TrueBlue™ (NYSE:TBI) Q3 2012 Results Cautionary Note About Forward-Looking Statements: This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “should,” “expects,” “intends,” “projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates,” and similar expressions are used to identify these forward-looking statements. Examples of forward-looking statements include statements relating to our future financial condition and operating results, as well as any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Examples of such factors can be found in our reports filed with the SEC, including the information under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended Dec. 30, 2011 and in our quarterly reports on Form 10-Q filed subsequent thereto. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

TrueBlue™ (NYSE:TBI) Q3 2012 Results 2 Q-3 2012 Highlights 2% revenue and 9% earnings per share growth Excluding large customer project, revenue increased 7% Revenue trends slowed in most industries Disciplined pricing driving higher gross margin * All calculations based on comparison to same period a year ago.

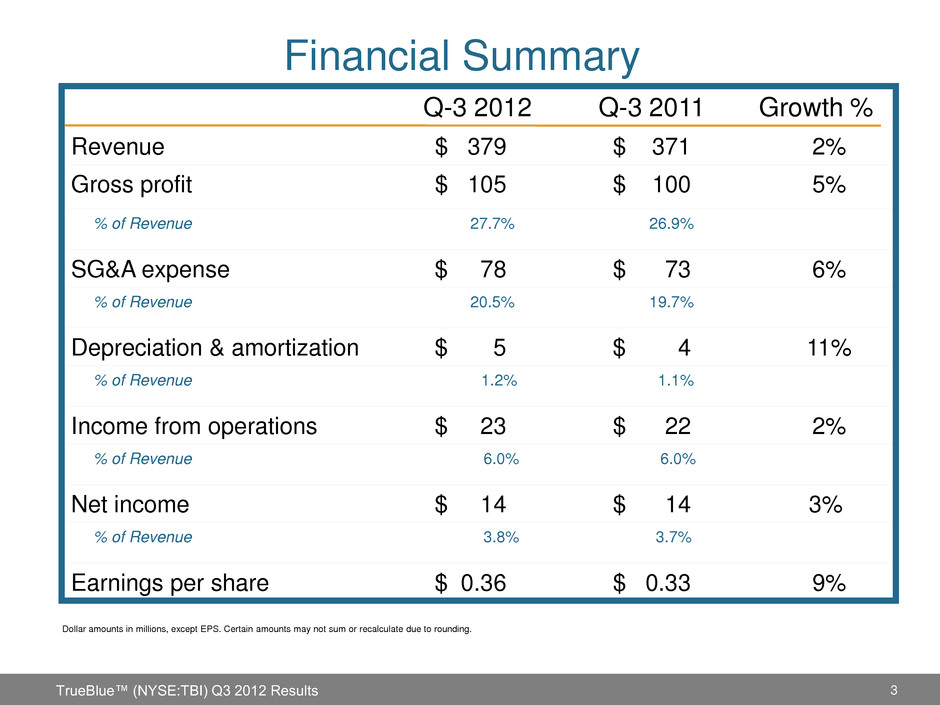

3 Financial Summary Q-3 2012 Q-3 2011 Growth % Revenue $ 379 $ 371 2% Gross profit $ 105 $ 100 5% % of Revenue 27.7% 26.9% SG&A expense $ 78 $ 73 6% % of Revenue 20.5% 19.7% Depreciation & amortization $ 5 $ 4 11% % of Revenue 1.2% 1.1% Income from operations $ 23 $ 22 2% % of Revenue 6.0% 6.0% Net income $ 14 $ 14 3% % of Revenue 3.8% 3.7% Earnings per share $ 0.36 $ 0.33 9% Dollar amounts in millions, except EPS. Certain amounts may not sum or recalculate due to rounding. TrueBlue™ (NYSE:TBI) Q3 2012 Results

