Acquisition of Seaton June 2, 2014

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “should,” “expects,” “intends,” “projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates,” and similar expressions are used to identify these forward-looking statements. Examples of forward-looking statements include the expected completion of the acquisition, the time frame in which this will occur, the expected benefits of the acquisition and the expected financial performance of TrueBlue following the acquisition and statements relating to our future financial condition and operating results, as well as any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are the occurrence of any event, change or other circumstances that could give rise to the termination of the acquisition agreement, the risk that the closing conditions, including regulatory approval, may not be satisfied, risks related to disruption of management time from ongoing business operations due to the acquisition and failure to realize the benefits expected from the acquisition. Examples of additional factors can be found in our most recent filings with the Securities Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise any forward- looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Use of estimates and forecasts: Any references made to 2014 are based on guidance issued as of June 2nd. We assume no obligation to update or revise any forward- looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other reference to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the Securities Exchange Commission. 1

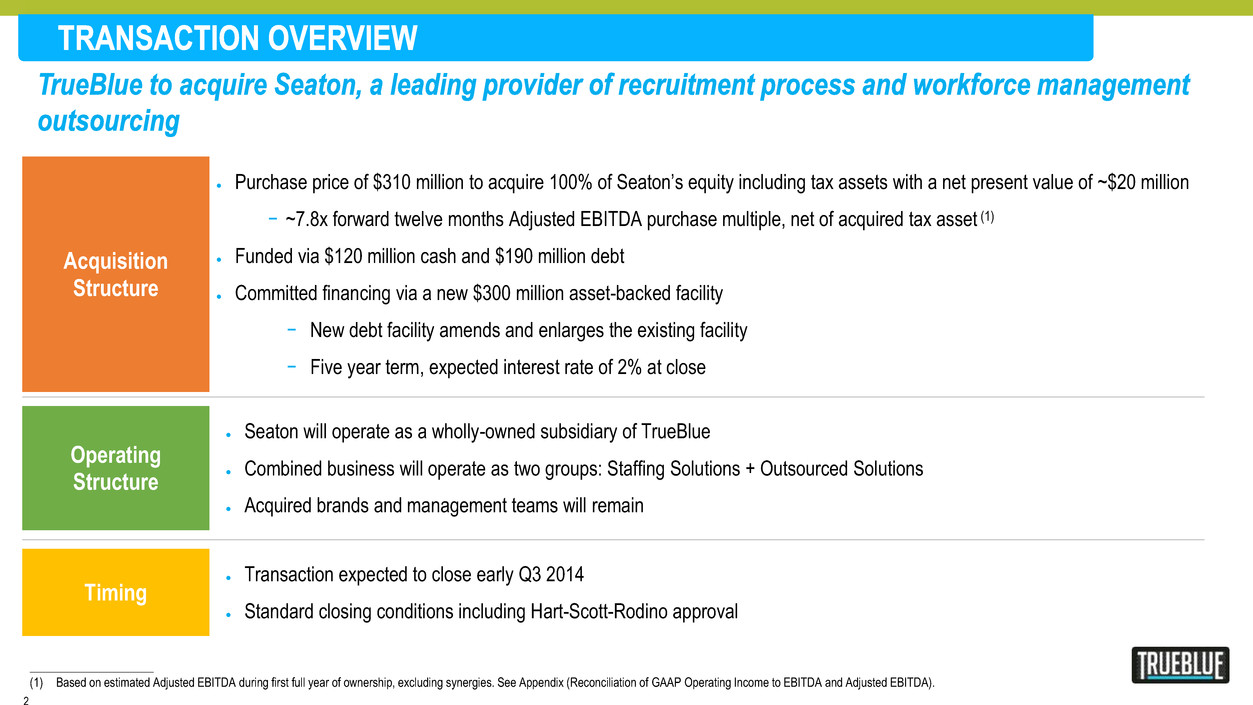

Acquisition Structure Purchase price of $310 million to acquire 100% of Seaton’s equity including tax assets with a net present value of ~$20 million − ~7.8x forward twelve months Adjusted EBITDA purchase multiple, net of acquired tax asset (1) Funded via $120 million cash and $190 million debt Committed financing via a new $300 million asset-backed facility − New debt facility amends and enlarges the existing facility − Five year term, expected interest rate of 2% at close Operating Structure Seaton will operate as a wholly-owned subsidiary of TrueBlue Combined business will operate as two groups: Staffing Solutions + Outsourced Solutions Acquired brands and management teams will remain Timing Transaction expected to close early Q3 2014 Standard closing conditions including Hart-Scott-Rodino approval _____________________ (1) Based on estimated Adjusted EBITDA during first full year of ownership, excluding synergies. See Appendix (Reconciliation of GAAP Operating Income to EBITDA and Adjusted EBITDA). 2

