November 5, 2018 www.TrueBlue.com

Forward-looking statements

Q3 2018 summary Another quarter of revenue growth Total revenue +3% v. +1% in Q2 Organic revenue1,2 +1% v. flat in Q2 PeopleReady, the largest segment, +3% v. +2% in Q2 PeopleManagement -8% v. -7% in Q2 PeopleScout +44% v. +25% in Q2 Strong EPS results EPS +20% and adjusted EPS2 +32% Programs to lower cost of sales are working – gross margin +110 bps Adjusted EBITDA2 +7% and adjusted EBITDA margin +20 bps Acquisition of UK-based TMP in Q2-18 is on-track Financial performance and PeopleScout integration are meeting expectations Returning capital to shareholders $25M of stock repurchased YTD $68M remaining under current authorization 1 Organic revenue excludes acquired revenue from TMP Holdings LTD. 2 See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

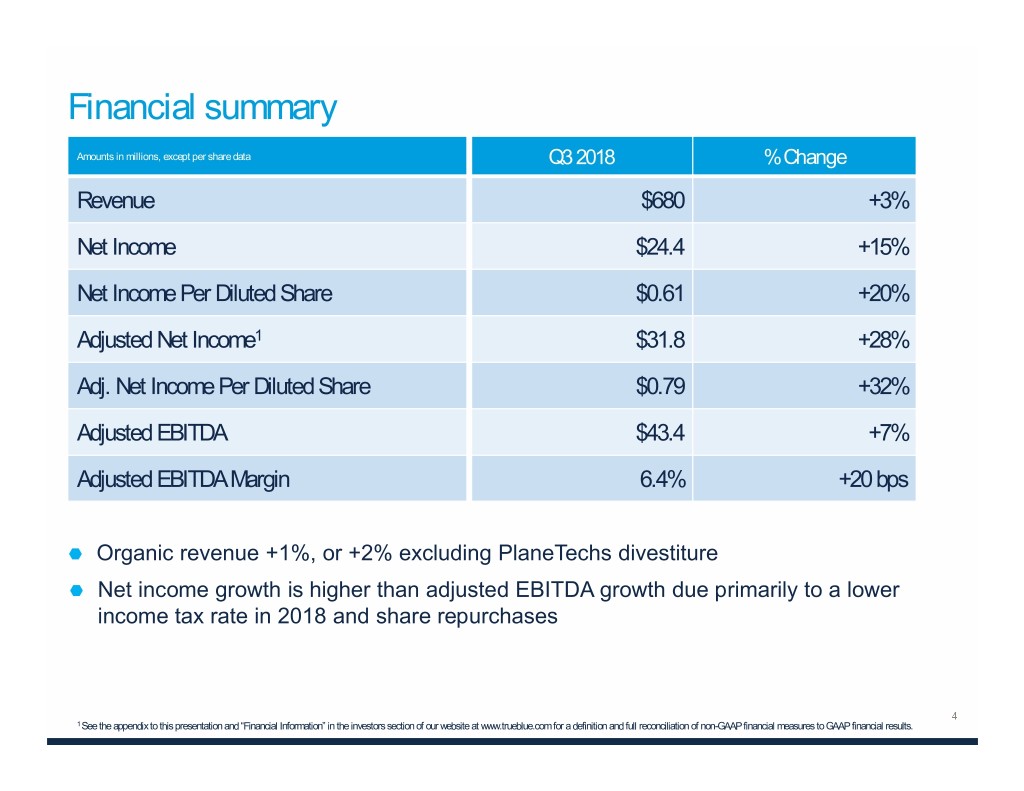

Financial summary Amounts in millions, except per share data Q3 2018 % Change Revenue $680 +3% Net Income $24.4 +15% Net Income Per Diluted Share $0.61 +20% Adjusted Net Income1 $31.8 +28% Adj. Net Income Per Diluted Share $0.79 +32% Adjusted EBITDA $43.4 +7% Adjusted EBITDA Margin 6.4% +20 bps Organic revenue +1%, or +2% excluding PlaneTechs divestiture Net income growth is higher than adjusted EBITDA growth due primarily to a lower income tax rate in 2018 and share repurchases 1 See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