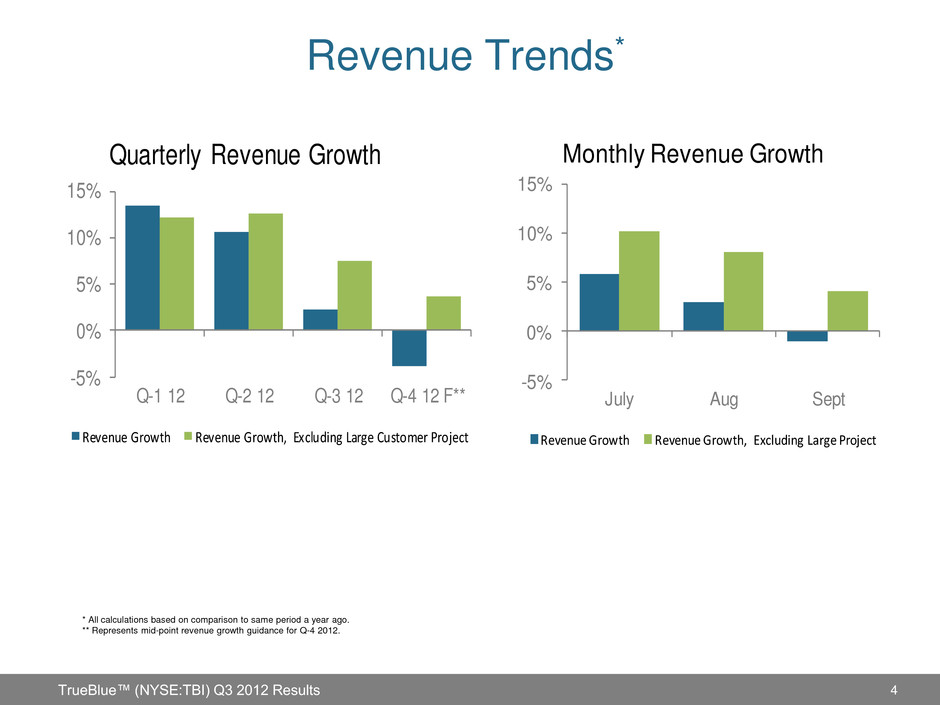

Revenue Trends* -5% 0% 5% 10% 15% Q-1 12 Q-2 12 Q-3 12 Q-4 12 F** Quarterly Revenue Growth Revenue Growth Revenue Growth, Excluding Large Customer Project 4 TrueBlue™ (NYSE:TBI) Q3 2012 Results * All calculations based on comparison to same period a year ago. ** Represents mid-point revenue growth guidance for Q-4 2012. -5% 0% 5% 10% 15% July Aug Sept Monthly Revenue Growth Revenue Growth Revenue Growth, Excluding Large Project