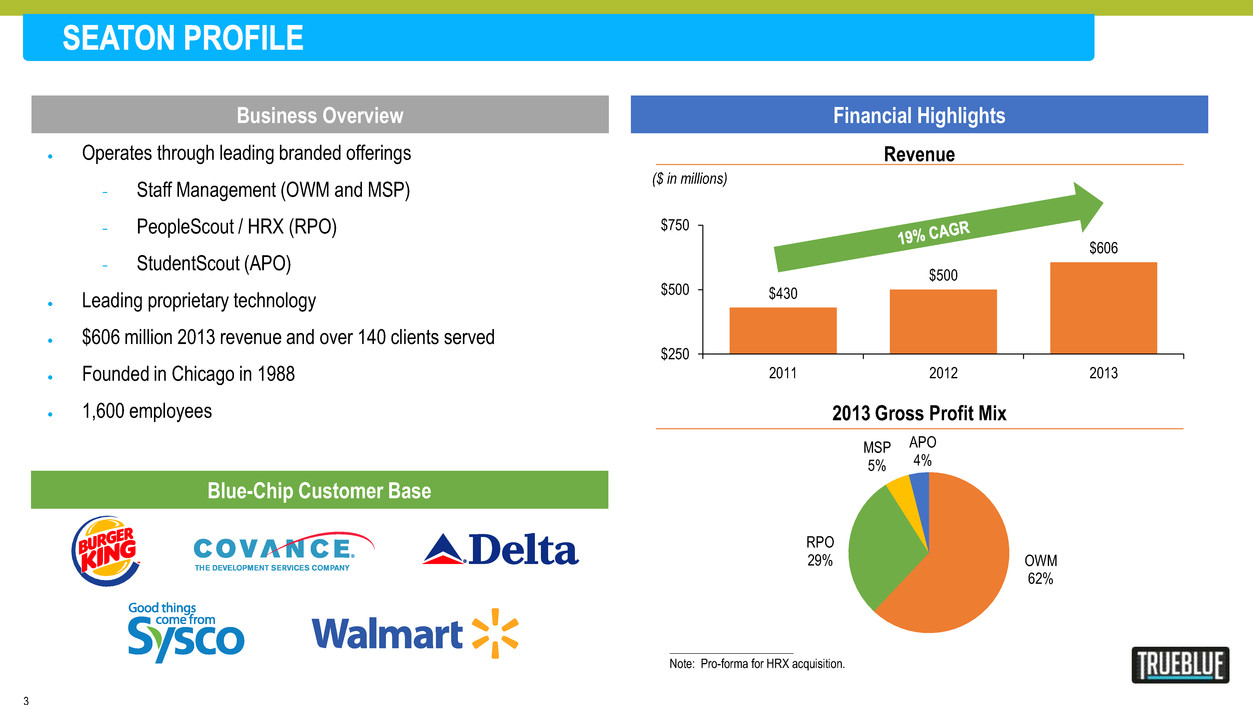

Operates through leading branded offerings − Staff Management (OWM and MSP) − PeopleScout / HRX (RPO) − StudentScout (APO) Leading proprietary technology $606 million 2013 revenue and over 140 clients served Founded in Chicago in 1988 1,600 employees Blue-Chip Customer Base 2013 Gross Profit Mix Business Overview Financial Highlights Revenue OWM 62% RPO 29% MSP 5% APO 4% $430 $500 $606 $250 $500 $750 2011 2012 2013 ($ in millions) _____________________ Note: Pro-forma for HRX acquisition. 3

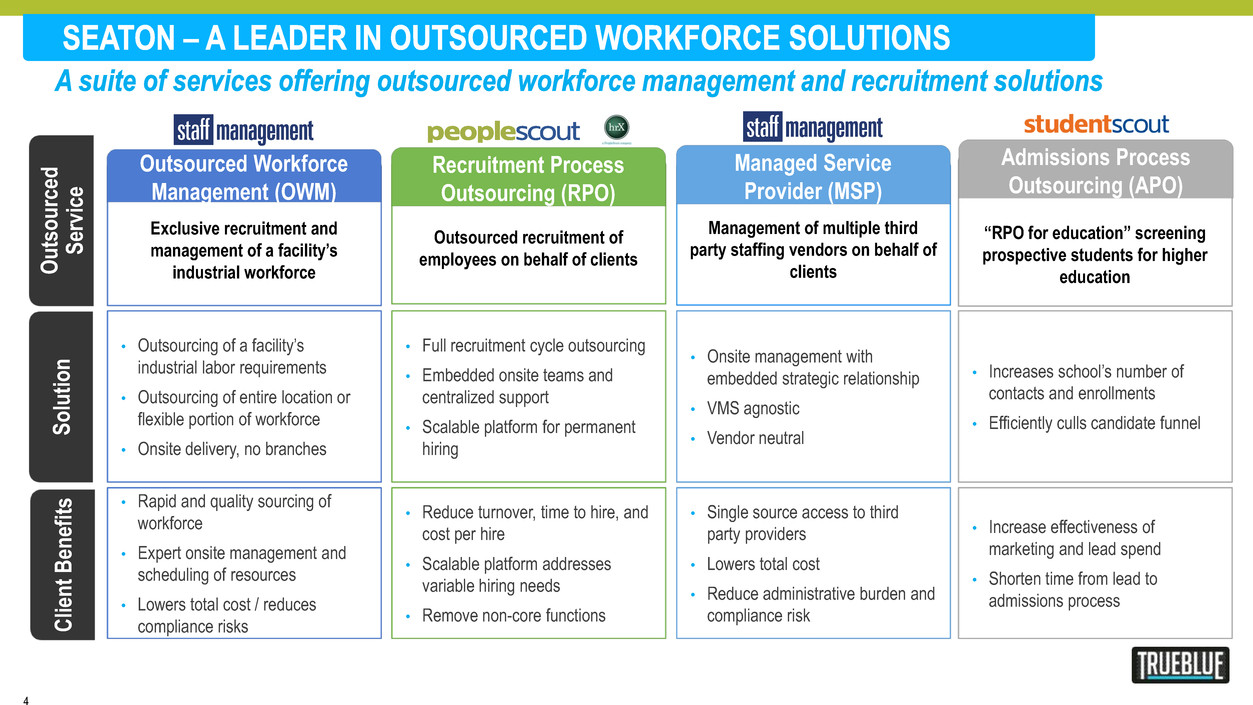

“RPO for education” screening prospective students for higher education Admissions Process Outsourcing (APO) Outso u rc ed S erv ic e Sol u tio n Cli ent Ben efit s • Outsourcing of a facility’s industrial labor requirements • Outsourcing of entire location or flexible portion of workforce • Onsite delivery, no branches • Rapid and quality sourcing of workforce • Expert onsite management and scheduling of resources • Lowers total cost / reduces compliance risks • Onsite management with embedded strategic relationship • VMS agnostic • Vendor neutral • Single source access to third party providers • Lowers total cost • Reduce administrative burden and compliance risk • Full recruitment cycle outsourcing • Embedded onsite teams and centralized support • Scalable platform for permanent hiring • Reduce turnover, time to hire, and cost per hire • Scalable platform addresses variable hiring needs • Remove non-core functions • Increases school’s number of contacts and enrollments • Efficiently culls candidate funnel • Increase effectiveness of marketing and lead spend • Shorten time from lead to admissions process Outsourced recruitment of employees on behalf of clients Recruitment Process Outsourcing (RPO) Management of multiple third party staffing vendors on behalf of clients Managed Service Provider (MSP) Exclusive recruitment and management of a facility’s industrial workforce Outsourced Workforce Management (OWM) 4