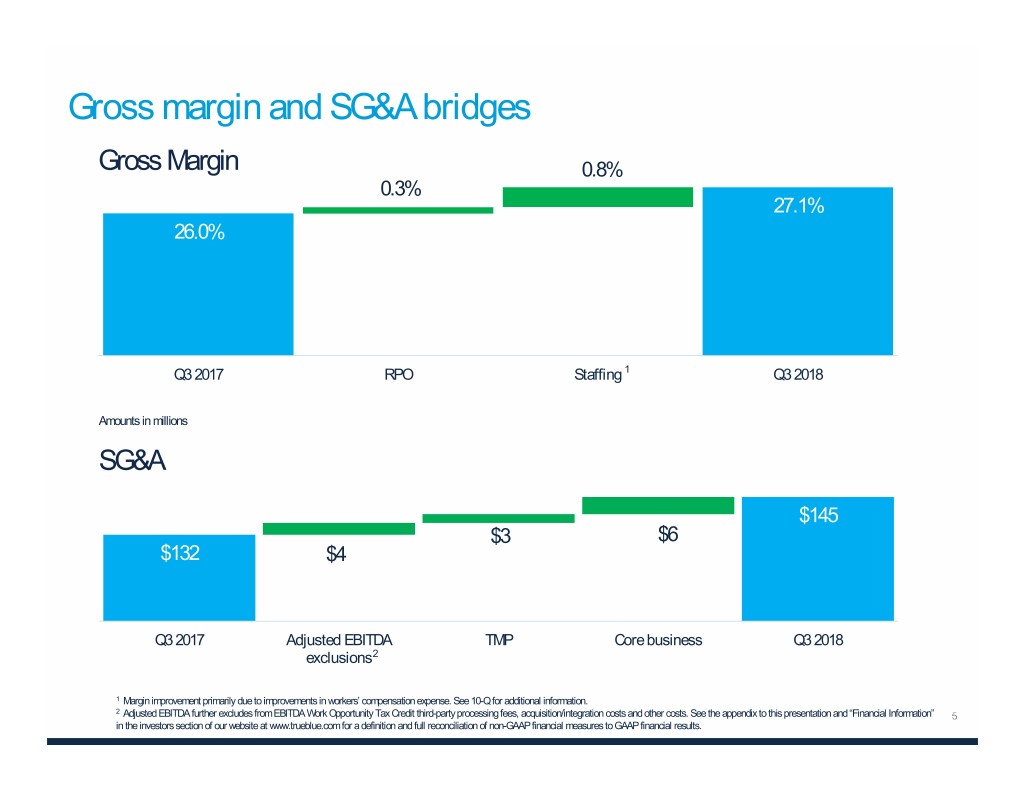

Gross margin and SG&A bridges Gross Margin 0.8% 0.3% 27.1% 26.0% Q3 2017 RPO Staffing1 Q3 2018 Amounts in millions SG&A $145 $3 $6 $132 $4 Q3 2017 Adjusted EBITDA TMP Core business Q3 2018 exclusions2 1 Margin improvement primarily due to improvements in workers’ compensation expense. See 10-Q for additional information. 2 Adjusted EBITDA further excludes from EBITDA Work Opportunity Tax Credit third-party processing fees, acquisition/integration costs and other costs. See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

