February 3, 2016 Q4 2015 Earnings Results

Forward-Looking Statement Certain statements made by us in this presentation that are not historical facts or that relate to future plans, events or performances are forward-looking statements that reflect management’s current outlook for future periods, including statements regarding future financial performance. These forward-looking statements are based upon our current expectations, and our actual results may differ materially from those described or contemplated in the forward–looking statements. Factors that may cause our actual results to differ materially from those contained in the forward-looking statements, include without limitation the following: 1) national and global economic conditions, including the impact of changes in national and global credit markets and other changes that affect our customers; 2) our ability to continue to attract and retain customers and maintain profit margins in the face of new and existing competition; 3) new laws and regulations that could have a materially adverse effect on our operations and financial results; 4) increased costs and collateral requirements in connection with our insurance obligations, including workers’ compensation insurance; 5) our continuing ability to comply with the financial covenants of our credit agreement; 6) our ability to attract and retain qualified employees in key positions or to find temporary and permanent employees with the right skills to fulfill the needs of our customers; 7) our ability to successfully complete and integrate acquisitions that we may make; and 8) other risks described in our most recent filings with the Securities and Exchange Commission. Use of estimates and forecasts: Any references made to fiscal 2016 are based on management guidance issued February 3, 2016, and are included for informational purposes only and are not an update or reaffirmation. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other reference to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the Securities Exchange Commission. Financial Comparisons All comparisons are to prior year periods unless stated otherwise. Q4 2015 Earnings Results | Feb. 3, 2016 2

Q4 2015 Growth Highlights • Organic growth accelerated to 14% vs. 8% in Q3 2015 o Construction – double-digit growth o Small to medium size customers – mid-single digit growth vs. flat Q3 2015 o On-premise – acceleration in double-digit growth trend o National customers –double-digit growth, slower growth at end of quarter o Manufacturing – low-single digit decline vs. high single-digit decline Q3 2015 • Completed two acquisitions1 expanding capabilities in on-premise management and recruitment process outsourcing • Renewal of WOTC2 reduces expected income tax rate from 38% to 32% for the next four years; Adjusted EBITDA3 and Adjusted EPS3 calculations have been modified: 1. Both measures now exclude WOTC processing fees, and 2. Adjusted EPS uses the new expected income tax rate of 32% 3 Q4 2015 Earnings Results | Feb. 3, 2016 1 SIMOS Insourcing Solutions acquired on December 1, 2015. Aon Hewitt RPO purchase agreement signed December 2015, but closed January 4, 2016. 2 Protecting Americans From Tax Hikes Act of 2015 extended the Work Opportunity Tax Credit (WOTC) retroactively from January 1, 2015 through December 31, 2019. 3 See Appendix for definitions of non-GAAP financial terms.

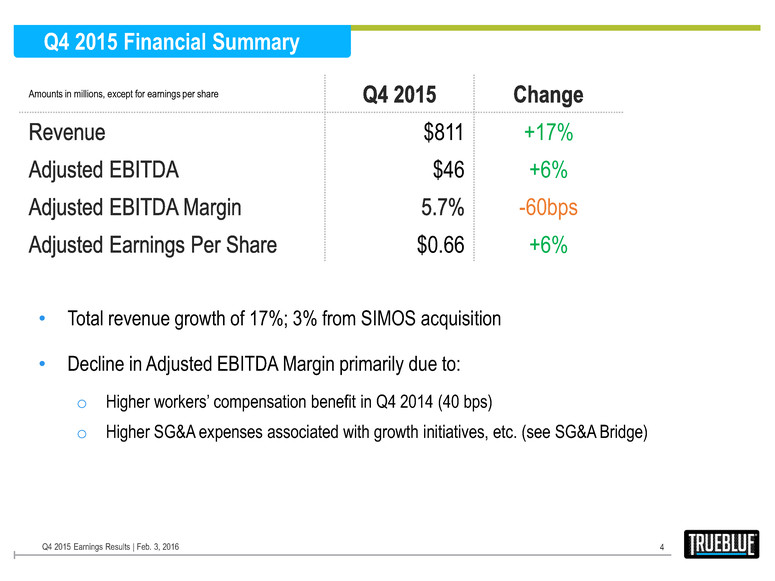

Q4 2015 Financial Summary 4 Amounts in millions, except for earnings per share $811 +17% $46 +6% -60bps $0.66 +6% • Total revenue growth of 17%; 3% from SIMOS acquisition • Decline in Adjusted EBITDA Margin primarily due to: o Higher workers’ compensation benefit in Q4 2014 (40 bps) o Higher SG&A expenses associated with growth initiatives, etc. (see SG&A Bridge) Q4 2015 Earnings Results | Feb. 3, 2016