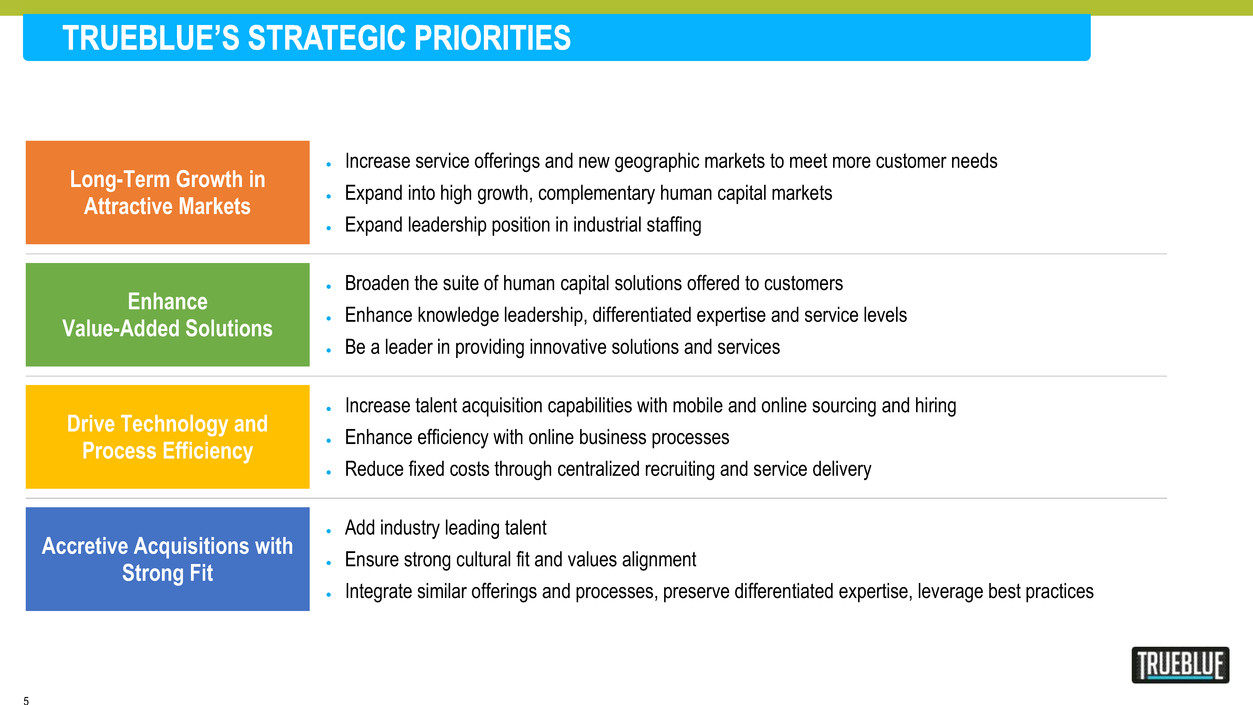

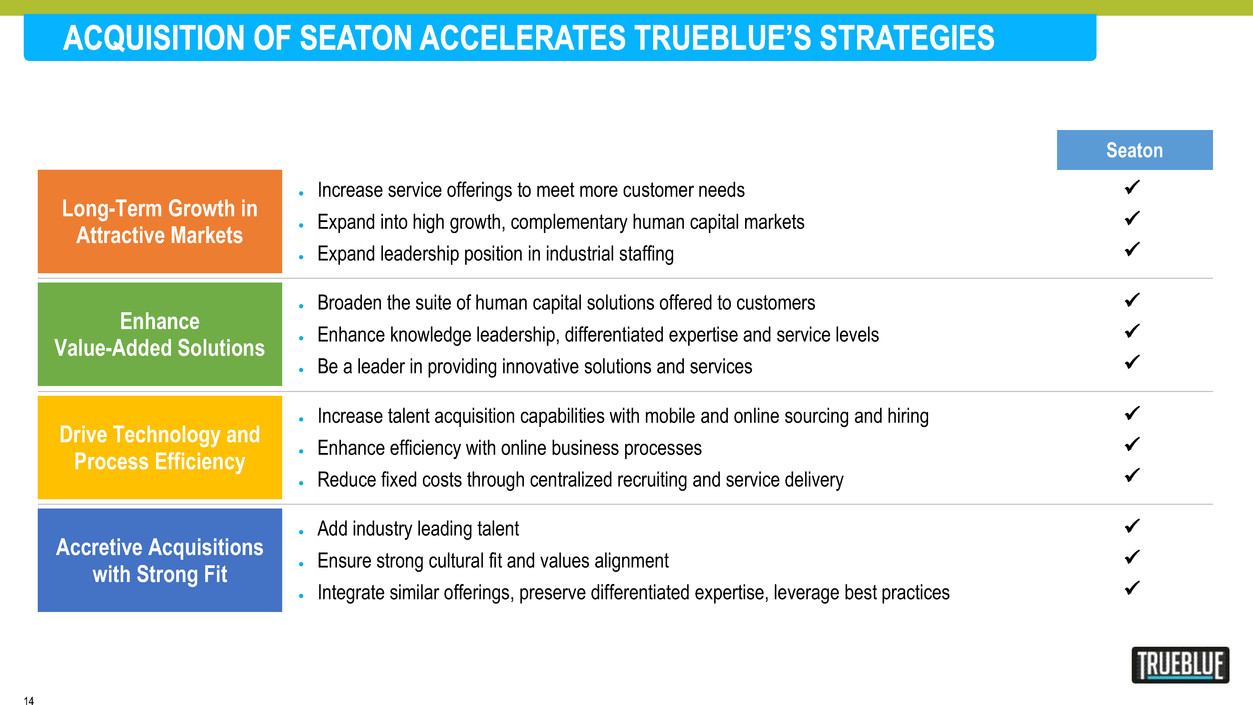

Long-Term Growth in Attractive Markets Increase service offerings and new geographic markets to meet more customer needs Expand into high growth, complementary human capital markets Expand leadership position in industrial staffing Enhance Value-Added Solutions Broaden the suite of human capital solutions offered to customers Enhance knowledge leadership, differentiated expertise and service levels Be a leader in providing innovative solutions and services Drive Technology and Process Efficiency Increase talent acquisition capabilities with mobile and online sourcing and hiring Enhance efficiency with online business processes Reduce fixed costs through centralized recruiting and service delivery Accretive Acquisitions with Strong Fit Add industry leading talent Ensure strong cultural fit and values alignment Integrate similar offerings and processes, preserve differentiated expertise, leverage best practices 5

TrueBlue + Seaton: Stronger Together Increases Scale in an Attractive Market Enter High Growth RPO Market Compelling Financial Characteristics 6