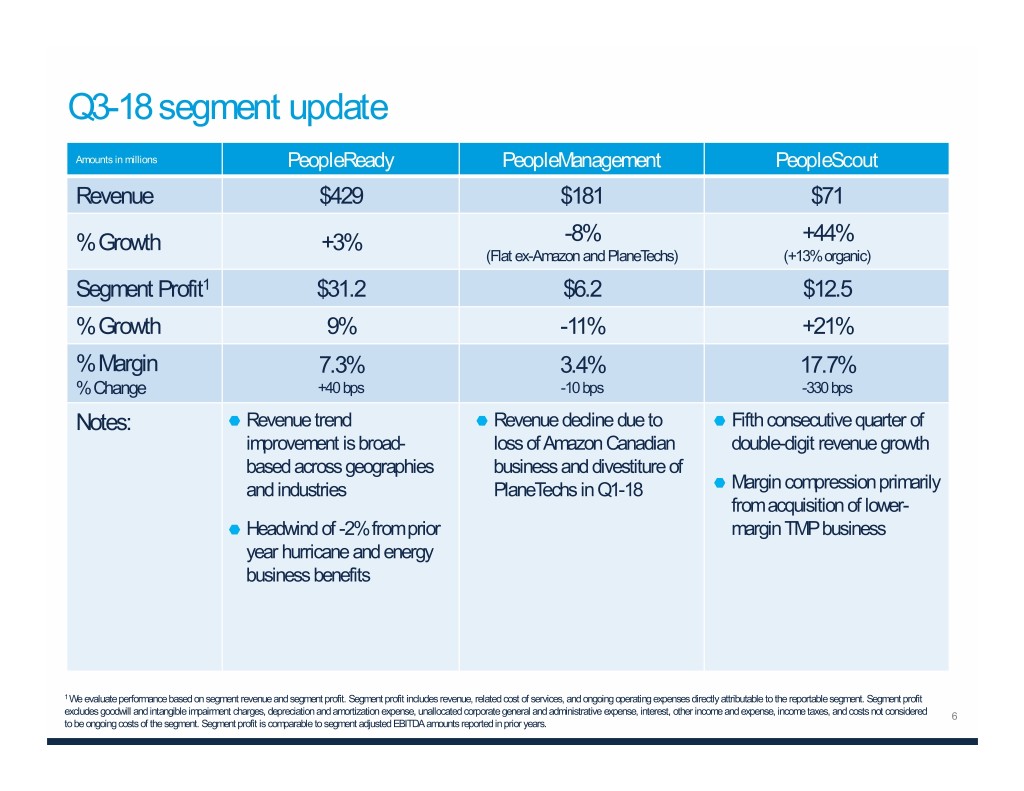

Q3-18 segment update Amounts in millions PeopleReady PeopleManagement PeopleScout Revenue $429 $181 $71 % Growth +3% -8% +44% (Flat ex-Amazon and PlaneTechs) (+13% organic) Segment Profit1 $31.2 $6.2 $12.5 % Growth 9% -11% +21% % Margin 7.3% 3.4% 17.7% % Change +40 bps -10 bps -330 bps Notes: Revenue trend Revenue decline due to Fifth consecutive quarter of improvement is broad- loss of Amazon Canadian double-digit revenue growth based across geographies business and divestiture of and industries PlaneTechs in Q1-18 Margin compression primarily from acquisition of lower- Headwind of -2% from prior margin TMP business year hurricane and energy business benefits 1 We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit excludes goodwill and intangible impairment charges, depreciation and amortization expense, unallocated corporate general and administrative expense, interest, other income and expense, income taxes, and costs not considered 6 to be ongoing costs of the segment. Segment profitQ2-18 is comparab leStrategic to segment adjusted Messages EBITDA amounts reported in prior years. June 2018

Segment strategy highlights JobStackTM creating Attractive on-premise Global RPO market favorable differentiation solution experiencing strong growth with customers and Perfect fit for larger associates clients with longer- Leverage TMP duration / strategic need acquisition to compete 30% of all jobs now filled for contingent workers for multi-continent by JobStack engagements Strength in the 15%+ potential operating e-commerce vertical Industry leading margin on incremental proprietary technology – Focused on new client revenue rolling out AffinixTM, a wins and margin next-generation HR tool expansion Attractive-margin business with compelling value proposition Boost shareholder returns through share repurchase

