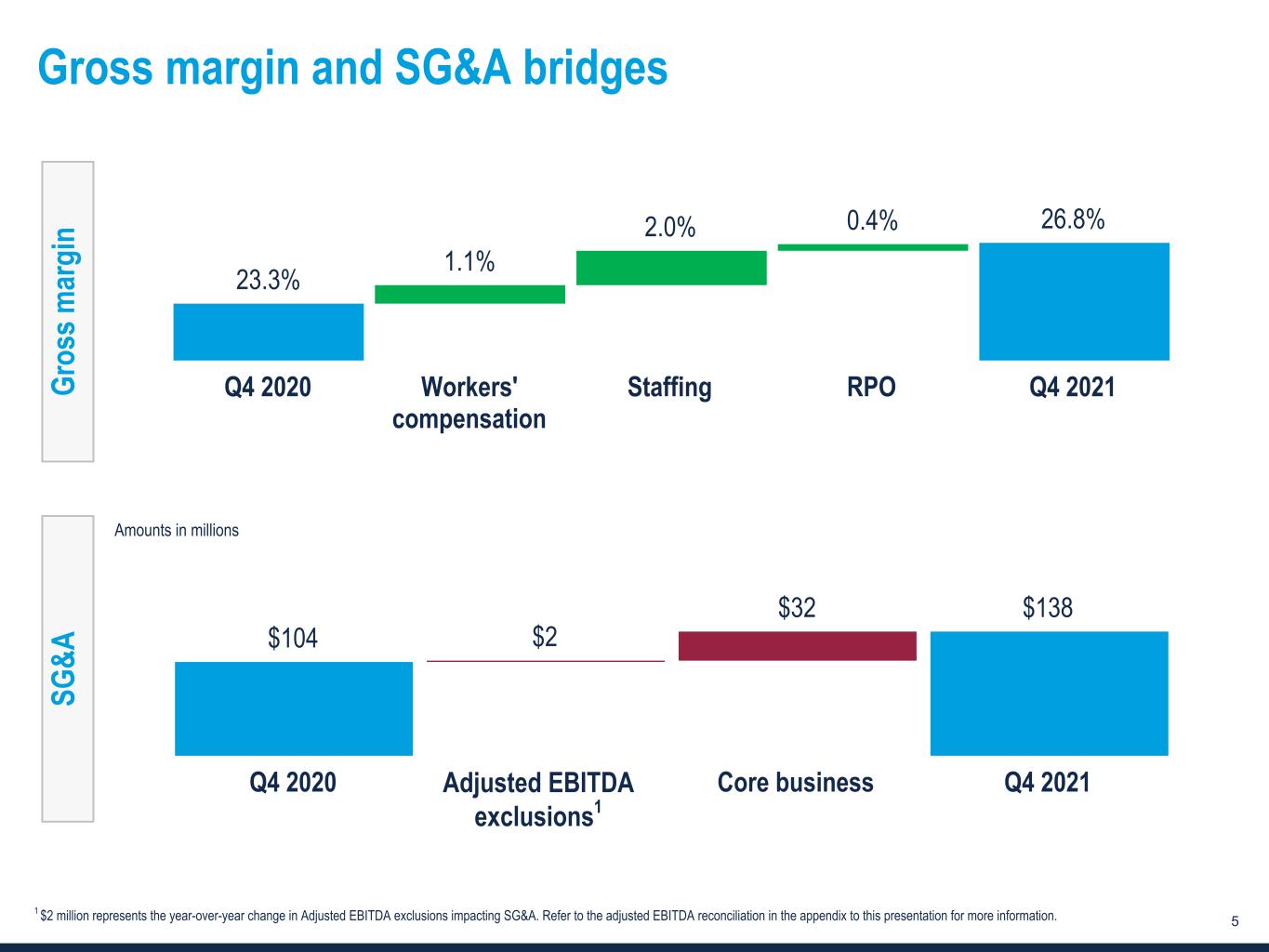

www.TrueBlue.c om 5 Gross margin and SG&A bridges Amounts in millions Gr os s m ar gi n SG &A $104 $2 $32 $138 Q4 2020 Core business Q4 2021 23.3% 1.1% 2.0% 0.4% 26.8% Q4 2020 Workers' compensation Staffing RPO Q4 2021 Adjusted EBITDA exclusions1 1 $2 million represents the year-over-year change in Adjusted EBITDA exclusions impacting SG&A. Refer to the adjusted EBITDA reconciliation in the appendix to this presentation for more information.