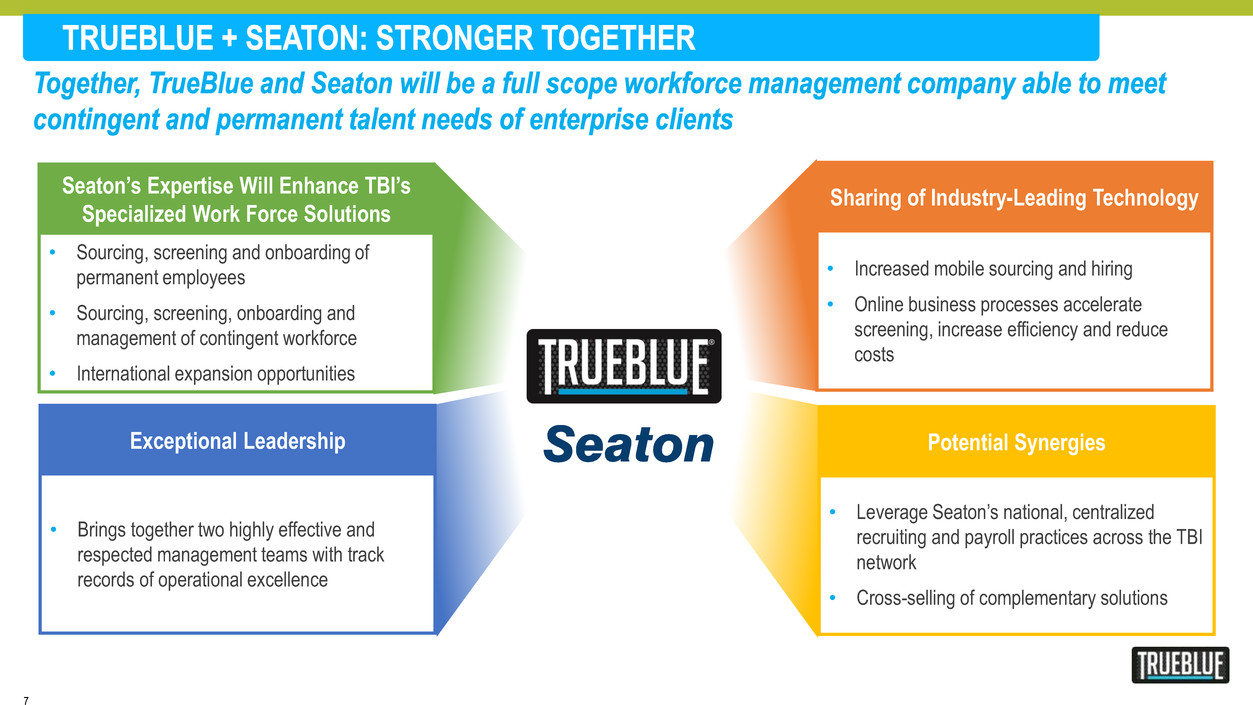

• Brings together two highly effective and respected management teams with track records of operational excellence Exceptional Leadership • Sourcing, screening and onboarding of permanent employees • Sourcing, screening, onboarding and management of contingent workforce • International expansion opportunities Seaton’s Expertise Will Enhance TBI’s Specialized Work Force Solutions • Leverage Seaton’s national, centralized recruiting and payroll practices across the TBI network • Cross-selling of complementary solutions Potential Synergies • Increased mobile sourcing and hiring • Online business processes accelerate screening, increase efficiency and reduce costs Sharing of Industry-Leading Technology 7

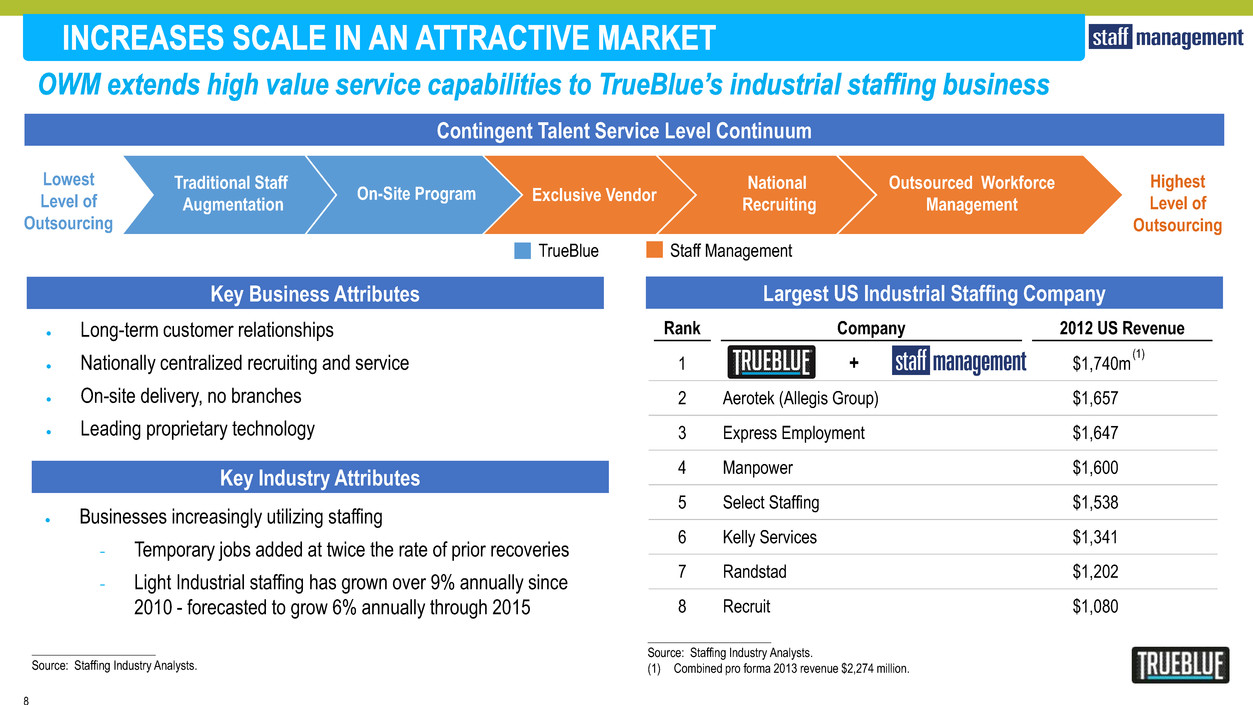

Rank Company 2012 US Revenue 1 $1,740m 2 Aerotek (Allegis Group) $1,657 3 Express Employment $1,647 4 Manpower $1,600 5 Select Staffing $1,538 6 Kelly Services $1,341 7 Randstad $1,202 8 Recruit $1,080 Long-term customer relationships Nationally centralized recruiting and service On-site delivery, no branches Leading proprietary technology Key Business Attributes Largest US Industrial Staffing Company _____________________ Source: Staffing Industry Analysts. (1) Combined pro forma 2013 revenue $2,274 million. (1) Traditional Staff Augmentation On-Site Program Exclusive Vendor National Recruiting Outsourced Workforce Management Lowest Level of Outsourcing Highest Level of Outsourcing Contingent Talent Service Level Continuum Key Industry Attributes Businesses increasingly utilizing staffing − Temporary jobs added at twice the rate of prior recoveries − Light Industrial staffing has grown over 9% annually since 2010 - forecasted to grow 6% annually through 2015 _____________________ Source: Staffing Industry Analysts. TrueBlue Staff Management + 8