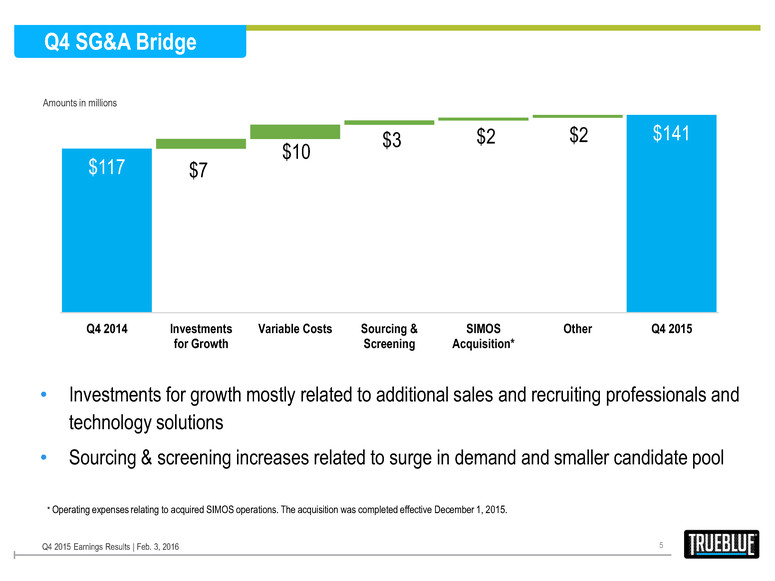

5 Q4 SG&A Bridge $117 $141 $7 $10 $3 $2 $2 Q4 2014 Investments for Growth Variable Costs Sourcing & Screening SIMOS Acquisition* Other Q4 2015 • Investments for growth mostly related to additional sales and recruiting professionals and technology solutions • Sourcing & screening increases related to surge in demand and smaller candidate pool Q4 2015 Earnings Results | Feb. 3, 2016 * Operating expenses relating to acquired SIMOS operations. The acquisition was completed effective December 1, 2015. Amounts in millions

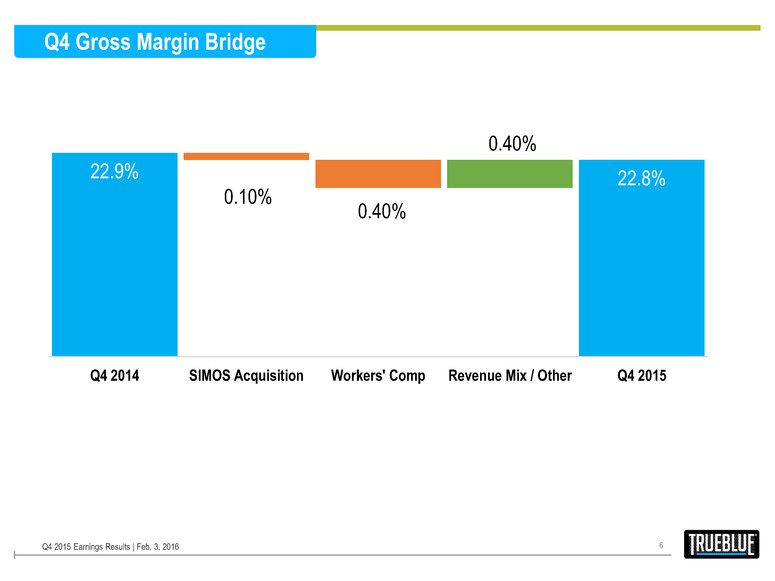

6 Q4 Gross Margin Bridge 22.9% 22.8% 0.10% 0.40% 0.40% Q4 2014 SIMOS Acquisition Workers' Comp Revenue Mix / Other Q4 2015 Q4 2015 Earnings Results | Feb. 3, 2016

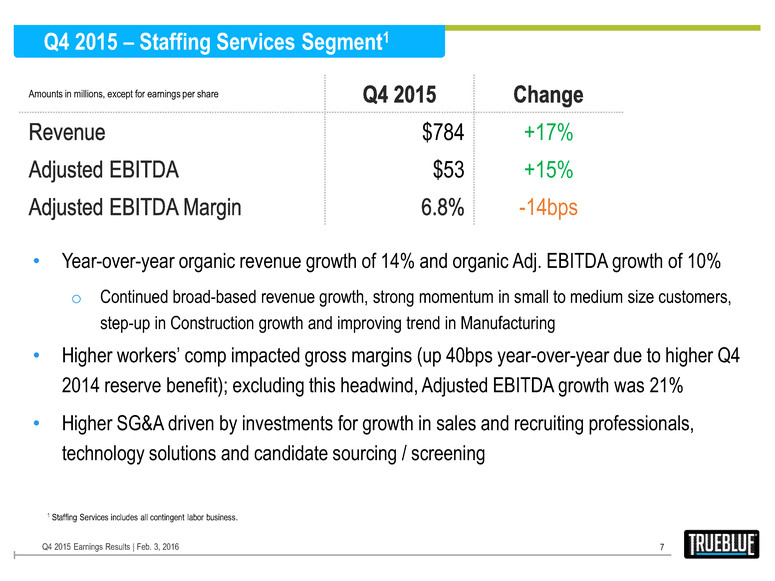

Q4 2015 – Staffing Services Segment1 7 Amounts in millions, except for earnings per share $784 +17% $53 +15% -14bps • Year-over-year organic revenue growth of 14% and organic Adj. EBITDA growth of 10% o Continued broad-based revenue growth, strong momentum in small to medium size customers, step-up in Construction growth and improving trend in Manufacturing • Higher workers’ comp impacted gross margins (up 40bps year-over-year due to higher Q4 2014 reserve benefit); excluding this headwind, Adjusted EBITDA growth was 21% • Higher SG&A driven by investments for growth in sales and recruiting professionals, technology solutions and candidate sourcing / screening Q4 2015 Earnings Results | Feb. 3, 2016 1 Staffing Services includes all contingent labor business.