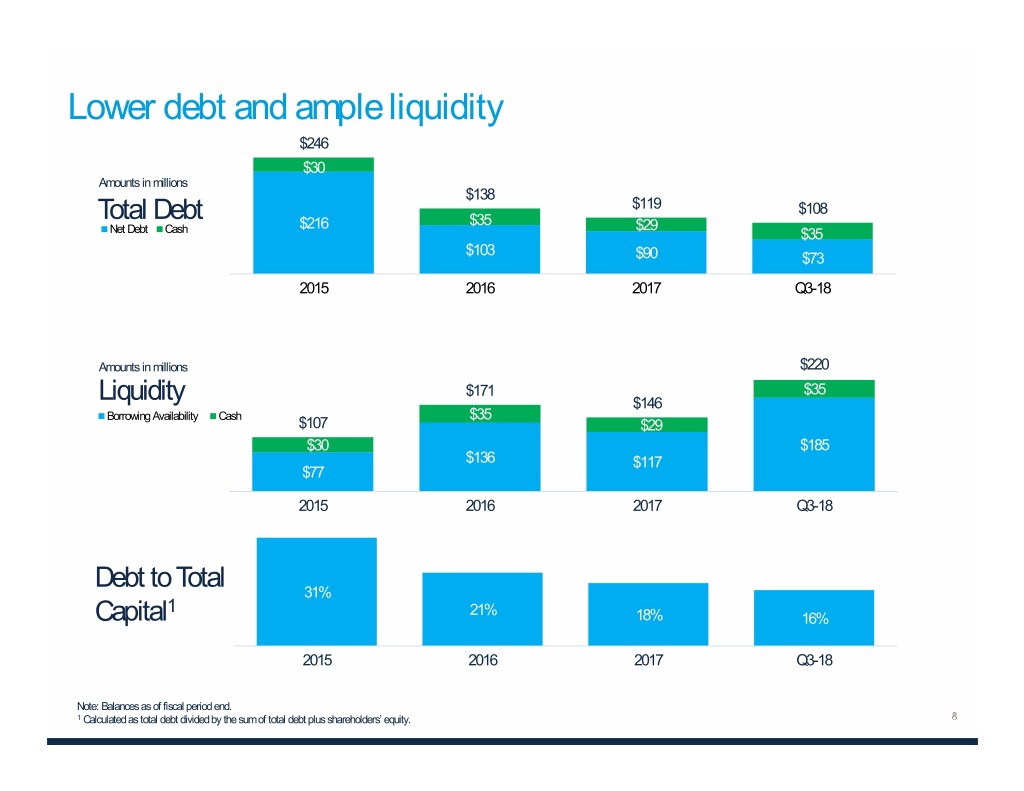

Lower debt and ample liquidity $246 $30 Amounts in millions $138 Total Debt $119 $108 $216 $35 $29 Net Debt Cash $35 $103 $90 $73 2015 2016 2017 Q3-18 Amounts in millions $220 $171 $35 Liquidity $146 Borrowing Availability Cash $35 $107 $29 $30 $185 $136 $117 $77 2015 2016 2017 Q3-18 Debt to Total 31% 1 21% Capital 18% 16% 2015 2016 2017 Q3-18 Note: Balances as of fiscal period end. 1 Calculated as total debt divided by the sum of total debt plus shareholders’ equity.

