Q2 2019 Earnings July 2019 www.TrueBlue.com

Forward-looking statements

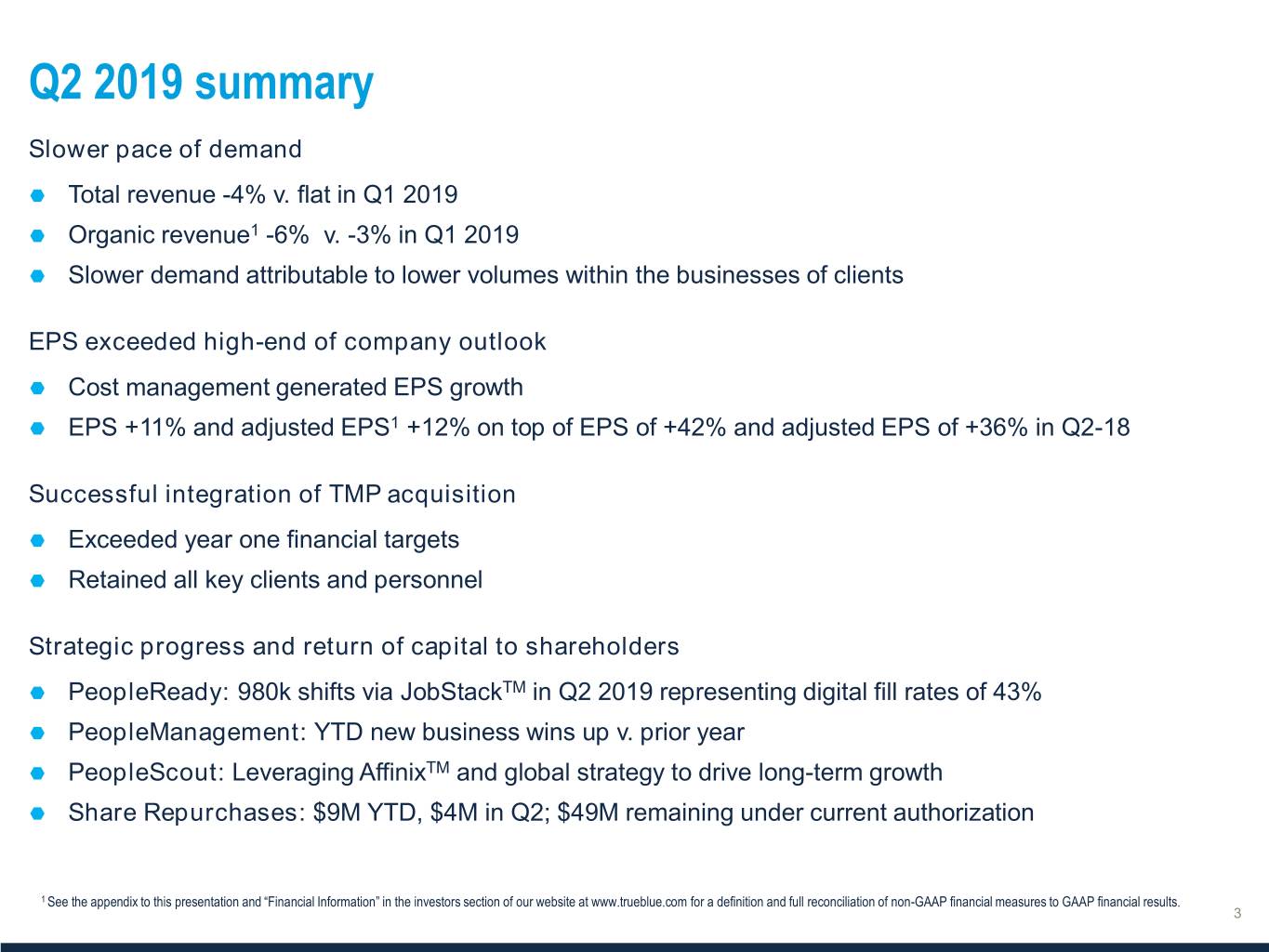

Q2 2019 summary Slower pace of demand Total revenue -4% v. flat in Q1 2019 Organic revenue1 -6% v. -3% in Q1 2019 Slower demand attributable to lower volumes within the businesses of clients EPS exceeded high-end of company outlook Cost management generated EPS growth EPS +11% and adjusted EPS1 +12% on top of EPS of +42% and adjusted EPS of +36% in Q2-18 Successful integration of TMP acquisition Exceeded year one financial targets Retained all key clients and personnel Strategic progress and return of capital to shareholders PeopleReady: 980k shifts via JobStackTM in Q2 2019 representing digital fill rates of 43% PeopleManagement: YTD new business wins up v. prior year PeopleScout: Leveraging AffinixTM and global strategy to drive long-term growth Share Repurchases: $9M YTD, $4M in Q2; $49M remaining under current authorization 1 See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

