Investor Roadshow Presentation July 2021

Forward-Looking Statements This document contains forward-looking statements relating to our plans and expectations, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this release and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions, (2) the continued impact of COVID-19 and related economic impact and governmental response, (3) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, (4) our ability to attract and retain clients, (5) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (6) our ability to maintain profit margins, (7) new laws, regulations, and government incentives that could affect our operations or financial results, (8) our ability to successfully execute on business strategies to further digitalize our business model, and (9) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. In addition, we use several non-GAAP financial measures when presenting our financial results in this document. Please refer to the reconciliations between our GAAP and non-GAAP financial measures in the appendix to this presentation and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated.

Investment highlights Return of Capital Market leader in U.S. blue collar staffing and global RPO with increasingly diverse service offerings Attractive growth potential from secular, cyclical and post-Covid recovery factors Strong balance sheet and cash flow to support stock buybacks Sound growth strategies applying industry leading digital technology to increase market share

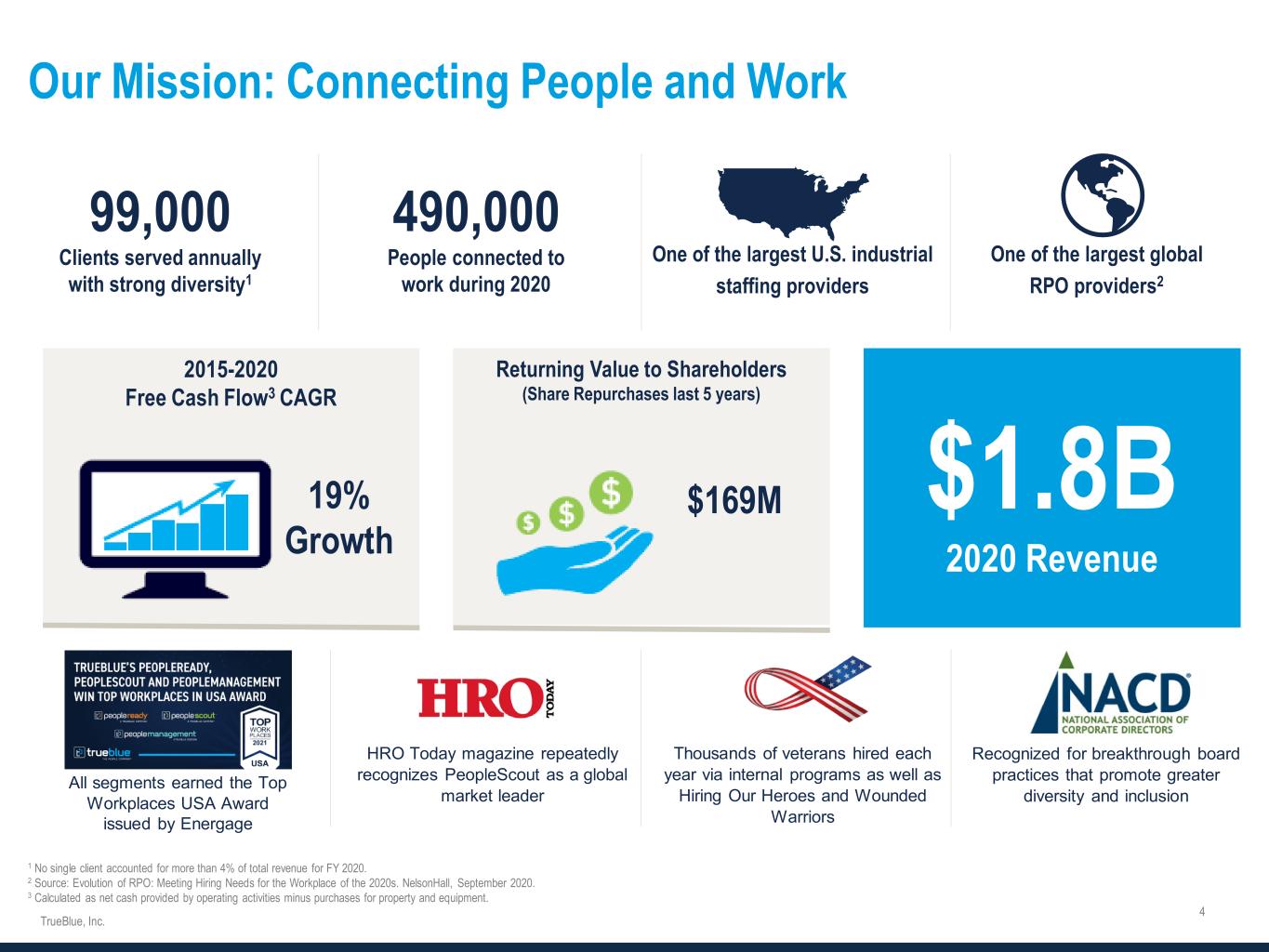

Our Mission: Connecting People and Work 99,000 Clients served annually with strong diversity1 490,000 People connected to work during 2020 One of the largest U.S. industrial staffing providers One of the largest global RPO providers2 Returning Value to Shareholders (Share Repurchases last 5 years) 2015-2020 Free Cash Flow3 CAGR $1.8B 2020 Revenue 19% Growth $169M HRO Today magazine repeatedly recognizes PeopleScout as a global market leader Thousands of veterans hired each year via internal programs as well as Hiring Our Heroes and Wounded Warriors Recognized for breakthrough board practices that promote greater diversity and inclusion 1 No single client accounted for more than 4% of total revenue for FY 2020. 2 Source: Evolution of RPO: Meeting Hiring Needs for the Workplace of the 2020s. NelsonHall, September 2020. 3 Calculated as net cash provided by operating activities minus purchases for property and equipment. All segments earned the Top Workplaces USA Award issued by Energage

