Q2 2020 Earnings July 2020

Forward-looking statements This document contains forward-looking statements relating to our plans and expectations, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this release and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions, (2) the continued impact of COVID-19 and related economic impact and governmental response, (3) our ability to successfully reduce operating expenses and otherwise adapt to the changing economic environment caused by COVID-19, (4) our ability to access sufficient capital to finance our operations, including our ability to comply with or obtain waivers for covenants contained in our revolving credit facility, (5) our ability to attract and retain clients, (6) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (7) our ability to maintain profit margins, (8) new laws and regulations that could affect our operations or financial results, (9) our ability to successfully execute on business strategies to further digitize our business model, and (10) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. In addition, we use several non-GAAP financial measures when presenting our financial results in this document. Please refer to the reconciliations between our GAAP and non-GAAP financial measures in the appendix to this presentation and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated. www.TrueBlue.com 2

Q2 2020 summary Q2 results impacted by COVID-19 disruption ▪ Total revenue -39% v. -11% for Q1 2020 ▪ Modest intra-quarter revenue trend improvement (June -35% v. April -42%) ▪ Net loss of $8 million, or $(0.23) per share ▪ Adjusted net loss1 of $4 million, or $(0.12) per share Strong cost management results ▪ Cost management strategies are on track ▪ SG&A $29 million lower, or -23%, v. Q2 2019 Strong liquidity position balanced with returning capital to shareholders ▪ Amended banking covenants to increase financial flexibility ▪ Net cash of $47 million (cash of $92 million less debt of $45 million) v. net debt of $28 million Q1 2020 ▪ $52 million of stock repurchased YTD,2 no current plans for additional repurchases Leveraging digital strategy ▪ JobStackTM is helping us safely connect people with work during this time of crisis ▪ 551,000 shifts filled via JobStack in Q2 2020, representing an all-time high digital fill rate3 of 53% ▪ 24,300 client users, up 38% compared to Q2 2019 ▪ New digital onboarding functionality shows favorable results 1 See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. 2 Cash settlement for the full $52 million occurred in Q1 2020 (pre-COVID-19). However, with regard to the $40M ASR, $32M of impact was reflected in our outstanding share count in Q1 and the remaining $8M will be reflected in Q3. 3 Representswww.TrueBlue.com orders filled via JobStack (calculation excludes unfilled orders). 3

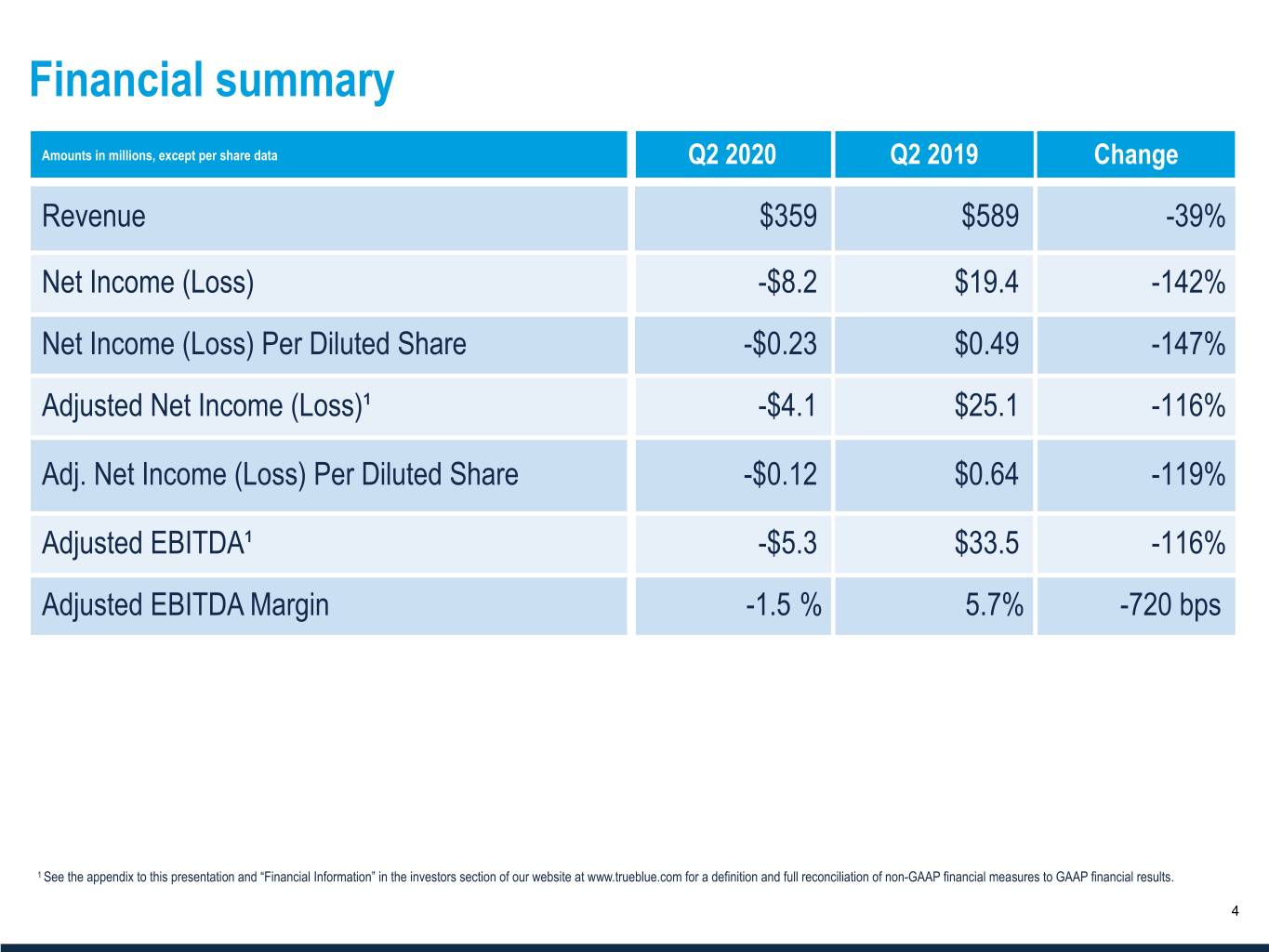

Financial summary Amounts in millions, except per share data Q2 2020 Q2 2019 Change Revenue $359 $589 -39% Net Income (Loss) -$8.2 $19.4 -142% Net Income (Loss) Per Diluted Share -$0.23 $0.49 -147% Adjusted Net Income (Loss)¹ -$4.1 $25.1 -116% Adj. Net Income (Loss) Per Diluted Share -$0.12 $0.64 -119% Adjusted EBITDA¹ -$5.3 $33.5 -116% Adjusted EBITDA Margin -1.5 % 5.7% -720 bps 1 See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. www.TrueBlue.com 4