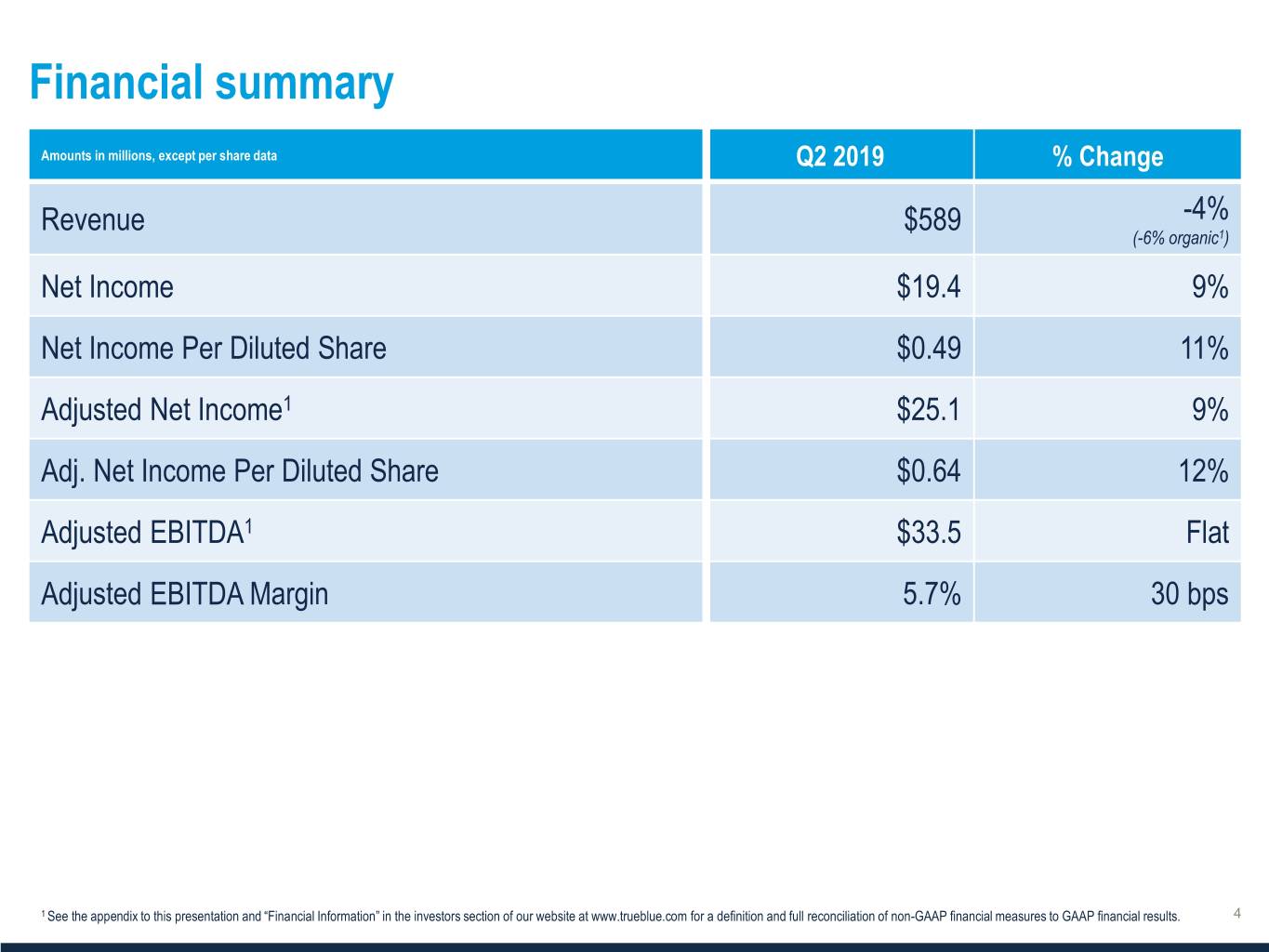

Financial summary Amounts in millions, except per share data Q2 2019 % Change Revenue $589 -4% (-6% organic1) Net Income $19.4 9% Net Income Per Diluted Share $0.49 11% Adjusted Net Income1 $25.1 9% Adj. Net Income Per Diluted Share $0.64 12% Adjusted EBITDA1 $33.5 Flat Adjusted EBITDA Margin 5.7% 30 bps 1 See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