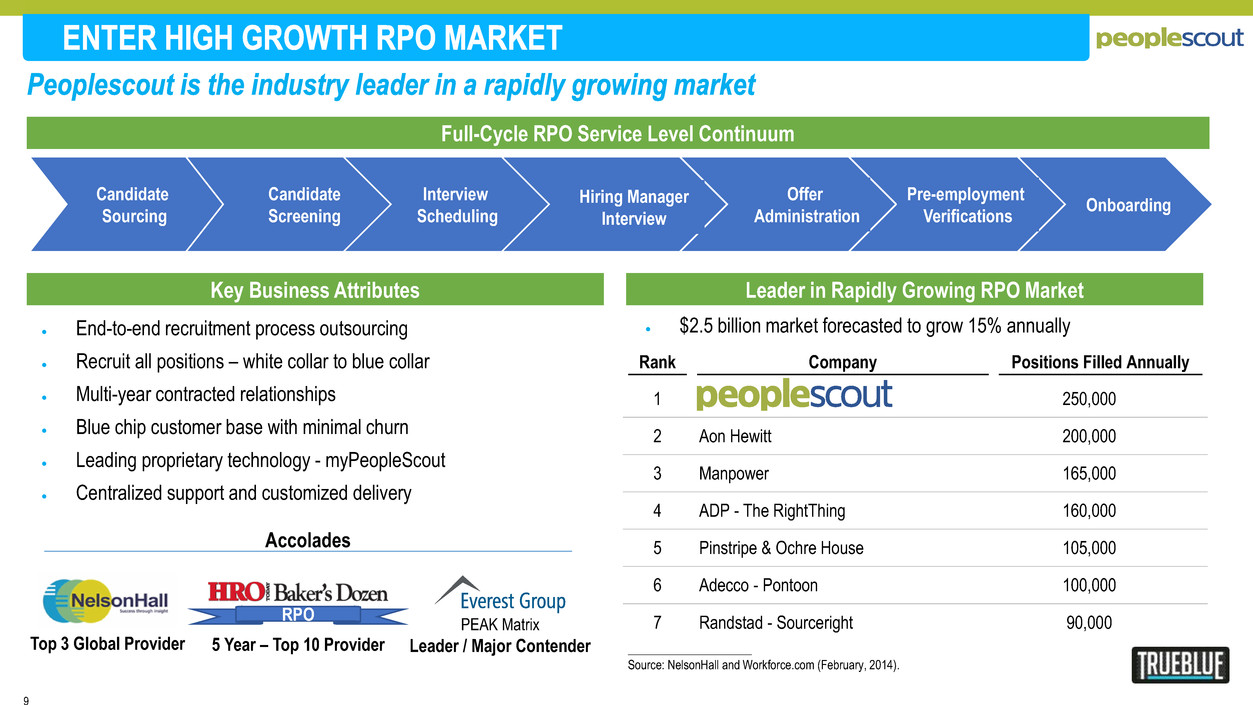

Rank Company Positions Filled Annually 1 250,000 2 Aon Hewitt 200,000 3 Manpower 165,000 4 ADP - The RightThing 160,000 5 Pinstripe & Ochre House 105,000 6 Adecco - Pontoon 100,000 7 Randstad - Sourceright 90,000 Leader in Rapidly Growing RPO Market 5 Year – Top 10 Provider RPO Leader / Major Contender PEAK Matrix End-to-end recruitment process outsourcing Recruit all positions – white collar to blue collar Multi-year contracted relationships Blue chip customer base with minimal churn Leading proprietary technology - myPeopleScout Centralized support and customized delivery Key Business Attributes Accolades Full-Cycle RPO Service Level Continuum Candidate Sourcing Candidate Screening Interview Scheduling Hiring Manager Interview Offer Administration Pre-employment Verifications Onboarding $2.5 billion market forecasted to grow 15% annually _____________________ Source: NelsonHall and Workforce.com (February, 2014). Top 3 Global Provider 9

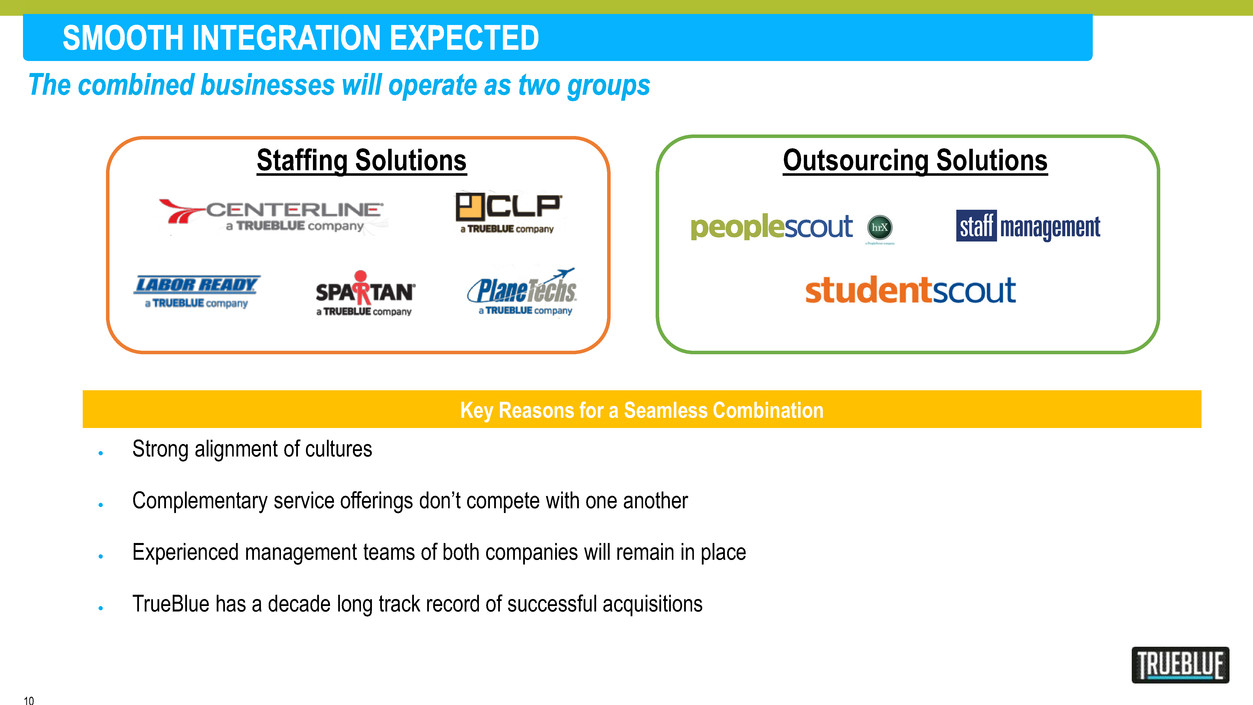

Staffing Solutions Strong alignment of cultures Complementary service offerings don’t compete with one another Experienced management teams of both companies will remain in place TrueBlue has a decade long track record of successful acquisitions Outsourcing Solutions Key Reasons for a Seamless Combination 10