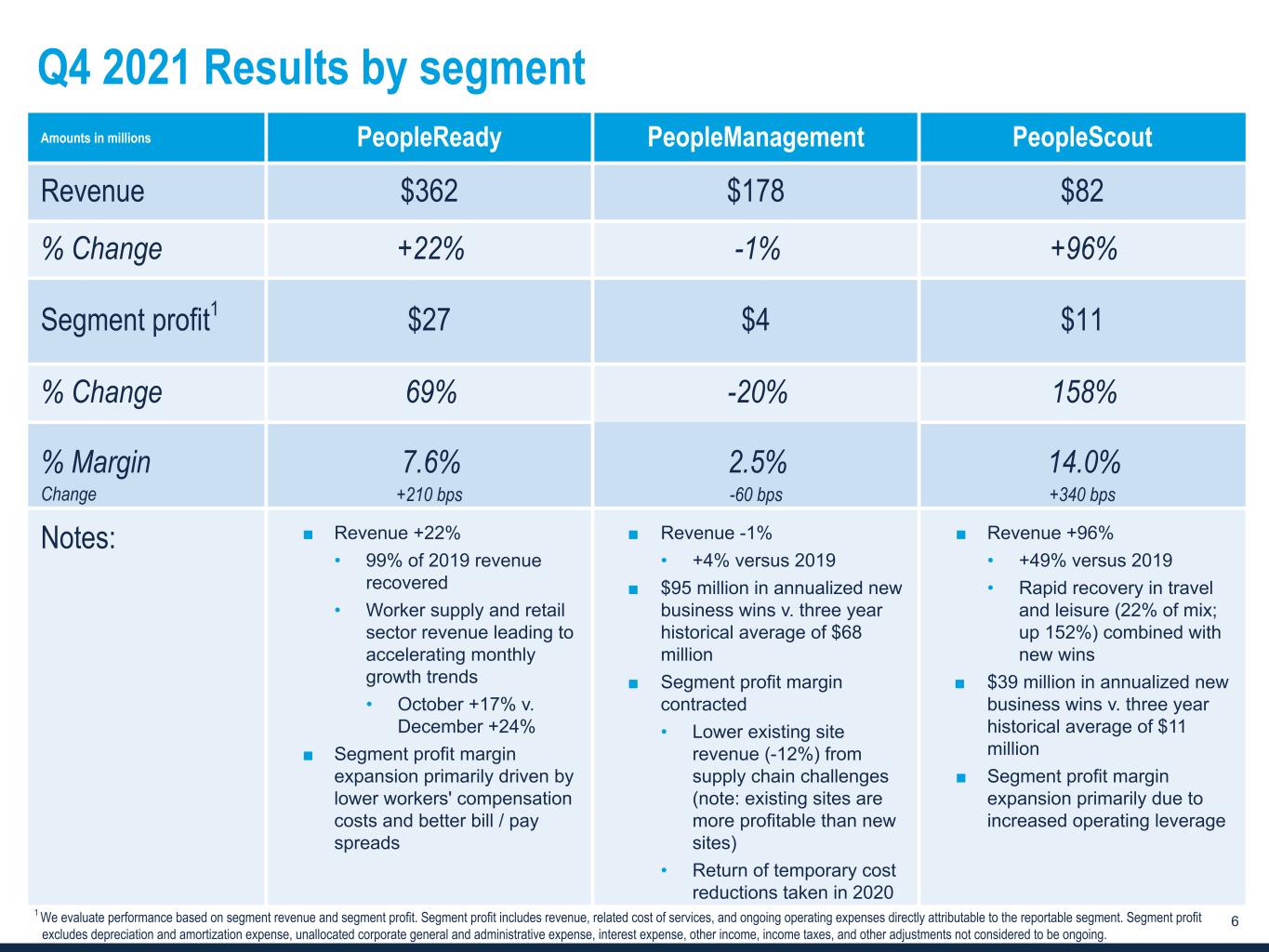

www.TrueBlue.c om 6 Q4 2021 Results by segment Amounts in millions PeopleReady PeopleManagement PeopleScout Revenue $362 $178 $82 % Change +22% -1% +96% Segment profit1 $27 $4 $11 % Change 69% -20% 158% % Margin 7.6% 2.5% 14.0% Change +210 bps -60 bps +340 bps Notes: ■ Revenue +22% • 99% of 2019 revenue recovered • Worker supply and retail sector revenue leading to accelerating monthly growth trends • October +17% v. December +24% ■ Segment profit margin expansion primarily driven by lower workers' compensation costs and better bill / pay spreads ■ Revenue -1% • +4% versus 2019 ■ $95 million in annualized new business wins v. three year historical average of $68 million ■ Segment profit margin contracted • Lower existing site revenue (-12%) from supply chain challenges (note: existing sites are more profitable than new sites) • Return of temporary cost reductions taken in 2020 ■ Revenue +96% • +49% versus 2019 • Rapid recovery in travel and leisure (22% of mix; up 152%) combined with new wins ■ $39 million in annualized new business wins v. three year historical average of $11 million ■ Segment profit margin expansion primarily due to increased operating leverage 1 We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit excludes depreciation and amortization expense, unallocated corporate general and administrative expense, interest expense, other income, income taxes, and other adjustments not considered to be ongoing.

www.TrueBlue.c om 7 Strategy highlights Leverage technology and industry leading position to grow market share and enhance efficiency ▪ Focus sales and marketing efforts to capitalize on industry trend towards outsourcing ▪ Leverage our strong brand; independently ranked as a market leader ▪ Expand technology offering to improve client delivery and recruiting efficiency ▪ Digitalize our business model to gain market share from smaller and less capitalized competitors and reduce expenses ▪ Drive higher client usage of JobStackTM, our industry-leading technology, to accelerate revenue growth ▪ Improve client and candidate experience using centralized services combined with digital onboarding platforms ▪ Continue momentum on new customer wins through strong execution of sales initiatives ▪ Leverage recent sales resource investments to expand into under- penetrated geographic markets ▪ Invest in client and associate care in addition to retention programs

