Forward-Looking Statements

1 The fiscal fourth quarter of 2016 included a 14th week and two additional days from moving the week-ending date from Friday to Sunday. The comparable period in 2016 excludes the first week (ended Sept. 30) of the fourth

quarter and the two additional days associated with the change in week-ending date.

2 The lower effective tax rate could extend beyond 2019 if Congress extends the Work Opportunity Tax Credit (WOTC). If the WOTC is not extended, the effective tax rate is expected to return to the historical rate of roughly 28%.

Q4 2017 Summary

Improving revenue trends

Revenue -9% for the 13-week fiscal period or -2% on a comparable basis1

Improving trends in all segments

Double-digit growth for PeopleScout

Solid gross margin performance

Eighth consecutive quarter of year-over-year gross margin expansion

Favorable future impact from tax reform

Effective tax rate for 2018 and 2019 expected to be roughly 16%2

Return of capital

$7 million of common stock repurchased in Q4 2017, $37 million for the year

The right strategic priorities to drive growth

PeopleReady – Innovative mobile strategy and simplified brand structure

PeopleManagement – Productivity solutions and e-commerce focus

PeopleScout – #1 in market, new proprietary technology, attractive margin

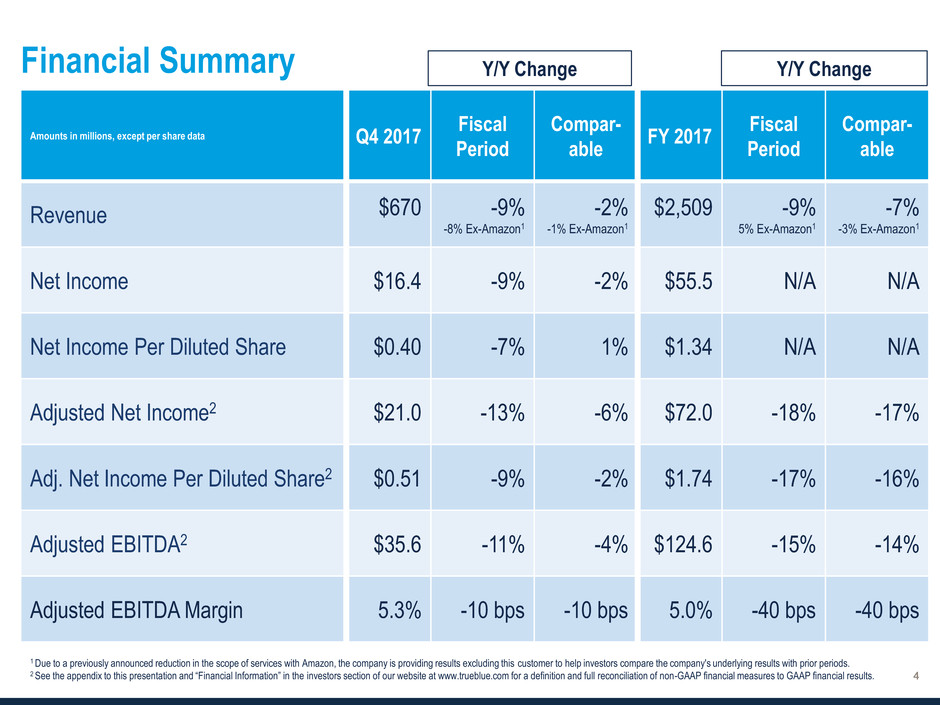

Financial Summary

Amounts in millions, except per share data Q4 2017

Fiscal

Period

Compar-

able

FY 2017

Fiscal

Period

Compar-

able

Revenue $670

-9%

-8% Ex-Amazon1

-2%

-1% Ex-Amazon1

$2,509

-9%

5% Ex-Amazon1

-7%

-3% Ex-Amazon1

Net Income $16.4 -9% -2% $55.5 N/A N/A

Net Income Per Diluted Share $0.40 -7% 1% $1.34 N/A N/A

Adjusted Net Income2 $21.0 -13% -6% $72.0 -18% -17%

Adj. Net Income Per Diluted Share2 $0.51 -9% -2% $1.74 -17% -16%

Adjusted EBITDA2 $35.6 -11% -4% $124.6 -15% -14%

Adjusted EBITDA Margin 5.3% -10 bps -10 bps 5.0% -40 bps -40 bps

1 Due to a previously announced reduction in the scope of services with Amazon, the company is providing results excluding this customer to help investors compare the company's underlying results with prior periods.

2 See the appendix to this presentation and “Financial Information” in the investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

