www.TrueBlue.com

www.TrueBlue.com

Forward-Looking Statements

www.TrueBlue.com

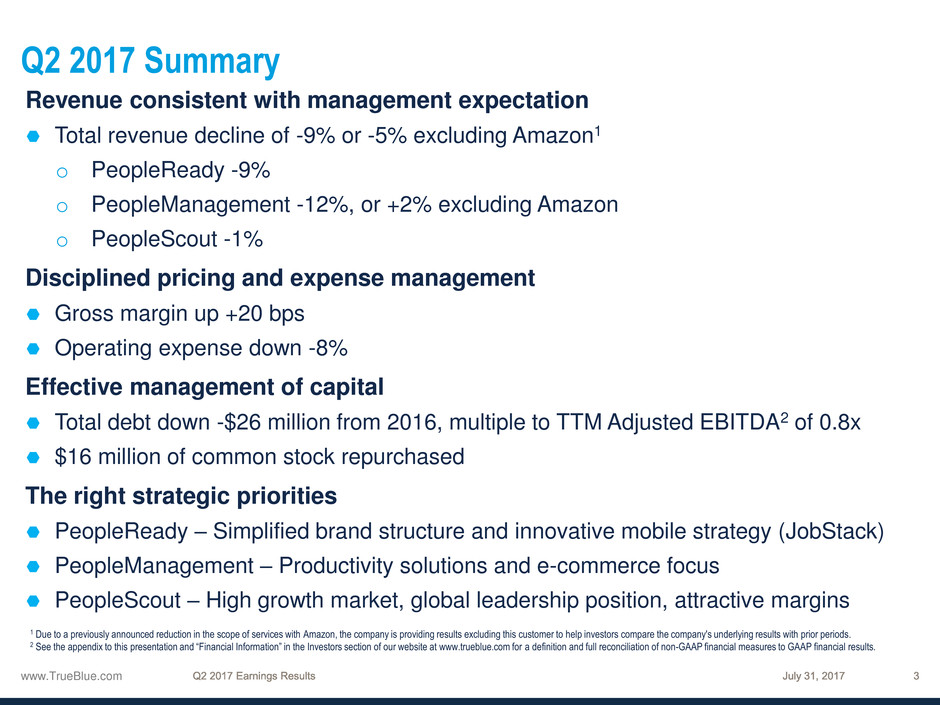

Q2 2017 Summary

Revenue consistent with management expectation

Total revenue decline of -9% or -5% excluding Amazon1

o PeopleReady -9%

o PeopleManagement -12%, or +2% excluding Amazon

o PeopleScout -1%

Disciplined pricing and expense management

Gross margin up +20 bps

Operating expense down -8%

Effective management of capital

Total debt down -$26 million from 2016, multiple to TTM Adjusted EBITDA2 of 0.8x

$16 million of common stock repurchased

The right strategic priorities

PeopleReady – Simplified brand structure and innovative mobile strategy (JobStack)

PeopleManagement – Productivity solutions and e-commerce focus

PeopleScout – High growth market, global leadership position, attractive margins

1 Due to a previously announced reduction in the scope of services with Amazon, the company is providing results excluding this customer to help investors compare the company's underlying results with prior periods.

