Forward-Looking Statements

February 2018

Investment Highlights

February 2018 3

Track record of favorable growth and investor returns

Strong free cash flow and balance sheet

TrueBlue at a Glance

February 2018 4

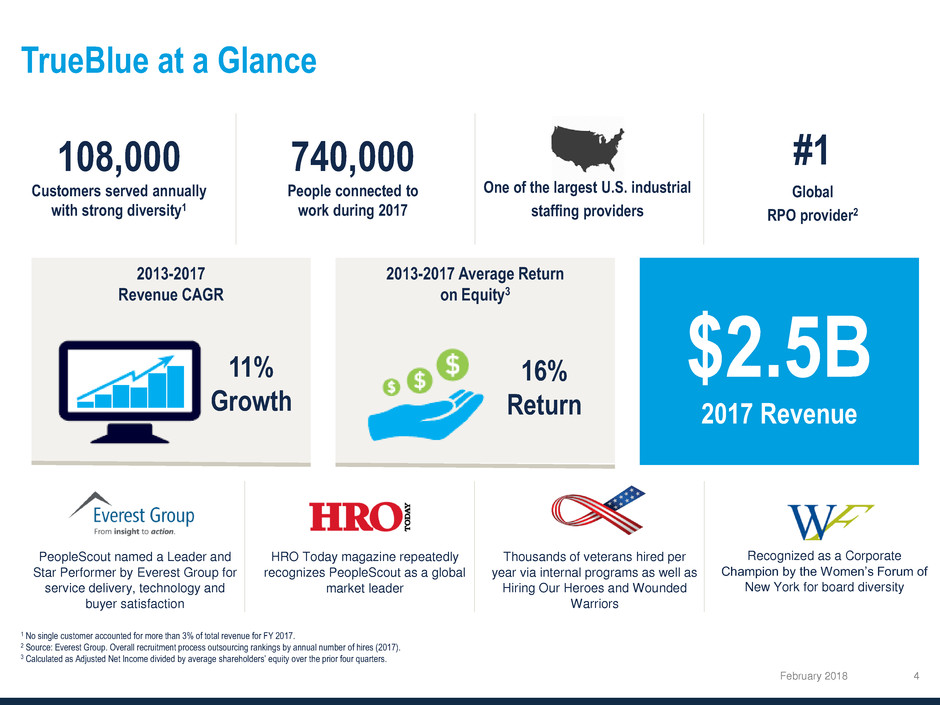

108,000

Customers served annually

with strong diversity1

740,000

People connected to

work during 2017

One of the largest U.S. industrial

staffing providers

#1

Global

RPO provider2

2013-2017 Average Return

on Equity3

2013-2017

Revenue CAGR

$2.5B

2017 Revenue

11%

Growth

16%

Return

PeopleScout named a Leader and

Star Performer by Everest Group for

service delivery, technology and

buyer satisfaction

HRO Today magazine repeatedly

recognizes PeopleScout as a global

market leader

Thousands of veterans hired per

year via internal programs as well as

Hiring Our Heroes and Wounded

Warriors

Recognized as a Corporate

Champion by the Women’s Forum of

New York for board diversity

1 No single customer accounted for more than 3% of total revenue for FY 2017.

2 Source: Everest Group. Overall recruitment process outsourcing rankings by annual number of hires (2017).

3 Calculated as Adjusted Net Income divided by average shareholders’ equity over the prior four quarters.

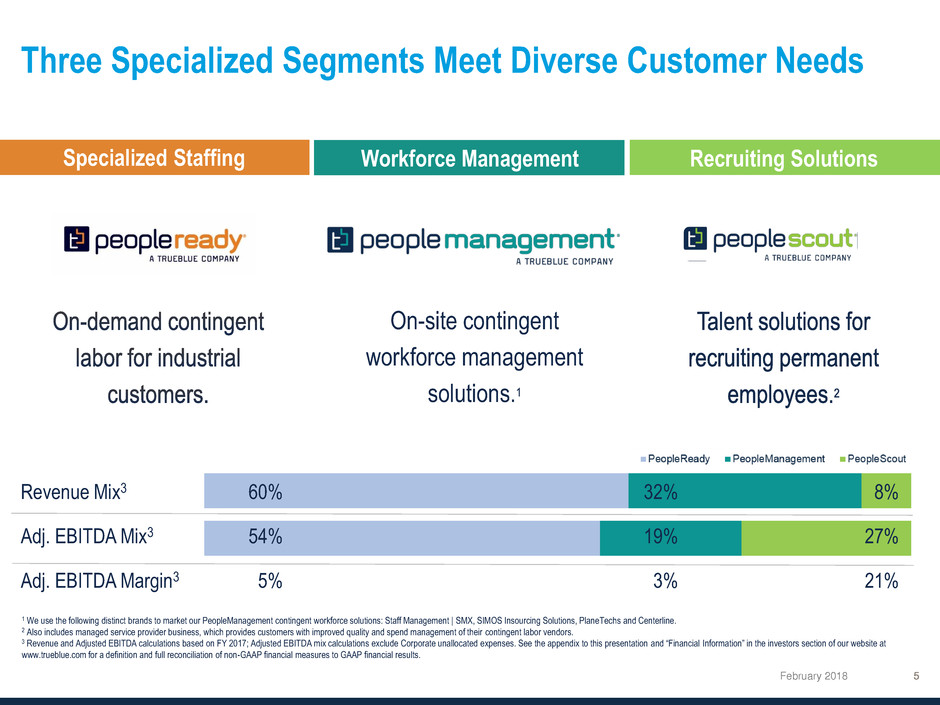

Three Specialized Segments Meet Diverse Customer Needs

February 2018

On-site contingent

workforce management

solutions.1

