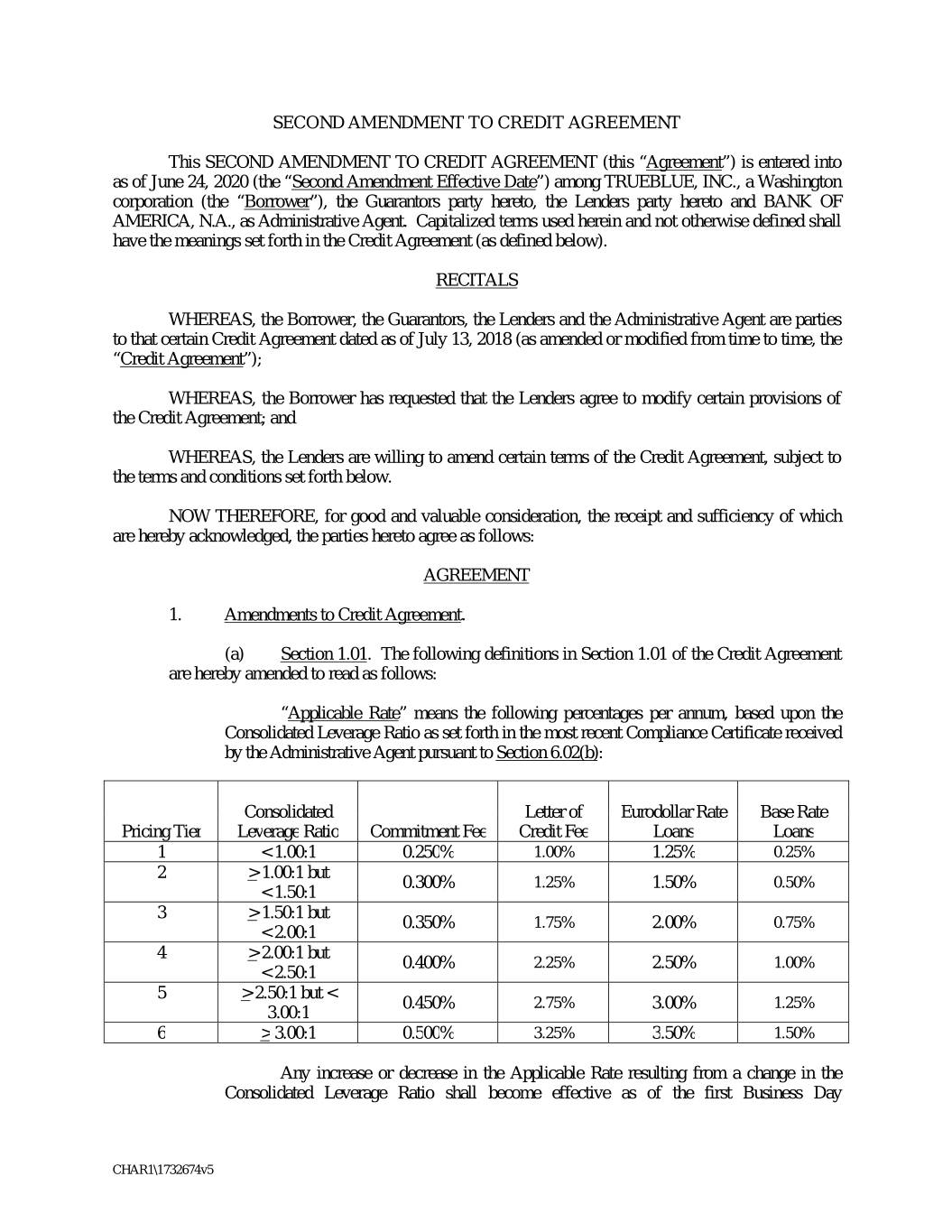

SECOND AMENDMENT TO CREDIT AGREEMENT This SECOND AMENDMENT TO CREDIT AGREEMENT (this “Agreement”) is entered into as of June 24, 2020 (the “Second Amendment Effective Date”) among TRUEBLUE, INC., a Washington corporation (the “Borrower”), the Guarantors party hereto, the Lenders party hereto and BANK OF AMERICA, N.A., as Administrative Agent. Capitalized terms used herein and not otherwise defined shall have the meanings set forth in the Credit Agreement (as defined below). RECITALS WHEREAS, the Borrower, the Guarantors, the Lenders and the Administrative Agent are parties to that certain Credit Agreement dated as of July 13, 2018 (as amended or modified from time to time, the “Credit Agreement”); WHEREAS, the Borrower has requested that the Lenders agree to modify certain provisions of the Credit Agreement; and WHEREAS, the Lenders are willing to amend certain terms of the Credit Agreement, subject to the terms and conditions set forth below. NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows: AGREEMENT 1. Amendments to Credit Agreement. (a) Section 1.01. The following definitions in Section 1.01 of the Credit Agreement are hereby amended to read as follows: “Applicable Rate” means the following percentages per annum, based upon the Consolidated Leverage Ratio as set forth in the most recent Compliance Certificate received by the Administrative Agent pursuant to Section 6.02(b): Consolidated Letter of Eurodollar Rate Base Rate Pricing Tier Leverage Ratio Commitment Fee Credit Fee Loans Loans 1 < 1.00:1 0.250% 1.00% 1.25% 0.25% 2 > 1.00:1 but 0.300% 1.25% 1.50% 0.50% < 1.50:1 3 > 1.50:1 but 0.350% 1.75% 2.00% 0.75% < 2.00:1 4 > 2.00:1 but 0.400% 2.25% 2.50% 1.00% < 2.50:1 5 > 2.50:1 but < 0.450% 2.75% 3.00% 1.25% 3.00:1 6 > 3.00:1 0.500% 3.25% 3.50% 1.50% Any increase or decrease in the Applicable Rate resulting from a change in the Consolidated Leverage Ratio shall become effective as of the first Business Day CHAR1\1732674v5

immediately following the date a Compliance Certificate is delivered pursuant to Section 6.02(b); provided, however, that if a Compliance Certificate is not delivered when due in accordance with such Section, then, upon the request of the Required Lenders, Pricing Tier 6 shall apply as of the first Business Day after the date on which such Compliance Certificate was required to have been delivered and shall remain in effect until the first Business Day immediately following the date on which such Compliance Certificate is delivered in accordance with Section 6.02(b), whereupon the Applicable Rate shall be adjusted based upon the calculation of the Consolidated Leverage Ratio contained in such Compliance Certificate. The