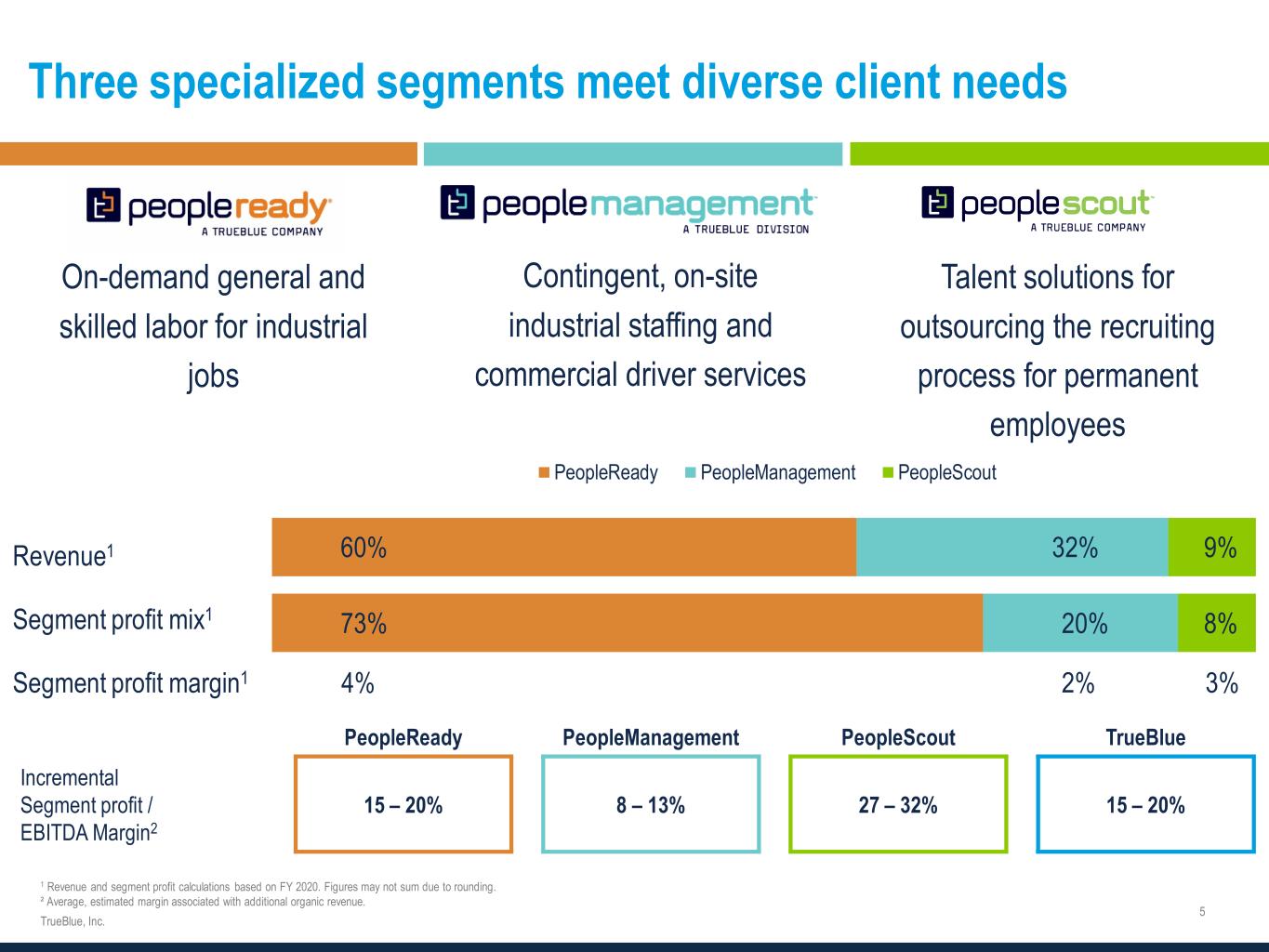

Three specialized segments meet diverse client needs On-demand general and skilled labor for industrial jobs Contingent, on-site industrial staffing and commercial driver services Talent solutions for outsourcing the recruiting process for permanent employees 1 Revenue and segment profit calculations based on FY 2020. Figures may not sum due to rounding. ² Average, estimated margin associated with additional organic revenue. PeopleReady PeopleManagement PeopleScout TrueBlue Incremental Segment profit / EBITDA Margin2 15 – 20% 8 – 13% 27 – 32% 15 – 20% 60% 73% 32% 20% 9% 8% PeopleReady PeopleManagement PeopleScout Revenue1 Segment profit mix1 Segment profit margin1 4% 2% 3%

Solving workforce challenges Workforce Complexity Many factors, including globalization, the “gig” economy and diversity are changing the world of work requiring a disciplined approach to hiring. Artificial Intelligence Companies are seeking ways to become nimbler and more efficient Deploying AI to source human capital will be a requirement to compete. Remote Recruiting The worker supply chain is becoming increasingly decentralized. TrueBlue’s digital strategy connects people anywhere at any time. Workforce solutions are in high demand as businesses increasingly turn to human capital experts to solve talent challenges. A robust value proposition with specialized, digital solutions for staffing, workforce management and recruitment process outsourcing.