1 We use the following distinct brands to market our PeopleManagement contingent workforce solutions: Staff Management | SMX, SIMOS Insourcing Solutions, PlaneTechs and Centerline.

2 Also includes managed service provider business, which provides customers with improved quality and spend management of their contingent labor vendors.

3 Revenue and Adjusted EBITDA calculations based on FY 2017; Adjusted EBITDA mix calculations exclude Corporate unallocated expenses. See the appendix to this presentation and “Financial Information” in the investors section of our website at

www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

Revenue Mix3 60% 32% 8%

Adj. EBITDA Mix3 54% 19% 27%

Adj. EBITDA Margin3 5% 3% 21%

Specialized Staffing Workforce Management Recruiting Solutions

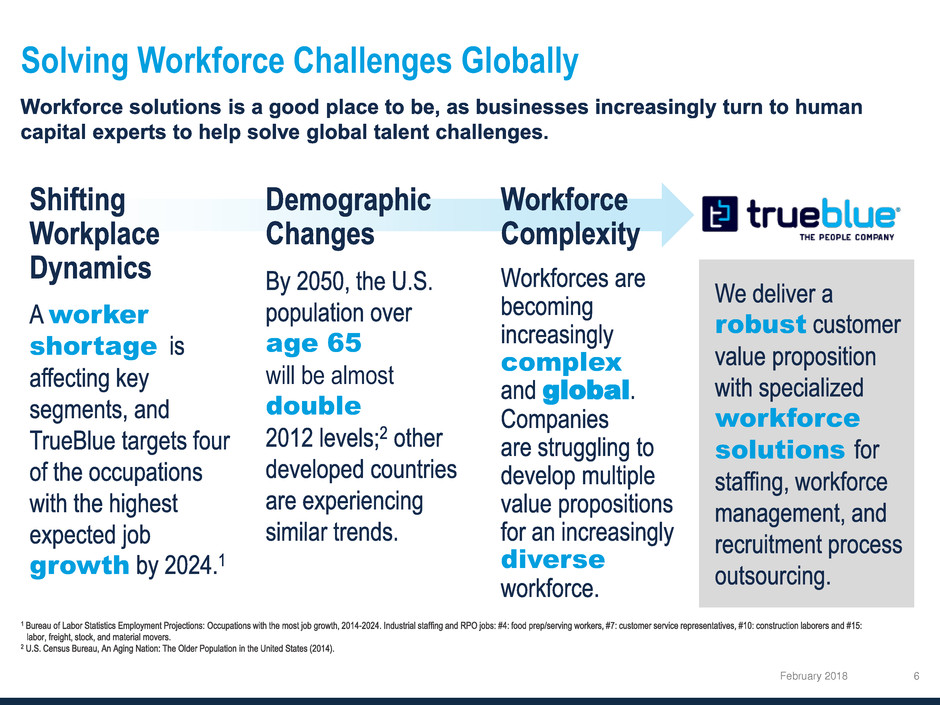

Solving Workforce Challenges Globally

February 2018 6

complex

global

diverse

age 65

will be almost

double

worker

shortage

growth

robust

workforce

solutions

Strong Position in Attractive Vertical Markets

February 2018 7

Construction Manufacturing Transport & Wholesale Retail & Services

In

d

u

s

tr

y

D

y

n

a

m

ic

s

FY-17 Business Mix: 23% FY-17 Business Mix: 26% FY-17 Business Mix: 22% FY-17 Business Mix: 20%

Housing Starts Have Not Kept Pace U.S. Manufacturing Renaissance Wholesale Trade At New High E-commerce Growing % of Retail Sales

Source: U.S. Census Bureau Source: U.S. Board of Governors of the Federal Reserve System (FRB) Source: Bureau of Labor Statistics Source: U.S. Census Bureau