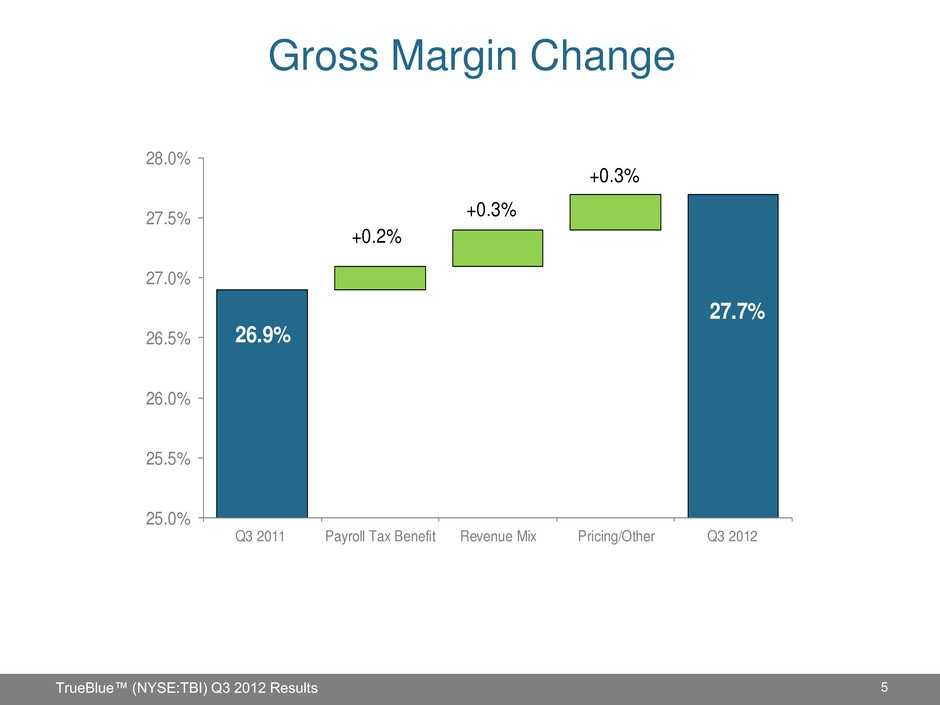

TrueBlue™ (NYSE:TBI) Q3 2012 Results 5 Gross Margin Change 25.0% 25.5% 26.0% 26.5% 27.0% 27.5% 28.0% Q3 2011 Payroll Tax Benefit Revenue Mix Pricing/Other Q3 2012 26.9% 27.7% +0.3% +0.3% +0.2% TrueBlue™ (NYSE:TBI) Q3 2012 Results

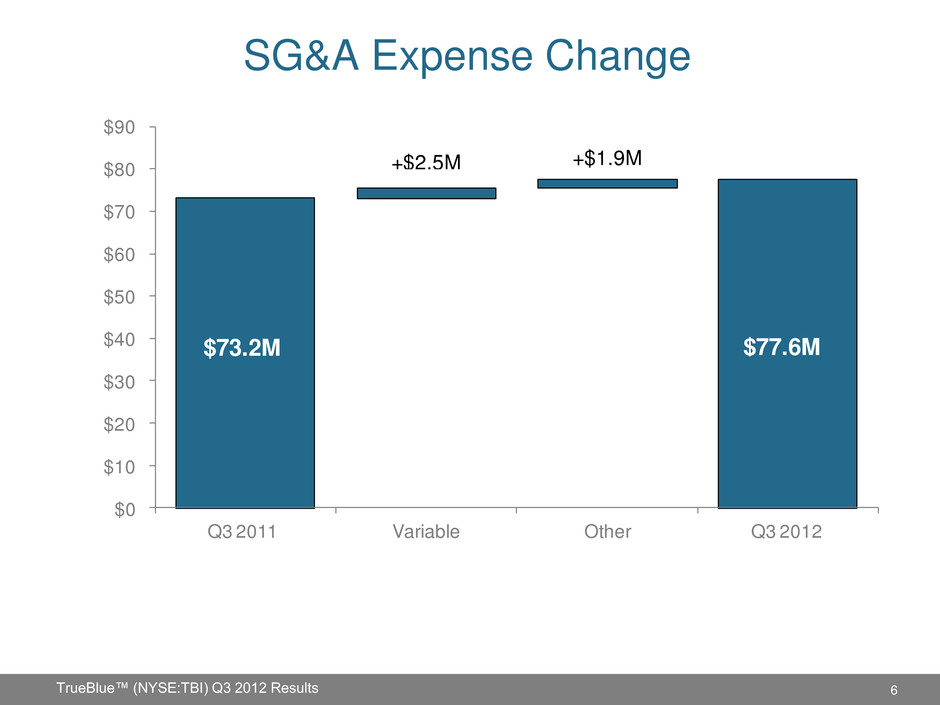

TrueBlue™ (NYSE:TBI) Q3 2012 Results 6 SG&A Expense Change $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 Q3 2011 Variable Other Q3 2012 +$2.5M $73.2M $77.6M +$1.9M

TrueBlue™ (NYSE:TBI) Q3 2012 Results 7 Closing Comments* Revenue expected to decline about 4% in Q4 2012** Excluding large customer project, revenue expected to grow about 4% in Q4 2012 Expect net income per diluted share in Q4 2012 of $0.11 - $0.16 Remain focused on current strategies of specialization, people, and technology to drive growth * All calculations based on comparison to same period a year ago. ** Represents mid-point revenue growth guidance for Q-4 2012.