Y/Y Change Y/Y Change

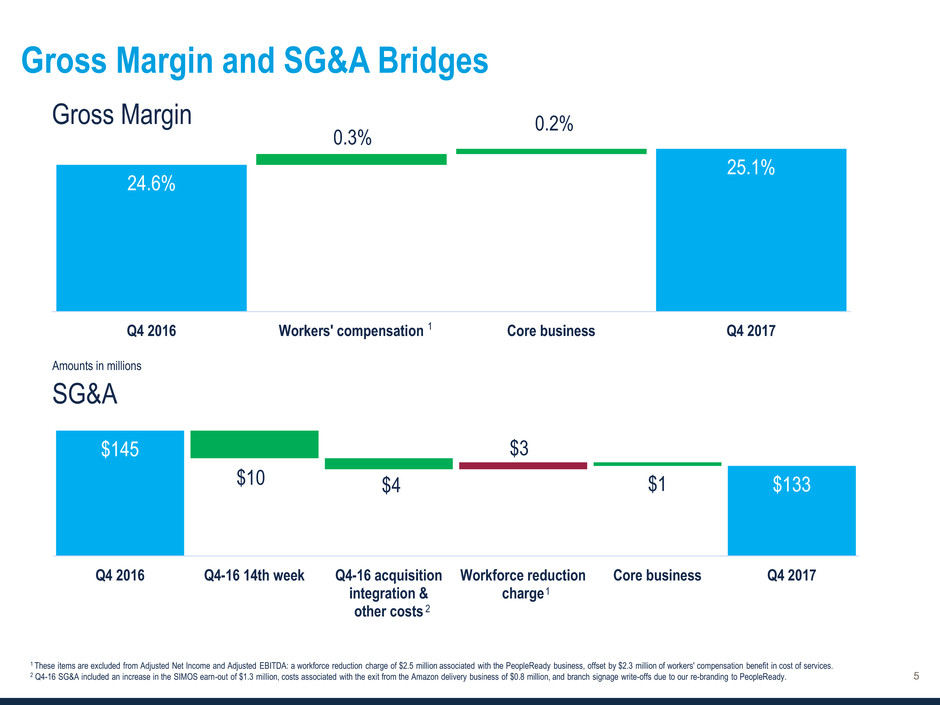

24.6%

25.1%

0.3%

0.2%

Q4 2016 Workers' compensation Core business Q4 2017

Gross Margin and SG&A Bridges

SG&A

Amounts in millions

$145

$133 $10 $4

$3

$1

Q4 2016 Q4-16 14th week Q4-16 acquisition

integration &

other costs

Workforce reduction

charge

Core business Q4 2017

2

Gross Margin

1 These items are excluded from Adjusted Net Income and Adjusted EBITDA: a workforce reduction charge of $2.5 million associated with the PeopleReady business, offset by $2.3 million of workers' compensation benefit in cost of services.

2 Q4-16 SG&A included an increase in the SIMOS earn-out of $1.3 million, costs associated with the exit from the Amazon delivery business of $0.8 million, and branch signage write-offs due to our re-branding to PeopleReady.

1

1

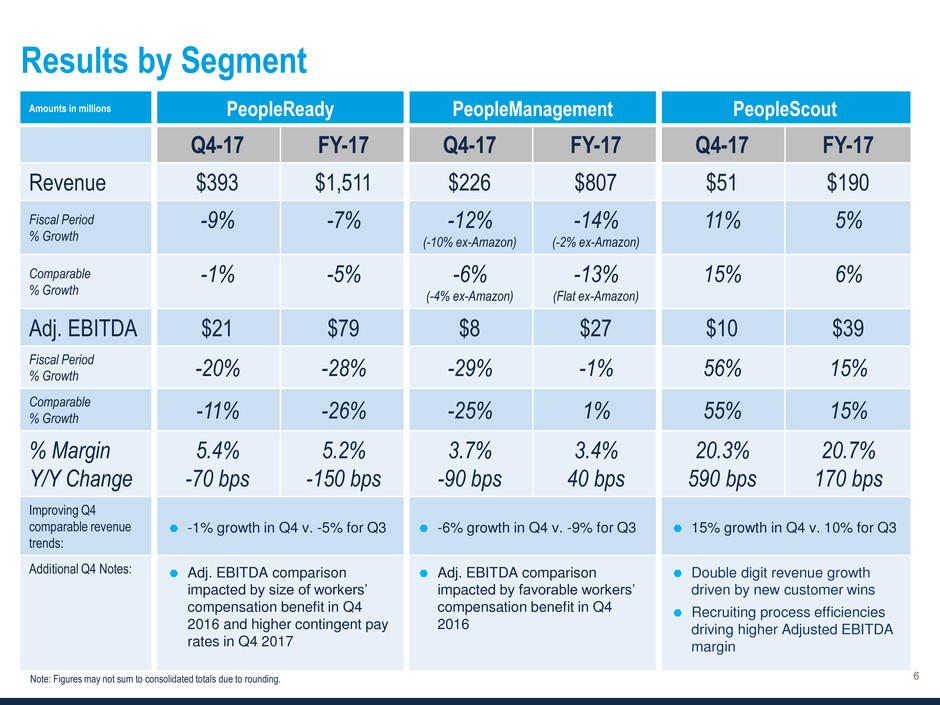

Amounts in millions PeopleReady PeopleManagement PeopleScout

Q4-17 FY-17 Q4-17 FY-17 Q4-17 FY-17

Revenue $393 $1,511 $226 $807 $51 $190

Fiscal Period

% Growth

-9%

-7%

-12%

(-10% ex-Amazon)

-14%

(-2% ex-Amazon)

11%

5%

Comparable

% Growth

-1%

-5%

-6%

(-4% ex-Amazon)

-13%

(Flat ex-Amazon)

15%

6%

Adj. EBITDA $21 $79 $8 $27 $10 $39

Fiscal Period

% Growth -20% -28% -29% -1% 56% 15%

Comparable

% Growth -11% -26% -25% 1% 55% 15%

% Margin

Y/Y Change

5.4%

-70 bps

5.2%

-150 bps

3.7%

-90 bps

3.4%

40 bps

20.3%

590 bps

20.7%

170 bps

Improving Q4

comparable revenue

trends:

Additional Q4 Notes:

Note: Figures may not sum to consolidated totals due to rounding.