60

65

70

75

80

85

90

95

100

105

110

19

90

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

Industrial Production

Index

3.0

3.5

4.0

4.5

5.0

5.5

19

90

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

Transportation and Warehousing Employment

Millions

-

500

1,000

1,500

2,000

2,500

150

170

190

210

230

250

270

290

310

330

350

19

70

19

75

19

80

19

85

19

90

19

95

20

00

20

05

20

10

20

15

US Population Housing Permits

Millions Thousands

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

E-commerce % of Retail Sales

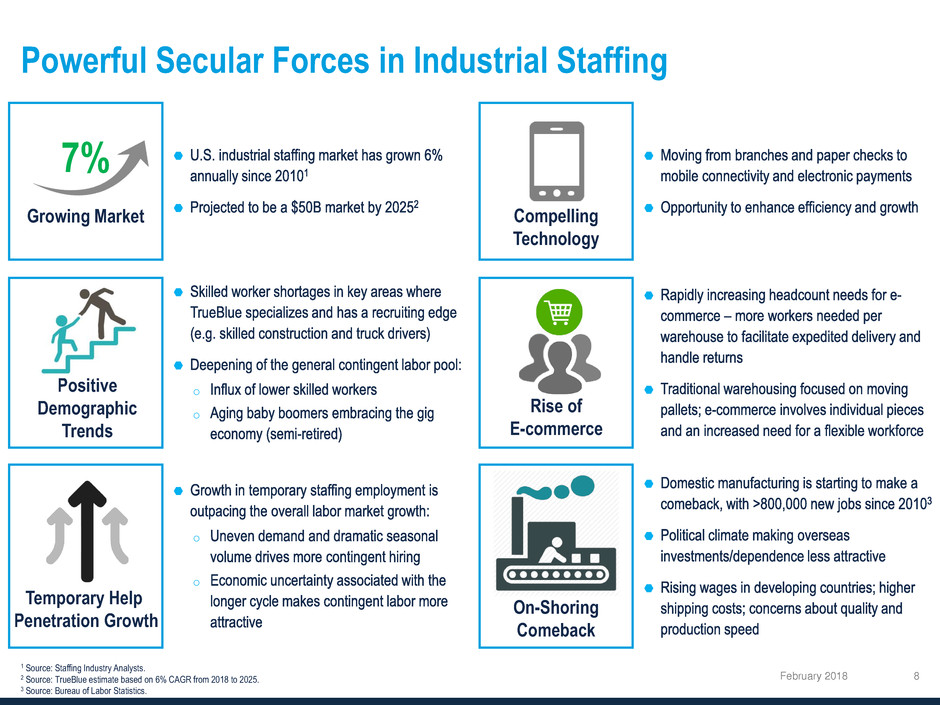

Powerful Secular Forces in Industrial Staffing

February 2018 8

7%

Growing Market

o

o

o

o

Positive

Demographic

Trends

Temporary Help

Penetration Growth

Compelling

Technology

Rise of

E-commerce

On-Shoring

Comeback

1 Source: Staffing Industry Analysts.

2 Source: TrueBlue estimate based on 6% CAGR from 2018 to 2025.

3 Source: Bureau of Labor Statistics.

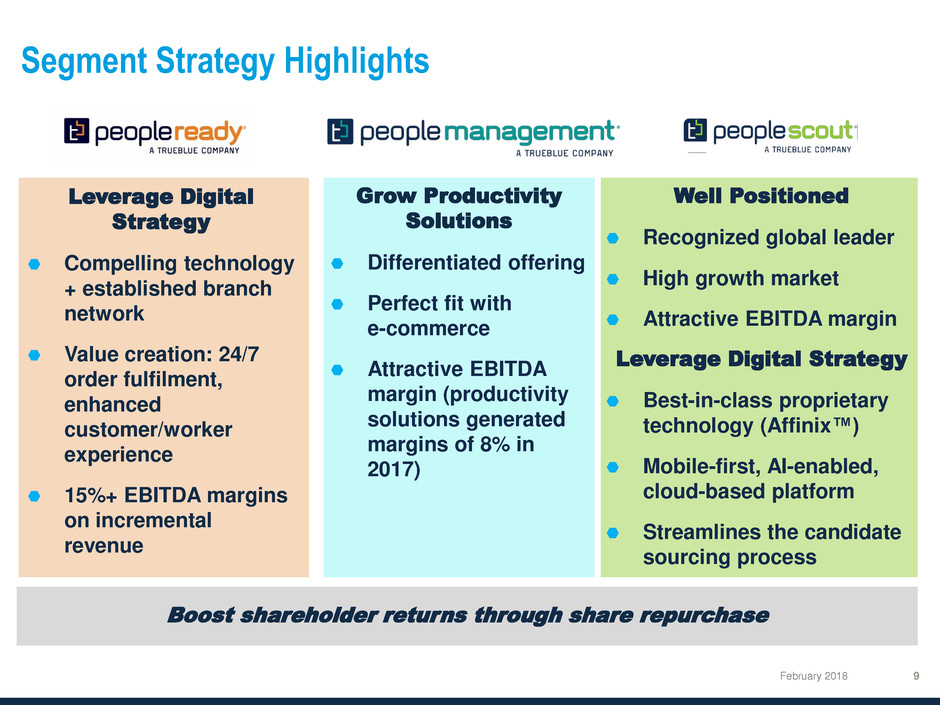

Segment Strategy Highlights

February 2018

Boost shareholder returns through share repurchase

Grow Productivity

Solutions

Differentiated offering

Perfect fit with

e-commerce

Attractive EBITDA

margin (productivity

solutions generated

margins of 8% in

2017)

Well Positioned

Recognized global leader

High growth market

Attractive EBITDA margin

Leverage Digital Strategy

Best-in-class proprietary

technology (Affinix™)

Mobile-first, AI-enabled,

cloud-based platform

Streamlines the candidate

sourcing process

Leverage Digital

Strategy

Compelling technology

+ established branch

network

Value creation: 24/7

order fulfilment,

enhanced

customer/worker

experience

15%+ EBITDA margins

on incremental

revenue

JobStackTM Mobile App – A Competitive Differentiator

February 2018

JobStackTM is a next generation mobile app that algorithmically matches workers with

available jobs.