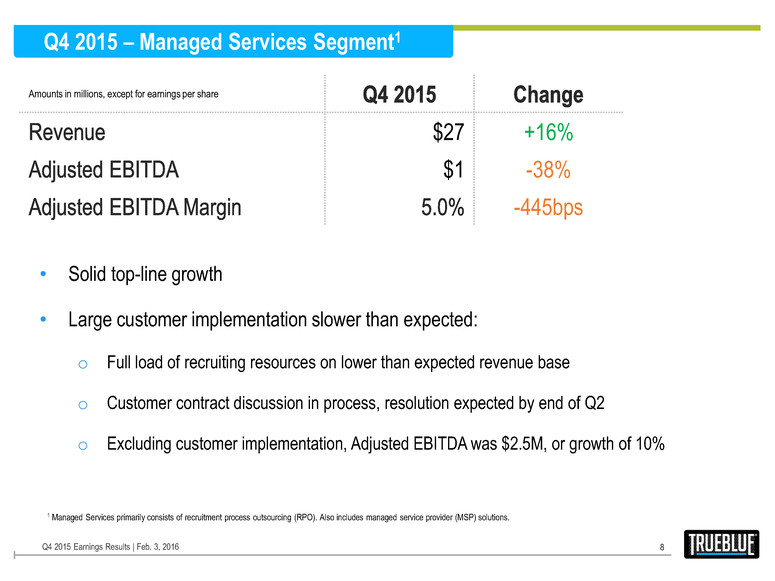

Q4 2015 – Managed Services Segment1 8 Amounts in millions, except for earnings per share $27 +16% $1 -38% -445bps • Solid top-line growth • Large customer implementation slower than expected: o Full load of recruiting resources on lower than expected revenue base o Customer contract discussion in process, resolution expected by end of Q2 o Excluding customer implementation, Adjusted EBITDA was $2.5M, or growth of 10% Q4 2015 Earnings Results | Feb. 3, 2016 1 Managed Services primarily consists of recruitment process outsourcing (RPO). Also includes managed service provider (MSP) solutions.

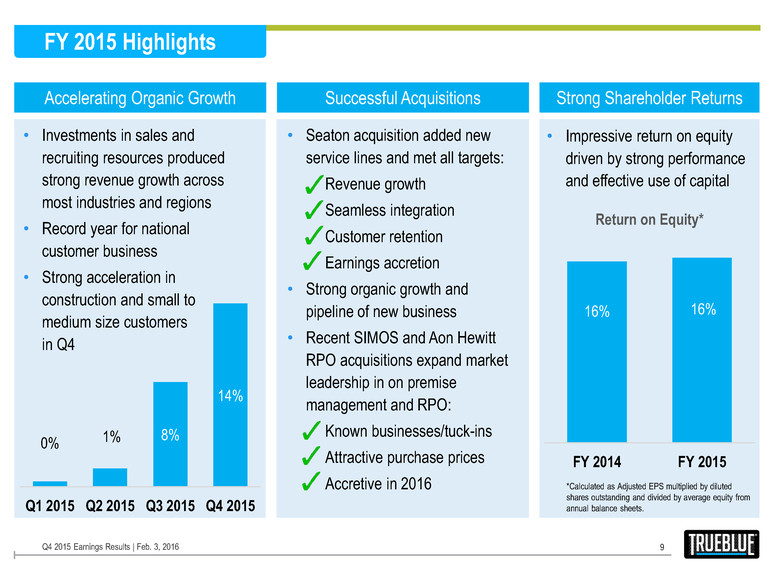

0% 1% 8% 14% Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Highlights 9 Q4 2015 Earnings Results | Feb. 3, 2016 Accelerating Organic Growth Successful Acquisitions Strong Shareholder Returns • Investments in sales and recruiting resources produced strong revenue growth across most industries and regions • Record year for national customer business • Strong acceleration in construction and small to medium size customers in Q4 • Seaton acquisition added new service lines and met all targets: Revenue growth Seamless integration Customer retention Earnings accretion • Strong organic growth and pipeline of new business • Recent SIMOS and Aon Hewitt RPO acquisitions expand market leadership in on premise management and RPO: Known businesses/tuck-ins Attractive purchase prices Accretive in 2016 • Impressive return on equity driven by strong performance and effective use of capital 16% 16% FY 2014 FY 2015 Return on Equity* *Calculated as Adjusted EPS multiplied by diluted shares outstanding and divided by average equity from annual balance sheets.