Applicable Rate in effect from the Second Amendment Effective Date through the first Business Day immediately following the date a Compliance Certificate is required to be delivered pursuant to Section 6.02(b) for the fiscal quarter ending December 27, 2020 shall be determined based upon Pricing Tier 6. Notwithstanding anything to the contrary contained in this definition, the determination of the Applicable Rate for any period shall be subject to the provisions of Section 2.10(b). “Base Rate” means for any day a fluctuating rate of interest per annum equal to the highest of (a) the Federal Funds Rate plus 0.50%, (b) the rate of interest in effect for such day as publicly announced from time to time by Bank of America as its “prime rate” and (c) the Eurodollar Rate plus 1.0%; provided that if the Base Rate shall be less than 0.75%, such rate shall be deemed 0.75% for purposes of this Agreement. The “prime rate” is a rate set by Bank of America based upon various factors including Bank of America’s costs and desired return, general economic conditions and other factors, and is used as a reference point for pricing some loans, which may be priced at, above, or below such announced rate. Any change in such “prime rate” announced by Bank of America shall take effect at the opening of business on the day specified in the public announcement of such change. If the Base Rate is being used as an alternate rate of interest pursuant to Section 3.07 hereof (for the avoidance of doubt, only until any amendment has become effective pursuant to Section 3.07), then the Base Rate shall be the greater of clauses (a) and (b) above and shall be determined without reference to clause (c) above. (b) Section 1.01. The following definitions are hereby added to Section 1.01 of the Credit Agreement in the appropriate alphabetical order to read as follows: “Accounts” shall have the meaning set forth in Article 9 of the UCC. “Asset Coverage Ratio” means, as of any date of determination, the ratio of (a) sixty percent (60%) of Accounts of the Loan Parties on an aggregate basis to (b) the difference of (i) the Total Revolving Outstandings on such date minus (ii) the difference of (A) unrestricted cash and Cash Equivalents of the Loan Parties on an aggregate basis minus (B) $50,000,000; provided, that, the amount of this clause (ii) shall not be less than zero. “Liquidity” means, as of any date of determination, the sum of (a) unrestricted cash and Cash Equivalents of the Loan Parties plus (b) availability under the Aggregate Revolving Commitments. (c) Section 1.01. The definition of “Eurodollar Rate” in the Credit Agreement is hereby amended to replace both instances of the text “zero” therein with “0.75%”. 2 CHAR1\1732674v5