24/7 order creation

Real-time order fill rates

Associate ratings

Worksite ratings

Work week control

Driving Value for TrueBlue Compelling Technology CUSTOMER

ASSOCIATE

Round-the-clock revenue generation

Improved associate experience

Lift associate quality

Enhanced communication & safety

Tap into larger and more diverse talent pool

Productivity Solutions and eCommerce

February 2018

eCommerce

Vertical Leadership

Labor intensive pick-and-pack

movement v. traditional bulk pallets

Increasing demand for

PeopleManagement's ability to

deliver a flexible, fully sourced and

managed workforce

Fastest growing segment is

smaller e-retailers (<$100 million

annual sales), which is a core

strength for PeopleManagment

Driving

Productivity Solutions

High margin business with

strong customer value proposition

and high customer retention

Value-add solutions include cost

per-unit pricing and process re-

engineering to help customers

reduce labor spend by 15% or more

SIMOS is PeopleManagement's

highest margin business and a

recognized leader in the productivity

solutions space

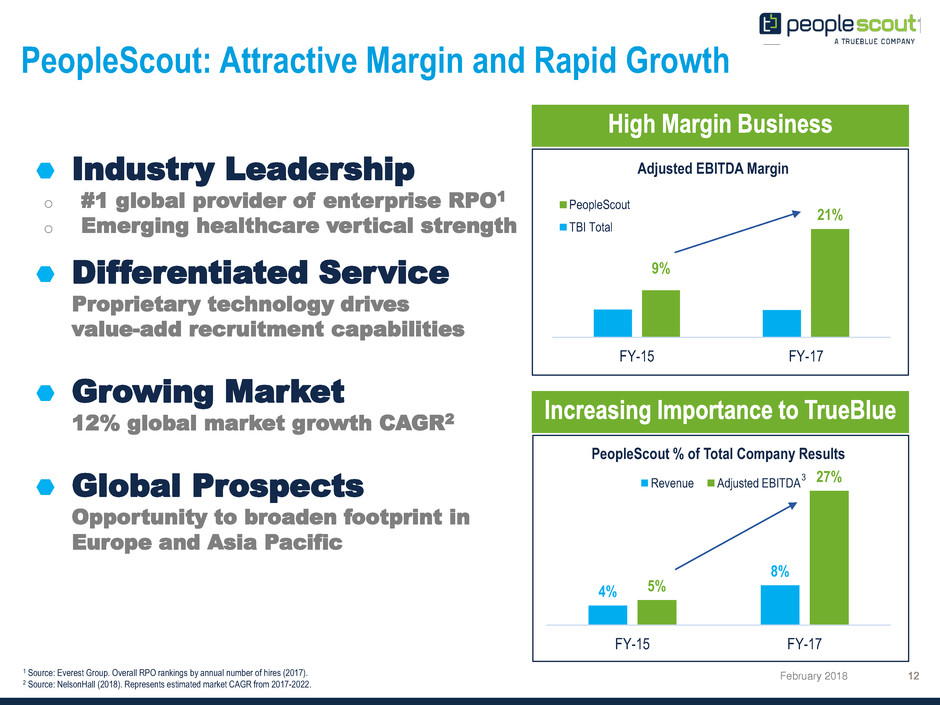

PeopleScout: Attractive Margin and Rapid Growth

February 2018

21%

9%

FY-17FY-15

Adjusted EBITDA Margin

PeopleScout

TBI Total

Industry Leadership

o #1 global provider of enterprise RPO1

o Emerging healthcare vertical strength

Differentiated Service

Proprietary technology drives

value-add recruitment capabilities

Growing Market

