June 2018 www.TrueBlue.com

Forward-Looking Statements

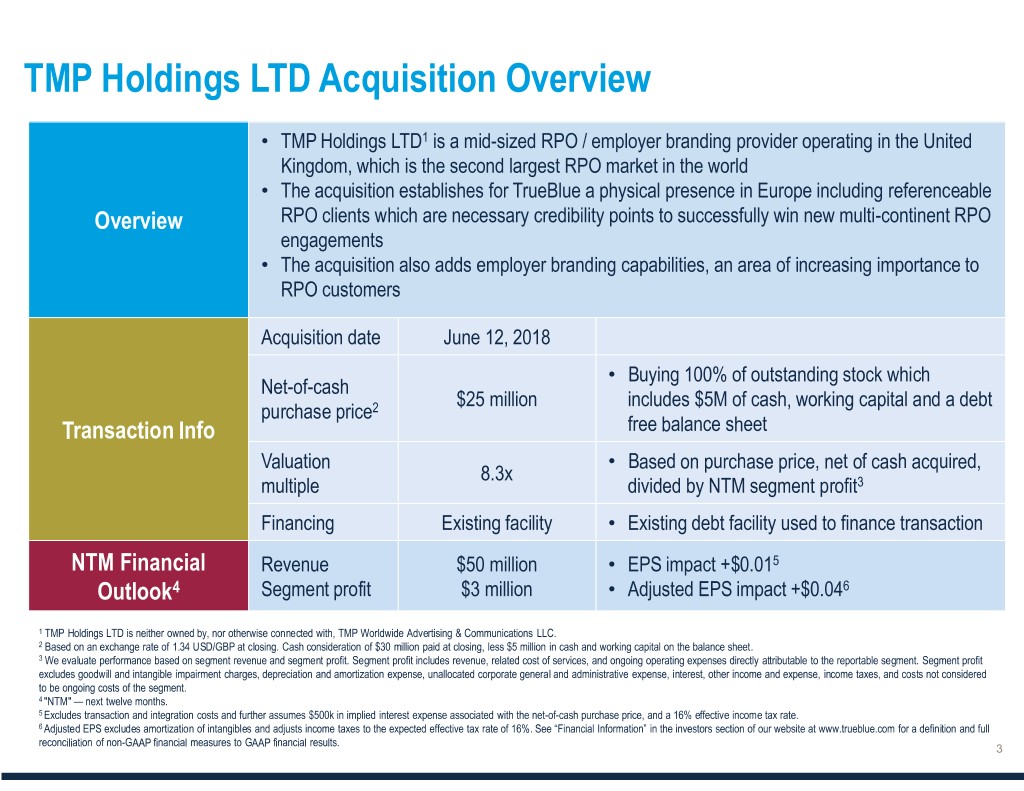

TMP Holdings LTD Acquisition Overview • TMP Holdings LTD1 is a mid-sized RPO / employer branding provider operating in the United Kingdom, which is the second largest RPO market in the world • The acquisition establishes for TrueBlue a physical presence in Europe including referenceable Overview RPO clients which are necessary credibility points to successfully win new multi-continent RPO engagements • The acquisition also adds employer branding capabilities, an area of increasing importance to RPO customers Acquisition date June 12, 2018 • Buying 100% of outstanding stock which Net-of-cash $25 million includes $5M of cash, working capital and a debt purchase price2 Transaction Info free balance sheet Valuation • Based on purchase price, net of cash acquired, 8.3x multiple divided by NTM segment profit3 Financing Existing facility • Existing debt facility used to finance transaction NTM Financial Revenue $50 million • EPS impact +$0.015 Outlook4 Segment profit $3 million • Adjusted EPS impact +$0.046 1 TMP Holdings LTD is neither owned by, nor otherwise connected with, TMP Worldwide Advertising & Communications LLC. 2 Based on an exchange rate of 1.34 USD/GBP at closing. Cash consideration of $30 million paid at closing, less $5 million in cash and working capital on the balance sheet. 3 We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit excludes goodwill and intangible impairment charges, depreciation and amortization expense, unallocated corporate general and administrative expense, interest, other income and expense, income taxes, and costs not considered to be ongoing costs of the segment. 4 "NTM" — next twelve months. 5 Excludes transaction and integration costs and further assumes $500k in implied interest expense associated with the net-of-cash purchase price, and a 16% effective income tax rate. 6 Adjusted EPS excludes amortization of intangibles and adjusts income taxes to the expected effective tax rate of 16%. See “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