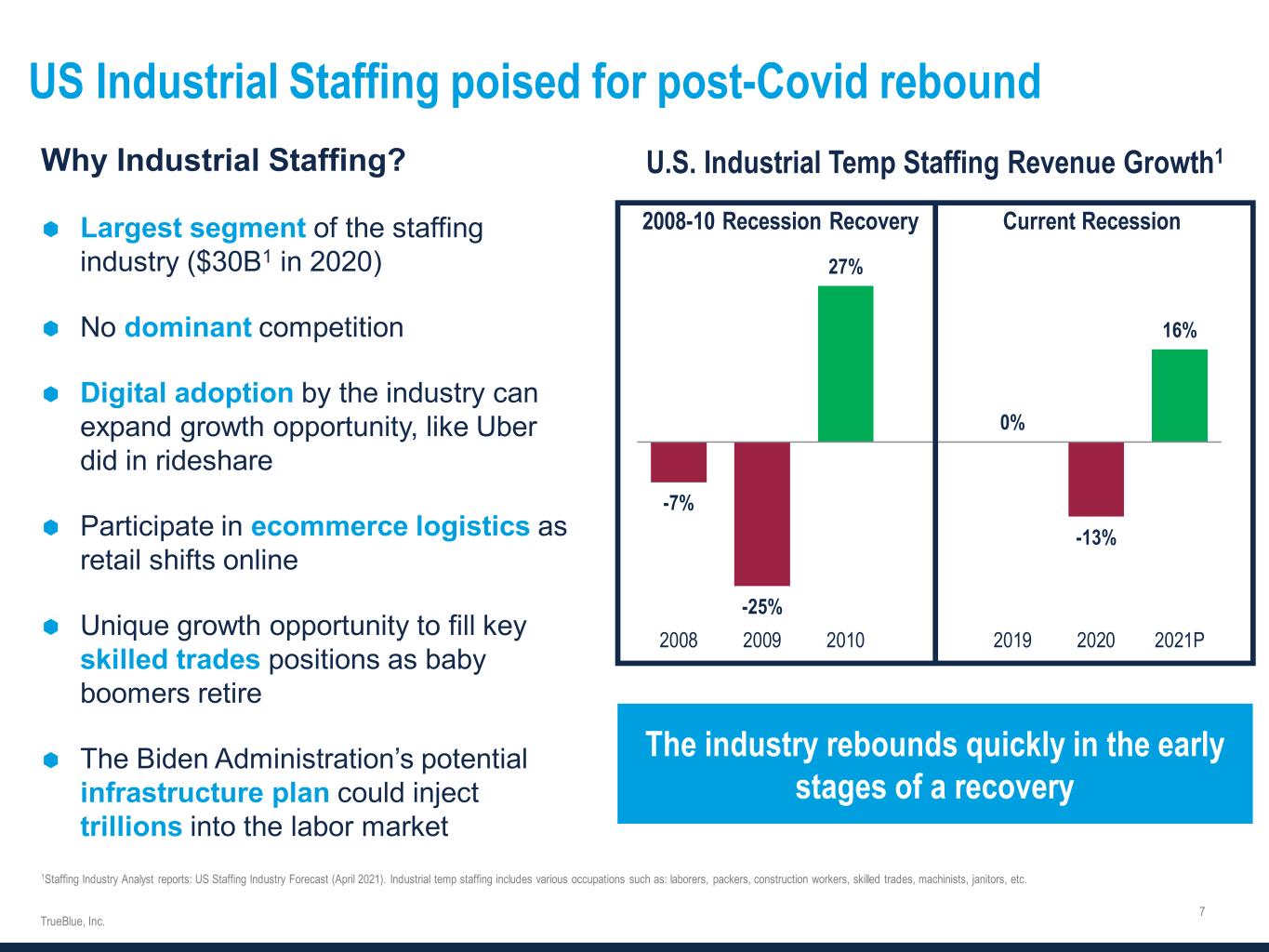

US Industrial Staffing poised for post-Covid rebound Why Industrial Staffing? Largest segment of the staffing industry ($30B1 in 2020) No dominant competition Digital adoption by the industry can expand growth opportunity, like Uber did in rideshare Participate in ecommerce logistics as retail shifts online Unique growth opportunity to fill key skilled trades positions as baby boomers retire The Biden Administration’s potential infrastructure plan could inject trillions into the labor market 1Staffing Industry Analyst reports: US Staffing Industry Forecast (April 2021). Industrial temp staffing includes various occupations such as: laborers, packers, construction workers, skilled trades, machinists, janitors, etc. U.S. Industrial Temp Staffing Revenue Growth1 -7% -25% 27% 0% -13% 16% 2008 2009 2010 2019 2020 2021P 2008-10 Recession Recovery Current Recession The industry rebounds quickly in the early stages of a recovery

