Q4 2012 Earnings Results

Forward-Looking Statement Certain statements made by us in this presentation that are not historical facts or that relate to future plans, events or performances are forward-looking statements that reflect management’s current outlook for future periods, including statements regarding future financial performance. These forward-looking statements are based upon our current expectations, and our actual results may differ materially from those described or contemplated in the forward–looking statements. Factors that may cause our actual results to differ materially from those contained in the forward-looking statements, include without limitation the following: 1) national and global economic conditions, including the impact of changes in national and global credit markets and other changes on our customers; 2) our ability to continue to attract and retain customers and maintain profit margins in the face of new and existing competition; 3) new laws and regulations that could have a materially adverse effect on our operations and financial results; 4) significant labor disturbances which could disrupt industries we serve; 5) increased costs and collateral requirements in connection with our insurance obligations, including workers’ compensation insurance; 6) the adequacy of our financial reserves; 7) our continuing ability to comply with financial covenants in our lines of credit and other financing agreements; 8) our ability to attract and retain competent employees in key positions or to find temporary employees to fulfill the needs of our customers; 9) our ability to successfully complete and integrate the MDT Personnel and other acquisitions that we may make from time to time; and 10) other risks described in our filings with the Securities and Exchange Commission, including our most recent Form 10-K and Form 10-Q filings. Use of estimates and forecasts: Any references made to 2013 or 2014 are based on management guidance issued Feb. 6, 2013, and are included for informational purposes only and are not an update or reaffirmation. Any other reference to future financial estimates are included for informational purposes only and subject to factors discussed in our 10-K and 10-Q filings. graphic, photo, chart TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 2

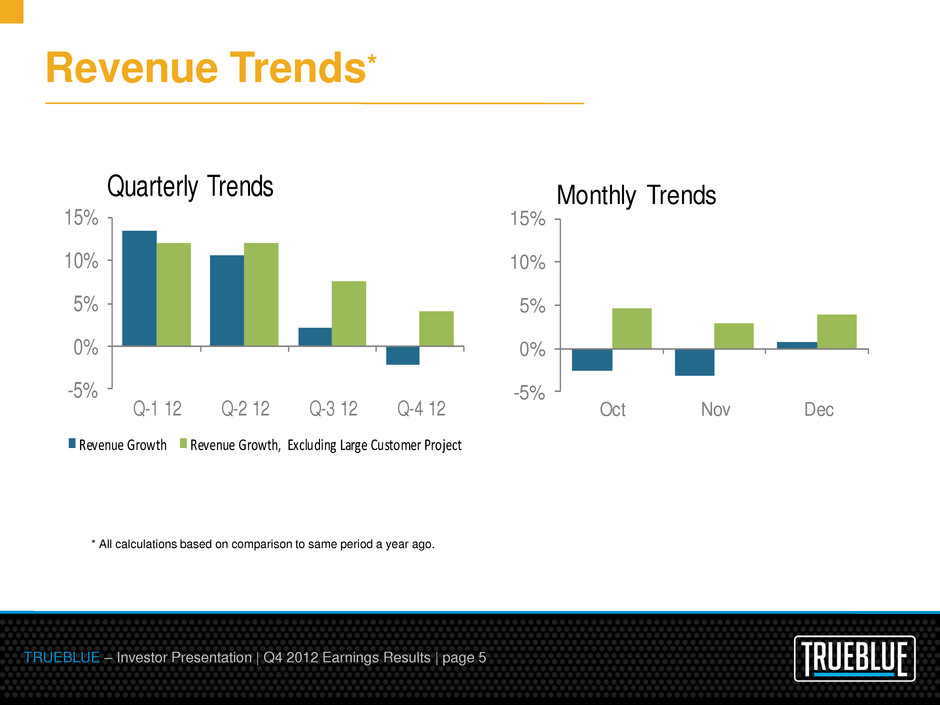

Q4 2012 Highlights • 2% total revenue decline; 3% gross profit increase • Revenue increased 4% excluding a large customer project • Stable monthly revenue trends • Improving construction market • Record year reducing accidents through improved safety practices graphic, photo, chart TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 3

