www.TrueBlue.com

www.TrueBlue.com

Forward-Looking Statements

This document contains forward-looking statements relating to our plans and expectations, all of which are subject to risks and

uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this release and

involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our

forward-looking statements. We presently consider the following to be important factors that could cause actual results to differ

materially from the company’s expectations: (1) national and global economic conditions, (2) our ability to attract and retain

customers, (3) our ability to maintain profit margins, (4) new laws and regulations that could have a material effect on our operations

or financial results, (5) our ability to successfully complete and integrate acquisitions. Other information regarding factors that could

affect our results is included in our SEC filings, including the company's most recent reports on Forms 10-K and 10-Q, copies of

which may be obtained by visiting our on our website at www.trueblue.com under the Investor Relations section or the SEC's

website at www.sec.gov. We assume no duty to update or revise any forward-looking statements contained in this release.

In addition, we use several non-GAAP financial measures when presenting our financial results in this release. Please refer to the

reconciliations between our GAAP and non-GAAP financial measures included below and on our website at www.trueblue.com

under the Investor Relations section for a complete perspective on both current and historical periods. Any comparisons made to

other periods today are based on a comparison to the same period in the prior year unless otherwise stated.

Use of estimates and forecasts:

Any references made to fiscal 2017 are based on management’s outlook issued February 8, 2017, and are included for

informational purposes only. We assume no obligation to update or revise any forward-looking statement, whether as a result of new

information, future events, or otherwise, except as required by law. Any other reference to future financial estimates are included for

informational purposes only and subject to risk factors discussed in our most recent filings with the Securities Exchange

Commission.

Financial Comparisons

All comparisons are to prior year periods unless stated otherwise.

www.TrueBlue.com

Q4 2016 Summary

14-week revenue and net income decline of -9% and -36%, respectively

Comparable 13-week revenue1 decline of -14%, or +5% growth excluding Amazon

Comparable 13-week revenue of $701M v. comparable 13-week outlook of $670M to $686M

Comparable 13-week adjusted EBITDA2 -12% with margin expansion of 10 bps

Disciplined pricing and cost management

Acquisitions accretive to adjusted EBITDA margin

Successful performance of acquisitions

Exceeded original full-year adjusted EBITDA targets

1 As previously disclosed, the company’s fiscal fourth quarter includes a 14th week and the week-ending date has been moved from Friday to the following Sunday, Jan 1st to better align with the work week of our customers. The

impact of the extra week is an EBITDA loss of approximately $1 million. All figures in this presentation are given on a 14-week and 53-week GAAP basis unless specifically noted.

2 See Appendix for definitions of non-GAAP financial terms.

www.TrueBlue.com

4 Comparable basis excludes the 14th week from Q4 2016 and Fiscal Year 2016 to be comparable to the prior year 13-week Q4 and 52-week fiscal year.