12% global market growth CAGR2

Global Prospects

Opportunity to broaden footprint in

Europe and Asia Pacific

1 Source: Everest Group. Overall RPO rankings by annual number of hires (2017).

2 Source: NelsonHall (2018). Represents estimated market CAGR from 2017-2022.

4%

8%

5%

27%

FY-15 FY-17

PeopleScout % of Total Company Results

Revenue Adjusted EBITDA

3

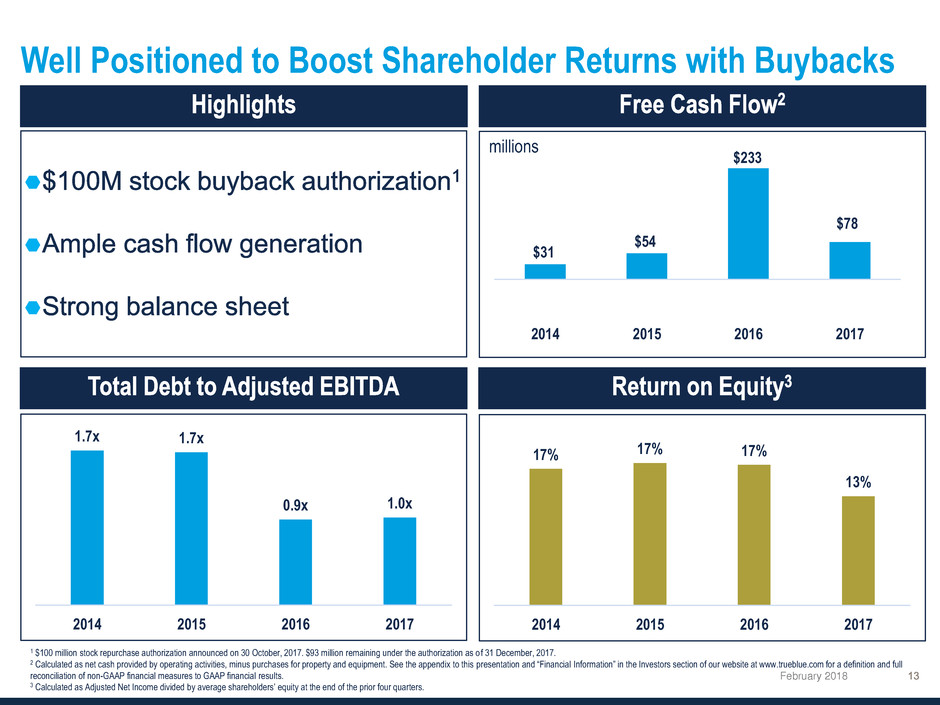

Well Positioned to Boost Shareholder Returns with Buybacks

February 2018

1 $100 million stock repurchase authorization announced on 30 October, 2017. $93 million remaining under the authorization as of 31 December, 2017.

2 Calculated as net cash provided by operating activities, minus purchases for property and equipment. See the appendix to this presentation and “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full

reconciliation of non-GAAP financial measures to GAAP financial results.

3 Calculated as Adjusted Net Income divided by average shareholders’ equity at the end of the prior four quarters.

$31

$54

$233

$78

2014 2015 2016 2017

1.7x 1.7x

0.9x 1.0x

2014 2015 2016 2017

17% 17% 17%

13%

2014 2015 2016 2017

millions

February 2018 15

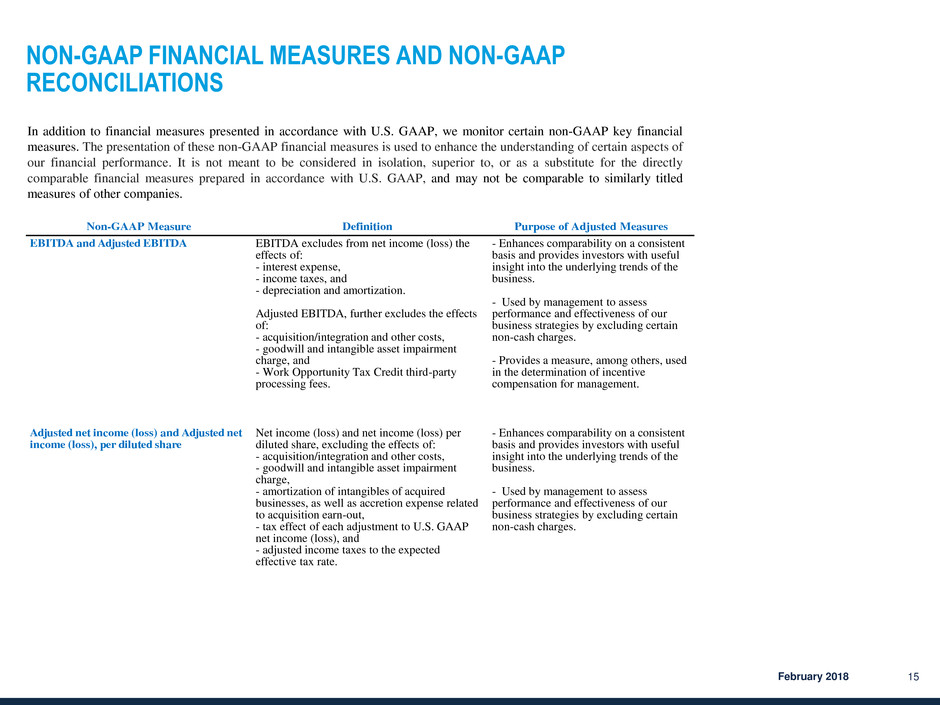

NON-GAAP FINANCIAL MEASURES AND NON-GAAP

RECONCILIATIONS

Non-GAAP Measure Definition Purpose of Adjusted Measures

EBITDA and Adjusted EBITDA EBITDA excludes from net income (loss) the

effects of:

- interest expense,

- income taxes, and

- depreciation and amortization.