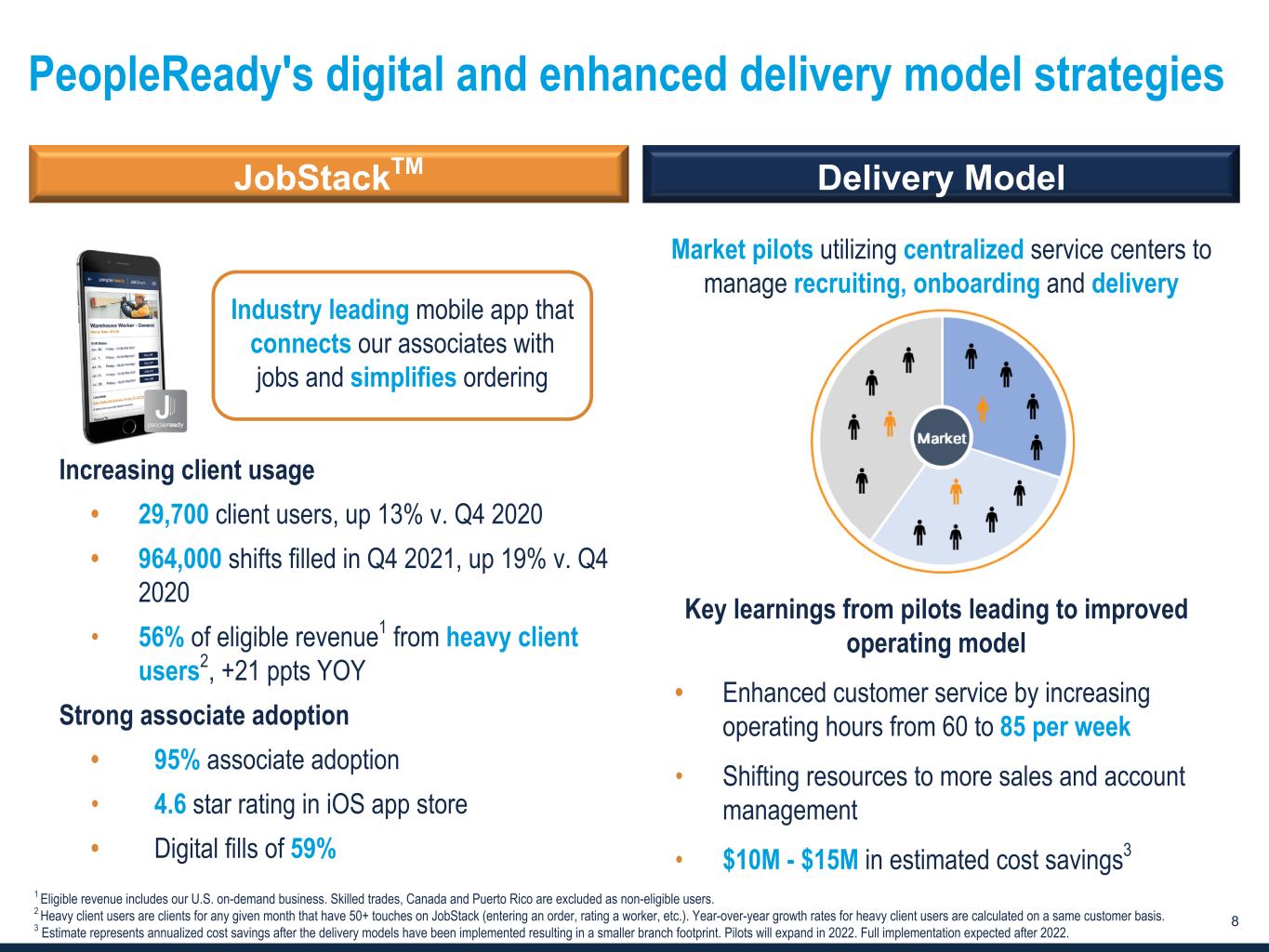

www.TrueBlue.c om 8 PeopleReady's digital and enhanced delivery model strategies Industry leading mobile app that connects our associates with jobs and simplifies ordering Market pilots utilizing centralized service centers to manage recruiting, onboarding and delivery Increasing client usage • 29,700 client users, up 13% v. Q4 2020 • 964,000 shifts filled in Q4 2021, up 19% v. Q4 2020 • 56% of eligible revenue1 from heavy client users2, +21 ppts YOY Strong associate adoption • 95% associate adoption • 4.6 star rating in iOS app store • Digital fills of 59% Key learnings from pilots leading to improved operating model • Enhanced customer service by increasing operating hours from 60 to 85 per week • Shifting resources to more sales and account management • $10M - $15M in estimated cost savings3 JobStackTM Delivery Model 1 Eligible revenue includes our U.S. on-demand business. Skilled trades, Canada and Puerto Rico are excluded as non-eligible users. 2 Heavy client users are clients for any given month that have 50+ touches on JobStack (entering an order, rating a worker, etc.). Year-over-year growth rates for heavy client users are calculated on a same customer basis. 3 Estimate represents annualized cost savings after the delivery models have been implemented resulting in a smaller branch footprint. Pilots will expand in 2022. Full implementation expected after 2022.

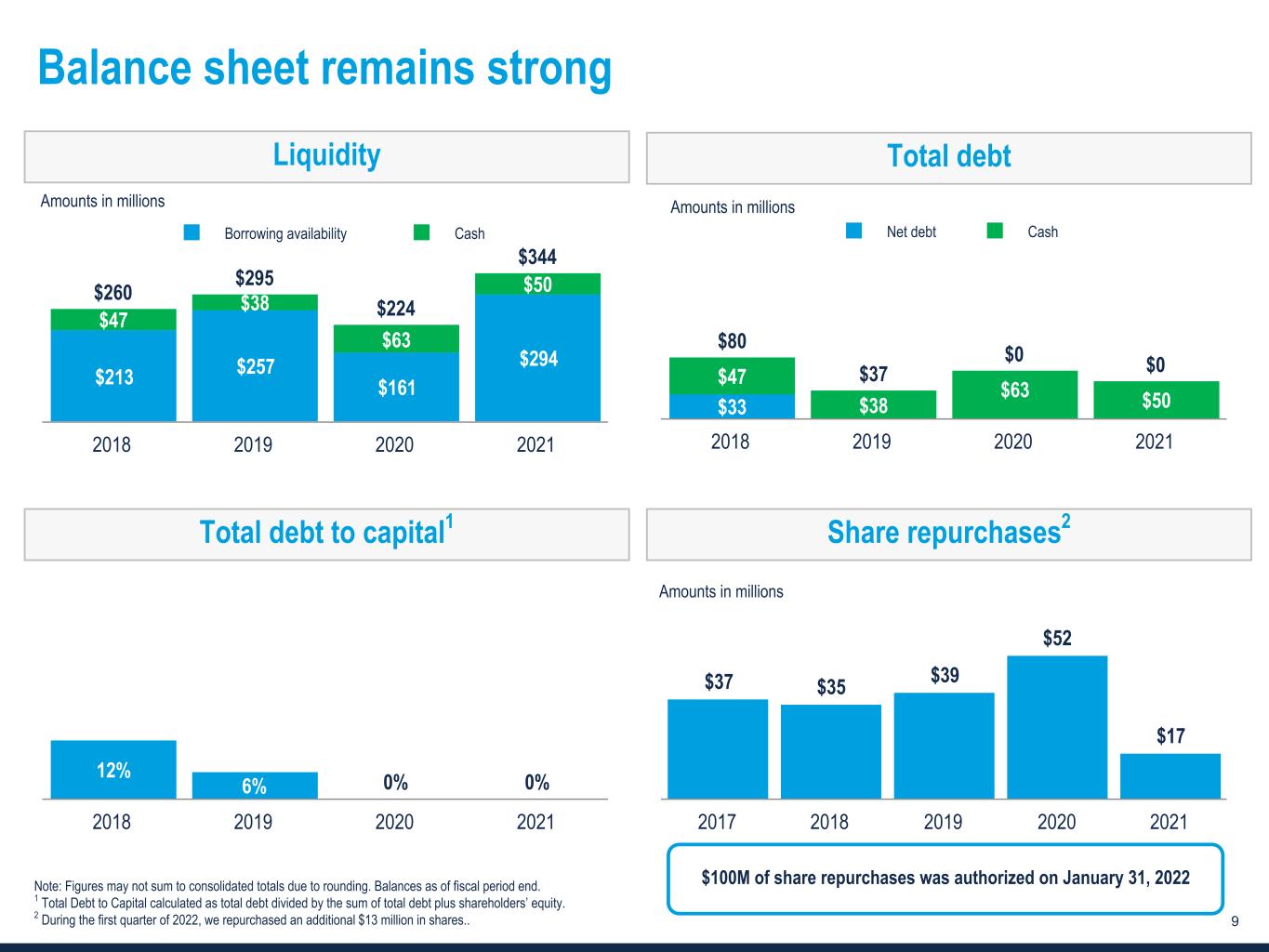

www.TrueBlue.c om 9 12% 6% 0% 0% 2018 2019 2020 2021 $80 $37 $0 $0 $33 $47 $38 $63 $50 Net debt Cash 2018 2019 2020 2021 $260 $295 $224 $344 $213 $257 $161 $294 $47 $38 $63 $50 Borrowing availability Cash 2018 2019 2020 2021 Balance sheet remains strong Amounts in millions Note: Figures may not sum to consolidated totals due to rounding. Balances as of fiscal period end. 1 Total Debt to Capital calculated as total debt divided by the sum of total debt plus shareholders’ equity. 2 During the first quarter of 2022, we repurchased an additional $13 million in shares.. Liquidity Amounts in millions Share repurchases2Total debt to capital1 Total debt $37 $35 $39 $52 $17 2017 2018 2019 2020 2021 Amounts in millions $100M of share repurchases was authorized on January 31, 2022

