www.TrueBlue.com

www.TrueBlue.com

Forward-Looking Statements

www.TrueBlue.com

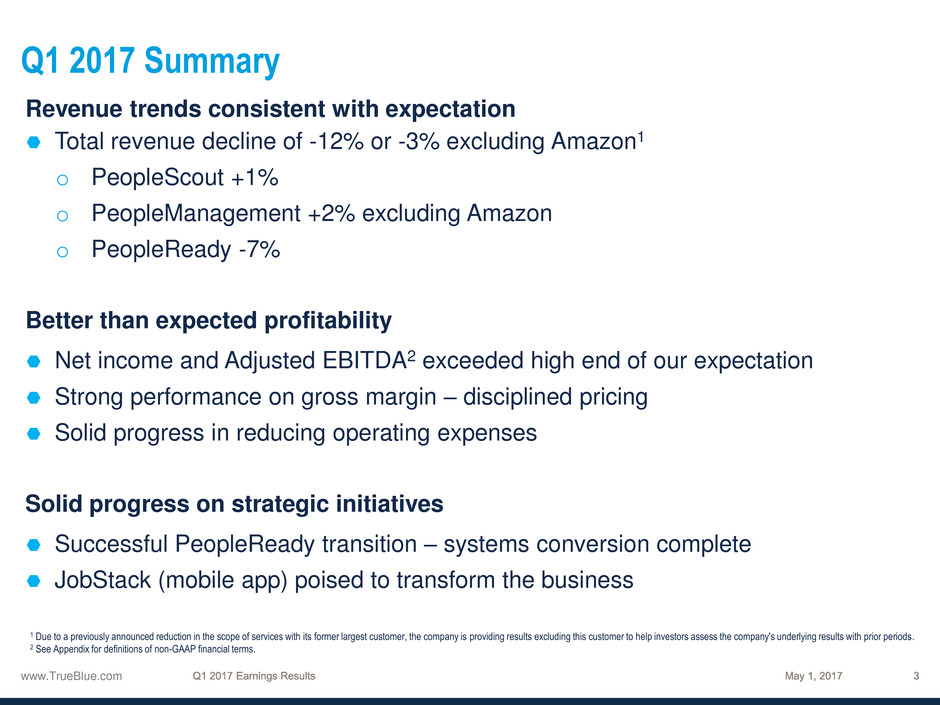

Q1 2017 Summary

Revenue trends consistent with expectation

Total revenue decline of -12% or -3% excluding Amazon1

o PeopleScout +1%

o PeopleManagement +2% excluding Amazon

o PeopleReady -7%

Better than expected profitability

Net income and Adjusted EBITDA2 exceeded high end of our expectation

Strong performance on gross margin – disciplined pricing

Solid progress in reducing operating expenses

Solid progress on strategic initiatives

Successful PeopleReady transition – systems conversion complete

JobStack (mobile app) poised to transform the business

1 Due to a previously announced reduction in the scope of services with its former largest customer, the company is providing results excluding this customer to help investors assess the company's underlying results with prior periods.