2 Organic calculations exclude acquired businesses from results.

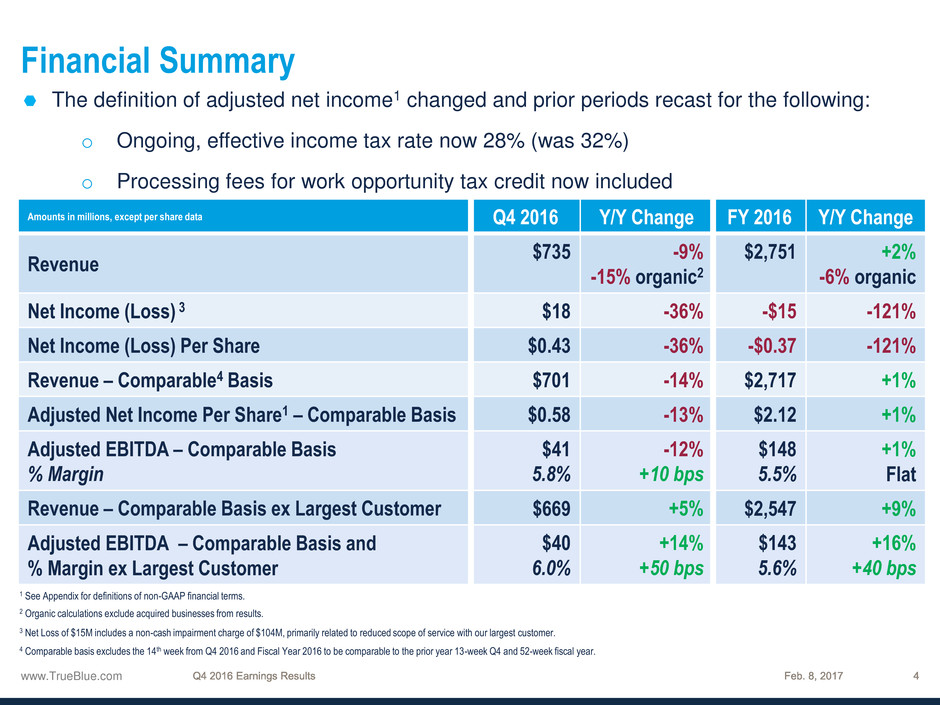

Financial Summary

The definition of adjusted net income1 changed and prior periods recast for the following:

o Ongoing, effective income tax rate now 28% (was 32%)

o Processing fees for work opportunity tax credit now included

1 See Appendix for definitions of non-GAAP financial terms.

Amounts in millions, except per share data Q4 2016 Y/Y Change FY 2016 Y/Y Change

Revenue

$735

-9%

-15% organic2

$2,751

+2%

-6% organic

Net Income (Loss) 3 $18 -36% -$15 -121%

Net Income (Loss) Per Share $0.43 -36% -$0.37 -121%

Revenue – Comparable4 Basis $701 -14% $2,717 +1%

Adjusted Net Income Per Share1 – Comparable Basis $0.58 -13% $2.12 +1%

Adjusted EBITDA – Comparable Basis

% Margin

$41

5.8%

-12%

+10 bps

$148

5.5%

+1%

Flat

Revenue – Comparable Basis ex Largest Customer $669 +5% $2,547 +9%

Adjusted EBITDA – Comparable Basis and

% Margin ex Largest Customer

$40

6.0%

+14%

+50 bps

$143

5.6%

+16%

+40 bps

3 Net Loss of $15M includes a non-cash impairment charge of $104M, primarily related to reduced scope of service with our largest customer.