Adjusted EBITDA, further excludes the effects

of:

- acquisition/integration and other costs,

- goodwill and intangible asset impairment

charge, and

- Work Opportunity Tax Credit third-party

processing fees.

- Enhances comparability on a consistent

basis and provides investors with useful

insight into the underlying trends of the

business.

- Used by management to assess

performance and effectiveness of our

business strategies by excluding certain

non-cash charges.

- Provides a measure, among others, used

in the determination of incentive

compensation for management.

Adjusted net income (loss) and Adjusted net

income (loss), per diluted share

Net income (loss) and net income (loss) per

diluted share, excluding the effects of:

- acquisition/integration and other costs,

- goodwill and intangible asset impairment

charge,

- amortization of intangibles of acquired

businesses, as well as accretion expense related

to acquisition earn-out,

- tax effect of each adjustment to U.S. GAAP

net income (loss), and

- adjusted income taxes to the expected

effective tax rate.

- Enhances comparability on a consistent

basis and provides investors with useful

insight into the underlying trends of the

business.

- Used by management to assess

performance and effectiveness of our

business strategies by excluding certain

non-cash charges.

In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial

measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of

our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly

comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled

measures of other companies.

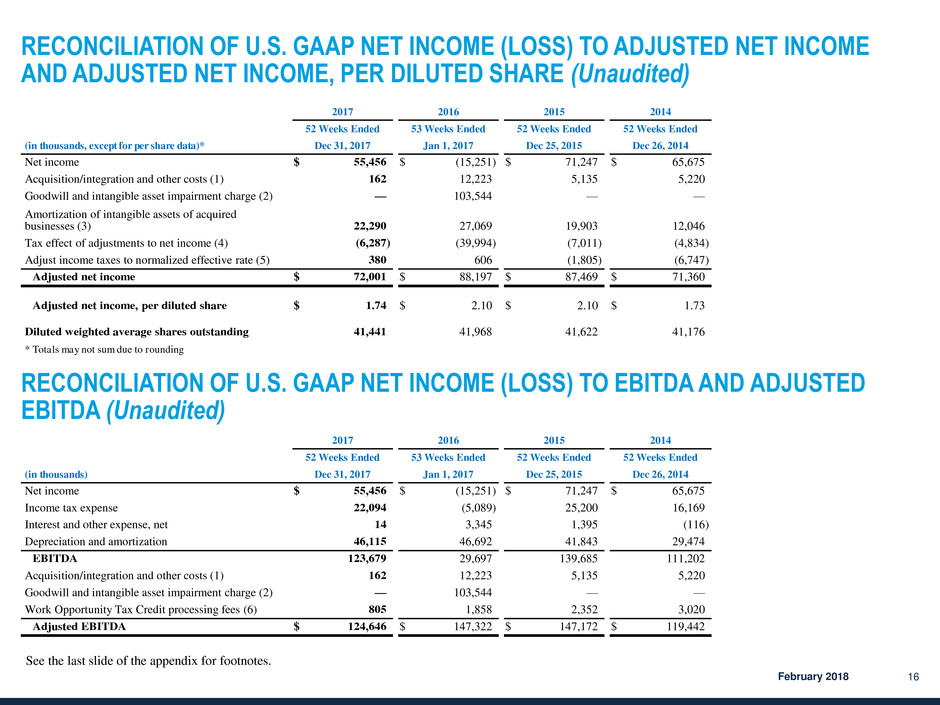

RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO ADJUSTED NET INCOME

AND ADJUSTED NET INCOME, PER DILUTED SHARE (Unaudited)

February 2018 16

2017 2016 2015 2014

52 Weeks Ended 53 Weeks Ended 52 Weeks Ended 52 Weeks Ended

(in thousands, except for per share data)* Dec 31, 2017 Jan 1, 2017 Dec 25, 2015 Dec 26, 2014

Net income $ 55,456 $ (15,251 ) $ 71,247 $ 65,675

Acquisition/integration and other costs (1) 162 12,223 5,135 5,220

Goodwill and intangible asset impairment charge (2) — 103,544 — —

Amortization of intangible assets of acquired

businesses (3) 22,290 27,069 19,903 12,046

Tax effect of adjustments to net income (4) (6,287 ) (39,994 ) (7,011 ) (4,834 )

Adjust income taxes to normalized effective rate (5) 380 606 (1,805 ) (6,747 )

Adjusted net income $ 72,001 $ 88,197 $ 87,469 $ 71,360

Adjusted net income, per diluted share $ 1.74 $ 2.10 $ 2.10 $ 1.73

Diluted weighted average shares outstanding 41,441 41,968 41,622 41,176

* Totals may not sum due to rounding

RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO EBITDA AND ADJUSTED

EBITDA (Unaudited)