(d) Section 3.07. The second to last paragraph in Section 3.07 of the Credit Agreement is hereby amended to replace the text “zero” therein with “0.75%”. (e) Section 4.02. A new clause (e) is hereby added to Section 4.02 of the Credit Agreement to read as follows: (e) The Borrower and its Subsidiaries shall be in compliance with Section 7.18. (f) Section 7.06. Section 7.06(e) of the Credit Agreement is hereby amended to replace the text “; and” with the text “; provided, further, that the Borrower shall not make any share repurchases pursuant to this Section 7.06(e) prior to June 30, 2021; and”. (g) Section 7.11. Section 7.11 of the Credit Agreement is hereby amended in its entirety to read as follows: 7.11 Financial Covenants. (a) Consolidated Leverage Ratio. Permit the Consolidated Leverage Ratio (x) as of the end of any fiscal quarter ending on or prior to June 27, 2020 to be greater than 3.00:1.00, (y) as of the end of any fiscal quarter ending from June 28, 2021 through and including December 26, 2021 to be greater than 4.00:1.00 and (z) as of the end of any fiscal quarter of the Borrower thereafter to be greater than 3.00:1.00; provided, that, at any time after December 27, 2021, for each of the four (4) fiscal quarters immediately following a Qualified Acquisition, commencing with the fiscal quarter in which such Qualified Acquisition was consummated (such period of increase, the “Leverage Increase Period”), the numerator of the required ratio set forth above shall be increased by 0.50; provided, further that (i) there shall only be two (2) Leverage Increase Periods during the term of this Agreement, (ii) the maximum Consolidated Leverage Ratio shall revert to the then required maximum ratio set forth above at the end of such four (4) fiscal quarter period and (iii) each Leverage Increase Period shall apply only with respect to the calculation of the Consolidated Leverage Ratio for purposes of determining compliance with this Section 7.11 and for purposes of any Qualified Acquisition Pro Forma Determination; provided, however, that the Consolidated Leverage Ratio shall not be tested for the fiscal quarters ending from June 28, 2020 through and including June 27, 2021. (b) Consolidated Fixed Charge Coverage Ratio. Permit the Consolidated Fixed Charge Coverage Ratio as of the end of any fiscal quarter of the Borrower to be less than 1.25:1.00; provided, however, that the Consolidated Fixed Charge Coverage Ratio shall not be tested for the fiscal quarters ending from June 28, 2020 through June 27, 2021. (c) Asset Coverage Ratio. Permit the Asset Coverage Ratio as of the end of any fiscal quarter of the Borrower ending from June 28, 2020 through June 27, 2021, to be less than 1.00:1.00. (d) Liquidity. Permit the Liquidity as of the end of any fiscal quarter of the Borrower ending from June 28, 2020 through June 27, 2021, to be less than $150,000,000. 3 CHAR1\1732674v5