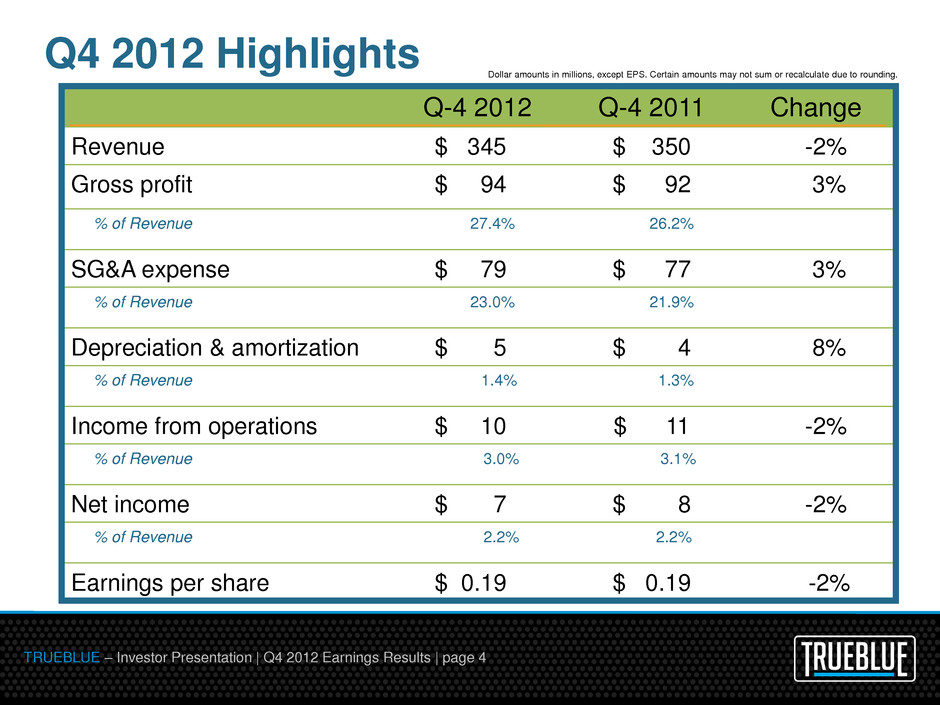

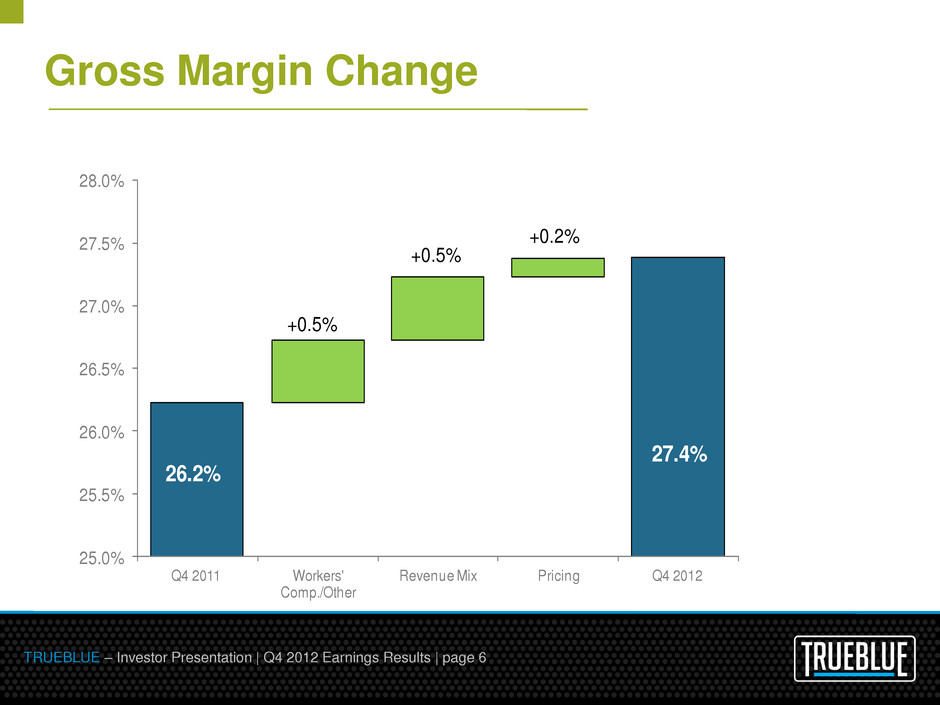

Q-4 2012 Q-4 2011 Change Revenue $ 345 $ 350 -2% Gross profit $ 94 $ 92 3% % of Revenue 27.4% 26.2% SG&A expense $ 79 $ 77 3% % of Revenue 23.0% 21.9% Depreciation & amortization $ 5 $ 4 8% % of Revenue 1.4% 1.3% Income from operations $ 10 $ 11 -2% % of Revenue 3.0% 3.1% Net income $ 7 $ 8 -2% % of Revenue 2.2% 2.2% Earnings per share $ 0.19 $ 0.19 -2% Dollar amounts in millions, except EPS. Certain amounts may not sum or recalculate due to rounding. Q4 2012 Highlights TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 4

Revenue Trends* graphic, photo, chart TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 5 -5% 0% 5% 10% 15% Q-1 12 Q-2 12 Q-3 12 Q-4 12 Quarterly Trends Revenue Growth Revenue Growth, Excluding Large Customer Project -5% 0% 5% 10% 15% Oct Nov Dec Monthly Trends * All calculations based on comparison to same period a year ago.

Gross Margin Change graphic, photo, chart TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 6 25.0% 25.5% 26.0% 26.5% 27.0% 27.5% 28.0% Q4 2011 Workers' Comp./Other Revenue Mix Pricing Q4 2012 26.2% 27.4% +0.5% +0.2% +0.5%

MDT Acquisition

MDT Business Overview • Third largest general labor staffing firm in the U.S. • $200 million annual revenue • 105 branches and 15 on-site locations in 25 states • Strongest presence in the Southeastern U.S. • Diversified customer base • Customer industries served similar to TrueBlue’s current business graphic, photo, chart TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 8

Combined Business • Annual revenue of $1.6 billion • MDT integration with Labor Ready creates $1 billion revenue general labor staffing business • Footprint of 800 branches at acquisition • Integration includes about 60 branch consolidations • Integration to be complete in Q2 2013 TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 9

