Certain statements made by us in this presentation that are not historical facts or that relate to future plans, events or performances are forward-looking statements that reflect management’s current outlook for future periods, including statements regarding future financial performance. These forward-looking statements are based upon our current expectations, and our actual results may differ materially from those described or contemplated in the forward–looking statements. Factors that may cause our actual results to differ materially from those contained in the forward-looking statements, include without limitation the following: 1) national and global economic conditions, including the impact of changes in national and global credit markets and other changes that affect our customers; 2) our ability to continue to attract and retain customers and maintain profit margins in the face of new and existing competition; 3) new laws and regulations that could have a materially adverse effect on our operations and financial results; 4) significant labor disturbances which could disrupt industries we serve; 5) increased costs and collateral requirements in connection with our insurance obligations, including workers’ compensation insurance; 6) the adequacy of our financial reserves; 7) our continuing ability to comply with financial covenants in our lines of credit and other financing agreements; 8) our ability to attract and retain competent employees in key positions or to find temporary employees to fulfill the needs of our customers; 9) our ability to successfully complete and integrate acquisitions that we may make; and 10) other risks described in our most recent filings with the Securities and Exchange Commission. Use of estimates and forecasts: Any references made to 2014 are based on management guidance issued April 22, 2014, and are included for informational purposes only and are not an update or reaffirmation. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other reference to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the Securities Exchange Commission. Q1 2014 Earnings Results | April 22, 2014 | page 2 FORWARD-LOOKING STATEMENT

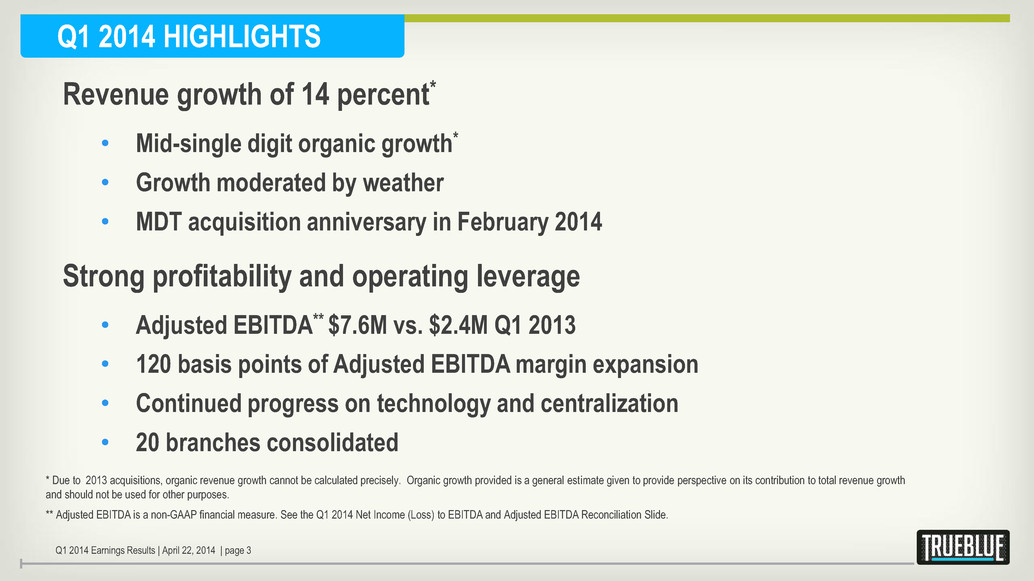

Q1 2014 HIGHLIGHTS Revenue growth of 14 percent* • Mid-single digit organic growth* • Growth moderated by weather • MDT acquisition anniversary in February 2014 Strong profitability and operating leverage • Adjusted EBITDA** $7.6M vs. $2.4M Q1 2013 • 120 basis points of Adjusted EBITDA margin expansion • Continued progress on technology and centralization • 20 branches consolidated * Due to 2013 acquisitions, organic revenue growth cannot be calculated precisely. Organic growth provided is a general estimate given to provide perspective on its contribution to total revenue growth and should not be used for other purposes. ** Adjusted EBITDA is a non-GAAP financial measure. See the Q1 2014 Net Income (Loss) to EBITDA and Adjusted EBITDA Reconciliation Slide. Q1 2014 Earnings Results | April 22, 2014 | page 3