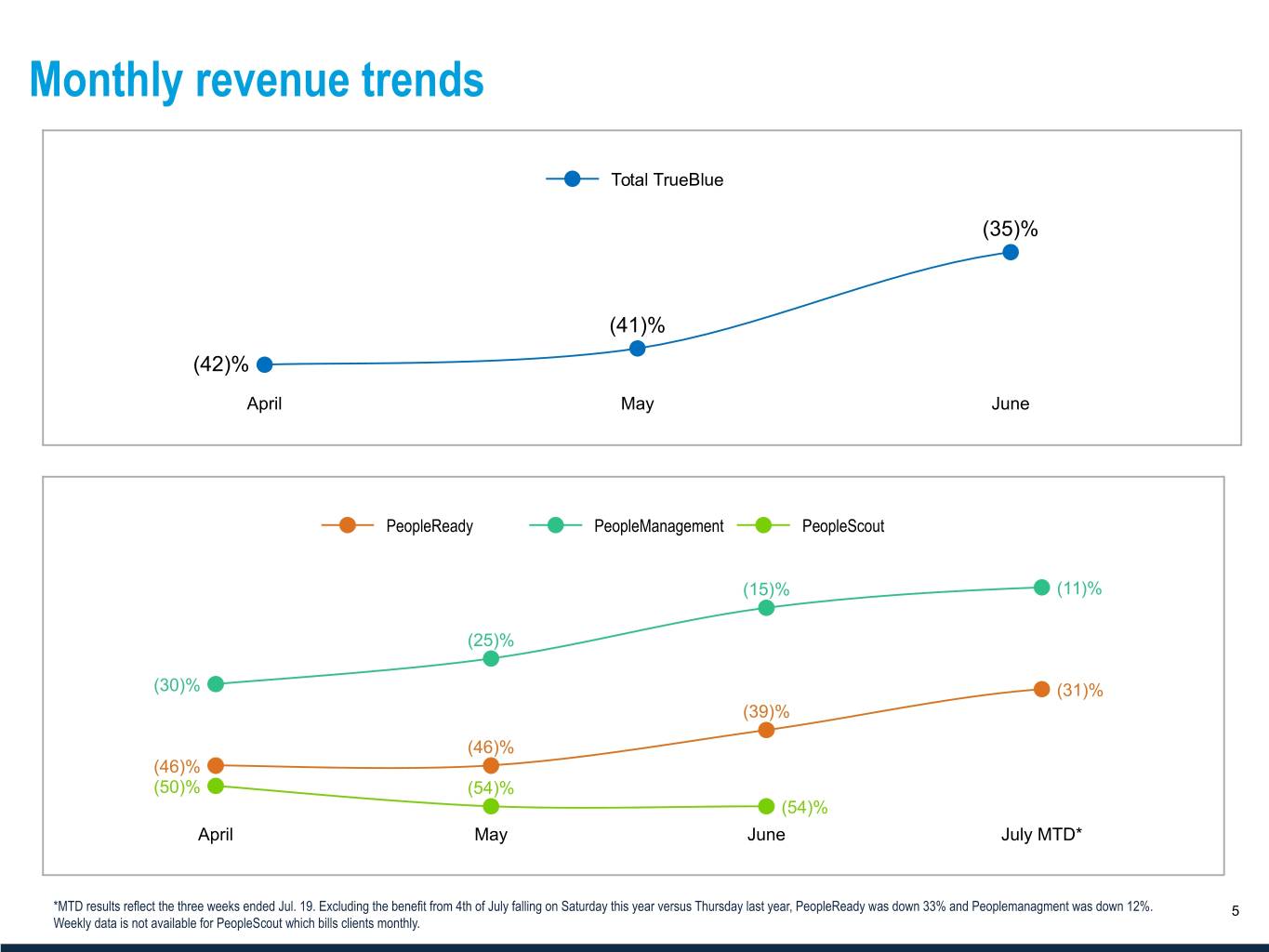

Monthly revenue trends Total TrueBlue (35)% (41)% (42)% April May June PeopleReady PeopleManagement PeopleScout (15)% (11)% (25)% (30)% (31)% (39)% (46)% (46)% (50)% (54)% (54)% April May June July MTD* www.TrueBlue.com*MTD results reflect the three weeks ended Jul. 19. Excluding the benefit from 4th of July falling on Saturday this year versus Thursday last year, PeopleReady was down 33% and Peoplemanagment was down 12%. 5 Weekly data is not available for PeopleScout which bills clients monthly.