Results by Segment

-1% growth in Q4 v. -5% for Q3

Adj. EBITDA comparison

impacted by size of workers’

compensation benefit in Q4

2016 and higher contingent pay

rates in Q4 2017

15% growth in Q4 v. 10% for Q3

Double digit revenue growth

driven by new customer wins

Recruiting process efficiencies

driving higher Adjusted EBITDA

margin

-6% growth in Q4 v. -9% for Q3

Adj. EBITDA comparison

impacted by favorable workers’

compensation benefit in Q4

2016

Segment Strategy Highlights

Worker component of

JobStackTM mobile app

fully deployed

1,600 customers on

JobStackTM – placing

orders, rating associates

and entering hours

Expect 10,000

customers to be actively

using JobStackTM by the

end of 2018

Productivity solutions

enhance future growth

prospects

o Compelling value

proposition

o Differentiated service,

attractive margin

o Perfect fit with the

growing world of

e-commerce

Global RPO market

experiencing double-

digit growth

Industry leading

proprietary technology –

recently launched

AffinixTM, a next-

generation HR tool

Attractive margin

business with

compelling value

proposition

Cross-Selling: Leverage opportunities with key strategic accounts

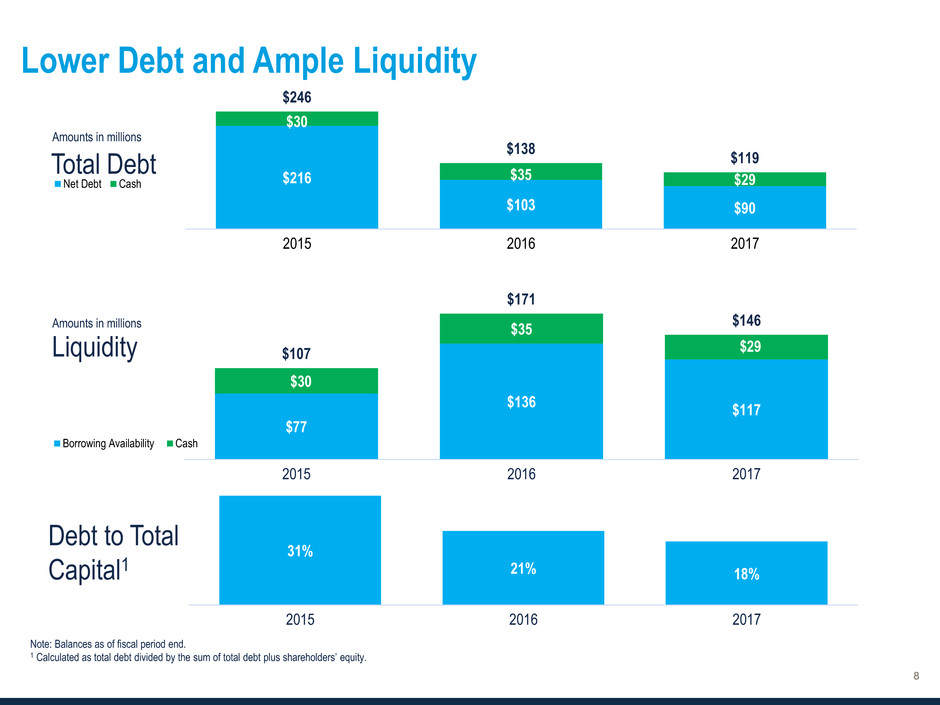

31%

21% 18%

2015 2016 2017

$216

$103 $90

$30

$35 $29

$246

$138

$119

2015 2016 2017

Net Debt Cash

$77

$136

$117

$30

$35

$29 $107

$171

$146

2015 2016 2017

Borrowing Availability Cash

Lower Debt and Ample Liquidity

Total Debt

Liquidity

Debt to Total

Capital1

Amounts in millions

Amounts in millions

Note: Balances as of fiscal period end.