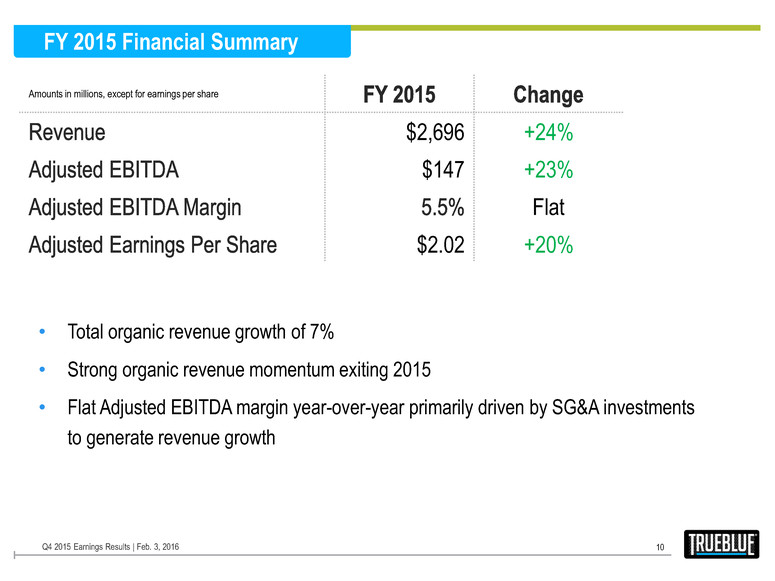

FY 2015 Financial Summary 10 Amounts in millions, except for earnings per share $2,696 +24% $147 +23% Flat $2.02 +20% • Total organic revenue growth of 7% • Strong organic revenue momentum exiting 2015 • Flat Adjusted EBITDA margin year-over-year primarily driven by SG&A investments to generate revenue growth Q4 2015 Earnings Results | Feb. 3, 2016

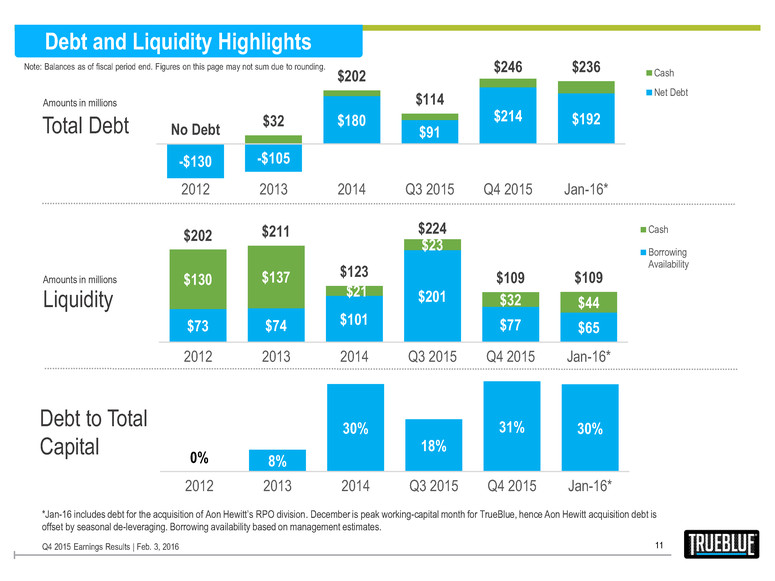

0% 8% 30% 18% 31% 30% 2012 2013 2014 Q3 2015 Q4 2015 Jan-16* -$130 -$105 $180 $91 $214 $192 No Debt $32 $202 $114 $246 $236 2012 2013 2014 Q3 2015 Q4 2015 Jan-16* Cash Net Debt Total Debt Liquidity Debt to Total Capital Amounts in millions Amounts in millions 11 *Jan-16 includes debt for the acquisition of Aon Hewitt’s RPO division. December is peak working-capital month for TrueBlue, hence Aon Hewitt acquisition debt is offset by seasonal de-leveraging. Borrowing availability based on management estimates. Debt and Liquidity Highlights $73 $74 $101 $201 $77 $65 $130 $137 $21 $23 $32 $44 $202 $211 $123 $224 $109 $109 2012 2013 2014 Q3 2015 Q4 2015 Jan-16* Cash Borrowing Availability Q4 2015 Earnings Results | Feb. 3, 2016 Note: Balances as of fiscal period end. Figures on this page may not sum due to rounding.

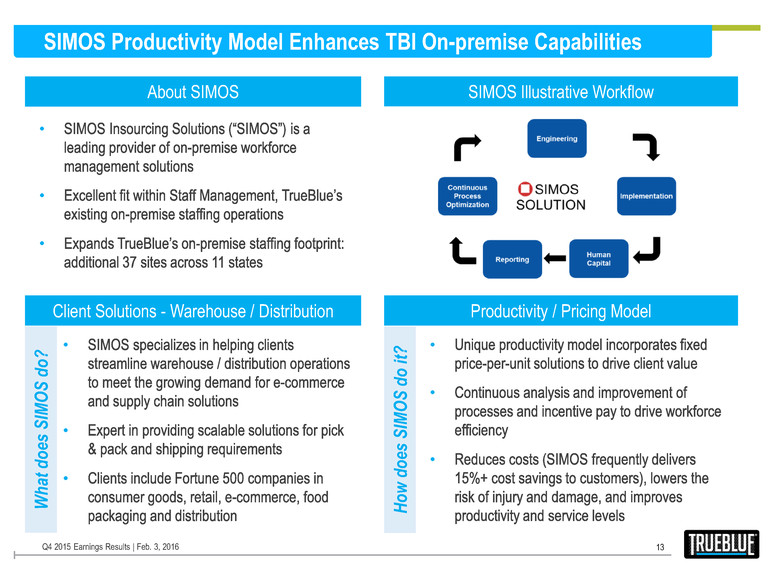

SIMOS Productivity Model Enhances TBI On-premise Capabilities 13 Q4 2015 Earnings Results | Feb. 3, 2016 • • • About SIMOS SIMOS Illustrative Workflow Client Solutions - Warehouse / Distribution Productivity / Pricing Model • • • • • • W h at d o es SI M O S d o ? Ho w d o es SI M O S d o it ?