www.TrueBlue.com

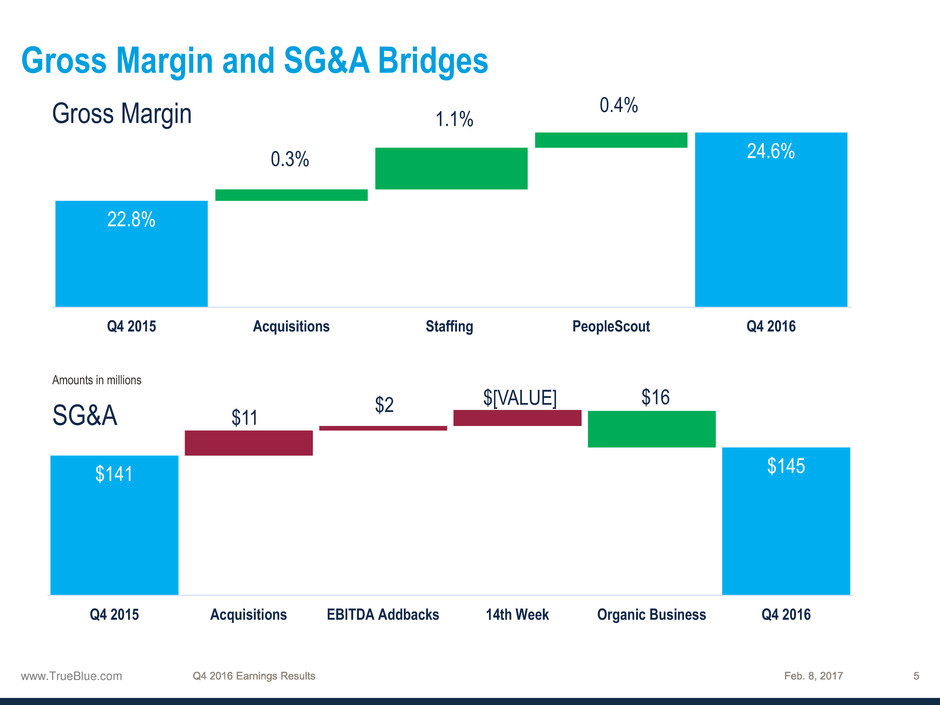

Gross Margin and SG&A Bridges

SG&A

Amounts in millions

Gross Margin

22.8%

24.6% 0.3%

1.1%

0.4%

Q4 2015 Acquisitions Staffing PeopleScout Q4 2016

$141 $145

$11

$2 $[VALUE] $16

Q4 2015 Acquisitions EBITDA Addbacks 14th Week Organic Business Q4 2016

www.TrueBlue.com

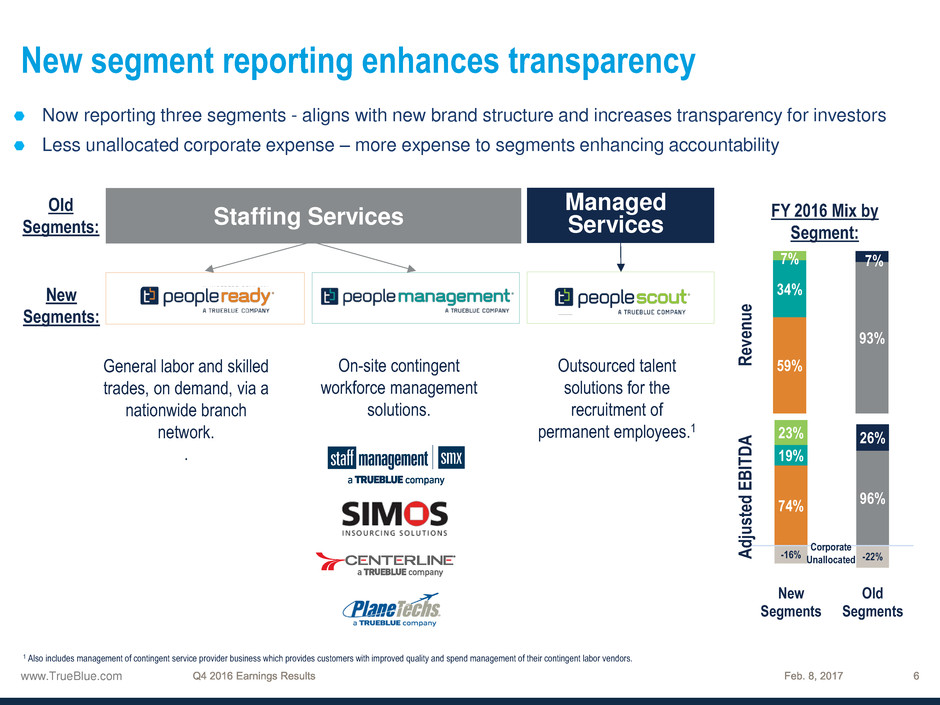

New segment reporting enhances transparency

Now reporting three segments - aligns with new brand structure and increases transparency for investors

Less unallocated corporate expense – more expense to segments enhancing accountability

New

Segments:

FY 2016 Mix by

Segment:

General labor and skilled

trades, on demand, via a

nationwide branch

network.

.

On-site contingent

workforce management

solutions.