2 See Appendix for definitions of non-GAAP financial terms.

www.TrueBlue.com

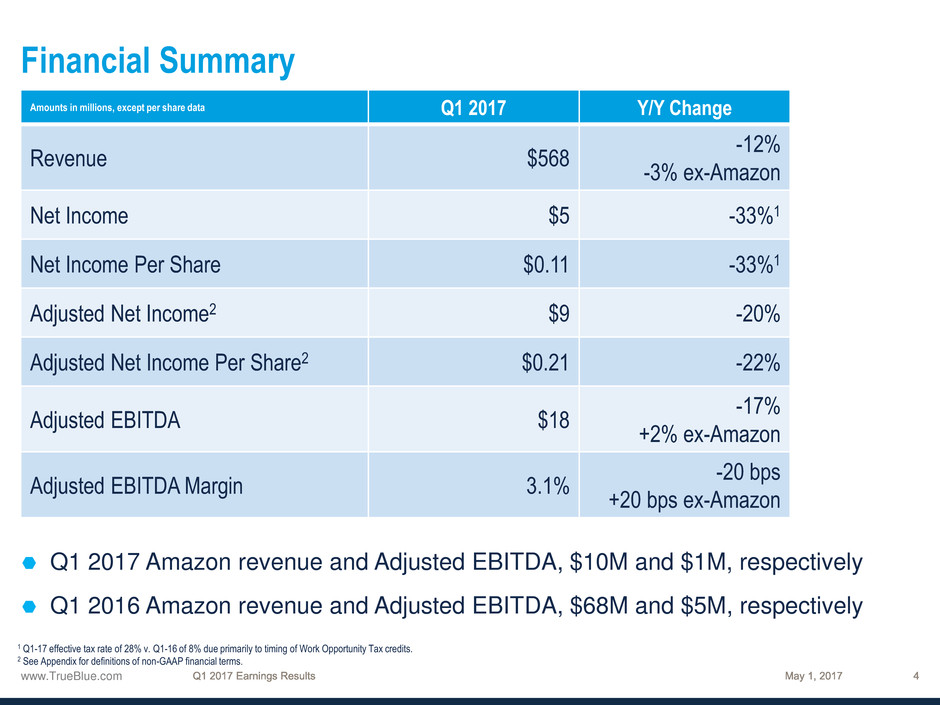

Financial Summary

Q1 2017 Amazon revenue and Adjusted EBITDA, $10M and $1M, respectively

Q1 2016 Amazon revenue and Adjusted EBITDA, $68M and $5M, respectively

Amounts in millions, except per share data Q1 2017 Y/Y Change

Revenue $568

-12%

-3% ex-Amazon

Net Income $5 -33%1

Net Income Per Share $0.11 -33%1

Adjusted Net Income2 $9 -20%

Adjusted Net Income Per Share2 $0.21 -22%

Adjusted EBITDA $18

-17%

+2% ex-Amazon

Adjusted EBITDA Margin 3.1%

-20 bps

+20 bps ex-Amazon

1 Q1-17 effective tax rate of 28% v. Q1-16 of 8% due primarily to timing of Work Opportunity Tax credits.

2 See Appendix for definitions of non-GAAP financial terms.

www.TrueBlue.com