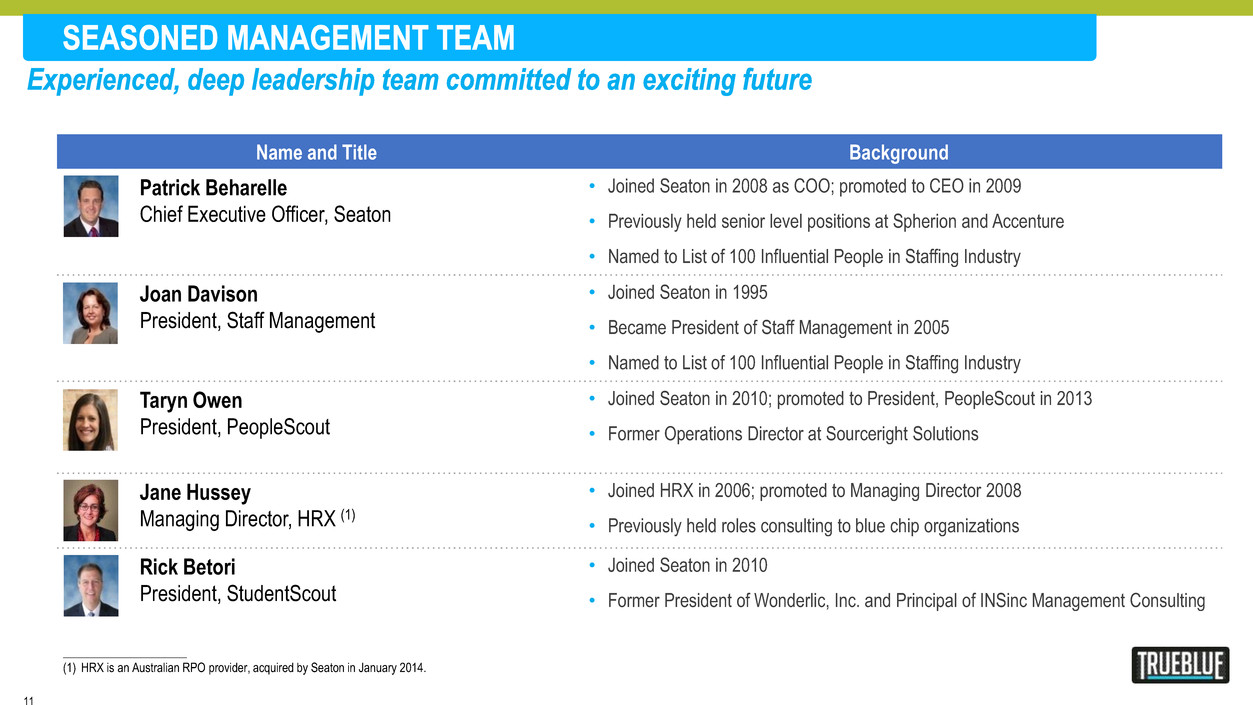

Name and Title Background Patrick Beharelle Chief Executive Officer, Seaton • Joined Seaton in 2008 as COO; promoted to CEO in 2009 • Previously held senior level positions at Spherion and Accenture • Named to List of 100 Influential People in Staffing Industry Joan Davison President, Staff Management • Joined Seaton in 1995 • Became President of Staff Management in 2005 • Named to List of 100 Influential People in Staffing Industry Taryn Owen President, PeopleScout • Joined Seaton in 2010; promoted to President, PeopleScout in 2013 • Former Operations Director at Sourceright Solutions Jane Hussey Managing Director, HRX (1) • Joined HRX in 2006; promoted to Managing Director 2008 • Previously held roles consulting to blue chip organizations Rick Betori President, StudentScout • Joined Seaton in 2010 • Former President of Wonderlic, Inc. and Principal of INSinc Management Consulting _____________________ (1) HRX is an Australian RPO provider, acquired by Seaton in January 2014. 11

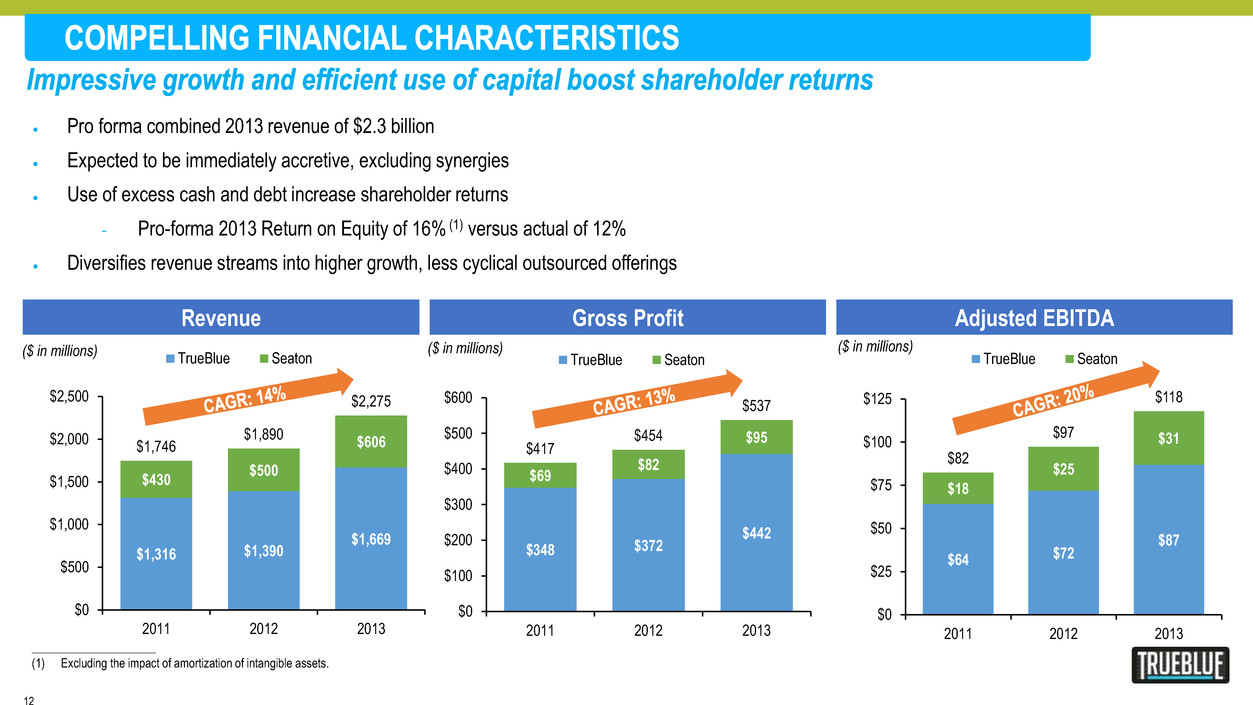

$1,316 $1,390 $1,669 $430 $500 $606 $1,746 $1,890 $2,275 $0 $500 $1,000 $1,500 $2,000 $2,500 2011 2012 2013 TrueBlue Seaton ($ in millions) Revenue Gross Profit Adjusted EBITDA ($ in millions) ($ in millions) $348 $372 $442 $69 $82 $95 $417 $454 $537 $0 $100 $200 $300 $400 $500 $600 2011 2012 2013 TrueBlue Seaton $64 $72 $87 $18 $25 $31 $82 $97 $118 $0 $25 $50 $75 $100 $125 2011 2012 2013 TrueBlue Seaton Pro forma combined 2013 revenue of $2.3 billion Expected to be immediately accretive, excluding synergies Use of excess cash and debt increase shareholder returns − Pro-forma 2013 Return on Equity of 16% (1) versus actual of 12% Diversifies revenue streams into higher growth, less cyclical outsourced offerings _____________________ (1) Excluding the impact of amortization of intangible assets. 12