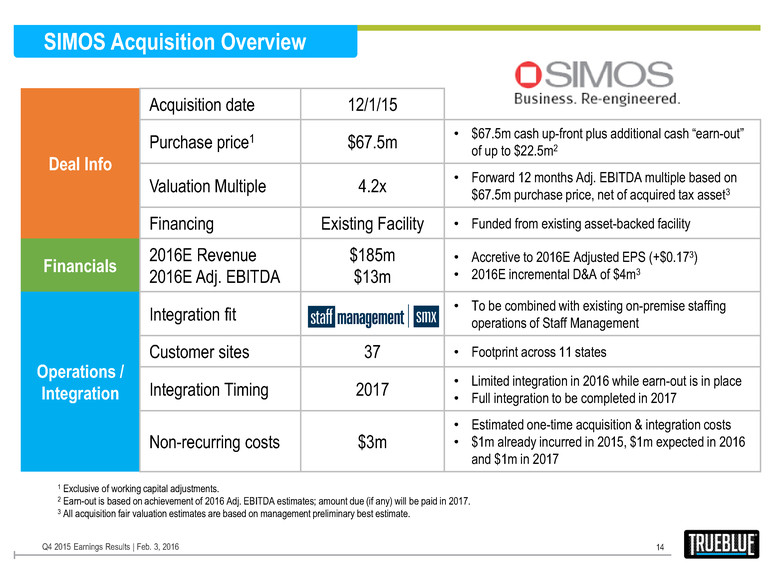

SIMOS Acquisition Overview 14 Q4 2015 Earnings Results | Feb. 3, 2016 Deal Info Acquisition date 12/1/15 Purchase price1 $67.5m • $67.5m cash up-front plus additional cash “earn-out” of up to $22.5m2 Valuation Multiple 4.2x • Forward 12 months Adj. EBITDA multiple based on $67.5m purchase price, net of acquired tax asset3 Financing Existing Facility • Funded from existing asset-backed facility Financials 2016E Revenue 2016E Adj. EBITDA $185m $13m • Accretive to 2016E Adjusted EPS (+$0.173) • 2016E incremental D&A of $4m3 Operations / Integration Integration fit • To be combined with existing on-premise staffing operations of Staff Management Customer sites 37 • Footprint across 11 states Integration Timing 2017 • Limited integration in 2016 while earn-out is in place • Full integration to be completed in 2017 Non-recurring costs $3m • Estimated one-time acquisition & integration costs • $1m already incurred in 2015, $1m expected in 2016 and $1m in 2017 1 Exclusive of working capital adjustments. 2 Earn-out is based on achievement of 2016 Adj. EBITDA estimates; amount due (if any) will be paid in 2017. 3 All acquisition fair valuation estimates are based on management preliminary best estimate.

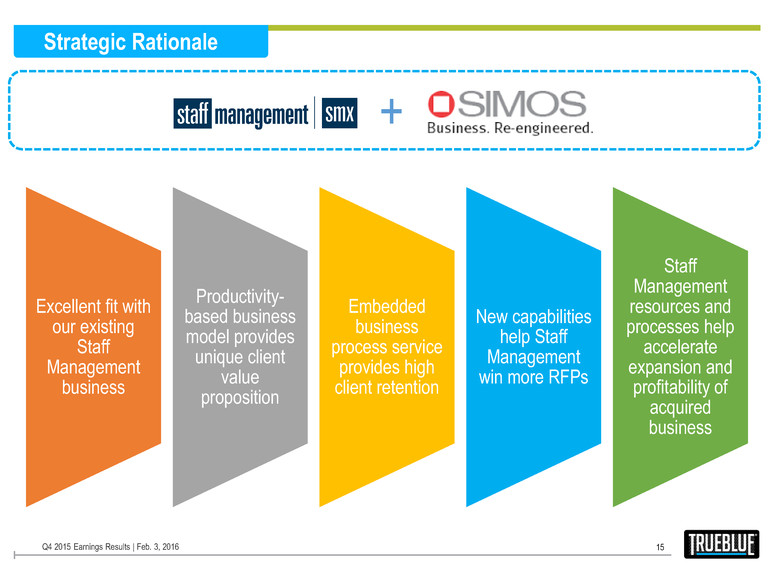

Strategic Rationale 15 Q4 2015 Earnings Results | Feb. 3, 2016 Excellent fit with our existing Staff Management business Productivity- based business model provides unique client value proposition Embedded business process service provides high client retention New capabilities help Staff Management win more RFPs Staff Management resources and processes help accelerate expansion and profitability of acquired business +

