Q4 2020 Earnings February 2021

www.TrueBlue.c om 2 Forward-looking statements This document contains forward-looking statements relating to our plans and expectations, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this release and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions, (2) the continued impact of COVID-19 and related economic impact and governmental response, (3) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, (4) our ability to attract and retain clients, (5) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (6) our ability to maintain profit margins, (7) new laws, regulations, and government incentives that could affect our operations or financial results, (8) our ability to successfully execute on business strategies to further digitize our business model, and (9) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. In addition, we use several non-GAAP financial measures when presenting our financial results in this document. Please refer to the reconciliations between our GAAP and non-GAAP financial measures in the appendix to this presentation and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated.

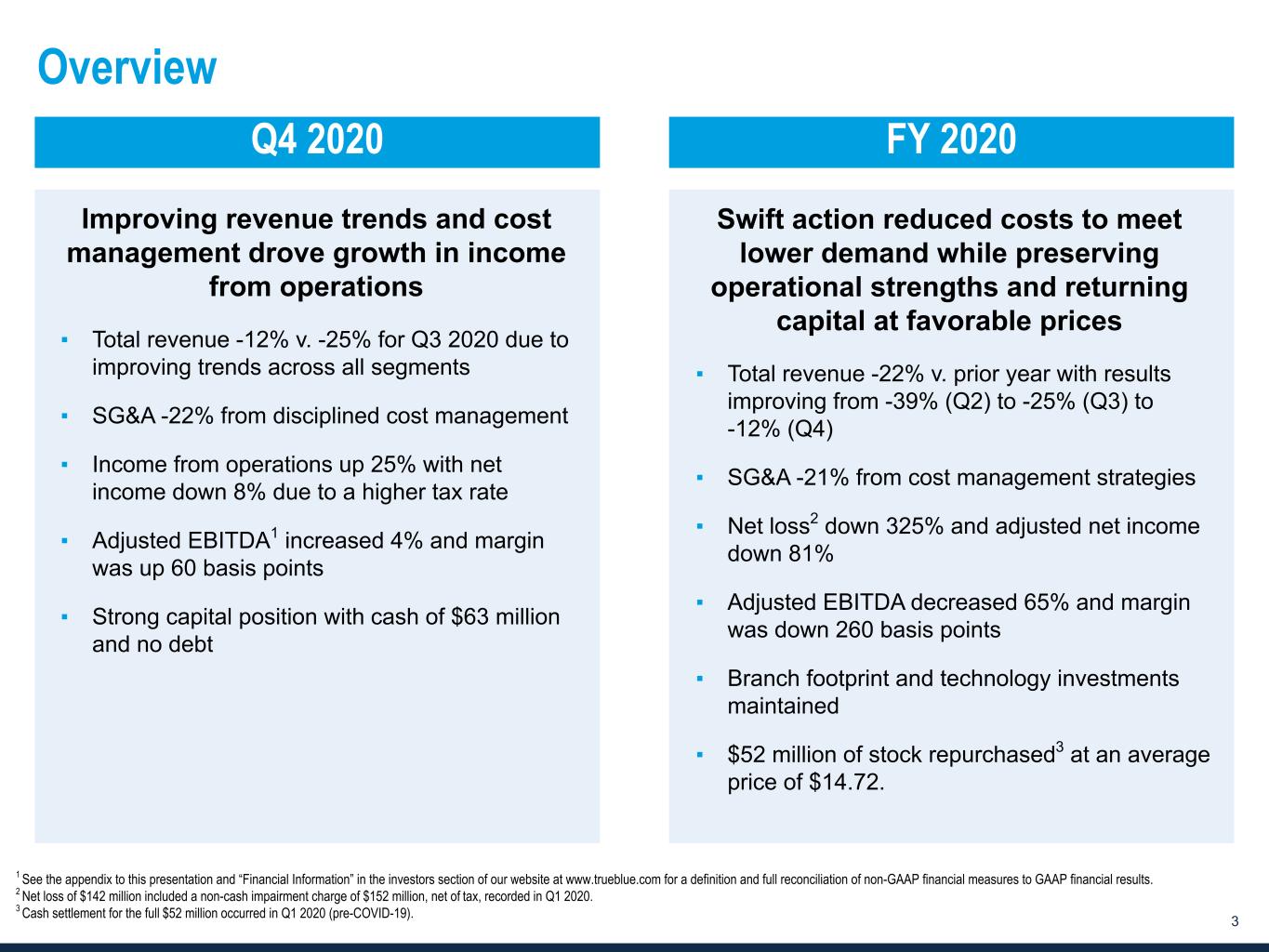

www.TrueBlue.c om 3 Overview Q4 2020 FY 2020 1 See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. 2 Net loss of $142 million included a non-cash impairment charge of $152 million, net of tax, recorded in Q1 2020. 3 Cash settlement for the full $52 million occurred in Q1 2020 (pre-COVID-19). Improving revenue trends and cost management drove growth in income from operations ▪ Total revenue -12% v. -25% for Q3 2020 due to improving trends across all segments ▪ SG&A -22% from disciplined cost management ▪ Income from operations up 25% with net income down 8% due to a higher tax rate ▪ Adjusted EBITDA1 increased 4% and margin was up 60 basis points ▪ Strong capital position with cash of $63 million and no debt Swift action reduced costs to meet lower demand while preserving operational strengths and returning capital at favorable prices ▪ Total revenue -22% v. prior year with results improving from -39% (Q2) to -25% (Q3) to -12% (Q4) ▪ SG&A -21% from cost management strategies ▪ Net loss2 down 325% and adjusted net income down 81% ▪ Adjusted EBITDA decreased 65% and margin was down 260 basis points ▪ Branch footprint and technology investments maintained ▪ $52 million of stock repurchased3 at an average price of $14.72.