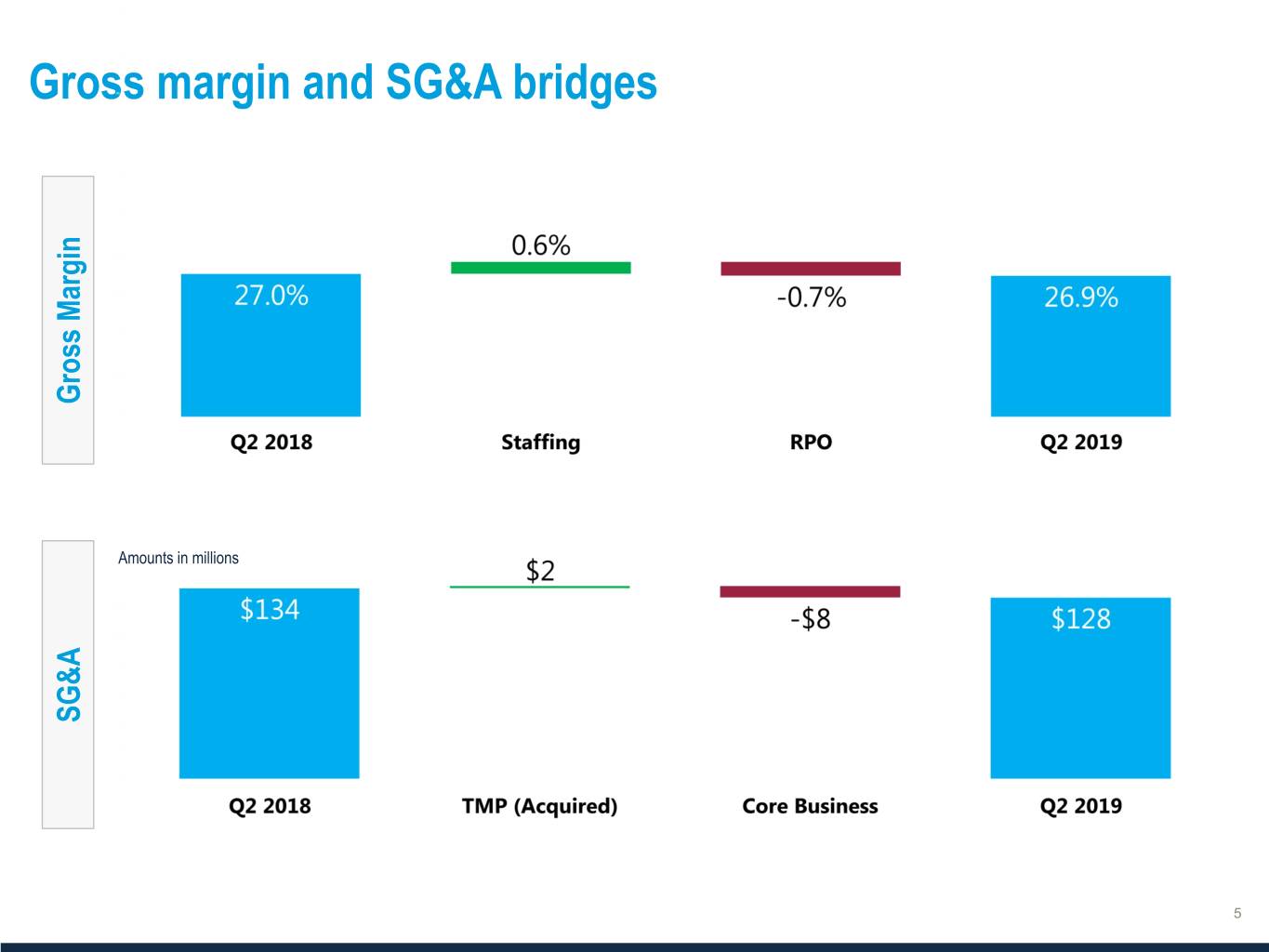

Gross margin and SG&A bridges Gross Gross Margin Amounts in millions SG&A

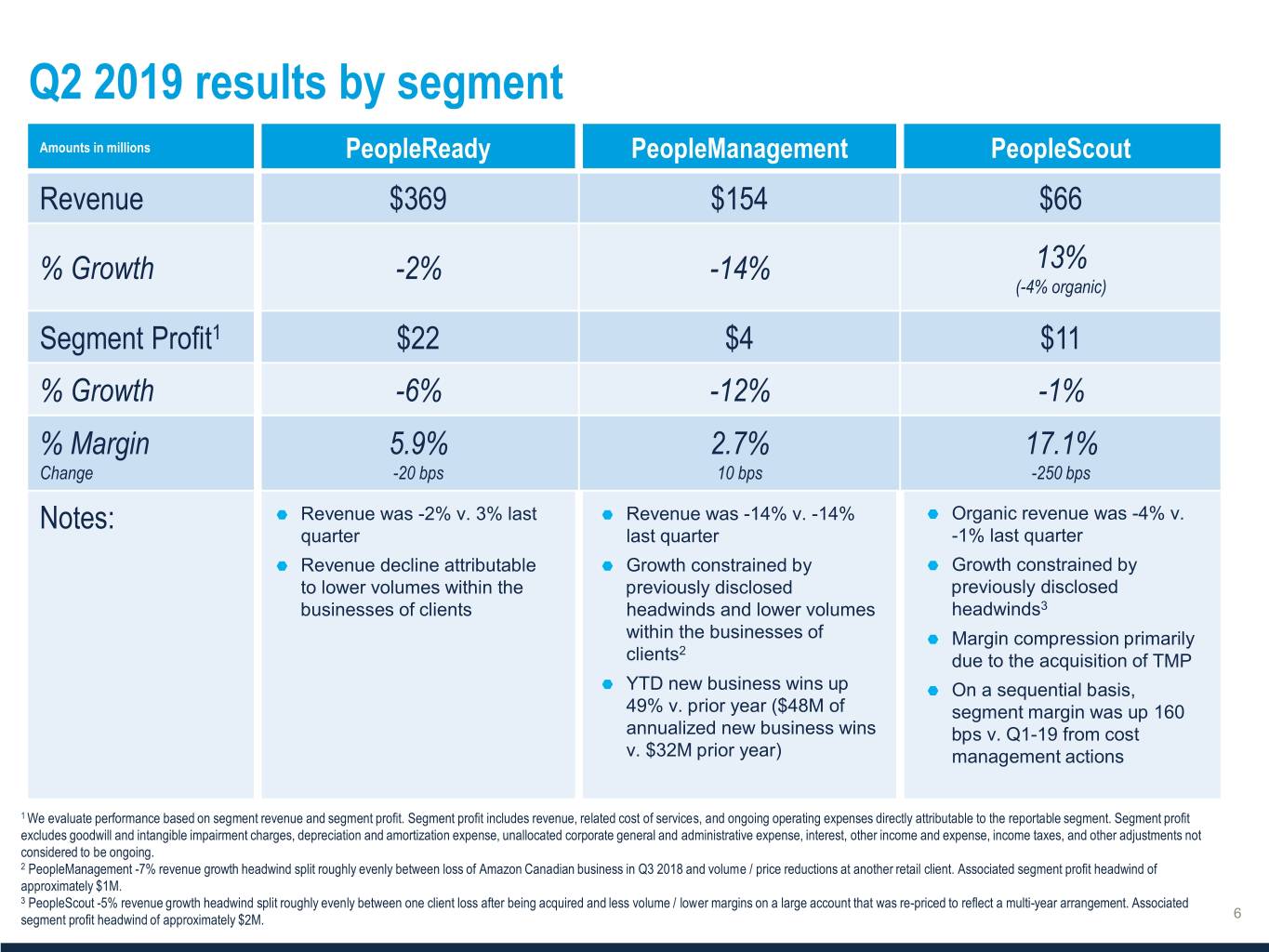

Q2 2019 results by segment Amounts in millions PeopleReady PeopleManagement PeopleScout Revenue $369 $154 $66 % Growth -2% -14% 13% (-4% organic) Segment Profit1 $22 $4 $11 % Growth -6% -12% -1% % Margin 5.9% 2.7% 17.1% Change -20 bps 10 bps -250 bps Notes: Revenue was -2% v. 3% last Revenue was -14% v. -14% Organic revenue was -4% v. quarter last quarter -1% last quarter Revenue decline attributable Growth constrained by Growth constrained by to lower volumes within the previously disclosed previously disclosed businesses of clients headwinds and lower volumes headwinds3 within the businesses of Margin compression primarily 2 clients due to the acquisition of TMP YTD new business wins up On a sequential basis, 49% v. prior year ($48M of segment margin was up 160 annualized new business wins bps v. Q1-19 from cost v. $32M prior year) management actions 1 We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit excludes goodwill and intangible impairment charges, depreciation and amortization expense, unallocated corporate general and administrative expense, interest, other income and expense, income taxes, and other adjustments not considered to be ongoing. 2 PeopleManagement -7% revenue growth headwind split roughly evenly between loss of Amazon Canadian business in Q3 2018 and volume / price reductions at another retail client. Associated segment profit headwind of approximately $1M. 3 PeopleScout -5% revenue growth headwind split roughly evenly between one client loss after being acquired and less volume / lower margins on a large account that was re-priced to reflect a multi-year arrangement. Associated segment profit headwind of approximately $2M.

Leading our business into a digital future JobStack TM Industry leading mobile app that connects our Industry leading platform for sourcing, screening associates with jobs and simplifies client ordering and delivering a permanent workforce Before Affinix After 86% worker adoption 30% applicant 80%+ applicant conversion rate1 conversion rate and 17,000 clients using Quick apply 4.6 stars in iOS app 50% of candidates Not mobile enabled apply with mobile store (worker app) Mobile enabled 980k shifts via JobStack Limited passive 40 candidates sourcing sourced per job in Q2 2019 representing Efficient sourcing digital fill rates of 43% >35 days to fill 25 days to fill Virtual screening Note: figures represent initial improvements experienced across a small portion of our client base that has been fully implemented on Affinix and tracks relevant statistics. 1 Applicant conversion rate represents the number of completed applications over the number of applications initiated.

