www.TrueBlue.com

www.TrueBlue.com

Forward-Looking Statements

October 19, 2016

www.TrueBlue.com

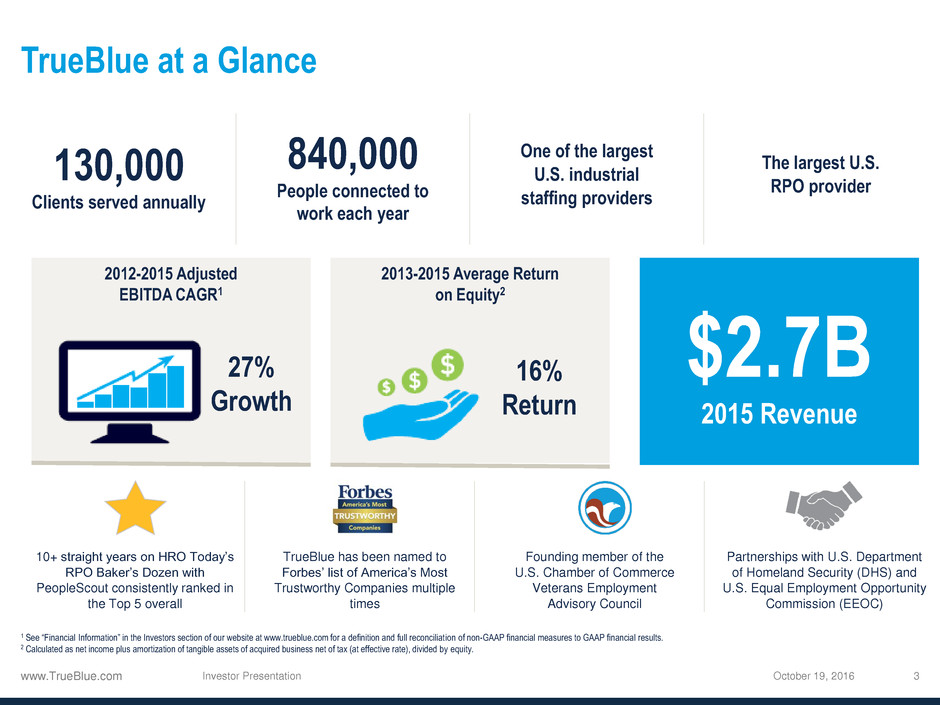

TrueBlue at a Glance

October 19, 2016 Investor Presentation 3

130,000

Clients served annually

840,000

People connected to

work each year

One of the largest

U.S. industrial

staffing providers

The largest U.S.

RPO provider

2013-2015 Average Return

on Equity2

2012-2015 Adjusted

EBITDA CAGR1

$2.7B

2015 Revenue

27%

Growth

16%

Return

10+ straight years on HRO Today’s

RPO Baker’s Dozen with

PeopleScout consistently ranked in

the Top 5 overall

TrueBlue has been named to

Forbes’ list of America’s Most

Trustworthy Companies multiple

times

Founding member of the

U.S. Chamber of Commerce

Veterans Employment

Advisory Council

Partnerships with U.S. Department

of Homeland Security (DHS) and

U.S. Equal Employment Opportunity

Commission (EEOC)

1 See “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full reconciliat ion of non-GAAP financial measures to GAAP financial results.

2 Calculated as net income plus amortization of tangible assets of acquired business net of tax (at effective rate), divided by equity.

www.TrueBlue.com

The TrueBlue Growth Story

October 19, 2016

www.TrueBlue.com

Investment Highlights

www.TrueBlue.com

Specialized Service Offerings to Meet Client Needs

October 19, 2016

Staffing Services Managed Services

www.TrueBlue.com

Solving Talent Challenges

October 19, 2016

complex

global

diverse

age 65

will be almost

double

73%

www.TrueBlue.com

Compelling Market Trends Driving Growth

October 19, 2016

CAGR

8%

Industry Highlights

Industry Highlights

Staffing Services Managed Services

CAGR

15%

2011 – 2015

www.TrueBlue.com

Construction Manufacturing Transport & Wholesale Retail

In

d

u

s

tr

y

D

y

n

a

m

ic

s

Construction Upside Potential Industrial Production Still Strong Wholesale Trade At New High Retail Trade Continued Growth