Outsourced talent

solutions for the

recruitment of

permanent employees.1

59%

34%

7%

93%

7%

74%

19%

23%

-16% -22%

96%

26%

New

Segments

Old

Segments

R

ev

en

u

e

Ad

ju

sted

EBI

T

D

A

Staffing Services

Managed

Services

Old

Segments:

1 Also includes management of contingent service provider business which provides customers with improved quality and spend management of their contingent labor vendors.

Corporate

Unallocated

www.TrueBlue.com

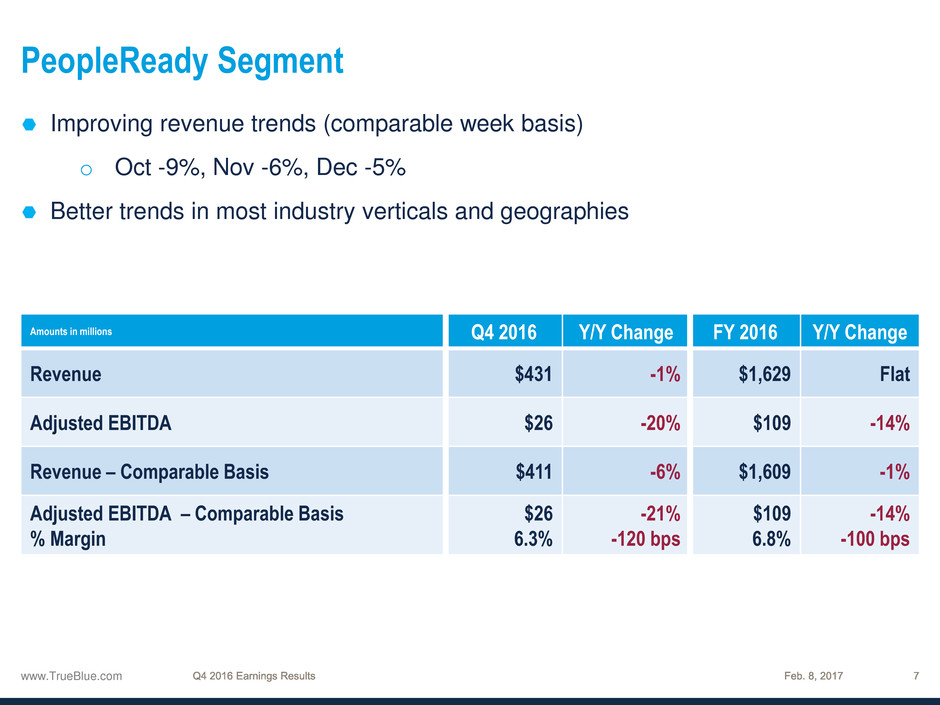

PeopleReady Segment

Amounts in millions Q4 2016 Y/Y Change FY 2016 Y/Y Change

Revenue $431 -1% $1,629 Flat

Adjusted EBITDA $26 -20% $109 -14%

Revenue – Comparable Basis $411 -6% $1,609 -1%

Adjusted EBITDA – Comparable Basis

% Margin

$26

6.3%

-21%

-120 bps

$109

6.8%

-14%

-100 bps

Improving revenue trends (comparable week basis)