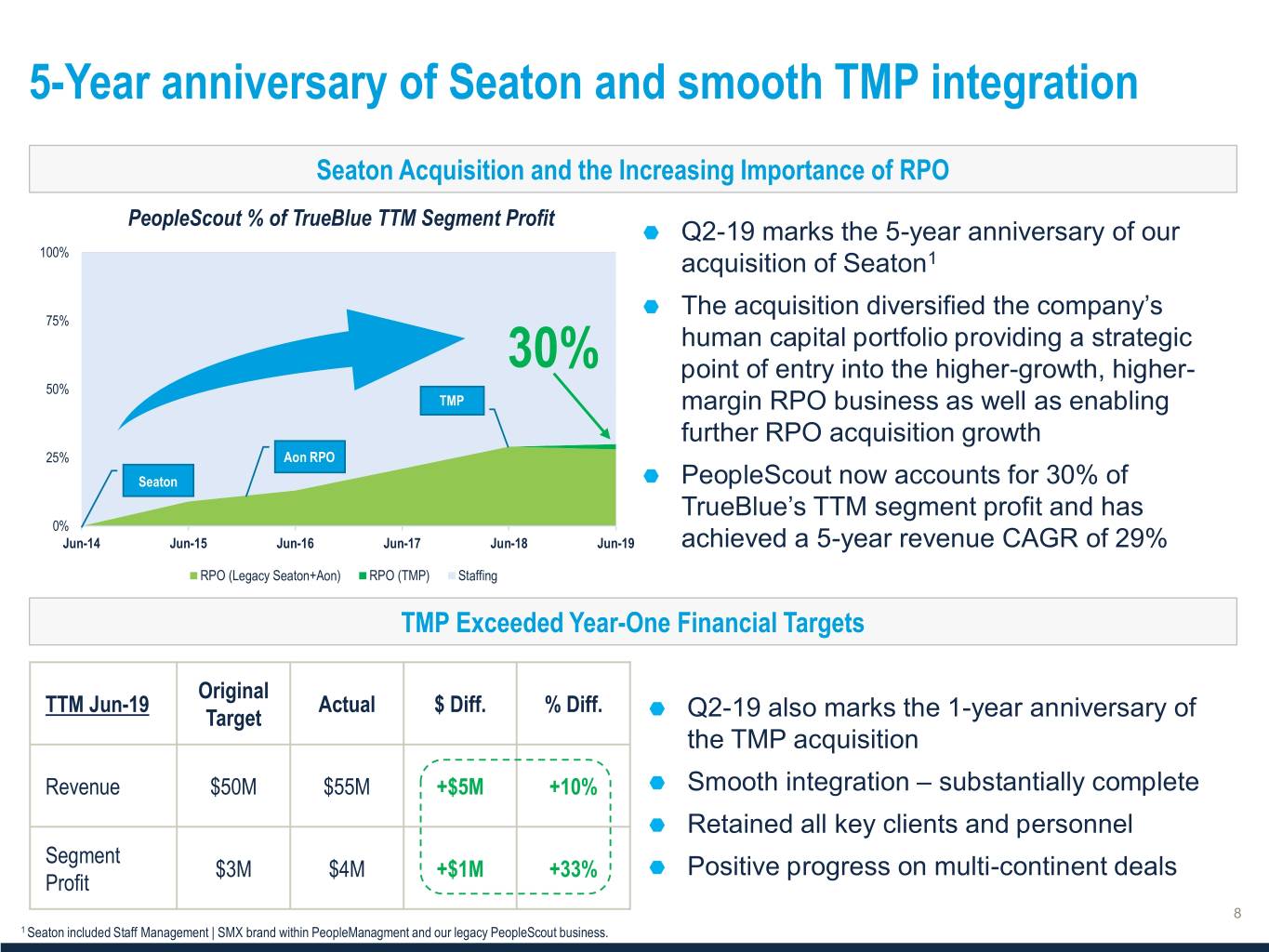

5-Year anniversary of Seaton and smooth TMP integration Seaton Acquisition and the Increasing Importance of RPO PeopleScout % of TrueBlue TTM Segment Profit Q2-19 marks the 5-year anniversary of our 100% acquisition of Seaton1 The acquisition diversified the company’s 75% human capital portfolio providing a strategic 30% point of entry into the higher-growth, higher- 50% TMP margin RPO business as well as enabling further RPO acquisition growth 25% Aon RPO Seaton PeopleScout now accounts for 30% of TrueBlue’s TTM segment profit and has 0% Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Jun-19 achieved a 5-year revenue CAGR of 29% RPO (Legacy Seaton+Aon) RPO (TMP) Staffing TMP Exceeded Year-One Financial Targets Original TTM Jun-19 Actual $ Diff. % Diff. Target Q2-19 also marks the 1-year anniversary of the TMP acquisition Revenue $50M $55M +$5M +10% Smooth integration – substantially complete Retained all key clients and personnel Segment $3M $4M +$1M +33% Positive progress on multi-continent deals Profit 1 Seaton included Staff Management | SMX brand within PeopleManagment and our legacy PeopleScout business.

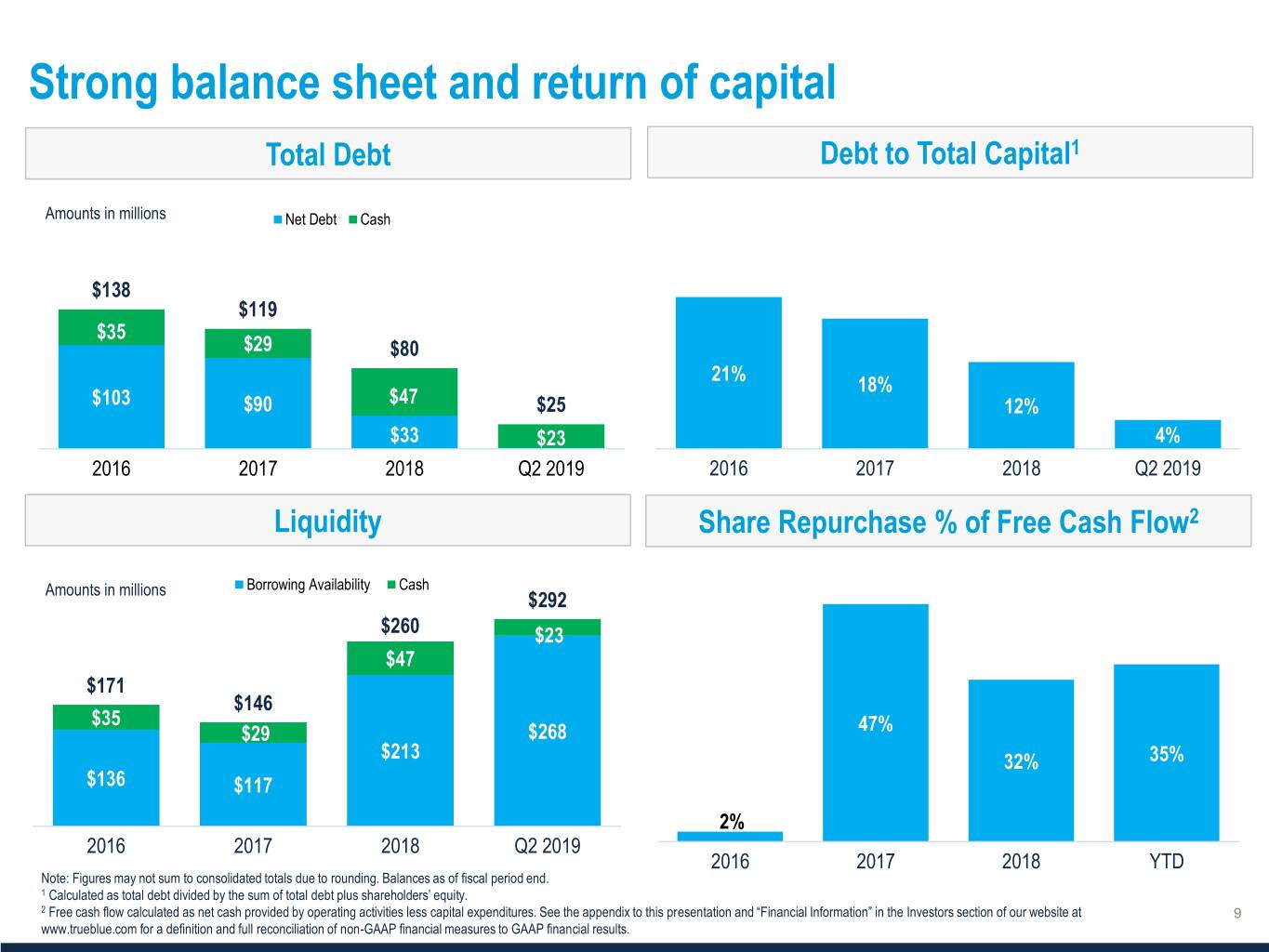

Strong balance sheet and return of capital Total Debt Debt to Total Capital1 Amounts in millions Net Debt Cash $138 $119 $35 $29 $80 21% 18% $103 $90 $47 $25 12% $33 $23 4% 2016 2017 2018 Q2 2019 2016 2017 2018 Q2 2019 Liquidity Share Repurchase % of Free Cash Flow2 Borrowing Availability Cash 50% Amounts in millions $292 45% $260 $23 40% $47 35% $171 30% $146 $35 25% 47% $29 $268 20% $213 35% 15% 32% $136 $117 10% 5% 2% 2016 2017 2018 Q2 2019 0% 2016 2017 2018 YTD Note: Figures may not sum to consolidated totals due to rounding. Balances as of fiscal period end. 1 Calculated as total debt divided by the sum of total debt plus shareholders’ equity. 2 Free cash flow calculated as net cash provided by operating activities less capital expenditures. See the appendix to this presentation and “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