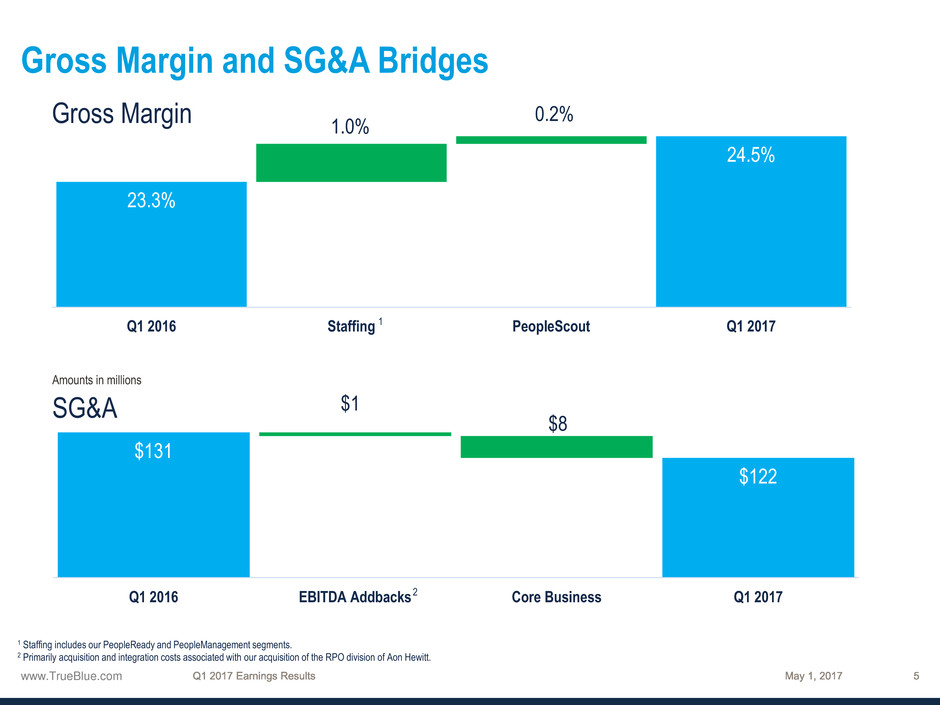

Gross Margin and SG&A Bridges

SG&A

Amounts in millions

Gross Margin

23.3%

24.5%

1.0%

0.2%

Q1 2016 Staffing PeopleScout Q1 2017

$131

$122

$1

$8

Q1 2016 EBITDA Addbacks Core Business Q1 2017

1

1 Staffing includes our PeopleReady and PeopleManagement segments.

2 Primarily acquisition and integration costs associated with our acquisition of the RPO division of Aon Hewitt.

2

www.TrueBlue.com

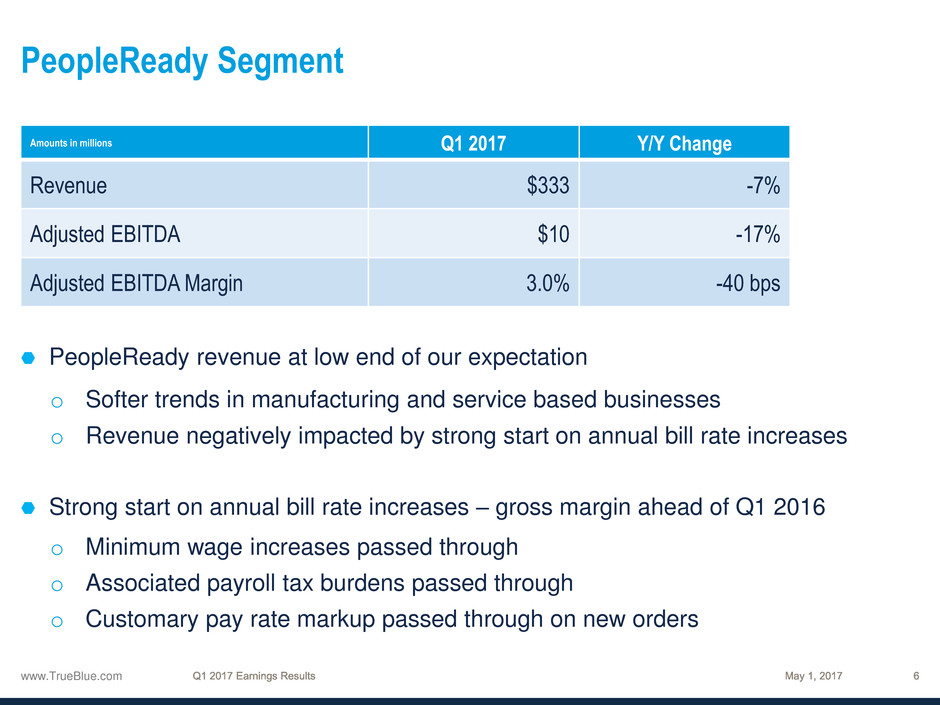

PeopleReady Segment

PeopleReady revenue at low end of our expectation

o Softer trends in manufacturing and service based businesses

o Revenue negatively impacted by strong start on annual bill rate increases

Strong start on annual bill rate increases – gross margin ahead of Q1 2016

o Minimum wage increases passed through