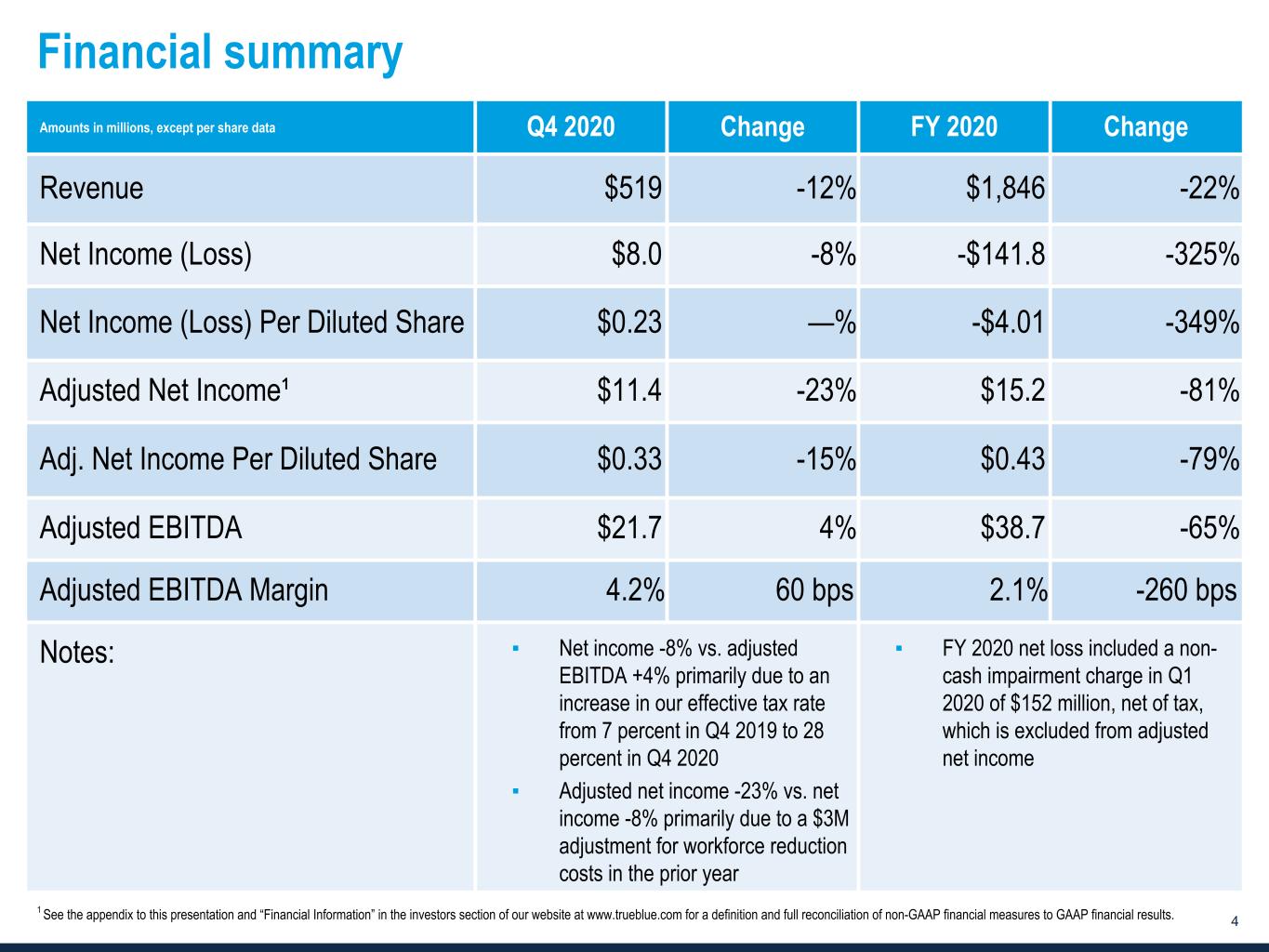

www.TrueBlue.c om 4 Financial summary 1 See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. Amounts in millions, except per share data Q4 2020 Change FY 2020 Change Revenue $519 -12 % $1,846 -22 % Net Income (Loss) $8.0 -8 % -$141.8 -325 % Net Income (Loss) Per Diluted Share $0.23 — % -$4.01 -349 % Adjusted Net Income¹ $11.4 -23 % $15.2 -81 % Adj. Net Income Per Diluted Share $0.33 -15 % $0.43 -79 % Adjusted EBITDA $21.7 4 % $38.7 -65 % Adjusted EBITDA Margin 4.2 % 60 bps 2.1 % -260 bps Notes: ▪ Net income -8% vs. adjusted EBITDA +4% primarily due to an increase in our effective tax rate from 7 percent in Q4 2019 to 28 percent in Q4 2020 ▪ Adjusted net income -23% vs. net income -8% primarily due to a $3M adjustment for workforce reduction costs in the prior year ▪ FY 2020 net loss included a non- cash impairment charge in Q1 2020 of $152 million, net of tax, which is excluded from adjusted net income

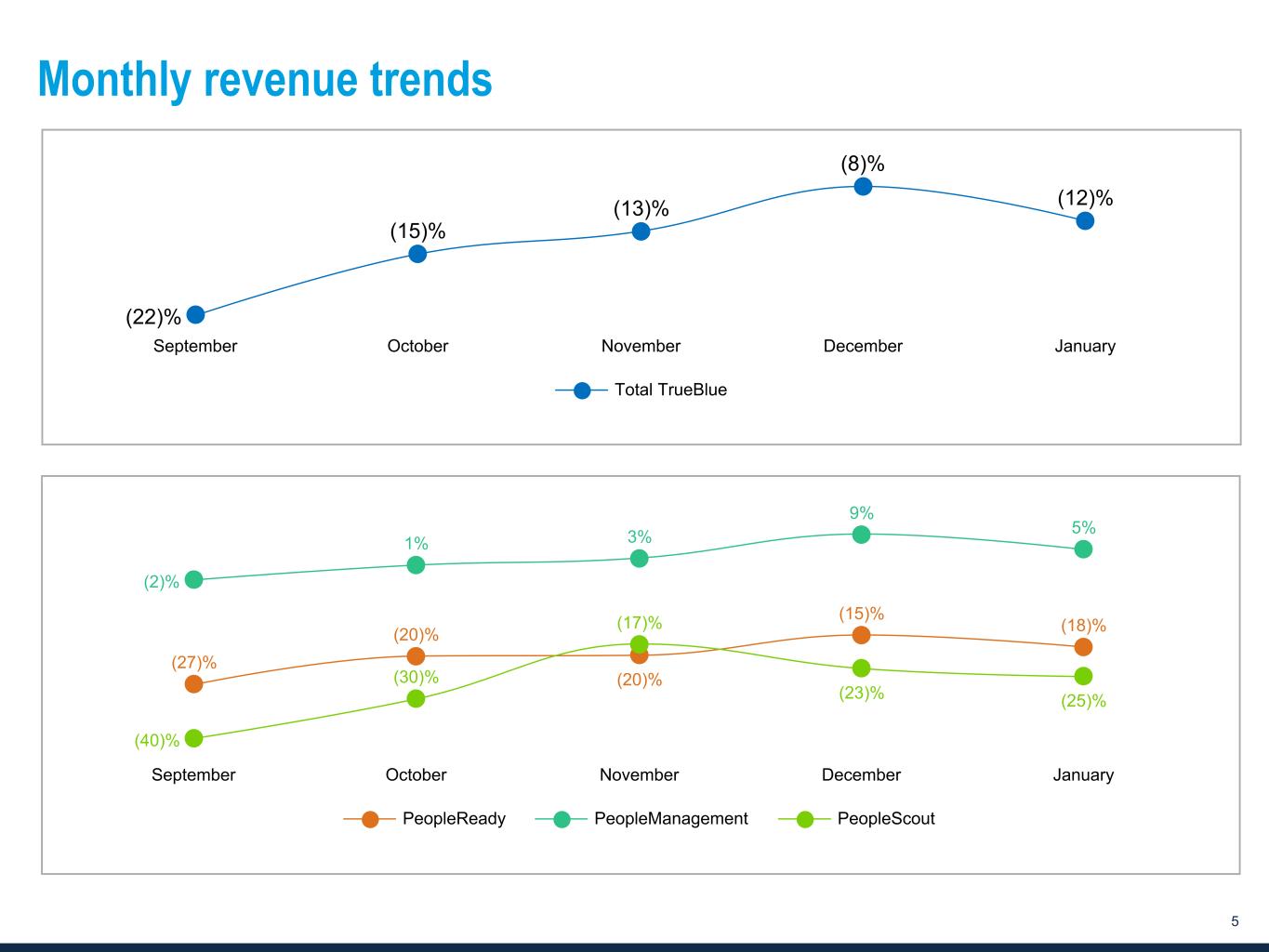

www.TrueBlue.c om 5 (27)% (20)% (20)% (15)% (18)% (2)% 1% 3% 9% 5% (40)% (30)% (17)% (23)% (25)% PeopleReady PeopleManagement PeopleScout September October November December January Monthly revenue trends (22)% (15)% (13)% (8)% (12)% Total TrueBlue September October November December January