Outlook

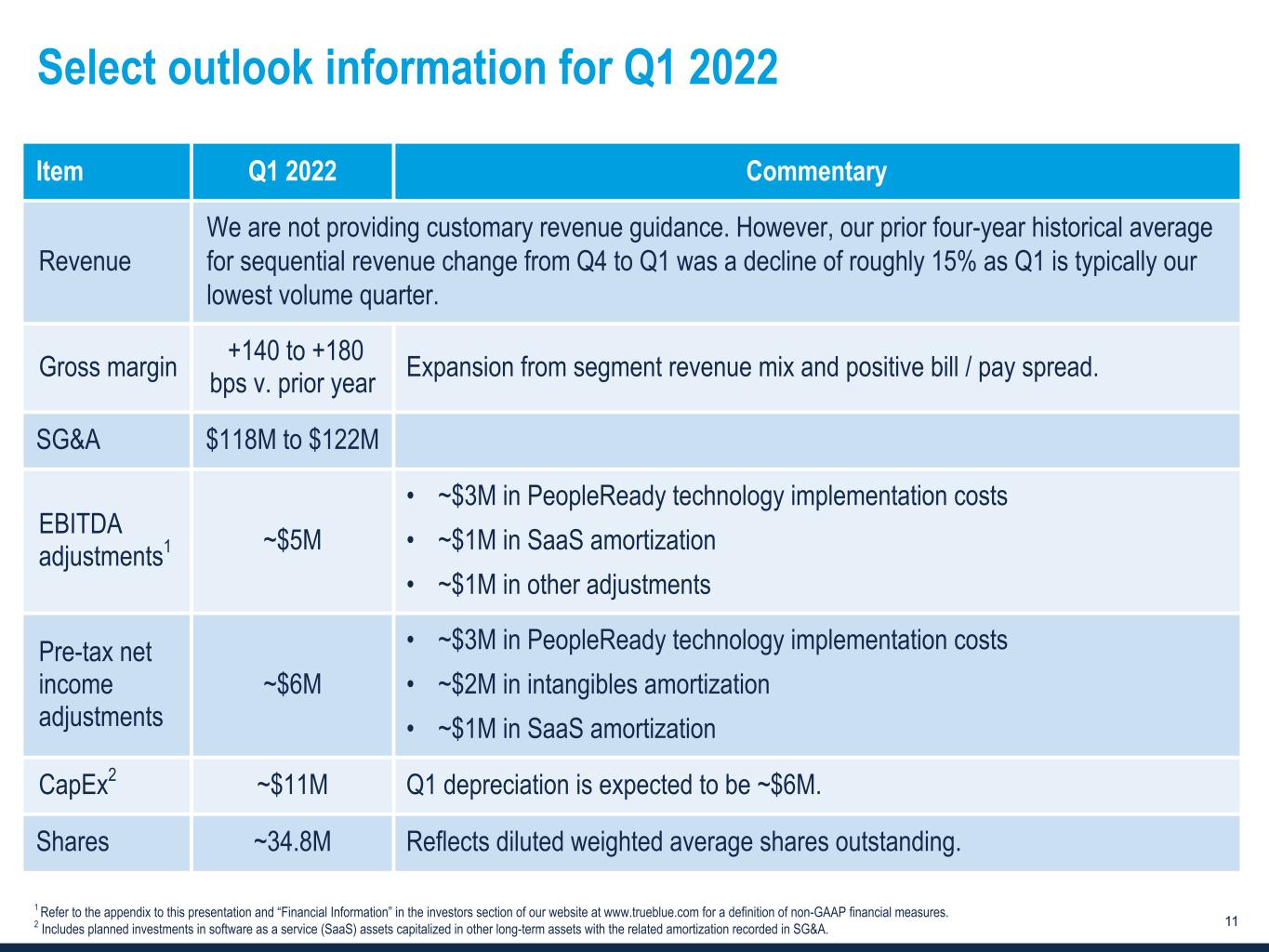

www.TrueBlue.c om 11 Select outlook information for Q1 2022 Item Q1 2022 Commentary Revenue We are not providing customary revenue guidance. However, our prior four-year historical average for sequential revenue change from Q4 to Q1 was a decline of roughly 15% as Q1 is typically our lowest volume quarter. Gross margin +140 to +180 bps v. prior year Expansion from segment revenue mix and positive bill / pay spread. SG&A $118M to $122M EBITDA adjustments1 ~$5M • ~$3M in PeopleReady technology implementation costs • ~$1M in SaaS amortization • ~$1M in other adjustments Pre-tax net income adjustments ~$6M • ~$3M in PeopleReady technology implementation costs • ~$2M in intangibles amortization • ~$1M in SaaS amortization CapEx2 ~$11M Q1 depreciation is expected to be ~$6M. Shares ~34.8M Reflects diluted weighted average shares outstanding. 1 Refer to the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition of non-GAAP financial measures. 2 Includes planned investments in software as a service (SaaS) assets capitalized in other long-term assets with the related amortization recorded in SG&A.