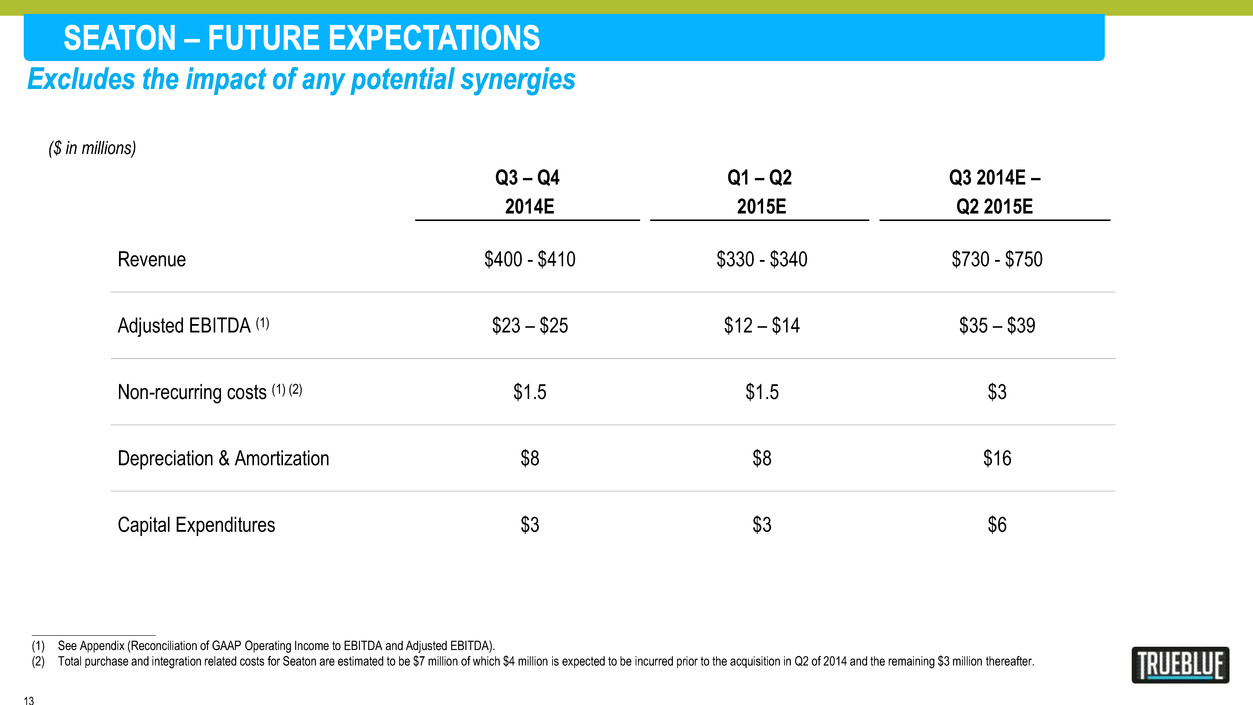

2014E 2014E 2015P 2015P Company SECOND CITY Pro Forma Company SECOND CITY Pro Forma GAAP Revenue $1,838.3 $689.9 $2,528.2 $1,960.0 $763.0 $2,723.0 Cost of Services 1,356.8 580.4 1,937.2 1,444.3 640.8 2,085.1 Gross Profit $481.5 $109.5 $591.0 $515.7 $122.2 $637.9 Operating Expenses 376.2 72.4 448.6 396.5 79.0 475.5 Adjusted EBITDA $105.4 $37.0 $142.4 $119.2 $43.2 $162.4 Revenue Growth 10.2% 13.9% 11.2% 6.6% 10.6% 7.7% Adjusted EBITDA Growth 31.6% 20.2% 28.4% 13.1% 16.6% 14.0% Gross Margin 26.2% 15.9% 23.4% 26.3% 16.0% 23.4% Operating Expenses / GAAP Revenue 20.5% 10.5% 17.7% 20.2% 10.4% 17.5% Adjusted EBITDA Margin 5.7% 5.4% 5.6% 6.1% 5.7% 6.0% ($ in millions) Q3 – Q4 2014E Q1 – Q2 2015E Q3 2014E – Q2 2015E Revenue $400 - $410 $330 - $340 $730 - $750 Adjusted EBITDA (1) $23 – $25 $12 – $14 $35 – $39 Non-recurring costs (1) (2) $1.5 $1.5 $3 Depreciation & Amortization $8 $8 $16 Capital Expenditures $3 $3 $6 _____________________ (1) See Appendix (Reconciliation of GAAP Operating Income to EBITDA and Adjusted EBITDA). (2) Total purchase and integration related costs for Seaton are estimated to be $7 million of which $4 million is expected to be incurred prior to the acquisition in Q2 of 2014 and the remaining $3 million thereafter. 13

Seaton Long-Term Growth in Attractive Markets Increase service offerings to meet more customer needs Expand into high growth, complementary human capital markets Expand leadership position in industrial staffing Enhance Value-Added Solutions Broaden the suite of human capital solutions offered to customers Enhance knowledge leadership, differentiated expertise and service levels Be a leader in providing innovative solutions and services Drive Technology and Process Efficiency Increase talent acquisition capabilities with mobile and online sourcing and hiring Enhance efficiency with online business processes Reduce fixed costs through centralized recruiting and service delivery Accretive Acquisitions with Strong Fit Add industry leading talent Ensure strong cultural fit and values alignment Integrate similar offerings, preserve differentiated expertise, leverage best practices 14

15

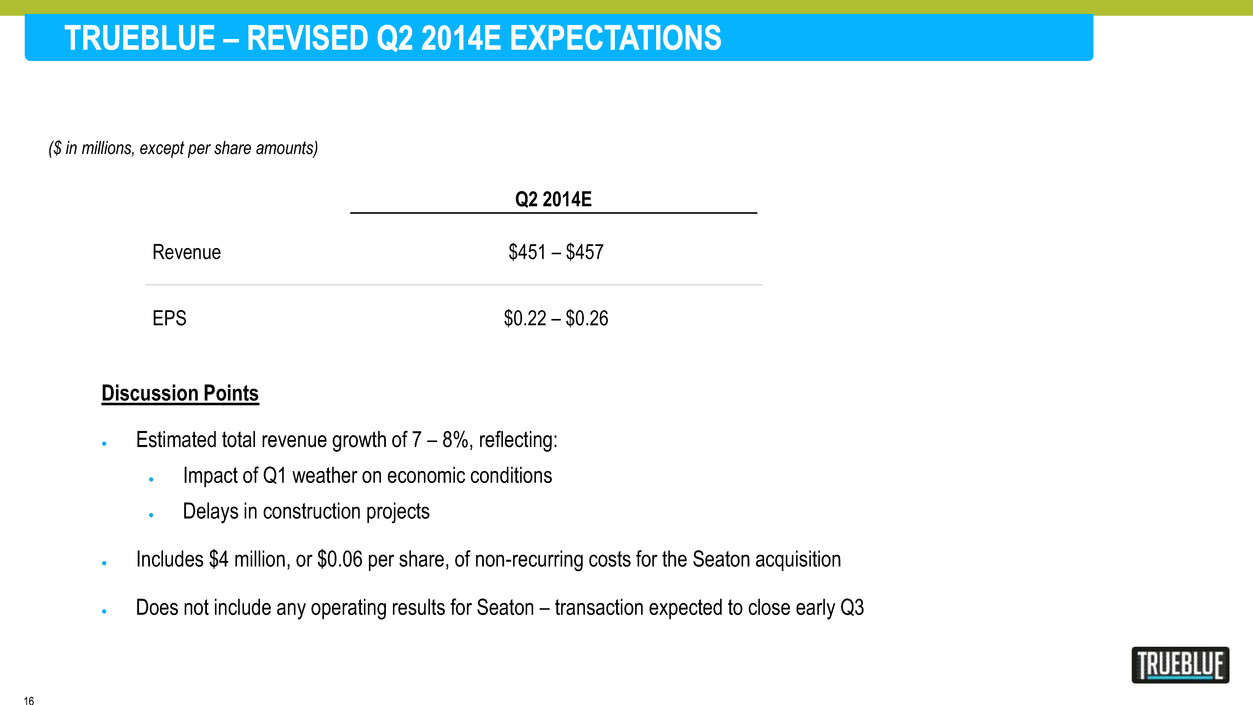

Q2 2014E Revenue $451 – $457 EPS $0.22 – $0.26 Discussion Points Estimated total revenue growth of 7 – 8%, reflecting: Impact of Q1 weather on economic conditions Delays in construction projects Includes $4 million, or $0.06 per share, of non-recurring costs for the Seaton acquisition Does not include any operating results for Seaton – transaction expected to close early Q3 ($ in millions, except per share amounts) 16