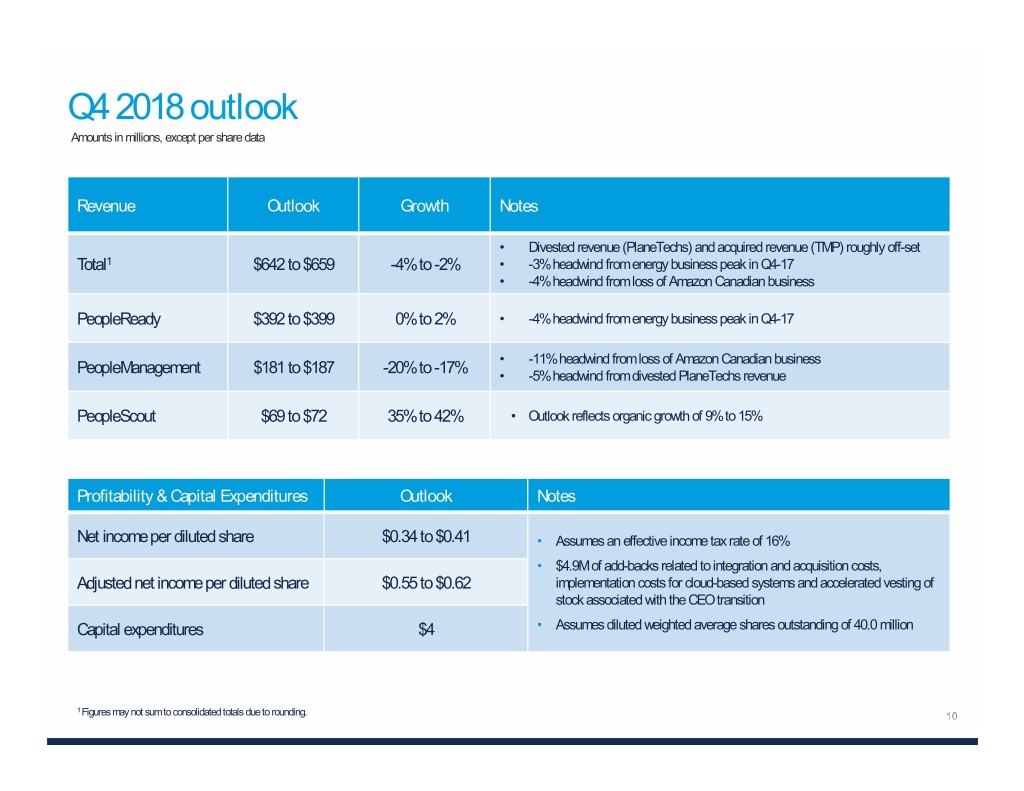

Q4 2018 outlook Amounts in millions, except per share data Revenue Outlook Growth Notes • Divested revenue (PlaneTechs) and acquired revenue (TMP) roughly off-set Total 1 $642 to $659 -4% to -2% • -3% headwind from energy business peak in Q4-17 • -4% headwind from loss of Amazon Canadian business PeopleReady $392 to $399 0% to 2% • -4% headwind from energy business peak in Q4-17 • -11% headwind from loss of Amazon Canadian business PeopleManagement $181 to $187 -20% to -17% • -5% headwind from divested PlaneTechs revenue PeopleScout $69 to $72 35% to 42% • Outlook reflects organic growth of 9% to 15% Profitability & Capital Expenditures Outlook Notes Net income per diluted share $0.34 to $0.41 • Assumes an effective income tax rate of 16% • $4.9M of add-backs related to integration and acquisition costs, Adjusted net income per diluted share $0.55 to $0.62 implementation costs for cloud-based systems and accelerated vesting of stock associated with the CEO transition Capital expenditures $4 • Assumes diluted weighted average shares outstanding of 40.0 million 1 Figures may not sum to consolidated totals due to rounding.

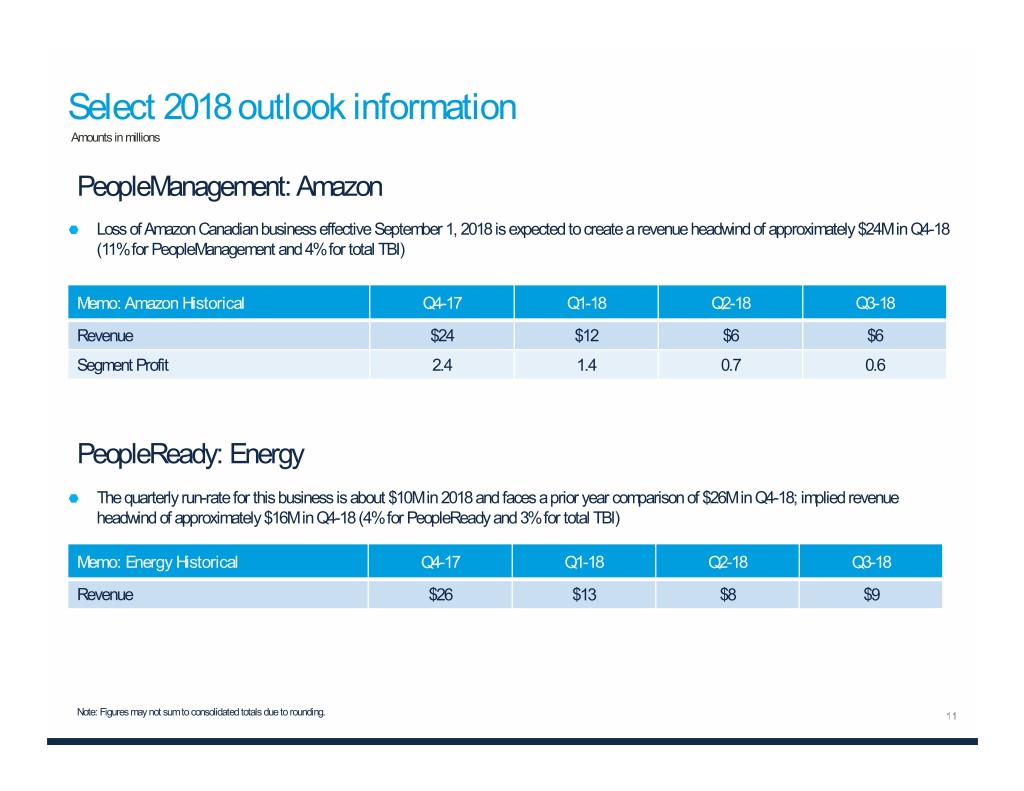

Select 2018 outlook information Amounts in millions PeopleManagement: Amazon Loss of Amazon Canadian business effective September 1, 2018 is expected to create a revenue headwind of approximately $24M in Q4-18 (11% for PeopleManagement and 4% for total TBI) Memo: Amazon Historical Q4-17 Q1-18 Q2-18 Q3-18 Revenue $24 $12 $6 $6 Segment Profit 2.4 1.4 0.7 0.6 PeopleReady: Energy The quarterly run-rate for this business is about $10M in 2018 and faces a prior year comparison of $26M in Q4-18; implied revenue headwind of approximately $16M in Q4-18 (4% for PeopleReady and 3% for total TBI) Memo: Energy Historical Q4-17 Q1-18 Q2-18 Q3-18 Revenue $26 $13 $8 $9 Note: Figures may not sum to consolidated totals due to rounding.