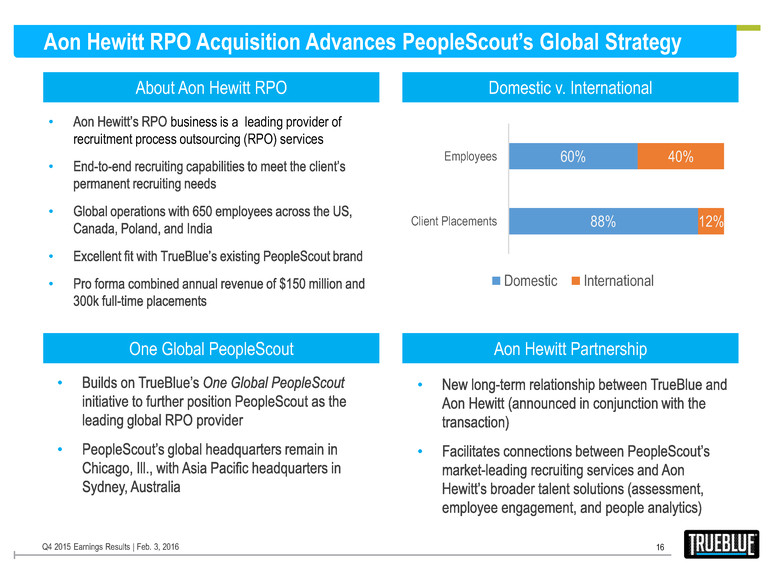

Aon Hewitt RPO Acquisition Advances PeopleScout’s Global Strategy 16 Q4 2015 Earnings Results | Feb. 3, 2016 • business is a leading provider of recruitment process outsourcing (RPO) services • • • • About Aon Hewitt RPO Domestic v. International One Global PeopleScout Aon Hewitt Partnership • • • • 88% 60% 12% 40% Client Placements Employees Domestic International

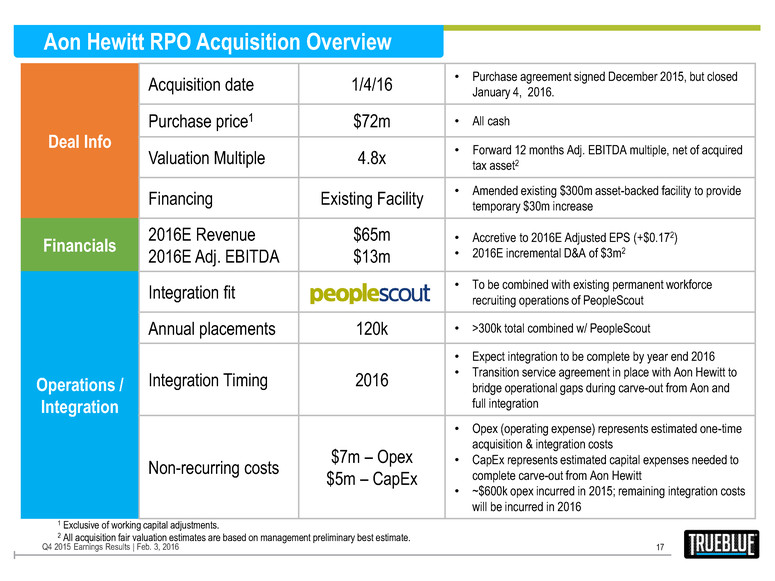

Deal Info Acquisition date 1/4/16 • Purchase agreement signed December 2015, but closed January 4, 2016. Purchase price1 $72m • All cash Valuation Multiple 4.8x • Forward 12 months Adj. EBITDA multiple, net of acquired tax asset2 Financing Existing Facility • Amended existing $300m asset-backed facility to provide temporary $30m increase Financials 2016E Revenue 2016E Adj. EBITDA $65m $13m • Accretive to 2016E Adjusted EPS (+$0.172) • 2016E incremental D&A of $3m2 Operations / Integration Integration fit • To be combined with existing permanent workforce recruiting operations of PeopleScout Annual placements 120k • >300k total combined w/ PeopleScout Integration Timing 2016 • Expect integration to be complete by year end 2016 • Transition service agreement in place with Aon Hewitt to bridge operational gaps during carve-out from Aon and full integration Non-recurring costs $7m – Opex $5m – CapEx • Opex (operating expense) represents estimated one-time acquisition & integration costs • CapEx represents estimated capital expenses needed to complete carve-out from Aon Hewitt • ~$600k opex incurred in 2015; remaining integration costs will be incurred in 2016 Aon Hewitt RPO Acquisition Overview 17 Q4 2015 Earnings Results | Feb. 3, 2016 1 Exclusive of working capital adjustments. 2 All acquisition fair valuation estimates are based on management preliminary best estimate.