2 See the appendix to this presentation and “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

www.TrueBlue.com

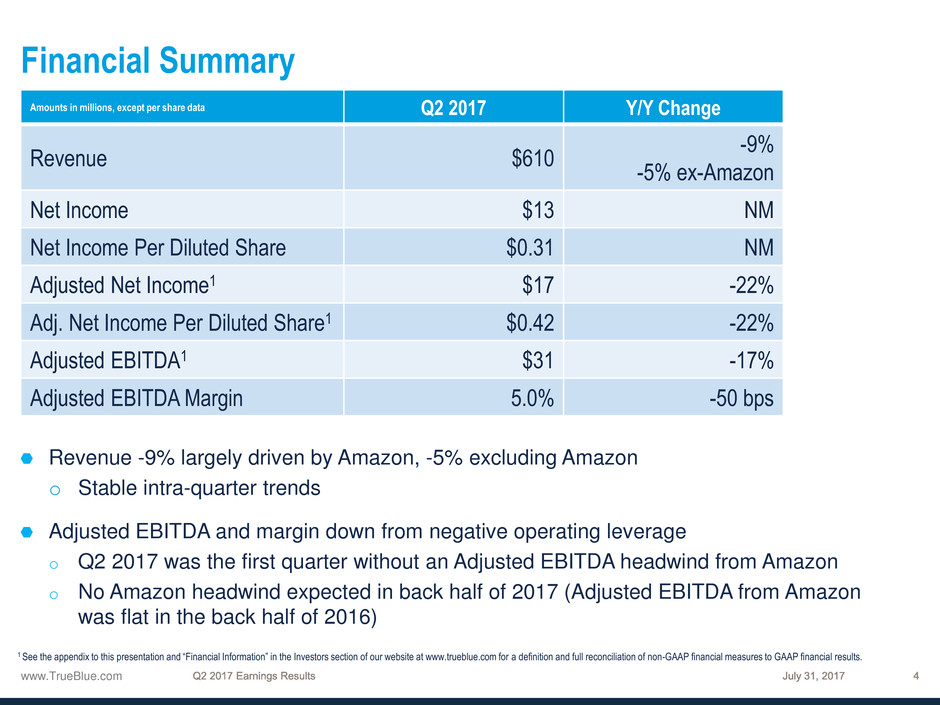

Financial Summary

Revenue -9% largely driven by Amazon, -5% excluding Amazon

o Stable intra-quarter trends

Adjusted EBITDA and margin down from negative operating leverage

o Q2 2017 was the first quarter without an Adjusted EBITDA headwind from Amazon

o No Amazon headwind expected in back half of 2017 (Adjusted EBITDA from Amazon

was flat in the back half of 2016)