o Associated payroll tax burdens passed through

o Customary pay rate markup passed through on new orders

Amounts in millions Q1 2017 Y/Y Change

Revenue $333 -7%

Adjusted EBITDA $10 -17%

Adjusted EBITDA Margin 3.0% -40 bps

www.TrueBlue.com

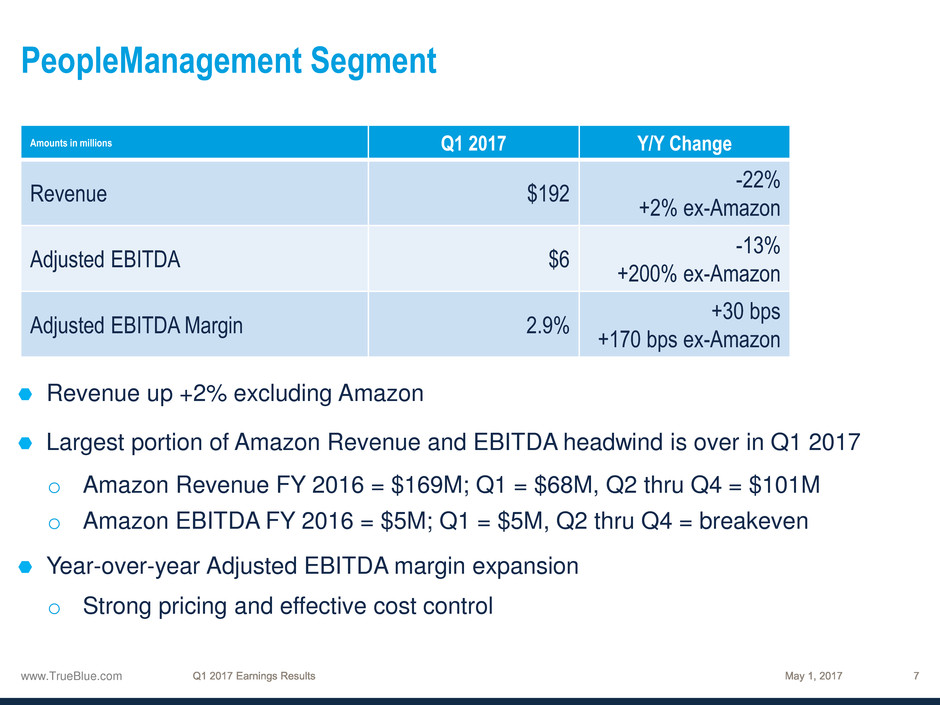

PeopleManagement Segment

Amounts in millions Q1 2017 Y/Y Change

Revenue $192

-22%

+2% ex-Amazon

Adjusted EBITDA $6

-13%

+200% ex-Amazon

Adjusted EBITDA Margin 2.9%

+30 bps

+170 bps ex-Amazon

Revenue up +2% excluding Amazon

Largest portion of Amazon Revenue and EBITDA headwind is over in Q1 2017

o Amazon Revenue FY 2016 = $169M; Q1 = $68M, Q2 thru Q4 = $101M

o Amazon EBITDA FY 2016 = $5M; Q1 = $5M, Q2 thru Q4 = breakeven

Year-over-year Adjusted EBITDA margin expansion

o Strong pricing and effective cost control