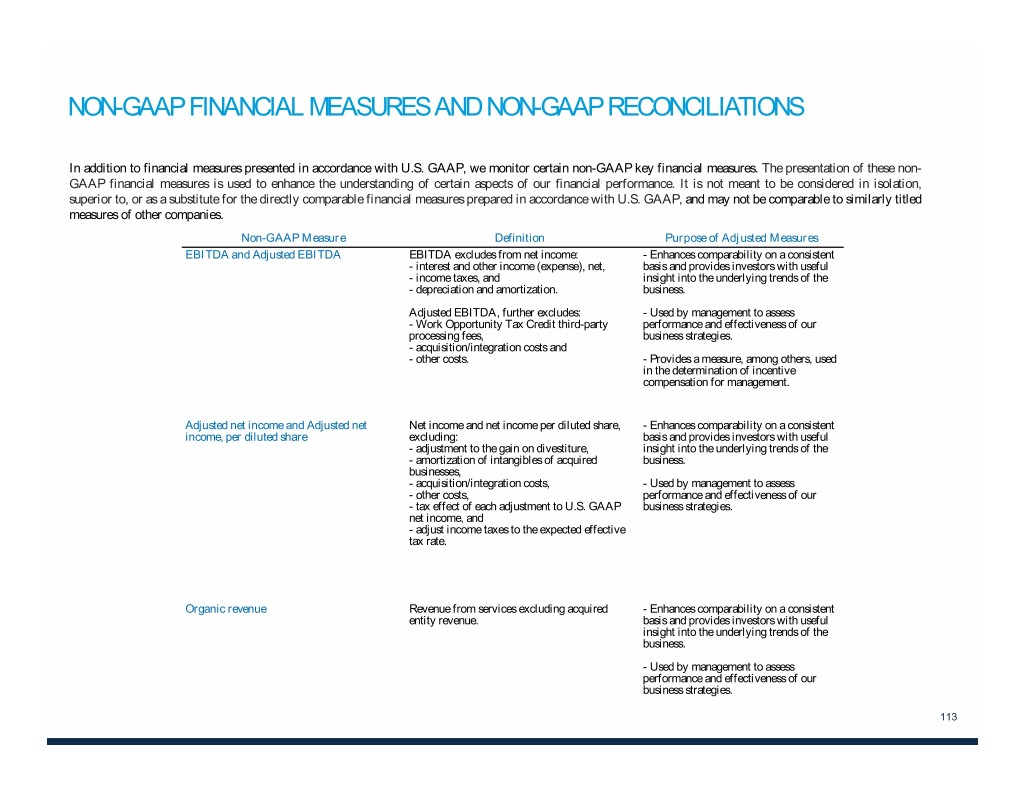

NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non- GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP Measure Definition Purpose of Adjusted Measures EBITDA and Adjusted EBITDA EBITDA excludes from net income: - Enhances comparability on a consistent - interest and other income (expense), net, basis and provides investors with useful - income taxes, and insight into the underlying trends of the - depreciation and amortization. business. Adjusted EBITDA, further excludes: - Used by management to assess - Work Opportunity Tax Credit third-party performance and effectiveness of our processing fees, business strategies. - acquisition/integration costs and - other costs. - Provides a measure, among others, used in the determination of incentive compensation for management. Adjusted net income and Adjusted net Net income and net income per diluted share, - Enhances comparability on a consistent income, per diluted share excluding: basis and provides investors with useful - adjustment to the gain on divestiture, insight into the underlying trends of the - amortization of intangibles of acquired business. businesses, - acquisition/integration costs, - Used by management to assess - other costs, performance and effectiveness of our - tax effect of each adjustment to U.S. GAAP business strategies. net income, and - adjust income taxes to the expected effective tax rate. Organic revenue Revenue from services excluding acquired - Enhances comparability on a consistent entity revenue. basis and provides investors with useful insight into the underlying trends of the business. - Used by management to assess performance and effectiveness of our business strategies. 113