1 Calculated as total debt divided by the sum of total debt plus shareholders’ equity.

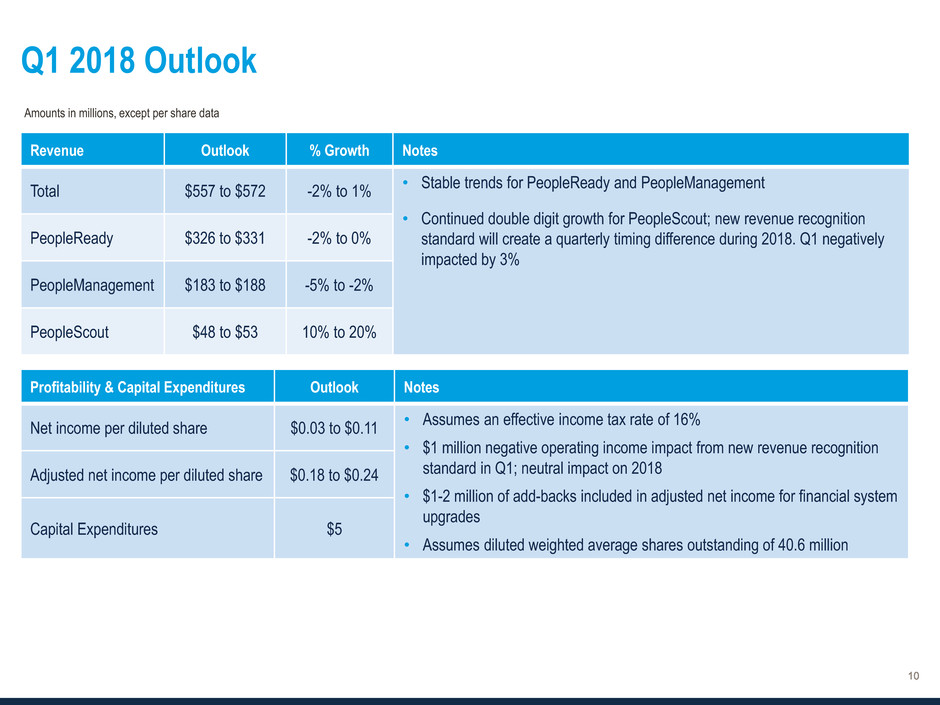

Q1 2018 Outlook

Revenue Outlook % Growth Notes

Total $557 to $572 -2% to 1%

• Stable trends for PeopleReady and PeopleManagement

• Continued double digit growth for PeopleScout; new revenue recognition

standard will create a quarterly timing difference during 2018. Q1 negatively

impacted by 3%

PeopleReady $326 to $331 -2% to 0%

PeopleManagement $183 to $188 -5% to -2%

PeopleScout $48 to $53 10% to 20%

Profitability & Capital Expenditures Outlook Notes

Net income per diluted share $0.03 to $0.11

• Assumes an effective income tax rate of 16%

• $1 million negative operating income impact from new revenue recognition

standard in Q1; neutral impact on 2018

• $1-2 million of add-backs included in adjusted net income for financial system

upgrades

• Assumes diluted weighted average shares outstanding of 40.6 million

Adjusted net income per diluted share $0.18 to $0.24

Capital Expenditures $5

Amounts in millions, except per share data

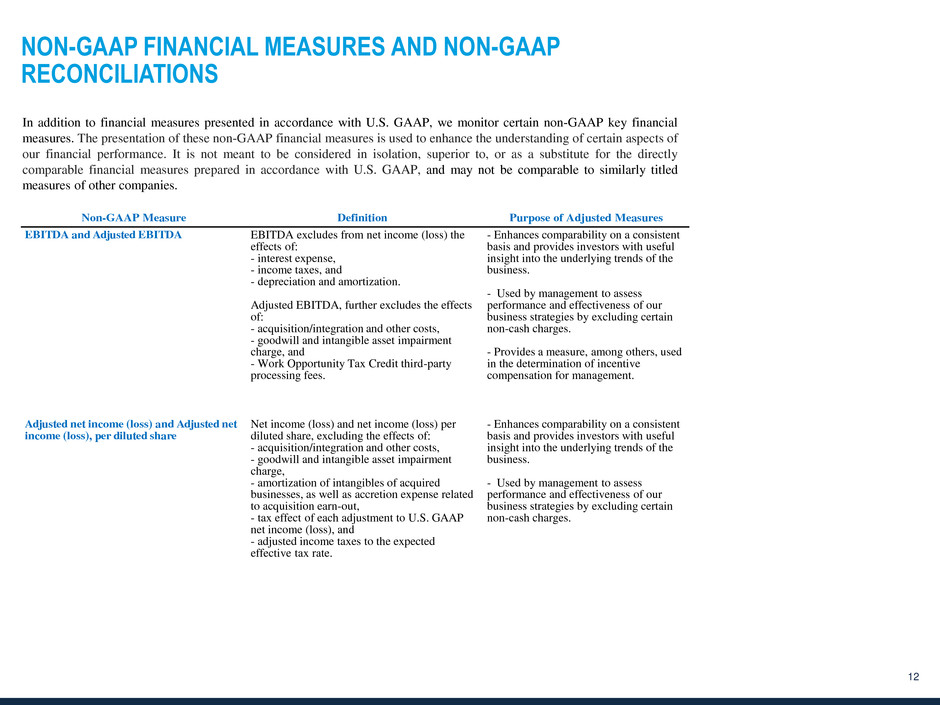

NON-GAAP FINANCIAL MEASURES AND NON-GAAP

RECONCILIATIONS

12

Non-GAAP Measure Definition Purpose of Adjusted Measures

EBITDA and Adjusted EBITDA EBITDA excludes from net income (loss) the

effects of:

- interest expense,

- income taxes, and

- depreciation and amortization.

Adjusted EBITDA, further excludes the effects

of:

- acquisition/integration and other costs,

- goodwill and intangible asset impairment

charge, and

- Work Opportunity Tax Credit third-party

processing fees.

- Enhances comparability on a consistent

basis and provides investors with useful

insight into the underlying trends of the

business.

- Used by management to assess

performance and effectiveness of our

business strategies by excluding certain

non-cash charges.

- Provides a measure, among others, used

in the determination of incentive

compensation for management.

Adjusted net income (loss) and Adjusted net

income (loss), per diluted share

Net income (loss) and net income (loss) per

diluted share, excluding the effects of:

- acquisition/integration and other costs,

- goodwill and intangible asset impairment

charge,

- amortization of intangibles of acquired

businesses, as well as accretion expense related

to acquisition earn-out,

- tax effect of each adjustment to U.S. GAAP

net income (loss), and

- adjusted income taxes to the expected

effective tax rate.

- Enhances comparability on a consistent

basis and provides investors with useful

insight into the underlying trends of the

business.

- Used by management to assess

performance and effectiveness of our

business strategies by excluding certain

non-cash charges.

In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial

measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of

our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly

comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled

measures of other companies.