2017 2016 2015 2014

52 Weeks Ended 53 Weeks Ended 52 Weeks Ended 52 Weeks Ended

(in thousands) Dec 31, 2017 Jan 1, 2017 Dec 25, 2015 Dec 26, 2014

Net income $ 55,456 $ (15,251 ) $ 71,247 $ 65,675

Income tax expense 22,094 (5,089 ) 25,200 16,169

Interest and other expense, net 14 3,345 1,395 (116 )

Depreciation and amortization 46,115 46,692 41,843 29,474

EBITDA 123,679 29,697 139,685 111,202

Acquisition/integration and other costs (1) 162 12,223 5,135 5,220

Goodwill and intangible asset impairment charge (2) — 103,544 — —

Work Opportunity Tax Credit processing fees (6) 805 1,858 2,352 3,020

Adjusted EBITDA $ 124,646 $ 147,322 $ 147,172 $ 119,442

See the last slide of the appendix for footnotes.

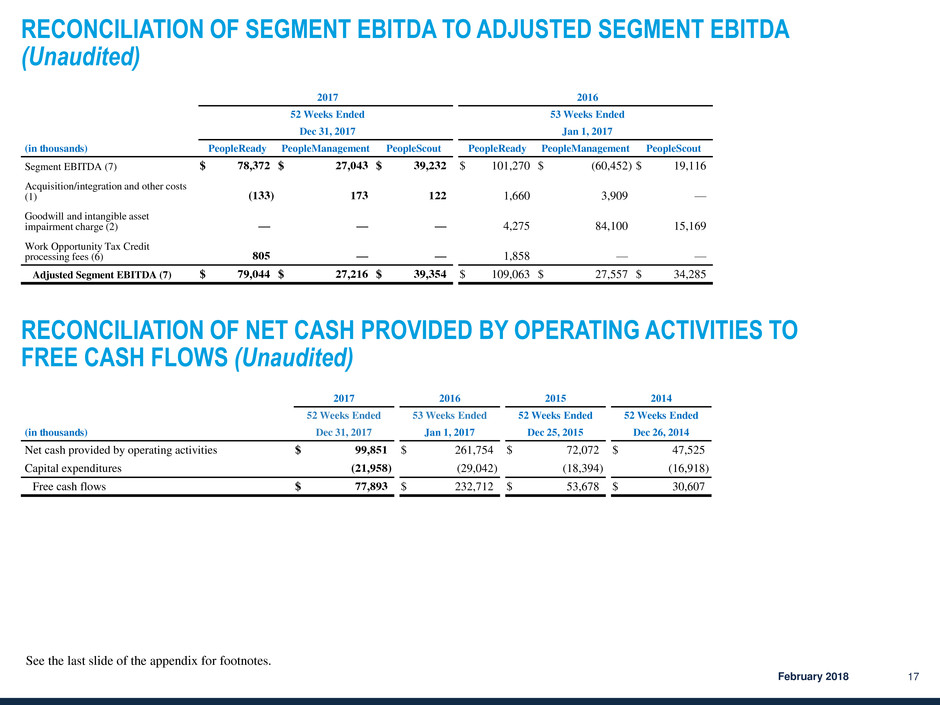

RECONCILIATION OF SEGMENT EBITDA TO ADJUSTED SEGMENT EBITDA

(Unaudited)

February 2018 17

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO

FREE CASH FLOWS (Unaudited)

2017 2016

52 Weeks Ended 53 Weeks Ended

Dec 31, 2017 Jan 1, 2017

(in thousands) PeopleReady PeopleManagement PeopleScout PeopleReady PeopleManagement PeopleScout

Segment EBITDA (7) $ 78,372 $ 27,043 $ 39,232 $ 101,270 $ (60,452 ) $ 19,116

Acquisition/integration and other costs

(1) (133 ) 173 122 1,660 3,909 —

Goodwill and intangible asset

impairment charge (2) — — — 4,275 84,100 15,169

Work Opportunity Tax Credit

processing fees (6) 805 — — 1,858 — —

Adjusted Segment EBITDA (7) $ 79,044 $ 27,216 $ 39,354 $ 109,063 $ 27,557 $ 34,285

2017 2016 2015 2014

52 Weeks Ended 53 Weeks Ended 52 Weeks Ended 52 Weeks Ended

(in thousands) Dec 31, 2017 Jan 1, 2017 Dec 25, 2015 Dec 26, 2014

Net cash provided by operating activities $ 99,851 $ 261,754 $ 72,072 $ 47,525

Capital expenditures (21,958 ) (29,042 ) (18,394 ) (16,918 )

Free cash flows $ 77,893 $ 232,712 $ 53,678 $ 30,607

See the last slide of the appendix for footnotes.