Amounts in millions, except per share data Q2 2017 Y/Y Change

Revenue $610

-9%

-5% ex-Amazon

Net Income $13 NM

Net Income Per Diluted Share $0.31 NM

Adjusted Net Income1 $17 -22%

Adj. Net Income Per Diluted Share1 $0.42 -22%

Adjusted EBITDA1 $31 -17%

Adjusted EBITDA Margin 5.0% -50 bps

1 See the appendix to this presentation and “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

www.TrueBlue.com

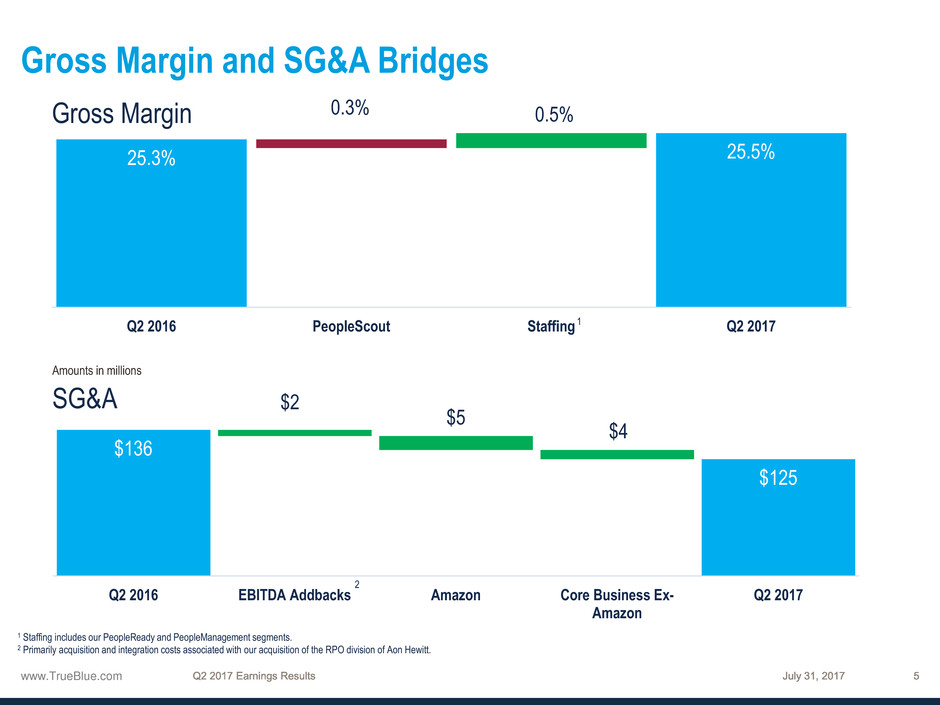

Gross Margin and SG&A Bridges

SG&A

Amounts in millions

Gross Margin

25.3% 25.5%

0.3% 0.5%

Q2 2016 PeopleScout Staffing Q2 2017

$136

$125

$2

$5

$4

Q2 2016 EBITDA Addbacks Amazon Core Business Ex-

Amazon

Q2 2017

1

1 Staffing includes our PeopleReady and PeopleManagement segments.

2 Primarily acquisition and integration costs associated with our acquisition of the RPO division of Aon Hewitt.

2

www.TrueBlue.com

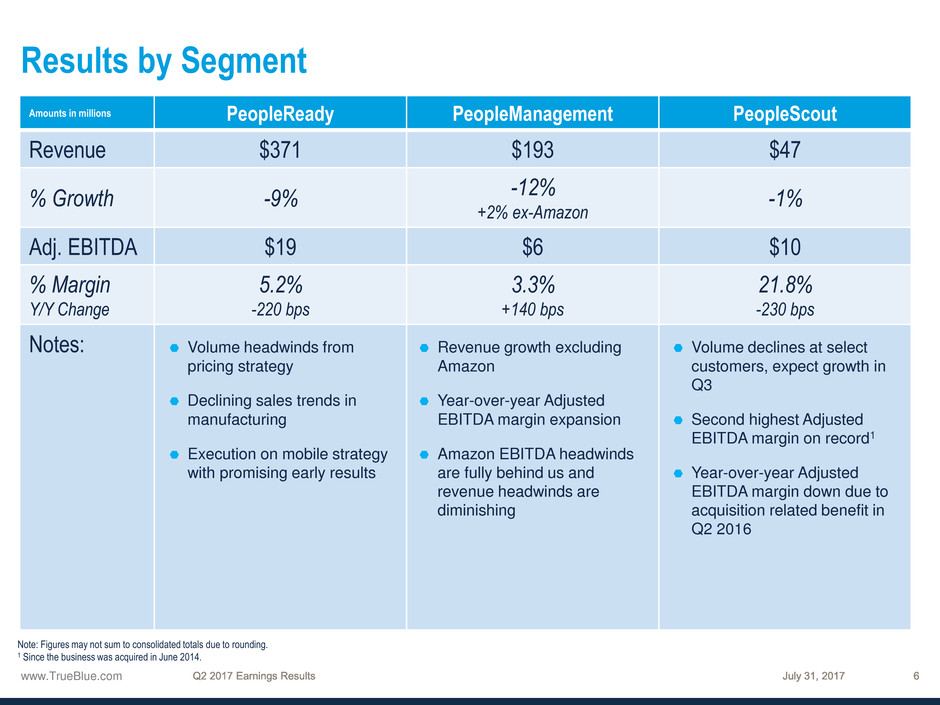

Note: Figures may not sum to consolidated totals due to rounding.