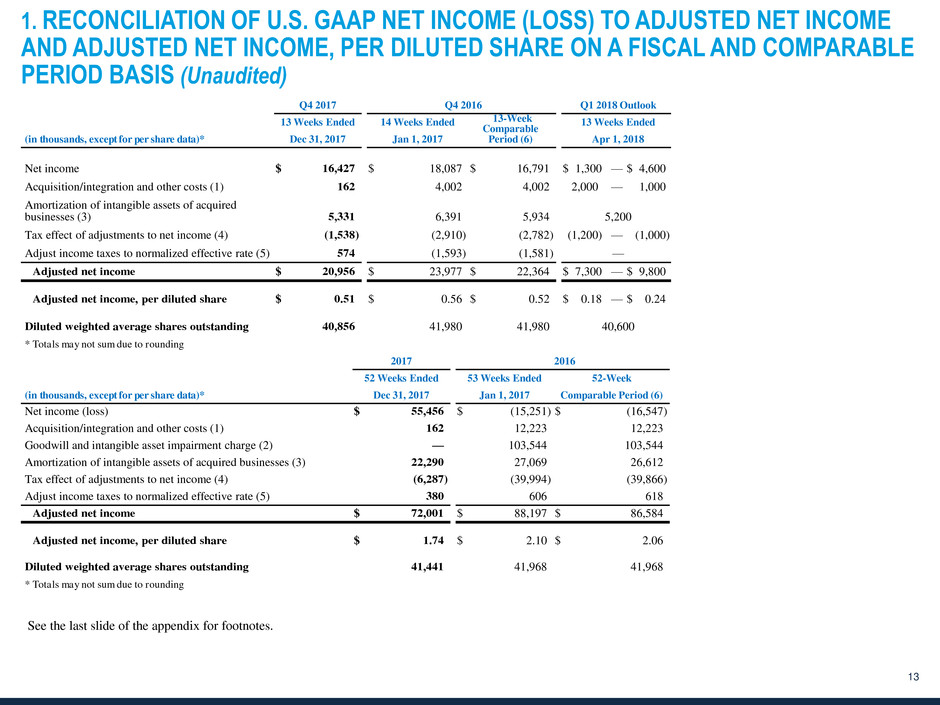

1. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO ADJUSTED NET INCOME

AND ADJUSTED NET INCOME, PER DILUTED SHARE ON A FISCAL AND COMPARABLE

PERIOD BASIS (Unaudited)

13

Q4 2017 Q4 2016 Q1 2018 Outlook

13 Weeks Ended 14 Weeks Ended 13-Week

Comparable

Period (6)

13 Weeks Ended

(in thousands, except for per share data)* Dec 31, 2017 Jan 1, 2017 Apr 1, 2018

Net income $ 16,427 $ 18,087 $ 16,791 $ 1,300 — $ 4,600

Acquisition/integration and other costs (1) 162 4,002 4,002 2,000 — 1,000

Amortization of intangible assets of acquired

businesses (3) 5,331 6,391 5,934 5,200

Tax effect of adjustments to net income (4) (1,538 ) (2,910 ) (2,782 ) (1,200) — (1,000 )

Adjust income taxes to normalized effective rate (5) 574 (1,593 ) (1,581 ) —

Adjusted net income $ 20,956 $ 23,977 $ 22,364 $ 7,300 — $ 9,800

Adjusted net income, per diluted share $ 0.51 $ 0.56 $ 0.52 $ 0.18 — $ 0.24

Diluted weighted average shares outstanding 40,856 41,980 41,980 40,600

* Totals may not sum due to rounding

2017 2016

52 Weeks Ended 53 Weeks Ended 52-Week

(in thousands, except for per share data)* Dec 31, 2017 Jan 1, 2017 Comparable Period (6)

Net income (loss) $ 55,456 $ (15,251 ) $ (16,547 )

Acquisition/integration and other costs (1) 162 12,223 12,223

Goodwill and intangible asset impairment charge (2) — 103,544 103,544

Amortization of intangible assets of acquired businesses (3) 22,290 27,069 26,612

Tax effect of adjustments to net income (4) (6,287 ) (39,994 ) (39,866 )

Adjust income taxes to normalized effective rate (5) 380 606 618

Adjusted net income $ 72,001 $ 88,197 $ 86,584

Adjusted net income, per diluted share $ 1.74 $ 2.10 $ 2.06

Diluted weighted average shares outstanding 41,441 41,968 41,968

* Totals may not sum due to rounding

See the last slide of the appendix for footnotes.