Strategic Rationale + TMP Holdings LTD � Bolsters PeopleScout's position as #1 global provider of enterprise RPO1 � RPO market is expected to grow 12% global over the next five years2 � PeopleScout’s segment profit margin was >20% in 2017 � 30% of all RPO engagements are now multi-country2 � UK presence improves our ability to compete on global engagements � Adds a value-added solution to our existing RPO services � Employer branding is now part of >50% of all RPO engagements � UK RPO market is the 2nd largest in the world (after the US) � TMP has strong brand reputation UK-based clients 1 Source: Everest Group. Overall RPO rankings by annual number of hires (2017). 2 Source: NelsonHall. Estimated market CAGR from 2017-2022; % multi-country RPO contracts for 2016/2017.

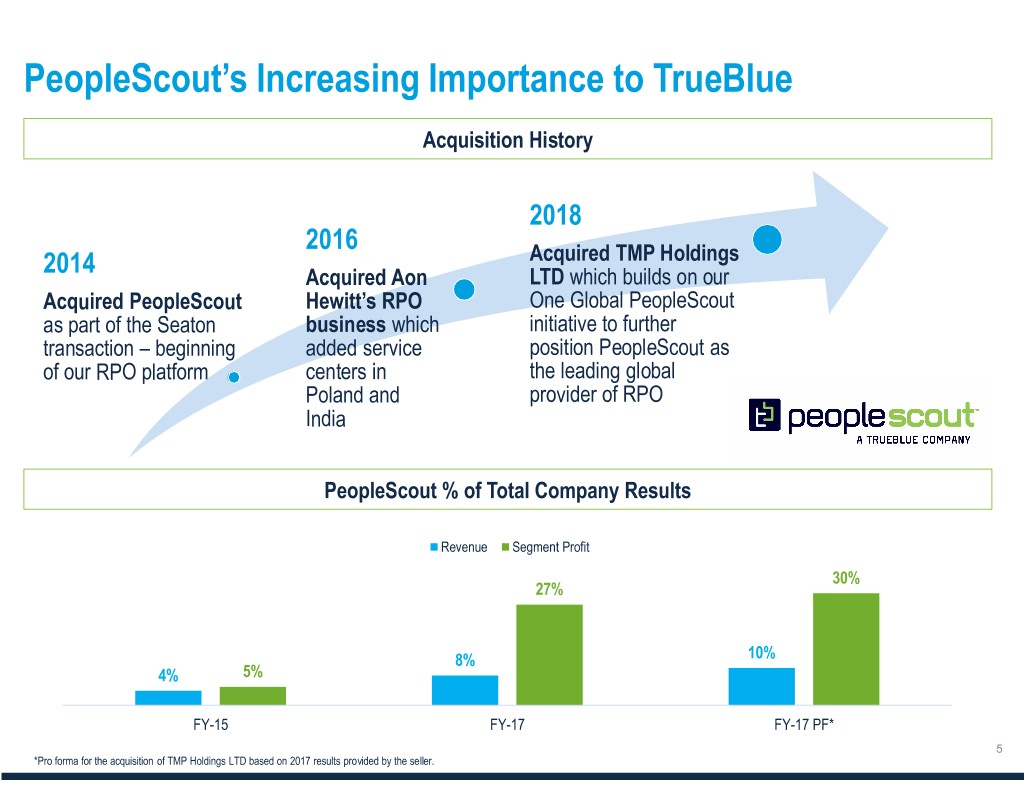

PeopleScout’s Increasing Importance to TrueBlue Acquisition History 2018 2016 Acquired TMP Holdings 2014 Acquired Aon LTD which builds on our Acquired PeopleScout Hewitt’s RPO One Global PeopleScout as part of the Seaton business which initiative to further transaction – beginning added service position PeopleScout as of our RPO platform centers in the leading global Poland and provider of RPO India PeopleScout % of Total Company Results Revenue Segment Profit 30% 27% 8% 10% 4% 5% FY-15 FY-17 FY-17 PF* *Pro forma for the acquisition of TMP Holdings LTD based on 2017 results provided by the seller.