February 2018 18

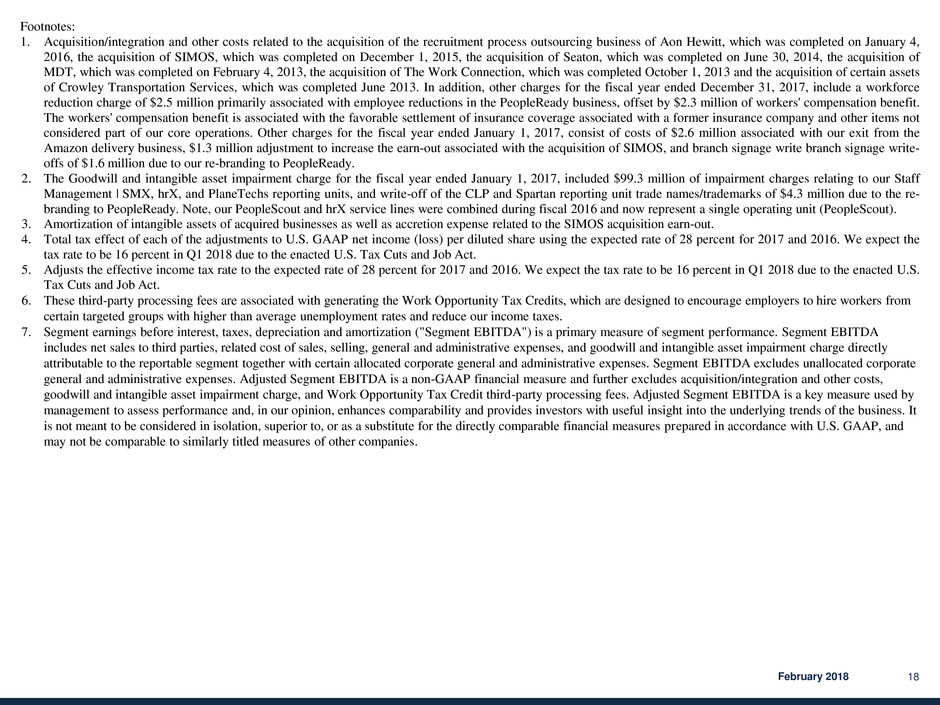

Footnotes:

1. Acquisition/integration and other costs related to the acquisition of the recruitment process outsourcing business of Aon Hewitt, which was completed on January 4,

2016, the acquisition of SIMOS, which was completed on December 1, 2015, the acquisition of Seaton, which was completed on June 30, 2014, the acquisition of

MDT, which was completed on February 4, 2013, the acquisition of The Work Connection, which was completed October 1, 2013 and the acquisition of certain assets

of Crowley Transportation Services, which was completed June 2013. In addition, other charges for the fiscal year ended December 31, 2017, include a workforce

reduction charge of $2.5 million primarily associated with employee reductions in the PeopleReady business, offset by $2.3 million of workers' compensation benefit.

The workers' compensation benefit is associated with the favorable settlement of insurance coverage associated with a former insurance company and other items not

considered part of our core operations. Other charges for the fiscal year ended January 1, 2017, consist of costs of $2.6 million associated with our exit from the

Amazon delivery business, $1.3 million adjustment to increase the earn-out associated with the acquisition of SIMOS, and branch signage write branch signage write-

offs of $1.6 million due to our re-branding to PeopleReady.

2. The Goodwill and intangible asset impairment charge for the fiscal year ended January 1, 2017, included $99.3 million of impairment charges relating to our Staff

Management | SMX, hrX, and PlaneTechs reporting units, and write-off of the CLP and Spartan reporting unit trade names/trademarks of $4.3 million due to the re-

branding to PeopleReady. Note, our PeopleScout and hrX service lines were combined during fiscal 2016 and now represent a single operating unit (PeopleScout).

3. Amortization of intangible assets of acquired businesses as well as accretion expense related to the SIMOS acquisition earn-out.

4. Total tax effect of each of the adjustments to U.S. GAAP net income (loss) per diluted share using the expected rate of 28 percent for 2017 and 2016. We expect the

tax rate to be 16 percent in Q1 2018 due to the enacted U.S. Tax Cuts and Job Act.

5. Adjusts the effective income tax rate to the expected rate of 28 percent for 2017 and 2016. We expect the tax rate to be 16 percent in Q1 2018 due to the enacted U.S.

Tax Cuts and Job Act.

6. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from

certain targeted groups with higher than average unemployment rates and reduce our income taxes.

7. Segment earnings before interest, taxes, depreciation and amortization ("Segment EBITDA") is a primary measure of segment performance. Segment EBITDA

includes net sales to third parties, related cost of sales, selling, general and administrative expenses, and goodwill and intangible asset impairment charge directly

attributable to the reportable segment together with certain allocated corporate general and administrative expenses. Segment EBITDA excludes unallocated corporate

general and administrative expenses. Adjusted Segment EBITDA is a non-GAAP financial measure and further excludes acquisition/integration and other costs,

goodwill and intangible asset impairment charge, and Work Opportunity Tax Credit third-party processing fees. Adjusted Segment EBITDA is a key measure used by

management to assess performance and, in our opinion, enhances comparability and provides investors with useful insight into the underlying trends of the business. It

is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and

may not be comparable to similarly titled measures of other companies.