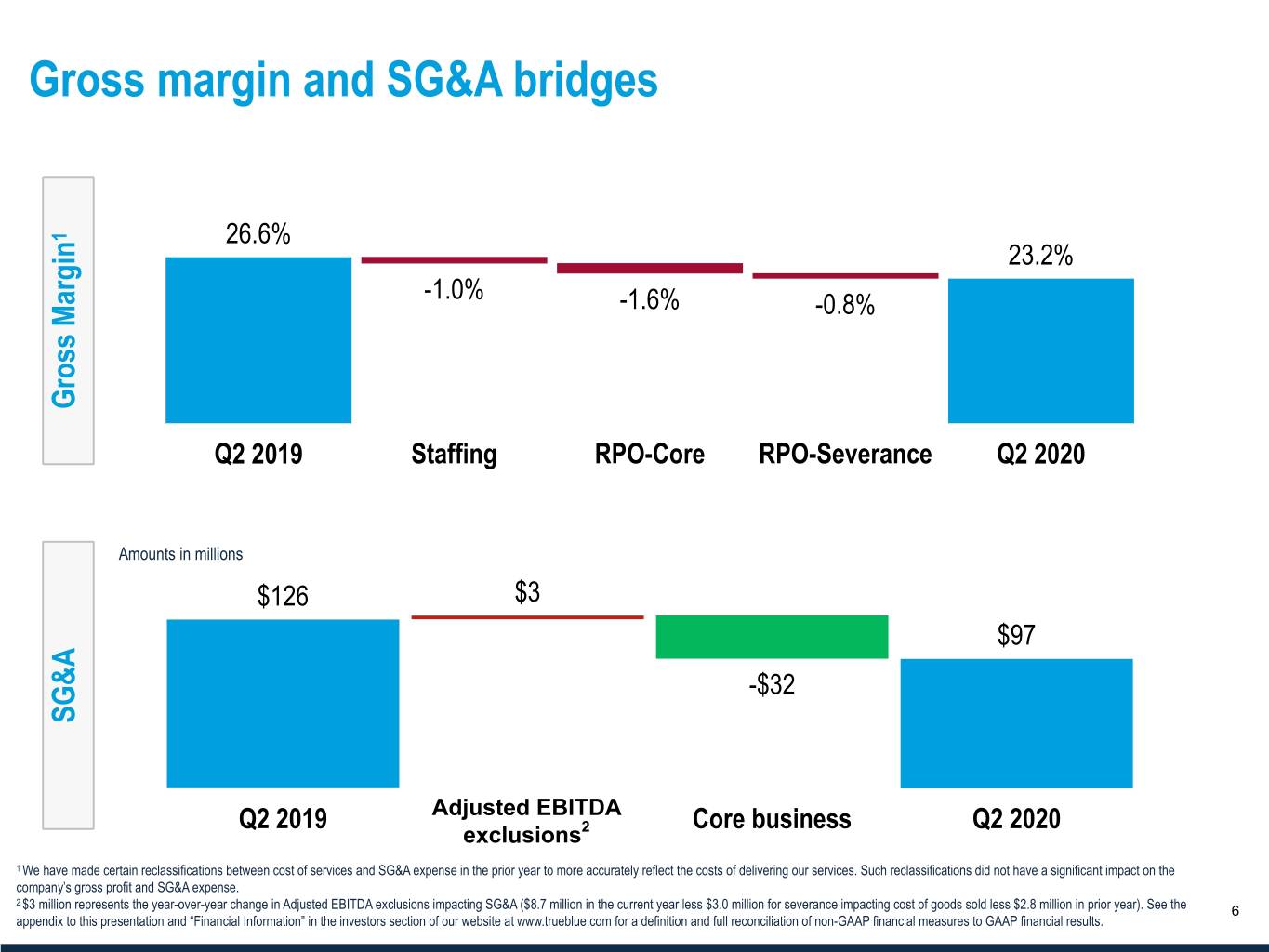

Gross margin and SG&A bridges 1 26.6% 23.2% -1.0% -1.6% -0.8% Gross Margin Q2 2019 Staffing RPO-Core RPO-Severance Q2 2020 Amounts in millions $126 $3 $97 -$32 SG&A Q2 2019 Adjusted EBITDA Core business Q2 2020 exclusions2 1 We have made certain reclassifications between cost of services and SG&A expense in the prior year to more accurately reflect the costs of delivering our services. Such reclassifications did not have a significant impact on the company’s gross profit and SG&A expense. 2 $3www.TrueBlue.com million represents the year-over-year change in Adjusted EBITDA exclusions impacting SG&A ($8.7 million in the current year less $3.0 million for severance impacting cost of goods sold less $2.8 million in prior year). See the 6 appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

