Q2 2014 INVESTOR PRESENTATION

Certain statements made by us in this presentation that are not historical facts or that relate to future plans, events or performances are forward-looking statements that reflect management’s current outlook for future periods, including statements regarding future financial performance. These forward-looking statements are based upon our current expectations, and our actual results may differ materially from those described or contemplated in the forward–looking statements. Factors that may cause our actual results to differ materially from those contained in the forward-looking statements, include without limitation the following: 1) national and global economic conditions, including the impact of changes in national and global credit markets and other changes that affect our customers; 2) our ability to continue to attract and retain customers and maintain profit margins in the face of new and existing competition; 3) new laws and regulations that could have a materially adverse effect on our operations and financial results; 4) significant labor disturbances which could disrupt industries we serve; 5) increased costs and collateral requirements in connection with our insurance obligations, including workers’ compensation insurance; 6) the adequacy of our financial reserves; 7) our continuing ability to comply with financial covenants in our lines of credit and other financing agreements; 8) our ability to attract and retain competent employees in key positions or to find temporary employees to fulfill the needs of our customers; 9) our ability to successfully complete and integrate acquisitions that we may make; and 10) other risks described in our most recent filings with the Securities and Exchange Commission. Use of estimates and forecasts: Any references made to 2014 are based on management guidance issued April 22, 2014, and are included for informational purposes only and are not an update or reaffirmation. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other reference to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the Securities Exchange Commission.

• Specialized approach in growing staffing market • Significant upside as construction market rebounds • Compelling growth and technology strategies • Strong operating leverage • Strong capital position supports growth

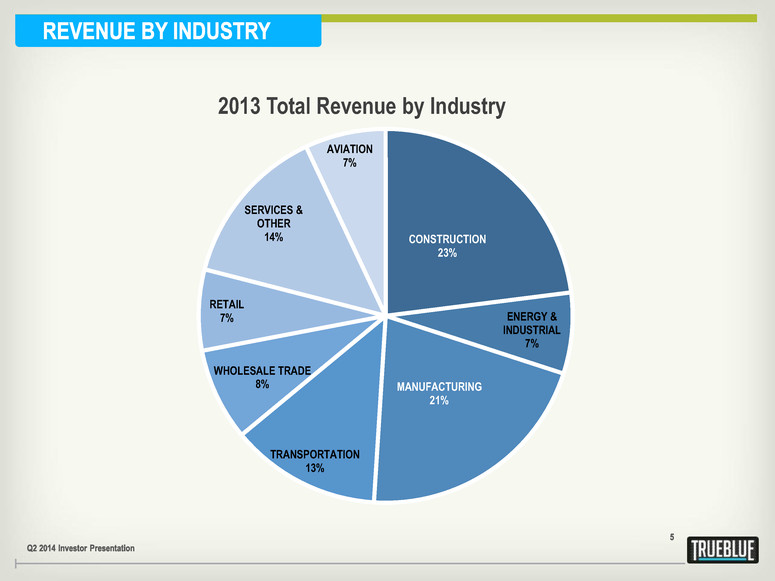

CONSTRUCTION 23% ENERGY & INDUSTRIAL 7% MANUFACTURING 21% TRANSPORTATION 13% WHOLESALE TRADE 8% RETAIL 7% SERVICES & OTHER 14% AVIATION 7% 2013 Total Revenue by Industry

25+ $1.7B Years in Business 2013 Revenue 375,000 Connect More Than People to Work Each Year 130,000 Serve More Than Businesses Annually Rounded