(e) EBITDA. Permit the EBITDA (i) as of the fiscal quarter ending March 28, 2021 and calculated based on the three fiscal quarter period ending on such date, to be less than $12,000,000 and (ii) as of the fiscal quarter ending June 27, 2021 and calculated based on the four fiscal quarter period ending on such date, to be less than $15,000,000. (h) Section 7.18. A new Section 7.18 is hereby added to the Credit Agreement to read as follows: 7.18 Anti-Cash Hoarding. Commencing July 10, 2020, at any time that any Loans are outstanding, permit the aggregate amount of cash and Cash Equivalents of the Borrower and its Subsidiaries to exceed $65,000,000 at any time for a period of longer than five (5) Business Days; provided, in such case, the Borrower shall, within two (2) Business Days of becoming aware of any such excess, repay any Loans outstanding in the aggregate principal amount equal to the lesser of (a) such excess and (b) the aggregate amount of Loans outstanding at such time. (i) Section 11.17. Section 11.17 of the Credit Agreement is hereby amended and restated in its entirety to read as follows: 11.17 Electronic Execution; Electronic Records. (a) The words “delivery,” “execute,” “execution,” “signed,” “signature,” and words of like import in any Loan Document or any other document executed in connection herewith shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms approved by the Administrative Agent, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any Applicable Law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act; provided that notwithstanding anything contained herein to the contrary, the Administrative Agent is under no obligation to agree to accept electronic signatures in any form or in any format unless expressly agreed to by the Administrative Agent pursuant to procedures approved by it; provided, further, without limiting the foregoing, upon the written request of the Administrative Agent, any electronic signature shall be promptly followed by such manually executed counterpart. For the avoidance of doubt, the authorization under this paragraph may include, without limitation, use or acceptance by the Administrative Agent and each of the Secured Parties of a manually signed paper document, amendment, approval, consent, information, notice, certificate, request, statement, disclosure or authorization related to this Agreement (each a “Communication”) which has been converted into electronic form (such as scanned into PDF format), or an electronically signed Communication converted into another format, for transmission, delivery and/or retention. 4 CHAR1\1732674v5

(b) The Borrower hereby acknowledges the receipt of a copy of this Agreement and all other Loan Documents. The Administrative Agent and each Lender may, on behalf of the Borrower, create a microfilm or optical disk or other electronic image of this Agreement and any or all of the other Loan Documents. The Administrative Agent and each Lender may store the electronic image of this Agreement and the other Loan Documents in its electronic form and then destroy the paper original as part of the Administrative Agent’s and each Lender’s normal business practices, with the electronic image deemed to be an original and of the same legal effect, validity and enforceability as the paper originals. 2. Effectiveness; Condition Precedent. This Agreement shall be effective upon satisfaction of the following conditions precedent: (a) Receipt by the Administrative Agent of counterparts of this Agreement duly executed by the Borrower, the Guarantors, the Required Lenders, the Lenders extending their Commitments, the Swingline Lender and the L/C Issuer; (b) Receipt by the Administrative Agent of the following, in form and substance satisfactory to the Administrative Agent: (i) a certificate from a Responsible Officer of each Loan Party certifying that there have been no changes to the Organization Documents of such Loan Party since the Closing Date; and (ii) such certificates of resolutions or other action, incumbency certificates and/or other certificates of Responsible Officers of each Loan Party as the Administrative Agent may require evidencing the identity, authority and capacity of each Responsible Officer thereof authorized to act as a Responsible Officer in connection with this Agreement, the Credit Agreement and the other Loan Documents to which such Person is a party; (c) Upon the reasonable request of any Lender made at least five (5) days prior to the Second Amendment Effective Date, the Borrower shall have provided to such Lender, and such Lender shall be reasonably satisfied with, the documentation and other information so requested in connection with applicable “know your customer” and anti-money-laundering rules and regulations, including, without limitation, the PATRIOT Act; (d) If the Borrower qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, it shall deliver, to each Lender that so requests, a Beneficial Ownership Certification in relation to the Borrower; (e) The Administrative Agent shall have received from the Borrower all fees required to be paid on or before the Second Amendment Effective Date; and (f) The Borrower shall have paid all reasonable out-of-pocket costs and expenses due and payable to the Administrative Agent on the date hereof, including without limitation, the reasonable, documented fees and out-of-pocket costs and expenses of Moore & Van Allen PLLC as counsel to the Administrative Agent to the extent invoiced at least two (2) Business Days prior to the Second Amendment Effective Date. 3. Reaffirmation. The Loan Parties acknowledge and confirm (a) that the Administrative Agent, for the benefit of the holder of the Obligations, has a valid and enforceable perfected security interest in the Collateral, which security interest is prior to all Liens other than Permitted Liens, (b) that the Borrower’s obligation to repay the outstanding principal amount of the Loans and reimburse the L/C Issuer for any drawing on a Letter of Credit and the Guarantors’ Obligations under the Loan Documents 5 CHAR1\1732674v5