www.TrueBlue.com

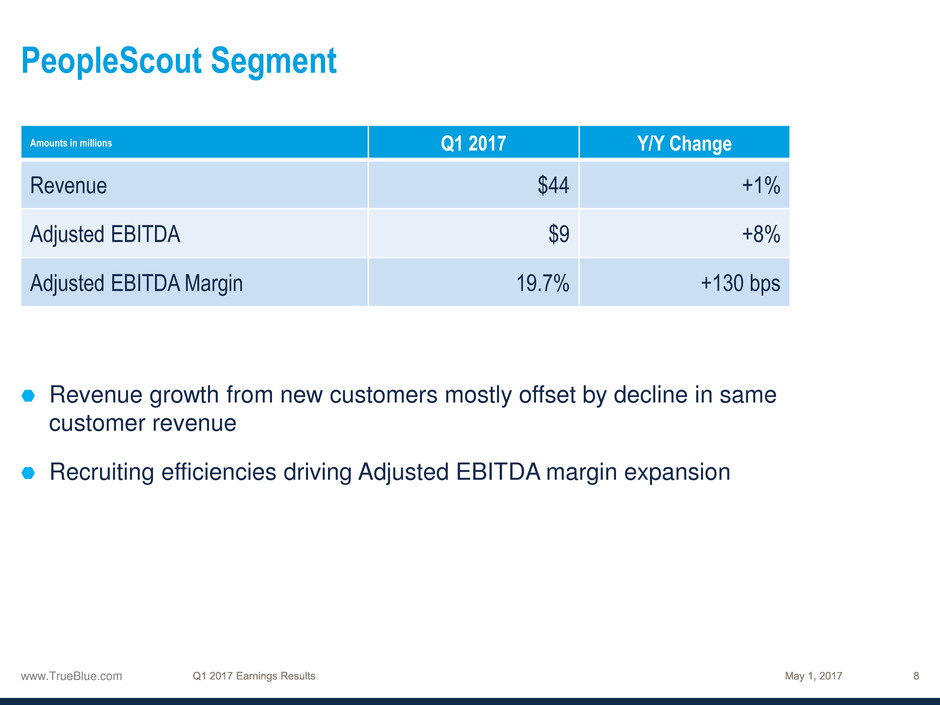

PeopleScout Segment

Revenue growth from new customers mostly offset by decline in same

customer revenue

Recruiting efficiencies driving Adjusted EBITDA margin expansion

Amounts in millions Q1 2017 Y/Y Change

Revenue $44 +1%

Adjusted EBITDA $9 +8%

Adjusted EBITDA Margin 19.7% +130 bps

www.TrueBlue.com

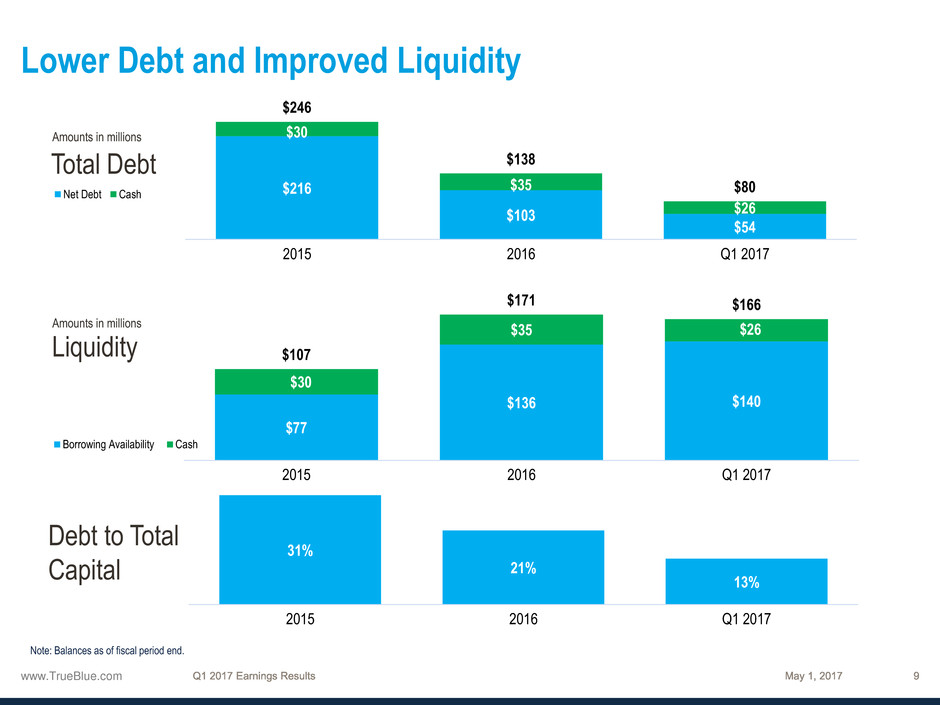

$216

$103

$54

$30

$35

$26

$246

$138

$80

2015 2016 Q1 2017

Net Debt Cash

$77

$136 $140

$30

$35 $26

$107

$171 $166

2015 2016 Q1 2017

Borrowing Availability Cash

Lower Debt and Improved Liquidity

31%

21%

13%

2015 2016 Q1 2017

Total Debt

Liquidity

Debt to Total

Capital

Amounts in millions

Amounts in millions

Note: Balances as of fiscal period end.