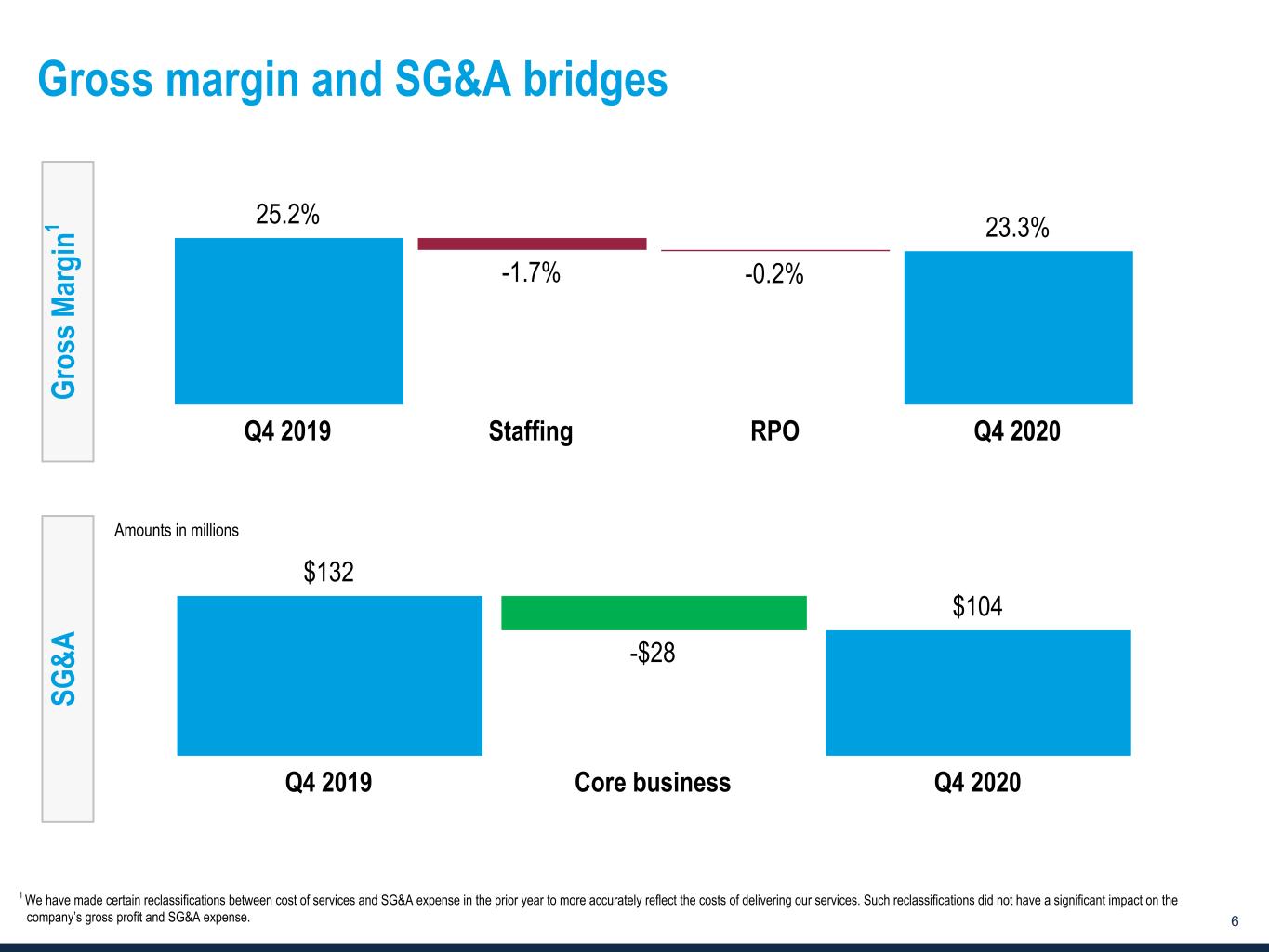

www.TrueBlue.c om 6 Gross margin and SG&A bridges Amounts in millions G ro ss M ar gi n1 SG &A $132 -$28 $104 Q4 2019 Core business Q4 2020 1 We have mad certain reclassifications between cost of services and SG&A expense in the prior year to more accurately reflect the costs of delivering our services. Such reclassifications did not have a significant impact on the company’s gross profit and SG&A expense. 25.2% -1.7% -0.2% 23.3% Q4 2019 Staffing RPO Q4 2020

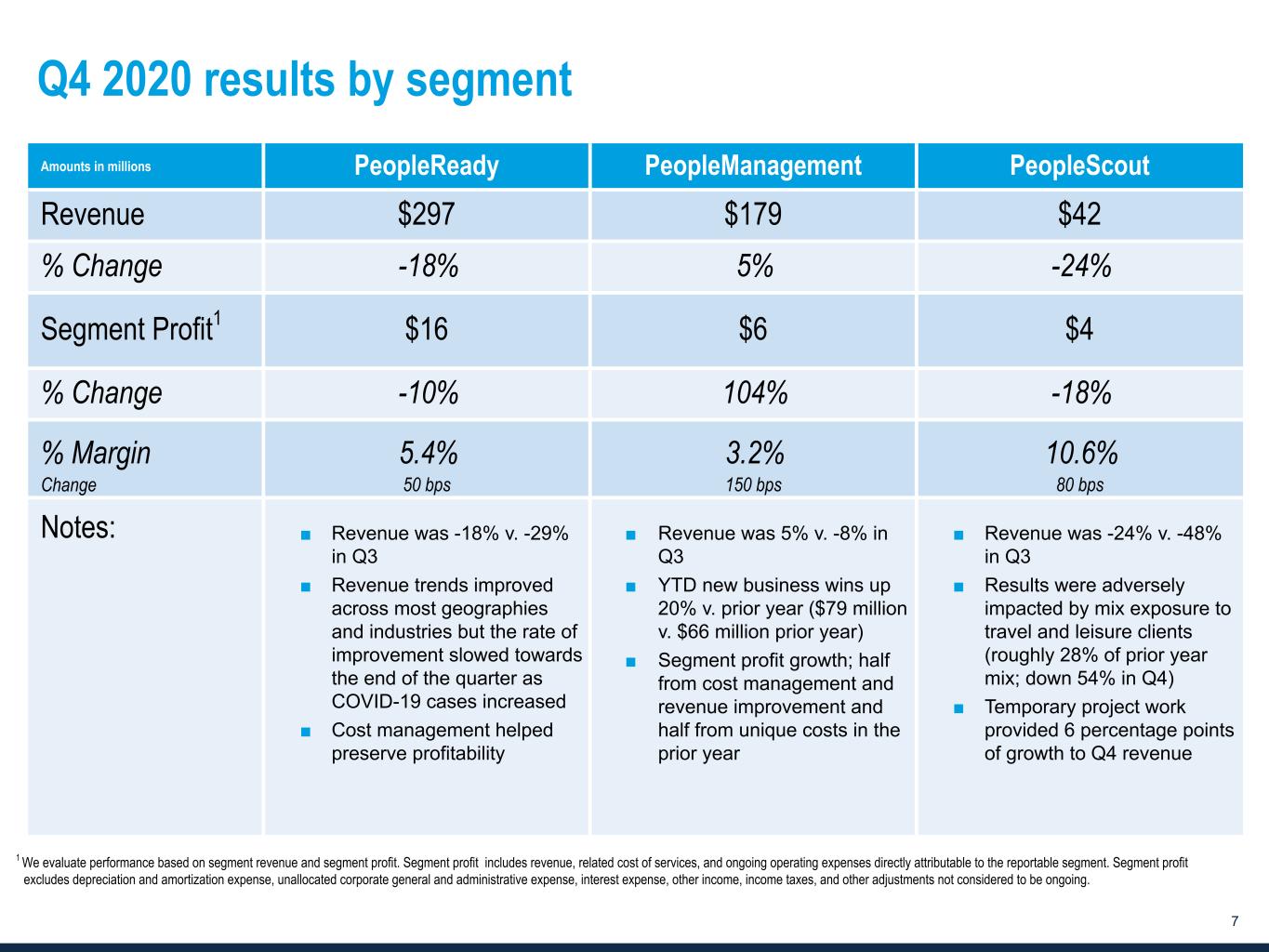

www.TrueBlue.c om 7 Q4 2020 results by segment Amounts in millions PeopleReady PeopleManagement PeopleScout Revenue $297 $179 $42 % Change -18% 5% -24% Segment Profit1 $16 $6 $4 % Change -10% 104% -18% % Margin 5.4% 3.2% 10.6% Change 50 bps 150 bps 80 bps Notes: ■ Revenue was -18% v. -29% in Q3 ■ Revenue trends improved across most geographies and industries but the rate of improvement slowed towards the end of the quarter as COVID-19 cases increased ■ Cost management helped preserve profitability ■ Revenue was 5% v. -8% in Q3 ■ YTD new business wins up 20% v. prior year ($79 million v. $66 million prior year) ■ Segment profit growth; half from cost management and revenue improvement and half from unique costs in the prior year ■ Revenue was -24% v. -48% in Q3 ■ Results were adversely impacted by mix exposure to travel and leisure clients (roughly 28% of prior year mix; down 54% in Q4) ■ Temporary project work provided 6 percentage points of growth to Q4 revenue 1 We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit excludes depreciation and amortization expense, unallocated corporate general and administrative expense, interest expense, other income, income taxes, and other adjustments not considered to be ongoing.