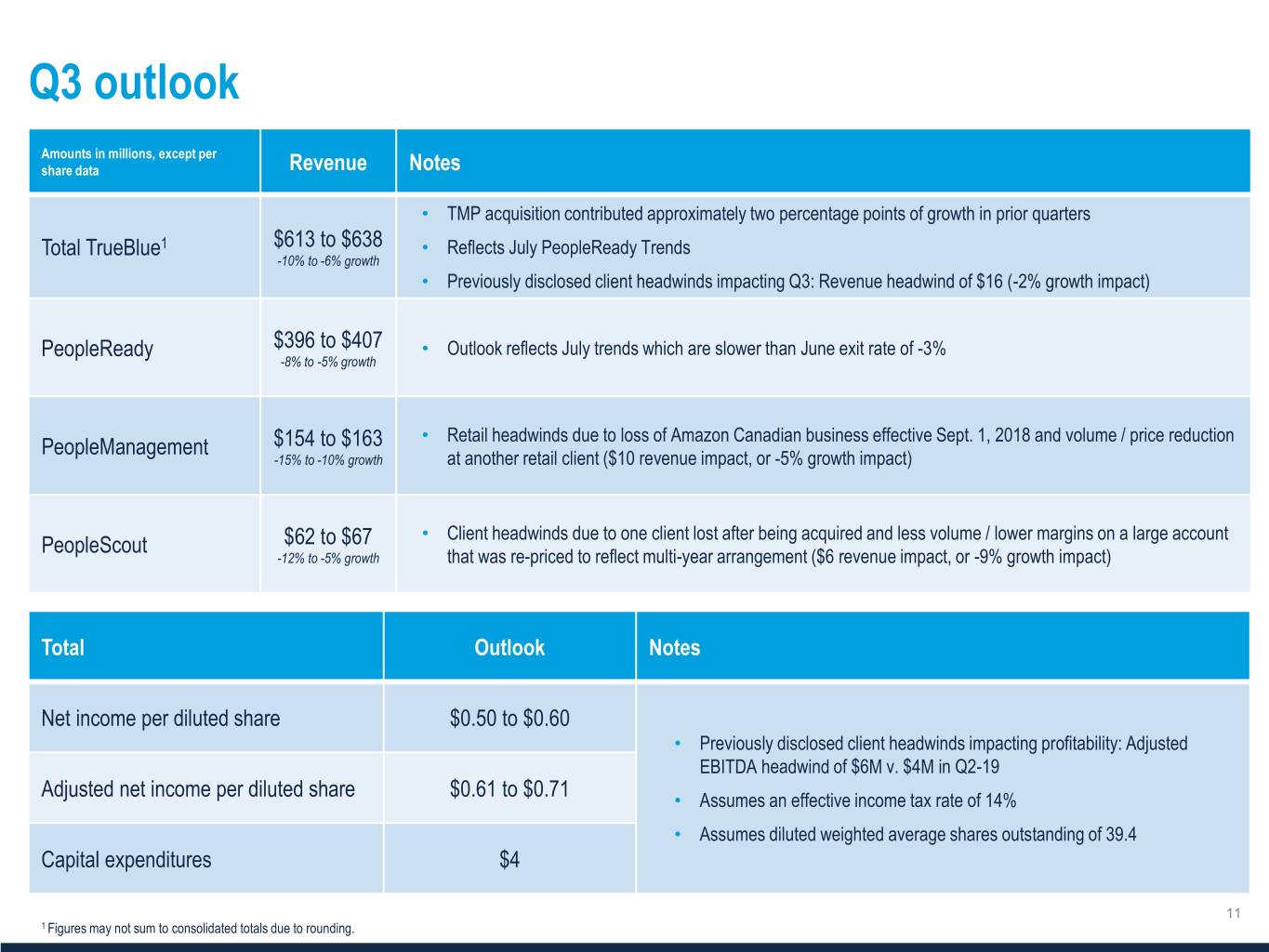

Q3 outlook Amounts in millions, except per share data Revenue Notes • TMP acquisition contributed approximately two percentage points of growth in prior quarters Total TrueBlue1 $613 to $638 • Reflects July PeopleReady Trends -10% to -6% growth • Previously disclosed client headwinds impacting Q3: Revenue headwind of $16 (-2% growth impact) PeopleReady $396 to $407 • Outlook reflects July trends which are slower than June exit rate of -3% -8% to -5% growth • Retail headwinds due to loss of Amazon Canadian business effective Sept. 1, 2018 and volume / price reduction PeopleManagement $154 to $163 -15% to -10% growth at another retail client ($10 revenue impact, or -5% growth impact) • Client headwinds due to one client lost after being acquired and less volume / lower margins on a large account PeopleScout $62 to $67 -12% to -5% growth that was re-priced to reflect multi-year arrangement ($6 revenue impact, or -9% growth impact) Total Outlook Notes Net income per diluted share $0.50 to $0.60 • Previously disclosed client headwinds impacting profitability: Adjusted EBITDA headwind of $6M v. $4M in Q2-19 Adjusted net income per diluted share $0.61 to $0.71 • Assumes an effective income tax rate of 14% • Assumes diluted weighted average shares outstanding of 39.4 Capital expenditures $4 1 Figures may not sum to consolidated totals due to rounding.