www.TrueBlue.com

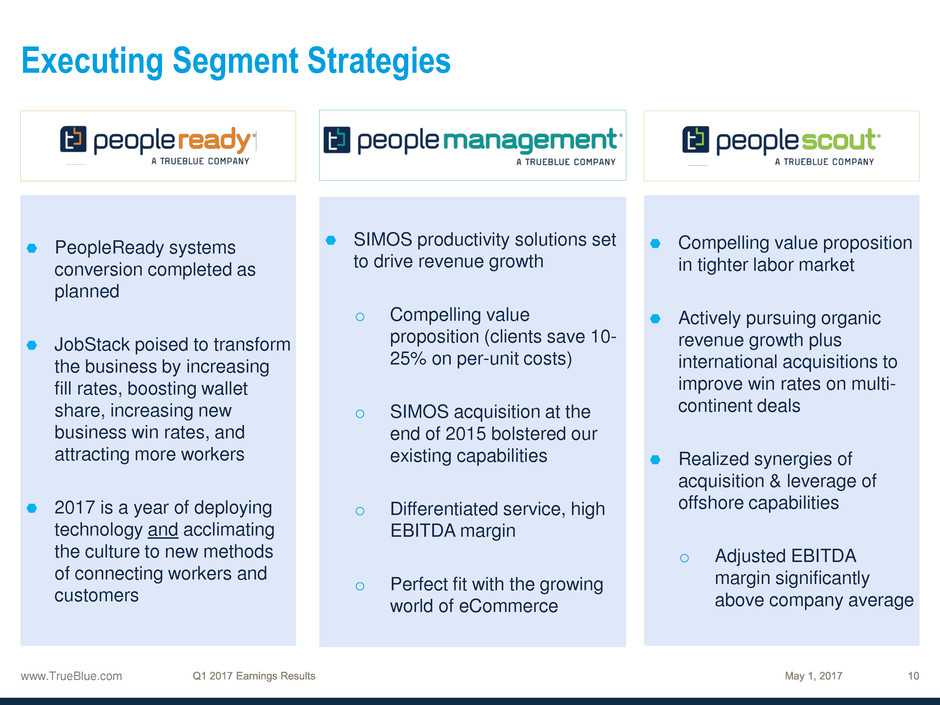

Executing Segment Strategies

PeopleReady systems

conversion completed as

planned

JobStack poised to transform

the business by increasing

fill rates, boosting wallet

share, increasing new

business win rates, and

attracting more workers

2017 is a year of deploying

technology and acclimating

the culture to new methods

of connecting workers and

customers

SIMOS productivity solutions set

to drive revenue growth

o Compelling value

proposition (clients save 10-

25% on per-unit costs)