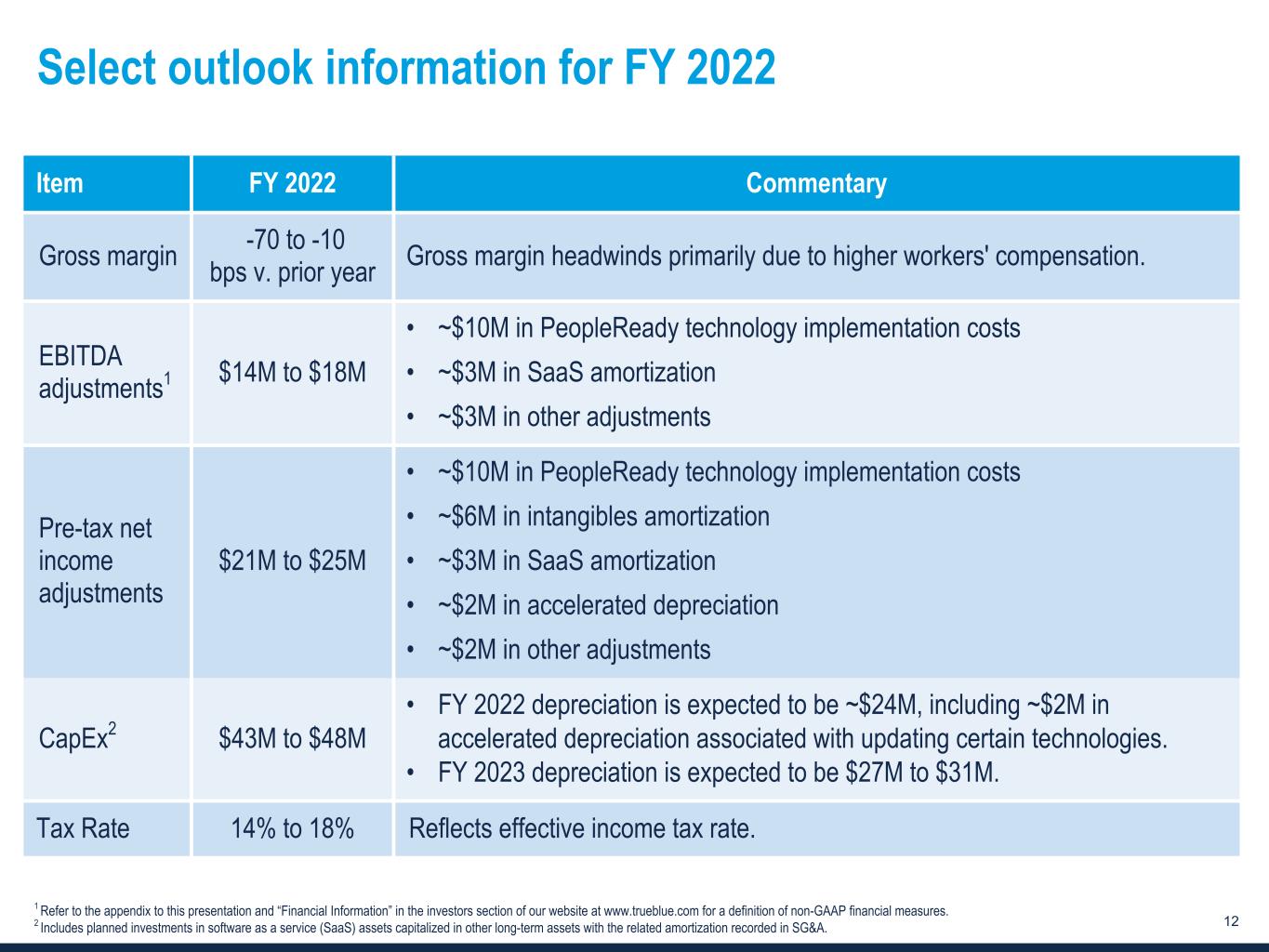

www.TrueBlue.c om 12 Select outlook information for FY 2022 1 Refer to the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition of non-GAAP financial measures. 2 Includes planned investments in software as a service (SaaS) assets capitalized in other long-term assets with the related amortization recorded in SG&A. Item FY 2022 Commentary Gross margin -70 to -10 bps v. prior year Gross margin headwinds primarily due to higher workers' compensation. EBITDA adjustments1 $14M to $18M • ~$10M in PeopleReady technology implementation costs • ~$3M in SaaS amortization • ~$3M in other adjustments Pre-tax net income adjustments $21M to $25M • ~$10M in PeopleReady technology implementation costs • ~$6M in intangibles amortization • ~$3M in SaaS amortization • ~$2M in accelerated depreciation • ~$2M in other adjustments CapEx2 $43M to $48M • FY 2022 depreciation is expected to be ~$24M, including ~$2M in accelerated depreciation associated with updating certain technologies. • FY 2023 depreciation is expected to be $27M to $31M. Tax Rate 14% to 18% Reflects effective income tax rate.