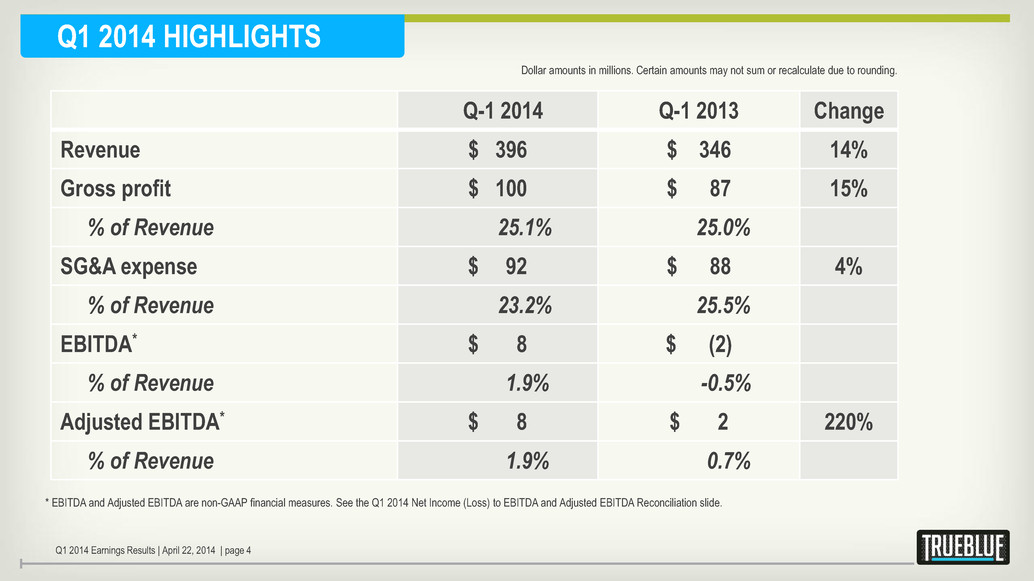

Q1 2014 HIGHLIGHTS Dollar amounts in millions. Certain amounts may not sum or recalculate due to rounding. Q-1 2014 Q-1 2013 Change Revenue $ 396 $ 346 14% Gross profit $ 100 $ 87 15% % of Revenue 25.1% 25.0% SG&A expense $ 92 $ 88 4% % of Revenue 23.2% 25.5% EBITDA* $ 8 $ (2) % of Revenue 1.9% -0.5% Adjusted EBITDA* $ 8 $ 2 220% % of Revenue 1.9% 0.7% * EBITDA and Adjusted EBITDA are non-GAAP financial measures. See the Q1 2014 Net Income (Loss) to EBITDA and Adjusted EBITDA Reconciliation slide. Q1 2014 Earnings Results | April 22, 2014 | page 4