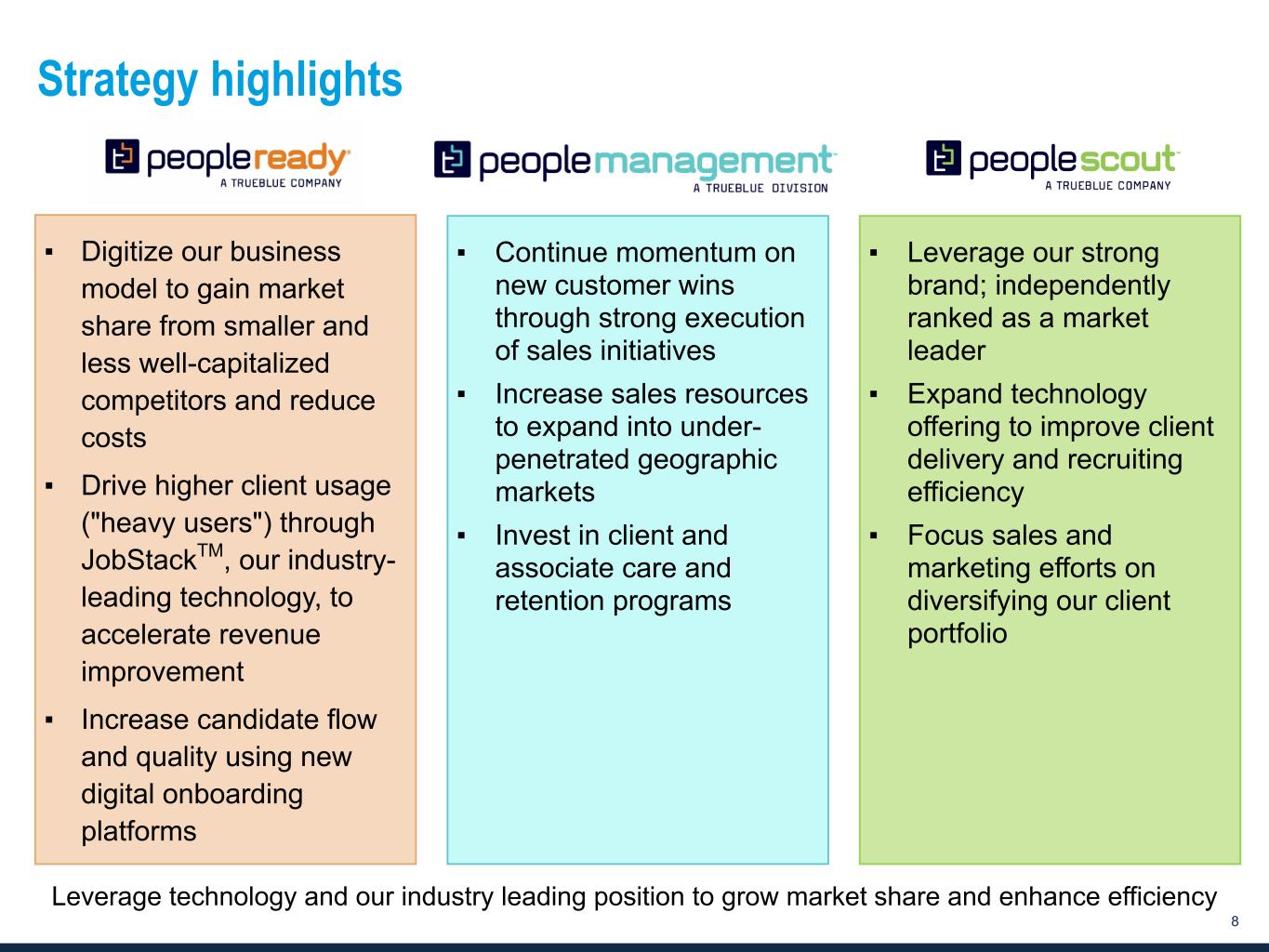

www.TrueBlue.c om 8 Strategy highlights Lev rage technology and our industry leading position to grow market share and enhance efficiency ▪ Leverage our strong brand; independently ranked as a market leader ▪ Expand technology offering to improve client delivery and recruiting efficiency ▪ Focus sales and marketing efforts on diversifying our client portfolio ▪ Digitize our business model to gain market share from smaller and less well-capitalized competitors and reduce costs ▪ Drive higher client usage ("heavy users") through JobStackTM, our industry- leading technology, to accelerate revenue improvement ▪ Increase candidate flow and quality using new digital onboarding platforms ▪ Continue momentum on new customer wins through strong execution of sales initiatives ▪ Increase sales resources to expand into under- penetrated geographic markets ▪ Invest in client and associate care and retention programs