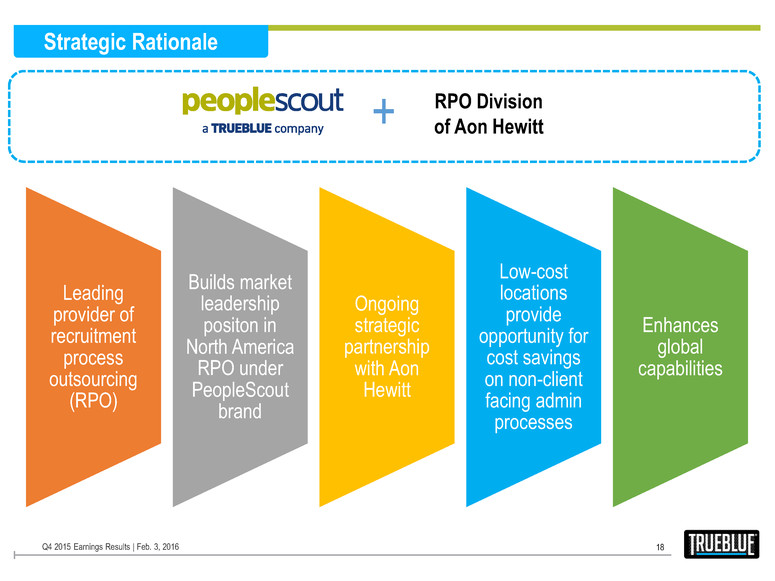

Strategic Rationale 18 Q4 2015 Earnings Results | Feb. 3, 2016 Leading provider of recruitment process outsourcing (RPO) Builds market leadership positon in North America RPO under PeopleScout brand Ongoing strategic partnership with Aon Hewitt Low-cost locations provide opportunity for cost savings on non-client facing admin processes Enhances global capabilities + RPO Division of Aon Hewitt

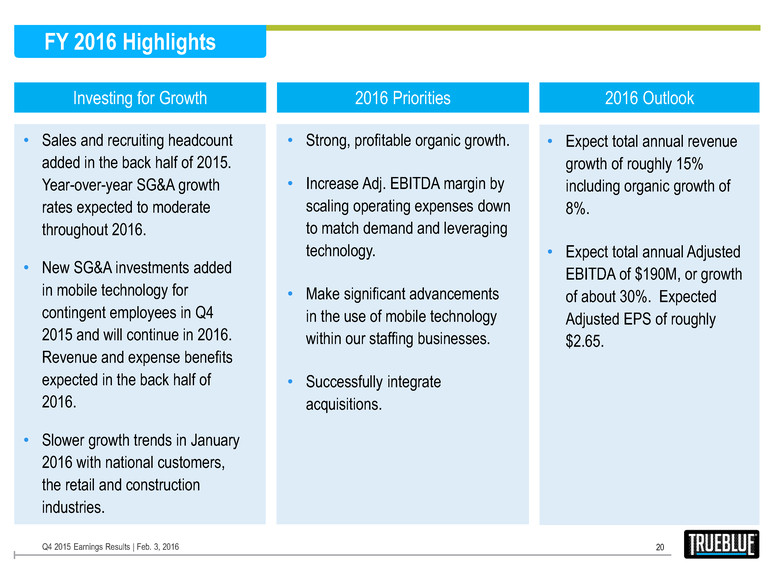

FY 2016 Highlights 20 Q4 2015 Earnings Results | Feb. 3, 2016 Investing for Growth 2016 Priorities 2016 Outlook • Sales and recruiting headcount added in the back half of 2015. Year-over-year SG&A growth rates expected to moderate throughout 2016. • New SG&A investments added in mobile technology for contingent employees in Q4 2015 and will continue in 2016. Revenue and expense benefits expected in the back half of 2016. • Slower growth trends in January 2016 with national customers, the retail and construction industries. • Top priority is strong, profitable organic growth • Make significant advancements in the use of mobile technology within our staffing businesses • Harness the benefit of 2015 investments and 2016 technology investments to drive progressively higher operating leverage throughout 2016. • Successfully integrate acquisitions. • Expect total annual revenue growth of roughly 15% including organic growth of 8%. • Expect total annual Adjusted EBITDA of $190M, or growth of about 30%. Expected Adjusted EPS of roughly $2.65. Strong, prof table organic growth. • Increase Adj. EBITDA margin by scaling operating expenses down to match demand and leveraging technology. • Make significant advancements in the use of mobile technology within our staffing businesses. • Successfully integrate acquisitions.