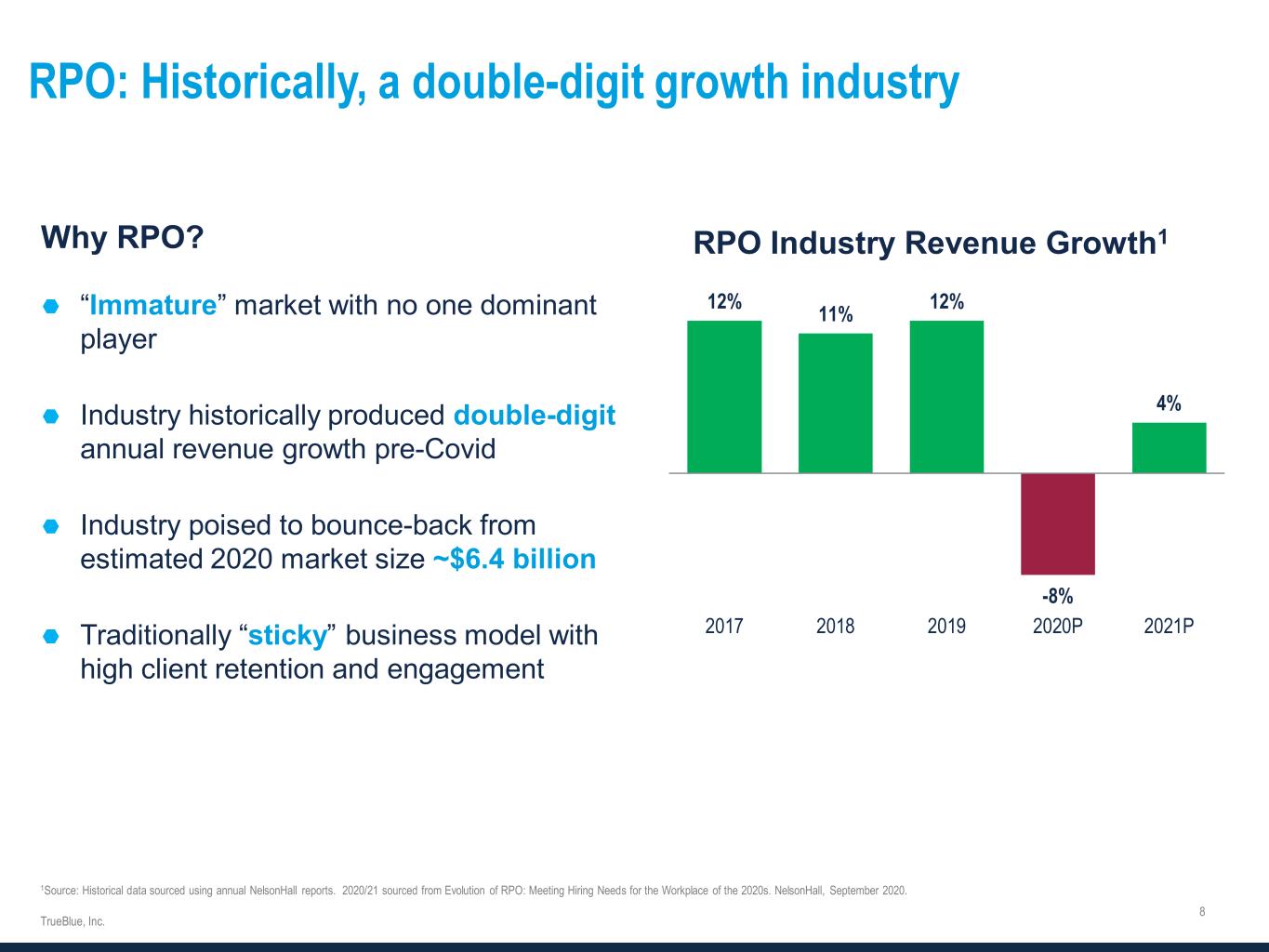

RPO: Historically, a double-digit growth industry Why RPO? “Immature” market with no one dominant player Industry historically produced double-digit annual revenue growth pre-Covid Industry poised to bounce-back from estimated 2020 market size ~$6.4 billion Traditionally “sticky” business model with high client retention and engagement 1Source: Historical data sourced using annual NelsonHall reports. 2020/21 sourced from Evolution of RPO: Meeting Hiring Needs for the Workplace of the 2020s. NelsonHall, September 2020. 12% 11% 12% -8% 4% 2017 2018 2019 2020P 2021P RPO Industry Revenue Growth1

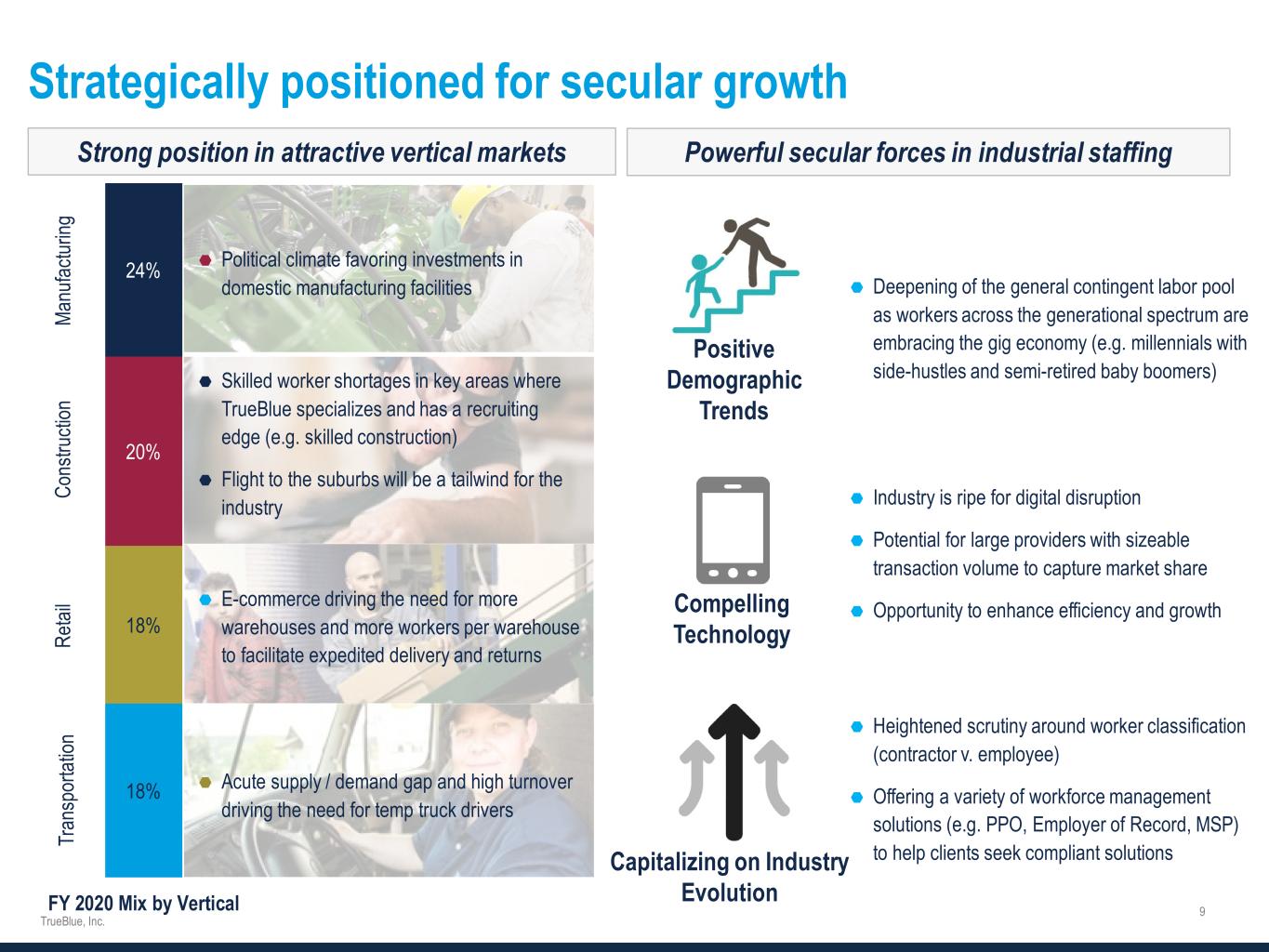

Strategically positioned for secular growth Strong position in attractive vertical markets Powerful secular forces in industrial staffing Deepening of the general contingent labor pool as workers across the generational spectrum are embracing the gig economy (e.g. millennials with side-hustles and semi-retired baby boomers) Positive Demographic Trends Industry is ripe for digital disruption Potential for large providers with sizeable transaction volume to capture market share Opportunity to enhance efficiency and growthCompelling Technology Heightened scrutiny around worker classification (contractor v. employee) Offering a variety of workforce management solutions (e.g. PPO, Employer of Record, MSP) to help clients seek compliant solutionsCapitalizing on Industry Evolution 18% 18% 20% 24% FY 2020 Mix by Vertical Co ns tru cti on Ma nu fac tur ing Tr an sp or tat ion Skilled worker shortages in key areas where TrueBlue specializes and has a recruiting edge (e.g. skilled construction) Flight to the suburbs will be a tailwind for the industry Political climate favoring investments in domestic manufacturing facilities Acute supply / demand gap and high turnover driving the need for temp truck drivers E-commerce driving the need for more warehouses and more workers per warehouse to facilitate expedited delivery and returnsRe tai l