1 Since the business was acquired in June 2014.

Results by Segment

Amounts in millions PeopleReady PeopleManagement PeopleScout

Revenue $371 $193 $47

% Growth -9% -12%

+2% ex-Amazon

-1%

Adj. EBITDA $19 $6 $10

% Margin

Y/Y Change

5.2%

-220 bps

3.3%

+140 bps

21.8%

-230 bps

Notes: Volume headwinds from

pricing strategy

Declining sales trends in

manufacturing

Execution on mobile strategy

with promising early results

Revenue growth excluding

Amazon

Year-over-year Adjusted

EBITDA margin expansion

Amazon EBITDA headwinds

are fully behind us and

revenue headwinds are

diminishing

Volume declines at select

customers, expect growth in

Q3

Second highest Adjusted

EBITDA margin on record1

Year-over-year Adjusted

EBITDA margin down due to

acquisition related benefit in

Q2 2016

www.TrueBlue.com

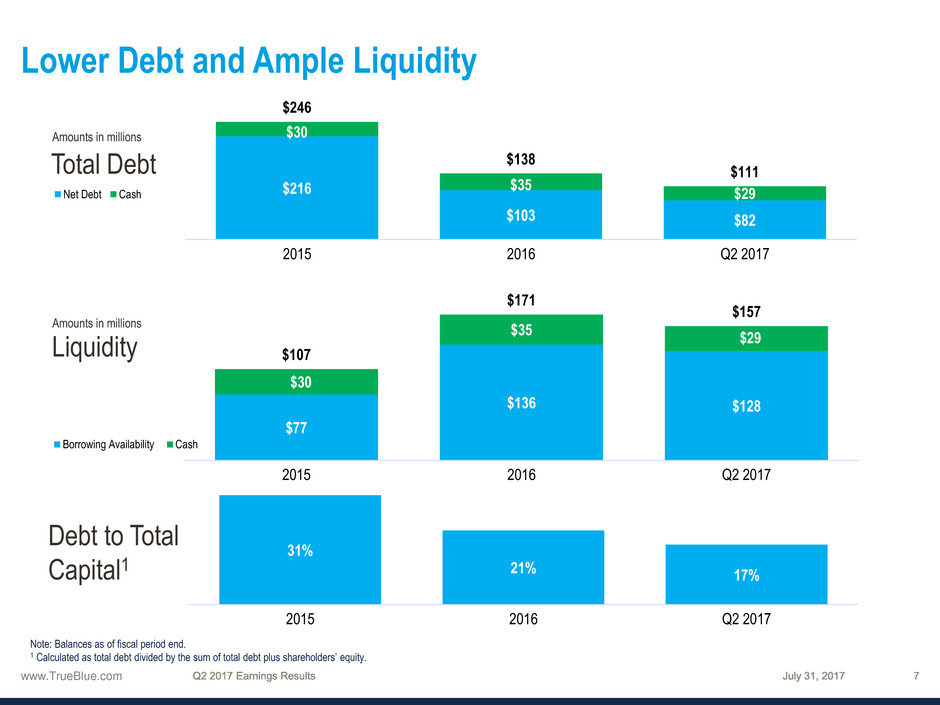

$216

$103 $82

$30

$35

$29

$246

$138

$111

2015 2016 Q2 2017

Net Debt Cash

$77

$136 $128

$30

$35

$29

$107

$171

$157

2015 2016 Q2 2017

Borrowing Availability Cash

Lower Debt and Ample Liquidity

31%

21% 17%

2015 2016 Q2 2017

Total Debt

Liquidity

Debt to Total

Capital1

Amounts in millions

Amounts in millions

Note: Balances as of fiscal period end.

1 Calculated as total debt divided by the sum of total debt plus shareholders’ equity.

www.TrueBlue.com

Segment Strategy Highlights

Rollout of mobile

strategy continues

(JobStack)