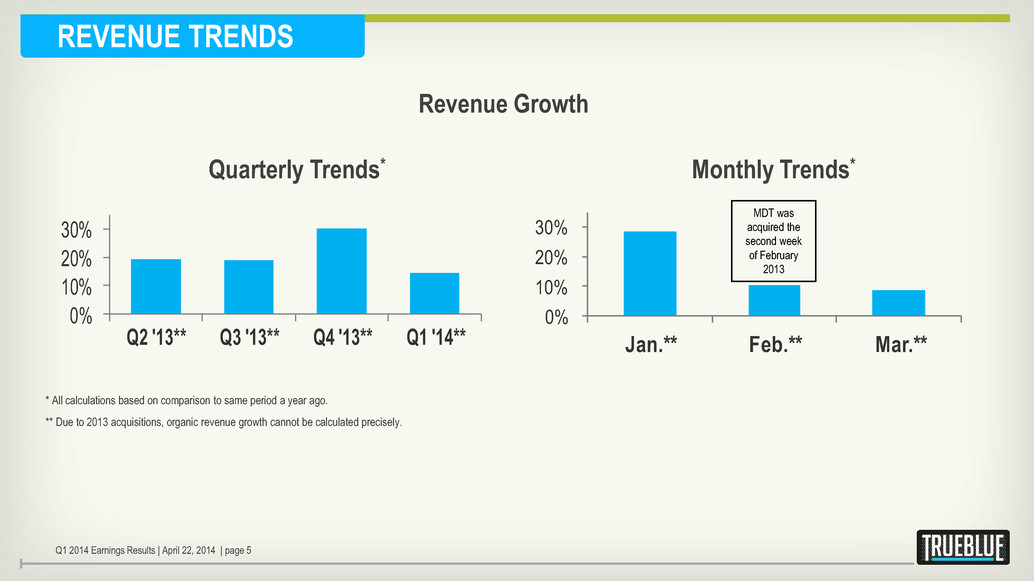

REVENUE TRENDS 0% 10% 20% 30% Q2 '13** Q3 '13** Q4 '13** Q1 '14**0% 10% 20% 30% Jan.** Feb.** Mar.** * All calculations based on comparison to same period a year ago. ** Due to 2013 acquisitions, organic revenue growth cannot be calculated precisely. Monthly Trends* Revenue Growth Quarterly Trends* Q1 2014 Earnings Results | April 22, 2014 | page 5 MDT was acquired the second week of February 2013

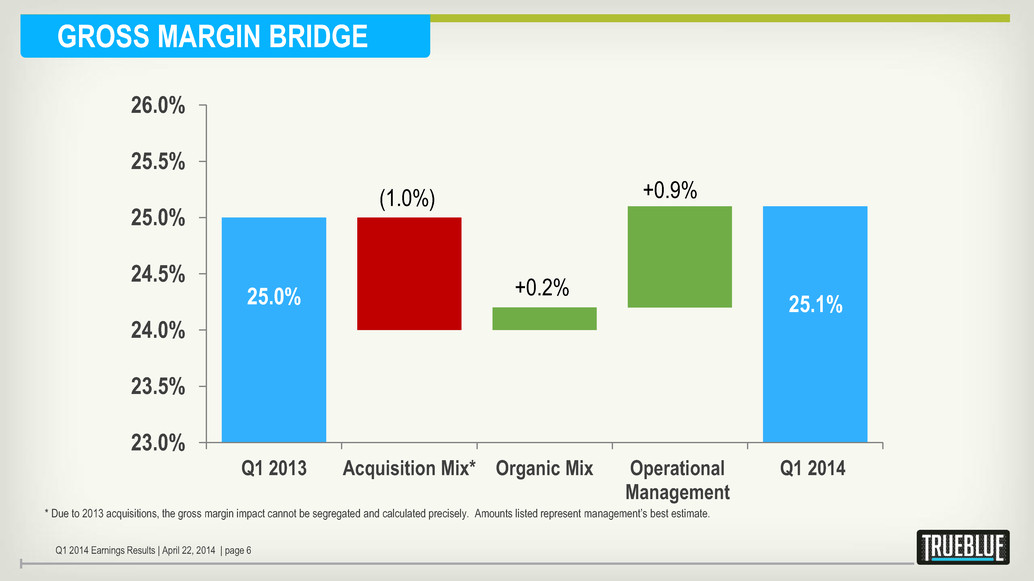

GROSS MARGIN BRIDGE * Due to 2013 acquisitions, the gross margin impact cannot be segregated and calculated precisely. Amounts listed represent management’s best estimate. 23.0% 23.5% 24.0% 24.5% 25.0% 25.5% 26.0% Q1 2013 Acquisition Mix* Organic Mix Operational Management Q1 2014 25.1% (1.0%) +0.9% +0.2% 25.0% Q1 2014 Earnings Results | April 22, 2014 | page 6