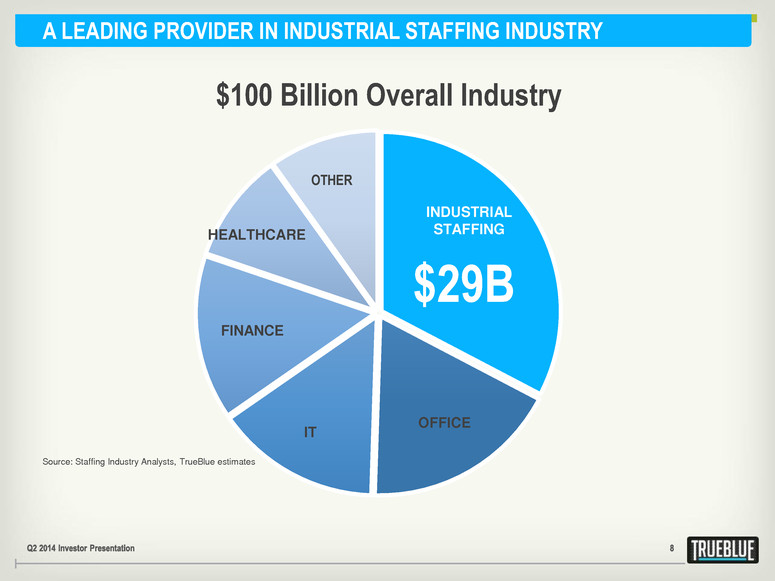

A LEADING PROVIDER IN INDUSTRIAL STAFFING INDUSTRY $100 Billion Overall Industry $29B OFFICE IT FINANCE HEALTHCARE OTHER INDUSTRIAL STAFFING Source: Staffing Industry Analysts, TrueBlue estimates

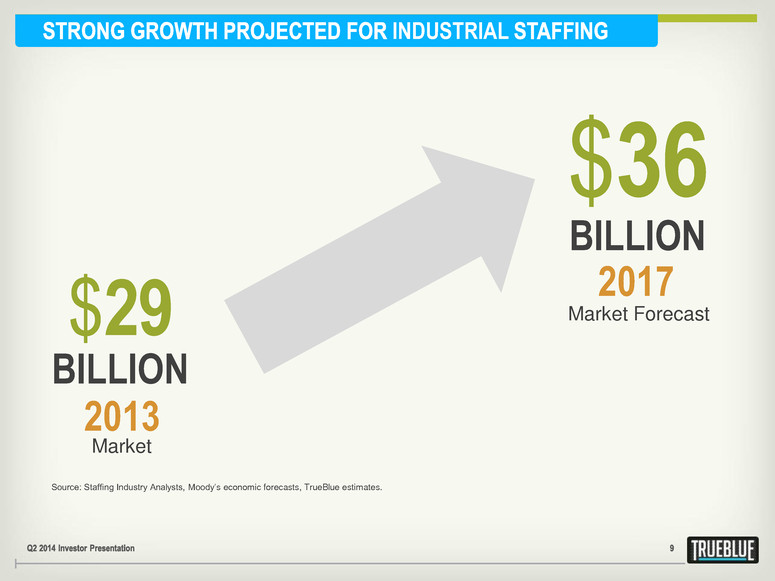

INDUSTRIAL Source: Staffing Industry Analysts, Moody’s economic forecasts, TrueBlue estimates. 2013 2017 $36 BILLION $29 BILLION Market Market Forecast

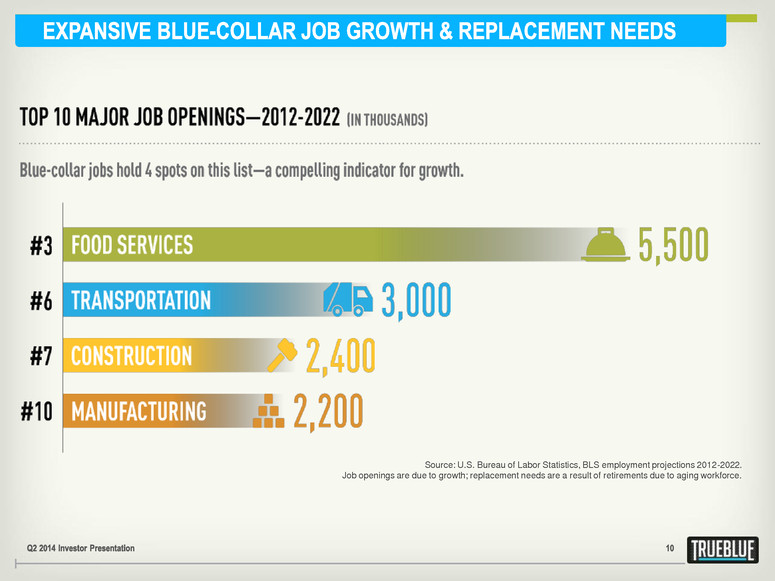

Source: U.S. Bureau of Labor Statistics, BLS employment projections 2012-2022. Job openings are due to growth; replacement needs are a result of retirements due to aging workforce.