Leverage technology and our industry leading position to grow share and enhance efficiency Strategy highlights Digitalize our business model to gain market share from smaller and less well-capitalized competitors and reduce costs Drive higher client usage ("heavy client users") of JobStackTM, our industry- leading technology, to accelerate revenue improvement Increase candidate flow and quality using new digital onboarding platforms Continue momentum on new customer wins through strong execution of sales initiatives Increase sales resources to expand into under- penetrated geographic markets Invest in client and associate care in addition to retention programs Focus sales and marketing efforts to capitalize on industry dynamics (i.e. outsourcing) and hard-hit sectors entering recovery (i.e. travel & leisure) Leverage our strong brand; independently ranked as a market leader Expand technology offering to improve client delivery and recruiting efficiency

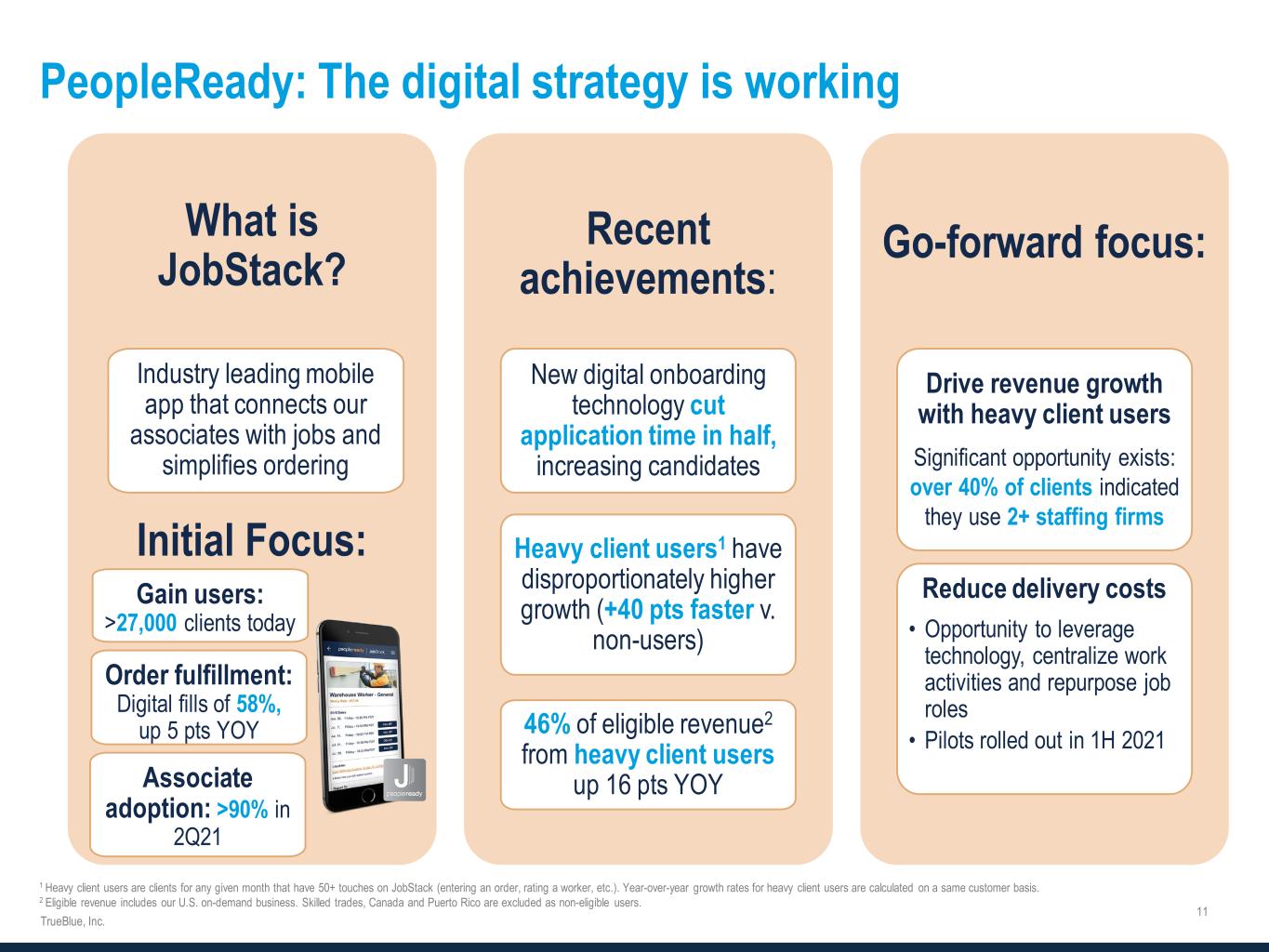

PeopleReady: The digital strategy is working What is JobStack? Initial Focus: Industry leading mobile app that connects our associates with jobs and simplifies ordering Order fulfillment: Digital fills of 58%, up 5 pts YOY Recent achievements: New digital onboarding technology cut application time in half, increasing candidates Heavy client users1 have disproportionately higher growth (+40 pts faster v. non-users) 46% of eligible revenue2 from heavy client users up 16 pts YOY Go-forward focus: Drive revenue growth with heavy client users Significant opportunity exists: over 40% of clients indicated they use 2+ staffing firms Reduce delivery costs • Opportunity to leverage technology, centralize work activities and repurpose job roles • Pilots rolled out in 1H 2021 Gain users: >27,000 clients today Associate adoption: >90% in 2Q21 1 Heavy client users are clients for any given month that have 50+ touches on JobStack (entering an order, rating a worker, etc.). Year-over-year growth rates for heavy client users are calculated on a same customer basis. 2 Eligible revenue includes our U.S. on-demand business. Skilled trades, Canada and Puerto Rico are excluded as non-eligible users.