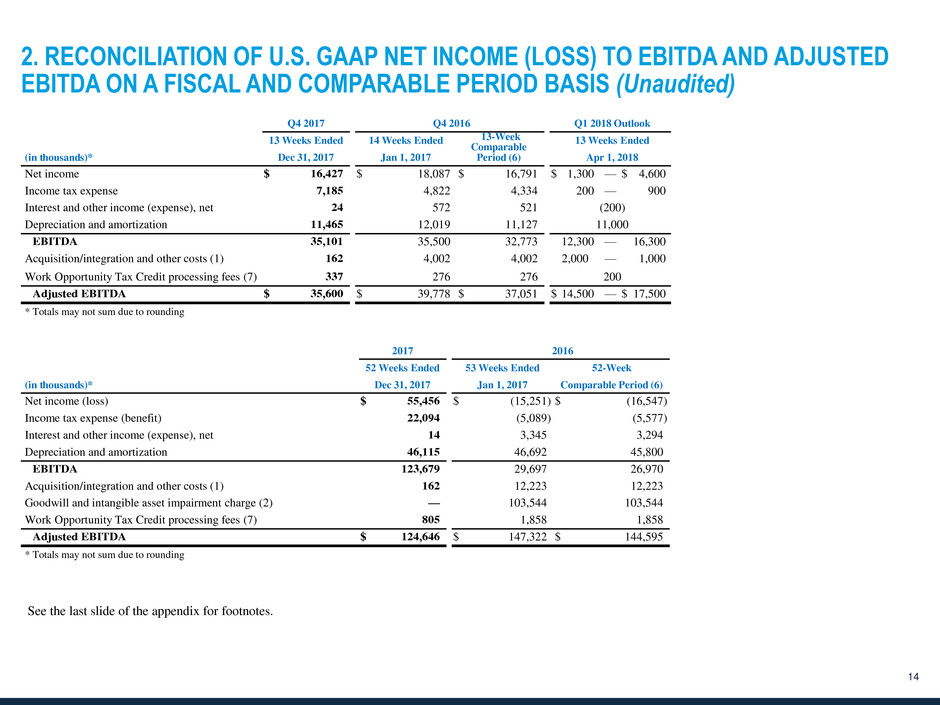

2. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO EBITDA AND ADJUSTED

EBITDA ON A FISCAL AND COMPARABLE PERIOD BASIS (Unaudited)

14

2017 2016

52 Weeks Ended 53 Weeks Ended 52-Week

(in thousands)* Dec 31, 2017 Jan 1, 2017 Comparable Period (6)

Net income (loss) $ 55,456 $ (15,251 ) $ (16,547 )

Income tax expense (benefit) 22,094 (5,089 ) (5,577 )

Interest and other income (expense), net 14 3,345 3,294

Depreciation and amortization 46,115 46,692 45,800

EBITDA 123,679 29,697 26,970

Acquisition/integration and other costs (1) 162 12,223 12,223

Goodwill and intangible asset impairment charge (2) — 103,544 103,544

Work Opportunity Tax Credit processing fees (7) 805 1,858 1,858

Adjusted EBITDA $ 124,646 $ 147,322 $ 144,595

* Totals may not sum due to rounding

Q4 2017 Q4 2016 Q1 2018 Outlook

13 Weeks Ended 14 Weeks Ended 13-Week

Comparable

Period (6)

13 Weeks Ended

(in thousands)* Dec 31, 2017 Jan 1, 2017 Apr 1, 2018

Net income $ 16,427 $ 18,087 $ 16,791 $ 1,300 — $ 4,600

Income tax expense 7,185 4,822 4,334 200 — 900

Interest and other income (expense), net 24 572 521 (200)

Depreciation and amortization 11,465 12,019 11,127 11,000

EBITDA 35,101 35,500 32,773 12,300 — 16,300

Acquisition/integration and other costs (1) 162 4,002 4,002 2,000 — 1,000

Work Opportunity Tax Credit processing fees (7) 337 276 276 200

Adjusted EBITDA $ 35,600 $ 39,778 $ 37,051 $ 14,500 — $ 17,500

* Totals may not sum due to rounding

See the last slide of the appendix for footnotes.

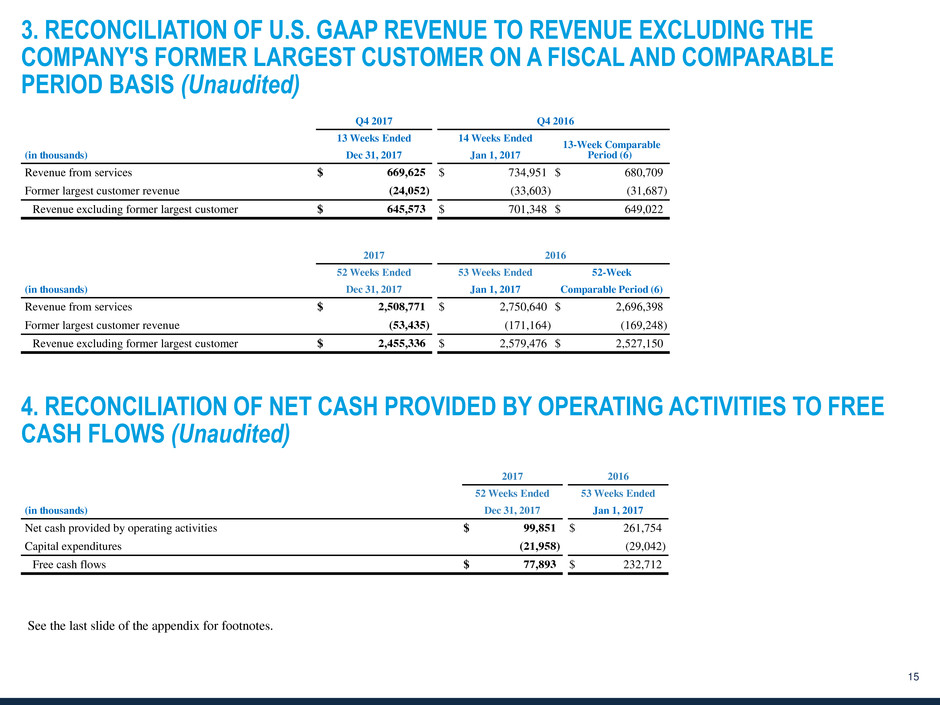

3. RECONCILIATION OF U.S. GAAP REVENUE TO REVENUE EXCLUDING THE

COMPANY'S FORMER LARGEST CUSTOMER ON A FISCAL AND COMPARABLE

PERIOD BASIS (Unaudited)

15

4. RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE

CASH FLOWS (Unaudited)

2017 2016

52 Weeks Ended 53 Weeks Ended 52-Week

(in thousands) Dec 31, 2017 Jan 1, 2017 Comparable Period (6)