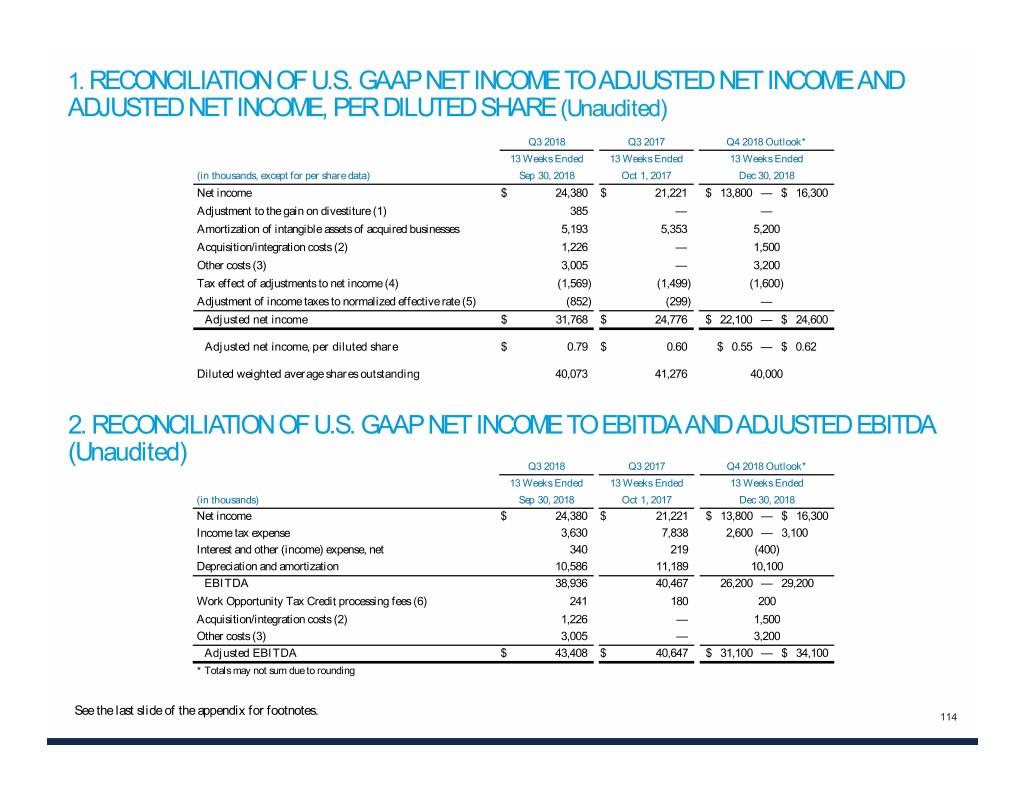

1. RECONCILIATION OF U.S. GAAP NET INCOME TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME, PER DILUTED SHARE (Unaudited) Q3 2018 Q3 2017 Q4 2018 Outlook* 13 Weeks Ended 13 Weeks Ended 13 Weeks Ended (in thousands, except for per share data) Sep 30, 2018 Oct 1, 2017 Dec 30, 2018 Net income $ 24,380 $ 21,221 $ 13,800 — $ 16,300 Adjustment to the gain on divestiture (1) 385 — — Amortization of intangible assets of acquired businesses 5,193 5,353 5,200 Acquisition/integration costs (2) 1,226 — 1,500 Other costs (3) 3,005 — 3,200 Tax effect of adjustments to net income (4) (1,569) (1,499) (1,600) Adjustment of income taxes to normalized effective rate (5) (852) (299) — Adjusted net income $ 31,768 $ 24,776 $ 22,100 — $ 24,600 Adjusted net income, per diluted share $ 0.79 $ 0.60 $ 0.55 — $ 0.62 Diluted weighted average shares outstanding 40,073 41,276 40,000 2. RECONCILIATION OF U.S. GAAP NET INCOME TO EBITDA AND ADJUSTED EBITDA (Unaudited) Q3 2018 Q3 2017 Q4 2018 Outlook* 13 Weeks Ended 13 Weeks Ended 13 Weeks Ended (in thousands) Sep 30, 2018 Oct 1, 2017 Dec 30, 2018 Net income $ 24,380 $ 21,221 $ 13,800 — $ 16,300 Income tax expense 3,630 7,838 2,600 — 3,100 Interest and other (income) expense, net 340 219 (400) Depreciation and amortization 10,586 11,189 10,100 EBITDA 38,936 40,467 26,200 — 29,200 Work Opportunity Tax Credit processing fees (6) 241 180 200 Acquisition/integration costs (2) 1,226 — 1,500 Other costs (3) 3,005 — 3,200 Adjusted EBITDA $ 43,408 $ 40,647 $ 31,100 — $ 34,100 * Totals may not sum due to rounding See the last slide of the appendix for footnotes. 114