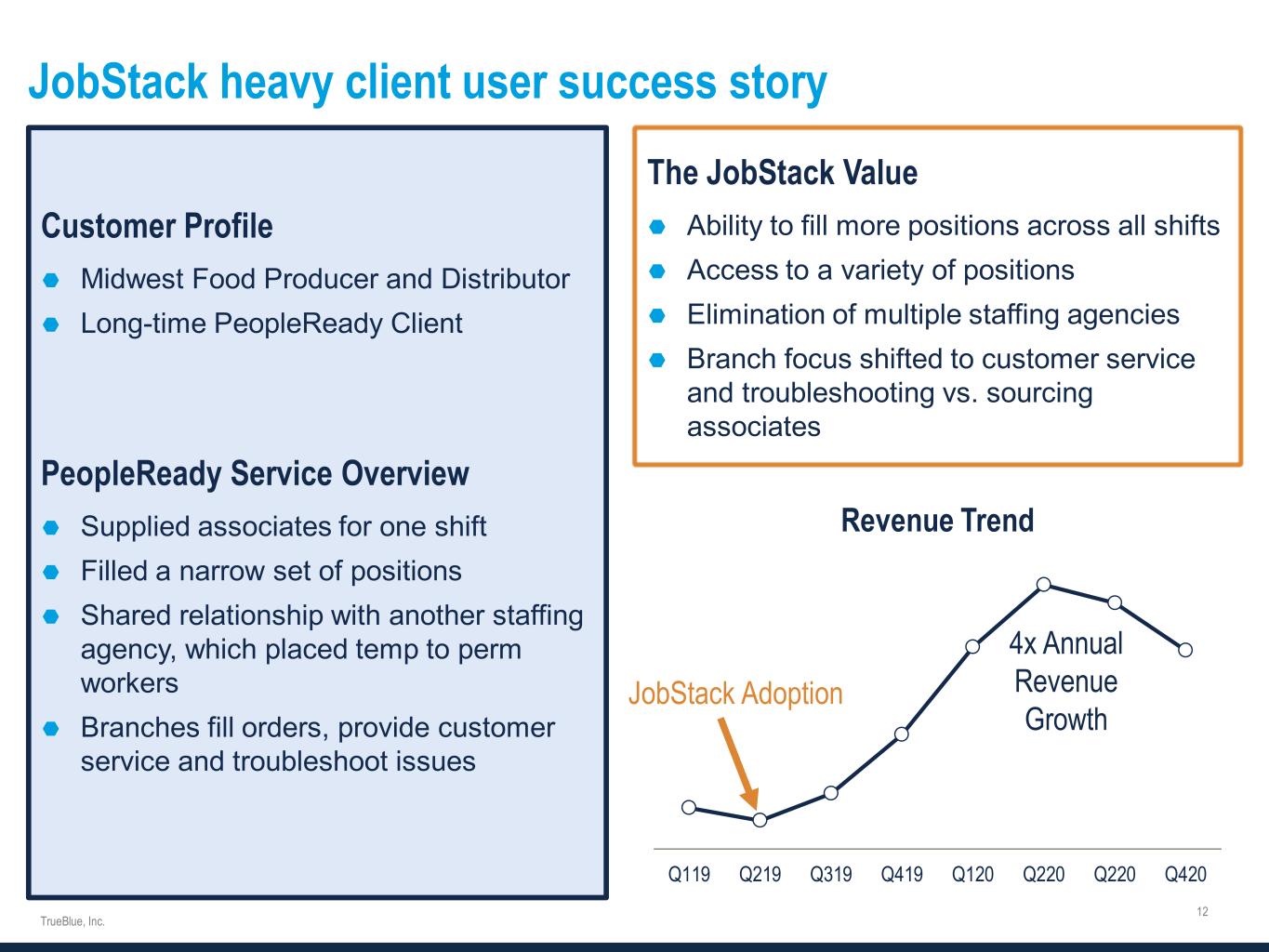

JobStack heavy client user success story Customer Profile Midwest Food Producer and Distributor Long-time PeopleReady Client PeopleReady Service Overview Supplied associates for one shift Filled a narrow set of positions Shared relationship with another staffing agency, which placed temp to perm workers Branches fill orders, provide customer service and troubleshoot issues The JobStack Value Ability to fill more positions across all shifts Access to a variety of positions Elimination of multiple staffing agencies Branch focus shifted to customer service and troubleshooting vs. sourcing associates Q119 Q219 Q319 Q419 Q120 Q220 Q220 Q420 Revenue Trend JobStack Adoption 4x Annual Revenue Growth

PeopleManagement: Expanding market share PeopleManagement proved more resilient during the pandemic due to the outsourced nature of our client relationships and is well-positioned for growth The team is deploying a variety of tactics and strategies to expand market share o Launching effort focused on smaller, local markets o Hiring additional salespeople and condensing their geographic footprint o Expanding into new sites at National Account clients o Cross-selling with other TrueBlue brands Approximately 90% of Onsite revenue is in the East and Midwest Onsite growth opportunities

PeopleScout: Industry leader with historically high margins Strong Brand Recognition o #1 by HRO Today’s Total Workforce Solution Baker’s Dozen o 3rd largest North American and 4th largest global RPO provider Affinix Technology: A Differentiated Experience o Connects clients and candidates using AI, machine learnings and predictive analytics ideal in today’s remote recruiting landscape o Flexible platform with plans to monetize services our clients can use directly Strong Growth & Profitability Prospects o Demonstrated track record servicing large employers with dynamic needs in industries (hospitality, travel) positioned for a rebound o Segment margins expected to increase as scale returns o Expanding sales and client delivery teams to accelerate new business o Global focus as growing number of deals are multi-region and multi-country $181 $252 $160 2016 2019 2020 Revenue 19% 15% 3% 2016 2019 2020 Segment Profit Margin

ESG principles help us make sound decisions External ESG Ratings: AA Rating Risk Ranking: Low Risk Exposure: Low Risk Management: Avg Key Statistics: MSCI ESG industry leader (top 20% of all rated companies) 67% of Board Members are women or racially diverse 51% of Senior Management are women 97% of shareholders approved Executive Compensation How ESG guides our decision making: Risk Management framework development and governance Board of Directors oversight & governance Executive Compensation structure Compliance, Ethics and Code of Conduct policymaking