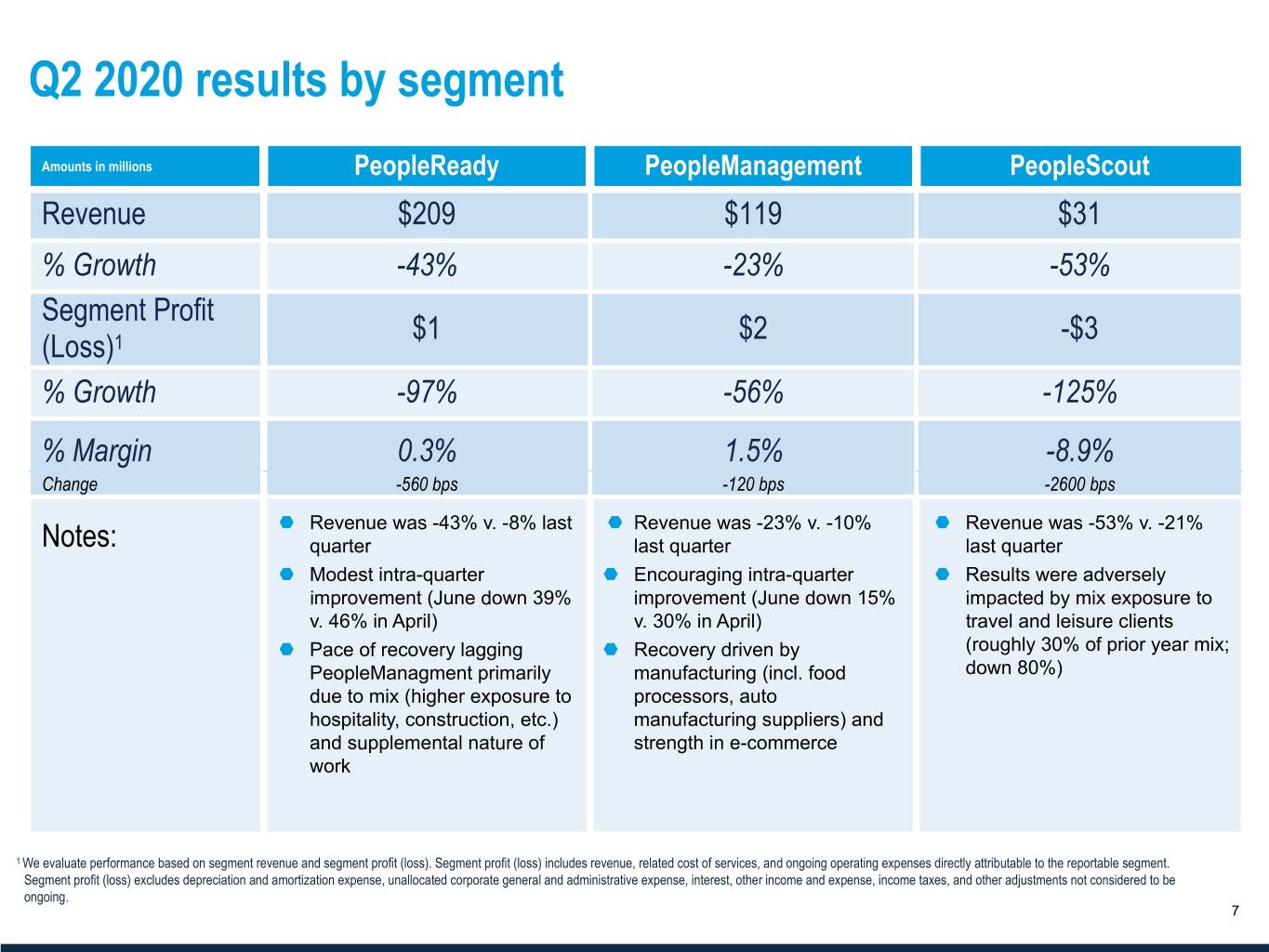

Q2 2020 results by segment Amounts in millions PeopleReady PeopleManagement PeopleScout Revenue $209 $119 $31 % Growth -43% -23% -53% Segment Profit $1 $2 -$3 (Loss)1 % Growth -97% -56% -125% % Margin 0.3% 1.5% -8.9% Change -560 bps -120 bps -2600 bps ¬ Revenue was -43% v. -8% last ¬ Revenue was -23% v. -10% ¬ Revenue was -53% v. -21% Notes: quarter last quarter last quarter ¬ Modest intra-quarter ¬ Encouraging intra-quarter ¬ Results were adversely improvement (June down 39% improvement (June down 15% impacted by mix exposure to v. 46% in April) v. 30% in April) travel and leisure clients ¬ Pace of recovery lagging ¬ Recovery driven by (roughly 30% of prior year mix; PeopleManagment primarily manufacturing (incl. food down 80%) due to mix (higher exposure to processors, auto hospitality, construction, etc.) manufacturing suppliers) and and supplemental nature of strength in e-commerce work 1 We evaluate performance based on segment revenue and segment profit (loss). Segment profit (loss) includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit (loss) excludes depreciation and amortization expense, unallocated corporate general and administrative expense, interest, other income and expense, income taxes, and other adjustments not considered to be ongoing. www.TrueBlue.com 7