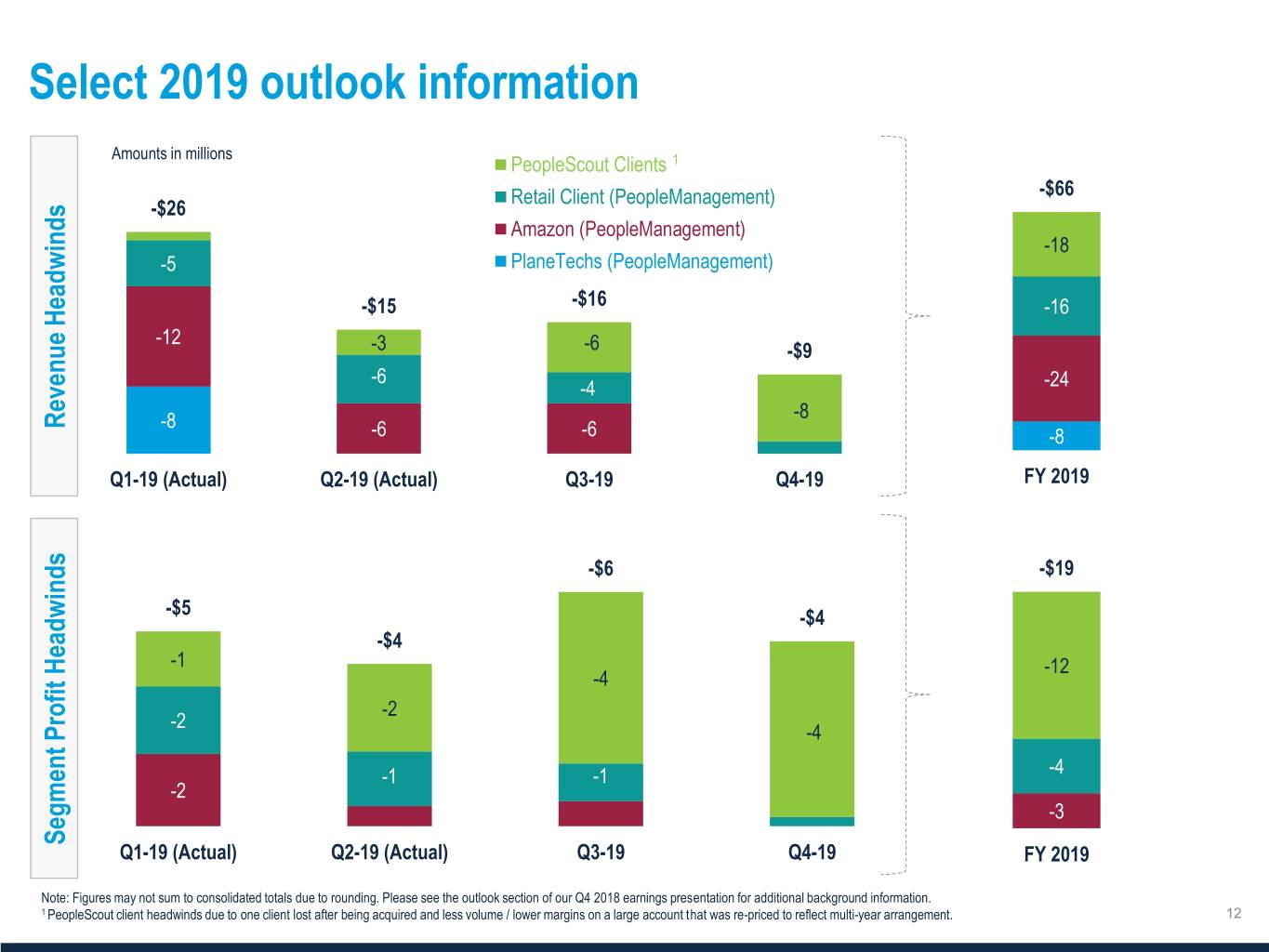

Select 2019 outlook information Amounts in millions PeopleScout Clients 1 Retail Client (PeopleManagement) -$66 -$26 Amazon (PeopleManagement) -18 -5 PlaneTechs (PeopleManagement) -$15 -$16 -16 -12 -3 -6 -$9 -6 -4 -24 -8 Revenue HeadwindsRevenue -8 -6 -6 -8 Q1-19 (Actual) Q2-19 (Actual) Q3-19 Q4-19 FY 2019 -$6 -$19 -$5 -$4 -$4 -1 -12 -4 -2 -2 -4 -1 -1 -4 -2 -3 Segment Profit Headwinds Profit Segment Q1-19 (Actual) Q2-19 (Actual) Q3-19 Q4-19 FY 2019 Note: Figures may not sum to consolidated totals due to rounding. Please see the outlook section of our Q4 2018 earnings presentation for additional background information. 1 PeopleScout client headwinds due to one client lost after being acquired and less volume / lower margins on a large account that was re-priced to reflect multi-year arrangement.