o SIMOS acquisition at the

end of 2015 bolstered our

existing capabilities

o Differentiated service, high

EBITDA margin

o Perfect fit with the growing

world of eCommerce

Compelling value proposition

in tighter labor market

Actively pursuing organic

revenue growth plus

international acquisitions to

improve win rates on multi-

continent deals

Realized synergies of

acquisition & leverage of

offshore capabilities

o Adjusted EBITDA

margin significantly

above company average

www.TrueBlue.com

www.TrueBlue.com

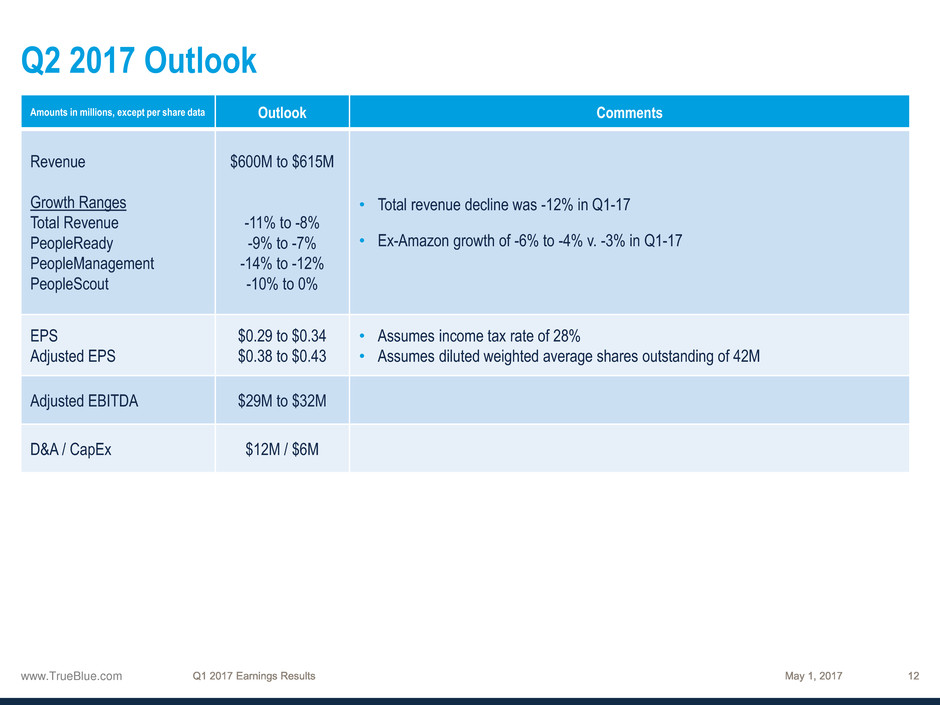

Q2 2017 Outlook

Amounts in millions, except per share data Outlook Comments

Revenue

Growth Ranges

Total Revenue

PeopleReady

PeopleManagement

PeopleScout

$600M to $615M

-11% to -8%

-9% to -7%

-14% to -12%

-10% to 0%

• Total revenue decline was -12% in Q1-17

• Ex-Amazon growth of -6% to -4% v. -3% in Q1-17

EPS

Adjusted EPS

$0.29 to $0.34

$0.38 to $0.43

• Assumes income tax rate of 28%

• Assumes diluted weighted average shares outstanding of 42M

Adjusted EBITDA $29M to $32M

D&A / CapEx $12M / $6M

www.TrueBlue.com

www.TrueBlue.com

Non-GAAP Terms and Definitions

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes interest, taxes, depreciation and

amortization. Adjusted EBITDA further excludes from EBITDA costs related to acquisition and integration costs and

Work Opportunity Tax Credit third-party processing fees. EBITDA and Adjusted EBITDA are key measures used by

management to assess performance and, in our opinion, enhance comparability and provide investors with useful insight into

the underlying trends of the business. EBITDA and Adjusted EBITDA should not be considered measures of financial

performance in isolation or as an alternative to Income from operations in the Consolidated Statements of Operations in

accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

Adjusted net income and Adjusted net income per diluted share are non-GAAP financial measures, which exclude from Net

income and Net income on a per diluted share basis, costs related to acquisition and integration costs, amortization of

intangibles of acquired businesses as well as accretion expense related to acquisition earn-out, tax effect of each adjustment

to U.S. GAAP Net income, and adjusts income taxes to the expected ongoing effective tax rate. Adjusted net income and

Adjusted net income per diluted share are key measures used by management to assess performance and, in our opinion,

enhance comparability and provide investors with useful insight into the underlying trends of the business. Adjusted net

income and Adjusted net income per diluted share should not be considered measures of financial performance in isolation

or as an alternative to net income or net income per diluted share in the Consolidated Statements of Operations in accordance

with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

See “Financials” in the Investors section of our web site at www.trueblue.com for a full reconciliation of non-GAAP financial

measures to U.S. GAAP financial results.

May 1, 2017