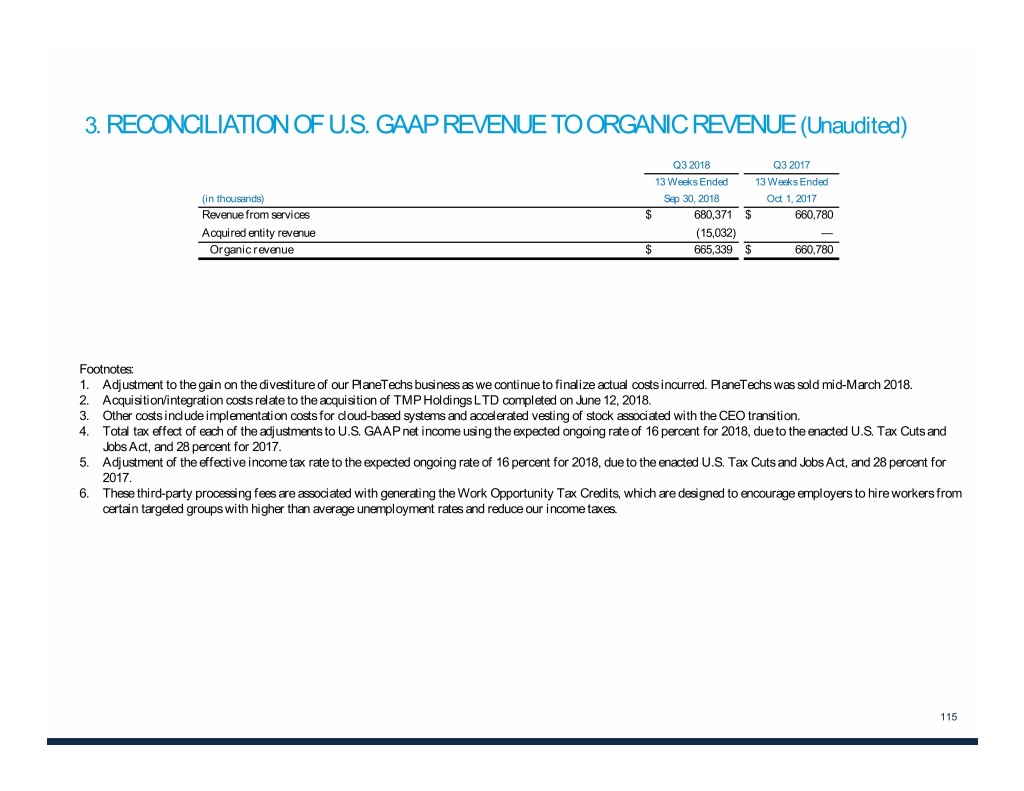

3. RECONCILIATION OF U.S. GAAP REVENUE TO ORGANIC REVENUE (Unaudited) Q3 2018 Q3 2017 13 Weeks Ended 13 Weeks Ended (in thousands) Sep 30, 2018 Oct 1, 2017 Revenue from services $ 680,371 $ 660,780 Acquired entity revenue (15,032) — Organic revenue $ 665,339 $ 660,780 Footnotes: 1. Adjustment to the gain on the divestiture of our PlaneTechs business as we continue to finalize actual costs incurred. PlaneTechs was sold mid-March 2018. 2. Acquisition/integration costs relate to the acquisition of TMP Holdings LTD completed on June 12, 2018. 3. Other costs include implementation costs for cloud-based systems and accelerated vesting of stock associated with the CEO transition. 4. Total tax effect of each of the adjustments to U.S. GAAP net income using the expected ongoing rate of 16 percent for 2018, due to the enacted U.S. Tax Cuts and Jobs Act, and 28 percent for 2017. 5. Adjustment of the effective income tax rate to the expected ongoing rate of 16 percent for 2018, due to the enacted U.S. Tax Cuts and Jobs Act, and 28 percent for 2017. 6. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from certain targeted groups with higher than average unemployment rates and reduce our income taxes. 115