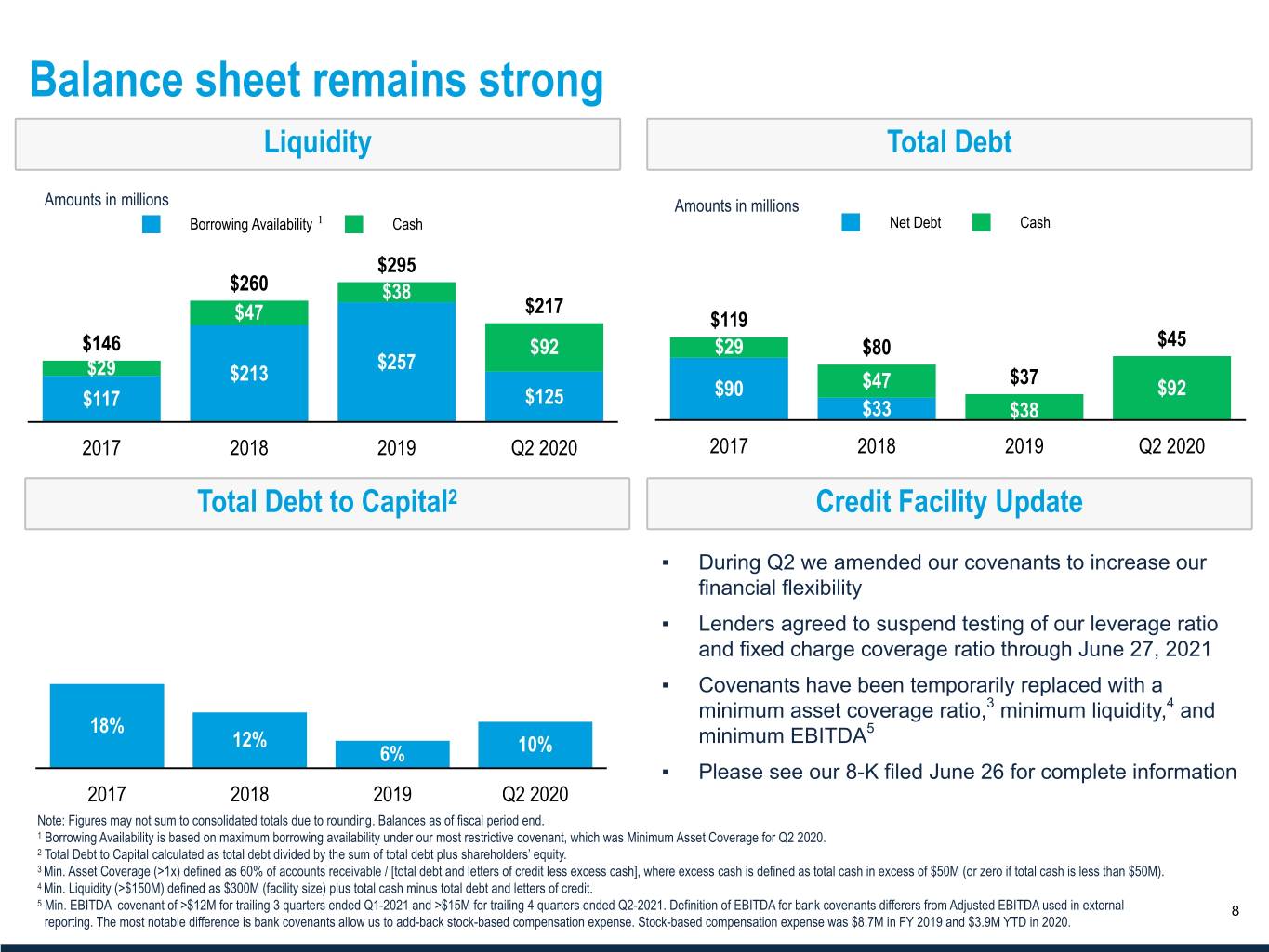

Balance sheet remains strong Liquidity Total Debt Amounts in millions Amounts in millions Borrowing Availability 1 Cash Net Debt Cash $295 $260 $38 $217 $47 $119 $146 $92 $29 $80 $45 $257 $29 $213 $37 $47 $92 $117 $125 $90 $33 $38 2017 2018 2019 Q2 2020 2017 2018 2019 Q2 2020 Total Debt to Capital2 Credit Facility Update ▪ During Q2 we amended our covenants to increase our financial flexibility ▪ Lenders agreed to suspend testing of our leverage ratio and fixed charge coverage ratio through June 27, 2021 ▪ Covenants have been temporarily replaced with a minimum asset coverage ratio,3 minimum liquidity,4 and 18% 5 12% minimum EBITDA 6% 10% ▪ Please see our 8-K filed June 26 for complete information 2017 2018 2019 Q2 2020 Note: Figures may not sum to consolidated totals due to rounding. Balances as of fiscal period end. 1 Borrowing Availability is based on maximum borrowing availability under our most restrictive covenant, which was Minimum Asset Coverage for Q2 2020. 2 Total Debt to Capital calculated as total debt divided by the sum of total debt plus shareholders’ equity. 3 Min. Asset Coverage (>1x) defined as 60% of accounts receivable / [total debt and letters of credit less excess cash], where excess cash is defined as total cash in excess of $50M (or zero if total cash is less than $50M). 4 Min. Liquidity (>$150M) defined as $300M (facility size) plus total cash minus total debt and letters of credit. 5 www.TrueBlue.com Min. EBITDA covenant of >$12M for trailing 3 quarters ended Q1-2021 and >$15M for trailing 4 quarters ended Q2-2021. Definition of EBITDA for bank covenants differers from Adjusted EBITDA used in external 8 reporting. The most notable difference is bank covenants allow us to add-back stock-based compensation expense. Stock-based compensation expense was $8.7M in FY 2019 and $3.9M YTD in 2020.

Strategic highlights Safety remains our top priority. Key elements of our plan include: • Communication: established a resource center for staff; safety specialists Employee and regularly meet with operational teams and clients client safety • Protective equipment: implemented social distancing measures at all our locations and provided PPE (masks) and hand sanitizer • Wellness checks: For all associates/staff at on-sites, symptom checking prior to entering building (e.g. temperature checks, questioning, etc.) • Adapting our business: drive-in job fairs/interviews for associates and staff working from home wherever possible • PeopleReady: Targeting high need areas, tracking competitor closures and Businesses tapping a broader worker pool. • PeopleManagement: Targeting essential businesses, e-commerce, etc. executing on Focus on consolidating client wallet share. recovery plans • PeopleScout: Supporting clients that laid off in-house recruitment teams and focus on project/burst hiring. • PeopleReady's new digital onboarding functionality shows favorable results: JobStack ◦ Recently deployed in 50 states digital ◦ Applicant time cut in half strategy ◦ Application completion rate 20 percentage points higher www.TrueBlue.com 9