Revenue from services $ 2,508,771 $ 2,750,640 $ 2,696,398

Former largest customer revenue (53,435 ) (171,164 ) (169,248 )

Revenue excluding former largest customer $ 2,455,336 $ 2,579,476 $ 2,527,150

Q4 2017 Q4 2016

13 Weeks Ended 14 Weeks Ended

13-Week Comparable

Period (6) (in thousands) Dec 31, 2017 Jan 1, 2017

Revenue from services $ 669,625 $ 734,951 $ 680,709

Former largest customer revenue (24,052 ) (33,603 ) (31,687 )

Revenue excluding former largest customer $ 645,573 $ 701,348 $ 649,022

2017 2016

52 Weeks Ended 53 Weeks Ended

(in thousands) Dec 31, 2017 Jan 1, 2017

Net cash provided by operating activities $ 99,851 $ 261,754

Capital expenditures (21,958 ) (29,042 )

Free cash flows $ 77,893 $ 232,712

See the last slide of the appendix for footnotes.

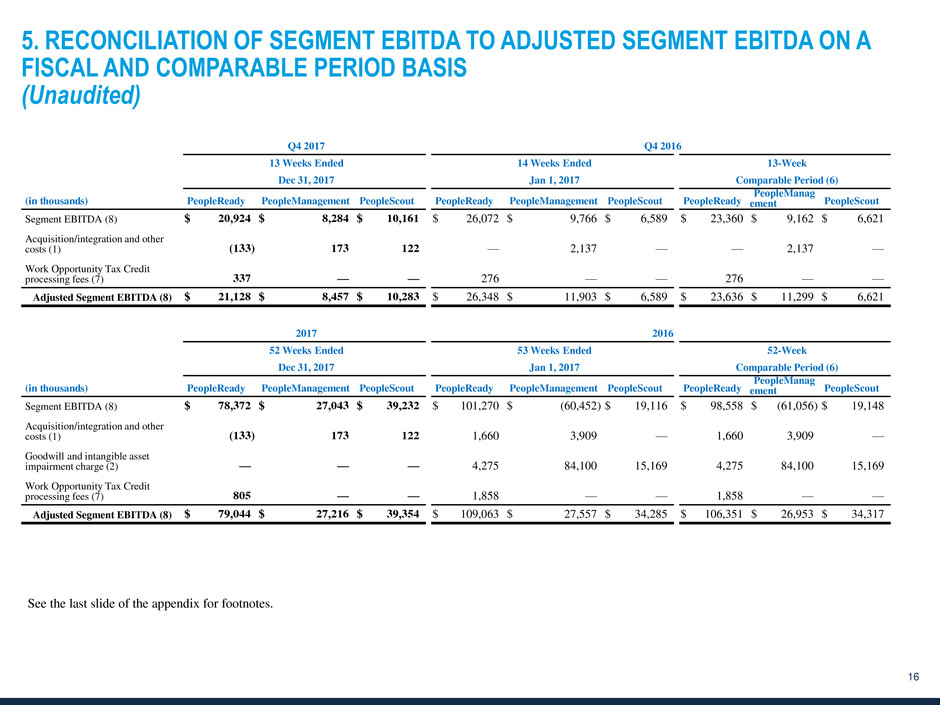

5. RECONCILIATION OF SEGMENT EBITDA TO ADJUSTED SEGMENT EBITDA ON A

FISCAL AND COMPARABLE PERIOD BASIS

(Unaudited)

16

Q4 2017 Q4 2016

13 Weeks Ended 14 Weeks Ended 13-Week

Dec 31, 2017 Jan 1, 2017 Comparable Period (6)

(in thousands) PeopleReady PeopleManagement PeopleScout PeopleReady PeopleManagement PeopleScout PeopleReady

PeopleManag

ement PeopleScout

Segment EBITDA (8) $ 20,924 $ 8,284 $ 10,161 $ 26,072 $ 9,766 $ 6,589 $ 23,360 $ 9,162 $ 6,621

Acquisition/integration and other

costs (1) (133 ) 173 122 — 2,137 — — 2,137 —

Work Opportunity Tax Credit

processing fees (7) 337 — — 276 — — 276 — —

Adjusted Segment EBITDA (8) $ 21,128 $ 8,457 $ 10,283 $ 26,348 $ 11,903 $ 6,589 $ 23,636 $ 11,299 $ 6,621

2017 2016

52 Weeks Ended 53 Weeks Ended 52-Week

Dec 31, 2017 Jan 1, 2017 Comparable Period (6)

(in thousands) PeopleReady PeopleManagement PeopleScout PeopleReady PeopleManagement PeopleScout PeopleReady

PeopleManag

ement PeopleScout

Segment EBITDA (8) $ 78,372 $ 27,043 $ 39,232 $ 101,270 $ (60,452 ) $ 19,116 $ 98,558 $ (61,056 ) $ 19,148

Acquisition/integration and other

costs (1) (133 ) 173 122 1,660 3,909 — 1,660 3,909 —

Goodwill and intangible asset

impairment charge (2) — — — 4,275 84,100 15,169 4,275 84,100 15,169

Work Opportunity Tax Credit

processing fees (7) 805 — — 1,858 — — 1,858 — —

Adjusted Segment EBITDA (8) $ 79,044 $ 27,216 $ 39,354 $ 109,063 $ 27,557 $ 34,285 $ 106,351 $ 26,953 $ 34,317

See the last slide of the appendix for footnotes.