o Worker app is being

rolled out across

branch network

o Promising trends on

worker app adoption

o Recently launched

new client app

Productivity solutions

enhance future growth

prospects

o Compelling value

proposition

o SIMOS acquisition at

the end of 2015

bolstered our existing

capabilities

o Differentiated service,

high EBITDA margin

o Perfect fit with the

growing world of

e-commerce

Attractive margin

business with

compelling value

proposition

Global RPO market

currently experiencing

double-digit growth

Actively pursuing

organic revenue growth

plus opportunistic

international

acquisitions to improve

win rates on multi-

continent deals

www.TrueBlue.com

www.TrueBlue.com

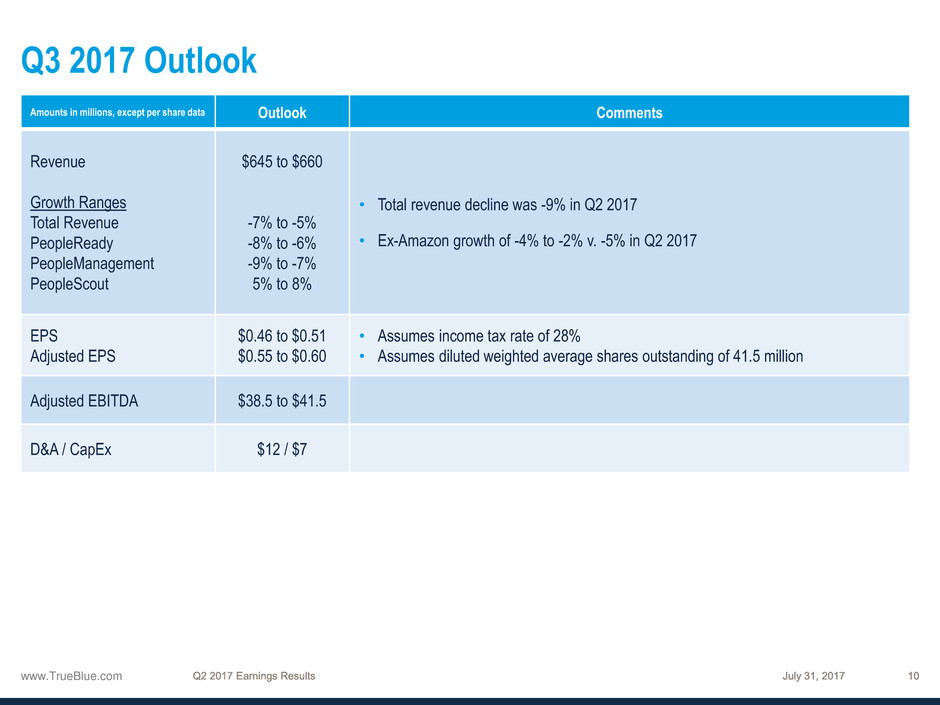

Q3 2017 Outlook

Amounts in millions, except per share data Outlook Comments

Revenue

Growth Ranges

Total Revenue

PeopleReady

PeopleManagement

PeopleScout

$645 to $660

-7% to -5%

-8% to -6%

-9% to -7%

5% to 8%

• Total revenue decline was -9% in Q2 2017

• Ex-Amazon growth of -4% to -2% v. -5% in Q2 2017

EPS

Adjusted EPS

$0.46 to $0.51

$0.55 to $0.60

• Assumes income tax rate of 28%

• Assumes diluted weighted average shares outstanding of 41.5 million

Adjusted EBITDA $38.5 to $41.5

D&A / CapEx $12 / $7

www.TrueBlue.com

www.TrueBlue.com

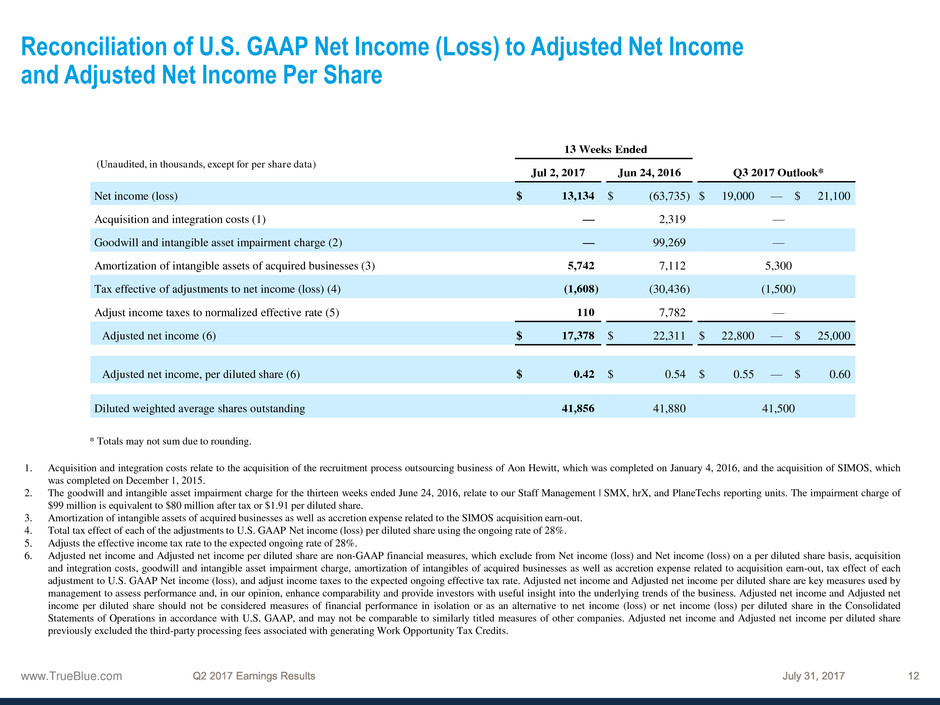

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted Net Income

and Adjusted Net Income Per Share

* Totals may not sum due to rounding.

1. Acquisition and integration costs relate to the acquisition of the recruitment process outsourcing business of Aon Hewitt, which was completed on January 4, 2016, and the acquisition of SIMOS, which

was completed on December 1, 2015.

2. The goodwill and intangible asset impairment charge for the thirteen weeks ended June 24, 2016, relate to our Staff Management | SMX, hrX, and PlaneTechs reporting units. The impairment charge of

$99 million is equivalent to $80 million after tax or $1.91 per diluted share.