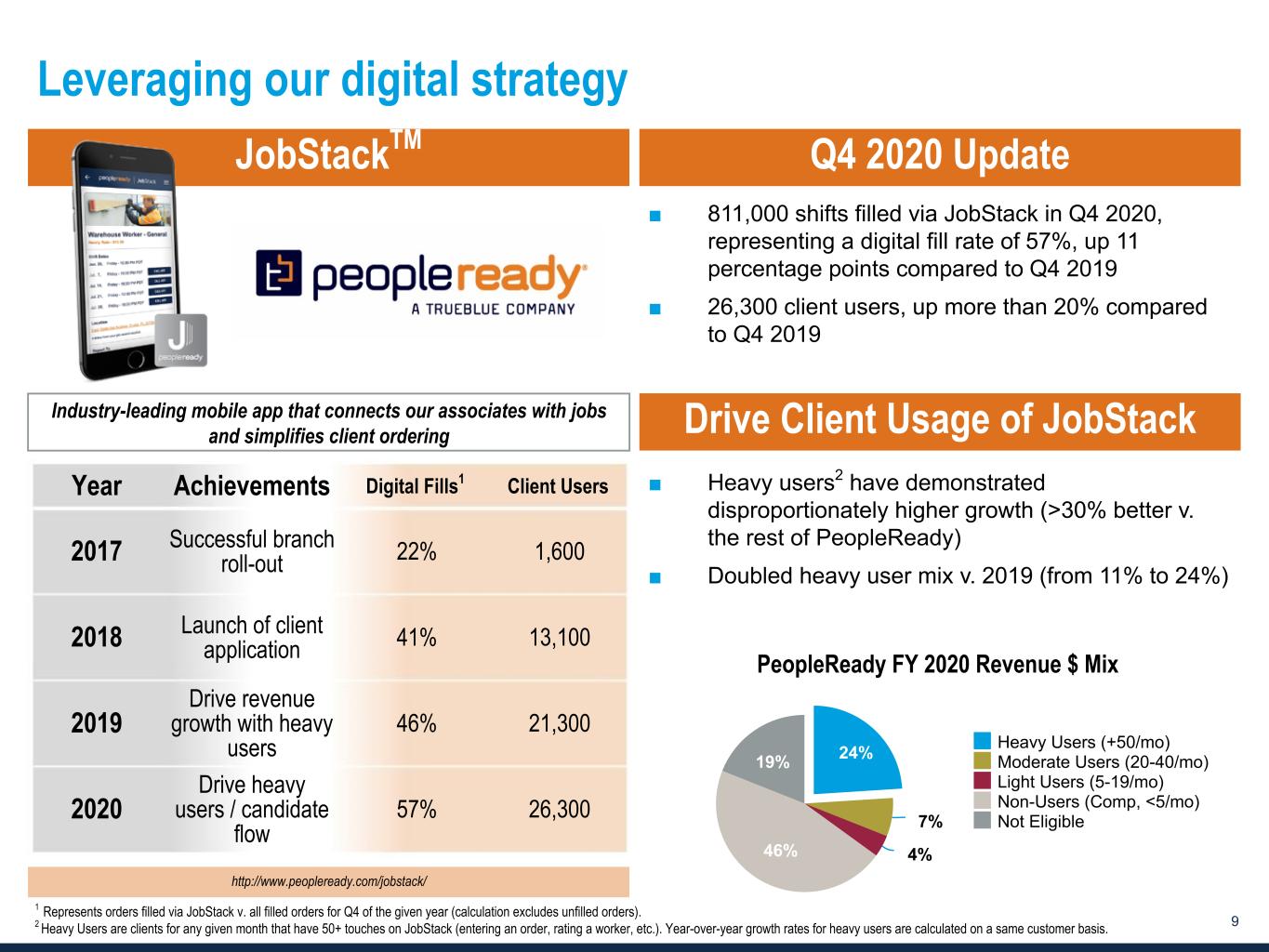

www.TrueBlue.c om 9 Leveraging our digital strategy JobStackTM Q4 2020 Update ■ 811,000 shifts filled via JobStack in Q4 2020, representing a digital fill rate of 57%, up 11 percentage points compared to Q4 2019 ■ 26,300 client users, up more than 20% compared to Q4 2019 ■ Heavy users2 have demonstrated disproportionately higher growth (>30% better v. the rest of PeopleReady) ■ Doubled heavy user mix v. 2019 (from 11% to 24%) Year Achievements Digital Fills1 Client Users 2017 Successful branch roll-out 22% 1,600 2018 Launch of client application 41% 13,100 2019 Drive revenue growth with heavy users 46% 21,300 2020 Drive heavy users / candidate flow 57% 26,300 Industry-leading mobile app that connects our associates with jobs and simplifies client ordering http://www.peopleready.com/jobstack/ 1 Represents orders filled via JobStack v. all filled orders for Q4 of the given year (calculation excludes unfilled orders). 2 Heavy Users are clients for any given month that have 50+ touches on JobStack (entering an order, rating a worker, etc.). Year-over-year growth rates for heavy users are calculated on a same customer basis. PeopleReady FY 2020 Revenue $ Mix 24% 7% 4%46% 19% Heavy Users (+50/mo) Moderate Users (20-40/mo) Light Users (5-19/mo) Non-Users (Comp, <5/mo) Not Eligible Drive Client Usage of JobStack

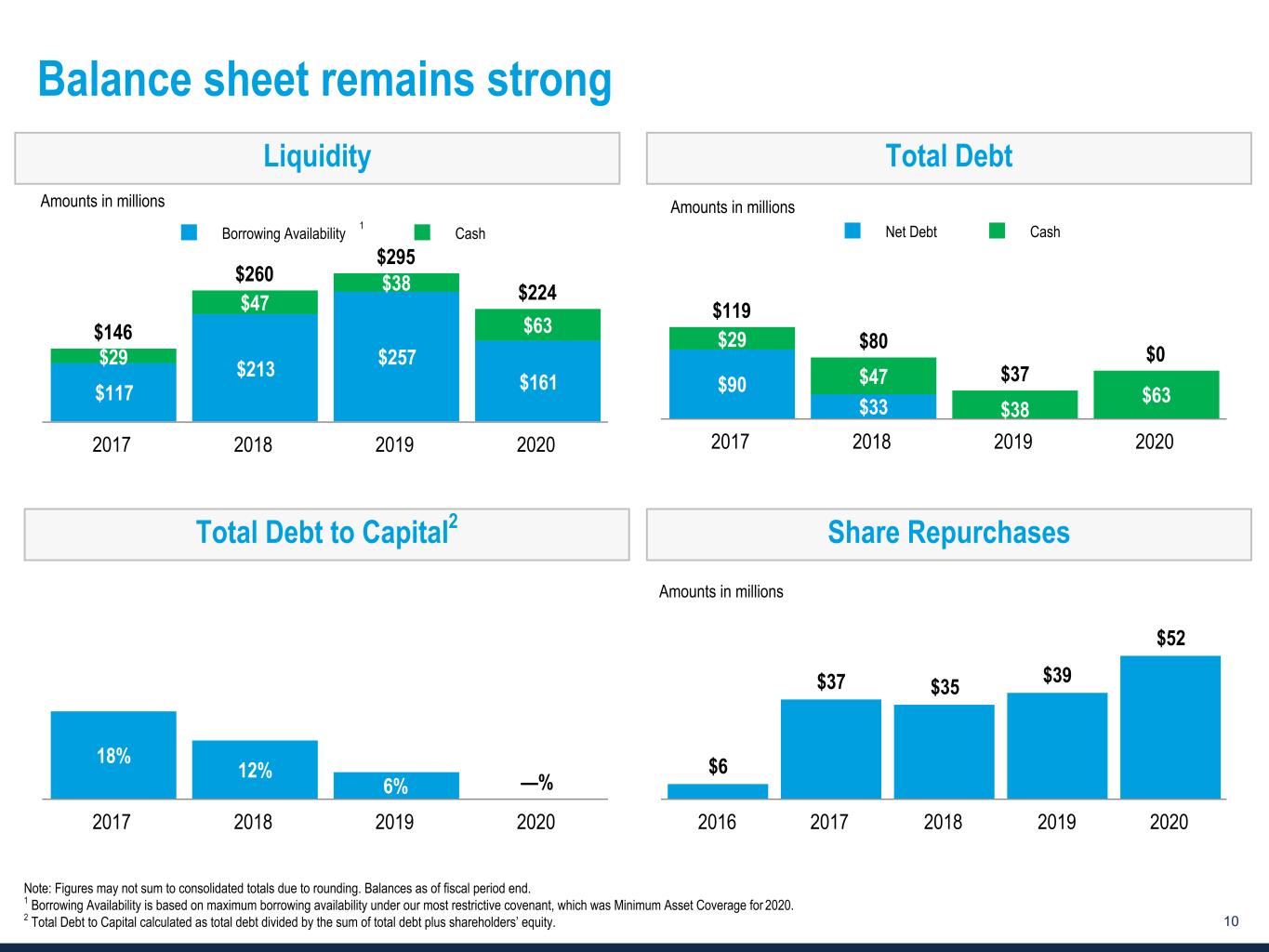

www.TrueBlue.c om 10 18% 12% 6% —% 2017 2018 2019 2020 $119 $80 $37 $0 $90 $33 $29 $47 $38 $63 Net Debt Cash 2017 2018 2019 2020 $146 $260 $295 $224 $117 $213 $257 $161 $29 $47 $38 $63 Borrowing Availability Cash 2017 2018 2019 2020 Balance sheet remains strong Amounts in millions Note: Figures may not sum to consolidated totals due to rounding. Balances as of fiscal period end. 1 Borrowing Availability is based on maximum borrowing availability under our most restrictive covenant, which was Minimum Asset Coverage for 2020. 2 T tal Debt to Capital calculated as total debt divided by the sum of total debt plus shareholders’ equity. Liquidity Amounts in millions Share RepurchasesTotal Debt to Capital2 Total Debt 1 $6 $37 $35 $39 $52 2016 2017 2018 2019 2020 Amounts in millions