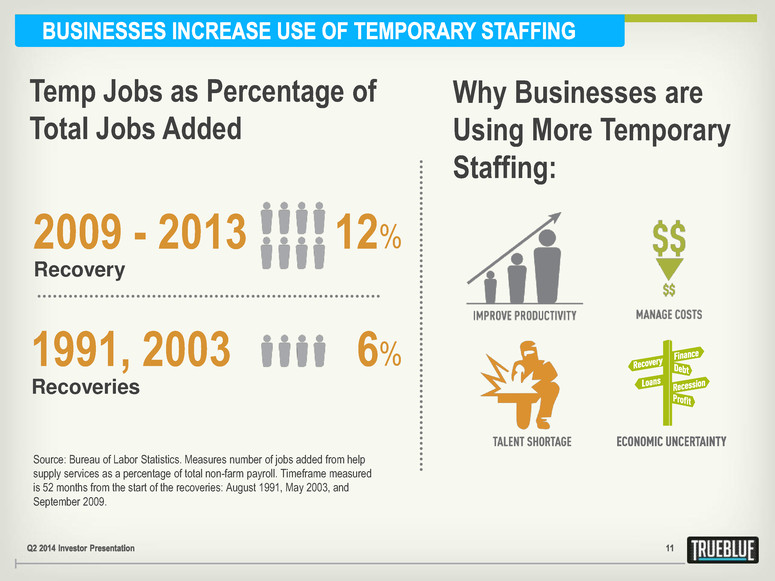

Why Businesses are Using More Temporary Staffing: Source: Bureau of Labor Statistics. Measures number of jobs added from help supply services as a percentage of total non-farm payroll. Timeframe measured is 52 months from the start of the recoveries: August 1991, May 2003, and September 2009. Temp Jobs as Percentage of Total Jobs Added 1991, 2003 Recoveries 6% 2009 - 2013 Recovery 12%

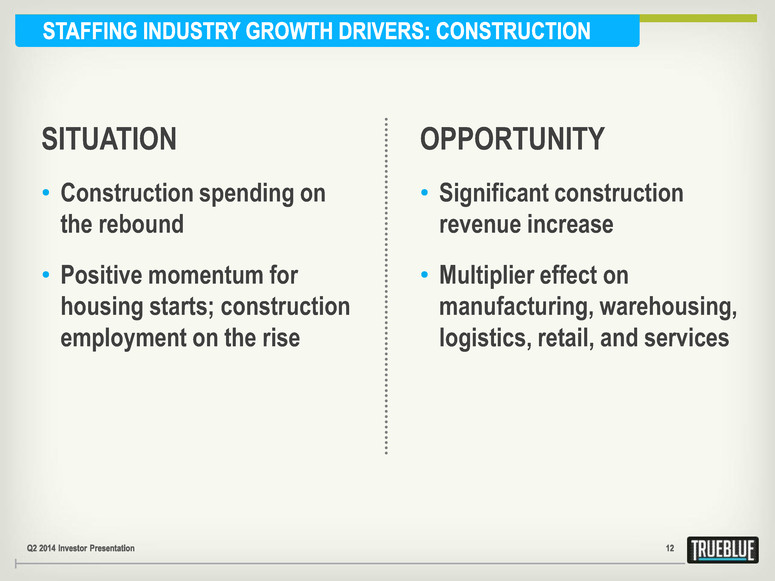

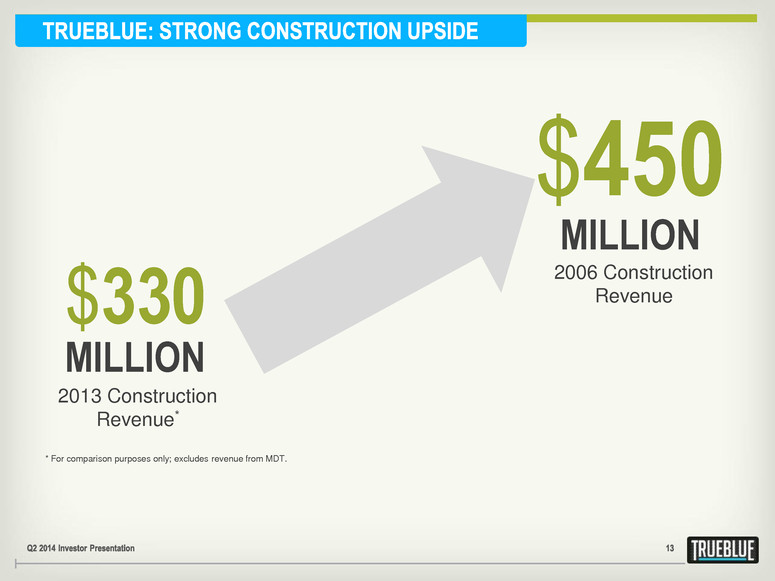

SITUATION • Construction spending on the rebound • Positive momentum for housing starts; construction employment on the rise OPPORTUNITY • Significant construction revenue increase • Multiplier effect on manufacturing, warehousing, logistics, retail, and services

$450 MILLION $330 MILLION 2013 Construction Revenue* 2006 Construction Revenue * For comparison purposes only; excludes revenue from MDT.