17

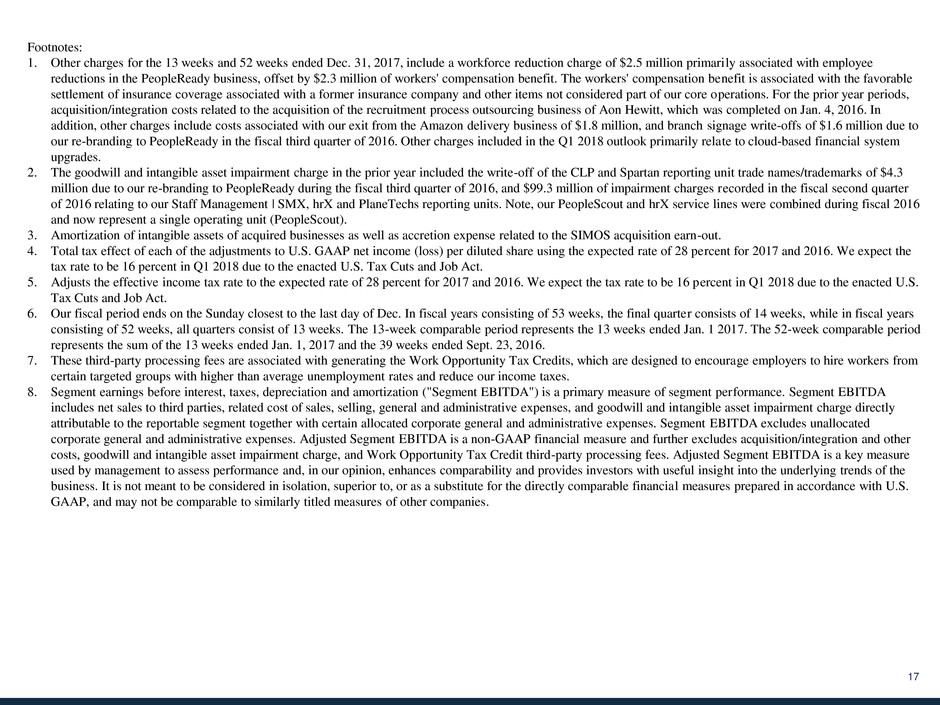

Footnotes:

1. Other charges for the 13 weeks and 52 weeks ended Dec. 31, 2017, include a workforce reduction charge of $2.5 million primarily associated with employee

reductions in the PeopleReady business, offset by $2.3 million of workers' compensation benefit. The workers' compensation benefit is associated with the favorable

settlement of insurance coverage associated with a former insurance company and other items not considered part of our core operations. For the prior year periods,

acquisition/integration costs related to the acquisition of the recruitment process outsourcing business of Aon Hewitt, which was completed on Jan. 4, 2016. In

addition, other charges include costs associated with our exit from the Amazon delivery business of $1.8 million, and branch signage write-offs of $1.6 million due to

our re-branding to PeopleReady in the fiscal third quarter of 2016. Other charges included in the Q1 2018 outlook primarily relate to cloud-based financial system

upgrades.

2. The goodwill and intangible asset impairment charge in the prior year included the write-off of the CLP and Spartan reporting unit trade names/trademarks of $4.3

million due to our re-branding to PeopleReady during the fiscal third quarter of 2016, and $99.3 million of impairment charges recorded in the fiscal second quarter

of 2016 relating to our Staff Management | SMX, hrX and PlaneTechs reporting units. Note, our PeopleScout and hrX service lines were combined during fiscal 2016

and now represent a single operating unit (PeopleScout).

3. Amortization of intangible assets of acquired businesses as well as accretion expense related to the SIMOS acquisition earn-out.

4. Total tax effect of each of the adjustments to U.S. GAAP net income (loss) per diluted share using the expected rate of 28 percent for 2017 and 2016. We expect the

tax rate to be 16 percent in Q1 2018 due to the enacted U.S. Tax Cuts and Job Act.

5. Adjusts the effective income tax rate to the expected rate of 28 percent for 2017 and 2016. We expect the tax rate to be 16 percent in Q1 2018 due to the enacted U.S.

Tax Cuts and Job Act.

6. Our fiscal period ends on the Sunday closest to the last day of Dec. In fiscal years consisting of 53 weeks, the final quarter consists of 14 weeks, while in fiscal years

consisting of 52 weeks, all quarters consist of 13 weeks. The 13-week comparable period represents the 13 weeks ended Jan. 1 2017. The 52-week comparable period

represents the sum of the 13 weeks ended Jan. 1, 2017 and the 39 weeks ended Sept. 23, 2016.

7. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from

certain targeted groups with higher than average unemployment rates and reduce our income taxes.

8. Segment earnings before interest, taxes, depreciation and amortization ("Segment EBITDA") is a primary measure of segment performance. Segment EBITDA

includes net sales to third parties, related cost of sales, selling, general and administrative expenses, and goodwill and intangible asset impairment charge directly

attributable to the reportable segment together with certain allocated corporate general and administrative expenses. Segment EBITDA excludes unallocated

corporate general and administrative expenses. Adjusted Segment EBITDA is a non-GAAP financial measure and further excludes acquisition/integration and other

costs, goodwill and intangible asset impairment charge, and Work Opportunity Tax Credit third-party processing fees. Adjusted Segment EBITDA is a key measure

used by management to assess performance and, in our opinion, enhances comparability and provides investors with useful insight into the underlying trends of the

business. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S.

GAAP, and may not be comparable to similarly titled measures of other companies.