o Oct -9%, Nov -6%, Dec -5%

Better trends in most industry verticals and geographies

www.TrueBlue.com

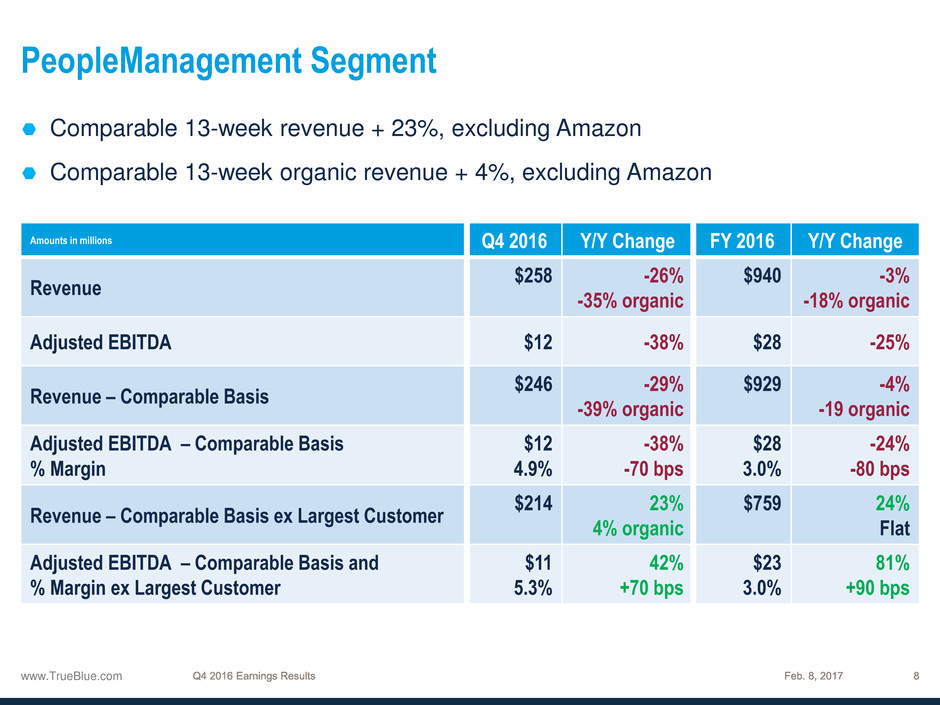

PeopleManagement Segment

Comparable 13-week revenue + 23%, excluding Amazon

Comparable 13-week organic revenue + 4%, excluding Amazon

Amounts in millions Q4 2016 Y/Y Change FY 2016 Y/Y Change

Revenue

$258

-26%

-35% organic

$940

-3%

-18% organic

Adjusted EBITDA $12 -38% $28 -25%

Revenue – Comparable Basis

$246

-29%

-39% organic

$929

-4%

-19 organic

Adjusted EBITDA – Comparable Basis

% Margin

$12

4.9%

-38%

-70 bps

$28

3.0%

-24%

-80 bps

Revenue – Comparable Basis ex Largest Customer

$214

23%

4% organic

$759

24%

Flat

Adjusted EBITDA – Comparable Basis and

% Margin ex Largest Customer

$11

5.3%

42%

+70 bps

$23

3.0%

81%

+90 bps

www.TrueBlue.com

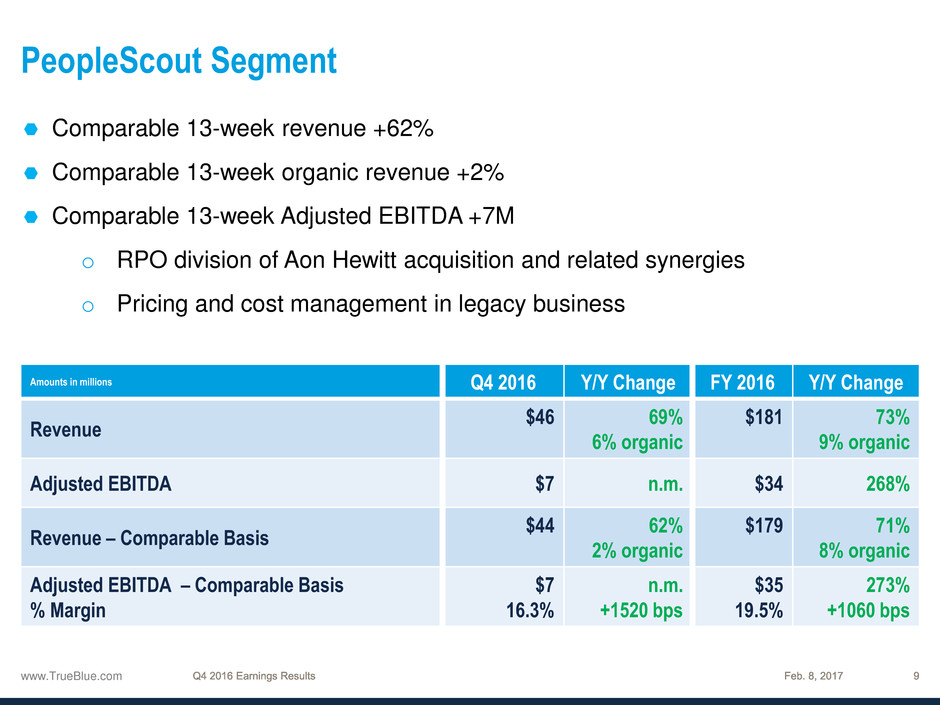

PeopleScout Segment

Amounts in millions Q4 2016 Y/Y Change FY 2016 Y/Y Change