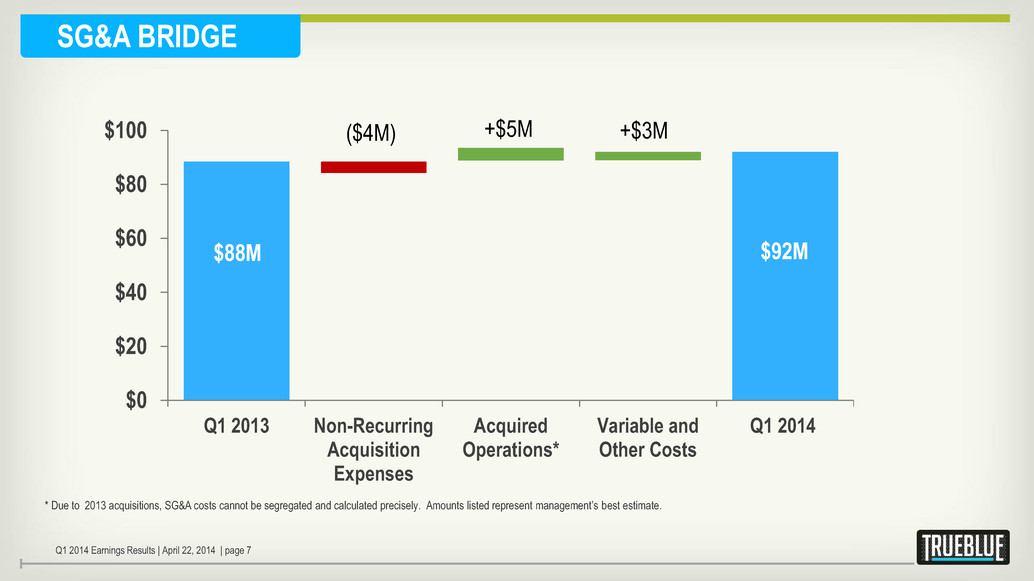

SG&A BRIDGE * Due to 2013 acquisitions, SG&A costs cannot be segregated and calculated precisely. Amounts listed represent management’s best estimate. $0 $20 $40 $60 $80 $100 Q1 2013 Non-Recurring Acquisition Expenses Acquired Operations* Variable and Other Costs Q1 2014 $88M $92M ($4M) +$3M +$5M Q1 2014 Earnings Results | April 22, 2014 | page 7