are unconditional and not subject to any offsets, defenses or counterclaims, and (c) by entering into this Agreement, the Administrative Agent and the Lenders do not waive or release any term or condition of the Credit Agreement or any of the other Loan Documents or any of their rights or remedies under such Loan Documents or applicable law or any of the obligations of any Loan Party thereunder. 4. Ratification of Credit Agreement. The term “Credit Agreement” as used in each of the Loan Documents shall hereafter mean the Credit Agreement as amended and modified by this Agreement. Except as herein specifically agreed, the Credit Agreement, as amended by this Agreement, is hereby ratified and confirmed and shall remain in full force and effect according to its terms. The Loan Parties acknowledge and consent to the modifications set forth herein and agree that this Agreement does not impair, reduce or limit any of their obligations under the Loan Documents (including, without limitation, the indemnity obligations set forth therein) and that, after the date hereof, this Agreement shall constitute a Loan Document. Notwithstanding anything herein to the contrary and without limiting the foregoing, each Guarantor reaffirms its guaranty obligations set forth in the Credit Agreement. 5. Authority/Enforceability. Each of the Loan Parties represents and warrants as follows: (a) It has taken all necessary action to authorize the execution, delivery and performance of this Agreement. (b) This Agreement has been duly executed and delivered by such Person and constitutes such Person’s legal, valid and binding obligation, enforceable in accordance with its terms, except as such enforceability may be subject to (i) Debtor Relief Laws and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding at law or in equity). (c) No consent, approval, authorization or order of, or filing, registration or qualification with, any court or Governmental Authority or third party is required in connection with the execution, delivery or performance by such Person of this Agreement. (d) The execution and delivery of this Agreement does not (i) contravene any provision of its Organization Documents or (ii) violate any Laws applicable to it except as could not reasonably be expected to have a Material Adverse Effect. 6. Representations. The Loan Parties represent and warrant to the Administrative Agent and the Lenders that (a) the representations and warranties of the Loan Parties set forth in Article V of the Credit Agreement and any other Loan Document are true and correct in all material respects (or, if qualified by materiality or Material Adverse Effect, in all respects) on and as of the date hereof, except to the extent that such representations and warranties specifically refer to a certain date, in which case they are true and correct in all material respects (or, if qualified by materiality or Material Adverse Effect, in all respects) as of such date and (b) no Default exists. 7. Counterparts/Telecopy. This Agreement may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Agreement by fax transmission or e-mail transmission (e.g., “pdf” or “tif”) shall be effective as delivery of a manually executed counterpart of this Agreement. 8. GOVERNING LAW. THIS AGREEMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. 6 CHAR1\1732674v5

[remainder of page intentionally left blank] 7 CHAR1\1732674v5

ADMINISTRATIVE AGENT: BANK OF AMERICA, N.A., as Administrative Agent By: Name: Aamir Saleem Title: Vice President TRUEBLUE, INC. SECOND AMENDMENT TO CREDIT AGREEMENT

KEYBANK NATIONAL ASSOCIATION, as a Lender By:________________________________ Name: Joseph M. Murry Title: Senior Vice President TRUEBLUE, INC. SECOND AMENDMENT TO CREDIT AGREEMENT

HSBC BANK USA, NATIONAL ASSOCIATION, as a Lender By:________________________________%,(+'*- %'))*. 9$/. 157 2020 14813 #"&: Name: Michael Madden Title: Vice President TRUEBLUE, INC. SECOND AMENDMENT TO CREDIT AGREEMENT