Revenue

$46

69%

6% organic

$181

73%

9% organic

Adjusted EBITDA $7 n.m. $34 268%

Revenue – Comparable Basis

$44

62%

2% organic

$179

71%

8% organic

Adjusted EBITDA – Comparable Basis

% Margin

$7

16.3%

n.m.

+1520 bps

$35

19.5%

273%

+1060 bps

Comparable 13-week revenue +62%

Comparable 13-week organic revenue +2%

Comparable 13-week Adjusted EBITDA +7M

o RPO division of Aon Hewitt acquisition and related synergies

o Pricing and cost management in legacy business

www.TrueBlue.com

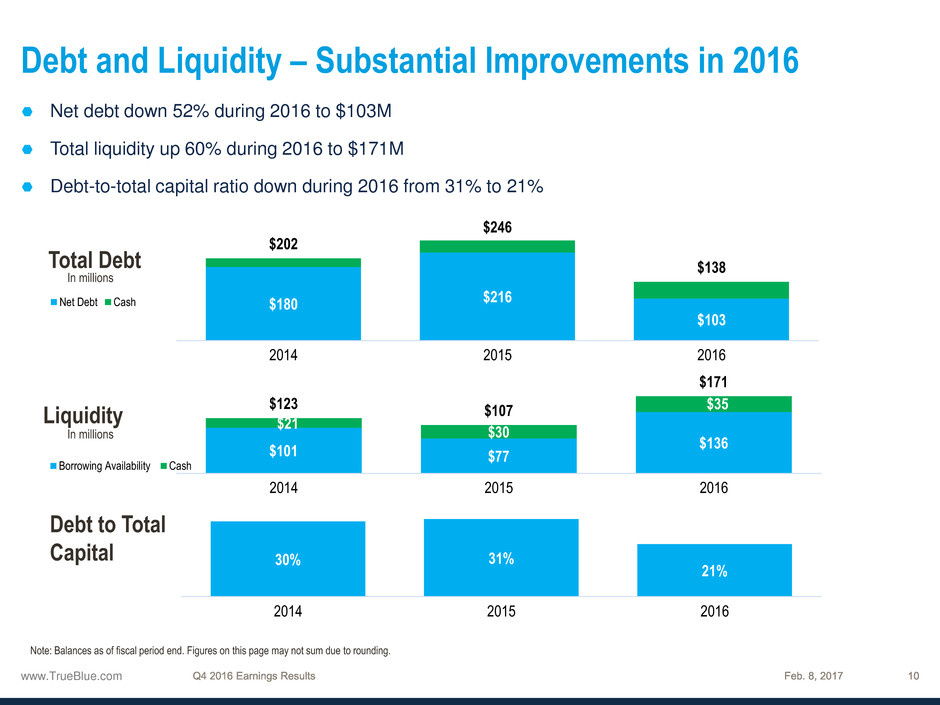

$180 $216

$103

$202

$246

$138

2014 2015 2016

Net Debt Cash

$101 $77

$136

$21

$30

$35 $123 $107

$171

2014 2015 2016

Borrowing Availability Cash

Debt and Liquidity – Substantial Improvements in 2016

30% 31%

21%

2014 2015 2016

Total Debt

Liquidity

Debt to Total

Capital

In millions

In millions

Note: Balances as of fiscal period end. Figures on this page may not sum due to rounding.