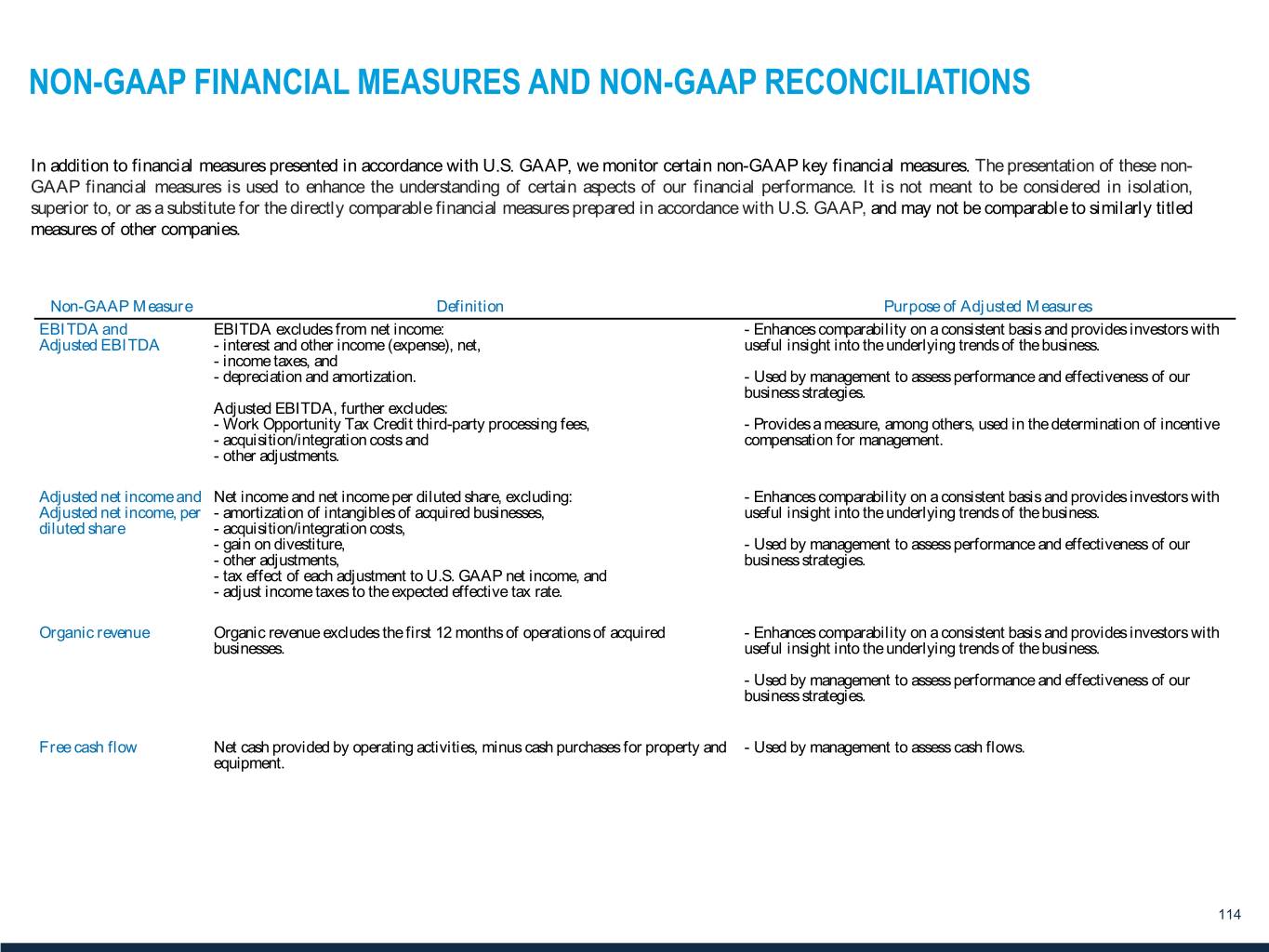

NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non- GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP Measure Definition Purpose of Adjusted Measures EBITDA and EBITDA excludes from net income: - Enhances comparability on a consistent basis and provides investors with Adjusted EBITDA - interest and other income (expense), net, useful insight into the underlying trends of the business. - income taxes, and - depreciation and amortization. - Used by management to assess performance and effectiveness of our business strategies. Adjusted EBITDA, further excludes: - Work Opportunity Tax Credit third-party processing fees, - Provides a measure, among others, used in the determination of incentive - acquisition/integration costs and compensation for management. - other adjustments. Adjusted net income and Net income and net income per diluted share, excluding: - Enhances comparability on a consistent basis and provides investors with Adjusted net income, per - amortization of intangibles of acquired businesses, useful insight into the underlying trends of the business. diluted share - acquisition/integration costs, - gain on divestiture, - Used by management to assess performance and effectiveness of our - other adjustments, business strategies. - tax effect of each adjustment to U.S. GAAP net income, and - adjust income taxes to the expected effective tax rate. Organic revenue Organic revenue excludes the first 12 months of operations of acquired - Enhances comparability on a consistent basis and provides investors with businesses. useful insight into the underlying trends of the business. - Used by management to assess performance and effectiveness of our business strategies. Free cash flow Net cash provided by operating activities, minus cash purchases for property and - Used by management to assess cash flows. equipment. 114

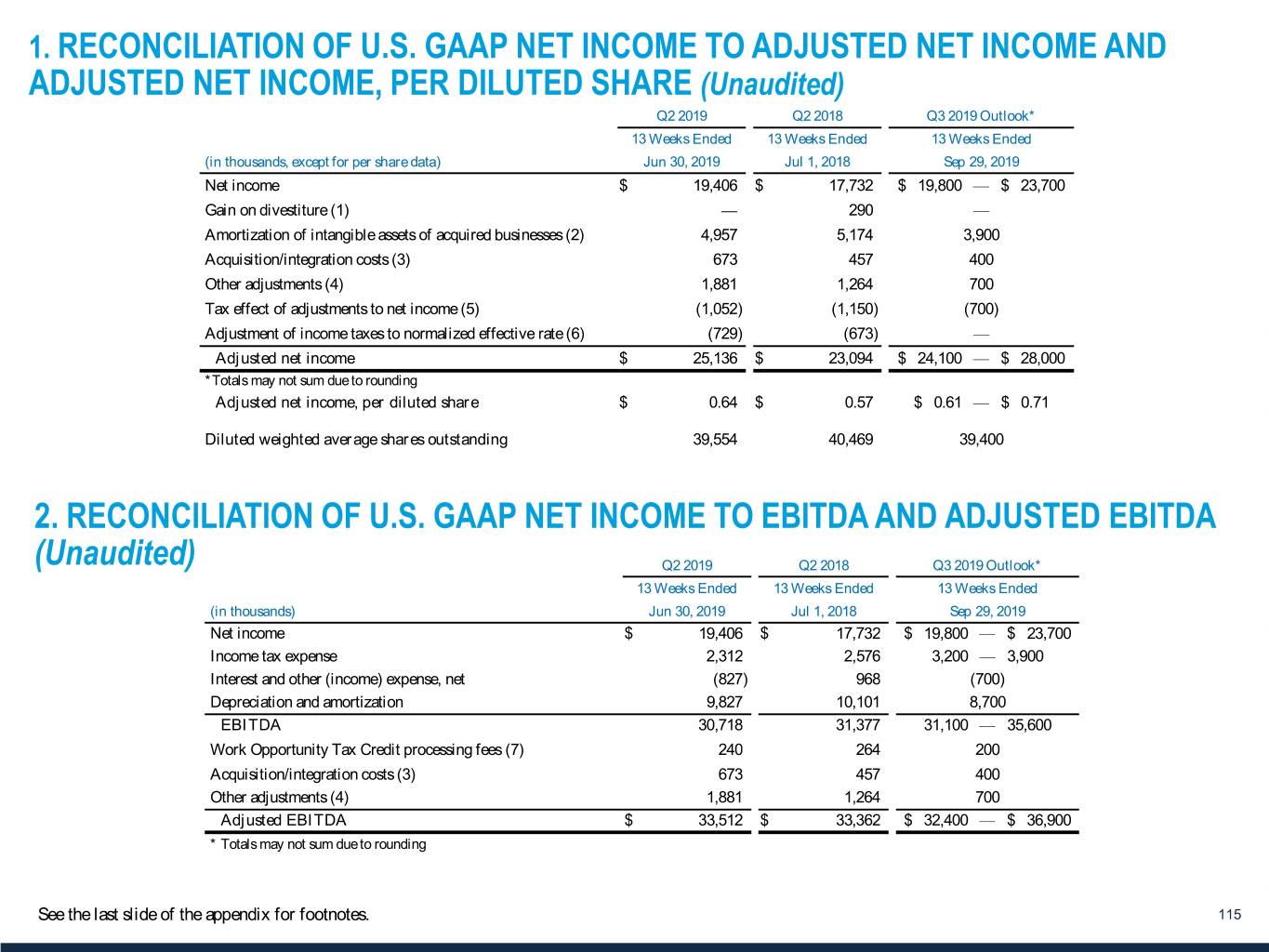

1. RECONCILIATION OF U.S. GAAP NET INCOME TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME, PER DILUTED SHARE (Unaudited) Q2 2019 Q2 2018 Q3 2019 Outlook* 13 Weeks Ended 13 Weeks Ended 13 Weeks Ended (in thousands, except for per share data) Jun 30, 2019 Jul 1, 2018 Sep 29, 2019 Net income $ 19,406 $ 17,732 $ 19,800 — $ 23,700 Gain on divestiture (1) — 290 — Amortization of intangible assets of acquired businesses (2) 4,957 5,174 3,900 Acquisition/integration costs (3) 673 457 400 Other adjustments (4) 1,881 1,264 700 Tax effect of adjustments to net income (5) (1,052) (1,150) (700) Adjustment of income taxes to normalized effective rate (6) (729) (673) — Adjusted net income $ 25,136 $ 23,094 $ 24,100 — $ 28,000 *Totals may not sum due to rounding Adjusted net income, per diluted share $ 0.64 $ 0.57 $ 0.61 — $ 0.71 Diluted weighted average shares outstanding 39,554 40,469 39,400 2. RECONCILIATION OF U.S. GAAP NET INCOME TO EBITDA AND ADJUSTED EBITDA (Unaudited) Q2 2019 Q2 2018 Q3 2019 Outlook* 13 Weeks Ended 13 Weeks Ended 13 Weeks Ended (in thousands) Jun 30, 2019 Jul 1, 2018 Sep 29, 2019 Net income $ 19,406 $ 17,732 $ 19,800 — $ 23,700 Income tax expense 2,312 2,576 3,200 — 3,900 Interest and other (income) expense, net (827) 968 (700) Depreciation and amortization 9,827 10,101 8,700 EBITDA 30,718 31,377 31,100 — 35,600 Work Opportunity Tax Credit processing fees (7) 240 264 200 Acquisition/integration costs (3) 673 457 400 Other adjustments (4) 1,881 1,264 700 Adjusted EBITDA $ 33,512 $ 33,362 $ 32,400 — $ 36,900 * Totals may not sum due to rounding See the last slide of the appendix for footnotes. 115