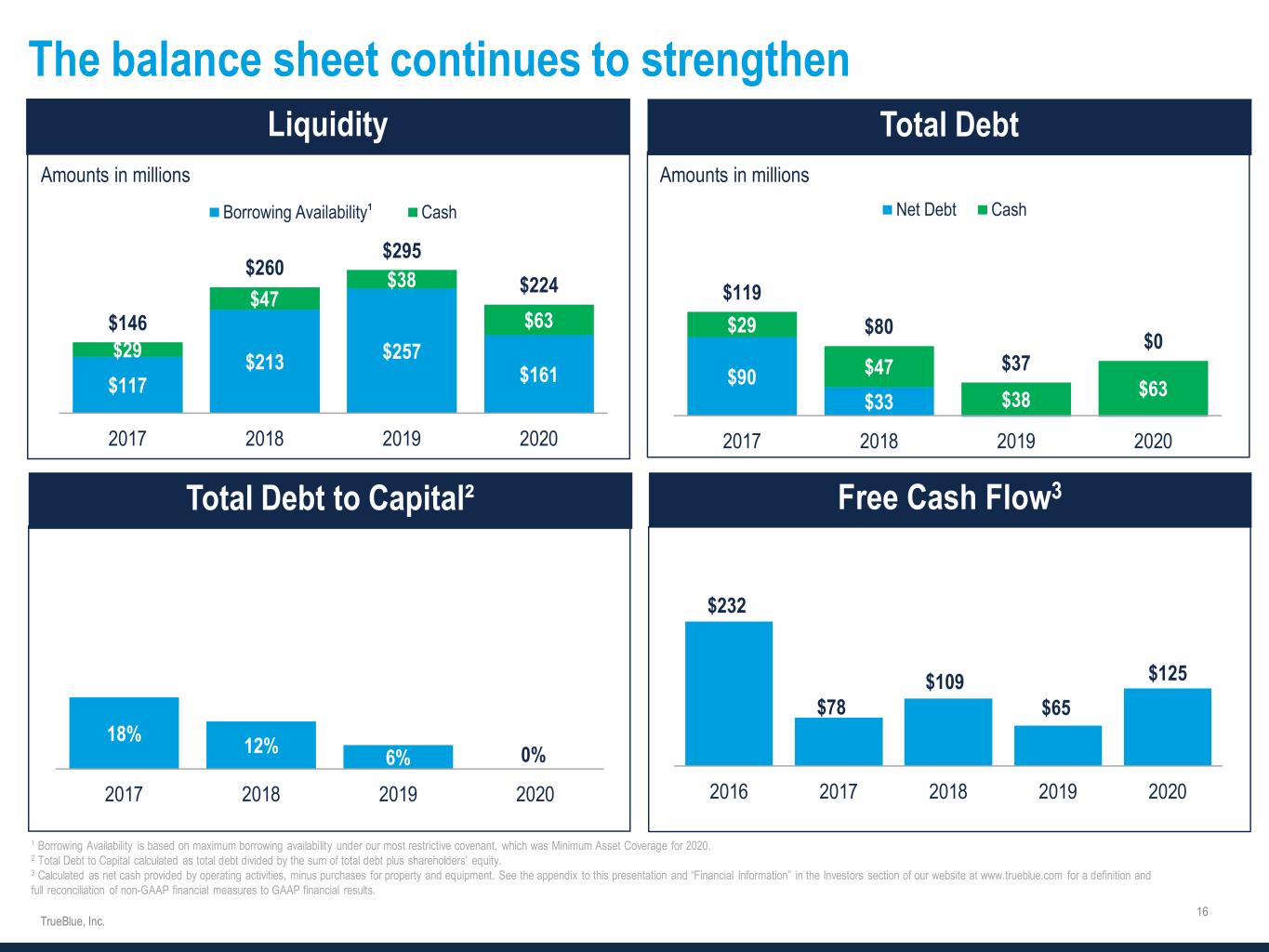

$90 $33 $29 $47 $38 $63 $119 $80 $37 $0 2017 2018 2019 2020 Net Debt Cash $117 $213 $257 $161 $29 $47 $38 $63$146 $260 $295 $224 2017 2018 2019 2020 Borrowing Availability Cash The balance sheet continues to strengthen 1 Borrowing Availability is based on maximum borrowing availability under our most restrictive covenant, which was Minimum Asset Coverage for 2020. 2 Total Debt to Capital calculated as total debt divided by the sum of total debt plus shareholders’ equity. 3 Calculated as net cash provided by operating activities, minus purchases for property and equipment. See the appendix to this presentation and “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. 3 Amounts in millions Amounts in millions $232 $78 $109 $65 $125 2016 2017 2018 2019 2020 18% 12% 6% 0% 2017 2018 2019 2020 ¹