3. Amortization of intangible assets of acquired businesses as well as accretion expense related to the SIMOS acquisition earn-out.

4. Total tax effect of each of the adjustments to U.S. GAAP Net income (loss) per diluted share using the ongoing rate of 28%.

5. Adjusts the effective income tax rate to the expected ongoing rate of 28%.

6. Adjusted net income and Adjusted net income per diluted share are non-GAAP financial measures, which exclude from Net income (loss) and Net income (loss) on a per diluted share basis, acquisition

and integration costs, goodwill and intangible asset impairment charge, amortization of intangibles of acquired businesses as well as accretion expense related to acquisition earn-out, tax effect of each

adjustment to U.S. GAAP Net income (loss), and adjust income taxes to the expected ongoing effective tax rate. Adjusted net income and Adjusted net income per diluted share are key measures used by

management to assess performance and, in our opinion, enhance comparability and provide investors with useful insight into the underlying trends of the business. Adjusted net income and Adjusted net

income per diluted share should not be considered measures of financial performance in isolation or as an alternative to net income (loss) or net income (loss) per diluted share in the Consolidated

Statements of Operations in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Adjusted net income and Adjusted net income per diluted share

previously excluded the third-party processing fees associated with generating Work Opportunity Tax Credits.

13 Weeks Ended

Jul 2, 2017 Jun 24, 2016 Q3 2017 Outlook*

Net income (loss) $ 13,134 $ (63,735 ) $ 19,000 — $ 21,100

Acquisition and integration costs (1) — 2,319 —

Goodwill and intangible asset impairment charge (2) — 99,269 —

Amortization of intangible assets of acquired businesses (3) 5,742 7,112 5,300

Tax effective of adjustments to net income (loss) (4) (1,608 ) (30,436 ) (1,500)