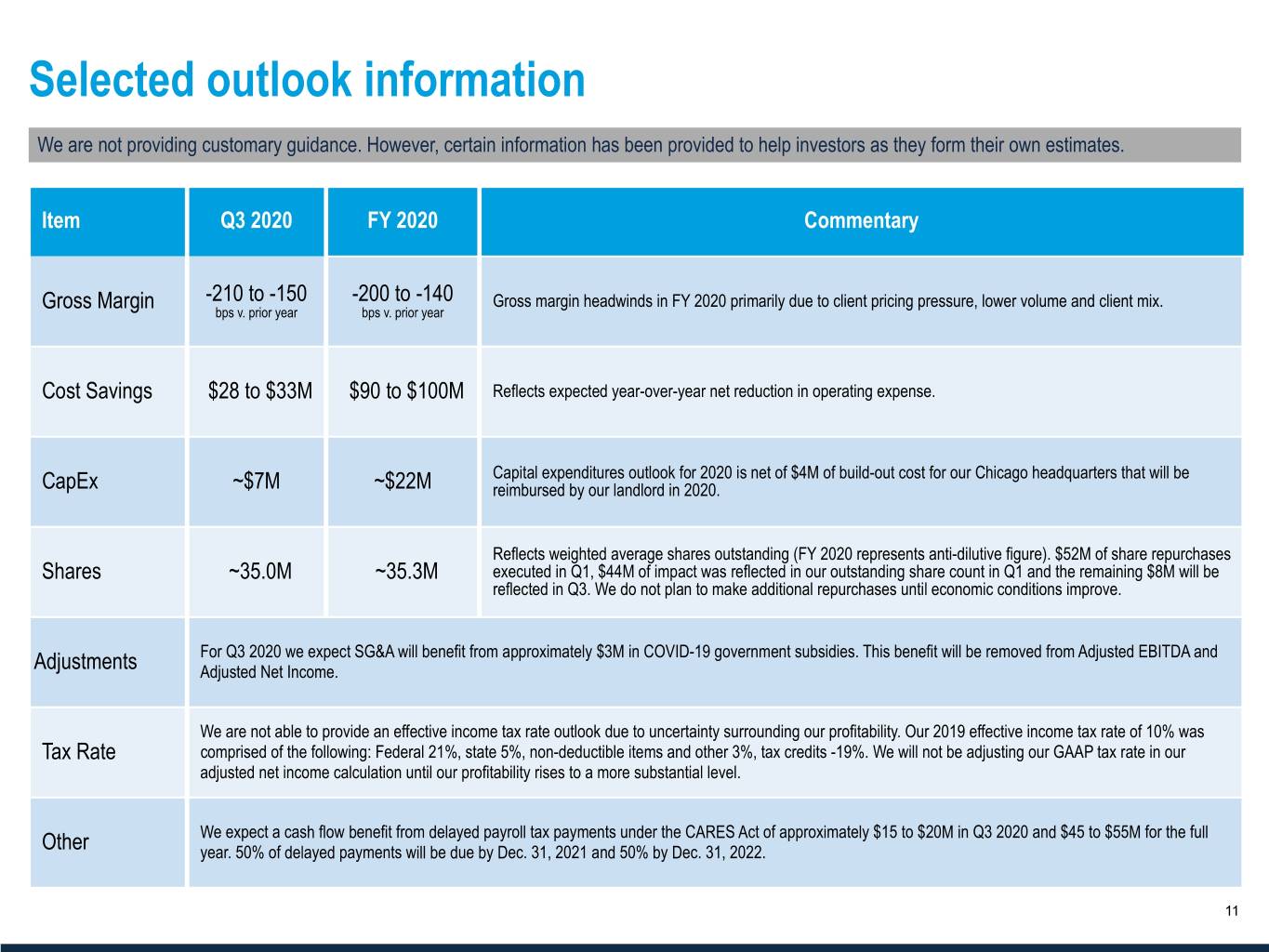

Outlook

Selected outlook information We are not providing customary guidance. However, certain information has been provided to help investors as they form their own estimates. Item Q3 2020 FY 2020 Commentary Gross Margin -210 to -150 -200 to -140 Gross margin headwinds in FY 2020 primarily due to client pricing pressure, lower volume and client mix. bps v. prior year bps v. prior year Cost Savings $28 to $33M $90 to $100M Reflects expected year-over-year net reduction in operating expense. Capital expenditures outlook for 2020 is net of $4M of build-out cost for our Chicago headquarters that will be CapEx ~$7M ~$22M reimbursed by our landlord in 2020. Reflects weighted average shares outstanding (FY 2020 represents anti-dilutive figure). $52M of share repurchases Shares ~35.0M ~35.3M executed in Q1, $44M of impact was reflected in our outstanding share count in Q1 and the remaining $8M will be reflected in Q3. We do not plan to make additional repurchases until economic conditions improve. For Q3 2020 we expect SG&A will benefit from approximately $3M in COVID-19 government subsidies. This benefit will be removed from Adjusted EBITDA and Adjustments Adjusted Net Income. We are not able to provide an effective income tax rate outlook due to uncertainty surrounding our profitability. Our 2019 effective income tax rate of 10% was Tax Rate comprised of the following: Federal 21%, state 5%, non-deductible items and other 3%, tax credits -19%. We will not be adjusting our GAAP tax rate in our adjusted net income calculation until our profitability rises to a more substantial level. We expect a cash flow benefit from delayed payroll tax payments under the CARES Act of approximately $15 to $20M in Q3 2020 and $45 to $55M for the full Other year. 50% of delayed payments will be due by Dec. 31, 2021 and 50% by Dec. 31, 2022. www.TrueBlue.com 11 ¬ TrueBlue revenue has historically tracked with gross domestic product (GDP) ¬ Regression analysis suggests that TrueBlue revenue would be down approximately 9% if GDP was flat, and would decline approximately 7 percentage points for every additional point of year-over-year GDP decline YoY GDP Growth1 0% -1% -2% -3% -4% -5% Revenue Implied TBI Growth2 -9% -16% -23% -30% -37% -44%