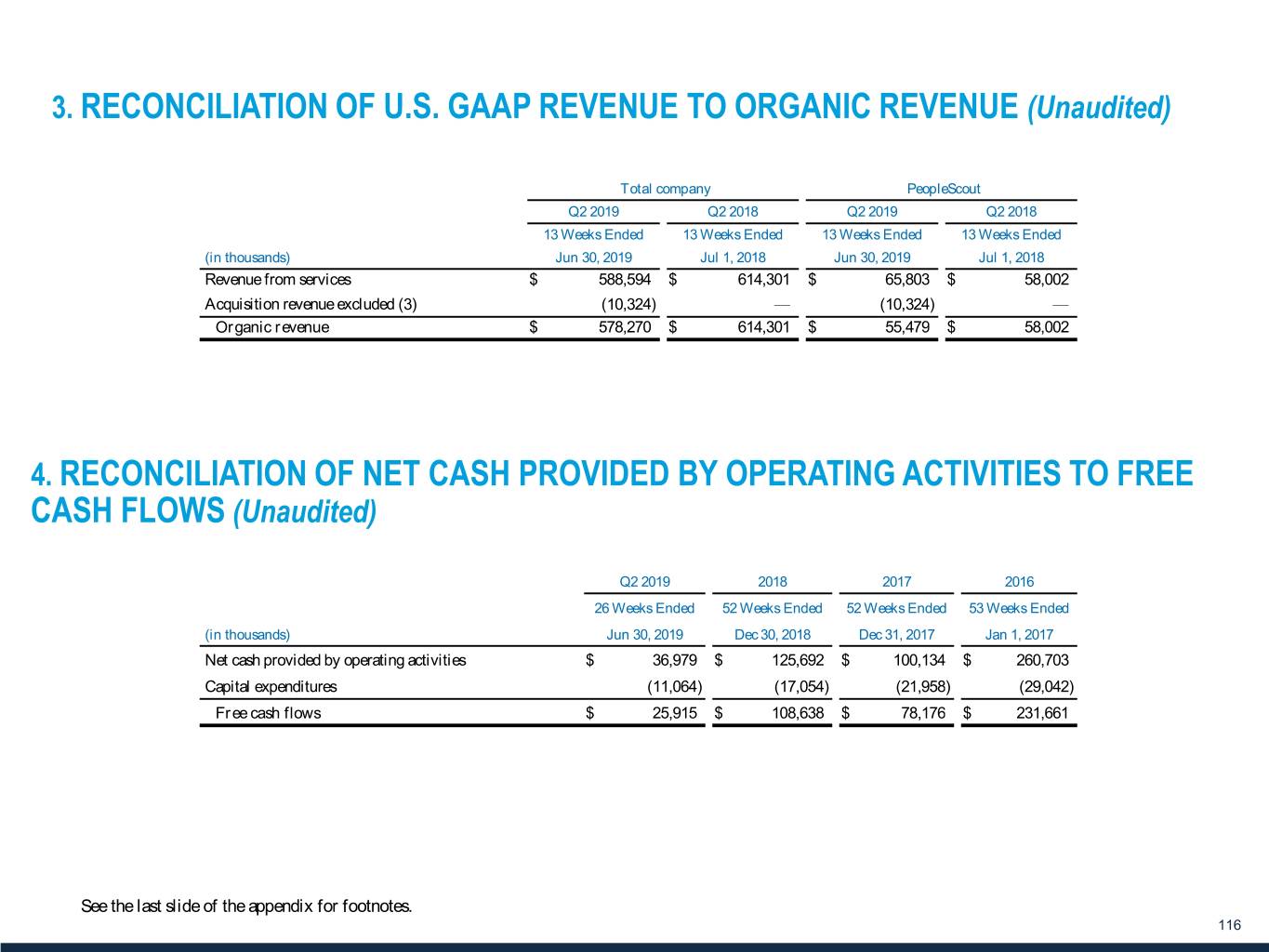

3. RECONCILIATION OF U.S. GAAP REVENUE TO ORGANIC REVENUE (Unaudited) Total company PeopleScout Q2 2019 Q2 2018 Q2 2019 Q2 2018 13 Weeks Ended 13 Weeks Ended 13 Weeks Ended 13 Weeks Ended (in thousands) Jun 30, 2019 Jul 1, 2018 Jun 30, 2019 Jul 1, 2018 Revenue from services $ 588,594 $ 614,301 $ 65,803 $ 58,002 Acquisition revenue excluded (3) (10,324) — (10,324) — Organic revenue $ 578,270 $ 614,301 $ 55,479 $ 58,002 4. RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOWS (Unaudited) Q2 2019 2018 2017 2016 26 Weeks Ended 52 Weeks Ended 52 Weeks Ended 53 Weeks Ended (in thousands) Jun 30, 2019 Dec 30, 2018 Dec 31, 2017 Jan 1, 2017 Net cash provided by operating activities $ 36,979 $ 125,692 $ 100,134 $ 260,703 Capital expenditures (11,064) (17,054) (21,958) (29,042) Free cash flows $ 25,915 $ 108,638 $ 78,176 $ 231,661 See the last slide of the appendix for footnotes. 116

Footnotes: 1. Gain on the divestiture of our PlaneTechs business sold mid-March 2018. 2. Amortization of intangible assets of acquired businesses. 3. Acquisition/integration costs for the acquisition of TMP Holding LTD ("TMP") completed on June 12, 2018. Organic revenue excludes the first 12 months of operations of TMP. 4. Other adjustments for the 13 weeks ended June 30, 2019 include implementation costs for cloud-based systems of $1.1 million, amortization of software as a service assets of $0.5 million which is reported in selling, general and administrative expense, a workforce reduction charge primarily associated with employee reductions in the PeopleReady business of $0.5 million, and reduced costs associated with the CEO transition of $0.2 million. Other adjustments for the 13 weeks ended July 1, 2018 include implementation costs for cloud-based systems of $1.3 million. Other adjustments for the 13 weeks ended September 29, 2019 include estimated implementations costs for cloud-based systems of $0.4 million and amortization of software as a service assets of $0.3 million. 5. Total tax effect of each of the adjustments to U.S. GAAP net income using the expected ongoing rate of 14 percent for 2019 and 16 percent for 2018. 6. Adjustment of the effective income tax rate to the expected ongoing rate of 14 percent for 2019 and 16 percent for 2018. 7. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from certain targeted groups with higher than average unemployment rates. 117