Source: U.S. Census Bureau Source: U.S. Board of Governors of the Federal Reserve System (FRB) Source: Bureau of Labor Statistics Source: US Census Bureau

-

1

1

2

2

3

20

05

20

06

20

07

20

07

20

08

20

09

20

10

20

11

20

12

20

12

20

13

20

14

20

15

20

16

Residential Housing Permits

Millions

80

85

90

95

100

105

110

20

05

20

06

20

07

20

07

20

08

20

09

20

10

20

11

20

12

20

12

20

13

20

14

20

15

20

16

Industrial Production

Index

275

325

375

425

20

05

20

05

20

06

20

07

20

08

20

09

20

10

20

10

20

11

20

12

20

13

20

14

20

15

20

15

Retail Sales

Billions

4.0

4.1

4.2

4.3

4.4

4.5

4.6

4.7

4.8

4.9

5.0

20

05

20

06

20

07

20

07

20

08

20

09

20

10

20

11

20

12

20

12

20

13

20

14

20

15

20

16

Transportation and Warehousing Employment

Millions

Serving Growing Vertical Markets

October 19, 2016

www.TrueBlue.com

Strategic Priorities

October 19, 2016

www.TrueBlue.com

Growth Strategies

October 19, 2016

www.TrueBlue.com

www.TrueBlue.com

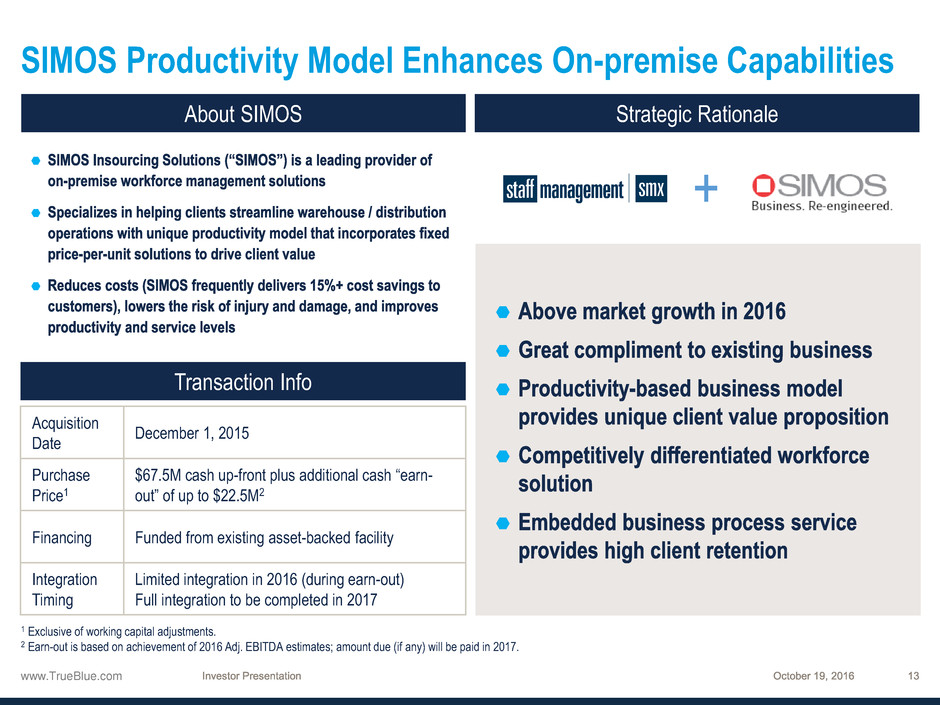

SIMOS Productivity Model Enhances On-premise Capabilities

Transaction Info

Acquisition

Date

December 1, 2015

Purchase

Price1

$67.5M cash up-front plus additional cash “earn-

out” of up to $22.5M2

Financing Funded from existing asset-backed facility

Integration

Timing

Limited integration in 2016 (during earn-out)