Adjust income taxes to normalized effective rate (5) 110 7,782 —

Adjusted net income (6) $ 17,378 $ 22,311 $ 22,800 — $ 25,000

Adjusted net income, per diluted share (6) $ 0.42 $ 0.54 $ 0.55 — $ 0.60

Diluted weighted average shares outstanding 41,856 41,880 41,500

(Unaudited, in thousands, except for per share data)

www.TrueBlue.com

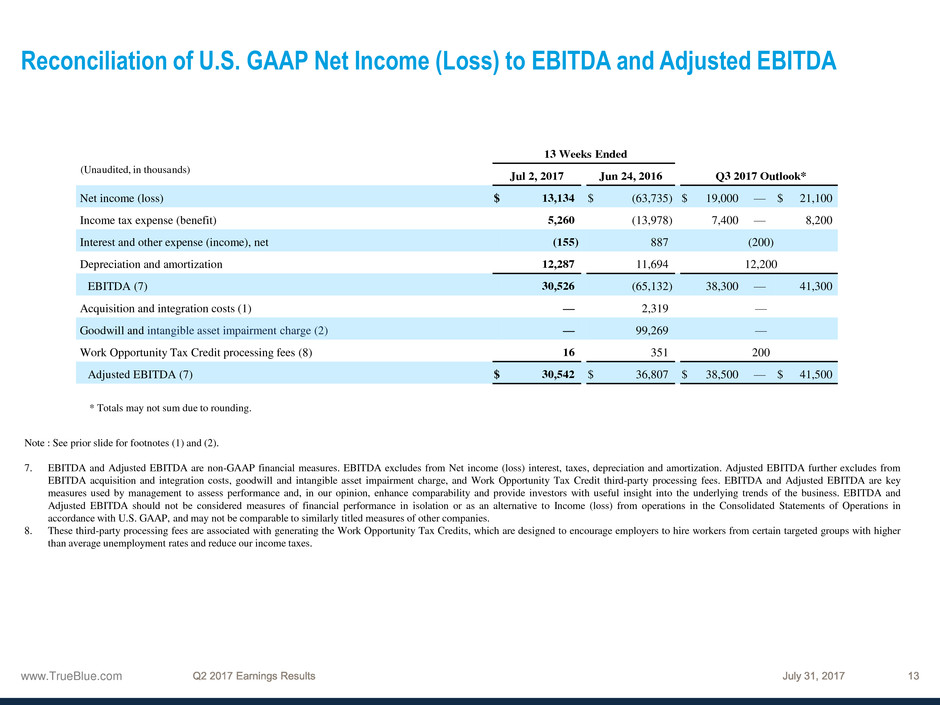

Reconciliation of U.S. GAAP Net Income (Loss) to EBITDA and Adjusted EBITDA

Note : See prior slide for footnotes (1) and (2).

7. EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes from Net income (loss) interest, taxes, depreciation and amortization. Adjusted EBITDA further excludes from

EBITDA acquisition and integration costs, goodwill and intangible asset impairment charge, and Work Opportunity Tax Credit third-party processing fees. EBITDA and Adjusted EBITDA are key

measures used by management to assess performance and, in our opinion, enhance comparability and provide investors with useful insight into the underlying trends of the business. EBITDA and

Adjusted EBITDA should not be considered measures of financial performance in isolation or as an alternative to Income (loss) from operations in the Consolidated Statements of Operations in

accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

8. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from certain targeted groups with higher

than average unemployment rates and reduce our income taxes.

* Totals may not sum due to rounding.

13 Weeks Ended

Jul 2, 2017 Jun 24, 2016 Q3 2017 Outlook*

Net income (loss) $ 13,134 $ (63,735 ) $ 19,000 — $ 21,100

Income tax expense (benefit) 5,260 (13,978 ) 7,400 — 8,200

Interest and other expense (income), net (155 ) 887 (200)

Depreciation and amortization 12,287 11,694 12,200

EBITDA (7) 30,526 (65,132 ) 38,300 — 41,300

Acquisition and integration costs (1) — 2,319 —

Goodwill and intangible asset impairment charge (2) — 99,269 —

Work Opportunity Tax Credit processing fees (8) 16 351 200

Adjusted EBITDA (7) $ 30,542 $ 36,807 $ 38,500 — $ 41,500

(Unaudited, in thousands)