Appendix

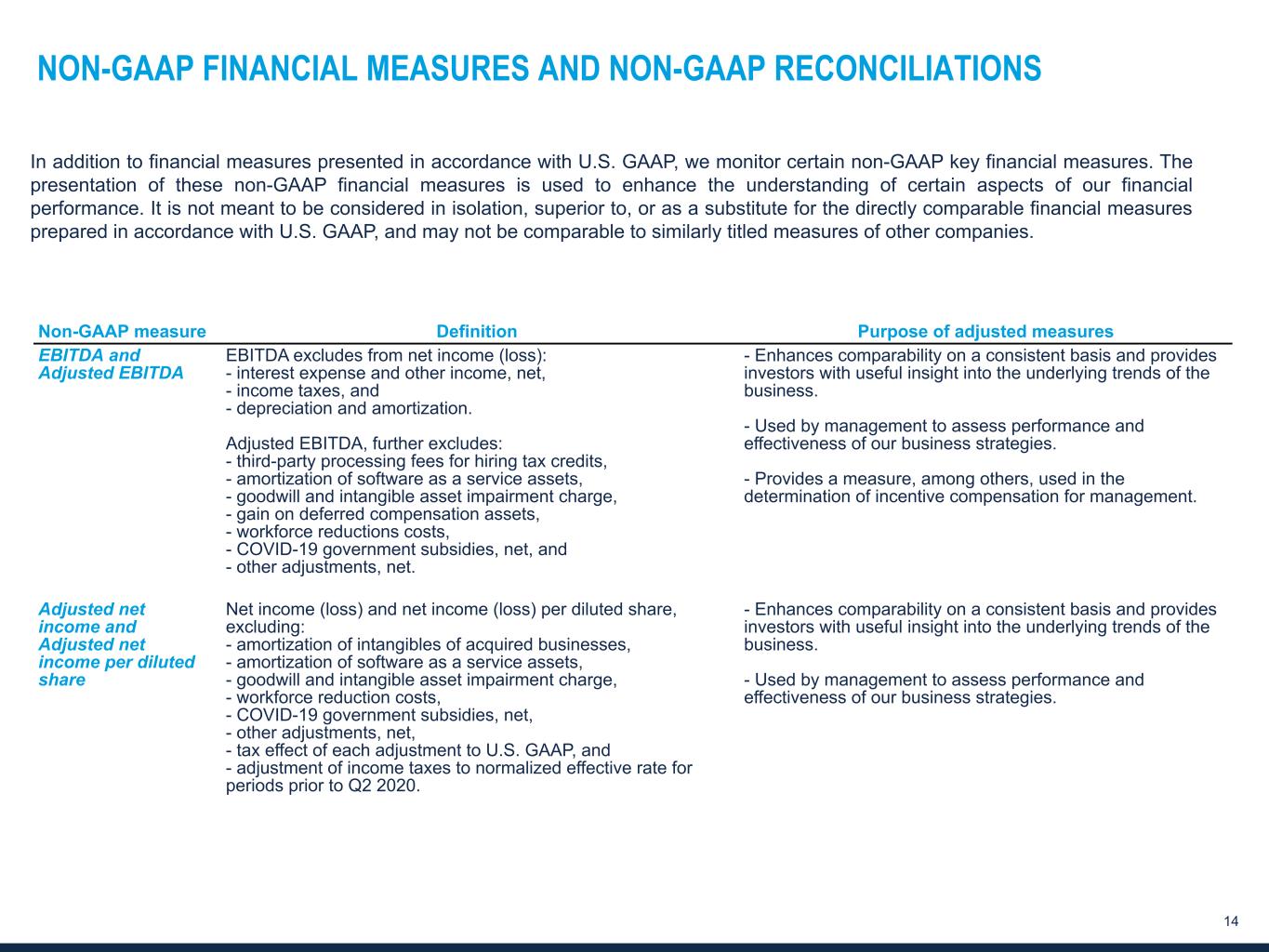

www.TrueBlue.c om 14 NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP measure Definition Purpose of adjusted measures EBITDA and Adjusted EBITDA EBITDA excludes from net income (loss): - interest expense and other income, net, - income taxes, and - depreciation and amortization. Adjusted EBITDA, further excludes: - third-party processing fees for hiring tax credits, - amortization of software as a service assets, - goodwill and intangible asset impairment charge, - gain on deferred compensation assets, - workforce reductions costs, - COVID-19 government subsidies, net, and - other adjustments, net. - Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. - Used by management to assess performance and effectiveness of our business strategies. - Provides a measure, among others, used in the determination of incentive compensation for management. Adjusted net income and Adjusted net income per diluted share Net income (loss) and net income (loss) per diluted share, excluding: - amortization of intangibles of acquired businesses, - amortization of software as a service assets, - goodwill and intangible asset impairment charge, - workforce reduction costs, - COVID-19 government subsidies, net, - other adjustments, net, - tax effect of each adjustment to U.S. GAAP, and - adjustment of income taxes to normalized effective rate for periods prior to Q2 2020. - Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. - Used by management to assess performance and effectiveness of our business strategies.

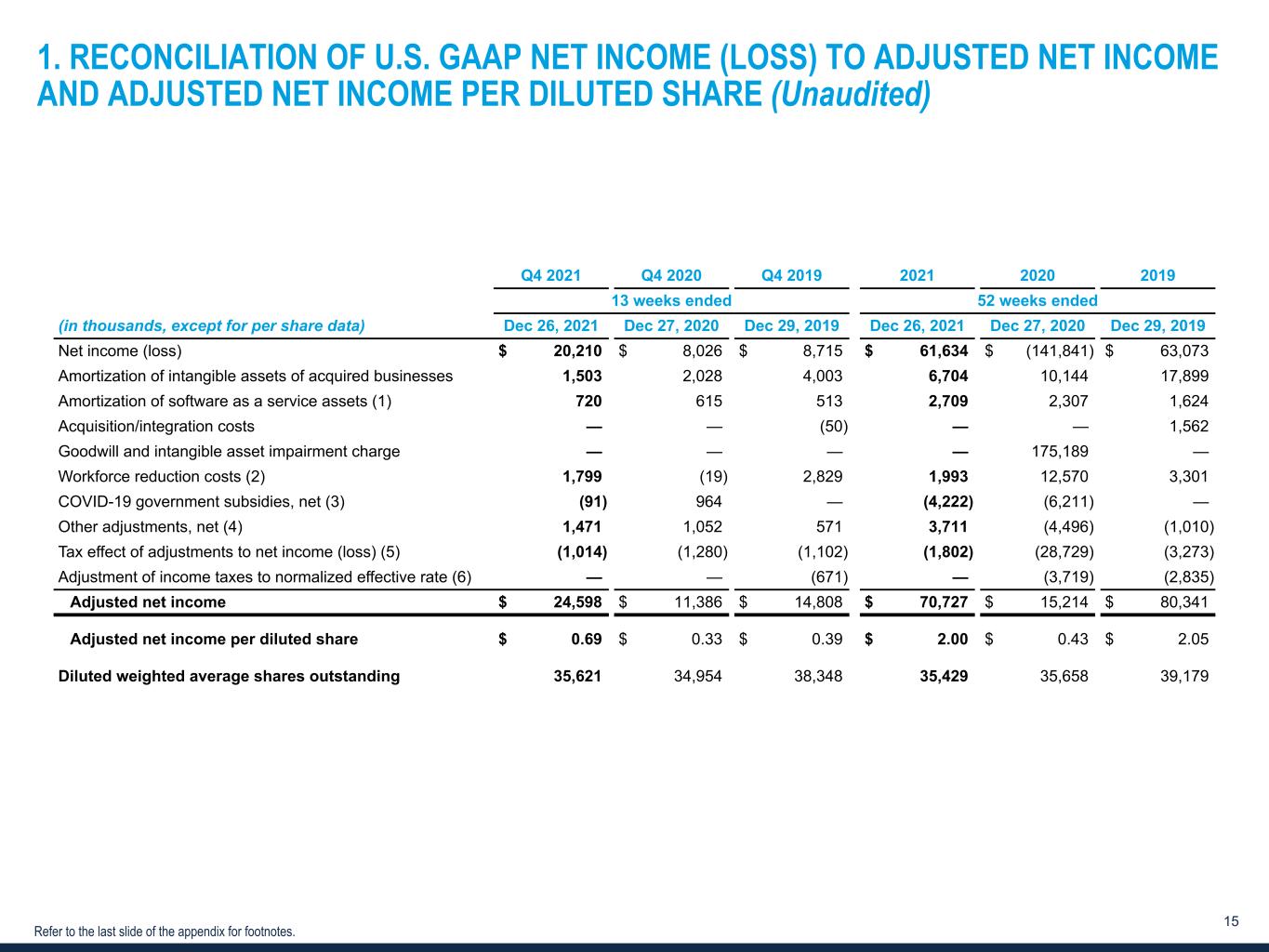

www.TrueBlue.c om 15 1. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME PER DILUTED SHARE (Unaudited) Refer to the last slide of the appendix for footnotes. Q4 2021 Q4 2020 Q4 2019 2021 2020 2019 13 weeks ended 52 weeks ended (in thousands, except for per share data) Dec 26, 2021 Dec 27, 2020 Dec 29, 2019 Dec 26, 2021 Dec 27, 2020 Dec 29, 2019 Net income (loss) $ 20,210 $ 8,026 $ 8,715 $ 61,634 $ (141,841) $ 63,073 Amortization of intangible assets of acquired businesses 1,503 2,028 4,003 6,704 10,144 17,899 Amortization of software as a service assets (1) 720 615 513 2,709 2,307 1,624 Acquisition/integration costs — — (50) — — 1,562 Goodwill and intangible asset impairment charge — — — — 175,189 — Workforce reduction costs (2) 1,799 (19) 2,829 1,993 12,570 3,301 COVID-19 government subsidies, net (3) (91) 964 — (4,222) (6,211) — Other adjustments, net (4) 1,471 1,052 571 3,711 (4,496) (1,010) Tax effect of adjustments to net income (loss) (5) (1,014) (1,280) (1,102) (1,802) (28,729) (3,273) Adjustment of income taxes to normalized effective rate (6) — — (671) — (3,719) (2,835) Adjusted net income $ 24,598 $ 11,386 $ 14,808 $ 70,727 $ 15,214 $ 80,341 Adjusted net income per diluted share $ 0.69 $ 0.33 $ 0.39 $ 2.00 $ 0.43 $ 2.05 Diluted weighted average shares outstanding 35,621 34,954 38,348 35,429 35,658 39,179