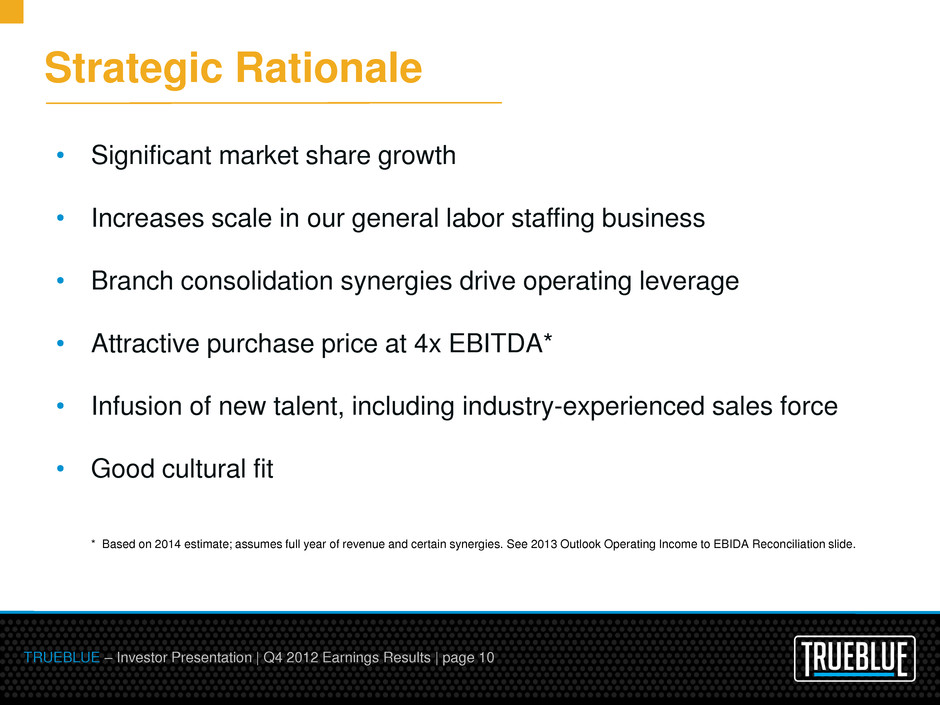

Strategic Rationale graphic, photo, chart • Significant market share growth • Increases scale in our general labor staffing business • Branch consolidation synergies drive operating leverage • Attractive purchase price at 4x EBITDA* • Infusion of new talent, including industry-experienced sales force • Good cultural fit * Based on 2014 estimate; assumes full year of revenue and certain synergies. See 2013 Outlook Operating Income to EBIDA Reconciliation slide. TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 10

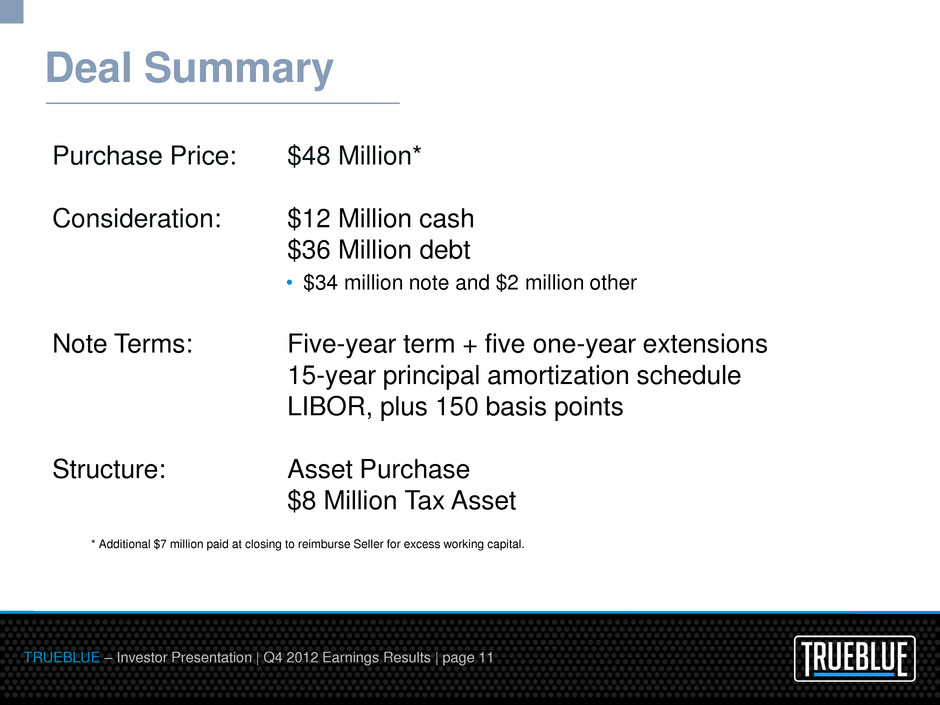

Deal Summary Purchase Price: $48 Million* Consideration: $12 Million cash $36 Million debt Note Terms: Five-year term + five one-year extensions 15-year principal amortization schedule LIBOR, plus 150 basis points Structure: Asset Purchase $8 Million Tax Asset * Additional $7 million paid at closing to reimburse Seller for excess working capital. TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 11 • $34 million note and $2 million other