Outlook

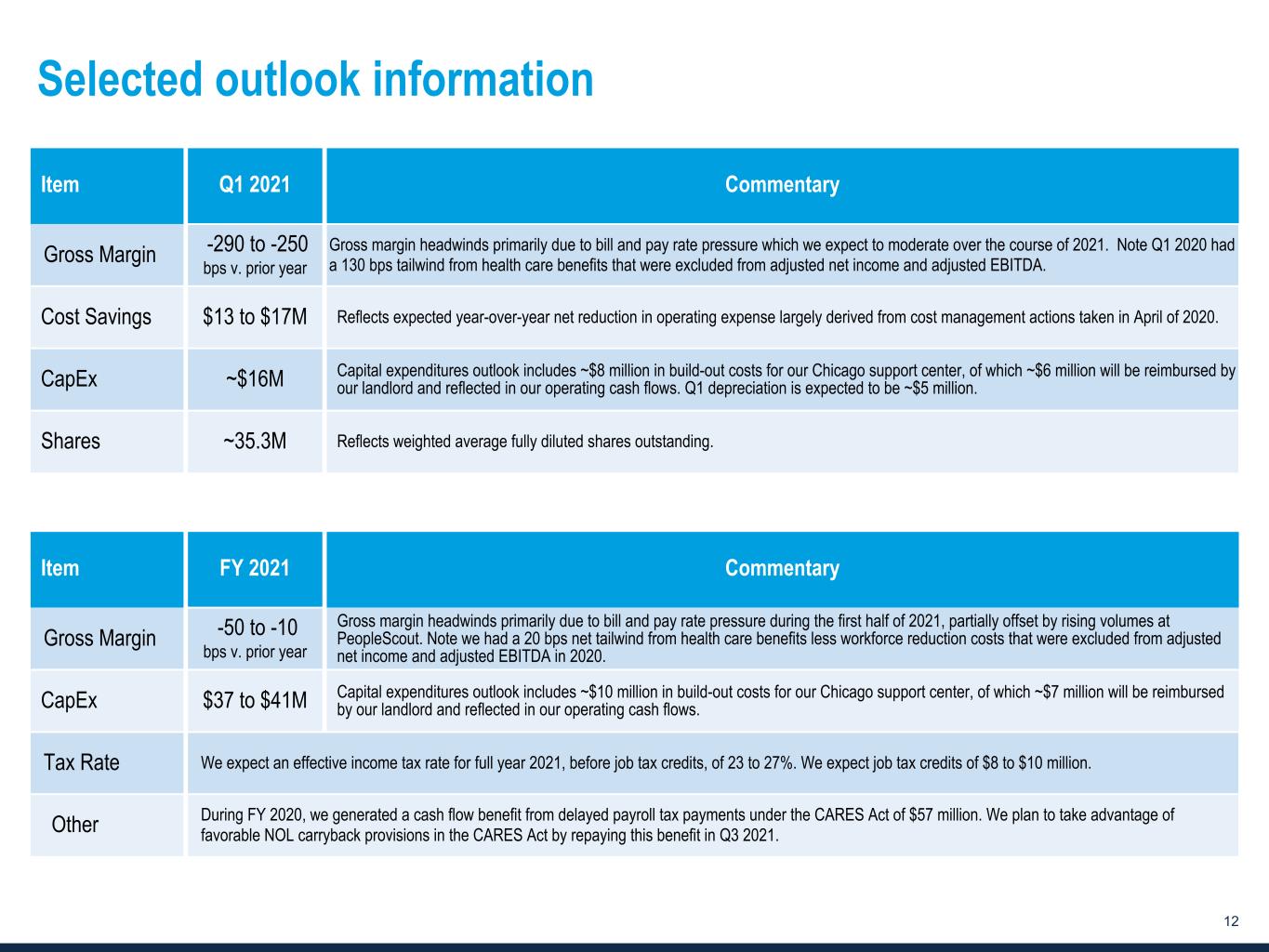

www.TrueBlue.c om 12 Selected outlook information Item Q1 2021 Commentary Gross Margin -290 to -250 bps v. prior year Gross margin headwinds primarily due to bill and pay rate pressure which we expect to moderate over the course of 2021. Note Q1 2020 had a 130 bps tailwind from health care benefits that were excluded from adjusted net income and adjusted EBITDA. Cost Savings $13 to $17M Reflects expected year-over-year net reduction in operating expense largely derived from cost management actions taken in April of 2020. CapEx ~$16M Capital expenditures outlook includes ~$8 million in build-out costs for our Chicago support center, of which ~$6 million will be reimbursed by our landlord and reflected in our operating cash flows. Q1 depreciation is expected to be ~$5 million. Shares ~35.3M Reflects weighted average fully diluted shares outstanding. Item FY 2021 Commentary Gross Margin -50 to -10 bps v. prior year Gross margin headwinds primarily due to bill and pay rate pressure during the first half of 2021, partially offset by rising volumes at PeopleScout. Note we had a 20 bps net tailwind from health care benefits less workforce reduction costs that were excluded from adjusted net income and adjusted EBITDA in 2020. CapEx $37 to $41M Capital expenditures outlook includes ~$10 million in build-out costs for our Chicago support center, of which ~$7 million will be reimbursed by our landlord and reflected in our operating cash flows. Tax Rate We expect an effective income tax rate for full year 2021, before job tax credits, of 23 to 27%. We expect job tax credits of $8 to $10 million. Other During FY 2020, we generated a cash flow benefit from delayed payroll tax payments under the CARES Act of $57 million. We plan to take advantage of favorable NOL carryback provisions in the CARES Act by repaying this benefit in Q3 2021.