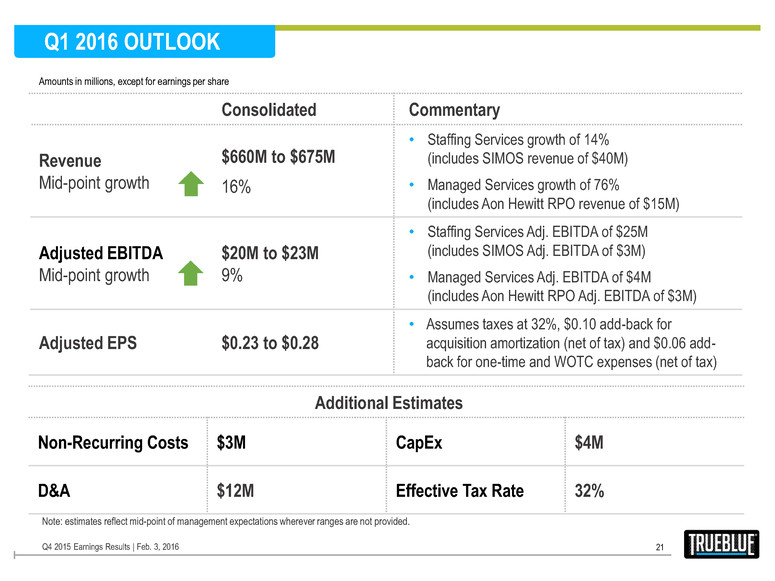

Consolidated Commentary Revenue Mid-point growth $660M to $675M 16% • Staffing Services growth of 14% (includes SIMOS revenue of $40M) • Managed Services growth of 76% (includes Aon Hewitt RPO revenue of $15M) Adjusted EBITDA Mid-point growth $20M to $23M 9% • Staffing Services Adj. EBITDA of $25M (includes SIMOS Adj. EBITDA of $3M) • Managed Services Adj. EBITDA of $4M (includes Aon Hewitt RPO Adj. EBITDA of $3M) Adjusted EPS $0.23 to $0.28 • Assumes taxes at 32%, $0.10 add-back for acquisition amortization (net of tax) and $0.06 add- back for one-time and WOTC expenses (net of tax) Amounts in millions, except for earnings per share Q1 2016 OUTLOOK 21 Q4 2015 Earnings Results | Feb. 3, 2016 Additional Estimates Non-Recurring Costs $3M CapEx $4M D&A $12M Effective Tax Rate 32% Note: estimates reflect mid-point of management expectations wherever ranges are not provided.

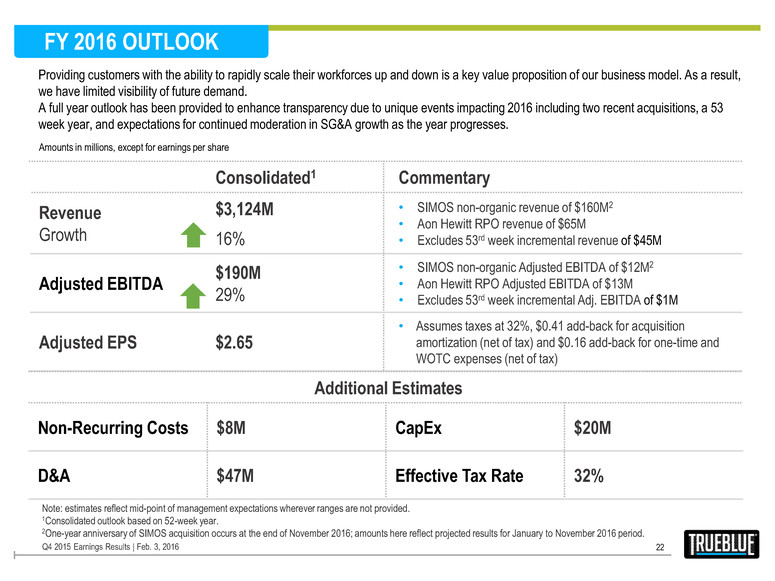

Consolidated1 Commentary Revenue Growth $3,124M 16% • SIMOS non-organic revenue of $160M2 • Aon Hewitt RPO revenue of $65M • Excludes 53rd week incremental revenue of $45M Adjusted EBITDA $190M 29% • SIMOS non-organic Adjusted EBITDA of $12M2 • Aon Hewitt RPO Adjusted EBITDA of $13M • Excludes 53rd week incremental Adj. EBITDA of $1M Adjusted EPS $2.65 • Assumes taxes at 32%, $0.41 add-back for acquisition amortization (net of tax) and $0.16 add-back for one-time and WOTC expenses (net of tax) Amounts in millions, except for earnings per share FY 2016 OUTLOOK 22 Q4 2015 Earnings Results | Feb. 3, 2016 Additional Estimates Non-Recurring Costs $8M CapEx $20M D&A $47M Effective Tax Rate 32% Note: estimates reflect mid-point of management expectations wherever ranges are not provided. 1Consolidated outlook based on 52-week year. 2One-year anniversary of SIMOS acquisition occurs at the end of November 2016; amounts here reflect projected results for January to November 2016 period. Providing customers with the ability to rapidly scale their workforces up and down is a key value proposition of our business model. As a result, we have limited visibility of future demand. A full year outlook has been provided to enhance transparency due to unique events impacting 2016 including two recent acquisitions, a 53 week year, and expectations for continued moderation in SG&A growth as the year progresses.

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes interest, taxes, depreciation and amortization from net income. Adjusted EBITDA further excludes from EBITDA non-recurring costs related to acquisition and integration costs, as well as, Work Opportunity Tax Credit third party processing fees. EBITDA and Adjusted EBITDA are key measures used by management to evaluate performance. EBITDA and Adjusted EBITDA should not be considered measures of financial performance in isolation or as an alternative to Income from operations in the Consolidated Statements of Operations in accordance with GAAP, and may not be comparable to similarly titled measures of other companies. Adjusted net income (loss) per diluted share is a non-GAAP financial measure which excludes from net income(loss) on a per diluted share basis non-recurring costs related to the purchase, integration, reorganization and shutdown activities related to acquisitions, net of tax, amortization of intangibles of acquired businesses, net of tax, as well as, Work Opportunity Tax Credit third party processing fees, net of tax, and adjusts income taxes to the expected ongoing effective rate. Adjusted net income(loss) per diluted share is a key measure used by management to evaluate performance and communicate comparable results. Adjusted net income(loss) per diluted share should not be considered a measure of financial performance in isolation or as an alternative to net income(loss) per diluted share in the Consolidated Statements of Operations in accordance with GAAP, and may not be comparable to similarly titled measures of other companies. See “Financials” in the Investors section of our web site at www.trueblue.com for a full reconciliation of non-GAAP financial measures to GAAP financial results. NON-GAAP TERMS AND DEFINITIONS 24 Q4 2015 Earnings Results | Feb. 3, 2016