SITUATION • U.S. Manufacturing Renaissance • Increased incentives to “re-shore” including increasing wages in China, offshore product quality concerns, and logistics costs • Decline in energy costs OPPORTUNITY • Provide flexible, skilled labor force • Closer-to-customer improves service

SITUATION • High driver turnover • New safety regulations create need for more drivers • 100,000 new drivers needed per year, over the next 10 years* OPPORTUNITY • Access to hard-to-find talent • Safety and compliance leadership • Flexible recruiting model • Logistics company partnerships * Source: The American Trucking Association

SITUATION • Growing energy independence • Skilled worker shortages • More than 100,000 new jobs in the solar industry by 2016* OPPORTUNITY • Deliver and manage skilled work force in remote areas • Deep technical knowledge in green industries • Partner with trades schools to fill skilled-worker gap • Business process improvements, not just service features * Source: The Solar Energy Industry Association

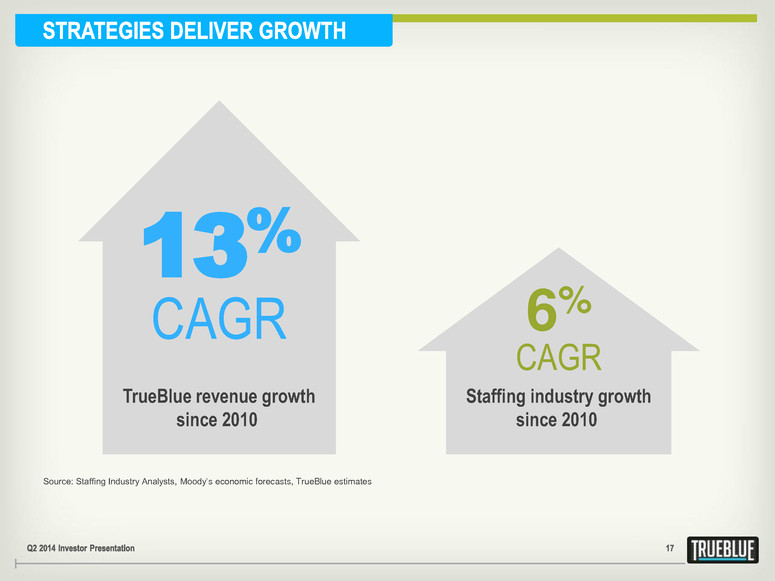

Source: Staffing Industry Analysts, Moody’s economic forecasts, TrueBlue estimates 13% CAGR 6% CAGR TrueBlue revenue growth since 2010 Staffing industry growth since 2010

ACQUISITION GROWTH COMPELLING In addition to organic revenue growth, TrueBlue has a proven track record of successfully acquiring and integrating staffing companies. Use of technology continues to improve the experience of our workers and customers and drive efficiency in our business. ORGANIC GROWTH TECHNOLOGY

• Expand knowledge of customers’ industries • Increase functional expertise: transition from generalist filed positions to dedicated sales, recruiting and service roles Differentiation Through Specialization Improve Service Delivery Service Line Expansion • Expand geographically through technology or existing branch network • Leverage industry knowledge to develop new, niche staffing services • Expand leadership roles to oversee multiple service lines • Provide customers a network of access points • Improve consistency of service model

• Increase scale and market share • Proven track record of successful integration • Opportunity for potential operational synergies Strengthen Existing Services Add New Capabilities • Provide new services to existing customers • Add knowledge and expertise • Diversify the business