2013 Expectations

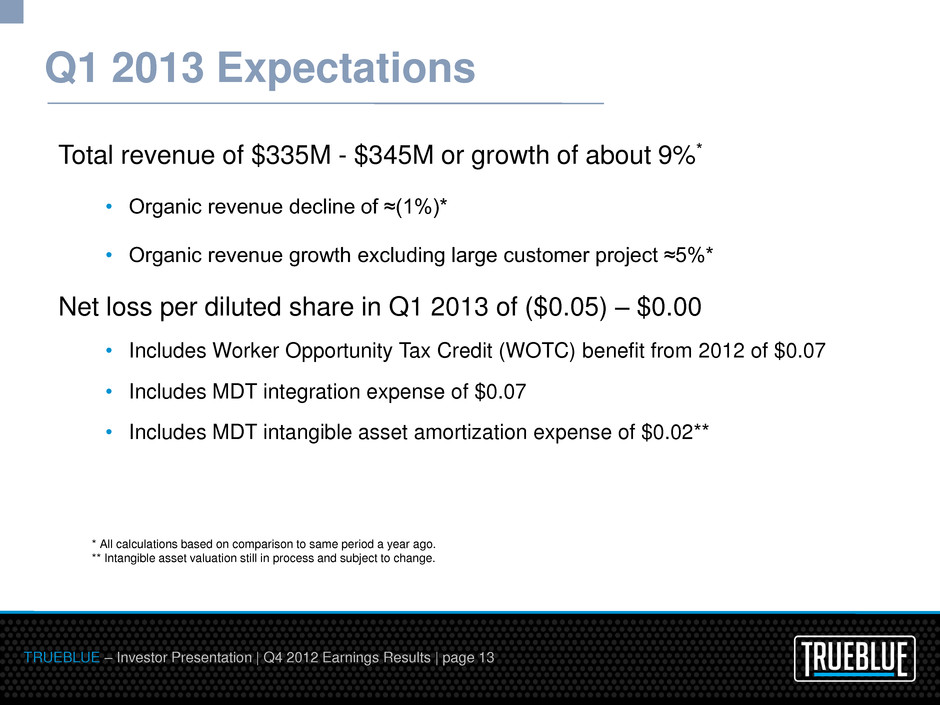

Q1 2013 Expectations Total revenue of $335M - $345M or growth of about 9%* • Organic revenue decline of ≈(1%)* • Organic revenue growth excluding large customer project ≈5%* Net loss per diluted share in Q1 2013 of ($0.05) – $0.00 • Includes Worker Opportunity Tax Credit (WOTC) benefit from 2012 of $0.07 • Includes MDT integration expense of $0.07 • Includes MDT intangible asset amortization expense of $0.02** * All calculations based on comparison to same period a year ago. ** Intangible asset valuation still in process and subject to change. TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 13