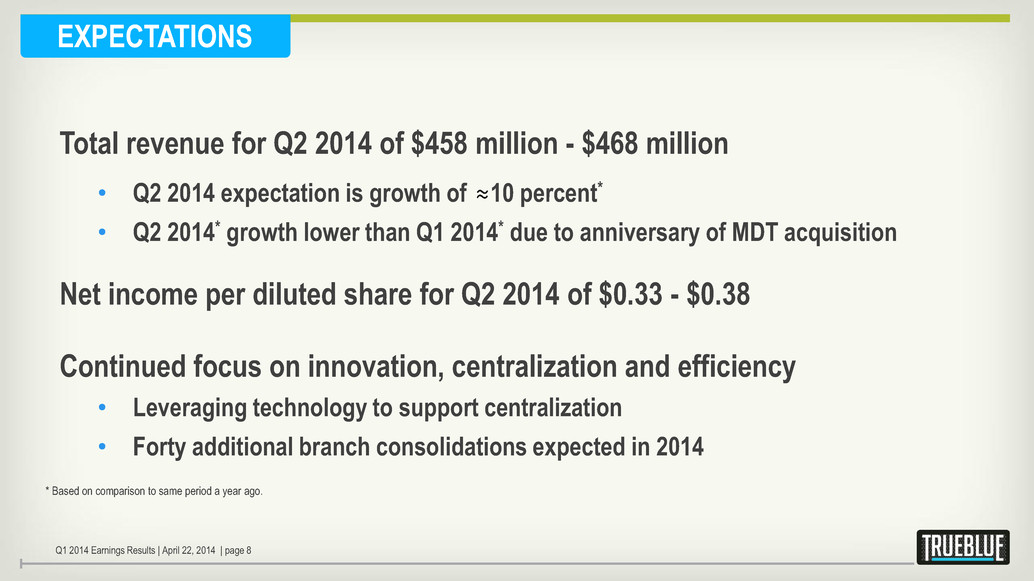

EXPECTATIONS Total revenue for Q2 2014 of $458 million - $468 million • Q2 2014 expectation is growth of 10 percent* • Q2 2014* growth lower than Q1 2014* due to anniversary of MDT acquisition Net income per diluted share for Q2 2014 of $0.33 - $0.38 Continued focus on innovation, centralization and efficiency • Leveraging technology to support centralization • Forty additional branch consolidations expected in 2014 * Based on comparison to same period a year ago. Q1 2014 Earnings Results | April 22, 2014 | page 8

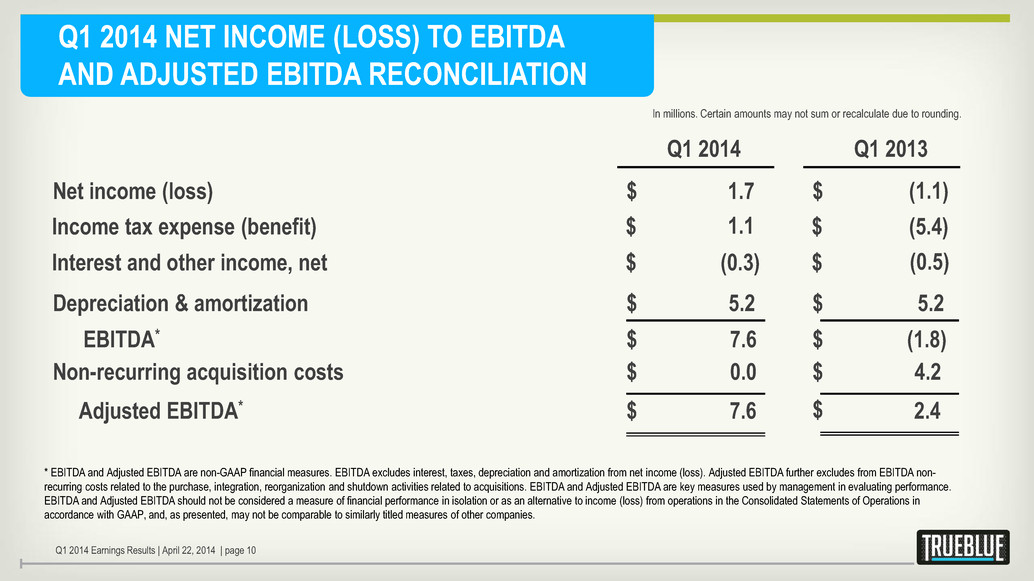

Q1 2014 NET INCOME (LOSS) TO EBITDA AND ADJUSTED EBITDA RECONCILIATION Q1 2014 Net income (loss) 1.7 $ Q1 2013 (1.1) $ In millions. Certain amounts may not sum or recalculate due to rounding. Depreciation & amortization 5.2 $ EBITDA* 7.6 $ Non-recurring acquisition costs 0.0 $ Adjusted EBITDA* 7.6 $ 5.2 $ (1.8) $ 4.2 $ 2.4 $ Income tax expense (benefit) 1.1 $ (5.4) $ Interest and other income, net (0.3) $ (0.5) $ * EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes interest, taxes, depreciation and amortization from net income (loss). Adjusted EBITDA further excludes from EBITDA non- recurring costs related to the purchase, integration, reorganization and shutdown activities related to acquisitions. EBITDA and Adjusted EBITDA are key measures used by management in evaluating performance. EBITDA and Adjusted EBITDA should not be considered a measure of financial performance in isolation or as an alternative to income (loss) from operations in the Consolidated Statements of Operations in accordance with GAAP, and, as presented, may not be comparable to similarly titled measures of other companies. Q1 2014 Earnings Results | April 22, 2014 | page 10