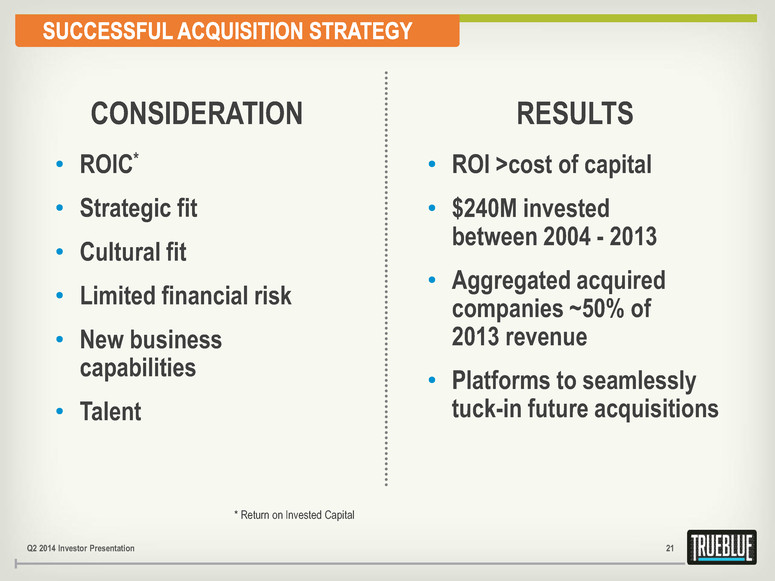

RESULTS CONSIDERATION • ROIC* • Strategic fit • Cultural fit • Limited financial risk • New business capabilities • Talent • ROI >cost of capital • $240M invested between 2004 - 2013 • Aggregated acquired companies ~50% of 2013 revenue • Platforms to seamlessly tuck-in future acquisitions * Return on Invested Capital 21 Q2 2014 Investor Presentation

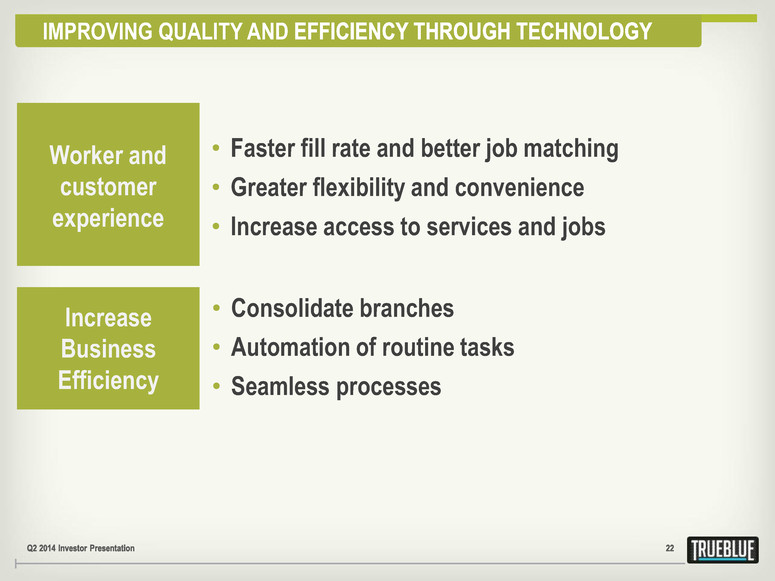

IMPROVING QUALITY AND • Faster fill rate and better job matching • Greater flexibility and convenience • Increase access to services and jobs Worker and customer experience • Consolidate branches • Automation of routine tasks • Seamless processes Increase Business Efficiency