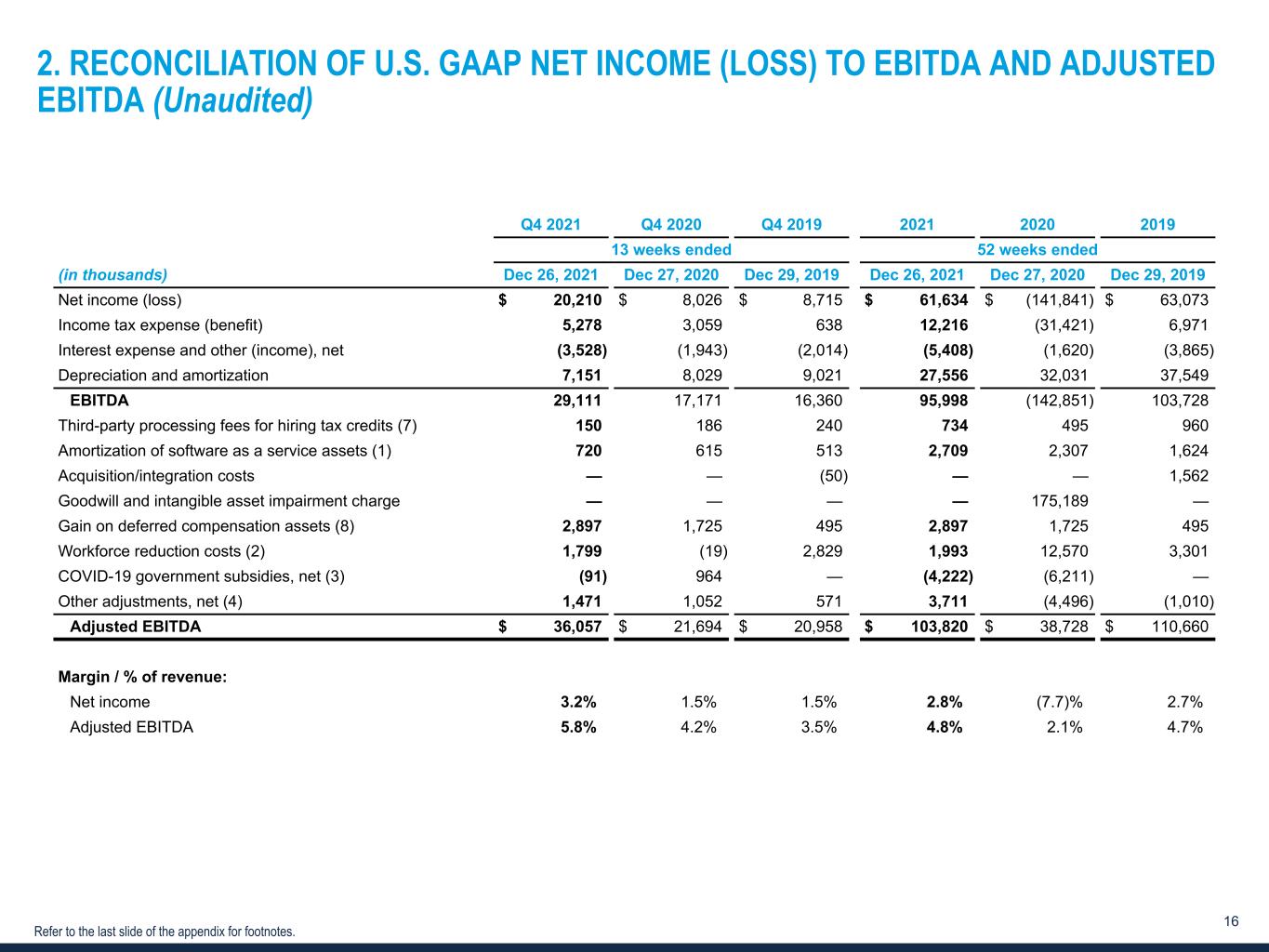

www.TrueBlue.c om 16 Refer to the last slide of the appendix for footnotes. 2. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO EBITDA AND ADJUSTED EBITDA (Unaudited) Q4 2021 Q4 2020 Q4 2019 2021 2020 2019 13 weeks ended 52 weeks ended (in thousands) Dec 26, 2021 Dec 27, 2020 Dec 29, 2019 Dec 26, 2021 Dec 27, 2020 Dec 29, 2019 Net income (loss) $ 20,210 $ 8,026 $ 8,715 $ 61,634 $ (141,841) $ 63,073 Income tax expense (benefit) 5,278 3,059 638 12,216 (31,421) 6,971 Interest expense and other (income), net (3,528) (1,943) (2,014) (5,408) (1,620) (3,865) Depreciation and amortization 7,151 8,029 9,021 27,556 32,031 37,549 EBITDA 29,111 17,171 16,360 95,998 (142,851) 103,728 Third-party processing fees for hiring tax credits (7) 150 186 240 734 495 960 Amortization of software as a service assets (1) 720 615 513 2,709 2,307 1,624 Acquisition/integration costs — — (50) — — 1,562 Goodwill and intangible asset impairment charge — — — — 175,189 — Gain on deferred compensation assets (8) 2,897 1,725 495 2,897 1,725 495 Workforce reduction costs (2) 1,799 (19) 2,829 1,993 12,570 3,301 COVID-19 government subsidies, net (3) (91) 964 — (4,222) (6,211) — Other adjustments, net (4) 1,471 1,052 571 3,711 (4,496) (1,010) Adjusted EBITDA $ 36,057 $ 21,694 $ 20,958 $ 103,820 $ 38,728 $ 110,660 Margin / % of revenue: Net income 3.2 % 1.5 % 1.5 % 2.8 % (7.7) % 2.7 % Adjusted EBITDA 5.8 % 4.2 % 3.5 % 4.8 % 2.1 % 4.7 %