www.TrueBlue.com

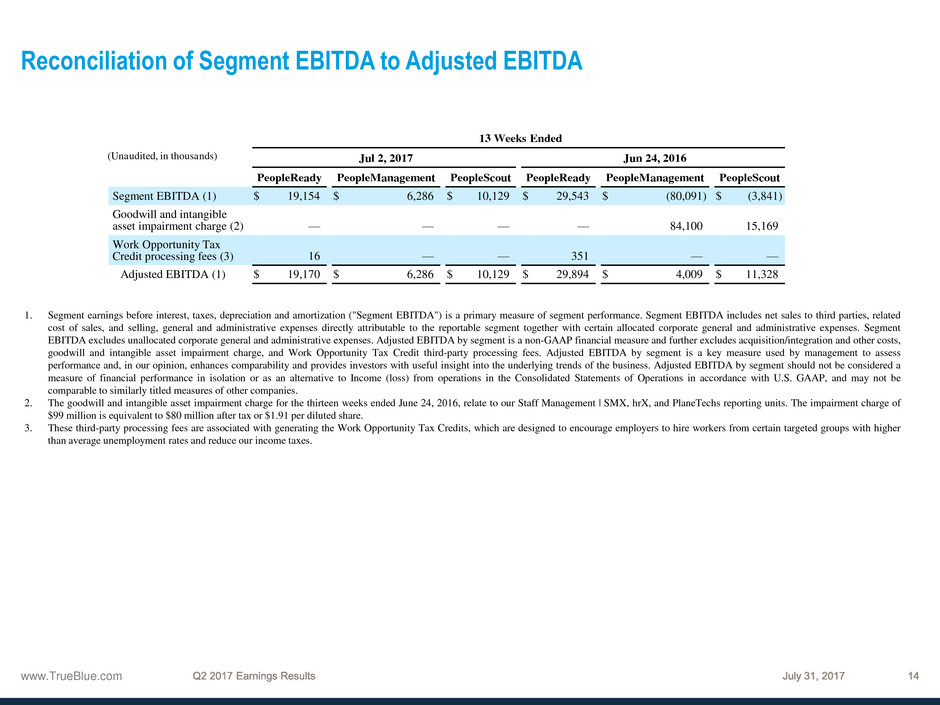

Reconciliation of Segment EBITDA to Adjusted EBITDA

13 Weeks Ended

Jul 2, 2017 Jun 24, 2016

PeopleReady PeopleManagement PeopleScout PeopleReady PeopleManagement PeopleScout

Segment EBITDA (1) $ 19,154 $ 6,286 $ 10,129 $ 29,543 $ (80,091 ) $ (3,841 )

Goodwill and intangible

asset impairment charge (2) — — — — 84,100 15,169

Work Opportunity Tax

Credit processing fees (3) 16 — — 351 — —

Adjusted EBITDA (1) $ 19,170 $ 6,286 $ 10,129 $ 29,894 $ 4,009 $ 11,328

1. Segment earnings before interest, taxes, depreciation and amortization ("Segment EBITDA") is a primary measure of segment performance. Segment EBITDA includes net sales to third parties, related

cost of sales, and selling, general and administrative expenses directly attributable to the reportable segment together with certain allocated corporate general and administrative expenses. Segment

EBITDA excludes unallocated corporate general and administrative expenses. Adjusted EBITDA by segment is a non-GAAP financial measure and further excludes acquisition/integration and other costs,

goodwill and intangible asset impairment charge, and Work Opportunity Tax Credit third-party processing fees. Adjusted EBITDA by segment is a key measure used by management to assess

performance and, in our opinion, enhances comparability and provides investors with useful insight into the underlying trends of the business. Adjusted EBITDA by segment should not be considered a

measure of financial performance in isolation or as an alternative to Income (loss) from operations in the Consolidated Statements of Operations in accordance with U.S. GAAP, and may not be

comparable to similarly titled measures of other companies.

2. The goodwill and intangible asset impairment charge for the thirteen weeks ended June 24, 2016, relate to our Staff Management | SMX, hrX, and PlaneTechs reporting units. The impairment charge of

$99 million is equivalent to $80 million after tax or $1.91 per diluted share.

3. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from certain targeted groups with higher

than average unemployment rates and reduce our income taxes.

(Unaudited, in thousands)