Full integration to be completed in 2017

1 Exclusive of working capital adjustments.

2 Earn-out is based on achievement of 2016 Adj. EBITDA estimates; amount due (if any) will be paid in 2017.

+

About SIMOS Strategic Rationale

www.TrueBlue.com

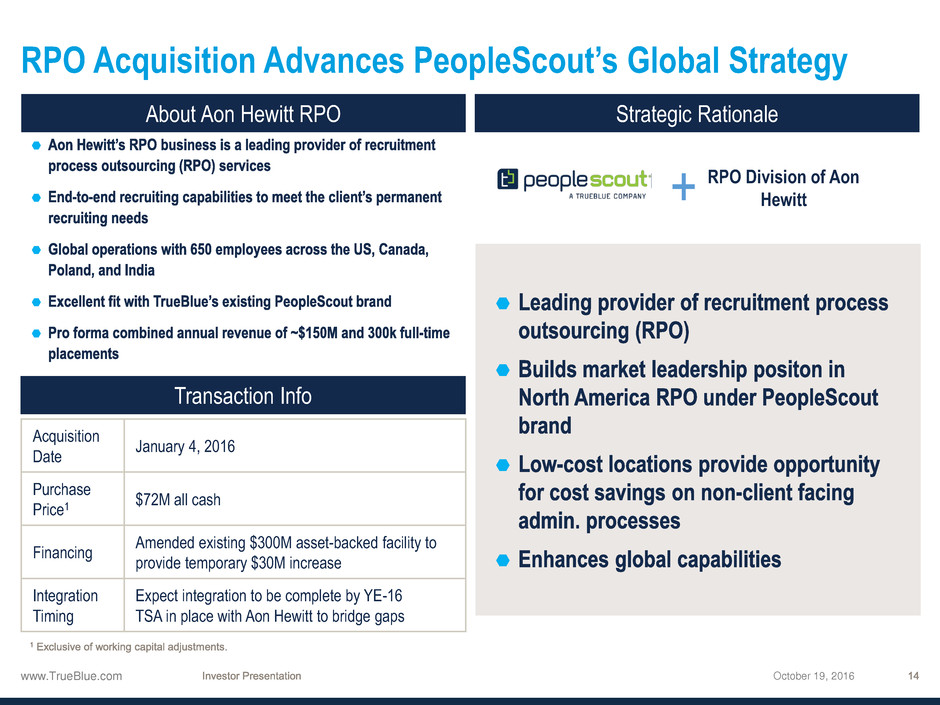

RPO Acquisition Advances PeopleScout’s Global Strategy

October 19, 2016

+

Acquisition

Date

January 4, 2016

Purchase

Price1

$72M all cash

Financing

Amended existing $300M asset-backed facility to

provide temporary $30M increase

Integration

Timing

Expect integration to be complete by YE-16

TSA in place with Aon Hewitt to bridge gaps

RPO Division of Aon

Hewitt

Transaction Info

About Aon Hewitt RPO Strategic Rationale

www.TrueBlue.com

www.TrueBlue.com

Non-GAAP Terms and Definitions

October 19, 2016

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes interest, taxes, depreciation and amortization.

Adjusted EBITDA further excludes from EBITDA, costs related to acquisition and integration, goodwill and intangible asset impairment

charges, other charges, and Work Opportunity Tax Credit third-party processing fees. EBITDA and Adjusted EBITDA are key measures

used by management to assess performance and, in our opinion, enhance comparability and provide investors with useful insight into

the underlying trends of the business. EBITDA and Adjusted EBITDA should not be considered measures of financial performance in

isolation or as an alternative to Income from operations in the Consolidated Statements of Operations in accordance with U.S. GAAP,

and may not be comparable to similarly titled measures of other companies.

Adjusted net income and adjusted net income per diluted share are non-GAAP financial measures which exclude from net income and

net income on a per diluted share basis costs related to acquisition and integration, goodwill and intangible asset impairment charges,

other charges, Work Opportunity Tax Credit third-party processing fees, amortization of intangibles of acquired businesses as well as

accretion expense related to acquisition earn-out, tax effect of each adjustment to U.S. GAAP net income, and adjusts income taxes to

the expected ongoing effective tax rate. Adjusted net income and adjusted net income per diluted share are key measures used by

management to assess performance and, in our opinion, enhance comparability and provide investors with useful insight into the

underlying trends of the business. Adjusted net income and adjusted net income per diluted share should not be considered measures

of financial performance in isolation or as an alternative to net income or net income per diluted share in the Consolidated Statements

of Operations in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

See “Financials” in the Investors section of our web site at www.trueblue.com for a full reconciliation of non-GAAP financial measures

to U.S. GAAP financial results.