Net debt down 52% during 2016 to $103M

Total liquidity up 60% during 2016 to $171M

Debt-to-total capital ratio down during 2016 from 31% to 21%

www.TrueBlue.com

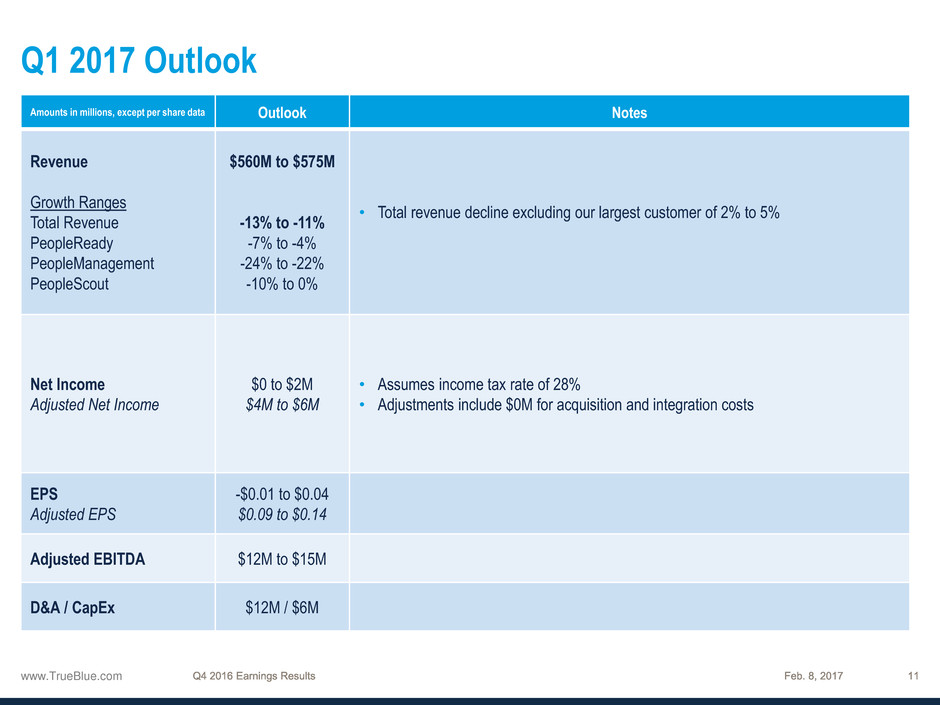

Q1 2017 Outlook

Amounts in millions, except per share data Outlook Notes

Revenue

Growth Ranges

Total Revenue

PeopleReady

PeopleManagement

PeopleScout

$560M to $575M

-13% to -11%

-7% to -4%

-24% to -22%

-10% to 0%

• Total revenue decline excluding our largest customer of 2% to 5%

Net Income

Adjusted Net Income

$0 to $2M

$4M to $6M

• Assumes income tax rate of 28%

• Adjustments include $0M for acquisition and integration costs

EPS

Adjusted EPS

-$0.01 to $0.04

$0.09 to $0.14

Adjusted EBITDA $12M to $15M

D&A / CapEx $12M / $6M

www.TrueBlue.com

www.TrueBlue.com

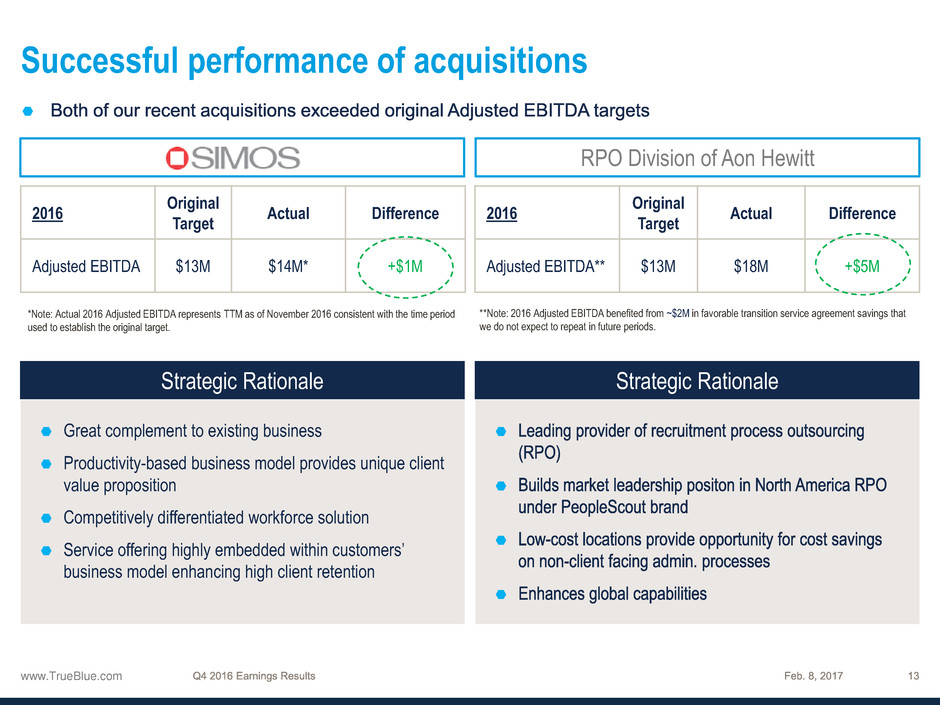

Successful performance of acquisitions

Strategic Rationale

Great complement to existing business

Productivity-based business model provides unique client

value proposition

Competitively differentiated workforce solution

Service offering highly embedded within customers’

business model enhancing high client retention

Strategic Rationale

2016

Original

Target

Actual Difference

Adjusted EBITDA $13M $14M* +$1M

RPO Division of Aon Hewitt SIMOS

2016

Original

Target

Actual Difference

Adjusted EBITDA** $13M $18M +$5M

**Note: 2016 Adjusted EBITDA benefited from ~$2M in favorable transition service agreement savings that

we do not expect to repeat in future periods.

*Note: Actual 2016 Adjusted EBITDA represents TTM as of November 2016 consistent with the time period

used to establish the original target.

www.TrueBlue.com

Non-GAAP Terms and Definitions

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes interest, taxes, depreciation and amortization.