Appendix

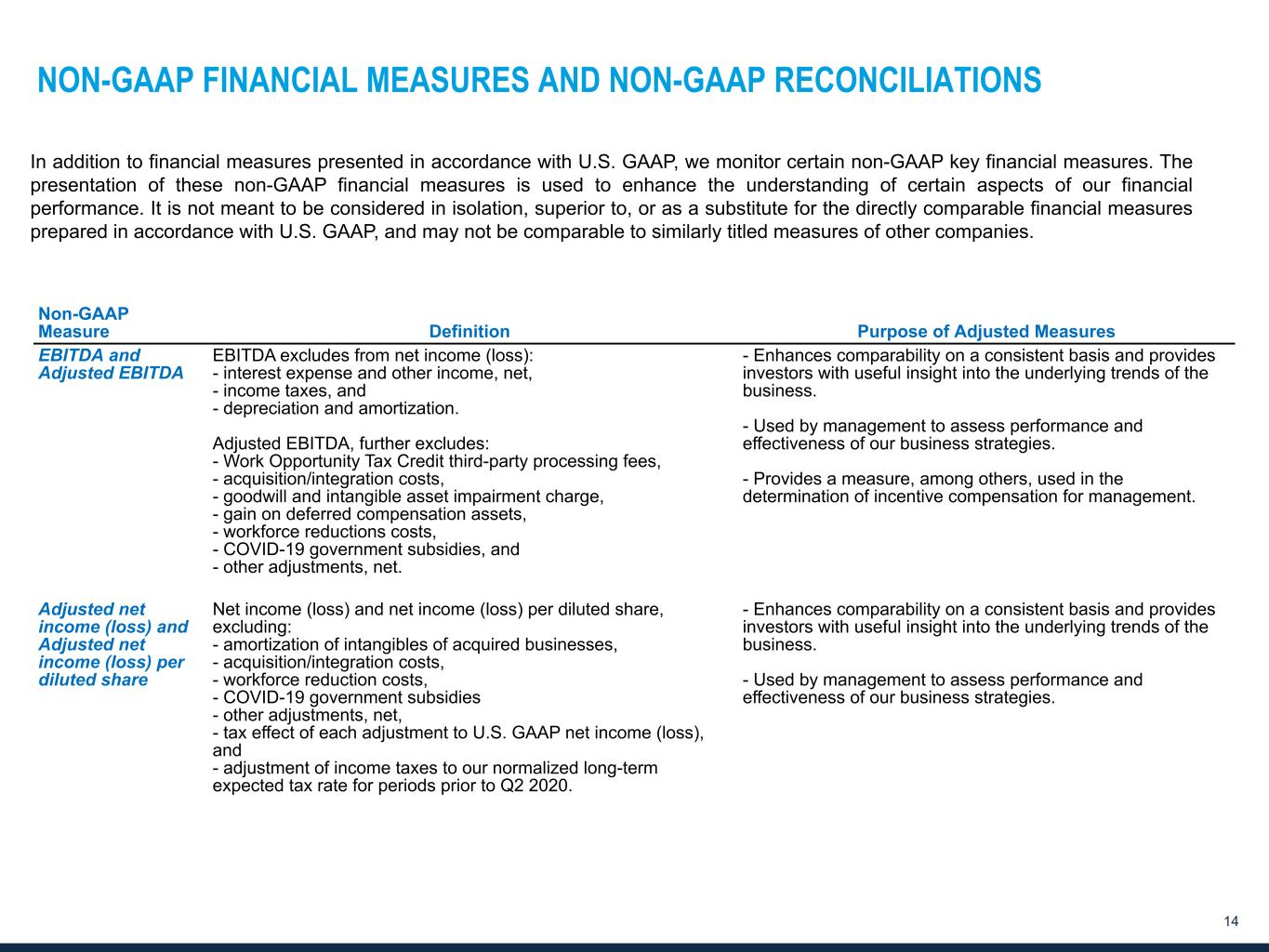

www.TrueBlue.c om 14 NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP Measure Definition Purpose of Adjusted Measures EBITDA and Adjusted EBITDA EBITDA excludes from net income (loss): - interest expense and other income, net, - income taxes, and - depreciation and amortization. Adjusted EBITDA, further excludes: - Work Opportunity Tax Credit third-party processing fees, - acquisition/integration costs, - goodwill and intangible asset impairment charge, - gain on deferred compensation assets, - workforce reductions costs, - COVID-19 government subsidies, and - other adjustments, net. - Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. - Used by management to assess performance and effectiveness of our business strategies. - Provides a measure, among others, used in the determination of incentive compensation for management. Adjusted net income (loss) and Adjusted net income (loss) per diluted share Net income (loss) and net income (loss) per diluted share, excluding: - amortization of intangibles of acquired businesses, - acquisition/integration costs, - workforce reduction costs, - COVID-19 government subsidies - other adjustments, net, - tax effect of each adjustment to U.S. GAAP net income (loss), and - adjustment of income taxes to our normalized long-term expected tax rate for periods prior to Q2 2020. - Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. - Used by management to assess performance and effectiveness of our business strategies.