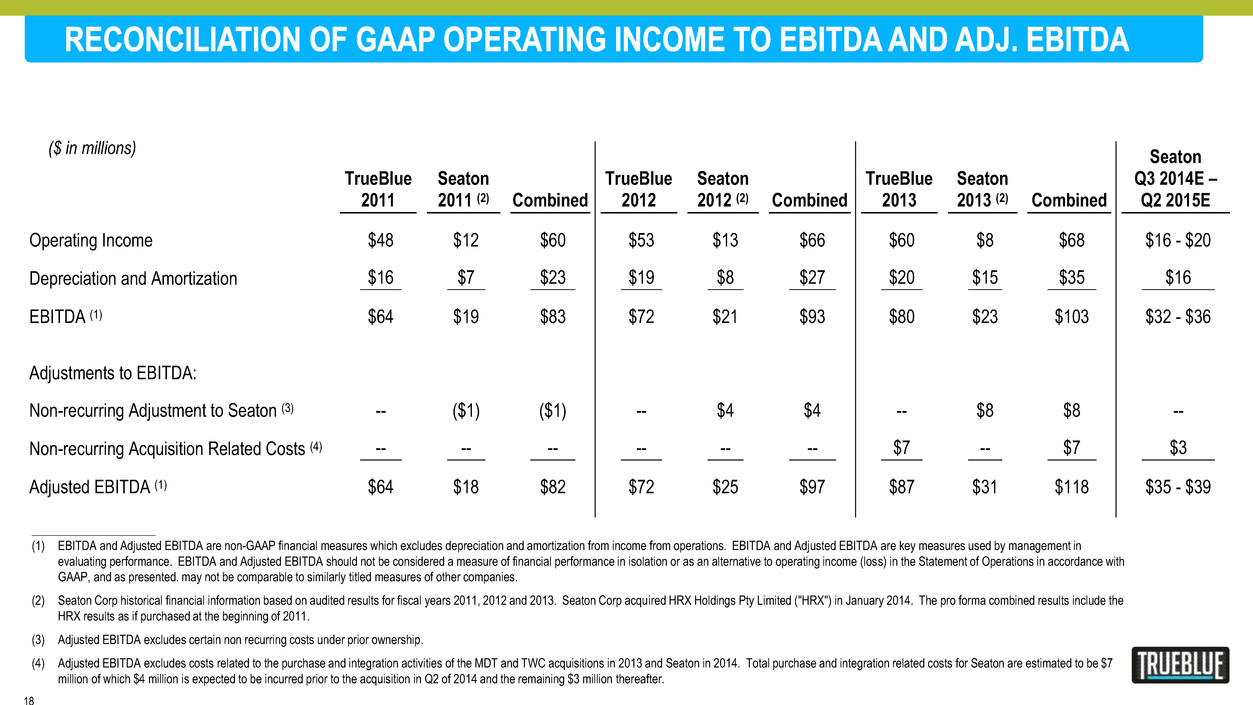

Management believes that certain non-GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results for the company, current results for Seaton, and current results on a pro-forma basis of the combined operations of the company and Seaton. Within this presentation, including the tables attached hereto, reference is made to adjusted earnings before interest, taxes, depreciation and amortization (EBITDA). See attached, “Reconciliation of GAAP Operating Income to EBITDA and Adjusted EBITDA”. EBITDA is a metric used by management and frequently used by the financial community which provides insight into an organization’s operating trends and facilitates comparisons between peer companies, since interest, taxes, depreciation and amortization can differ greatly between organizations as a result of differing capital structures and tax strategies. EBITDA also can be a useful measure of a company’s ability to service debt and is one of the measures used for determining the company’s debt covenant compliance. Adjusted EBITDA excludes certain items that are unusual in nature or not comparable from period to period. The company provides this information to investors to assist in comparisons of past, present and future operating results and to assist in highlighting the results of on-going operations. While the company’s management believes that non-GAAP measurements are useful supplemental information, such adjusted results are not intended to replace the company’s GAAP financial results and should be read in conjunction with those GAAP results. 17

TrueBlue 2011 Seaton 2011 (2) Combined TrueBlue 2012 Seaton 2012 (2) Combined TrueBlue 2013 Seaton 2013 (2) Combined Seaton Q3 2014E – Q2 2015E Operating Income $48 $12 $60 $53 $13 $66 $60 $8 $68 $16 - $20 Depreciation and Amortization $16 $7 $23 $19 $8 $27 $20 $15 $35 $16 EBITDA (1) $64 $19 $83 $72 $21 $93 $80 $23 $103 $32 - $36 Adjustments to EBITDA: Non-recurring Adjustment to Seaton (3) -- ($1) ($1) -- $4 $4 -- $8 $8 -- Non-recurring Acquisition Related Costs (4) -- -- -- -- -- -- $7 -- $7 $3 Adjusted EBITDA (1) $64 $18 $82 $72 $25 $97 $87 $31 $118 $35 - $39 _____________________ (1) EBITDA and Adjusted EBITDA are non-GAAP financial measures which excludes depreciation and amortization from income from operations. EBITDA and Adjusted EBITDA are key measures used by management in evaluating performance. EBITDA and Adjusted EBITDA should not be considered a measure of financial performance in isolation or as an alternative to operating income (loss) in the Statement of Operations in accordance with GAAP, and as presented. may not be comparable to similarly titled measures of other companies. (2) Seaton Corp historical financial information based on audited results for fiscal years 2011, 2012 and 2013. Seaton Corp acquired HRX Holdings Pty Limited ("HRX") in January 2014. The pro forma combined results include the HRX results as if purchased at the beginning of 2011. (3) Adjusted EBITDA excludes certain non recurring costs under prior ownership. (4) Adjusted EBITDA excludes costs related to the purchase and integration activities of the MDT and TWC acquisitions in 2013 and Seaton in 2014. Total purchase and integration related costs for Seaton are estimated to be $7 million of which $4 million is expected to be incurred prior to the acquisition in Q2 of 2014 and the remaining $3 million thereafter. ($ in millions) 18