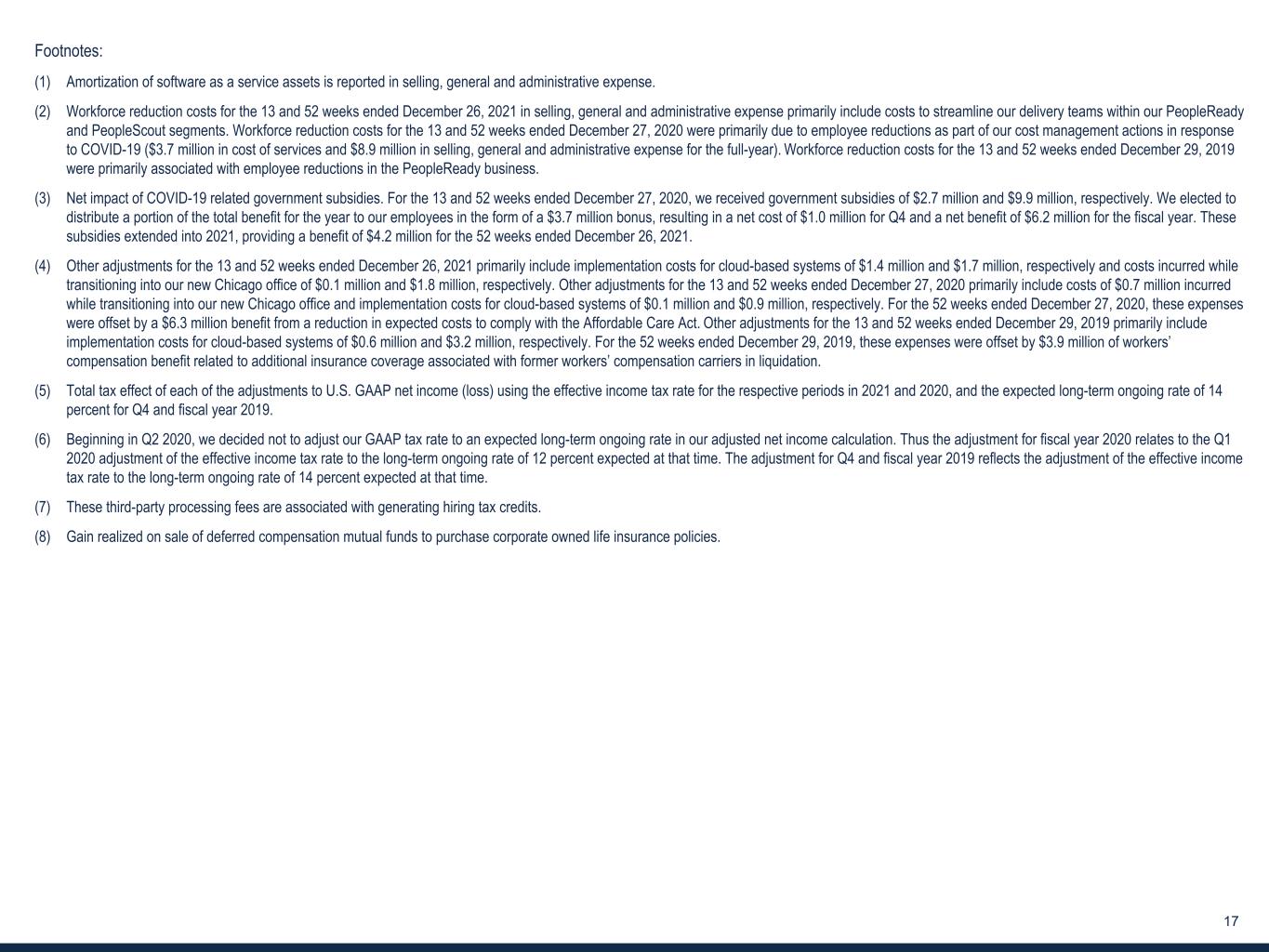

www.TrueBlue.c om 17 Footnotes: (1) Amortization of software as a service assets is reported in selling, general and administrative expense. (2) Workforce reduction costs for the 13 and 52 weeks ended December 26, 2021 in selling, general and administrative expense primarily include costs to streamline our delivery teams within our PeopleReady and PeopleScout segments. Workforce reduction costs for the 13 and 52 weeks ended December 27, 2020 were primarily due to employee reductions as part of our cost management actions in response to COVID-19 ($3.7 million in cost of services and $8.9 million in selling, general and administrative expense for the full-year). Workforce reduction costs for the 13 and 52 weeks ended December 29, 2019 were primarily associated with employee reductions in the PeopleReady business. (3) Net impact of COVID-19 related government subsidies. For the 13 and 52 weeks ended December 27, 2020, we received government subsidies of $2.7 million and $9.9 million, respectively. We elected to distribute a portion of the total benefit for the year to our employees in the form of a $3.7 million bonus, resulting in a net cost of $1.0 million for Q4 and a net benefit of $6.2 million for the fiscal year. These subsidies extended into 2021, providing a benefit of $4.2 million for the 52 weeks ended December 26, 2021. (4) Other adjustments for the 13 and 52 weeks ended December 26, 2021 primarily include implementation costs for cloud-based systems of $1.4 million and $1.7 million, respectively and costs incurred while transitioning into our new Chicago office of $0.1 million and $1.8 million, respectively. Other adjustments for the 13 and 52 weeks ended December 27, 2020 primarily include costs of $0.7 million incurred while transitioning into our new Chicago office and implementation costs for cloud-based systems of $0.1 million and $0.9 million, respectively. For the 52 weeks ended December 27, 2020, these expenses were offset by a $6.3 million benefit from a reduction in expected costs to comply with the Affordable Care Act. Other adjustments for the 13 and 52 weeks ended December 29, 2019 primarily include implementation costs for cloud-based systems of $0.6 million and $3.2 million, respectively. For the 52 weeks ended December 29, 2019, these expenses were offset by $3.9 million of workers’ compensation benefit related to additional insurance coverage associated with former workers’ compensation carriers in liquidation. (5) Total tax effect of each of the adjustments to U.S. GAAP net income (loss) using the effective income tax rate for the respective periods in 2021 and 2020, and the expected long-term ongoing rate of 14 percent for Q4 and fiscal year 2019. (6) Beginning in Q2 2020, we decided not to adjust our GAAP tax rate to an expected long-term ongoing rate in our adjusted net income calculation. Thus the adjustment for fiscal year 2020 relates to the Q1 2020 adjustment of the effective income tax rate to the long-term ongoing rate of 12 percent expected at that time. The adjustment for Q4 and fiscal year 2019 reflects the adjustment of the effective income tax rate to the long-term ongoing rate of 14 percent expected at that time. (7) These third-party processing fees are associated with generating hiring tax credits. (8) Gain realized on sale of deferred compensation mutual funds to purchase corporate owned life insurance policies.