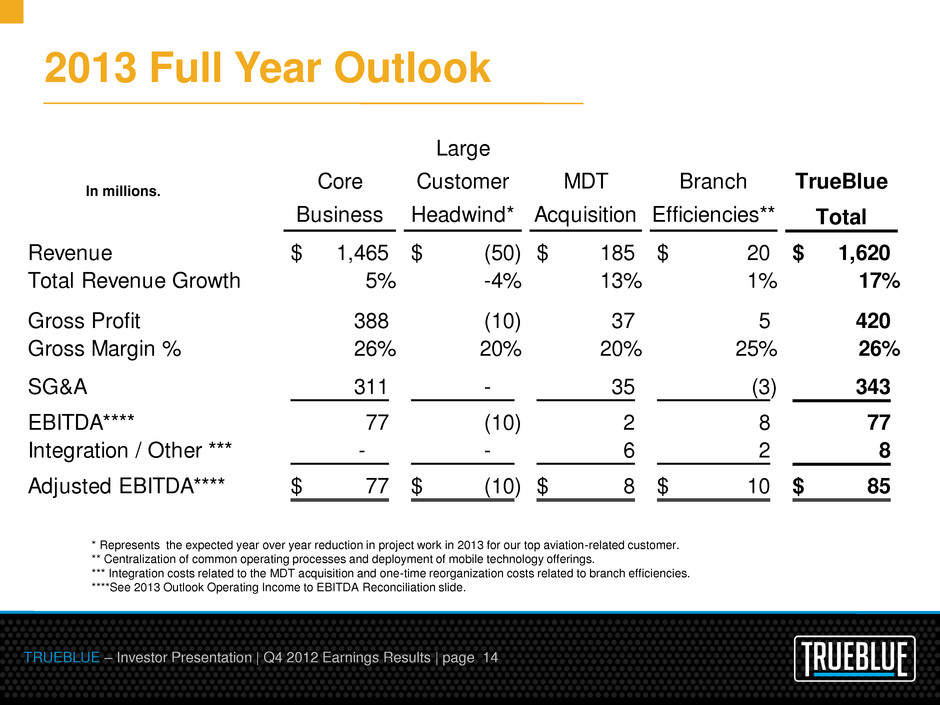

2013 Full Year Outlook graphic, photo, chart TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 14 In millions. * Represents the expected year over year reduction in project work in 2013 for our top aviation-related customer. ** Centralization of common operating processes and deployment of mobile technology offerings. *** Integration costs related to the MDT acquisition and one-time reorganization costs related to branch efficiencies. ****See 2013 Outlook Operating Income to EBITDA Reconciliation slide. Core Business Large Customer Headwind* MDT Acquisition Branch Efficiencies** TrueBlue Total Revenue 1,465$ (50)$ 185$ 20$ 1,620$ Total Revenue Growth 5% -4% 13% 1% 17% Gross Profit 388 (10) 37 5 420 Gross Margin % 26% 20% 20% 25% 26% SG&A 311 - 35 (3) 343 EBITDA**** 77 (10) 2 8 77 Integra ion / Other *** - - 6 2 8 Adjusted EBITDA**** 77$ (10)$ 8$ 10$ 85$

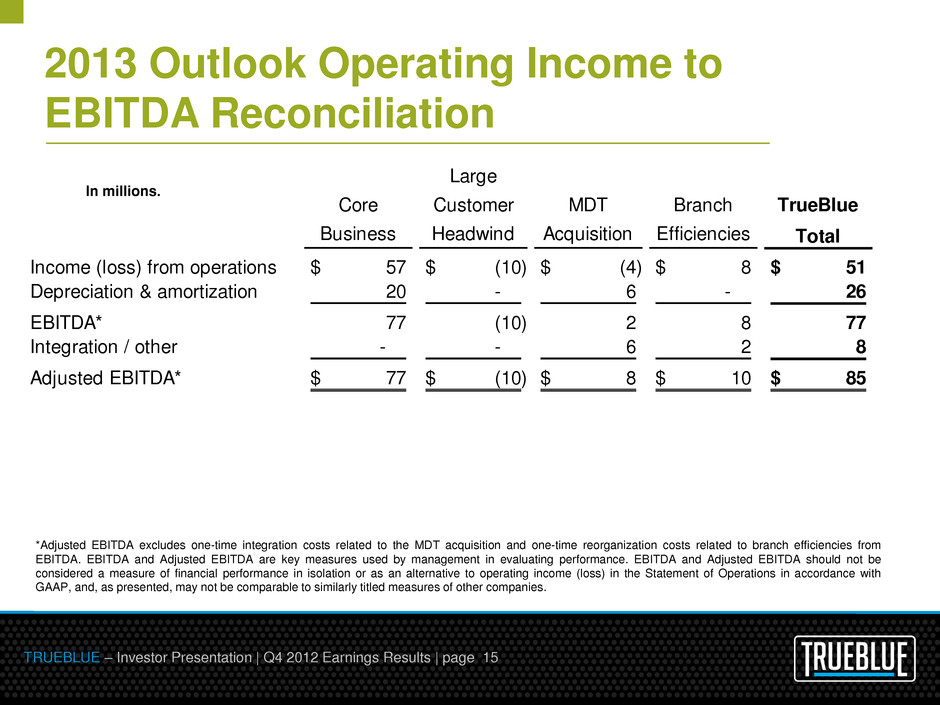

2013 Outlook Operating Income to EBITDA Reconciliation graphic, photo, chart *Adjusted EBITDA excludes one-time integration costs related to the MDT acquisition and one-time reorganization costs related to branch efficiencies from EBITDA. EBITDA and Adjusted EBITDA are key measures used by management in evaluating performance. EBITDA and Adjusted EBITDA should not be considered a measure of financial performance in isolation or as an alternative to operating income (loss) in the Statement of Operations in accordance with GAAP, and, as presented, may not be comparable to similarly titled measures of other companies. TRUEBLUE – Investor Presentation | Q4 2012 Earnings Results | page 15 In millions. Core Business Large Customer Headwind MDT Acquisition Branch Efficiencies TrueBlue Total Income (loss) from operations 57$ (10)$ (4)$ 8$ 51$ Depreciation & amortization 20 - 6 - 26 EBITDA* 77 (10) 2 8 77 Integration / other - - 6 2 8 Adjusted EBITDA* 77$ (10)$ 8$ 10$ 85$