Appendix

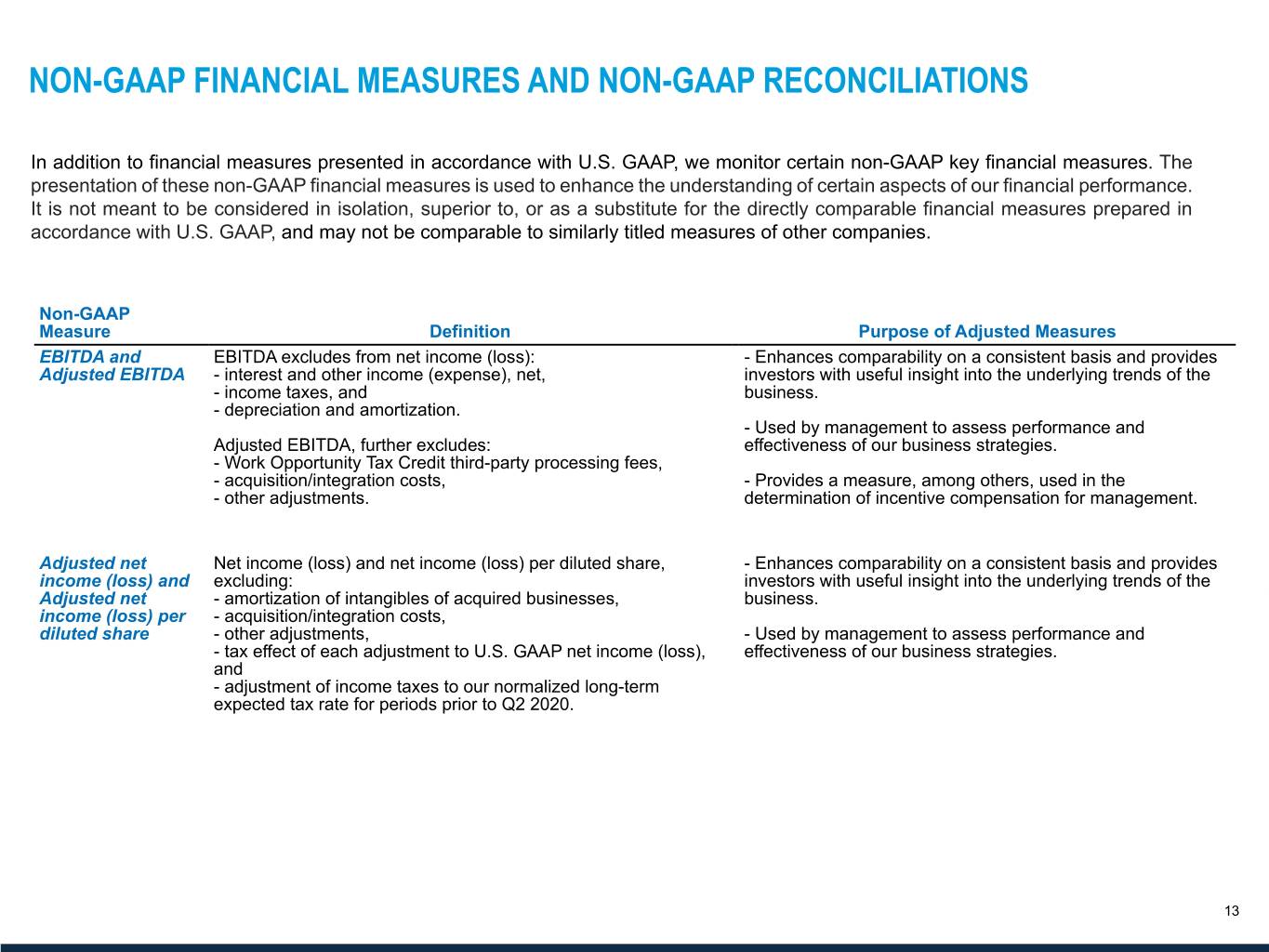

NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP Measure Definition Purpose of Adjusted Measures EBITDA and EBITDA excludes from net income (loss): - Enhances comparability on a consistent basis and provides Adjusted EBITDA - interest and other income (expense), net, investors with useful insight into the underlying trends of the - income taxes, and business. - depreciation and amortization. - Used by management to assess performance and Adjusted EBITDA, further excludes: effectiveness of our business strategies. - Work Opportunity Tax Credit third-party processing fees, - acquisition/integration costs, - Provides a measure, among others, used in the - other adjustments. determination of incentive compensation for management. Adjusted net Net income (loss) and net income (loss) per diluted share, - Enhances comparability on a consistent basis and provides income (loss) and excluding: investors with useful insight into the underlying trends of the Adjusted net - amortization of intangibles of acquired businesses, business. income (loss) per - acquisition/integration costs, diluted share - other adjustments, - Used by management to assess performance and - tax effect of each adjustment to U.S. GAAP net income (loss), effectiveness of our business strategies. and - adjustment of income taxes to our normalized long-term expected tax rate for periods prior to Q2 2020. www.TrueBlue.com 13