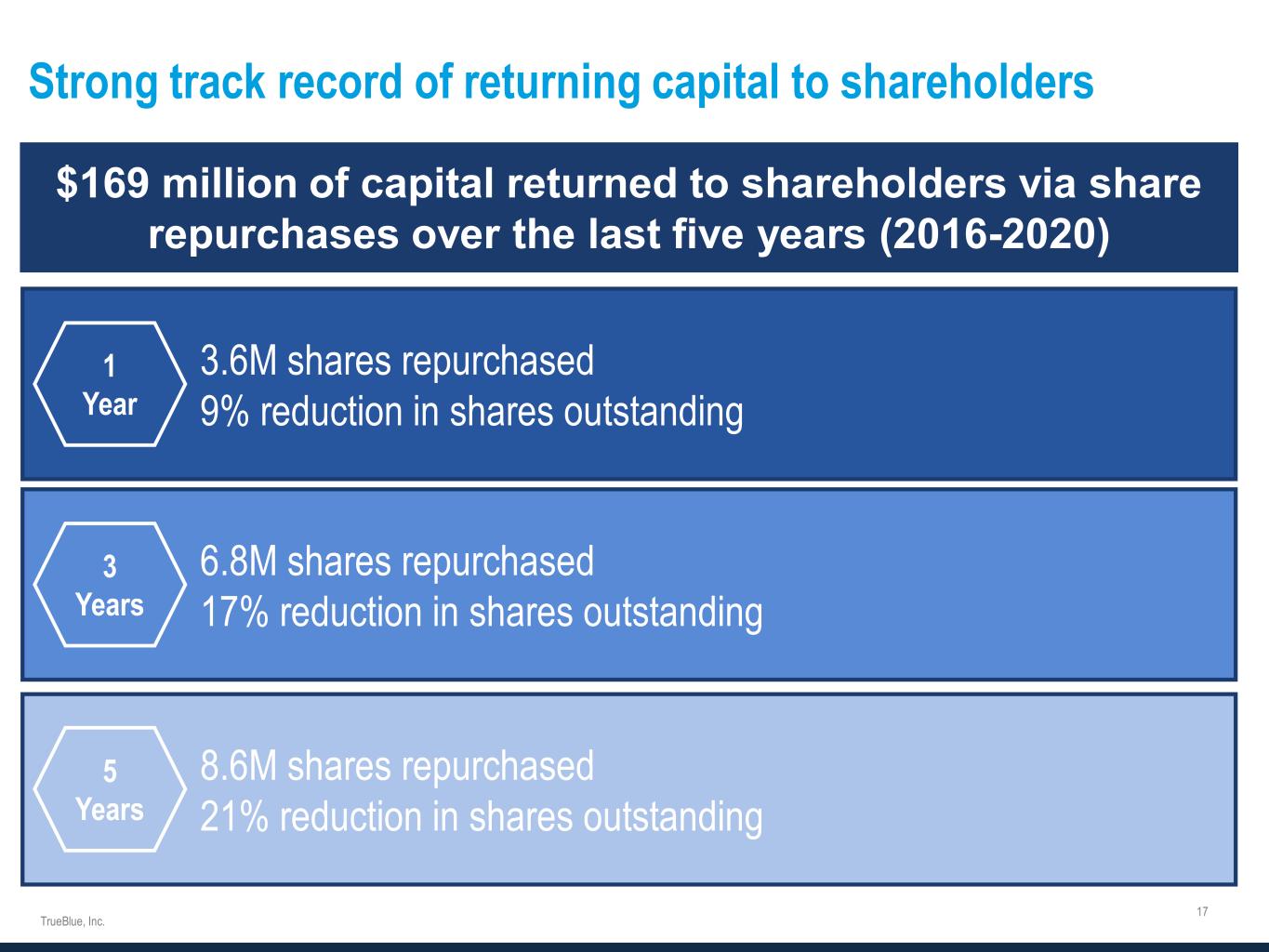

Strong track record of returning capital to shareholders $169 million of capital returned to shareholders via share repurchases over the last five years (2016-2020) 3.6M shares repurchased 9% reduction in shares outstanding 1 Year 6.8M shares repurchased 17% reduction in shares outstanding 8.6M shares repurchased 21% reduction in shares outstanding 3 Years 5 Years

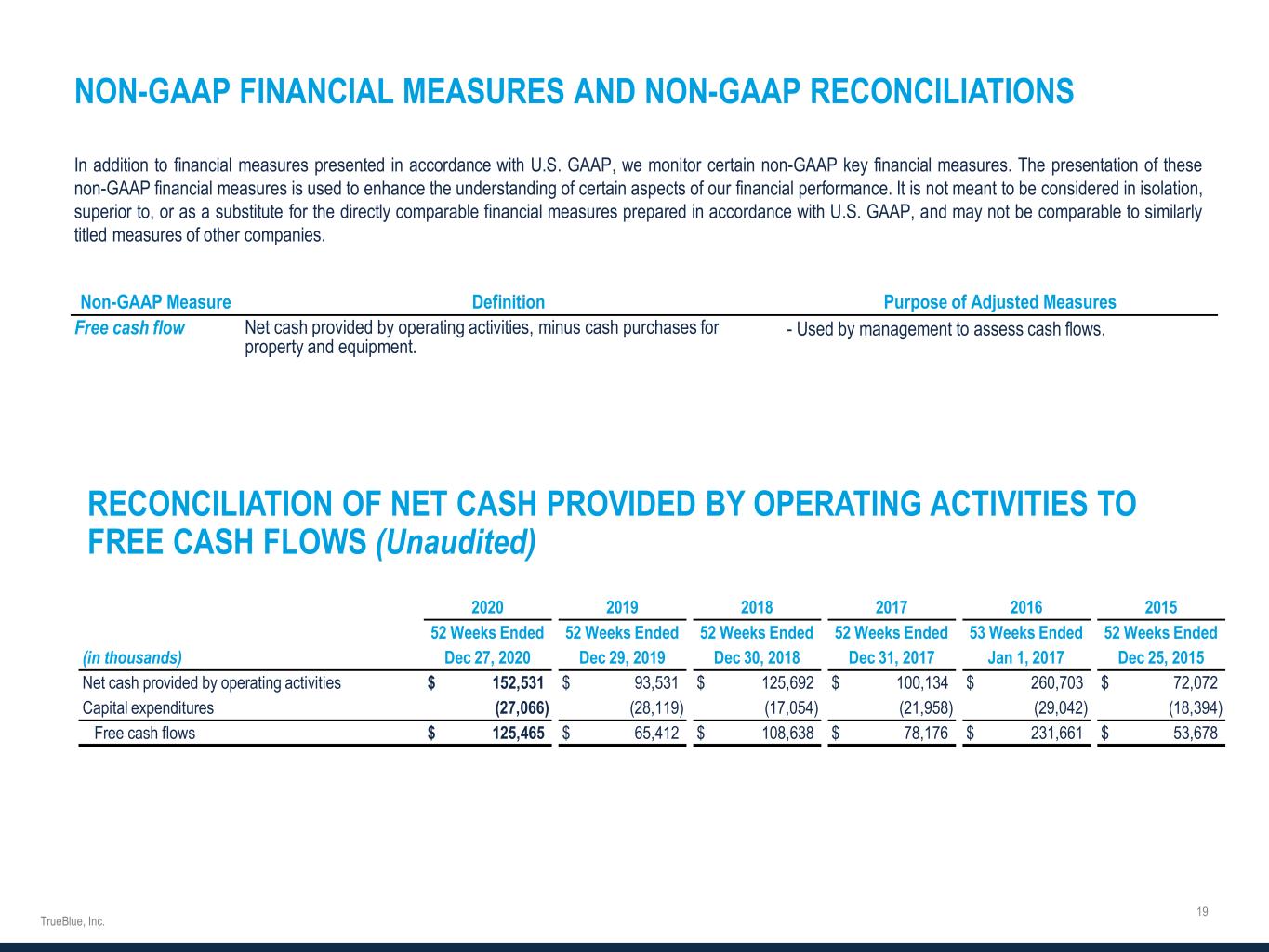

NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP Measure Definition Purpose of Adjusted Measures Free cash flow Net cash provided by operating activities, minus cash purchases for property and equipment. - Used by management to assess cash flows. RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOWS (Unaudited) 2020 2019 2018 2017 2016 2015 52 Weeks Ended 52 Weeks Ended 52 Weeks Ended 52 Weeks Ended 53 Weeks Ended 52 Weeks Ended (in thousands) Dec 27, 2020 Dec 29, 2019 Dec 30, 2018 Dec 31, 2017 Jan 1, 2017 Dec 25, 2015 Net cash provided by operating activities $ 152,531 $ 93,531 $ 125,692 $ 100,134 $ 260,703 $ 72,072 Capital expenditures (27,066) (28,119) (17,054) (21,958) (29,042) (18,394) Free cash flows $ 125,465 $ 65,412 $ 108,638 $ 78,176 $ 231,661 $ 53,678