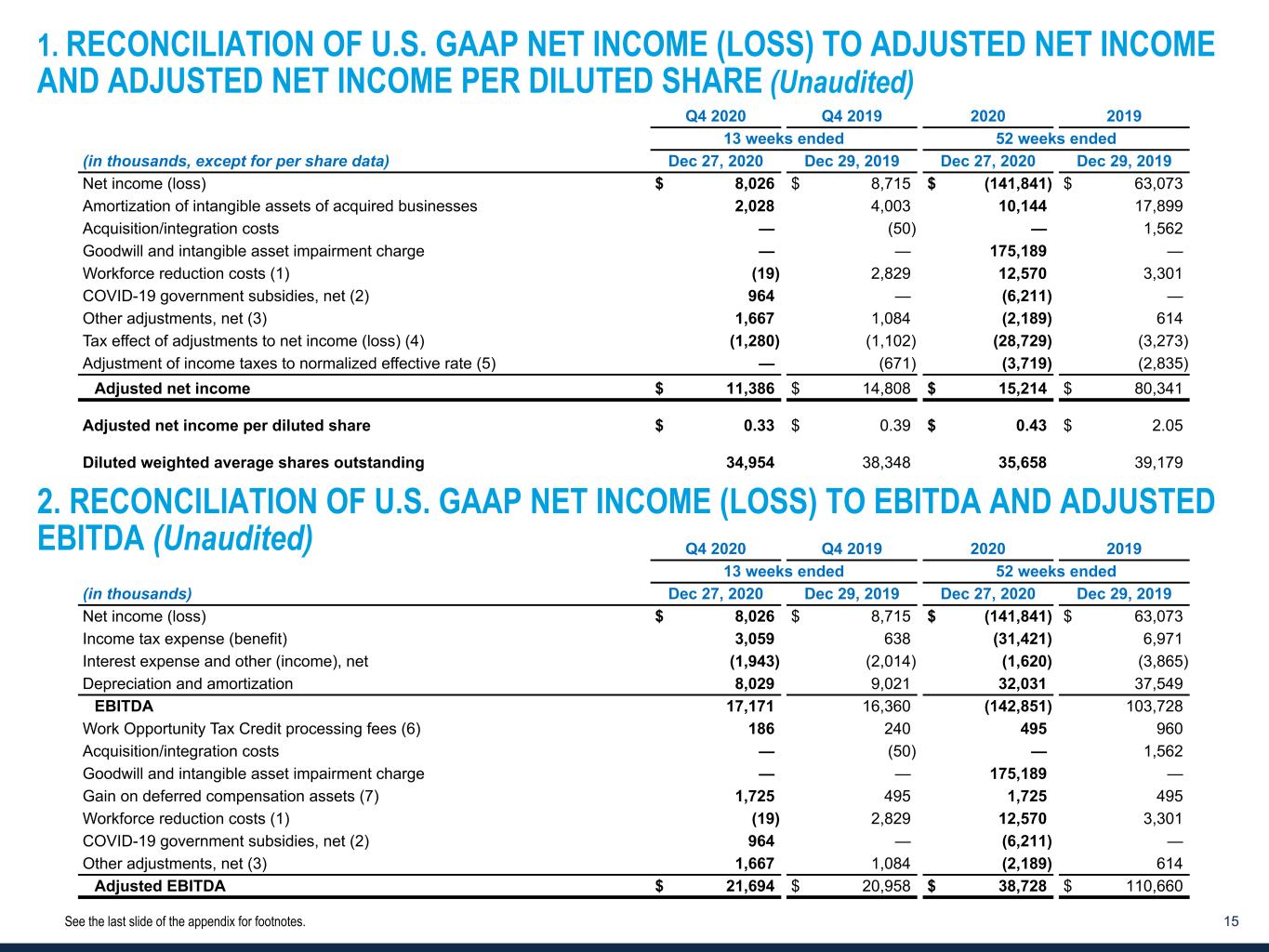

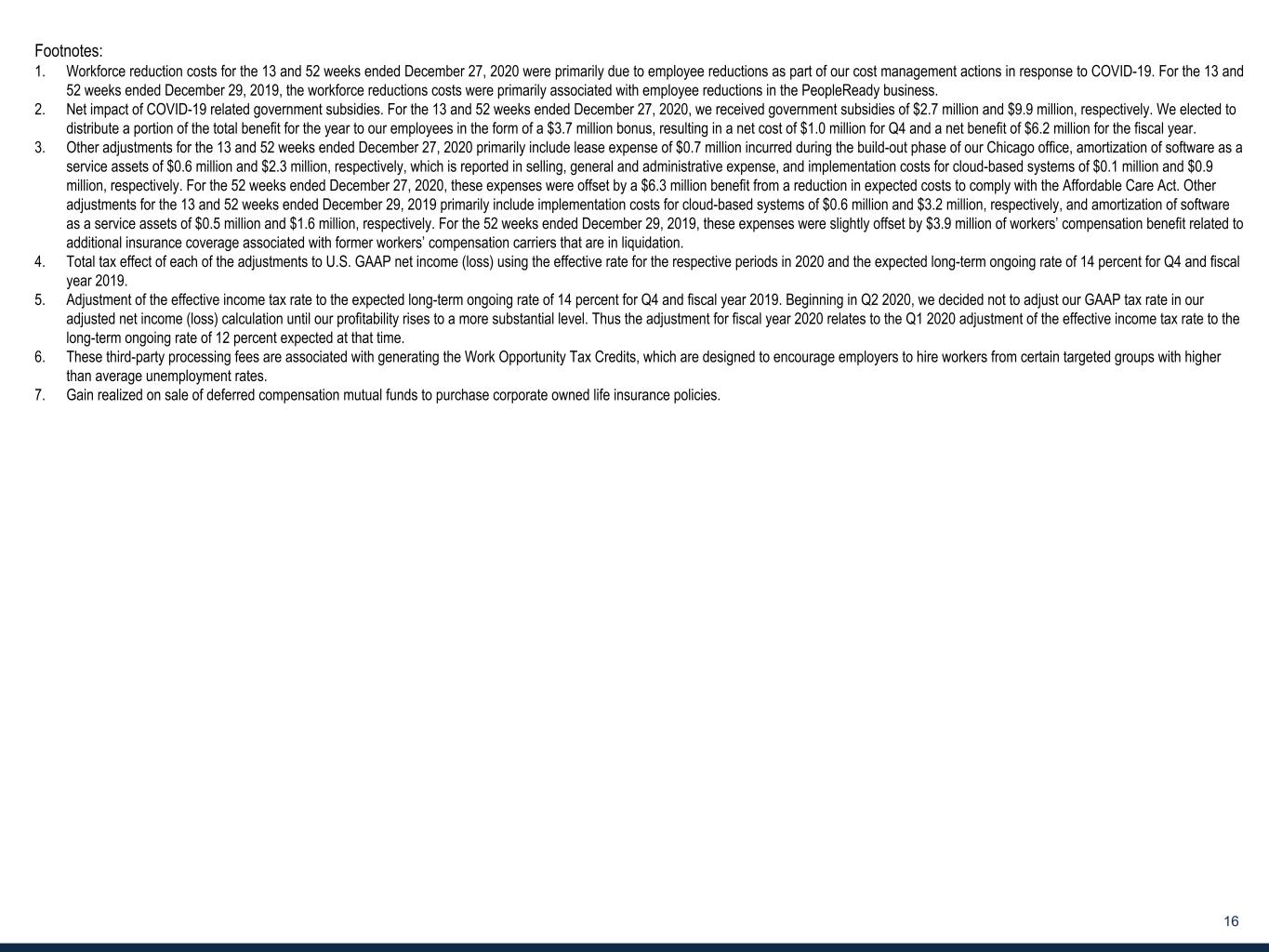

www.TrueBlue.c om 15 1. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME PER DILUTED SHARE (Unaudited) Q4 2020 Q4 2019 2020 2019 13 weeks ended 52 weeks ended (in thousands, except for per share data) Dec 27, 2020 Dec 29, 2019 Dec 27, 2020 Dec 29, 2019 Net income (loss) $ 8,026 $ 8,715 $ (141,841) $ 63,073 Amortization of intangible assets of acquired businesses 2,028 4,003 10,144 17,899 Acquisition/integration costs — (50) — 1,562 Goodwill and intangible asset impairment charge — — 175,189 — Workforce reduction costs (1) (19) 2,829 12,570 3,301 COVID-19 government subsidies, net (2) 964 — (6,211) — Other adjustments, net (3) 1,667 1,084 (2,189) 614 Tax effect of adjustments to net income (loss) (4) (1,280) (1,102) (28,729) (3,273) Adjustment of income taxes to normalized effective rate (5) — (671) (3,719) (2,835) Adjusted net income $ 11,386 $ 14,808 $ 15,214 $ 80,341 Adjusted net income per diluted share $ 0.33 $ 0.39 $ 0.43 $ 2.05 Diluted weighted average shares outstanding 34,954 38,348 35,658 39,179 See the last slide of the appendix for footnotes. 2. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO EBITDA AND ADJUSTED EBITDA (Unaudited) Q4 2020 Q4 2019 2020 2019 13 weeks ended 52 weeks ended (in thousands) Dec 27, 2020 Dec 29, 2019 Dec 27, 2020 Dec 29, 2019 Net income (loss) $ 8,026 $ 8,715 $ (141,841) $ 63,073 Income tax expense (benefit) 3,059 638 (31,421) 6,971 Interest expense and other (income), net (1,943) (2,014) (1,620) (3,865) Depreciation and amortization 8,029 9,021 32,031 37,549 EBITDA 17,171 16,360 (142,851) 103,728 Work Opportunity Tax Credit processing fees (6) 186 240 495 960 Acquisition/integration costs — (50) — 1,562 Goodwill and intangible asset impairment charge — — 175,189 — Gain on deferred compensation assets (7) 1,725 495 1,725 495 Workforce reduction costs (1) (19) 2,829 12,570 3,301 COVID-19 government subsidies, net (2) 964 — (6,211) — Other adjustments, net (3) 1,667 1,084 (2,189) 614 Adjusted EBITDA $ 21,694 $ 20,958 $ 38,728 $ 110,660

www.TrueBlue.c om 16 Footnotes: 1. Workforce reduction costs for the 13 and 52 weeks ended December 27, 2020 were primarily due to employee reductions as part of our cost management actions in response to COVID-19. For the 13 and 52 weeks ended December 29, 2019, the workforce reductions costs were primarily associated with employee reductions in the PeopleReady business. 2. Net impact of COVID-19 related government subsidies. For the 13 and 52 weeks ended December 27, 2020, we received government subsidies of $2.7 million and $9.9 million, respectively. We elected to distribute a portion of the total benefit for the year to our employees in the form of a $3.7 million bonus, resulting in a net cost of $1.0 million for Q4 and a net benefit of $6.2 million for the fiscal year. 3. Other adjustments for the 13 and 52 weeks ended December 27, 2020 primarily include lease expense of $0.7 million incurred during the build-out phase of our Chicago office, amortization of software as a service assets of $0.6 million and $2.3 million, respectively, which is reported in selling, general and administrative expense, and implementation costs for cloud-based systems of $0.1 million and $0.9 million, respectively. For the 52 weeks ended December 27, 2020, these expenses were offset by a $6.3 million benefit from a reduction in expected costs to comply with the Affordable Care Act. Other adjustments for the 13 and 52 weeks ended December 29, 2019 primarily include implementation costs for cloud-based systems of $0.6 million and $3.2 million, respectively, and amortization of software as a service assets of $0.5 million and $1.6 million, respectively. For the 52 weeks ended December 29, 2019, these expenses were slightly offset by $3.9 million of workers’ compensation benefit related to additional insurance coverage associated with former workers’ compensation carriers that are in liquidation. 4. Total tax effect of each of the adjustments to U.S. GAAP net income (loss) using the effective rate for the respective periods in 2020 and the expected long-term ongoing rate of 14 percent for Q4 and fiscal year 2019. 5. Adjustment of the effective income tax rate to the expected long-term ongoing rate of 14 percent for Q4 and fiscal year 2019. Beginning in Q2 2020, we decided not to adjust our GAAP tax rate in our adjusted net income (loss) calculation until our profitability rises to a more substantial level. Thus the adjustment for fiscal year 2020 relates to the Q1 2020 adjustment of the effective income tax rate to the long-term ongoing rate of 12 percent expected at that time. 6. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from certain targeted groups with higher than average unemployment rates. 7. Gain realized on sale of deferred compensation mutual funds to purchase corporate owned life insurance policies.