Adjusted EBITDA further excludes from EBITDA, costs related to acquisition and integration, goodwill and intangible asset

impairment charges, other charges, and Work Opportunity Tax Credit third-party processing fees. EBITDA and Adjusted EBITDA

are key measures used by management to assess performance and, in our opinion, enhance comparability and provide investors

with useful insight into the underlying trends of the business. EBITDA and Adjusted EBITDA should not be considered measures of

financial performance in isolation or as an alternative to Income from operations in the Consolidated Statements of Operations in

accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

Adjusted net income and adjusted net income per diluted share are non-GAAP financial measures which exclude from net income

and net income on a per diluted share basis costs related to acquisition and integration, goodwill and intangible asset impairment

charges, other charges, amortization of intangibles of acquired businesses as well as accretion expense related to acquisition

earn-out, tax effect of each adjustment to U.S. GAAP net income, and adjusts income taxes to the expected ongoing effective tax

rate. Adjusted net income and adjusted net income per diluted share are key measures used by management to assess

performance and, in our opinion, enhance comparability and provide investors with useful insight into the underlying trends of the

business. Adjusted net income and adjusted net income per diluted share should not be considered measures of financial

performance in isolation or as an alternative to net income or net income per diluted share in the Consolidated Statements of

Operations in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

See “Financials” in the Investors section of our web site at www.trueblue.com for a full reconciliation of non-GAAP financial

measures to U.S. GAAP financial results.

Feb. 8, 2017