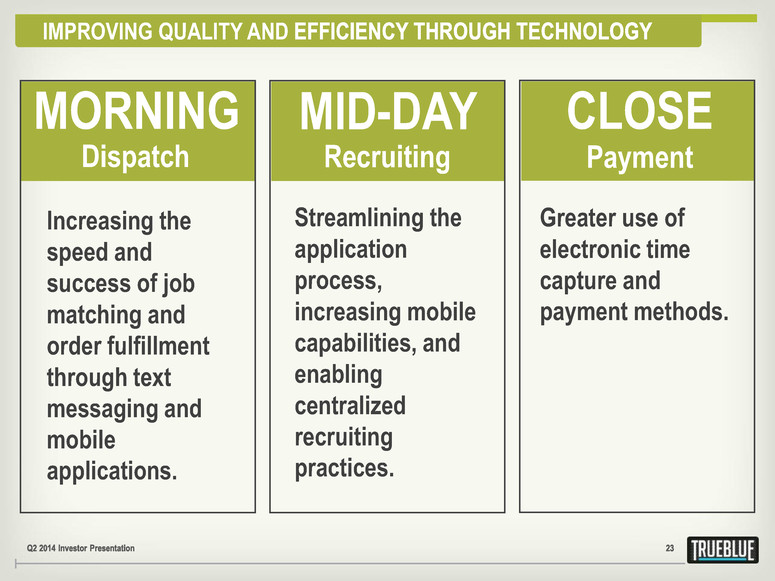

Dispatch MORNING Increasing the speed and success of job matching and order fulfillment through text messaging and mobile applications. Payment Greater use of electronic time capture and payment methods. Recruiting MID-DAY Streamlining the application process, increasing mobile capabilities, and enabling centralized recruiting practices. CLOSE IMPROVING QUALITY AND

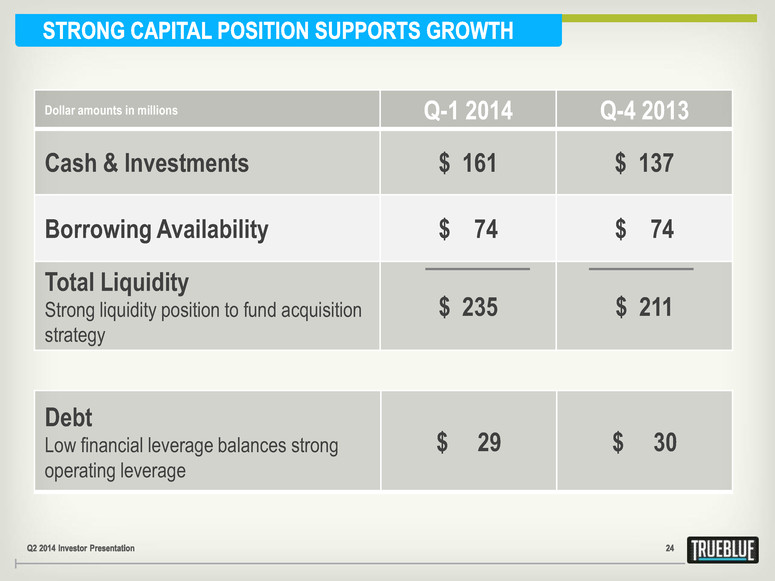

Dollar amounts in millions Q-1 2014 Q-4 2013 Cash & Investments $ 161 $ 137 Borrowing Availability $ 74 $ 74 Total Liquidity Strong liquidity position to fund acquisition strategy $ 235 $ 211 Debt Low financial leverage balances strong operating leverage $ 29 $ 30

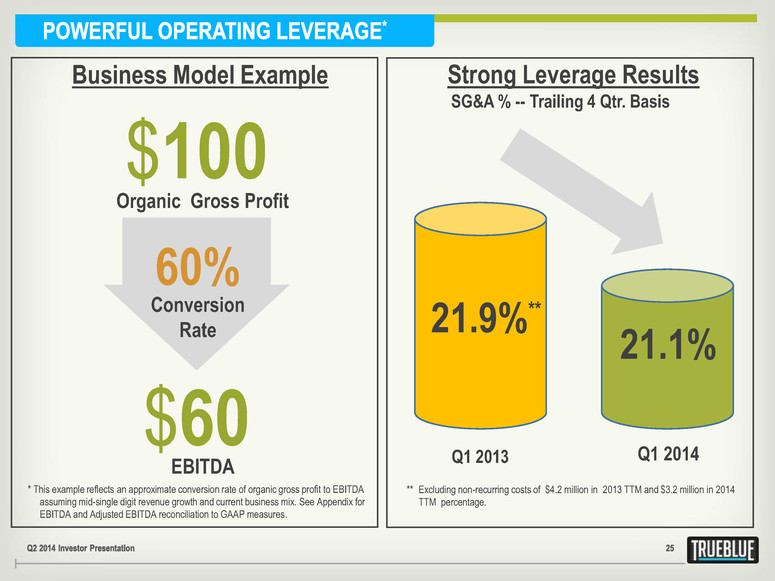

* This example reflects an approximate conversion rate of organic gross profit to EBITDA assuming mid-single digit revenue growth and current business mix. See Appendix for EBITDA and Adjusted EBITDA reconciliation to GAAP measures. 60% $100 Conversion Rate $60 Organic Gross Profit EBITDA 21.1% 21.9%** ** Excluding non-recurring costs of $4.2 million in 2013 TTM and $3.2 million in 2014 TTM percentage. Q1 2014 Business Model Example Strong Leverage Results SG&A % -- Trailing 4 Qtr. Basis Q1 2013