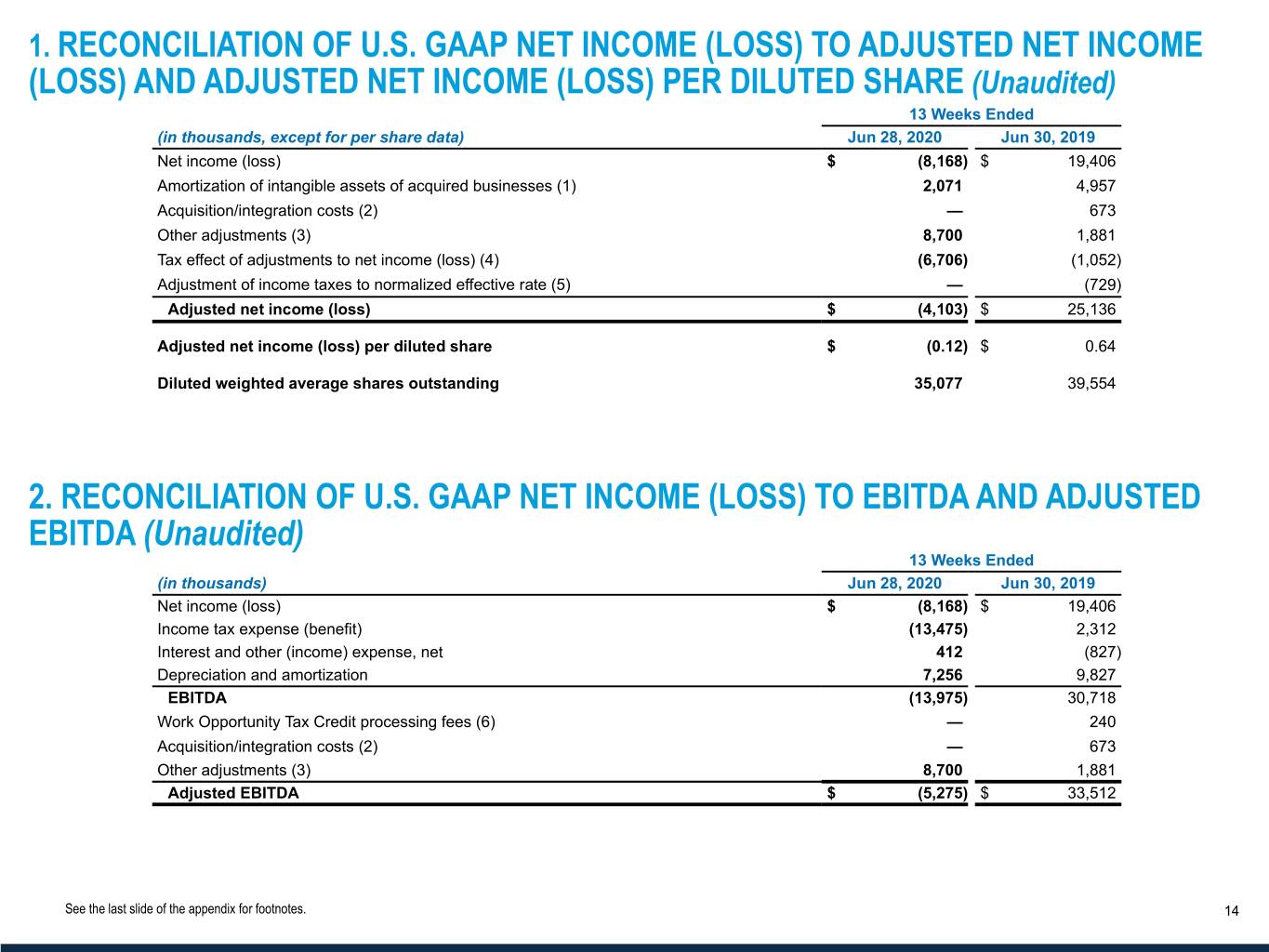

1. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO ADJUSTED NET INCOME (LOSS) AND ADJUSTED NET INCOME (LOSS) PER DILUTED SHARE (Unaudited) 13 Weeks Ended (in thousands, except for per share data) Jun 28, 2020 Jun 30, 2019 Net income (loss) $ (8,168) $ 19,406 Amortization of intangible assets of acquired businesses (1) 2,071 4,957 Acquisition/integration costs (2) — 673 Other adjustments (3) 8,700 1,881 Tax effect of adjustments to net income (loss) (4) (6,706) (1,052) Adjustment of income taxes to normalized effective rate (5) — (729) Adjusted net income (loss) $ (4,103) $ 25,136 Adjusted net income (loss) per diluted share $ (0.12) $ 0.64 Diluted weighted average shares outstanding 35,077 39,554 2. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO EBITDA AND ADJUSTED EBITDA (Unaudited) 13 Weeks Ended (in thousands) Jun 28, 2020 Jun 30, 2019 Net income (loss) $ (8,168) $ 19,406 Income tax expense (benefit) (13,475) 2,312 Interest and other (income) expense, net 412 (827) Depreciation and amortization 7,256 9,827 EBITDA (13,975) 30,718 Work Opportunity Tax Credit processing fees (6) — 240 Acquisition/integration costs (2) — 673 Other adjustments (3) 8,700 1,881 Adjusted EBITDA $ (5,275) $ 33,512 www.TrueBlue.comSee the last slide of the appendix for footnotes. 14

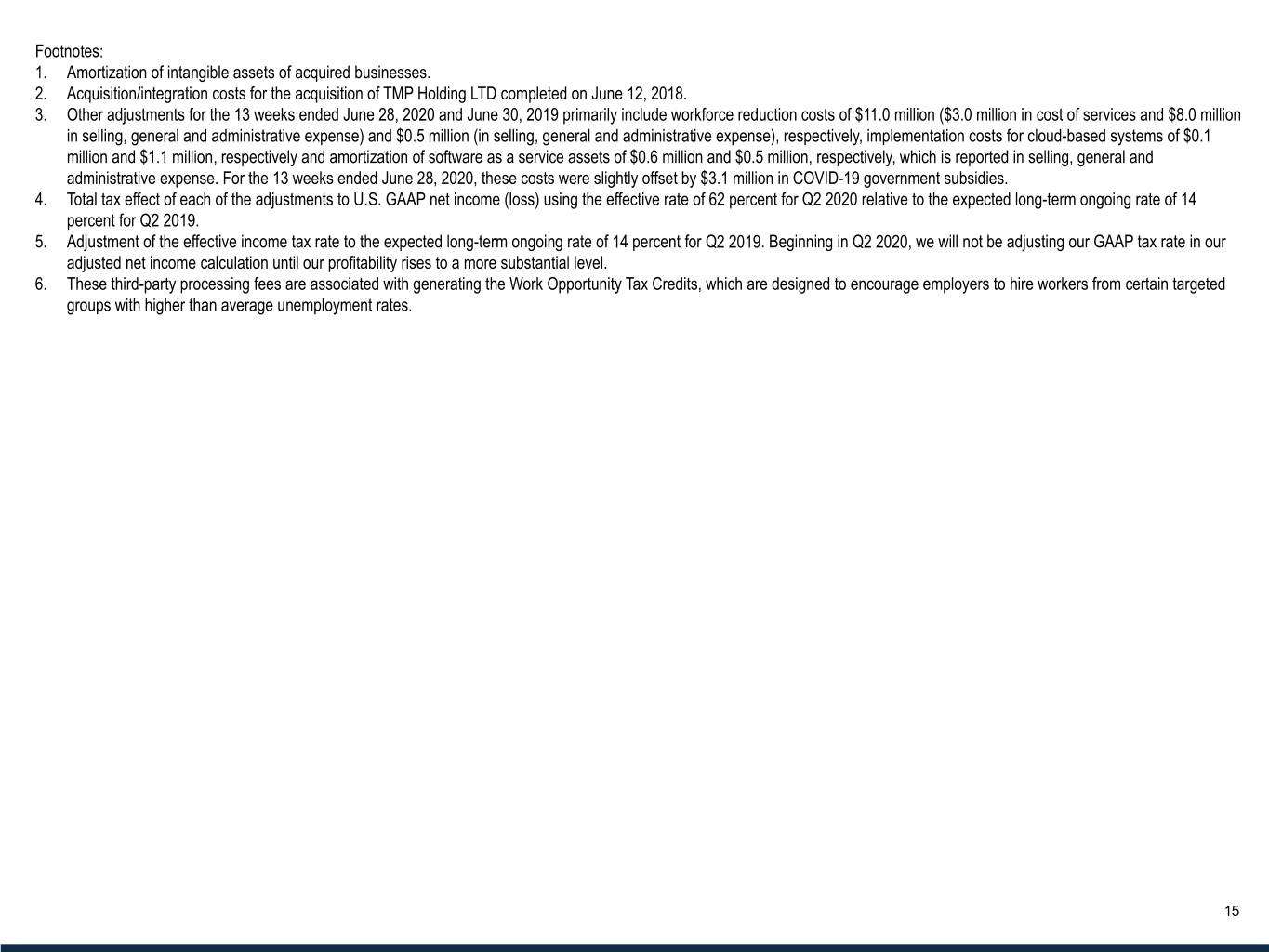

Footnotes: 1. Amortization of intangible assets of acquired businesses. 2. Acquisition/integration costs for the acquisition of TMP Holding LTD completed on June 12, 2018. 3. Other adjustments for the 13 weeks ended June 28, 2020 and June 30, 2019 primarily include workforce reduction costs of $11.0 million ($3.0 million in cost of services and $8.0 million in selling, general and administrative expense) and $0.5 million (in selling, general and administrative expense), respectively, implementation costs for cloud-based systems of $0.1 million and $1.1 million, respectively and amortization of software as a service assets of $0.6 million and $0.5 million, respectively, which is reported in selling, general and administrative expense. For the 13 weeks ended June 28, 2020, these costs were slightly offset by $3.1 million in COVID-19 government subsidies. 4. Total tax effect of each of the adjustments to U.S. GAAP net income (loss) using the effective rate of 62 percent for Q2 2020 relative to the expected long-term ongoing rate of 14 percent for Q2 2019. 5. Adjustment of the effective income tax rate to the expected long-term ongoing rate of 14 percent for Q2 2019. Beginning in Q2 2020, we will not be adjusting our GAAP tax rate in our adjusted net income calculation until our profitability rises to a more substantial level. 6. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from certain targeted groups with higher than average unemployment rates. www.TrueBlue.com 15