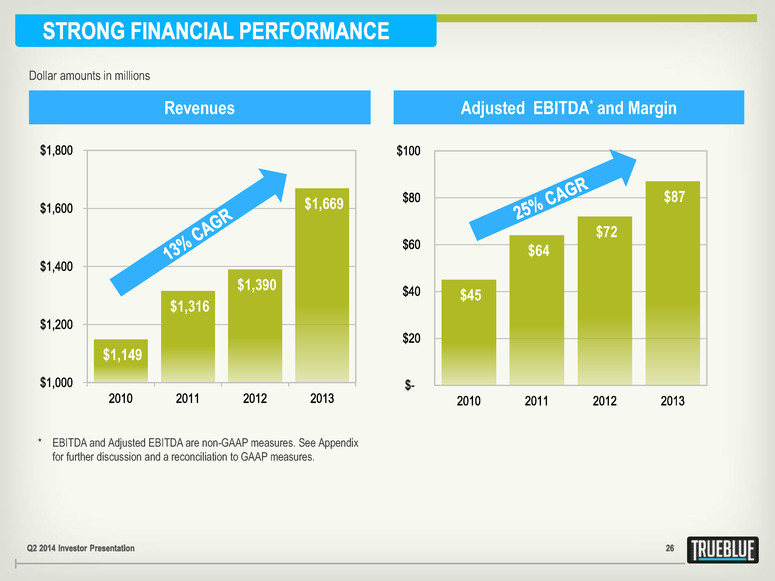

Dollar amounts in millions Revenues Adjusted EBITDA* and Margin $45 $64 $72 $87 $1,149 $1,316 $1,390 $1,669 * EBITDA and Adjusted EBITDA are non-GAAP measures. See Appendix for further discussion and a reconciliation to GAAP measures.

• Specialized approach in growing staffing market • Significant upside as construction market rebounds • Compelling growth and technology strategies • Strong operating leverage • Strong capital position supports growth

Appendix

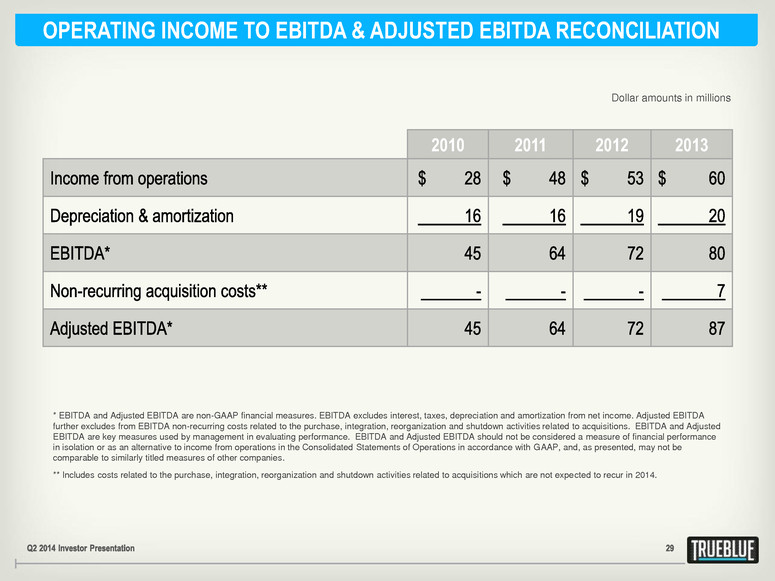

OPERATING INCOME TO EBITDA & ADJUSTED EBITDA RECONCILIATION 2010 2011 2012 2013 * EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes interest, taxes, depreciation and amortization from net income. Adjusted EBITDA further excludes from EBITDA non-recurring costs related to the purchase, integration, reorganization and shutdown activities related to acquisitions. EBITDA and Adjusted EBITDA are key measures used by management in evaluating performance. EBITDA and Adjusted EBITDA should not be considered a measure of financial performance in isolation or as an alternative to income from operations in the Consolidated Statements of Operations in accordance with GAAP, and, as presented, may not be comparable to similarly titled measures of other companies. ** Includes costs related to the purchase, integration, reorganization and shutdown activities related to acquisitions which are not expected to recur in 2014. Dollar amounts in millions